Europe Electric Vehicle Charging Station Market Size, Share, Trends & Growth Forecast Report – Segmented By Level of Charging, Mode, Connection Phase, Dc Fast Charging Type, Charging Point Type, Application, Installation, Charging Infrastructure, Electric Bus Charging Type, Charging Service Type, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Electric Vehicle Charging Station Market Size

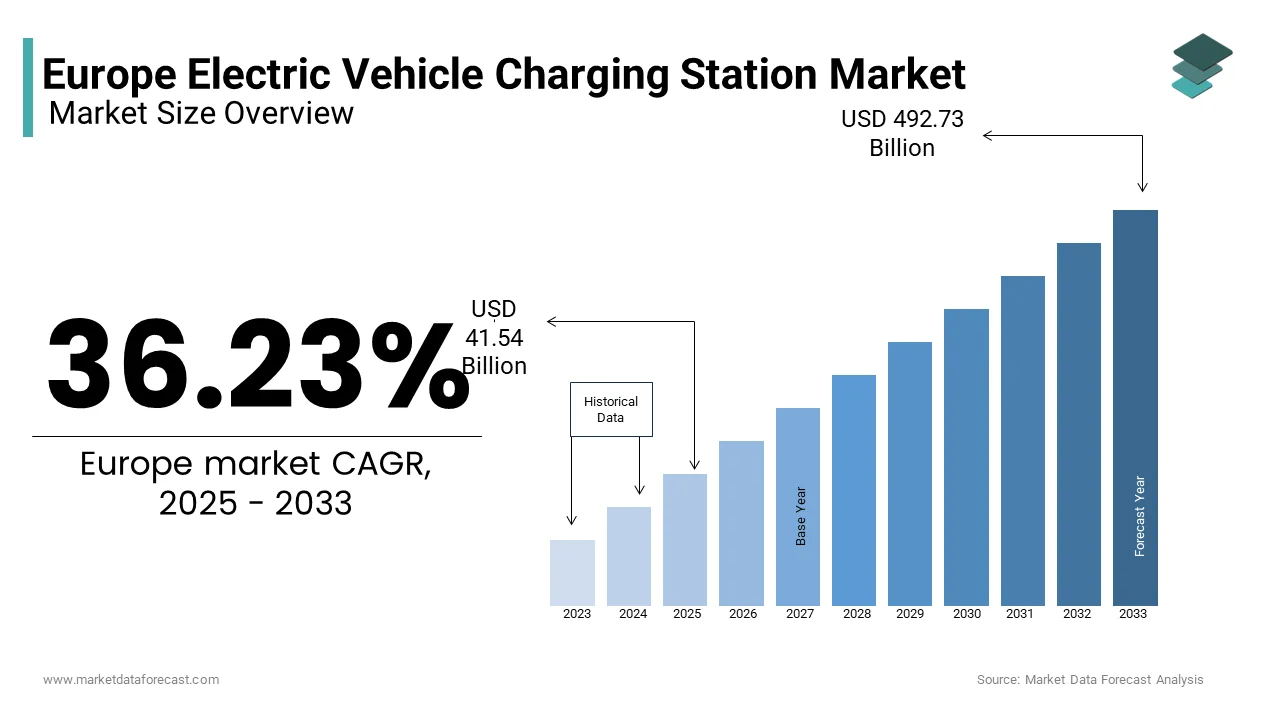

The Europe electric Vehicle charging station market size was valued at USD 30.49 billion in 2024 and is anticipated to reach USD 41.54 billion in 2025 from USD 492.73 billion in 2033, growing at CAGR 36.23% during the forecast period from 2025 to 2033.

charging stations serve as critical infrastructure for supporting the growing adoption of electric vehicles, providing the necessary ecosystem for both private and public charging needs. The European electric vehicle (EV) charging station market is a rapidly expanding which is accelerated by the continent’s commitment to decarbonize transportation and achieve net-zero emissions by 2050 under the European Green Deal.

According to the European Automobile Manufacturers’ Association (ACEA), Europe accounted for over 2 million new EV registrations in 2022, representing a 40% year-on-year increase. This surge in EV adoption has necessitated a parallel expansion of charging infrastructure, with the European Commission mandating the installation of 1 million public charging points by 2025 under the Alternative Fuels Infrastructure Regulation (AFIR).

