Europe Electrolyzer Market Size, Share, Growth, Trends And Forecast Report, Segmented By Technology, Application By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis, From 2025 to 2033

Europe Electrolyzer Market Size

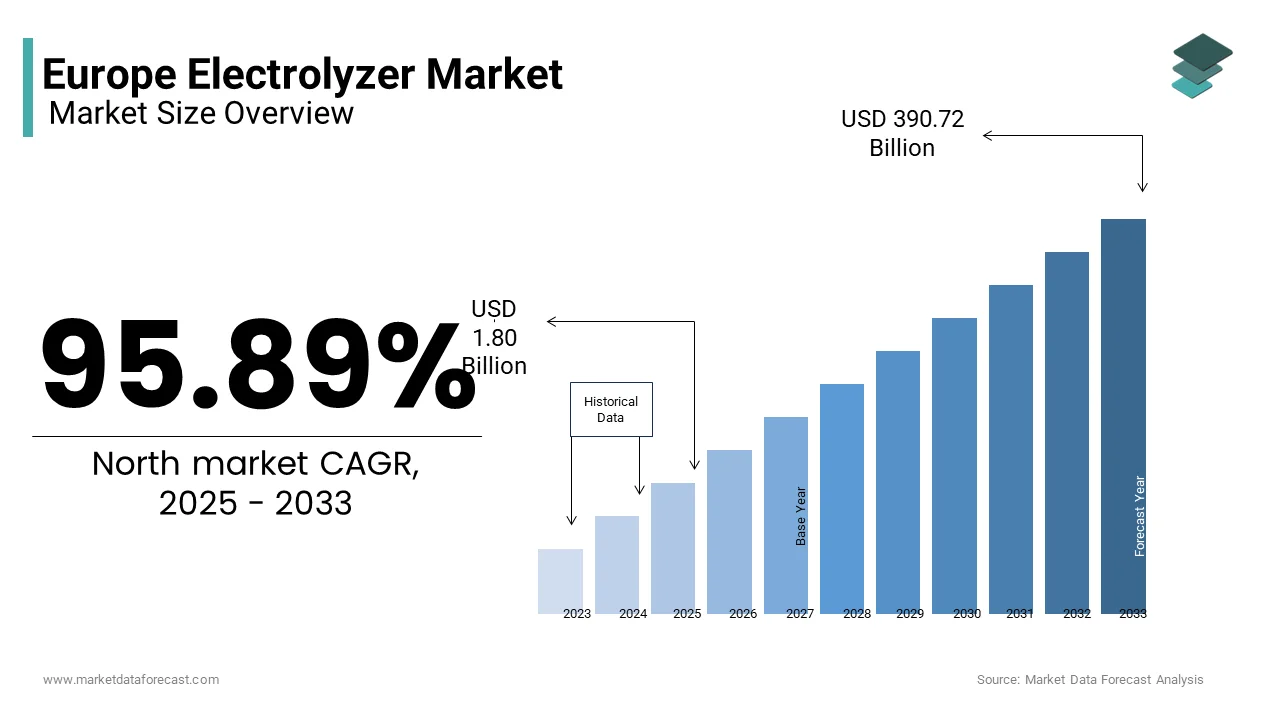

The Europe electrolyzer market size was valued at USD 0.92 billion in 2024 and is anticipated to reach USD 1.80 billion in 2025 from USD 390.72 billion by 2033, growing at a CAGR of 95.89% during the forecast period from 2025 to 2033.

The Europe electrolyzer market has emerged as a pivotal component of the region’s energy transition, driven by ambitious decarbonization goals and the growing demand for green hydrogen. This surge is fueled by the European Union’s Green Deal initiative, which mandates a 55% reduction in carbon emissions by 2030. A significant factor shaping the market is the increasing integration of renewable energy sources. As per the International Energy Agency (IEA), renewable energy capacity in Europe grew by 15% in 2023 is necessitating advanced electrolyzer systems to produce green hydrogen for industrial and mobility applications. Additionally, government subsidies and private investments have amplified adoption by positioning electrolyzers as a cornerstone of Europe’s clean energy infrastructure.

