Europe Embedded Software Market Size, Share, Trends, & Growth Forecast Report By Category (Software and Service), Component, Operating System, Function, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Embedded Software Market Size

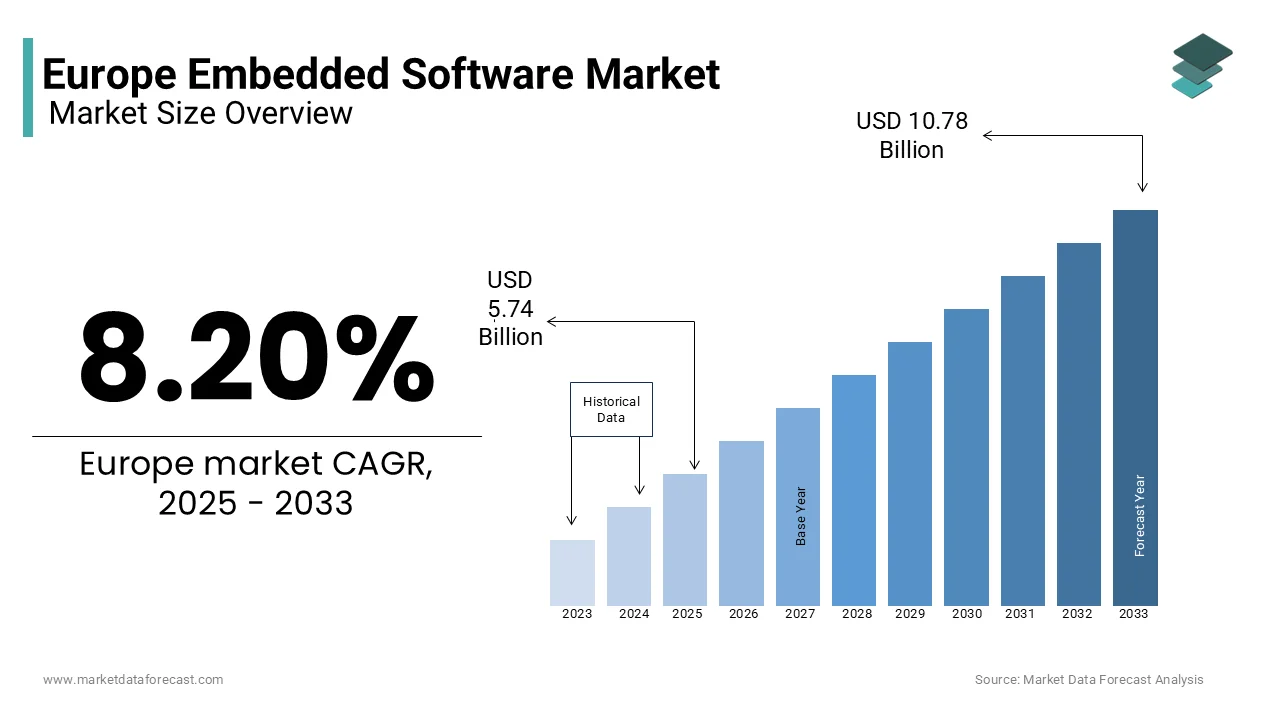

The Europe embedded software market was worth USD 5.30 billion in 2024. The European market is expected to reach USD 10.78 billion by 2033 from USD 5.74 billion in 2025, rising at a CAGR of 8.20% from 2025 to 2033.

Embedded software enables the seamless integration of software into hardware systems to perform dedicated functions across diverse industries. Embedded software is integral to devices ranging from consumer electronics and automotive systems to industrial automation and healthcare equipment, driving efficiency, connectivity, and intelligence in modern applications. According to the European Semiconductor Industry Association (ESIA), the demand for embedded software in Europe has surged by 25% since 2021 due to the advancements in IoT, AI, and 5G technologies. The automotive sector, in particular, accounts for over 40% of the market share, as highlighted by the German Association of the Automotive Industry, with electric vehicles (EVs) and autonomous driving systems relying heavily on embedded solutions.

