Europe Enterprise Mobility Market Size, Share, Trends, & Growth Forecast Report By Component (Solutions and Services), Deployment Mode (Cloud and On-Premises), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Enterprise Mobility Market Size

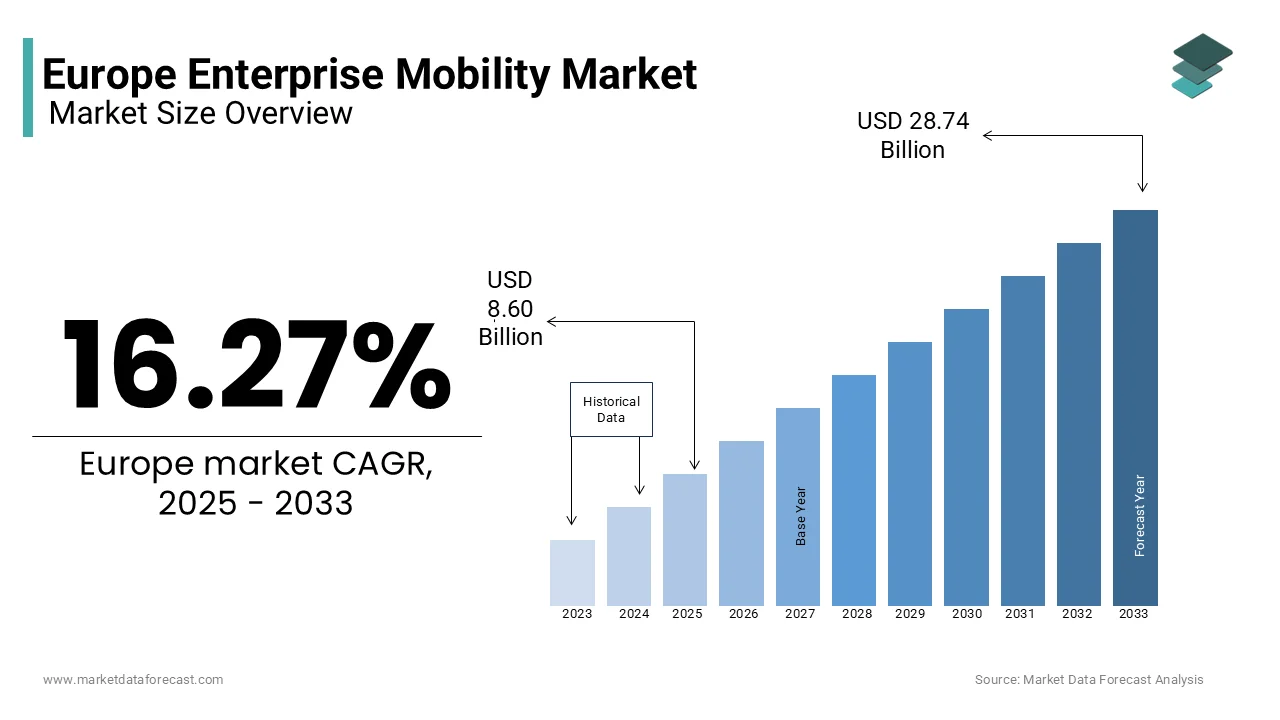

The Europe enterprise mobility market was valued at USD 7.40 billion in 2024. The European market is estimated to reach USD 28.74 billion by 2033 from USD 8.60 billion in 2025, rising at a CAGR of 16.27% from 2025 to 2033.

Enterprise mobility is critical for the integration of mobile technologies into business operations to enhance productivity, streamline workflows, and foster innovation. Enterprise mobility refers to the use of mobile devices, applications, cloud services, and related infrastructure to enable employees to perform their tasks efficiently from any location. This paradigm shift is driven by the growing adoption of smartphones, tablets, wearables, and IoT-enabled devices, coupled with advancements in 5G connectivity, artificial intelligence, and cybersecurity solutions. In essence, enterprise mobility empowers organizations to create a flexible, connected, and agile work environment that aligns with the demands of the modern workforce.

