Europe Energy Storage Market Research Report – Segmented By Type (Batteries segment, Thermal energy storage (TES) segment ) Application ( industrial , residential ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Energy Storage Market Size

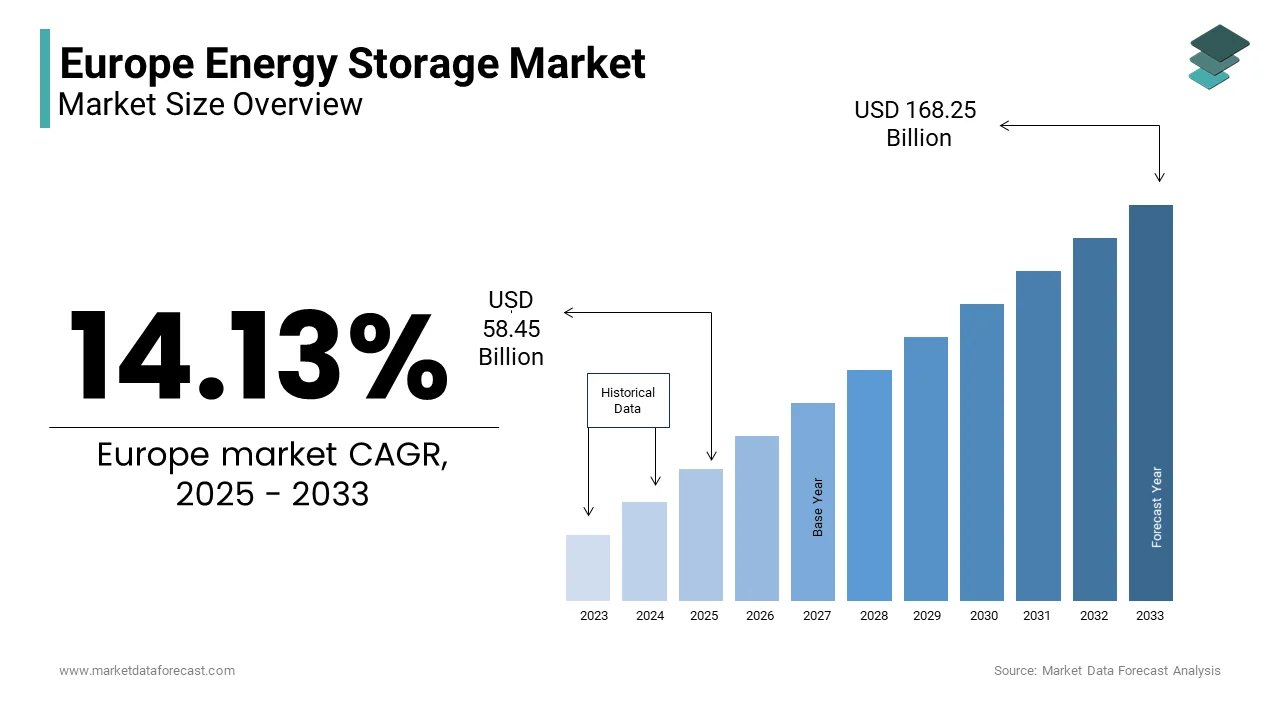

The Europe Energy Storage Market Size was valued at USD 51.21 billion in 2024. The Europe Energy Storage Market size is expected to have 14.13 % CAGR from 2025 to 2033 and be worth USD 168.25 billion by 2033 from USD 58.45 billion in 2025.

The Europe energy storage market is witnessing remarkable growth, driven by a combination of policy frameworks, technological advancements, and increasing renewable energy integration. As per a study by the European Association for Storage of Energy (EASE), the cumulative installed energy storage capacity in Europe exceeded 5 GW in 2023, with projections indicating a surge to over 20 GW by 2030. This growth is fueled by ambitious climate goals set by the European Union, including the target to achieve carbon neutrality by 2050. Germany leads the region with a significant share of installations, followed by the UK and Italy, according to data from BloombergNEF. The market's robustness is further underscored by substantial investments in grid modernization and decentralized energy systems. A notable trend is the growing adoption of lithium-ion batteries, which accounted for nearly 70% of new installations in 2022, as stated by Wood Mackenzie. Additionally, regulatory incentives and subsidies have played a pivotal role in fostering market expansion by making Europe a global leader in energy storage innovation.