Eurostat in its study found that as of 2023, there are approximately 400,000 publicly accessible charging stations across Europe, with countries like Germany, France, and the Netherlands leading in deployment. Moreover, according to the International Energy Agency (IEA), the market is transitioning toward fast and ultra-fast chargers which now account for 15% of all installations and is reducing charging times significantly. Additionally, private charging solutions including home and workplace chargers, dominate the market, representing over 70% of total installations. The European Investment Bank has allocated €25 billion to support EV infrastructure projects and is illustrating the region’s commitment to sustainable mobility. Despite this progress, challenges such as uneven regional distribution, grid capacity constraints, and high upfront costs persist. As Europe accelerates its transition to electric mobility, the EV charging station market is poised to play a pivotal role in shaping the future of transportation.

Market Drivers

Government Policies and Incentives

Government policies and incentives play a pivotal role in driving the Europe electric vehicle charging station market. The European Commission’s Green Deal which aims for carbon neutrality by 2050 has catalyzed significant investments in EV infrastructure. According to the European Alternative Fuels Observatory (EAFO), the number of publicly accessible charging points in the EU surged from 143,000 in 2019 to over 330,000 by the end of 2021. Financial incentives such as subsidies for private chargers and grants for public stations have further accelerated this growth. Germany’s KfW Development Bank reported disbursing €300 million in 2022 for EV-related infrastructure projects. These measures address range anxiety and encourage widespread EV adoption across Europe which is aligning with sustainability goals.

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles is also a major propellent of the charging station market in Europe. A study by the International Energy Agency (IEA) revealed that EV sales in Europe grew by 65% in 2021, accounting for 17% of total car sales. This surge is fueled by stringent emission regulations, such as the EU’s target to reduce CO2 emissions from new cars by 55% by 2030 compared to 2021 levels. Automakers like Volkswagen and Renault have committed billions to electrification, launching affordable EV models to meet consumer demand. A report by Statista reveals that Norway leads globally, with EVs comprising 86% of new car sales in 2022. This strong consumer interest underscores the urgent need for an expansive and reliable charging network across the continent.

Market Restraints

High Initial Investment Costs

The high initial investment required for setting up electric vehicle charging stations is a significant restraint in the European market. According to the European Investment Bank (EIB), installing a single fast-charging station can cost between €50,000 and €150,000 which depends on location and power capacity. These costs include hardware, grid upgrades, and installation fees that often deter small and medium enterprises from entering the market. The EIB also stated that upgrading the existing power grid to support widespread EV charging infrastructure could require an estimated €375 billion by 2030 across Europe. Such financial barriers limit the pace of expansion, particularly in rural and underdeveloped areas where profitability is uncertain. This challenge focuses on the need for innovative financing models and increased public-private partnerships to bridge the funding gap.

Grid Capacity and Energy Management Challenges

Grid capacity limitations and energy management issues pose another key restraint for the EV charging station market in Europe. A report by the European Network of Transmission System Operators for Electricity (ENTSO-E) warns that the current electricity grid may not handle the additional load from mass EV adoption without significant upgrades. For instance, if 80% of Europeans were to switch to EVs by 2040 then electricity demand could increase by 20% which will strain existing infrastructure. ENTSO-E further notes that peak charging times, especially during evenings, could lead to localized blackouts unless smart grid technologies are implemented. Additionally, integrating renewable energy sources into the grid remains complex, with only 38% of Europe’s electricity currently generated from renewables as per Eurostat. These challenges show the urgent need for advanced energy management solutions and grid modernization efforts.

Market Opportunities

Expansion of Smart Charging Infrastructure

The integration of smart charging technologies presents a potential opportunity for the Europe electric vehicle charging station market. The European Commission’s Joint Research Centre (JRC) reported that smart charging can reduce peak electricity demand by up to 30% and thereby optimizing energy use and minimizing strain on the grid. The JRC estimates that smart charging could save European consumers €1.5 billion annually in energy costs by 2030 while supporting renewable energy integration. Furthermore, the International Energy Agency (IEA) reports that over 70% of EV owners prefer chargers with smart features like remote monitoring and dynamic pricing. The EU is mandating interoperability standards for chargers under its Alternative Fuels Infrastructure Regulation so smart charging adoption is set to accelerate. This trend creates opportunities for tech companies and utilities to innovate and capture a growing market segment.

