Europe Endpoint Security Market Size, Share, Trends, & Growth Forecast Report Segmented By Solution (Antivirus, Antispyware, Antimalware, Firewall, Endpoint Device Control, Intrusion Prevention, and Endpoint Application Control), Services, Deployment, and Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Endpoint Security Market Size

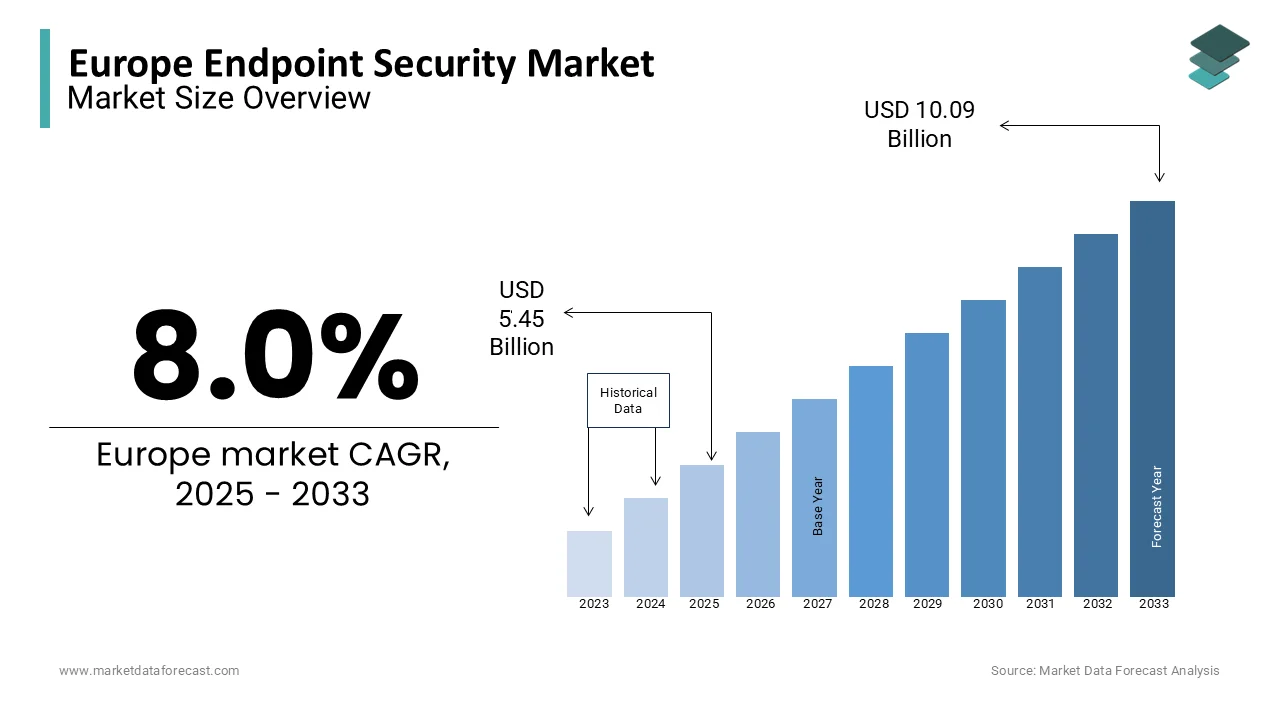

The Europe endpoint security market was worth USD 5.05 billion in 2024. The European market is estimated to reach USD 10.09 billion by 2033 from USD 5.45 billion in 2025, rising with a CAGR of 8.0% from 2025 to 2033.

The Europe endpoint security market is a critical segment within the broader cybersecurity landscape, reflecting the region's commitment to addressing digital threats. The market growth is hold up by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR), which mandates robust data protection measures. According to Eurostat, over 60% of European enterprises have implemented advanced cybersecurity solutions showcasing the widespread adoption of endpoint security tools.

Europe’s market conditions are shaped by its diverse economic landscape, with Western Europe leading in technological adoption while Eastern Europe shows significant potential for expansion. The proliferation of remote work models during the pandemic has further fueled demand, with Gartner estimating that 74% of organizations plan to permanently adopt hybrid work policies. In addition, the rise in ransomware attacks across Europe, as reported by ENISA, highlights the urgent need for comprehensive endpoint protection. These factors collectively position Europe as a dynamic and rapidly evolving hub for endpoint security innovations.

