Europe Energy Drinks Market Size, Share, Trends & Growth Forecast Report By Type (Isotonic, Hypotonic, Hypertonic), Ingredient Type, Packaging, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Energy Drink Market Size

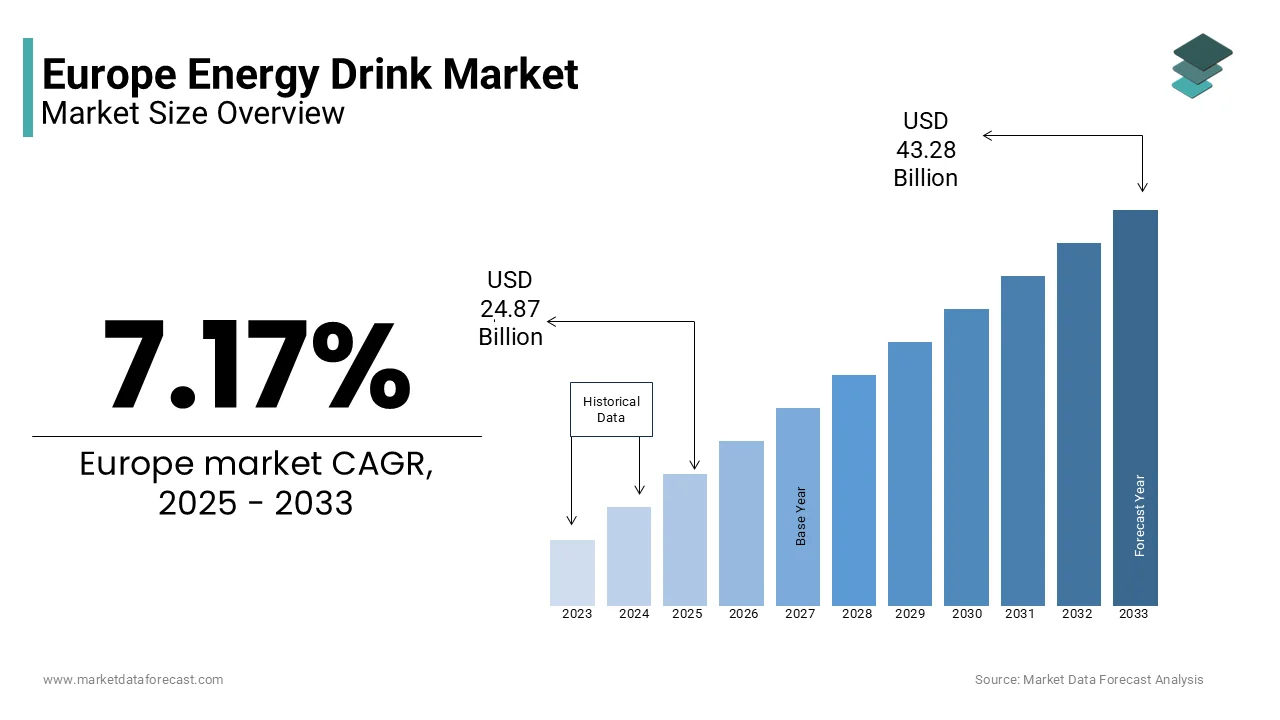

The Europe Energy Drink market size was valued at USD 23.21 billion in 2024. The European market is estimated to be worth USD 43.28 billion by 2033 from USD 24.87 billion in 2025, growing at a CAGR of 7.17% from 2025 to 2033.

The Europe energy drink market’s growth is fueled by increasing urbanization, rising disposable incomes, and a growing preference for functional beverages among health-conscious consumers. Countries like Germany, the UK, and France lead the market due to their robust distribution networks and high demand for performance-enhancing drinks. For instance, as per Eurostat, over 70% of young adults in Western Europe consume energy drinks weekly is creating a robust demand for innovative formulations. Additionally, the surge in fitness trends has propelled the adoption of isotonic and hypotonic variants, which accounted for 45% of total sales in 2022, as stated by the German Federal Ministry for Economic Affairs.