Growth Potential in Rural and Underserved Areas

Expanding EV charging infrastructure into rural and underserved areas offers immense growth potential for the European market. According to the European Environment Agency (EEA), only 10% of public charging stations are currently located in rural regions despite these areas accounting for 45% of the EU’s total land area. Bridging this gap aligns with the EU’s goal of achieving equitable access to EV infrastructure by 2030. The EEA also notes that rural EV adoption could increase by 200% if charging accessibility improves, driving demand for new stations. Additionally, the European Investment Bank (EIB) has earmarked €10 billion for green infrastructure projects, including rural EV chargers, by 2025. This focus on underserved regions not only boosts market expansion but also supports sustainable mobility for all citizens across Europe.

Market Challenge

Interoperability and Standardization Issues

The lack of full interoperability and standardization across charging networks is a notable challenge for the Europe electric vehicle charging station market. According to the European Commission’s Directorate-General for Mobility and Transport (DG MOVE), over 20 different charging connectors and payment systems are currently in use and is creating confusion for EV users. This fragmentation often forces drivers to subscribe to multiple services or face difficulties accessing chargers during cross-border travel. DG MOVE estimates that achieving seamless interoperability could increase charger utilization rates by up to 40%, benefiting both operators and consumers. Furthermore, a study by the European Automobile Manufacturers’ Association (ACEA) reveals that only 60% of public chargers in Europe are fully interoperable as of 2022. Addressing these inconsistencies through unified standards remains critical to enhancing user experience and accelerating EV adoption.

Uneven Regional Distribution of Charging Infrastructure

The uneven distribution of charging stations across Europe poses another grave challenge, particularly in Eastern and Southern regions. According to the European Alternative Fuels Observatory (EAFO), countries like Romania and Bulgaria have fewer than 100 publicly accessible chargers per million inhabitants when compared to over 1,000 in the Netherlands. This disparity discourages EV adoption in less-developed regions and exacerbates range anxiety for long-distance travelers. The EAFO also reports that 70% of all charging points in Europe are concentrated in just four countries: Germany, France, the Netherlands, and the UK. Additionally, Eurostat data shows that rural areas lag significantly behind urban centers in terms of infrastructure density, with urban regions hosting 80% of fast chargers. Bridging this regional gap is essential to ensure equitable access and support the EU’s green mobility goals.

SEGMENTAL ANALYSIS

Europe Electric Vehicle Charging Station Market By Level Of Charging

The Level 2 charging segment dominated the European EV charging station market by accounting for 85.8% of all publicly accessible charging points in 2024. Its widespread adoption stems from its balance of affordability, speed, and compatibility with most EV models. Offering 20-40 kilometers of range per hour, Level 2 chargers are ideal for residential, workplace, and urban public parking settings. The European Commission highlights that their lower installation costs compared to DC fast chargers make them a practical choice for mass deployment. As the backbone of Europe’s EV infrastructure, Level 2 charging supports daily commuting needs and reduces reliance on slower Level 1 chargers, making it critical for sustained EV adoption.

The Level 3 charging or DC fast charging segment is anticipated to witness the fastest CAGR of 32% . This is influenced by the increasing demand for long-distance travel and the rise of high-capacity EV batteries. ENTSO-E reports that DC fast chargers can deliver up to 100 kilometers of range in 10 minutes, addressing range anxiety effectively. Despite representing only 10% of Europe’s current charging infrastructure, their strategic placement along highways and urban hubs ensures quick recharging for travelers. The IEA emphasizes that expanding Level 3 networks is vital for supporting Europe’s goal of achieving 30 million EVs on roads by 2030, making it a key enabler of sustainable mobility.

Europe Electric Vehicle Charging Station Market Mode

The Mode 3 charging segment had the controlling share of 65.2% in the European EV charging market due to its advanced safety features, interoperability, and compatibility with Level 2 charging systems, making it ideal for both private and public use. Operating at power levels of 3.7 kW to 22 kW, Mode 3 supports efficient daily charging for homes, workplaces, and urban areas. The European Commission revealed that Mode 3 aligns with EU regulations and is making sure of standardized and reliable infrastructure. Its widespread adoption is critical for supporting Europe’s growing EV fleet, reducing range anxiety, and enabling seamless integration of renewable energy sources, solidifying its role as the backbone of EV charging infrastructure.

