Europe Enterprise Mobility Management Market Size, Share, Trends, & Growth Forecast Report By Type (Solutions and Services), End User (BFSI, Healthcare, IT and Telecom, Manufacturing, and Retail), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Enterprise Mobility Management Market Size

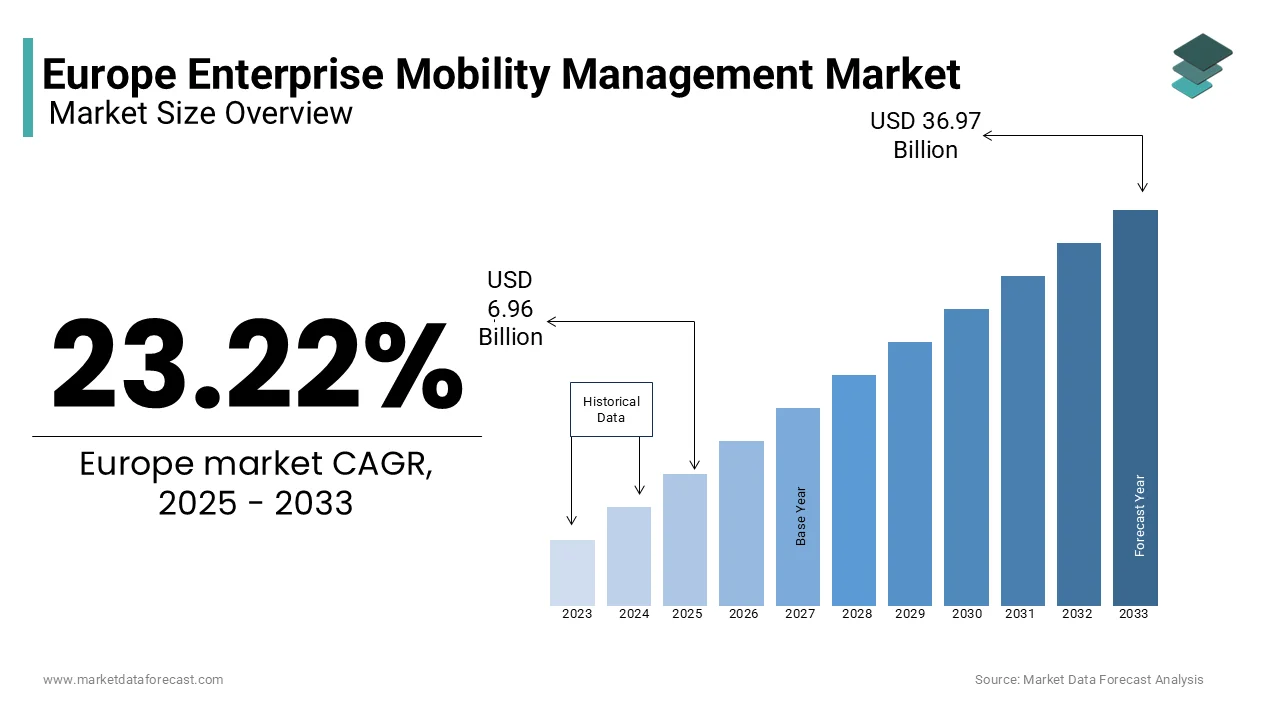

The Europe enterprise mobility management market was worth USD 5.65 billion in 2024. The European market is expected to reach USD 36.97 billion by 2033 from USD 6.96 billion in 2025, growing at a CAGR of 23.22% from 2025 to 2033.

Enterprise Mobility Management (EMM) refers to a comprehensive approach that enables organizations to manage and secure mobile devices, applications, and data across their workforce. The European enterprise mobility management market is pivotal in supporting remote work, enhancing productivity, and ensuring cybersecurity in an increasingly mobile-first business environment. In Europe, the EMM market has witnessed robust growth due to the proliferation of smartphones, tablets, and IoT devices, coupled with the rise of hybrid work models. According to the European Commission, more than 70% of enterprises have adopted some form of mobility management solution to address security concerns and streamline operations. Key industries such as BFSI, healthcare, and IT are leading adopters, driven by stringent regulatory requirements and the need for real-time data access. As Europe continues its digital transformation journey, EMM solutions are becoming indispensable for businesses seeking agility, scalability, and enhanced user experiences.