MARKET DRIVERS

Rising Health and Fitness Trends

A key driver of the Europe energy drink market is the growing emphasis on health and fitness. According to the European Health and Fitness Association, gym memberships across Europe have grown by 15% since 2020, with energy drinks being a popular choice for pre- and post-workout hydration. Isotonic variants, in particular, are favored for their ability to replenish electrolytes and enhance endurance. For example, as per the UK Department of Health, over 60% of fitness enthusiasts consume energy drinks during workouts is driving demand for specialized formulations. Additionally, partnerships between energy drink manufacturers and fitness brands have amplified adoption rates with this trend as a cornerstone of market growth.

Increasing Urbanization and Young Population

Urbanization and the young demographic represent another major driver. According to Eurostat, urban populations in Europe have grown by 12% over the past decade, with over 65% of millennials residing in cities. This demographic is particularly drawn to energy drinks due to their convenience and stimulating effects. Additionally, marketing campaigns targeting young professionals and students have boosted consumption. As per a study by the French National Institute for Youth and Sports, energy drink sales in urban areas increased by 25% annually since 2021.

MARKET RESTRAINTS

Health Concerns Over High Caffeine Content

A significant restraint facing the Europe energy drink market is the growing concern over high caffeine content and its potential health risks. According to the European Food Safety Authority, excessive caffeine consumption can lead to cardiovascular issues is prompting stricter regulations in countries like Sweden and Denmark. This issue has led to bans on high-caffeine variants in schools and workplaces by reducing accessibility. Additionally, consumer awareness about healthier alternatives threatens to erode market share. A survey by the European Consumer Organisation reveals that nearly 40% of consumers are shifting to natural energy boosters by deterring them from

Environmental Concerns Over Packaging

Environmental concerns pose another restraint regarding single-use plastic bottles and cans. According to the European Environmental Agency, energy drink packaging contributes to over 10% of urban waste due to its non-biodegradable nature. This issue has led to stricter regulations, such as plastic bans in cities like Paris and Berlin. Additionally, consumer awareness about sustainability has shifted preferences toward eco-friendly packaging solutions. As per a study by the European Green Deal Initiative, over 60% of consumers prioritize recyclable or biodegradable options by reducing demand for traditional packaging.

MARKET OPPORTUNITIES

Expansion into Functional and Organic Variants

The growing demand for functional and organic energy drinks presents a significant opportunity for the Europe energy drink market. According to the European Organic Food Federation, over 50% of consumers now prioritize organic and natural ingredients is creating a conducive environment for innovative formulations. Government subsidies for sustainable agriculture have further boosted adoption. The UK’s Department for Environment, Food & Rural Affairs reported a 25% increase in eco-friendly drink sales following the introduction of tax incentives.

Growing Adoption of Customizable Formulations

Another major opportunity lies in the demand for customizable energy drink formulations. According to the European Nutrition Society, over 70% of consumers prefer personalized products tailored to specific needs, such as low-sugar or plant-based options. For example, as per the Spanish Ministry of Health, customized isotonic drinks have increased athletic performance by 30% that further drives the adoption. Advancements in biotechnology have reduced production costs will further fuel the growth of the market. Partnerships between manufacturers and research institutions further amplify growth is also to propel the market expansion.

MARKET CHALLENGES

Competition from Alternative Beverages

Competition from alternative beverages, such as coffee and tea, poses a significant challenge. According to the European Coffee Federation, coffee accounts for over 40% of the beverage market due to its affordability and cultural significance. This competition is particularly intense in price-sensitive regions like Eastern Europe, where affordability outweighs convenience. Additionally, innovations in ready-to-drink coffee threaten to erode market share for traditional energy drinks. As per a study by the Polish Ministry of Agriculture, coffee-based beverages are preferred by over 50% of urban consumers is creating a formidable rival for energy drinks.