MARKET DRIVERS

Increasing Cybersecurity Threats and Sophistication of Attacks

The surge in sophisticated cyberattacks has emerged as a primary driver for the Europe endpoint security market. As per the ENISA, there was a 67% increase in ransomware incidents across Europe in 2022 compared to the previous year, with attackers exploiting vulnerabilities in remote work infrastructure. This alarming trend has compelled organizations to adopt advanced endpoint security solutions capable of detecting and mitigating zero-day exploits and polymorphic malware. A report indicates that financial losses due to cybercrime in Europe exceeded €10 billion annually emphasizing the economic stakes involved. Furthermore, industries like banking and healthcare, which handle sensitive data, are prioritizing endpoint protection to safeguard against breaches. With cybercriminals leveraging artificial intelligence and automation to launch attacks, the demand for adaptive and predictive endpoint security technologies continues to grow, propelling the market forward.

Stringent Regulatory Compliance Requirements

Regulatory compliance remains another pivotal factor driving the adoption of endpoint security solutions in Europe. The implementation of GDPR has mandated organizations to ensure the confidentiality and integrity of personal data, imposing penalties of up to €20 million or 4% of global turnover for non-compliance, as stated by the European Commission. This has led businesses to invest heavily in endpoint security tools that align with these regulations. For instance, a survey conducted by PwC revealed that 85% of European companies have increased their cybersecurity budgets post-GDPR enforcement. Moreover, industry-specific mandates, such as the Network and Information Systems (NIS) Directive, further necessitate robust endpoint defenses. As organizations strive to meet these stringent requirements, the endpoint security market benefits from sustained demand, creating a fertile ground for innovation and expansion.

MARKET RESTRAINTS

High Costs Associated with Advanced Solutions

One of the key restraints hindering the growth of the Europe endpoint security market is the substantial cost associated with deploying cutting-edge solutions. KPMG notes that small and medium-sized enterprises (SMEs) often face budgetary constraints, with nearly 40% citing high costs as a barrier to adopting comprehensive endpoint security systems. Advanced features such as real-time threat detection, behavioral analytics, and AI-driven response mechanisms require significant upfront investment is making them less accessible to smaller organizations. Additionally, ongoing maintenance and subscription fees further strain financial resources. While larger corporations can absorb these expenses, SMEs, which constitute a significant portion of Europe’s business ecosystem are often forced to opt for basic security measures that may not suffice against sophisticated threats. This disparity limits the overall penetration of advanced endpoint security solutions, particularly in economically challenged regions.

Complexity in Integration and Management

Another notable restraint is the complexity involved in integrating endpoint security solutions with existing IT infrastructures. According to a Deloitte study, nearly 35% of European organizations struggle with the interoperability of new security tools, leading to inefficiencies and operational disruptions. The fragmented nature of legacy systems, combined with the rapid pace of technological advancements, creates challenges in seamless deployment. Furthermore, managing multiple endpoint security platforms requires specialized skills, which are in short supply. A report by ISC shows that Europe faces a cybersecurity workforce gap of over 290,000 professionals, exacerbating the issue. Organizations must invest in training and upskilling personnel, adding to their operational burden. This complexity not only deters adoption but also increases the likelihood of misconfigurations, potentially leaving systems vulnerable to attacks.

MARKET OPPORTUNITIES

Adoption of Cloud-Based Endpoint Security Solutions

The shift towards cloud-based endpoint security solutions presents a significant opportunity for the Europe endpoint security market. The Gartne notes that the adoption of cloud-delivered security services is expected to grow by 25% annually driven by their scalability and cost-effectiveness. Cloud-based solutions eliminate the need for extensive on-premise hardware reducing capital expenditure while offering real-time updates and centralized management. This is particularly advantageous for SMEs seeking affordable yet robust security options. Moreover, the increasing reliance on remote work has amplified the demand for cloud-enabled endpoint protection, as it ensures secure access to corporate networks from diverse locations. A survey reveals that over 60% of European organizations are planning to migrate their endpoint security operations to the cloud within the next three years showcasing the vast untapped potential in this segment.

