Europe Elevators Market Size, Share, Trends & Growth Forecast Report By Type (Passenger Elevator, Goods Elevator, Capsule Elevator, Automobile Elevator, Stretcher Elevator, and Hydraulic Elevator), By Application (Residential and Commercial), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Elevators Market Size

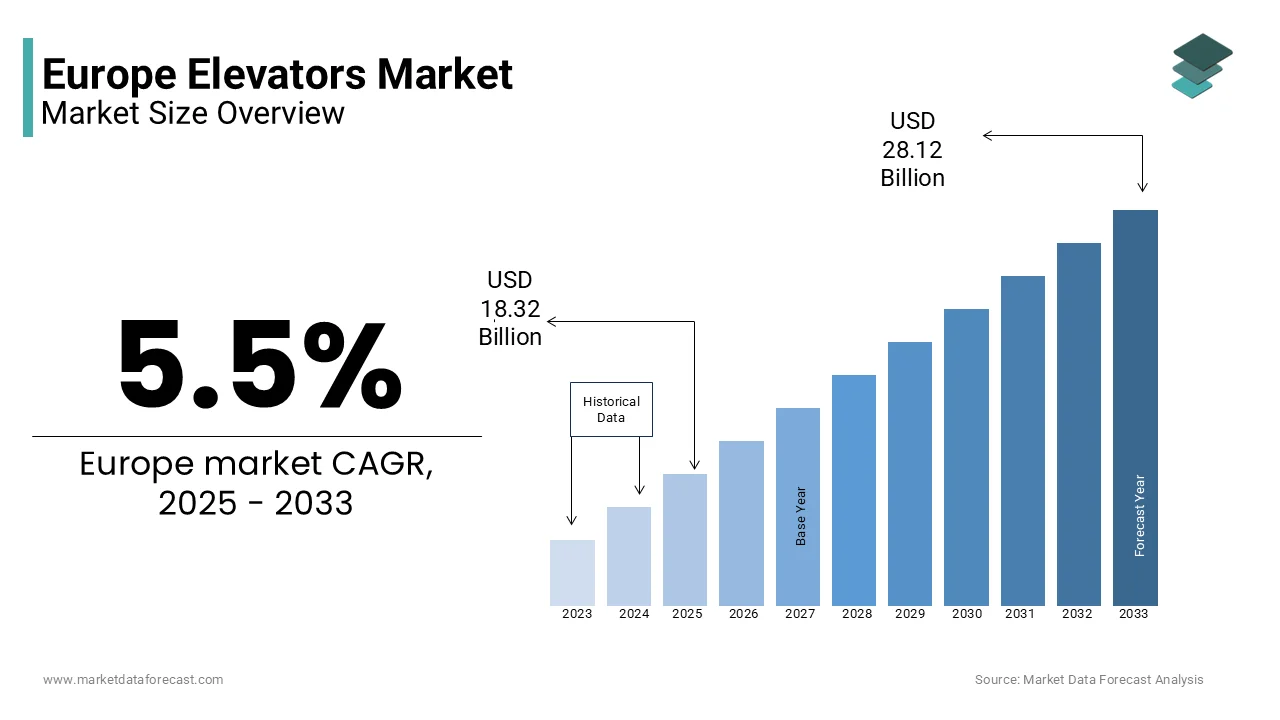

The elevators market size in Europe was valued at USD 17.36 billion in 2024. The European market is estimated to be worth USD 28.12 billion by 2033 from USD 18.32 billion in 2025, growing at a CAGR of 5.5% from 2025 to 2033.

The Europe elevator market growth is driven by rapid urbanization and the proliferation of high-rise buildings. According to Eurostat, over 75% of Europe’s population resides in urban areas, necessitating efficient vertical transportation systems. The market is further bolstered by stringent safety regulations, such as the European EN 81 standards, which mandate modernization of aging elevators. The rise of smart cities has also fueled demand for IoT-enabled elevators, with predictive maintenance systems gaining traction. Additionally, the growing emphasis on energy-efficient solutions aligns with Europe’s green building initiatives is driving innovation in this sector.

MARKET DRIVERS

Urbanization and High-Rise Construction

Urbanization remains a key driver for the Europe elevator market, with cities like London, Paris, and Berlin witnessing a surge in skyscraper projects. These structures rely heavily on advanced vertical transportation systems to ensure efficient movement. Furthermore, the European Commission reports that urban populations are projected to grow by 8% by 2030 with the need for elevators in residential and commercial spaces. Smart technologies, such as IoT integration, are being adopted to enhance operational efficiency for smart elevators.