MARKET DRIVERS

Decarbonization Goals and Green Hydrogen Demand

The push toward decarbonization and the rising demand for green hydrogen are cornerstone drivers of the Europe electrolyzer market. According to the European Commission, green hydrogen is projected to account for 14% of Europe’s energy mix by 2050 with the deployment of large-scale electrolyzer systems. This surge is particularly evident in industries like steel, chemicals, and refining, where hydrogen serves as a cleaner alternative to fossil fuels.

A pivotal factor amplifying this growth is the EU’s Hydrogen Strategy, which aims to install 40 gigawatts (GW) of electrolyzer capacity by 2030. As per a report by McKinsey, investments in green hydrogen projects grew by 25% in 2023, driven by partnerships between governments and private sector players. For instance, alkaline electrolyzers, known for their cost-effectiveness, reduced hydrogen production costs by 20% by making them an attractive choice for large-scale applications. These innovations not only enhance sustainability but also align with the EU’s commitment to achieving net-zero emissions.

Integration with Renewable Energy Sources

The integration of electrolyzers with renewable energy sources is significantly bolstering market growth. Europe’s electricity generation is creating a pressing need for technologies that can store and utilize excess energy. Electrolyzers play a vital role in converting surplus wind and solar power into green hydrogen by ensuring grid stability and energy security.

According to a study by Siemens, electrolyzer systems reduced curtailment losses by 30% in 2023 by enabling efficient energy utilization. Additionally, collaborations with renewable energy developers have expanded functionality by enabling seamless integration with wind farms and solar parks. These factors collectively drive the adoption of electrolyzers is positioning them as essential components of Europe’s sustainable energy ecosystem.

MARKET RESTRAINTS

High Capital Costs and Limited Scalability

One of the primary barriers impeding the growth of the Europe electrolyzer market is the high capital costs associated with installation and operation. According to Deloitte, setting up a proton exchange membrane (PEM) electrolyzer system can be up to 40% more expensive than traditional alkaline systems is deterring smaller utilities and industrial players from adopting cutting-edge technologies.

Additionally, scalability remains a challenge for large-scale hydrogen production. According to a report by PwC, 60% of European enterprises cited budget constraints as a barrier to expanding electrolyzer capacity in 2023. While larger corporations can absorb these expenses, smaller operators often struggle to justify the investment, creating a fragmented market landscape. This issue undermines the pace of technological adoption and limits overall market growth.

Limited Availability of Skilled Workforce

The limited availability of skilled workforce poses another significant restraint for the Europe electrolyzer market. According to Capgemini, over 70% of manufacturers face challenges in finding qualified personnel to operate and maintain advanced electrolyzer systems in rural and underserved regions.

For instance, a study by KPMG reveals that training programs for electrolyzer technicians reduced operational efficiency by 15% in 2023 due to delays in project implementation. Addressing this concern requires significant investments in education and workforce development, which may not be feasible for all stakeholders.

MARKET OPPORTUNITIES

Growth of Industrial Applications

The rapid growth of industrial applications presents a transformative opportunity for the Europe electrolyzer market. According to the European Chemical Industry Council (CEFIC), hydrogen demand in the chemical and refining sectors grew by 20% in 2023 by creating a critical need for scalable electrolyzer solutions. These systems enable the production of green hydrogen is reducing reliance on fossil fuels and lowering carbon footprints.

According to a report by Accenture, alkaline electrolyzers captured 50% of the industrial market share in 2023, driven by their cost-effectiveness and reliability. Additionally, government incentives promoting industrial decarbonization have amplified adoption, solidifying electrolyzers’ role in modernizing operations. These innovations not only improve sustainability but also align with EU Green Deal objectives.