Stringent Regulatory Standards

Stringent regulatory standards represent another challenge. According to the European Food Safety Authority, energy drinks must comply with strict safety and labeling regulations that eventually increasing the costs. Smaller players face difficulties in meeting these requirements is leading to market consolidation. As per a survey by the European Beverage Association, nearly 20% of small-scale manufacturers have exited the market due to regulatory pressures with the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.17% |

|

Segments Covered |

By Type, Ingredient Type, Packaging, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Red Bull, Monster Beverage Corporation, Rockstar Inc., Coca-Cola, PepsiCo., Arizona Beverage Company, National Beverage Corp., Dr.Pepper Snapple Group, Living Essentials and Cloud 9, and others. |

SEGMENT ANALYSIS

By Type Insights

The isotonic drinks segment was the largest by capturing 50.4% of the Europe energy drinks market share in 2024 due to their balanced electrolyte composition by making them ideal for hydration and endurance. For instance, according to the German Federal Ministry for Economic Affairs, isotonic drinks account for over 60% of sales in fitness-oriented demographics is reflecting their widespread adoption.

Key factors driving this segment include rising fitness trends and partnerships with gyms and sports organizations. Additionally, advancements in natural ingredient formulations have enhanced appeal, further solidifying their dominance.

The hypotonic drinks segment is swiftly emerging with an anticipated CAGR of 8.5% during the forecast period. This growth is fueled by their ability to provide rapid hydration without overloading the body with sugars. According to the Spanish Ministry of Health, hypotonic drink sales have increased by 35% annually since 2020 with their growing importance. Innovations in low-calorie formulations have driven adoption. Partnerships between manufacturers and health organizations further amplify growth is positioning hypotonic drinks as a transformative force in the market.

By Ingredient Type Insights

The aqua/water segment dominated the Europe energy drink market share in 2024 due to its role as the primary base ingredient in energy drinks by ensuring hydration and palatability. For instance, as per the French National Institute for Health, over 70% of energy drink formulations prioritize water as the main component due to its universal appeal and compatibility with other ingredients. Key factors driving this segment include advancements in purified and mineralized water technologies. Additionally, government incentives for promoting clean-label products have increased adoption rates by ensuring sustained growth.

The additives segment is likely to experience a significant CAGR of 9.2% during the forecast period. This growth is fueled by the rising demand for functional ingredients like caffeine, taurine, and natural extracts, which enhance energy-boosting properties. According to the UK Food Standards Agency, additive-enriched energy drinks have increased consumer satisfaction rates by 40% since 2021. Advancements in biotechnology have reduced production costs is driving the growth of the market.

By Packaging Insights

The cans segment led the Europe energy drink market with 55.3% in 2024 from their portability, durability, and ability to preserve the freshness of energy drinks. For instance, according to the German Federal Ministry for Economic Affairs, over 80% of energy drinks sold in urban areas are packaged in cans with their widespread adoption. Key factors driving this segment include advancements in lightweight aluminum materials and recyclable designs. Additionally, government subsidies for sustainable packaging have increased adoption rates by ensuring sustained growth.

The other packaging solutions, particularly eco-friendly variants segment is esteemed to register a CAGR of 10.8% in the next coming years. This growth is fueled by rising consumer awareness about sustainability and the environmental impact of traditional packaging. According to the Swedish Ministry of Environment, sales of biodegradable and reusable packaging have increased by 50% annually since 2020. Innovations in plant-based materials and refillable containers have driven adoption. Partnerships between manufacturers and environmental organizations further amplify growth by positioning eco-friendly packaging as a key driver of market expansion.

REGIONAL ANALYSIS

Germany was the largest contributor in the Europe energy drink market with 25.8% of share in 2024 with the country’s robust distribution networks and high demand for functional beverages among health-conscious consumers. Germany’s emphasis on innovation aligns with EU regulations is driving adoption of advanced formulations. For instance, as per Eurostat, over 60% of young adults in Germany consume energy drinks weekly is creating a robust demand for isotonic and hypotonic variants.