MARKET DRIVERS

Integration of Renewable Energy Sources

The escalating deployment of renewable energy sources such as wind and solar is a primary driver propelling the Europe energy storage market. According to the International Energy Agency (IEA), renewable energy accounted for 40% of the EU’s electricity generation in 2022, with intermittent power generation necessitating robust storage solutions. Energy storage systems mitigate the variability of renewables by storing excess energy during peak production and releasing it during periods of high demand. For instance, Germany's renewable energy penetration reached 46% in 2022, creating a pressing need for advanced storage technologies. As per a report by Fraunhofer ISE, battery storage installations in Germany alone grew by 30% year-on-year in 2022 by reaching a cumulative capacity of 2.3 GWh. The surge in residential solar-plus-storage systems, supported by favorable feed-in tariffs and tax incentives, further amplifies this trend. The demand for storage solutions is expected to grow exponentially with the EU aiming for 42.5% renewable energy by 2030.

Policy Support and Regulatory Frameworks

Government policies and regulatory frameworks are instrumental in driving the Europe energy storage market. The European Commission’s REPowerEU plan emphasizes accelerating energy storage deployment to enhance grid resilience and reduce dependence on fossil fuels. According to Eurostat, public funding for energy storage projects increased by 25% in 2022, reflecting heightened governmental commitment. For example, the UK introduced the Smart Export Guarantee (SEG) scheme, incentivizing households to install energy storage systems. Similarly, France’s Multiannual Energy Program allocates €9 billion for energy storage initiatives through 2028, as stated by the French Ministry of Ecological Transition. These policies not only stimulate demand but also attract private investments, fostering innovation and cost reductions. The declining costs of lithium-ion batteries, which fell by 89% between 2010 and 2022 as per BloombergNEF.

MARKET RESTRAINTS

High Initial Investment Costs

One of the most significant barriers to the widespread adoption of energy storage systems in Europe is the high upfront investment required. According to a study by the European Investment Bank, the initial capital expenditure for deploying large-scale battery storage systems can range from €500 to €1,000 per kWh by depending on the technology and scale. This financial burden often deters small and medium enterprises (SMEs) and residential consumers from adopting energy storage solutions, despite long-term savings. For instance, in Spain, where energy storage adoption remains relatively low, less than 5% of households have installed solar-plus-storage systems, as per data from the Spanish Photovoltaic Union. Although financing mechanisms such as green loans and subsidies exist, they are often insufficient to offset the initial costs. Moreover, the lack of standardized pricing models across Europe exacerbates the issue is making it challenging for consumers to compare options and make informed decisions.

Limited Grid Infrastructure Compatibility

Another critical restraint is the limited compatibility of existing grid infrastructure with advanced energy storage technologies. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), approximately 40% of Europe’s grid infrastructure requires upgrades to accommodate large-scale energy storage systems. Aging transmission networks in Eastern European countries like Poland and Romania, pose significant challenges to integrating storage solutions seamlessly. For example, according to 2022 report by the Polish Energy Regulatory Office, only 10% of the country’s grid is equipped to handle bidirectional energy flows, which are essential for effective storage utilization. Furthermore, the absence of standardized interconnection protocols across member states creates additional barriers. These infrastructural limitations not only hinder the scalability of energy storage projects but also increase operational complexities and also hinders the market growth.

MARKET OPPORTUNITIES

Electrification of Transport and Vehicle-to-Grid (V2G) Systems

The rapid electrification of transport presents a significant opportunity for the Europe energy storage market through the development of vehicle-to-grid (V2G) systems. According to the European Automobile Manufacturers' Association (ACEA), electric vehicle (EV) sales in Europe surged by 40% in 2022, reaching 2.6 million units. These EVs, equipped with advanced battery systems, can serve as decentralized energy storage units, feeding electricity back into the grid during peak demand. A pilot project conducted by Nissan and E.ON in the UK demonstrated that V2G systems could reduce household energy costs by up to 60%, as reported by the UK Department for Business, Energy & Industrial Strategy. The EU’s Alternative Fuels Infrastructure Regulation mandates the installation of 1.3 million public charging points by 2025 by creating a fertile ground for V2G integration. With EV adoption projected to reach 50% of all new car sales by 2030 and the potential for energy storage through V2G systems is immense.