MARKET DRIVERS

Increasing Adoption of Bring Your Own Device (BYOD) Policies in Europe

The widespread adoption of BYOD policies is a significant driver of the EMM market in Europe. According to Eurostat, over 60% of European organizations now allow employees to use personal devices for work purposes, up from 45% in 2018. This trend has created a pressing need for robust EMM solutions to ensure data security and compliance. For instance, the UK’s Information Commissioner’s Office reports that BYOD-related security breaches increased by 25% in 2022, underscoring the importance of EMM in mitigating risks. Highlighting this demand, Germany alone witnessed a 30% surge in EMM deployments in its corporate sector during the same period.

Stringent Data Protection Regulations

Stringent data protection regulations, such as the General Data Protection Regulation (GDPR), are driving the adoption of EMM solutions. According to the European Data Protection Board, non-compliance with GDPR can result in fines of up to EUR 20 million or 4% of global turnover, whichever is higher. This has compelled organizations to invest in EMM tools that offer advanced encryption, device management, and access control features. France, for example, reported a 40% increase in EMM spending in 2022, primarily to align with GDPR mandates.

MARKET RESTRAINTS

High Implementation Costs

The high cost of implementing EMM solutions remains a significant barrier for small and medium-sized enterprises (SMEs). According to the European Central Bank, the average cost of deploying an EMM solution ranges from EUR 50,000 to EUR 200,000, depending on the scale and complexity. A study by the European Association of Small Businesses reveals that nearly 50% of SMEs cite financial constraints as a major obstacle to adopting EMM technologies.

Complexity of Integration with Legacy Systems

Integration challenges with legacy systems also hinder the European market growth. According to the European Telecommunications Network Operators’ Association (ETNO), over 60% of enterprises face compatibility issues when integrating EMM solutions with existing IT infrastructure. This complexity often leads to delays and increased operational costs, deterring potential adopters.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe, particularly Eastern Europe, present significant opportunities for EMM growth. According to the European Bank for Reconstruction and Development, investments in digital infrastructure in countries like Poland and Romania grew by 25% in 2022, creating a conducive environment for EMM adoption.

Integration with Artificial Intelligence and Machine Learning

The integration of AI and ML into EMM solutions offers immense potential for innovation. According to the European Innovation Council, over 70% of new EMM products launched in 2022 incorporated AI-driven analytics for predictive threat detection and automated device management.

MARKET CHALLENGES

Rapidly Evolving Cybersecurity Threats

The rapid evolution of cybersecurity threats poses a significant challenge for EMM providers. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks targeting mobile devices increased by 35% in 2022, necessitating continuous updates and enhancements to EMM solutions.

Regulatory Fragmentation Across Countries

Regulatory fragmentation across European countries complicates compliance efforts. According to the European Commission, variations in national data protection laws create operational hurdles for multinational enterprises deploying EMM solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.22% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Citrix Systems, Inc., IBM Corporation, Microsoft Corporation, BlackBerry Limited, and AirWatch (Vmware Inc.). |

SEGMENTAL ANALYSIS

By Type Insights

The solutions segment accounted for the major share of 66.2% of the European enterprise mobility management market in 2024. According to the European Telecommunications Standards Institute (ETSI), this leadership is driven by the growing demand for mobile device management (MDM) and mobile application management (MAM) tools. These solutions are critical for enterprises seeking to secure and manage mobile devices, applications, and data in a rapidly evolving digital landscape. Features such as remote wipe, app whitelisting, and secure containerization make these solutions indispensable for industries like IT, healthcare, and BFSI. The scalability and flexibility of EMM solutions further enhance their appeal, ensuring their position as the largest segment in the market.

The services segment is predicted to register a CAGR of 18.8% over the forecast period. According to Eurostat, managed services such as consulting, implementation, and support are gaining traction as organizations increasingly seek end-to-end mobility solutions. Enterprises are outsourcing EMM-related tasks to third-party providers to reduce operational burdens and ensure compliance with stringent regulations like GDPR. This trend is particularly prominent in sectors like healthcare and retail, where specialized expertise is required to manage complex mobility ecosystems.