Aging Infrastructure Modernization

The modernization of aging infrastructure is another significant driver for the Europe elevator market. Governments across the region are implementing policies to encourage retrofitting, with subsidies available for energy-efficient models. Energy-efficient elevators, equipped with regenerative drives, reduce power consumption by up to 50%, as per findings from the Fraunhofer Institute. This dual focus on safety and sustainability ensures sustained demand for modernization services.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

One of the primary restraints for the Europe elevator market is the high initial cost associated with installation and modernization. According to a study by the European Construction Technology Platform, the average cost of installing a new elevator ranges from €20,000 to €50,000, depending on specifications. This financial burden often deters small-scale developers and property owners from investing in advanced systems. Additionally, economic uncertainties, exacerbated by inflation and geopolitical tensions, have tightened budgets for large-scale infrastructure projects. Eurostat reports that construction spending in Europe declined by 5% in 2022, reflecting reduced investment in vertical transportation systems. While energy-efficient models offer long-term savings, their upfront costs remain prohibitive for many stakeholders. This financial barrier hinders widespread adoption in economically weaker regions.

Stringent Regulatory Compliance Challenges

Stringent regulatory requirements pose significant challenges for manufacturers and installers in the Europe elevator market. Compliance with safety standards, such as EN 81-20 and EN 81-50, demands rigorous testing and certification by increasing production timelines and costs. According to the European Committee for Standardization, non-compliance can result in penalties exceeding €100,000 by deterring smaller players from entering the market. Additionally, frequent updates to these regulations create uncertainty by complicating product development. For instance, the introduction of EN 81-28 mandates audio-visual alarms in elevators by requiring costly retrofits for existing systems. As per a report by the UK’s Building Research Establishment, regulatory compliance accounts for 20% of total project costs.

MARKET OPPORTUNITIES

Adoption of IoT and Smart Technologies

The integration of IoT and smart technologies presents a transformative opportunity for the Europe elevator market. IoT-enabled elevators leverage predictive maintenance systems by reducing downtime by up to 30%, as per findings from the Fraunhofer Institute. These systems analyze real-time data to identify potential faults by enhancing operational efficiency. Additionally, smart elevators contribute to energy savings, with regenerative drives reducing power consumption by 40%. Governments across Europe are incentivizing the adoption of such technologies through green building certifications, such as BREEAM. This convergence of innovation and sustainability positions smart elevators as a key growth driver in the coming years.

Expansion into Residential Retrofit Projects

Residential retrofit projects represent a lucrative opportunity for the Europe elevator market, driven by aging populations and accessibility mandates. According to Eurostat, over 20% of Europe’s population will be aged 65 or above by 2030. The European Accessibility Act mandates the installation of elevators in multi-story residential buildings that is create huge opportunities for the market in the next coming years. As per a report by the UK’s Department for Levelling Up, Housing and Communities, retrofit projects account for 40% of total elevator installations. Manufacturers are capitalizing on this trend by offering compact and cost-effective models tailored for residential use. Additionally, government subsidies, such as Italy’s "Superbonus 110%," provide financial incentives for home renovations, including elevator installations.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose significant challenges to the Europe elevator market. The ongoing semiconductor shortage has impacted the production of IoT-enabled elevators, which rely on advanced sensors and control systems. According to the European Semiconductor Industry Association, lead times for critical components have increased by 50% since 2021 thereby delaying project timelines. Additionally, rising steel prices, driven by geopolitical tensions, have escalated manufacturing costs. The European Steel Association reports that steel prices surged by 25% in 2022, affecting elevator production. These disruptions are compounded by logistical bottlenecks, particularly in cross-border shipments. As a result, manufacturers face delays and increased expenses by hindering their ability to meet growing demand. Addressing these supply chain vulnerabilities is crucial for sustaining market growth.

Intense Price Competition Among Manufacturers

Intense price competition among manufacturers is another challenge for the Europe elevator market. According to a study by Deloitte, profit margins for mid-tier manufacturers have contracted by 10% over the past five years due to pricing pressures. Additionally, the prevalence of counterfeit products exacerbates the issue, as they flood the market with low-cost alternatives that compromise quality. The European Anti-Counterfeiting Network estimates that counterfeit elevator components account for 7% of total sales by posing risks to safety and reliability.

