Europe Electronic Toll Collection (ETC) Market Size, Share, Trends & Growth Forecast Research Report – Segmented By Type, Technology, End-User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Electronic Toll Collection (ETC) Market Size

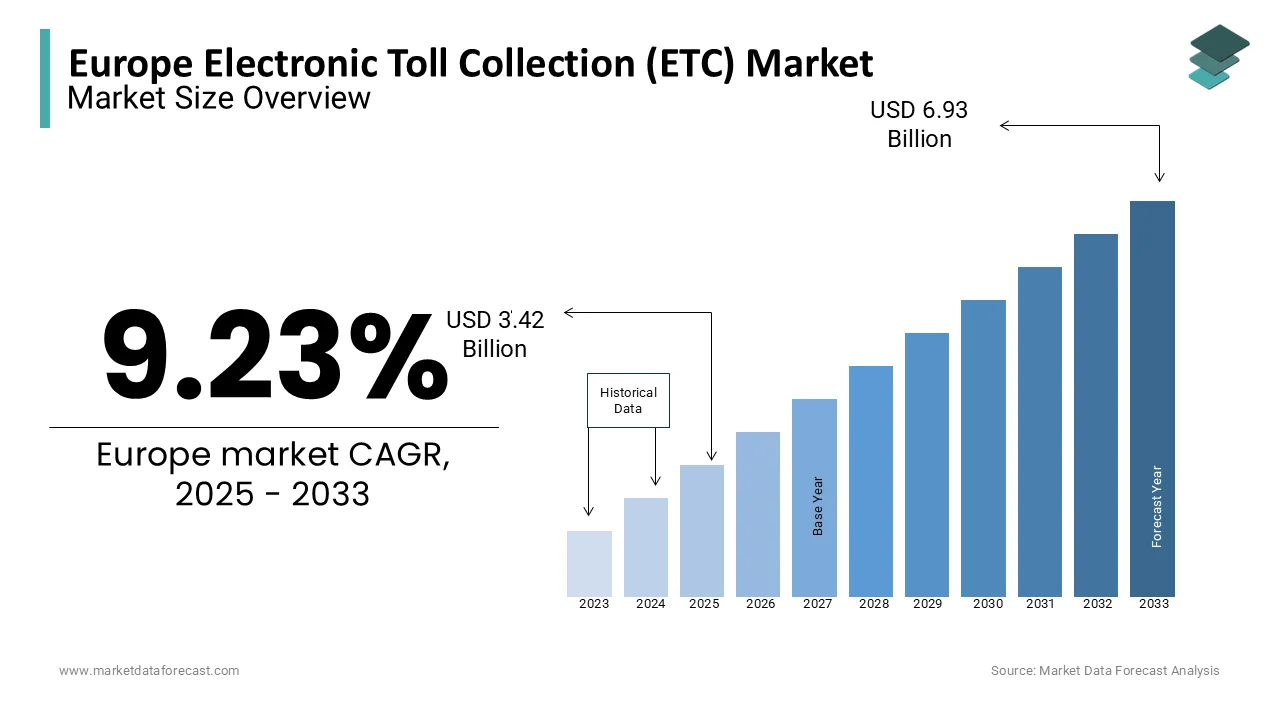

The Europe's electronic toll collection market size was valued at USD 3.13 billion in 2024 and is anticipated to reach USD 3.42 billion in 2025 from USD 6.93 billion by 2033, growing at a CAGR of 9.23% from 2025 to 2033.

Electronic Toll Collection (ETC) is designed to streamline toll payment processes and reduce traffic congestion and enhance overall road network efficiency. ETC systems utilize advanced technologies such as Radio Frequency Identification (RFID), Dedicated Short-Range Communication (DSRC), and Global Navigation Satellite Systems (GNSS) to enable seamless, cashless transactions for vehicles passing through toll plazas.