According to the reports of the UK Department for Business, Energy & Industrial Strategy, the industrial automation segment is another key contributor, with embedded software enhancing operational efficiency in smart factories. Furthermore, Eurostat reveals that over 60% of European enterprises have adopted IoT-enabled devices, creating a robust ecosystem for embedded software development. France’s National Institute for Research in Digital Science and Technology emphasizes the role of embedded systems in healthcare, where wearable devices and telemedicine platforms are transforming patient care.

MARKET DRIVERS

Rising Adoption of IoT and Smart Devices in Europe

The proliferation of Internet of Things (IoT) devices is a major driver propelling the Europe embedded software market. According to Eurostat, over 60% of European enterprises have integrated IoT-enabled solutions into their operations by 2023, with embedded software serving as the backbone for these connected systems. The UK Department for Business, Energy & Industrial Strategy highlights that IoT adoption in smart homes, industrial automation, and healthcare has surged by 35% annually since 2021. Embedded software enables real-time data processing, connectivity, and device interoperability, which are critical for IoT functionality. Furthermore, the German Association of the Automotive Industry reports that the automotive sector alone accounts for 40% of embedded software demand, driven by IoT applications in connected vehicles. As industries increasingly rely on IoT for operational efficiency and innovation, the demand for robust embedded software solutions continues to grow, solidifying its role as a key growth driver.

Advancements in Automotive Technologies

The rapid evolution of automotive technologies, particularly in electric vehicles (EVs) and autonomous driving systems is another significant driver of the Europe embedded software market. The German Association of the Automotive Industry states that embedded software accounts for up to 80% of a vehicle’s innovation, with EVs requiring sophisticated software for battery management, infotainment, and driver assistance systems. France’s National Institute for Research in Digital Science and Technology highlights that investments in autonomous driving technologies have grown by 50% since 2020, with embedded systems enabling functionalities like lane detection and collision avoidance. Additionally, the European Commission projects that the EV market will expand at a CAGR of 20% through 2028, further amplifying the need for advanced embedded solutions. As automakers prioritize software-driven innovations, embedded software remains indispensable for maintaining Europe’s leadership in the global automotive industry.

MARKET RESTRAINTS

High Development Costs and Complexity

The high costs and technical complexity associated with embedded software development pose significant restraints to the Europe embedded software market. According to the European Commission, the initial investment required for developing custom embedded solutions can exceed €500,000 for small and medium-sized enterprises (SMEs), limiting their ability to adopt advanced technologies. According to the UK Department for Business, Energy & Industrial Strategy, over 40% of SMEs in Europe face challenges in hiring skilled developers, as embedded systems require expertise in both hardware and software integration. Furthermore, France’s National Institute for Research in Digital Science and Technology reports that debugging and testing embedded software can increase project timelines by up to 30%, adding to operational costs. These financial and technical barriers hinder widespread adoption, particularly among smaller players, slowing the overall growth of the embedded software market in Europe.

Stringent Regulatory Compliance and Security Concerns

Stringent regulatory requirements and cybersecurity vulnerabilities present another major restraint for the Europe embedded software market. The European Union Agency for Cybersecurity (ENISA) reports that cyberattacks on IoT devices, which rely heavily on embedded software, increased by 50% in 2023, raising concerns about data privacy and system integrity. Germany’s Federal Office for Information Security emphasizes that non-compliance with regulations like GDPR can result in fines of up to €20 million, deterring companies from deploying embedded systems without robust security measures. Additionally, the UK Health and Safety Executive highlights that 60% of industrial embedded systems lack adequate protection against cyber threats, posing risks to critical infrastructure. As industries increasingly rely on interconnected devices, ensuring compliance and addressing security gaps remain significant challenges, constraining the rapid expansion of the embedded software market.

MARKET OPPORTUNITIES

Integration of AI and Machine Learning in Embedded Systems

The integration of artificial intelligence (AI) and machine learning (ML) into embedded software is a significant opportunity for the Europe embedded software market. According to the European Commission, investments in AI-driven embedded solutions have grown by 45% annually since 2021, driven by their ability to enhance predictive maintenance, automation, and real-time decision-making. Germany’s Federal Ministry for Economic Affairs highlights that industries such as manufacturing and automotive are leveraging AI-enabled embedded systems to improve operational efficiency by up to 30%. Furthermore, France’s National Institute for Research in Digital Science and Technology reports that AI-powered embedded software is expected to account for 60% of IoT applications by 2025, enabling smarter devices and interconnected ecosystems. As Europe prioritizes digital transformation, the adoption of AI and ML in embedded systems is set to unlock new revenue streams and drive innovation across sectors.