Growing Demand for AI-Driven Endpoint Security

Artificial intelligence (AI) is revolutionizing the endpoint security landscape, creating immense opportunities for innovation and growth. As per McKinsey, AI-powered security tools can enhance threat detection accuracy by up to 90% enabling proactive identification of anomalies and minimizing false positives. In Europe, where cyberattacks are becoming increasingly sophisticated, AI-driven solutions offer a competitive edge by providing predictive analytics and automated responses. The European Commission estimates that AI adoption in cybersecurity could generate an additional €20 billion in annual revenue by 2025. Furthermore, industries such as finance and healthcare are investing heavily in AI-integrated endpoint security to combat targeted attacks. This convergence of AI and endpoint security not only addresses current challenges but also paves the way for next-generation protection mechanisms positioning Europe as a leader in intelligent cybersecurity solutions.

MARKET CHALLENGES

Evolving Nature of Threat Vectors

One of the foremost challenges confronting the Europe endpoint security market is the constantly evolving nature of cyber threats. According to ENISA, attackers are leveraging advanced techniques such as fileless malware and supply chain vulnerabilities, which traditional security measures often fail to detect. In 2022 alone, Europe witnessed a 50% increase in phishing attacks targeting endpoints, as reported by Proofpoint. This dynamic threat landscape necessitates continuous innovation and frequent updates to security protocols, placing immense pressure on vendors to stay ahead. However, developing and deploying effective countermeasures takes time and resources, creating a lag between emerging threats and available defenses. Also, the diversity of devices used in modern workplaces ranging from IoT devices to mobile phones further complicates endpoint security strategies, requiring tailored solutions for each type of endpoint.

Lack of Standardized Security Frameworks

Another significant challenge is the absence of standardized security frameworks across Europe, which hampers cohesive defense strategies. While initiatives like GDPR provide guidelines for data protection, they do not address specific technical requirements for endpoint security. Based on a study by Capgemini, inconsistent regulations across EU member states lead to fragmented approaches making it difficult for multinational organizations to implement uniform security policies. This lack of standardization also affects collaboration between public and private entities in combating cybercrime. Furthermore, differing national priorities and resource allocations result in uneven levels of preparedness leaving some regions more vulnerable than others. Addressing this challenge requires concerted efforts to establish unified frameworks that align with both regional and global cybersecurity standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.0% |

|

Segments Covered |

By Solution, Services, Deployment, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

CrowdStrike, Symantec (Broadcom), AO Kaspersky Lab, Avast Software s.r.o., Bitdefender, Cisco Systems, Inc., ESET, spol. s r.o., Fortinet, Inc., F-Secure, McAfee, LLC, F-Secure, Microsoft Corporation, and Palo Alto Networks, Inc., |

SEGMENTAL ANALYSIS

By Solution Insights

The antivirus solutions segment dominated the Europe endpoint security market by accounting for 35% of the total market share 2024. This market control is due to their foundational role in protecting endpoints against common malware threats. The widespread adoption of antivirus software is driven by its affordability and ease of integration into existing IT ecosystems. As per the AV-TEST Institute, over 1 billion antivirus licenses were active globally in 2022, with Europe contributing significantly to this figure. Key factors propelling its dominance include the prevalence of legacy systems requiring basic protection and the familiarity of users with antivirus interfaces. Additionally, the rise in email-based phishing attacks, which account for nearly 90% of all breaches as reported by Verizon, underscores the continued relevance of antivirus solutions.

Endpoint device control is the fastest-growing segment, with a projected CAGR of 18% through 2033. This growth is fueled by the proliferation of IoT devices and the need to manage unauthorized access points. As noted by Cisco, the number of connected devices in Europe is expected to reach 5 billion by 2025, amplifying the demand for robust device control mechanisms. Organizations are increasingly prioritizing visibility and control over peripheral devices such as USB drives and printers, which are often entry points for malicious activities. Moreover, the rise in bring-your-own-device (BYOD) policies has intensified the need for endpoint device control, ensuring compliance with security protocols without compromising productivity.