The European ETC market has witnessed significant growth in recent years due to the increasing urbanization, rising vehicle ownership, and the need for efficient traffic management solutions. According to a report by the European Automobile Manufacturers Association, over 70% of toll transactions in Europe are now conducted electronically, which indicates the widespread adoption of ETC systems. Countries such as France, Germany, and Italy have been at the forefront of this transformation, with well-established ETC networks like France’s Liber-T and Italy’s Telepass. Additionally, the push of the European Union for interoperability under the European Electronic Toll Service (EETS) framework has further accelerated market expansion, enabling cross-border toll collection without the need for multiple devices.

MARKET DRIVERS

Urbanization and Traffic Congestion in Europe

Rapid urbanization across Europe has led to increased traffic congestion, particularly in metropolitan areas, driving the demand for efficient toll-collection systems. According to Eurostat, over 75% of the European Union’s population resides in urban areas, contributing to significant traffic bottlenecks. Electronic toll collection systems alleviate congestion by enabling seamless vehicle movement through toll plazas, reducing average wait times by up to 80%. For instance, Germany’s implementation of ETC on its autobahns has decreased traffic delays by approximately 30%, as reported by the Federal Ministry of Transport and Digital Infrastructure. These systems are essential for managing the growing volume of vehicles in urban centers, ensuring smoother traffic flow and reducing environmental impact.

Government Initiatives and Regulatory Support

Government policies and regulatory frameworks have been instrumental in propelling the adoption of electronic toll collection systems across Europe. The European Union’s European Electronic Toll Service (EETS) mandates interoperability, allowing vehicles to use a single device for toll payments across member states. According to the European Commission, this initiative has increased ETC adoption rates by 40% since its introduction. Additionally, countries like France and Italy have implemented tax incentives for ETC users, further boosting market penetration. The French Ministry of Ecological Transition reported a 25% increase in ETC device registrations following the introduction of such incentives. These efforts underscore the critical role of government support in fostering market growth.

MARKET RESTRAINTS

High Initial Implementation Costs

The deployment of electronic toll collection systems requires substantial upfront investment in infrastructure, including gantries, sensors, and backend software, which can be a significant barrier for many regions. According to the European Court of Auditors, the average cost of implementing an ETC system on a major highway can exceed €50 million, depending on the scale and complexity. Smaller countries or regions with limited budgets often struggle to allocate funds for such projects. For instance, a report by the Polish Ministry of Infrastructure highlighted that the high costs delayed the adoption of ETC systems in certain areas by nearly five years. These financial constraints hinder widespread adoption, particularly in less economically developed regions.

Privacy and Data Security Concerns

The reliance on advanced technologies like RFID and GNSS in electronic toll collection systems raises concerns about data privacy and security. The European Data Protection Board has emphasized that the collection and storage of vehicle movement data pose risks of misuse or breaches. A survey conducted by the European Union Agency for Cybersecurity revealed that 60% of respondents expressed concerns about the potential misuse of their travel data. In Germany, the Federal Commissioner for Data Protection and Freedom of Information has flagged instances of unauthorized access to toll data, further exacerbating public distrust. These concerns can deter users from adopting ETC systems, slowing market growth.

MARKET OPPORTUNITIES

Integration with Smart City Initiatives

The growing emphasis on smart city development across Europe presents a significant opportunity for the electronic toll collection market. Smart city projects aim to enhance urban living through technology-driven solutions, including intelligent transportation systems. According to the European Commission, over 300 cities in the EU are actively implementing smart city strategies, with transportation being a key focus area. ETC systems can integrate seamlessly with these initiatives, providing real-time traffic data and enabling dynamic toll pricing to manage congestion. For example, the Dutch Ministry of Infrastructure and Water Management reported a 20% improvement in traffic flow in cities where ETC systems were integrated with smart city frameworks. This synergy positions ETC as a critical component of future urban mobility.