By End User Insights

The IT and telecom segment had 36.3% of the European market share in 2024. The growth of the IT and telecom segment in the European market is attributed to the sector’s reliance on mobile technologies and the need for secure data management. With the proliferation of IoT devices and cloud-based applications, IT and telecom companies are investing heavily in EMM solutions to protect sensitive information and ensure seamless operations. The sector’s proactive adoption of digital transformation initiatives further solidifies its leadership in the EMM market.

The healthcare segment is predicted to grow at a CAGR of 20.8% over the forecast period owing to the adoption of telemedicine and remote patient monitoring is driving demand for EMM solutions in this sector. Healthcare providers require secure platforms to manage patient data and ensure compliance with regulations like GDPR. The increasing use of mobile devices for diagnostics and treatment planning has created a pressing need for robust EMM tools, making healthcare a key growth driver in the coming years.

REGIONAL ANALYSIS

Western Europe accounts for the major share of the European enterprise mobility management market. This dominance of Western Europe in the overall European market is driven by advanced infrastructure, high disposable incomes, and stringent regulatory frameworks that prioritize data security. Countries like Germany, the UK, and France are at the forefront of adopting EMM solutions, leveraging their technological expertise to maintain leadership. Eastern Europe is the fastest-growing region. According to the European Bank for Reconstruction and Development, this growth is supported by government incentives, rising digital transformation initiatives, and increasing investments in IT infrastructure. Countries like Poland and Romania are emerging as key players, offering affordable yet high-quality EMM services to attract multinational enterprises.

KEY MARKET PLAYERS

The major players in the European enterprise mobility management market include Citrix Systems, Inc., IBM Corporation, Microsoft Corporation, BlackBerry Limited, and AirWatch (Vmware Inc.).

TOP 3 PLAYERS IN THE MARKET

VMware, IBM, and Microsoft dominate the Europe EMM market, collectively contributing to major share of the European market. VMware focuses on providing scalable MDM and MAM solutions, catering to enterprises seeking secure mobility management. IBM emphasizes AI-driven analytics and automation, enabling predictive threat detection and enhanced device management. Microsoft integrates EMM capabilities into its Azure ecosystem, offering seamless compatibility with its suite of productivity tools. These players leverage their technological expertise and strategic partnerships to maintain their leadership positions in the competitive EMM landscape

KEY STRATEGIES USED BY THE MARKET PARTICIPANTS

To strengthen their market positions, key players in the Europe EMM market employ several strategic approaches. Partnerships and collaborations are a primary focus, with VMware working closely with EU governments to promote secure mobility solutions. According to the European Innovation Council, IBM invests heavily in R&D, particularly in AI-driven innovations that enhance threat detection and response capabilities. Microsoft, on the other hand, focuses on expanding its cloud ecosystem, integrating EMM functionalities into its Azure platform to provide end-to-end solutions. Additionally, these players emphasize mergers and acquisitions to expand their service portfolios and geographic reach. For instance, IBM acquired a leading cybersecurity firm in 2022 to bolster its EMM offerings. These strategies not only drive innovation but also ensure sustained growth and customer loyalty in a rapidly evolving market.

MARKET SEGMENTATION

This research report on the Europe enterprise mobility management market is segmented and sub-segmented into the following categories.

By Type

- Solutions

- Services

By End User

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Retail

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Enterprise Mobility Management (EMM) market?

The growth of the Europe EMM market is driven by the increasing adoption of remote work, the rising use of mobile devices for business operations, strict data protection regulations like GDPR, and the growing need for secure access to enterprise applications.

Which industries are the largest adopters of EMM solutions in Europe?

The largest adopters of EMM solutions in Europe include IT & telecom, healthcare, BFSI (banking, financial services, and insurance), manufacturing, and retail, as these industries require secure mobile device management and data protection.

What role does Artificial Intelligence (AI) play in EMM solutions?

AI enhances EMM solutions by automating threat detection, improving predictive security analytics, enabling intelligent automation for device management, and enhancing user authentication through behavioral biometrics.

How is the shift to hybrid work models affecting the demand for EMM solutions?

The shift to hybrid work models has increased the need for EMM solutions to ensure secure remote access, protect corporate data on personal devices, and manage diverse endpoint security risks across different locations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]