The Mode 4 charging, or DC fast charging segment is quickly expanding and is likely to experience the fastest CAGR of 35%, This swift rise is due to the surging demand for long-distance travel and the rise of high-capacity EV batteries. ENTSO-E reports that Mode 4 chargers can deliver up to 350 kW, providing 100 kilometers of range in just 10 minutes, making them indispensable for highway corridors and urban hubs. Despite representing only 10% of Europe’s current charging infrastructure, Mode 4 is pivotal for reducing range anxiety and supporting mass EV adoption. The IEA emphasizes that expanding Mode 4 networks is essential for achieving Europe’s target of 30 million EVs by 2030, ensuring sustainable and efficient mobility across the continent.

Europe Electric Vehicle Charging Station Market By Connection Phase

The Single-phase charging commanded the European market by accounting for 70.1% of all installations in 2024. Its extensive implementation is caused by its compatibility with standard household electrical systems, lower installation costs, and suitability for residential overnight charging. Operating at 230V, single-phase chargers deliver power outputs of 3.7 kW to 7.4 kW, making them ideal for urban areas where three-phase connections are less common. The European Commission emphasised that single-phase systems are critical for supporting daily commuting needs, particularly in densely populated regions. Their affordability and ease of integration into existing infrastructure ensure they remain a cornerstone of Europe’s EV charging ecosystem and is enabling gradual electrification.

The Three-phase charging segment emerged is the fastest-growing category with a projected CAGR of 28% because of the increasing demand for faster charging solutions in commercial and public settings. Operating at 400V, three-phase systems deliver up to 22 kW, considerably reducing charging times compared to single-phase systems. The EAFO reports that three-phase chargers are essential for workplaces, public parking facilities, and fleet operators, where high-power charging is critical. The IEA emphasizes that their ability to support larger EV fleets and integrate with renewable energy sources makes them vital for achieving Europe’s sustainability goals, ensuring scalable and efficient EV infrastructure expansion.

Europe Electric Vehicle Charging Station Market By Dc Fast Charging Type

The Fast DC charging segment led the market by occupying a share of 45% of all installations in 2024. These chargers deliver 100 kilometers of range in 15-30 minutes which is making them ideal for highway rest stops and urban hubs. According to the International Energy Agency (IEA), their widespread adoption is driven by their balance of speed, cost-effectiveness, and compatibility with most EV models. Fast DC chargers are critical for reducing range anxiety and supporting daily commuting needs, particularly in high-demand areas. Their scalability ensures they remain a cornerstone of Europe’s EV infrastructure and is enabling efficient energy distribution and fostering sustainable mobility.

The DC Ultrafast 2 charging segment is anticipated to witness the fastest CAGR of 40% over the estimation period. Operating at 150 kW to 350 kW, these chargers can provide up to 300 kilometers of range in just 10 minutes, catering to long-haul travel and high-capacity EVs. The EAFO reports that their deployment is concentrated along key transport corridors like the Trans-European Transport Network (TEN-T). This rapid growth is fueled by advancements in battery technology and increasing consumer demand for ultrafast recharging. Despite higher installation costs, DC Ultrafast 2 is pivotal for achieving Europe’s goal of accommodating 30 million EVs by 2030 which is ensuring seamless integration of renewable energy and supporting future-proof EV infrastructure.

Europe Electric Vehicle Charging Station Market By Charging Point Type

The AC charging segment was the largest segment and held 85% of all charging point in 2024. Its widespread adoption is mainly accelerating the growth of its affordability, ease of installation, and compatibility with residential and workplace settings. Operating at power levels of 3.7 kW to 22 kW, AC chargers are ideal for overnight charging, providing sufficient range for daily commuting needs. The International Energy Agency (IEA) stated that AC charging supports grid stability by enabling slower, distributed energy use. Its dominance ensures a scalable and cost-effective foundation for Europe’s EV infrastructure, fostering mass adoption and aligning with renewable energy integration goals.

The DC charging segment is predicted to witness the highest CAGR of 35.3% from 2025 to 2033. Operating at 50 kW to 350 kW, DC chargers cater to high-demand environments like highways and urban hubs, delivering up to 300 kilometers of range in just 10 minutes. The EAFO reports that DC charging is critical for reducing range anxiety and supporting long-distance travel, particularly along key transport corridors. This rapid growth is fueled by advancements in battery technology and increasing consumer demand for faster recharging solutions. Despite higher costs, DC charging is essential for enabling seamless EV adoption and achieving Europe’s goal of accommodating 30 million EVs by 2030, ensuring efficient and sustainable mobility.