Expansion of Embedded Software in Healthcare and Wearables

The growing demand for healthcare innovations and wearable devices offers another major opportunity for the Europe embedded software market. The UK Department for Business, Energy & Industrial Strategy reports that the wearable medical device market is projected to grow at a CAGR of 15% through 2028, with embedded software playing a critical role in functionalities like health monitoring and data analytics. France’s National Institute for Research in Digital Science and Technology highlights that over 70% of European hospitals are adopting IoT-enabled medical devices, which rely on embedded systems for seamless integration and real-time patient data processing. Additionally, Eurostat notes that 65% of European consumers prefer wearable devices for fitness tracking, driving demand for compact, energy-efficient embedded solutions. As healthcare systems embrace digitization, embedded software is poised to revolutionize patient care and create lucrative opportunities for market expansion.

MARKET CHALLENGES

Increasing Demand for Cybersecurity Measures

As embedded systems become more interconnected, the demand for cybersecurity measures has surged, posing a major challenge to the Europe embedded software market. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks on industrial control systems and embedded devices increased by 50% in 2022 compared to the previous year. This highlights the growing vulnerability of critical infrastructure. The European Commission estimates that cybercrime costs the EU economy approximately €490 billion annually, underscoring the financial impact of inadequate security. Companies are forced to invest heavily in secure coding practices and regular updates, straining resources. ENISA points out that small and medium enterprises often lack the expertise to implement comprehensive cybersecurity strategies, leaving them particularly exposed to threats.

Shortage of Skilled Embedded Software Professionals

The shortage of skilled professionals in embedded software development is another pressing challenge for the European market. The European Commission projects a deficit of 800,000 ICT professionals by 2030, with embedded systems being a critical area affected by this gap. Eurostat reveals that only 1.7% of the EU workforce is employed in ICT roles, indicating a significant underrepresentation of tech talent. The European Centre for the Development of Vocational Training highlights that while the demand for embedded software skills is rising, educational institutions are not aligning their programs with industry needs. This mismatch between supply and demand hinders innovation and slows project timelines, as companies struggle to fill specialized roles. The lack of qualified personnel threatens the competitiveness of Europe’s embedded software sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.20% |

|

Segments Covered |

By Category, Component, Operating System, Function, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Softeq Development Corp. (U.S), STMicroelectronics (Switzerland), Mitsubishi Electric Corporation (Japan), Microsoft (U.S), Emerson Electric Co. (U.S), Intel Corporation (U.S), Enea (Italy), Renesas Electronics Corporation (Japan), NXP Semiconductors (Netherlands), and Microchip Technology Inc (U.S). |

SEGMENTAL ANALYSIS

By Category Insights

The software segment dominated the Europe embedded software market by accounting for 65.8% of the European market share in 2024. The dominating position of software segment in the European market is driven by the increasing adoption of IoT and AI-driven applications, particularly in automotive and healthcare sectors. Eurostat reports that over 40% of embedded systems rely on advanced software for real-time data processing, making it indispensable. The demand for secure, reliable, and compliant software solutions drives its dominance. For instance, ISO 26262 compliance in automotive software is mandatory, with the sector investing €10 billion annually in embedded software development. Its importance lies in enabling innovation, ensuring safety, and supporting interconnected ecosystems across industries.

The service segment is anticipated to showcase the fastest CAGR of 12.8% over the forecast period owing to the rising need for maintenance, cybersecurity updates, and technical support for embedded systems. The European Union Agency for Cybersecurity (ENISA) highlights that 70% of companies now prioritize outsourced services for system upgrades due to skill gaps. With IoT devices projected to reach 5 billion in Europe by 2025, the demand for post-deployment services is surging. The segment’s importance lies in ensuring system longevity, reducing downtime, and addressing vulnerabilities, making it critical for sustainable operations in an increasingly connected world.