Adoption of Advanced Technologies

The incorporation of emerging technologies such as artificial intelligence, IoT, and blockchain into electronic toll collection systems offers immense growth potential. These technologies can enhance accuracy, security, and user experience. The European GNSS Agency (GSA) highlighted that the use of AI in toll systems could reduce operational costs by up to 15% while improving transaction processing speeds. Additionally, blockchain technology can address data security concerns by providing tamper-proof transaction records. A pilot project in Austria, supported by the Austrian Ministry for Climate Action, demonstrated a 30% increase in user trust when blockchain was integrated into toll systems. Such advancements are expected to drive market expansion and innovation.

MARKET CHALLENGES

Interoperability Issues Across Borders

Despite the European Electronic Toll Service (EETS) framework, achieving full interoperability across member states remains a significant challenge. Differences in technology standards, pricing models, and regulatory requirements create complexities for seamless cross-border toll collection. The European Commission reported that only 60% of ETC systems in the EU are fully interoperable as of 2023, leading to inefficiencies for international travelers. For instance, a study by the German Federal Highway Research Institute found that 25% of cross-border trucking companies face delays due to incompatible toll systems. These interoperability gaps hinder the user experience and limit the effectiveness of ETC systems in promoting frictionless mobility across Europe.

Resistance to Adoption Among Users

Consumer reluctance to adopt electronic toll collection systems, particularly among older demographics, poses a challenge to market growth. According to Eurostat, nearly 30% of individuals aged 50 and above in the EU are hesitant to use digital toll systems due to perceived complexity or lack of trust. A survey conducted by the French National Institute for Transport and Safety Research revealed that 40% of non-users prefer traditional cash-based toll payments. This resistance is further compounded by concerns over hidden fees and technical glitches, as highlighted by the UK Department for Transport. Overcoming this resistance requires targeted awareness campaigns and user-friendly solutions to boost adoption rates.

SEGMENTAL ANALYSIS

Europe Electronic Toll Collection (ETC) Market By Type

The automatic vehicle identification system (AVIS) segment led the market by accounting for 46.1% of the European market share in 2024. AVIS plays critical role in electronic toll collection (ETC) and traffic management. According to the U.S. Department of Transportation, ETC systems using AVIS technologies like RFID have reduced toll plaza congestion by 5-90%, significantly improving traffic flow. The importance of AVIS lies in its ability to enable seamless, contactless transactions, with over 70% of toll transactions in developed countries processed through AVIS-based systems, as reported by the International Bridge, Tunnel and Turnpike Association (IBTTA).

The violation enforcement system (VES) is growing at a promising pace and is anticipated to grow at a CAGR of 12.5% over the forecast period owing to the increasing adoption of automated traffic enforcement solutions to enhance road safety and reduce violations. For instance, the European Transport Safety Council states that speed cameras, a key VES application, have reduced speeding violations by 30-50% in Europe. Similarly, the National Highway Traffic Safety Administration (NHTSA) reports that red-light cameras in the U.S. have decreased fatal crashes at signalized intersections by 21%. The rising focus on smart city initiatives and stricter traffic regulations globally further accelerates VES adoption.

Europe Electronic Toll Collection (ETC) Market By Technology

The RFID segment dominated the market and accounted for 40.4% of the European market share in 2024. The reliability, non-contact operation, and widespread adoption of RFID in toll systems across the European region are major factors propelling the growth of the RFID segment. RFID ensures seamless toll collection, reducing traffic congestion by enabling vehicles to pass through toll plazas at high speeds. For instance, the U.S. E-ZPass system, which uses RFID, processes over 1 billion transactions annually, highlighting its importance in modern transportation infrastructure. Governments favor RFID due to its cost-effectiveness and ability to integrate with existing systems, making it a cornerstone of ETC solutions.