The passenger elevators segment dominated the Europe elevator market by capturing 60.4% of total share in 2024 with their widespread application in residential and commercial buildings in urban areas with high-rise structures. According to Eurostat, over 75% of Europe’s population resides in cities, necessitating efficient vertical transportation systems. Passenger elevators are favored for their versatility, accommodating both low- and high-rise buildings while adhering to stringent safety standards like EN 81. Additionally, advancements in energy-efficient technologies, such as regenerative drives, have enhanced their appeal. The growing emphasis on accessibility is mandated by regulations like the European Accessibility Act that further accelerates the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

KONE Corporation, Otis Elevator Company, TK Elevator, Schindler Group, Mitsubishi Electric Corporation, Fujitec, Hyundai Elevator, Hitachi, Orona Elevators, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The smart elevators segment is likely to gain huge traction with a CAGR of 12.6% throughout the forecast period. This growth is fueled by the integration of IoT and predictive maintenance systems, which enhance operational efficiency and reduce downtime. For instance, IoT-enabled elevators can predict potential faults with 95% accuracy, as reported by the UK’s Building Research Establishment. The rise of smart cities across Europe in Germany and France, has accelerated adoption. Government incentives for green building certifications, such as BREEAM, further drive demand for energy-efficient smart elevators. Additionally, the increasing focus on user experience, including touchless operation and real-time monitoring, appeals to modern consumers.

By Application Insights

The residential segment led the Europe elevator market by accounting for 55.8% of total share in 2024. This dominance is driven by aging populations and accessibility mandates, such as the European Accessibility Act, which require elevators in multi-story residential buildings. According to Eurostat, over 20% of Europe’s population will be aged 65 or above by 2030, necessitating accessible housing solutions. Retrofit projects, supported by government subsidies like Italy’s "Superbonus 110%," further boost demand. Compact and cost-effective models tailored for residential use are gaining traction in densely populated urban areas.

The commercial segment is anticipated to grow with a CAGR of 9.8% in the next coming years. The growth of the segment is fueled by the proliferation of office spaces, shopping malls, and hospitality facilities in emerging urban hubs. High-rise commercial buildings rely heavily on advanced elevator systems, including capsule and smart elevators, to ensure efficient movement. Additionally, the growing emphasis on sustainability has led to the adoption of energy-efficient models thereby reducing operational costs.

REGIONAL ANALYSIS

Germany dominated the Europe elevator market by accounting for 25.5% of the share in 2024 owing to the country’s robust construction industry, producing over 150,000 new residential units annually. Germany’s stringent safety regulations, such as EN 81 standards, mandate the modernization of aging elevators by creating a steady demand for retrofitting projects. Additionally, the country’s focus on smart city initiatives and energy-efficient solutions enhances the growth of the market in this countery. The government’s emphasis on sustainability, through policies like the "Energiewende" initiative, further accelerates the adoption of eco-friendly elevators.

France is estimated to register a CAGR of 8.5% during the forecast period. This growth is fueled by urbanization trends and government incentives like the "Plan de Rénovation Énergétique," which promotes elevator modernization. Cities like Paris are leading the charge, with high-rise residential and commercial projects driving demand for advanced vertical transportation systems. France’s focus on accessibility mandates, coupled with its thriving tourism sector, further propels demand for elevators in hotels and public infrastructure.

The UK benefits from aging infrastructure modernization, with over 60% of elevators requiring upgrades to comply with current safety standards, as per the UK Health and Safety Executive. Subsidies for energy-efficient models enhance adoption rates. Spain’s growing tourism sector drives demand for elevators in hospitality and commercial spaces by ensuring steady growth.

KEY MARKET PLAYERS

The major key players in Europe elevators market are KONE Corporation, Otis Elevator Company, TK Elevator, Schindler Group, Mitsubishi Electric Corporation, Fujitec, Hyundai Elevator, Hitachi, Orona Elevators, and others.

The Europe elevator market is highly competitive, characterized by the presence of global leaders like KONE, Schindler, and Thyssenkrupp, alongside regional players offering cost-effective solutions. Global players leverage innovation, offering advanced technologies such as IoT-enabled systems and predictive maintenance. For example, KONE’s "DX Class" elevators and Thyssenkrupp’s "MAX" system set benchmarks for operational efficiency and user experience. Regional players compete on price and customization, targeting niche segments like low-rise residential projects. The market’s fragmentation intensifies competition, prompting manufacturers to differentiate through value-added services like extended warranties and rapid installation timelines. Stringent safety regulations and the rise of smart cities have shifted focus toward sustainable solutions, creating opportunities for innovation. Collaborations with governments ensure stable demand, while investments in R&D drive technological advancements. Supply chain disruptions and economic uncertainties further shape the competitive landscape by pressuring companies to balance affordability with quality.