By Component Insights

The operating systems segment held 36.3% of the European market share in 2024. The critical role that operating systems play in managing hardware resources and enabling real-time operations in industries like automotive and healthcare is majorly driving the growth of the segment in the European market. According to Eurostat, 70% of new vehicles in Europe rely on real-time operating systems (RTOS) for advanced driver-assistance systems (ADAS). The importance of operating systems lies in their ability to ensure reliability, security, and compliance with standards like ISO 26262. With RTOS adoption growing at 25% annually, its foundational role in supporting interconnected devices and IoT ecosystems underscores its dominance in driving innovation and system performance.

The middleware segment is projected to expand at the fastest CAGR of 14.2% over the forecast period owing to the rise of IoT, where middleware facilitates device interoperability and data management. The European Commission notes that over 60% of IoT projects depend on middleware for seamless communication. With IoT devices projected to reach 5 billion in Europe by 2025, middleware's role becomes critical. Its importance lies in reducing development complexity, enhancing scalability, and enabling real-time data processing, making it essential for industries transitioning to smart and connected solutions. This rapid adoption positions middleware as a key enabler of digital transformation.

By Operating System Insights

The Real-Time Operating Systems (RTOS) segment held 40.8% of the European market share in 2024. RTOS is critical for time-sensitive applications, such as automotive ADAS and industrial automation, where delays can cause system failures. Eurostat reports that RTOS adoption grew by 25% annually, with over 70% of new vehicles in Europe relying on it for safety-critical functions. Compliance with standards like ISO 26262 further boosts its dominance. The European Union Agency for Cybersecurity (ENISA) highlights that RTOS reduces system vulnerabilities by 30%. Its importance lies in ensuring reliability, low latency, and precision, making it indispensable for industries requiring real-time performance and safety.

The Linux segment is expected to record a CAGR of 15.3% over the forecast period. Its open-source nature and flexibility make it ideal for IoT and edge computing, with Linux powering over 60% of IoT devices in Europe, according to the European Commission. The projected 5 billion IoT devices by 2025 will further accelerate its adoption. Linux’s modular architecture supports rapid customization, while its active community ensures frequent updates. Its cost-effectiveness and scalability are driving its growth, particularly in smart homes and industrial IoT. Linux’s ability to support innovation and security makes it pivotal for next-generation embedded systems.

By Function Insights

The real-time systems segment accounted for 45.5% of the European market share in 2024. These systems are essential for applications requiring precise timing and immediate responses, such as automotive braking systems, medical devices, and industrial automation. Eurostat highlights that real-time systems reduce operational errors by 35%, making them critical for safety and efficiency. The European Union Agency for Cybersecurity (ENISA) notes that industries like automotive rely on real-time systems to comply with ISO 26262 standards, ensuring functional safety. With over 70% of new vehicles in Europe equipped with real-time capabilities, their importance lies in enabling reliable, time-sensitive operations that enhance performance and safety across industries.

The network systems segment is estimated to register a CAGR of 16.7% over the forecast period due to the rise of IoT, 5G, and smart infrastructure, which demand seamless connectivity and data exchange. The European Commission reports that network systems will support over 5 billion IoT devices in Europe by 2025. Their ability to integrate distributed devices and enable real-time communication makes them vital for smart cities, healthcare, and industrial IoT. Network systems also address cybersecurity challenges, with ENISA emphasizing their role in securing interconnected ecosystems. Their scalability and adaptability make them indispensable for modern embedded applications reliant on connectivity and data-driven insights.

By Application Insights

The automotive segment led the Europe embedded software market by occupying 38.5% of the European market share in 2024. The leading position of automotive segment in the European market is driven by the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected car technologies. Eurostat reports that over 70% of new vehicles in Europe now integrate embedded systems for safety, navigation, and infotainment. Compliance with stringent safety standards like ISO 26262 further boosts demand. The European Automobile Manufacturers' Association (ACEA) highlights that embedded software contributes to a 20% improvement in vehicle efficiency and reduces emissions. Its importance lies in enabling innovation, ensuring safety, and supporting the transition to smart and sustainable mobility solutions.

The healthcare segment is estimated to grow at a significant CAGR of 17.5% over the forecast period due to the rising demand for medical devices, telemedicine, and AI-driven diagnostics. The European Commission notes that embedded software enhances the accuracy of diagnostic tools by 30%, improving patient outcomes. With the global healthcare IoT market projected to reach €260 billion by 2025, embedded systems are critical for wearable devices, remote monitoring, and robotic surgeries. Their ability to ensure real-time data processing, security, and compliance with regulations like GDPR makes them indispensable. Embedded software's role in advancing precision medicine and patient care underscores its rapid expansion in the healthcare sector.