Emergence of Green Hydrogen Storage

Green hydrogen is emerging as a transformative opportunity for the Europe energy storage market, particularly for long-duration storage needs. According to the European Clean Hydrogen Alliance, green hydrogen production capacity in Europe is expected to reach 40 GW by 2030 owing to the investments exceeding €100 billion. Countries like Germany and France are at the forefront, with Germany allocating €9 billion for hydrogen projects under its National Hydrogen Strategy. A study by the German Energy Agency (dena) revealed that hydrogen-based storage could account for 20% of Europe’s energy storage capacity by 2040. This technology addresses the limitations of lithium-ion batteries in storing energy for extended periods, making it ideal for stabilizing grids during prolonged renewable energy shortages. Furthermore, the EU’s Hydrogen Strategy aims to establish a robust hydrogen infrastructure is fostering collaboration between public and private stakeholders to accelerate market growth.

MARKET CHALLENGES

Supply Chain Vulnerabilities

Supply chain vulnerabilities pose a significant challenge to the Europe energy storage market due to the concerning critical raw materials like lithium, cobalt, and nickel. According to the European Raw Materials Alliance (ERMA), Europe imports over 90% of its lithium and 60% of its cobalt is making the market highly dependent on external suppliers. Geopolitical tensions and trade restrictions further exacerbate this dependency, as seen in China’s dominance of the global lithium-ion battery supply chain. According to a report by the International Energy Agency (IEA), disruptions in raw material supply could lead to a 10-15% increase in battery costs by 2025. Additionally, environmental concerns surrounding mining practices have sparked regulatory scrutiny is delaying project timelines. For instance, lithium mining projects in Portugal faced significant opposition from local communities, as per data from the Portuguese Environmental Agency. These supply chain risks threaten the scalability and sustainability of energy storage deployments across Europe.

Public Awareness and Consumer Engagement

Low public awareness and consumer engagement represent another formidable challenge for the Europe energy storage market. Despite the availability of innovative storage solutions, many consumers remain uninformed about their benefits and applications. According to a survey conducted by the European Consumer Organisation (BEUC), only 25% of European households are aware of energy storage technologies, with even fewer understanding their economic and environmental advantages. In countries like Italy and Spain, where energy literacy is relatively low, adoption rates lag behind regional averages. A study by the University of Cambridge underscores that lack of awareness contributes to skepticism about upfront costs and perceived risks, deterring potential adopters. Furthermore, inconsistent marketing efforts by industry players fail to address misconceptions effectively. Bridging this knowledge gap requires targeted educational campaigns and transparent communication strategies to build trust and encourage broader participation in the energy transition.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.13 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

BYD Co. Ltd.,CMBlu Energy AG,Contemporary Amperex Technology Co. Ltd.,Deutsche Telekom AG |

SEGMENT ANALYSIS

By Type Insights

The batteries segment was the largest and held 60.1% of the Europe energy storage market share in 2024. The widespread adoption of lithium-ion batteries, which offer high energy density, efficiency, and scalability is escalating the growth of the market. According to Wood Mackenzie, the declining costs of lithium-ion batteries, which fell by 89% between 2010 and 2022, have significantly enhanced their affordability. Additionally, the proliferation of residential solar-plus-storage systems is supported by feed-in tariffs that has further solidified batteries’ dominance. The EU’s Battery Regulation, which mandates sustainable sourcing and recycling, ensures long-term market stability by fostering innovation and reducing environmental impacts.

The Thermal energy storage (TES) segment is likely to gain huge traction with an estimated CAGR of 12.5% from 2025 to 2033. This growth is fueled by rising demand for efficient heating and cooling solutions in commercial and industrial sectors. TES systems store thermal energy in materials like molten salt or phase-change materials by enabling energy release during peak demand. Denmark exemplifies this trend, with TES installations increasing by 20% annually since 2020, as per the Danish Energy Agency. The EU’s Energy Efficiency Directive, which mandates a 9% reduction in energy consumption by 2030, further accelerates TES adoption. Additionally, advancements in heat pump technologies have enhanced TES efficiency by making it a cost-effective solution for decarbonizing heating systems across Europe.