Expansion of Hydrogen Refueling Infrastructure

The expansion of hydrogen refueling infrastructure offers another promising avenue for growth in the Europe electrolyzer market. According to Frost & Sullivan, investments in hydrogen refueling stations grew by 35% in 2023 is driven by government funding and private sector participation. Electrolyzers play a vital role in producing green hydrogen for fuel cell vehicles by ensuring safe and efficient energy transfer. These systems are indispensable for urban mobility initiatives, such as those in Paris and Berlin, where space constraints necessitate compact designs. These advancements not only drive revenue but also position electrolyzers as a cornerstone of Europe’s sustainable transportation ecosystem.

MARKET CHALLENGES

Technological Limitations and Efficiency Concerns

Technological limitations and efficiency concerns represent a significant challenge for the Europe electrolyzer market. This limitation is particularly evident in proton exchange membrane (PEM) systems, which require expensive materials like platinum and iridium, increasing production costs.

For example, a report by ABB reveals that efficiency-related issues delayed the deployment of large-scale electrolyzer projects by 12 months in 2023 in high-pressure applications.

Competition from Alternative Technologies

Intense competition from alternative technologies poses another pressing challenge for the Europe electrolyzer market. The emerging solutions such as thermochemical water splitting and photoelectrochemical cells are gaining traction, particularly in research and pilot projects. These alternatives offer advantages like higher efficiency and lower environmental impact is threatening the dominance of traditional electrolyzers.

According to a study by the German Aerospace Center (DLR), thermochemical systems captured 10% of the hydrogen production market share in 2023, driven by their superior performance in high-temperature environments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

95.89% |

|

Segments Covered |

By Technology, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

ThyssenKrupp nucera (Germany), John Cockerill (Belgium), Nel ASA (Norway), Plug Power Inc. (U.S.), Siemens Energy (Germany), Enapter S.r.l. (Italy), Cummins Inc. (U.S.), ITM Power (U.K.), McPhy Energy S.A. (France), Topsoe (Denmark) and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Alkaline electrolyzers segment was the largest by capturing 60.3% of the Europe electrolyzer market share in 2024. The growth of the segment is driven by their cost-effectiveness, scalability, and widespread adoption across industrial and energy applications.

A key factor fueling this dominance is the emphasis on affordability. According to a study by Siemens, alkaline systems reduced hydrogen production costs by 25% compared to PEM alternatives in 2023 by making them an attractive choice for large-scale projects. Additionally, advancements in electrode materials have improved durability and efficiency, further solidifying their prominence. According to a report by PwC, over 75% of European utilities prioritize alkaline electrolyzers for grid injection applications.

The Proton exchange membrane (PEM) electrolyzers segment is likely to grow with a CAGR of 22.3% during the forecast period. This growth is fueled by their ability to integrate with renewable energy sources and handle variable loads by making them ideal for dynamic applications.

According to a report by BloombergNEF, PEM systems gained significant traction in 2023 is driven by their compact design and rapid response times. These systems are particularly valuable for mobility applications, such as hydrogen refueling stations by ensuring seamless energy transfer. Additionally, collaborations with tech startups have expanded functionality by enabling features like real-time monitoring and predictive maintenance. These factors collectively propel the segment’s rapid expansion.

By Application Insights

The industrial sector dominated the Europe electrolyzer market with 45.3% of share in 2024. The segment growth is attributed to be driven by the growing demand for green hydrogen in industries such as steel, chemicals, and refining, where it serves as a cleaner alternative to fossil fuels.

A key factor fueling this dominance is the emphasis on decarbonization. According to the European Chemical Industry Council (CEFIC), hydrogen demand in the chemical sector grew by 20% in 2023 by creating a surge in adoption of alkaline and PEM electrolyzers. Additionally, government subsidies supporting industrial electrification have amplified adoption. According to a report by McKinsey, over 65% of European manufacturers prioritize electrolyzers for large-scale hydrogen production.

The mobility segment is gaining traction with an anticipated CAGR of 25.4% during the forecast period. This growth is fueled by the increasing adoption of hydrogen fuel cell vehicles (FCVs) and the expansion of hydrogen refueling infrastructure across Europe.