REGIONAL ANALYSIS

Germany played the leading role in the Europe embedded software market by accounting for 28.8% of the European market share in 2024 owing to its robust automotive and manufacturing sectors. According to the European Commission, Germany accounts for over 30% of Europe’s automotive production, with embedded systems playing a critical role in innovations like electric vehicles and Industry 4.0. The country’s strong emphasis on R&D, supported by institutions like the Fraunhofer Society, fosters technological advancements. Germany’s leadership is further reinforced by its dominance in industrial automation, where embedded software ensures precision and efficiency. According to the German Federal Ministry for Economic Affairs, investments in smart manufacturing technologies have grown by 20% annually. This focus on innovation and industrial integration positions Germany as a key driver of the embedded software market.

France is a promising player in the European embedded software market owing to its aerospace and healthcare industries. The French Ministry of Economy reports that investments in IoT and smart healthcare solutions have surged by 25% annually, driving demand for embedded systems. France’s aerospace sector, led by companies like Airbus, relies heavily on embedded software for avionics and satellite systems, contributing significantly to its market position. Additionally, the rise of telemedicine and wearable health devices has increased the need for secure and efficient embedded solutions. Eurostat notes that France accounts for 15% of Europe’s medical device production, underscoring its importance in healthcare innovation. The country’s strategic focus on high-tech industries solidifies its role as a top performer in the embedded software market.

The UK is projected to witness a promising CAGR in the European market over the forecast period owing to its expertise in IT & telecom and defense applications, with London being a hub for embedded software startups. The UK’s defense sector, supported by initiatives from the Ministry of Defence, leverages embedded systems for advanced surveillance and communication technologies. Furthermore, the growth of 5G networks and smart city projects has accelerated demand for embedded solutions in telecommunications. According to the UK Office for National Statistics, the IT & telecom sector contributes over £150 billion annually to the economy, with embedded software being a core enabler. The UK’s focus on cutting-edge technologies and digital transformation ensures its prominence in the regional market.

KEY MARKET PLAYERS

The major players in the Europe embedded software market include Softeq Development Corp. (U.S), STMicroelectronics (Switzerland), Mitsubishi Electric Corporation (Japan), Microsoft (U.S), Emerson Electric Co. (U.S), Intel Corporation (U.S), Enea (Italy), Renesas Electronics Corporation (Japan), NXP Semiconductors (Netherlands), and Microchip Technology Inc (U.S).

MARKET SEGMENTATION

This research report on the Europe embedded software market is segmented and sub-segmented into the following categories.

By Category

- Software

- Service

By Component

- Operating Systems

- Middleware

- Firmware

- Application Software

By Operating System

- General Purpose Operating System (GPOS)

- Real-Time Operating System (RTOS)

- Linux

- QNX

- Windows

- Android

- VxWorks

- Others

By Function

- Standalone System

- Real-Time System

- Network System

- Mobile System

By Application

- Automotive

- Aerospace

- Consumer Electronics

- Manufacturing

- Healthcare

- Military & Defense

- IT & Telecom

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key industries driving the embedded software market in Europe?

The major industries driving the embedded software market in Europe include automotive, industrial automation, consumer electronics, healthcare, and telecommunications. The automotive sector, especially with advancements in electric and autonomous vehicles, is a significant contributor.

What role does IoT play in the growth of the embedded software market in Europe?

IoT is a major factor in the market's growth, as embedded software is essential for connected devices in industries like smart homes, industrial automation, healthcare, and smart cities. The expansion of 5G networks is further accelerating IoT adoption.

Which technologies are shaping the future of embedded software in Europe?

AI-driven embedded systems, real-time operating systems (RTOS), edge computing, and machine learning are shaping the future. These technologies enhance efficiency, security, and performance in applications like industrial automation and healthcare.

What are the key trends in embedded software development in Europe?

Key trends include the shift towards software-defined vehicles, increased adoption of embedded AI, greater focus on cybersecurity, and the use of model-based design for efficient software development. Cloud integration is also gaining traction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]