By Application Insights

The industrial sector was the largest segment in the Europe energy storage market by accounting for 45.3% of share in 2024. This dominance arises from the sector’s high energy consumption and reliance on uninterrupted power supply. Germany and France lead industrial energy storage adoption, driven by stringent regulations mandating energy efficiency improvements. For instance, the French government’s Industrie du Futur initiative allocates €5 billion for industrial decarbonization projects, including energy storage. According to McKinsey, industrial facilities leveraging energy storage systems achieved a 20% reduction in energy costs in 2022. The proliferation of microgrids and on-site storage solutions further supports industrial applications is ensuring reliable energy access while reducing carbon footprints.

The residential segment is experiencing to witness a fastest CAGR of 15.3% in the next coming years. This surge is driven by increasing rooftop solar installations and rising electricity prices, which motivate homeowners to adopt storage solutions. In 2022, residential solar-plus-storage systems in Germany grew by 45%, supported by subsidies like the EEG surcharge exemption. According to the European Solar Thermal Industry Federation, the average payback period for residential storage systems has decreased to five years, enhancing their appeal. Additionally, smart home technologies and IoT-enabled energy management systems have simplified energy usage monitoring, boosting consumer confidence. As households seek greater energy independence, the residential segment is poised to become a cornerstone of the European energy transition.

Country Level Analysis

Germany was the largest contributor for the Europe energy storage market by accounting for 25.6% of share in 2024 owing to its robust renewable energy framework and proactive policies supporting energy storage. Initiatives like the KfW Development Bank’s subsidy program have spurred residential battery installations, which grew by 30% in 2022. Germany’s National Hydrogen Strategy further bolsters its dominance by promoting green hydrogen storage, with investments exceeding €9 billion.

The UK energy storage market is likely to gain huge traction with an expected CAGR of 7.6% during the forecast period. Its prominence is driven by ambitious targets to decarbonize the power sector by 2035. The Smart Export Guarantee (SEG) scheme has incentivized residential and commercial energy storage adoption, with battery installations increasing by 25% annually since 2020. Offshore wind farms, which accounted for 13% of the UK’s electricity generation in 2022, rely heavily on storage systems to stabilize grid operations. Additionally, the UK’s Hydrogen Strategy aims to deploy 5 GW of low-carbon hydrogen production by 2030.

France is likely to gain huge opportunities in next coming years. The country’s nuclear-heavy energy mix is gradually incorporating renewables is necessitating advanced storage solutions. The Multiannual Energy Program allocates €9 billion for energy storage initiatives through 2028 by fostering innovation and adoption. Thermal energy storage systems in district heating networks, have gained traction, with installations growing by 15% annually. France’s commitment to reducing greenhouse gas emissions by 55% by 2030 reinforces the importance of energy storage in its energy transition strategy.

Italy is likely to have a significant growth in next coming years. The country’s abundant solar resources have propelled residential solar-plus-storage systems, with installations increasing by 40% in 2022. Feed-in tariff schemes and tax incentives have further stimulated adoption in regions like Lombardy and Veneto. Italy’s National Energy and Climate Plan aims to achieve 55% renewable energy by 2030 with the pivotal role of energy storage in meeting these targets.

Spain energy storage market is growing steadly throughout the forecast period. The country’s favorable climatic conditions have fostered rapid solar energy growth is driving demand for storage solutions. In 2022, Spain installed 7.5 GW of renewable capacity, with energy storage playing a critical role in grid stabilization. The Spanish government’s Recovery and Resilience Plan allocates €13.2 billion for renewable energy and storage projects by ensuring sustained market growth. Spain’s goal to achieve 74% renewable electricity by 2030.

Top 3 Players in the market

Tesla

Tesla has established itself as a pioneer in the Europe energy storage market through its innovative Powerwall and Megapack solutions. The company leverages its expertise in lithium-ion battery technology to deliver scalable storage systems for residential, commercial, and utility applications. Tesla’s Gigafactory in Berlin plays a crucial role in meeting regional demand, ensuring localized production and reduced costs. By collaborating with European utilities, Tesla has facilitated grid-scale storage projects by enhancing grid resilience and renewable energy integration.

Siemens

Siemens contributes significantly to the Europe energy storage market by offering integrated energy management solutions. Its portfolio includes advanced battery systems and digital platforms for optimizing energy storage operations. Siemens collaborates with governments and private entities to develop microgrid and industrial storage projects, aligning with Europe’s sustainability goals. The company’s focus on research and development ensures continuous innovation by addressing evolving market needs and regulatory requirements.