As of 2023, Europe stands as one of the most mature markets for enterprise mobility, accounting for a significant share of global investments in this domain. The growing demand for remote working tools, especially in the wake of the COVID-19 pandemic that accelerated digital transformation across industries such as healthcare, retail, manufacturing, and financial services is promoting the demand for enterprise mobility services in the European region. Furthermore, as per a study by Statista, over 60% of European businesses have implemented some form of enterprise mobility solution, underscoring its critical role in achieving operational resilience and competitive advantage. As regulatory frameworks around data privacy and security continue to evolve, particularly under the General Data Protection Regulation (GDPR), enterprises are prioritizing secure and compliant mobility strategies to safeguard sensitive information while maximizing efficiency.

MARKET DRIVERS

Adoption of Remote and Hybrid Work Models

The widespread adoption of remote and hybrid work models is majorly driving the growth of the Europe enterprise mobility market. The European Union's Digital Economy and Society Index (DESI) 2022 reveals that over 40% of EU workers now regularly engage in remote work, a trend significantly accelerated by the pandemic. This shift has created an urgent need for enterprise mobility solutions to facilitate seamless communication, collaboration, and secure access to corporate data. Eurostat reports that approximately 68% of European enterprises invested in cloud-based tools and mobile applications in 2021 to support their remote workforce. Additionally, the International Data Corporation (IDC) highlights that spending on mobile device management and cybersecurity solutions in Europe grew by 18% year-on-year in 2022. These investments reflect the critical role of mobility technologies in maintaining productivity while addressing challenges such as data privacy compliance under GDPR and rising cyber threats.

Proliferation of IoT-Enabled Devices and Smart Infrastructure

The rapid proliferation of IoT-enabled devices and smart infrastructure across Europe is another major driver propelling the enterprise mobility market forward. According to the European Commission’s Joint Research Centre, the number of connected devices in Europe is projected to exceed 5 billion by 2025, fueled by advancements in 5G networks and edge computing. This growth is particularly evident in sectors like manufacturing and logistics, where real-time data analytics and mobile accessibility are essential for optimizing supply chains. The World Economic Forum notes that IoT-driven enterprise mobility initiatives have led to a 25% improvement in operational efficiency among European businesses. Furthermore, the European Investment Bank highlights that investments in smart city projects, which rely heavily on mobility technologies, reached €20 billion in 2022. These developments underscore how IoT integration enhances the demand for enterprise mobility solutions, enabling smarter decision-making and resource optimization across industries.

MARKET RESTRAINTS

Stringent Data Privacy Regulations

One of the significant restraints in the Europe enterprise mobility market is the stringent data privacy and security regulations imposed by frameworks such as the General Data Protection Regulation (GDPR). The European Data Protection Board reports that over 40% of enterprises face challenges in aligning their mobility solutions with GDPR compliance requirements, leading to increased operational costs. Non-compliance can result in hefty fines, with penalties reaching up to €20 million or 4% of global annual turnover, as outlined by the European Commission. Additionally, a study by the European Union Agency for Cybersecurity (ENISA) highlights that 60% of businesses perceive regulatory compliance as a barrier to adopting advanced mobility technologies. These complexities are further compounded by the need to secure sensitive data across multiple devices and cloud platforms. As a result, organizations often delay or scale back their investments in enterprise mobility solutions, hindering market growth despite the rising demand for flexible work environments.

Cybersecurity Threats and Vulnerabilities

The rising prevalence of cybersecurity threats targeting mobile devices and enterprise networks that undermines trust in mobility solutions is another major factor impeding the European enterprise mobility market growth. According to Europol’s Internet Organised Crime Threat Assessment (IOCTA) 2022, cyberattacks on mobile platforms have surged by 30% in Europe over the past two years, with ransomware and phishing being the most common threats. The European Union Agency for Cybersecurity (ENISA) estimates that the average cost of a data breach for European enterprises exceeds €3 million, deterring companies from fully embracing enterprise mobility. Furthermore, a report by the European Network and Information Security Agency reveals that 70% of businesses cite cybersecurity risks as a major concern when deploying mobility solutions. These vulnerabilities are exacerbated by the increasing use of personal devices for work purposes, known as Bring Your Own Device (BYOD), which creates additional entry points for cybercriminals. Such risks compel organizations to allocate substantial resources to mitigate threats, slowing down the adoption of enterprise mobility technologies.