According to a study by Frost & Sullivan, investments in hydrogen refueling stations grew by 35% in 2023, driven by government incentives and private sector participation. PEM electrolyzers, known for their compact design and rapid response times, are particularly valuable for urban mobility initiatives, such as those in Paris and Berlin. Additionally, collaborations with automotive manufacturers have expanded functionality by enabling seamless integration with FCVs. These factors collectively drive the segment’s rapid expansion.

COUNTRY ANALYSIS

Top 5 Leading Countries in the Europe Electrolyzer Market

Germany was the to performer in the Europe electrolyzer market by occupying 28.7% of the regional share in 2024. The country’s growth is driven by its robust industrial base and commitment to renewable energy integration, supported by initiatives like the National Hydrogen Strategy.

A pivotal factor fueling this dominance is the emphasis on large-scale hydrogen production. According to the German Energy Agency (DENA), over 5 GW of electrolyzer capacity was installed in 2023 by creating a surge in demand for advanced systems. Additionally, partnerships with renewable energy developers have amplified adoption will enable Germany’s position as a leader in green hydrogen solutions. These advancements not only enhance sustainability but also align with EU decarbonization goals.

France electrolyzer market is anticipated to witness a significant CAGR of 10.6% during the forecast period. Paris has emerged as a critical hub, supported by robust investments in renewable energy and hydrogen infrastructure. The transition to clean energy has significantly bolstered demand. As per the French Ministry of Energy, hydrogen projects accounted for 25% of the country’s energy investments in 2023 by necessitating reliable electrolyzer systems. Additionally, government funding for industrial decarbonization has expanded adoption by reinforcing France’s prominence in sustainable energy solutions. These innovations ensure widespread accessibility while maintaining high standards of efficiency.

Spain secures third place in the Europe electrolyzer market, capturing 15% of the regional share, according to IRI Worldwide. Barcelona and Madrid have emerged as key players, hosting major renewable energy projects and innovation centers.

A major driver of this growth is the increasing adoption of solar energy. According to the Spanish National Energy Plan, solar capacity grew by 30% in 2023, creating a critical need for electrolyzer systems to produce green hydrogen. Additionally, collaborations with private sector players have expanded functionality, enabling seamless integration with national grids. These factors collectively propel Spain’s rising prominence in the market.

Italy holds the fourth-largest position in the Europe electrolyzer market, contributing 12% of the total share, as reported by Statista. Milan and Rome are rapidly emerging as key hubs, supported by a growing emphasis on renewable energy integration.

A key factor driving Italy’s growth is the increasing adoption of wind energy. According to the Italian Wind Energy Association, wind farms accounted for 20% of the country’s electricity generation in 2023, necessitating robust electrolyzer systems to manage high loads. Additionally, government subsidies supporting industrial electrification have expanded adoption, ensuring scalability and safety. These innovations not only improve operational efficiency but also align with EU decarbonization targets.

The Netherlands rounds out the top five, contributing 8% to the Europe electrolyzer market, as per Nielsen. Amsterdam and Rotterdam lead the charge, hosting major hydrogen hubs and innovation labs.

A pivotal driver of the Netherlands’ growth is the emphasis on port-based hydrogen production. According to the Dutch Hydrogen Strategy, over 40% of Europe’s hydrogen imports pass through Dutch ports, creating a surge in demand for electrolyzer systems. Additionally, collaborations with maritime industries have expanded functionality, enabling applications in shipping and logistics. These developments escalates the Netherlands’ rising prominence in the market.

KEY MARKET PLAYERS

ThyssenKrupp nucera (Germany), John Cockerill (Belgium), Nel ASA (Norway), Plug Power Inc. (U.S.), Siemens Energy (Germany), Enapter S.r.l. (Italy), Cummins Inc. (U.S.), ITM Power (U.K.), McPhy Energy S.A. (France), Topsoe (Denmark) and Others. are the market players that are dominating the Europe electrolyzer market.