Fluence

Fluence, a joint venture between Siemens and AES, specializes in grid-scale energy storage solutions, catering to the unique demands of the European market. Its AI-driven software optimizes energy storage performance, ensuring maximum efficiency and reliability. Fluence has executed numerous projects across Europe, including the UK and Germany, supporting renewable energy integration and grid modernization. The company’s commitment to sustainability and technological advancement positions it as a key player in driving Europe’s energy transition.

Top strategies used by the key market participants

Strategic Partnerships and Collaborations

Key players in the Europe energy storage market actively engage in strategic partnerships to enhance their market presence. For instance, Tesla collaborates with European utilities to deploy large-scale battery storage systems by ensuring seamless integration with renewable energy sources. These partnerships enable companies to leverage complementary strengths, access new markets, and co-develop innovative solutions tailored to regional needs.

Investments in R&D and Innovation

Investments in research and development are pivotal for maintaining a competitive edge in the Europe energy storage market. Companies like Siemens allocate substantial resources to developing cutting-edge technologies, such as AI-driven energy management systems. These innovations not only improve system efficiency but also address regulatory and environmental challenges by fostering long-term market growth.

Expansion of Manufacturing Facilities

Expanding manufacturing capabilities is another key strategy adopted by market leaders. For example, Tesla’s Gigafactory in Berlin enhances localized production, reducing logistical costs and lead times. The companies ensure timely delivery of products by meeting the growing demand for energy storage solutions across Europe.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Energy Storage Market are BYD Co. Ltd.,CMBlu Energy AG,Contemporary Amperex Technology Co. Ltd.,Deutsche Telekom AG,Enel SPA,Fluence Energy LLC,GS Yuasa International Ltd.,Iberdrola SA,Innovo Renewables S.p.a.,Invinity Energy Systems plc,LG Energy Solution Ltd.

The Europe energy storage market is characterized by intense competition is driven by the presence of both established players and emerging startups. Tesla, Siemens, and Fluence dominate the landscape by leveraging their technological expertise and extensive portfolios to capture significant market shares. However, the market also witnesses the entry of niche players specializing in innovative solutions like green hydrogen storage and thermal energy systems. According to a report by the European Association for Storage of Energy (EASE), the market’s competitive dynamics are shaped by factors such as technological advancements, regulatory compliance, and cost competitiveness. Companies are increasingly focusing on differentiation through value-added services, such as predictive maintenance and energy optimization platforms. Collaborative efforts, including joint ventures and consortiums, further intensify competition, as players strive to expand their reach and influence. The EU’s stringent sustainability mandates and ambitious climate goals create a level playing field by encouraging innovation and fostering healthy rivalry among participants.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Tesla announced a partnership with Enel, Italy’s largest utility, to deploy 1 GWh of battery storage systems across Europe, enhancing grid stability and renewable energy integration.

- In June 2023, Siemens launched its AI-driven energy management platform, GridIQ, aimed at optimizing energy storage operations for industrial clients in Germany and France.

- In February 2024, Fluence completed the acquisition of Advanced Microgrid Solutions, expanding its portfolio of grid-scale storage solutions and strengthening its presence in the UK.

- In September 2023, Northvolt secured €2.5 billion in funding from the European Investment Bank to expand its battery production facilities in Sweden by targeting the residential storage market.

- In November 2023, ENGIE partnered with Storengy to develop a 100 MW green hydrogen storage project in France by aligning with the EU’s hydrogen strategy and decarbonization goals.

MARKET SEGMENTATION

This research report on the Europe Energy Storage Market has been segmented and sub-segmented into the following categories.

By Type

- Batteries segment

- Thermal energy storage (TES) segment

By Application

- industrial

- residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is driving the growth of the energy storage market in Europe?

The key drivers include increasing renewable energy adoption, government policies and incentives, advancements in battery technology, and the need for grid stability.

What are the main types of energy storage technologies used in Europe?

The primary technologies include lithium-ion batteries, pumped hydro storage, flow batteries, compressed air energy storage (CAES), and thermal energy storage.

Which European countries are leading in energy storage deployment?

Germany, the UK, France, Spain, and Italy are among the leaders due to their strong renewable energy policies and investments in grid modernization.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]