MARKET OPPORTUNITIES

Integration of 5G Networks and Edge Computing

The integration of 5G networks and edge computing is a notable opportunity for the Europe enterprise mobility market. The European Commission’s Digital Decade Report 2023 highlights that 5G coverage is expected to reach 85% of Europe’s population by 2025, enabling ultra-fast connectivity and low-latency applications. This advancement supports real-time data processing and enhances the performance of mobility solutions, particularly in industries like healthcare, manufacturing, and logistics. According to the European Investment Bank, investments in 5G infrastructure surpassed €100 billion in 2022, underscoring its pivotal role in driving innovation. Additionally, a study by the European Telecommunications Network Operators’ Association (ETNO) reveals that 5G-enabled enterprise mobility solutions could contribute up to €113 billion annually to Europe’s GDP by 2030. By leveraging edge computing, businesses can process data closer to the source, reducing latency and improving operational efficiency. These technological advancements create a fertile ground for enterprises to adopt cutting-edge mobility solutions.

Expansion of Smart City Initiatives Across Europe

The expansion of smart city initiatives across Europe is another promising opportunity for the enterprise mobility market. The European Smart Cities Observatory reports that over 300 cities in Europe are actively implementing smart city projects, integrating mobility solutions into urban planning and infrastructure development. These initiatives rely heavily on mobile technologies to enhance public services, transportation systems, and energy management. For instance, the European Investment Bank notes that funding for smart city projects reached €25 billion in 2022, with mobility solutions accounting for a substantial share. Furthermore, a report by the European Environment Agency highlights that smart mobility applications, such as intelligent traffic management and connected public transit systems, have reduced urban congestion by 20% in pilot cities. As governments prioritize sustainability and digital transformation, the demand for enterprise mobility solutions tailored to smart city ecosystems is expected to grow significantly, creating lucrative opportunities for market players.

MARKET CHALLENGES

Stringent Data Protection and Privacy Regulations

Stringent data protection and privacy regulations that are primarily governed by the General Data Protection Regulation (GDPR) is a major challenge to the European enterprise mobility market. Enforced by the European Union, GDPR mandates strict compliance for handling personal data, requiring enterprises to invest heavily in secure mobility solutions. According to the European Commission, businesses spend an average of 1.3 million euros annually to ensure GDPR compliance, with small and medium enterprises particularly affected. Non-compliance can result in hefty fines, up to 20 million euros or 4% of global turnover, as per the European Data Protection Board. While these regulations are crucial for safeguarding consumer data, they create operational complexities for enterprises deploying mobility solutions that rely on extensive data processing.

Fragmented Regulatory Environment Across Countries

Fragmented regulatory landscape across European countries that complicates cross-border enterprise mobility operations is another major factor hindering the European market expansion. According to Eurostat, differing national laws, such as tax incentives for electric vehicles, create inconsistencies in fleet management strategies. This fragmentation increases operational costs by 5-10%, as noted by the European Automobile Manufacturers Association. Enterprises must adopt country-specific approaches, hindering the scalability of mobility initiatives. For instance, varying labor laws and environmental regulations further exacerbate the complexity of implementing unified mobility solutions. This lack of harmonization across Europe forces companies to navigate a patchwork of rules, reducing efficiency and raising expenses for multinational operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.27% |

|

Segments Covered |

By Component, Deployment Mode, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Cisco Systems, Inc., SAP SE, Broadcom, Inc., AppTec GmbH, VMware, Inc., Citrix Systems, Ivanti, IBM Corporation, Microsoft Corporation, Micro Focus, Zoho Corporation Pvt. Ltd., Matrix42, Sophos, Blackberry, and Esper. |

SEGMENTAL ANALYSIS

By Component Insights

The services segment accounted for the major share of 61.9% in the European market in 2024. The dominance of the services segment is majorly due to the growing complexity of integrating mobility solutions with legacy systems, driving demand for consulting and managed services. The European Commission highlights that over 40% of enterprises outsource mobility services to address skill gaps and ensure compliance with regulations like GDPR. Services are vital as they enable seamless deployment, maintenance, and optimization of mobility strategies. With the increasing adoption of cloud-based mobility solutions, the reliance on services is expected to grow further, reinforcing its leadership position in the market.