By Services Insights

The managed services segment held the biggest share in the Europe endpoint security market i.e. capturing 45.2% in 2024. This influence is associated with the growing preference for outsourcing cybersecurity operations to specialized providers. In line with Deloitte, over 60% of European enterprises now rely on managed service providers (MSPs) to manage their endpoint security and is driven by the expertise and round-the-clock monitoring they offer. MSPs enable organizations to focus on core competencies while ensuring compliance with regulations such as GDPR. Additionally, the scalability of managed services allows businesses to adapt to fluctuating security needs without heavy upfront investments.

The training and support services segment are experiencing the highest growth rate, with a CAGR of 20.2%. This surge is caused by the increasing complexity of endpoint security tools and the shortage of skilled professionals. A study by ISC2 reveals that Europe faces a cybersecurity workforce gap of 290,000 prompting organizations to invest in training programs. Furthermore, the rise in remote work has amplified the need for user education, with phishing attacks accounting for 90% of breaches, as per Verizon. Comprehensive training programs empower employees to recognize and mitigate threats effectively, enhancing overall organizational resilience.

By Deployment Insights

The on-premise deployment category spearheaded the Europe endpoint security market by holding a 60.5% share in 2024. This preference is driven by organizations prioritizing data sovereignty and control over sensitive information. Industries such as government and defense, which handle classified data, rely heavily on on-premise solutions to comply with stringent regulatory requirements. As stated by the Eurostat, over 70% of critical infrastructure operators in Europe prefer on-premise setups to mitigate risks associated with third-party data handling. Moreover, on-premise solutions offer greater customization, allowing organizations to tailor security measures to their unique needs.

The cloud-based deployment is the fastest-growing segment, with a CAGR of 22.1%. This progress is propelled by the scalability and cost-efficiency of cloud solutions, particularly for SMEs. Gartner reports that cloud adoption in Europe is expected to grow by 30% annually, driven by the flexibility it offers in managing remote endpoints. The rise in hybrid work models has further accelerated this trend, with organizations seeking centralized security management capabilities. Cloud solutions also facilitate real-time updates and threat intelligence sharing, enhancing overall cybersecurity posture.

By Vertical Insights

The BFSI sector led the Europe endpoint security market by commanding a 25.9% share in 2024. This dominance of the segment is propelled by the sector's reliance on digital transactions and the sensitivity of financial data. According to Europol, cyberattacks targeting banks increased by 40% in 2022, showcasing the critical need for robust endpoint protection. Additionally, regulatory mandates such as PSD2 require stringent security measures, further boosting adoption. The sector's willingness to invest in advanced solutions ensures its leadership in driving market growth.

Healthcare is the swiftest-growing vertical, with a CAGR of 23%. This development is credited to the digitization of patient records and the increasing frequency of ransomware attacks targeting hospitals. According to IBM, the average cost of a healthcare data breach in Europe reached €6 million in 2022, spotlighting the urgency for enhanced security. The sector's focus on protecting sensitive medical information and ensuring uninterrupted operations propels the adoption of endpoint security solutions.

REGIONAL ANALYSIS

Germany maintains its lead position in the region with an estimated 2024 market share of 24.1% due to its robust industrial base and stringent regulatory environment. The country’s trajectory is driven by its manufacturing sector, which relies heavily on secure digital infrastructures. According to Bitkom, cyberattacks cost German businesses €223 billion annually prompting significant investments in endpoint security. Also, Germany’s adherence to GDPR ensures widespread adoption of advanced security measures. The federal government allocated €2 billion in 2023 to bolster national cybersecurity initiatives, further solidifying its position. With over 70% of German enterprises adopting AI-driven endpoint solutions, the country remains at the forefront of innovation.

The UK’s endpoint security market is characterized by early maturity and strong demand for advanced solutions. It is fueled by its financial services sector and proactive cybersecurity policies. As per TechUK, the UK’s cybersecurity industry grew by 46% between 2020 and 2022, with endpoint security being a key contributor. London’s status as a global fintech hub has amplified demand for sophisticated protection mechanisms. The National Cyber Security Centre (NCSC) reported that ransomware attacks targeting UK organizations surged by 64% in 2022. This has led to increased spending on endpoint security, with British firms investing £1.9 billion annually. The UK’s emphasis on public-private partnerships also accelerates technological advancements.