TOP PLAYERS IN THIS MARKET

KONE Corporation

KONE is a global leader in the Europe elevator market. The company’s innovative solutions, such as eco-efficient elevators and IoT-enabled systems, cater to both residential and commercial segments. KONE’s focus on sustainability aligns with Europe’s green building initiatives, enhancing its market presence. Its "DX Class" elevators, equipped with touchless technology and predictive maintenance, have gained significant traction in urban hubs like London and Berlin. KONE’s strategic partnerships with governments and developers ensure compliance with stringent safety and energy efficiency standards.

Schindler Group

Schindler’s strong focus on modular designs and energy-efficient models will amplify its position in the marketplace. The company targets urbanization trends in emerging markets like Eastern Europe, where demand for high-rise residential and commercial elevators is rising. Schindler’s "PORT Technology" offers intelligent destination control systems, enhancing user experience and operational efficiency. Its commitment to innovation, coupled with localized production facilities, ensures consistent demand across Europe. Schindler’s collaboration with French developers for smart city projects further strengthens its technological portfolio.

Thyssenkrupp Elevator

Thyssenkrupp’s focus on predictive maintenance and digitalization positions it as a leader in the smart elevator segment. Thyssenkrupp’s "MAX" system, powered by Microsoft Azure, enables real-time monitoring and fault prediction by reducing downtime by up to 50%. Its acquisition of regional manufacturers in Poland and Spain has expanded its production capacity, catering to growing demand in Eastern and Southern Europe. Thyssenkrupp’s emphasis on sustainability, through regenerative drives and eco-friendly materials that aligns with Europe’s regulatory landscape, enhancing its competitive edge.

STRATEGIES USED BY THE KEY PLAYERS

Key players in the Europe elevator market employ diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies investing heavily in IoT-enabled systems, predictive maintenance, and energy-efficient technologies. For instance, KONE’s "DX Class" elevators and Thyssenkrupp’s "MAX" system exemplify this trend. Geographic expansion is another critical strategy, with manufacturers targeting emerging markets in Eastern Europe to capitalize on urbanization trends. Strategic partnerships with governments and developers ensure compliance with stringent safety and accessibility regulations. Companies also focus on sustainability by leveraging green building certifications like BREEAM to enhance market appeal. Additionally, mergers and acquisitions consolidate market positions by enabling access to new technologies and customer bases.

RECENT HAPPENINGS IN THE MARKET

- In March 2023 , KONE launched a new line of energy-efficient elevators in Germany by reducing power consumption by 40%. This initiative strengthened its position in the sustainability segment by aligning with Europe’s green building initiatives.

- In June 2023 , Schindler partnered with a French developer to supply IoT-enabled elevators for a smart city project in Lyon. This collaboration enhanced its technological portfolio and positioned Schindler as a leader in intelligent vertical transportation systems.

- In September 2023 , Thyssenkrupp acquired a Polish manufacturer, expanding its production capacity in Eastern Europe. This move enabled the company to meet growing demand in emerging markets while reducing logistical bottlenecks.

- In November 2023 , Mitsubishi Electric introduced a predictive maintenance system in Spain, targeting commercial high-rise projects in Madrid and Barcelona. This innovation reduced downtime by 50%, which is appealing to property developers and facility managers.

- In January 2024 , Otis Corporation launched an online platform for aftermarket services in Italy, improving accessibility and customer engagement. This platform streamlined maintenance scheduling and spare parts procurement by enhancing customer satisfaction and loyalty.

MARKET SEGMENTATION

This research report on the Europe elevators market is segmented and sub-segmented into the following categories.

By Type

- Passenger Elevator

- Goods Elevator

- Capsule Elevator

- Automobile Elevator

- Stretcher Elevator

- Hydraulic Elevator

By Application

- Residential

- Commercial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size and projected growth of the Europe elevators market?

The Europe elevators market was valued at USD 17.36 billion in 2024 and is projected to reach USD 28.12 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033.

2. What factors are driving the growth of the elevators market in Europe?

Key drivers include rapid urbanization leading to increased high-rise constructions, substantial investments in residential and commercial infrastructure, and a focus on sustainability initiatives promoting energy-efficient elevator systems.

3. Which countries are leading the elevators market in Europe?

Major markets include Germany, the UK, France, Italy, and Spain, driven by robust construction activities and modernization efforts in these countries.

4. What are the primary types of elevators in demand within the European market?

The market demand encompasses various types of elevators, including passenger elevators, goods elevators, capsule elevators, automobile elevators, stretcher elevators, and hydraulic elevators, catering to diverse applications in residential and commercial sectors.

5. How is the aging building infrastructure impacting the elevators market in Europe?

A significant portion of Europe's building infrastructure is aging, leading to increased modernization projects to upgrade elevator systems for enhanced safety, compliance with current standards, and improved energy efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]