Europe Electric Vehicle Charging Station Market By Application

The Private charging segment was the largest segment and held 60.4% of all charging points in 2024. Its affordability, convenience, and suitability for overnight use, particularly among homeowners. Operating at 3.7 kW to 22 kW, private chargers provide sufficient range for daily commuting while leveraging off-peak electricity rates which is primarily influencing the growth of this segment. The International Energy Agency (IEA) highlights that private charging reduces dependency on public infrastructure and supports grid stability. With over 80% of EV charging occurring at home, private charging forms the backbone of Europe’s EV ecosystem, ensuring widespread adoption and enabling seamless integration of renewable energy sources.

The Public charging segment is anticipated to witness the fastest CAGR of 40.4% from 2025 to 2033 owing to the increasing demand for fast and ultrafast DC chargers along highways and in urban hubs, catering to long-distance travelers and high-density areas. The EAFO reports that public charging is critical for reducing range anxiety and supporting mass EV adoption and particularly in cities where private charging is limited. By 2030, Europe aims to install 3 million public chargers under the EU Green Deal. Public charging ensures equitable access to EV infrastructure is enabling sustainable mobility and aligning with Europe’s goal of achieving carbon neutrality by 2050.

Europe Electric Vehicle Charging Station Market By Installation Type

The Fixed chargers led the European EV charging market by capturing 85.3% of all installations in 2024 because of their widespread adoption is propelled by their ability to provide reliable, high-capacity charging solutions, ranging from 3.7 kW for homes to 350 kW for ultrafast public stations. The International Energy Agency (IEA) shows that fixed chargers are essential for supporting daily commuting and long-distance travel, making them critical for reducing range anxiety. Their compatibility with smart grid technologies ensures efficient energy management and scalability. Fixed chargers form the backbone of Europe’s EV infrastructure, enabling mass adoption and aligning with the EU’s goal of achieving 30 million EVs on roads by 2030.

The Portable chargers segment is estimated to register the fastest CAGR of 25% from 2025 to 2033. These compact devices, operating at 2.3 kW to 3.7 kW, cater to urban dwellers and renters who lack access to fixed charging infrastructure. The EAFO reports that portable chargers are gaining traction due to their affordability and versatility, particularly in densely populated areas. While their slower charging speeds limit reliance, advancements in technology and declining costs are driving adoption. Portable chargers ensure equitable access to EV charging, addressing gaps in infrastructure and supporting Europe’s transition to sustainable mobility, especially for underserved communities.

Europe Electric Vehicle Charging Station Market By Charging Infrastructure Type

The Type 2 connectors segment dominated Europe’s EV charging market and accounted for 70.4% of all AC charging installations in 2024. Their widespread adoption is driven by compatibility with both single-phase and three-phase systems which is supporting power outputs of up to 22 kW for AC charging. As per the International Energy Agency (IEA), Type 2 is also integrated into CCS for DC fast charging, ensuring versatility across applications. Its alignment with EU regulations and widespread use in homes, workplaces, and public stations make it indispensable for daily commuting needs. Type 2’s standardization fosters seamless EV adoption, reduces range anxiety, and supports Europe’s transition to sustainable mobility.

The CCS (Combined Charging System) segment is predicted to witness the highest CAGR of 35.5%. Operating at power levels of up to 350 kW, CCS supports both AC and DC charging is making it ideal for fast and ultrafast public charging along highways and urban hubs. The EAFO reports that CCS is favored by major European automakers and aligns with EU goals to expand fast-charging networks. Its scalability and interoperability ensure it meets the demands of modern EVs, reducing range anxiety and enabling long-distance travel. Europe accelerates its electrification efforts. CCS is critical for achieving the EU’s target of accommodating 30 million EVs by 2030.

Europe Electric Vehicle Charging Station Market By Electric Bus Charging Type

The Charging via connectors segment was the largest segment and held 45.7% of installations in 2024. Affordability, compatibility with existing grid infrastructure, and suitability for overnight depot charging are driving the growth of the segment. Operating at AC or lower-power DC levels, this method supports predictable schedules and smaller fleets. The International Energy Agency (IEA) revealed that connector-based systems require minimal upfront investment, making them ideal for cities transitioning to electric buses. Their widespread adoption ensures reliable and scalable charging, forming the backbone of Europe’s shift toward zero-emission public transport and enabling gradual fleet electrification.