France continues to see progressive gains in the market that is propelled by its strong emphasis on digital transformation and defense capabilities. The ANSSI states that France witnessed a 50% rise in cyber incidents in 2022 is compelling enterprises to adopt endpoint security solutions. The French government launched a €1.5 billion cybersecurity strategy in 2023 focusing on critical infrastructure protection. Industries such as aerospace and energy are prioritizing endpoint security to counteract targeted attacks. With Paris emerging as a European tech hub, startups and SMEs are increasingly adopting cloud-based endpoint solutions, contributing to market growth.

Italy’s endpoint security space is on a steady growth path in the regional market which is backed by its growing digital economy and increased awareness of cyber risks. A study by Censis revealed that 60% of Italian companies experienced cyberattacks in 2022 leading to heightened demand for endpoint security tools. The Italian government introduced a €300 million fund in 2023 to enhance national cybersecurity resilience. Manufacturing and retail sectors dominate adoption, leveraging endpoint security to protect supply chains and customer data. Furthermore, Italy’s participation in EU-wide cybersecurity initiatives strengthens its position in the market.

Spain is emerging as the fastest-growing country in the endpoint security segment, witnessing a CAGR of 7.5% in 2024. It is supported by its burgeoning IT services sector and regulatory compliance efforts. According to INCIBE, cybercrime incidents in Spain rose by 75% in 2022 prompting businesses to prioritize endpoint protection. The Spanish government invested €1 billion in 2023 to combat rising threats, particularly targeting SMEs. Madrid’s emergence as a tech innovation center has spurred demand for advanced endpoint solutions, especially among startups. The adoption of hybrid work models has further accelerated growth, with organizations seeking scalable and cost-effective security options.

KEY MARKET PLAYERS

CrowdStrike, Symantec (Broadcom), AO Kaspersky Lab, Avast Software s.r.o., Bitdefender, Cisco Systems, Inc., ESET, spol. s r.o., Fortinet, Inc., F-Secure, McAfee, LLC, F-Secure, Microsoft Corporation, and Palo Alto Networks, Inc., are some of the key players in the Europe endpoint security market.

TOP 3 PLAYERS IN THE MARKET

CrowdStrike

CrowdStrike has established itself as a leader in the Europe endpoint security market through its innovative Falcon platform, which leverages artificial intelligence for real-time threat detection. The company’s cloud-native architecture enables seamless integration across diverse IT environments, making it a preferred choice for enterprises transitioning to remote work models. CrowdStrike’s contribution to the global market includes pioneering the use of behavioral analytics to identify zero-day vulnerabilities. Its commitment to innovation is reflected in its continuous expansion of threat intelligence capabilities, addressing the evolving needs of European organizations.

McAfee Enterprise

McAfee Enterprise plays a pivotal role in the global endpoint security landscape by offering comprehensive solutions tailored to enterprise needs. Its MVISION portfolio provides unified protection across endpoints, networks, and clouds, ensuring consistent security policies. In Europe, McAfee’s focus on regulatory compliance aligns with GDPR requirements, enhancing its appeal to businesses handling sensitive data. By emphasizing affordability and scalability, McAfee addresses the cybersecurity challenges faced by SMEs while maintaining robust defenses against advanced threats. Its strategic partnerships with European MSPs further strengthen its market presence.

Symantec (Broadcom)

Symantec, now part of Broadcom, continues to shape the endpoint security market with its integrated cybersecurity solutions. Its Endpoint Protection platform combines traditional antivirus capabilities with machine learning to deliver superior threat prevention. Symantec’s global influence is evident in its ability to cater to large-scale deployments, particularly in industries like finance and healthcare. In Europe, Symantec’s emphasis on data privacy and encryption ensures compliance with regional regulations. The company’s ongoing investments in AI and automation underscore its dedication to combating sophisticated cyber threats effectively.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Acquisitions

Key players in the Europe endpoint security market have aggressively pursued acquisitions to expand their product portfolios and technological capabilities. For instance, acquiring niche startups specializing in AI-driven threat detection allows companies to enhance their offerings. These acquisitions enable firms to address gaps in their services while gaining access to new customer segments. By integrating acquired technologies into existing platforms, companies can provide more comprehensive solutions, strengthening their competitive edge.