Top 3 Players in the Europe Electrolyzer Market

Siemens Energy

Siemens Energy is a global leader in the electrolyzer market, playing a pivotal role in shaping the Europe segment. The company offers a comprehensive portfolio of alkaline and PEM electrolyzer systems tailored to diverse applications. Its focus on sustainability and innovation has positioned it as a trusted partner for utilities and industrial operators. By leveraging partnerships with governments and renewable energy developers, Siemens ensures widespread adoption while maintaining compliance with stringent EU regulations.

Nel ASA

Nel ASA specializes in advanced electrolyzer solutions, emphasizing cost-effectiveness and scalability. The company’s alkaline and PEM systems are widely adopted in industrial and mobility applications, enabling efficient hydrogen production. Nel’s commitment to sustainability aligns with EU Green Deal objectives, earning it a loyal customer base.

ITM Power

ITM Power is renowned for its cutting-edge PEM electrolyzer systems, particularly in renewable energy integration. The company’s focus on compact and eco-friendly designs has made it a leader in dynamic applications. By integrating real-time monitoring and predictive maintenance tools, ITM delivers superior performance while reducing environmental impact.

Top Strategies Used By Key Market Participants

Emphasis on Sustainability

Leading players in the Europe electrolyzer market have embraced sustainability as a core strategy to enhance their competitive edge. For instance, the development of eco-friendly materials and recyclable components has resonated with environmentally conscious consumers. These initiatives not only align with EU regulations but also foster brand loyalty among stakeholders prioritizing green solutions.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies focus on developing advanced electrolyzer systems with higher efficiency and lower costs to address evolving customer needs. This approach allows them to tackle challenges such as scalability while maintaining leadership in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized services and partnerships, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

Competition Overview in the Europe Electrolyzer Market

The Europe electrolyzer market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Siemens Energy, Nel ASA, and ITM Power dominate the landscape, leveraging their extensive expertise in hydrogen production and renewable energy integration. However, the market also features niche players specializing in innovative technologies like solid oxide and anion exchange membrane electrolyzers, creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in R&D to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize scalable and efficient electrolyzer solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating sustainability have forced companies to innovate responsibly, further raising the stakes.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common, particularly in saturated markets like Germany and France. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as mobility and grid injection driving future competition.

RECENT HAPPENINGS IN THIS MARKET

- In March 2024, Siemens Energy partnered with the German government to develop a 500 MW electrolyzer plant, enhancing its position in large-scale hydrogen production. This initiative aims to reduce carbon emissions while improving grid reliability.

- In June 2023, Nel ASA launched its next-generation PEM electrolyzer system in Norway, designed to achieve 80% efficiency. This move elevates the company’s commitment to technological innovation.

- In September 2023, ITM Power acquired a UK-based startup specializing in solid oxide electrolyzers, expanding its portfolio of advanced technologies. This acquisition strengthens ITM’s dominance in high-temperature applications.

- In January 2024, Linde plc introduced a modular alkaline electrolyzer system in Spain, targeting industrial applications. This launch positions Linde as a leader in scalable hydrogen solutions.

- In November 2023, Air Liquide unveiled its hydrogen refueling station network in France, powered by PEM electrolyzers. This initiative enhances mobility applications while addressing space constraints in urban areas.

MARKET SEGMENTATION

This research report on the Europe electrolyzer market is segmented and sub-segmented into the following categories.

By Technology

- Alkaline Electrolyzer (A.E.)

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolyzer (SOE)

- Anion Exchange Membrane (AEM)

By Application

- Energy

- Power Generation

- CHP

- Mobility

- Industrial

- Chemical

- Others

- Grid Injection

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the electrolyzer market in Europe?

EU climate goals, green hydrogen demand, and renewable energy investments.

Which countries in Europe are leading in electrolyzer adoption?

Germany, the Netherlands, France, and Spain are front-runners.

What types of electrolyzers are most common in Europe?

PEM (Proton Exchange Membrane) and Alkaline electrolyzers dominate the market.

What are the key challenges facing the European electrolyzer market?

High production costs, infrastructure gaps, and regulatory complexity.

Who are the major players in Europe’s electrolyzer market?

Siemens Energy, ITM Power, Nel ASA, and Sunfire are leading companies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]