The Off-board top-down pantograph systems is expected to exhibit a noteworthy CAGR of 30% over the forecast period. These systems deliver high-power DC charging of up to 600 kW, enabling rapid recharging during short stops at terminals or along routes. The JRC reports that their growth is fueled by increasing demand for efficient, high-capacity solutions to support urban transit fleets. As cities aim to reduce emissions, off-board pantographs minimize operational disruptions and enhance route flexibility. Their scalability and ability to integrate with smart grids make them critical for achieving Europe’s goal of fully decarbonizing public transport by 2050, ensuring sustainable urban mobility.

Europe Electric Vehicle Charging Station Market By Charging Service Type

The EV charging services segment dominated the market and accounted for 95.8% of all charging solutions in 2024 owing to their versatility, scalability, and compatibility with diverse EV models and use cases. As per the International Energy Agency (IEA), these services support both AC and DC charging, catering to residential, public, and commercial needs. With over 330,000 public chargers in Europe as of 2022, EV charging services are critical for reducing range anxiety and enabling mass adoption. Their integration with renewable energy and smart grids ensures efficient energy management which is making them indispensable for achieving Europe’s goal of 30 million EVs by 2030.

The battery-swapping services segment is on the rise and is expected to be the fastest-growing segment in the global market by witnessing a CAGR of 40% from 2025 to 2033. This rapid growth is driven by demand for time-efficient solutions among commercial fleets, such as taxis and delivery vehicles. The EAFO reports that pilot projects in France and Germany demonstrate its potential to reduce downtime and grid strain. While challenges like high infrastructure costs persist, advancements in modular battery designs are boosting adoption. Battery swapping complements traditional charging by addressing long charging times, enhancing operational efficiency, and supporting urban electrification goals, ensuring it becomes a key enabler of sustainable mobility in Europe.

COUNTRY ANALYSIS

Germany: The Largest Market Leader

Germany had the biggest share of the European electric vehicle charging station market and held a 30.9% market share in 2024. Its prominence is linked to robust government incentives, including subsidies for charger installations and tax benefits for EV users. The German Federal Ministry for Economic Affairs highlights that the country has over 70,000 public charging points, supported by initiatives like the €3.5 billion National Charging Infrastructure Plan. Germany’s strong automotive industry, with companies like Volkswagen and BMW investing heavily in electrification, further solidifies its dominance. The nation’s proactive approach to expanding infrastructure ensures it remains a key player in Europe’s EV transition.

The Netherlands: A Rapidly Growing Market

The Netherlands is trailing closely and is likely to experience the fastest CAGR of 30% because of the ambitious policies such as the ban on petrol cars by 2030 and widespread adoption of smart charging technologies. The Dutch government has implemented programs like the Subsidy Scheme for Electric Transport (SETE), which encourages both private and public investments in EV infrastructure. The Netherlands has one of the highest densities of EV chargers in Europe, boasting over 100,000 charging points per million inhabitants. Its focus on sustainability, coupled with strong public-private partnerships, ensures the Netherlands remains a leader in fostering clean mobility solutions.

France: A Strategic Contributor

France is expected to exhibit considerable growth over the forecast period. This can be due to its focus on renewable energy integration and supportive regulations, such as the Advenir program, which funds EV infrastructure. The French Ministry for Ecological Transition notes that France has over 50,000 charging stations, with significant investments in urban and rural areas. The country’s commitment to reducing carbon emissions aligns with its goal of achieving 100% clean mobility by 2050. France’s balanced approach to infrastructure development ensures equitable access to EV charging, making it a pivotal contributor to Europe’s sustainable mobility goals.

MARKET SEGMENTATION

This research report on the Europe electric vehicle charging station market is segmented and sub-segmented into the following categories.

By Level Of Charging

- Level 1

- Level 2

- Level 3

By Mode

- Mode 1

- Mode 2

- Mode 3

- Mode 4

By Connection Phase

- Single Phase

- Three Phase

By Dc Fast Charging Type

- Slow Dc

- Fast Dc

- Dc Ultrafast 1

- Dc Ultrafast 2

By Charging Point Type

- Ac Charging

- Dc Charging

By Application

- Private

- Semi-Public

- Public

By Installation Type

- Portable Chargers

- Fixed Chargers

By Charging Infrastructure Type

- Ccs

- Chademo

- Type 1

- Nacs

- Type 2

- Gb/T Fast

By Electric Bus Charging Type

- Off-Board Top-Down Pantographs

- Onboard Bottom-Up Pantographs

- Charging Via Connectors

By Charging Service Type

- Ev Charging Services

- Battery Swapping Services

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]