The GNSS/GPS segment is anticipated to register the fastest CAGR of 12.5% over the forecast period owing to the shift toward open-road tolling and distance-based charging to eliminate the need for physical toll plazas. GNSS-based systems are gaining traction due to their scalability and ability to cover vast geographic areas. For example, the European Union’s Galileo GNSS system supports tolling across over 30 countries, reducing infrastructure costs and improving efficiency. The increasing adoption of connected vehicles and smart transportation systems further accelerates this segment’s growth, making GNSS a critical technology for future tolling solutions.

Europe Electronic Toll Collection (ETC) Market By End-user

The highways segment had 60.3% of the European market share in 2024. The domination of the highways segment in the European market is primarily attributed to the key role that highways play in long-distance travel and freight movement. ETC systems on highways, such as RFID-based solutions, enable seamless toll collection, reducing congestion and travel time. For example, the U.S. E-ZPass system processes over 1 billion transactions annually, significantly improving traffic flow and fuel efficiency. Governments prioritize highway ETC systems to modernize infrastructure and support economic growth, making it the largest and most important segment in the ETC market.

The urban area segment is estimated to progress at a CAGR of 10.8% during the forecast period. Rapid urbanization, increasing traffic congestion, and the need for sustainable transportation solutions are contributing to the expansion of the urban areas segment in the European market. Urban ETC systems, such as London’s Congestion Charge Zone, use technologies like ANPR to manage traffic and reduce emissions, generating over £200 million annually (Transport for London). The adoption of GNSS-based systems for dynamic pricing and zone-based tolling further accelerates growth. Urban ETC systems are vital for smart city initiatives, making this segment crucial for future transportation planning and environmental sustainability.

REGIONAL ANALYSIS

Germany holds the leading position in the European electronic toll collection (ETC) market and captured 33.8% of the European market share in 2024. The country benefits from substantial government investments in road infrastructure, ensuring efficient and widespread ETC system coverage. Its advanced tolling network, including satellite-based toll collection for trucks, has strengthened its dominance.

France is another key player in the ETC market. The extensive highway network of France and the adoption of cutting-edge tolling technologies are driving the ETC market in France. The country has implemented interoperable tolling solutions that facilitate seamless transportation across major routes. The government's focus on reducing congestion and improving traffic flow has further accelerated the market's growth.

Italy is one of the top-performing countries in the European market owing to its well-established tolling infrastructure and integration of electronic payment systems. The country's extensive use of RFID and GPS-based toll collection ensures minimal traffic disruptions. Italy's commitment to smart mobility solutions continues to drive its market share and growth in the ETC sector.

KEY MARKET PLAYERS

Kapsch TrafficCom, Q-Free ASA, Siemens Mobility, Toll Collect GmbH, Emovis, Egis Group, Neology, Thales Group (France). These are the market players that are dominating the Europe electronic toll-collection market.

MARKET SEGMENTATION

This research report on the Europe electronic toll collection (ETC) is segmented and sub-segmented into the following categories.

By Type

- Automatic Vehicle Classification (AVC)

- Violation Enforcement System (VES)

- Automatic Vehicle Identification System (AVIS)

- Others (Transaction Processing/Back Office)

By Technology

- Radio Frequency Identification (RFID)

- Dedicated Short Range Communication (DSRC)

- Global Navigation Satellite System (GNSS)/GPS

- Video Analytics

- Cell Phone Tolling

- Others (Barcode-based ETC)

By End-user

- Highway

- Urban Area

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe electronic toll collection market?

Europe electronic toll collection market size was valued at USD 3.13 billion in 2024

What market drivers are driving the Europe electronic toll collection market?

Urbanization and Traffic Congestion in Europe and Government Initiatives and Regulatory Support are the major market drivers that are driving the Europe electronic toll collection market.

Who are the market key players that are dominating the Europe electronic toll collection market?

Kapsch TrafficCom, Q-Free ASA, Siemens Mobility, Toll Collect GmbH, Emovis, Egis Group, Neology, Thales Group (France). These are the market players that are dominating the Europe electronic toll collection market

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com