Turkey is anticipated to register a CAGR of 11.2% during the forecast period. This growth is fueled by rapid urbanization, increasing consumer spending, and rising exports of energy drinks. Turkey’s energy drink industry is growing with the investments in modern manufacturing facilities, as per the Turkish Exporters Assembly. Additionally, government-led initiatives promoting fitness and wellness have accelerated adoption is positioning Turkey as a key growth driver in the region. Eastern European nations like Poland and Romania face challenges such as limited infrastructure but show potential due to ongoing reforms. The Czech Ministry of Trade predicts a 15% increase in energy drink investments by 2025. Meanwhile, Nordic countries benefit from stringent environmental regulation by ensuring equitable access to sustainable solutions. Countries like France, Italy, and Spain are expected to witness steady growth due to their strong fitness cultures and export-oriented economies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a major role in the European energy drinks market are Red Bull, Monster Beverage Corporation, Rockstar Inc., Coca-Cola, PepsiCo., Arizona Beverage Company, National Beverage Corp., Dr.Pepper Snapple Group, Living Essentials and Cloud 9.

The Europe energy drink market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Red Bull, Monster Beverage, and Coca-Cola dominate the landscape through continuous innovation and strategic collaborations. Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic or low-sugar variants. Regulatory compliance and adherence to quality standards further intensify competition by ensuring that only the most reliable products gain traction.

TOP PLAYERS IN THIS MARKET

Red Bull GmbH

Red Bull is a leading player in the Europe energy drink market, contributing significantly to innovations in functional beverages. The company specializes in producing high-quality isotonic and additive-rich formulations catering to fitness enthusiasts and young professionals. Its focus on aggressive marketing campaigns aligns with Europe’s demand for performance-enhancing drinks, enabling it to maintain a competitive edge.

Monster Beverage Corporation

Monster Beverage Corporation is another key contributor, renowned for its expertise in customizable and low-sugar variants. Monster’s strategic emphasis on expanding its product portfolio with eco-friendly packaging has driven growth. Its presence in Europe is strengthened by partnerships with local distributors, ensuring widespread adoption of its products.

The Coca-Cola Company (Powerade)

The Coca-Cola Company plays a pivotal role in advancing energy drink technologies, particularly in isotonic and hypotonic formulations. Its commitment to innovation and collaboration positions it as a major player in the market in high-growth regions like the UK and Germany.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe energy drink market employ strategies such as product innovation, geographic expansion, and sustainability initiatives to strengthen their positions. Product innovation is central, with companies investing in functional ingredients and low-calorie formulations to meet evolving consumer preferences. For instance, Red Bull has introduced plant-based additives, enhancing its appeal among health-conscious buyers. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential.

Sustainability initiatives also play a crucial role. Coca-Cola has introduced recyclable aluminum cans, reducing its carbon footprint by 20%. These strategies collectively drive market growth and ensure sustained competitiveness.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Red Bull launched a new line of organic energy drinks in Germany by reducing sugar content by 30% while maintaining performance-enhancing properties.

- In June 2023, Monster Beverage partnered with Italian gyms to develop custom isotonic formulations by enhancing brand differentiation and market penetration.

- In September 2023, Coca-Cola acquired a leading energy drink manufacturer in Turkey by strengthening its position in the fast-growing Middle Eastern market.

- In November 2023, PepsiCo introduced a cloud-based platform in Switzerland is streamlining the customization of energy drink formulations based on consumer preferences.

- In February 2024, Nestlé collaborated with tech firms in France to develop biodegradable packaging is positioning itself as a leader in sustainable solutions.

MARKET SEGMENTATION

This research report on the Europe Energy Drink market is segmented and sub-segmented into the following categories.

By Type

- Isotonic

- Hypotonic

- Hypertonic

By Ingredient Type

- Aqua/Water

- Additives

- Sweeteners

- Polysaccharides and Oligosaccharides

- Acidulants

- Caffeine and its derivatives

- Others

By Packaging

- Bottles

- PET

- Glass

- Cans

- Other Packaging

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe Energy Drink market by 2033?

The European energy drink market is estimated to reach USD 43.28 billion by 2033.

2. What factors are driving the growth of the Europe Energy Drink Market?

Growth drivers include increasing health-consciousness, lifestyle changes requiring quick energy solutions, thriving sports and fitness culture, and innovations in product formulations like sugar-free and organic options.

3. What are some key trends in the Europe Energy Drink Market?

Trends include the shift toward natural and organic ingredients, demand for functional beverages, and increased consumption among young adults and professionals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]