The solutions segment is anticipated to register a CAGR of 14.5% over the forecast period owing to the rising adoption of remote work and the need for secure mobility tools like MDM and MAM platforms. ENISA reports that over 70% of enterprises prioritize cybersecurity solutions to combat rising mobile threats, further accelerating demand. Additionally, the proliferation of IoT devices and BYOD policies has increased the need for scalable mobility solutions. As businesses digitize operations, solutions play a critical role in ensuring data security, operational efficiency, and regulatory compliance, making this segment pivotal for future growth.

By Deployment Mode Insights

The cloud segment dominated the market by accounting for 67.8% of the European market share in 2024. The dominance of the cloud segment in the European market is primarily attributed to its cost-effectiveness, scalability, and ability to support remote work trends. The European Commission highlights that 70% of enterprises prioritize cloud solutions for digital transformation, reducing infrastructure costs by up to 30% compared to on-premises systems, according to the European Data Protection Supervisor (EDPS). Cloud deployment enables real-time data access and seamless integration of mobility tools, making it indispensable for modern businesses. With increasing IoT adoption and BYOD policies, cloud solutions are critical for ensuring operational efficiency, flexibility, and compliance with evolving regulations like GDPR.

REGIONAL ANALYSIS

Germany dominated enterprise mobility market in Europe by occupying a share of 28.7% in the European market in 2024. The strong industrial foundation, particularly in manufacturing, and the widespread adoption of Industry 4.0 technologies have majorly contributed to the domination of Germany in the European market. Germany’s robust IT infrastructure and focus on digital transformation have spurred investments in cloud-based mobility solutions. Eurostat reports that over 70% of German enterprises now utilize IoT-enabled systems, enabling seamless integration of mobility tools. Additionally, stringent data protection laws like GDPR have encouraged businesses to adopt secure and compliant mobility frameworks, further solidifying Germany’s leading position in the regional market.

The UK occupied the second largest share of the European market in 2024. The advanced telecom infrastructure of the UK and high adoption of remote work tools post-Brexit have been key drivers of the UK market growth. The British government’s emphasis on digital innovation has also accelerated mobility adoption, with over 60% of UK businesses investing in cloud-based solutions to enhance operational efficiency. Furthermore, the rise of smart city initiatives and the proliferation of 5G networks have created a conducive environment for enterprise mobility. These factors, combined with a tech-savvy workforce, have positioned the UK as a leader in this domain.

France is predicted to account for a notable share of the European market over the forecast period owing to initiatives like the France Relance plan. The French Ministry of Economy highlights that 65% of French businesses have accelerated mobility adoption, driven by investments in smart city projects and cybersecurity measures. France’s leadership is bolstered by its focus on fostering innovation through tax incentives and grants for digital transformation. Additionally, the country’s commitment to sustainability has led to increased adoption of IoT and green mobility solutions. With a strong emphasis on regulatory compliance and cutting-edge technology, France continues to play a pivotal role in shaping the future of enterprise mobility across Europe.

KEY MARKET PLAYERS

The major players in the Europe enterprise mobility market include Cisco Systems, Inc., SAP SE, Broadcom, Inc., AppTec GmbH, VMware, Inc., Citrix Systems, Ivanti, IBM Corporation, Microsoft Corporation, Micro Focus, Zoho Corporation Pvt. Ltd., Matrix42, Sophos, Blackberry, and Esper.

MARKET SEGMENTATION

This research report on the Europe enterprise mobility market is segmented and sub-segmented into the into the following categories.

By Component

- Solutions

- Services

By Deployment Mode

- Cloud

- On-Premises

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe enterprise mobility market?

The growth is driven by the increasing adoption of remote work, the rise of cloud-based solutions, and the need for secure mobile device management across enterprises.

Which industries are adopting enterprise mobility solutions the most in Europe?

Key industries include IT & telecom, healthcare, banking & financial services, manufacturing, and retail, where secure and flexible workforce mobility is crucial.

How does enterprise mobility impact employee productivity?

It improves productivity by enabling remote access to enterprise applications, facilitating real-time collaboration, and reducing downtime associated with traditional office setups.

What is the impact of GDPR on the enterprise mobility market in Europe?

GDPR has pushed companies to enhance data security in mobile solutions, ensuring strict access controls, encryption, and compliance with data privacy regulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]