Partnerships with Managed Service Providers (MSPs)

Collaborations with MSPs represent another critical strategy, particularly in reaching SMEs across Europe. By partnering with local MSPs, endpoint security vendors can offer tailored solutions that meet specific regional needs. These partnerships also facilitate faster deployment and ongoing support, ensuring higher customer satisfaction. Additionally, MSPs serve as valuable channels for promoting cloud-based security services, driving adoption among organizations with limited internal expertise.

Investment in R&D for AI and Automation

Investing in research and development focused on AI and automation has become a cornerstone strategy for market leaders. By leveraging AI for predictive analytics and automated response mechanisms, companies can detect threats faster and reduce manual intervention. This approach not only enhances operational efficiency but also aligns with the growing demand for intelligent security solutions. Continuous innovation in this area ensures that vendors stay ahead of emerging threats while meeting the dynamic needs of European enterprises.

COMPETITIVE LANDSCAPE

The Europe endpoint security market is characterized by intense competition, with both established players and emerging startups vying for dominance. This competitive landscape is shaped by rapid technological advancements, increasing cyber threats, and evolving regulatory frameworks. Large vendors like CrowdStrike, McAfee, and Symantec dominate through their extensive product ecosystems and global reach, while smaller firms differentiate themselves through specialized solutions targeting niche markets. According to Gartner, the market is expected to grow at a CAGR of 15% through 2028, attracting significant investment and fostering innovation. However, the fragmented nature of the market creates opportunities for consolidation through mergers and acquisitions. Regional players also benefit from localized strategies, catering to specific regulatory and cultural requirements. As demand shifts towards cloud-based and AI-driven solutions, companies are increasingly focusing on scalability, usability, and integration capabilities to maintain their competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, CrowdStrike acquired Preempt Security, an Israel-based startup specializing in identity protection. This acquisition strengthened CrowdStrike’s ability to offer holistic endpoint security solutions by integrating identity-based threat detection into its Falcon platform.

- In June 2023, McAfee Enterprise partnered with Kaspersky Lab to co-develop advanced anti-ransomware tools tailored for European SMEs. This collaboration enabled both companies to address the rising incidence of ransomware attacks in the region effectively.

- In September 2023, Symantec launched its AI-Powered Endpoint Detection and Response (EDR) solution exclusively for the European market. This move aimed to capitalize on the growing demand for intelligent cybersecurity tools capable of mitigating zero-day exploits.

- In January 2024, Palo Alto Networks expanded its partnership with Deutsche Telekom to deliver managed endpoint security services across Germany and Austria. This initiative enhanced Palo Alto’s market penetration in Central Europe.

- In November 2023, Sophos introduced its next-generation firewall technology integrated with endpoint device control features. This innovation positioned Sophos as a leader in providing unified security solutions for hybrid work environments.

MARKET SEGMENTATION

This research report on the European endpoint security market is segmented and sub-segmented into the following categories.

By Solution

- Antivirus

- Antispyware

- Antimalware

- Firewall

- Endpoint Device Control

- Intrusion Prevention

- Endpoint Application Control

By Services

- Consulting

- Training & Support

- Managed Services

By Deployment

- Cloud

- On-premise

By Vertical

- Government and Defense

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Energy & Utilities

- Education

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which industries drive the demand for endpoint security in Europe?

Key industries driving demand include banking, financial services, healthcare, IT and telecom, retail, and government sectors, which require robust security measures to protect sensitive data.

What are the primary threats addressed by endpoint security solutions?

Endpoint security solutions primarily address threats like malware, phishing attacks, ransomware, data breaches, insider threats, and advanced persistent threats (APTs).

Why is endpoint security crucial for European businesses?

Endpoint security is critical for European businesses to ensure data privacy, meet stringent regulations like GDPR, protect against financial losses, and maintain customer trust.

How are innovations like AI and machine learning impacting the endpoint security market in Europe?

Innovations like AI and machine learning are enhancing threat detection capabilities, enabling predictive analytics, and automating incident responses, which improve the efficiency and effectiveness of endpoint security solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]