Europe Electric Outboard Market Size, Share, Trends & Growth Forecast Report – Segmented By Power, Seed, Application, Distribution Channel, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Electric Outboard Market Size

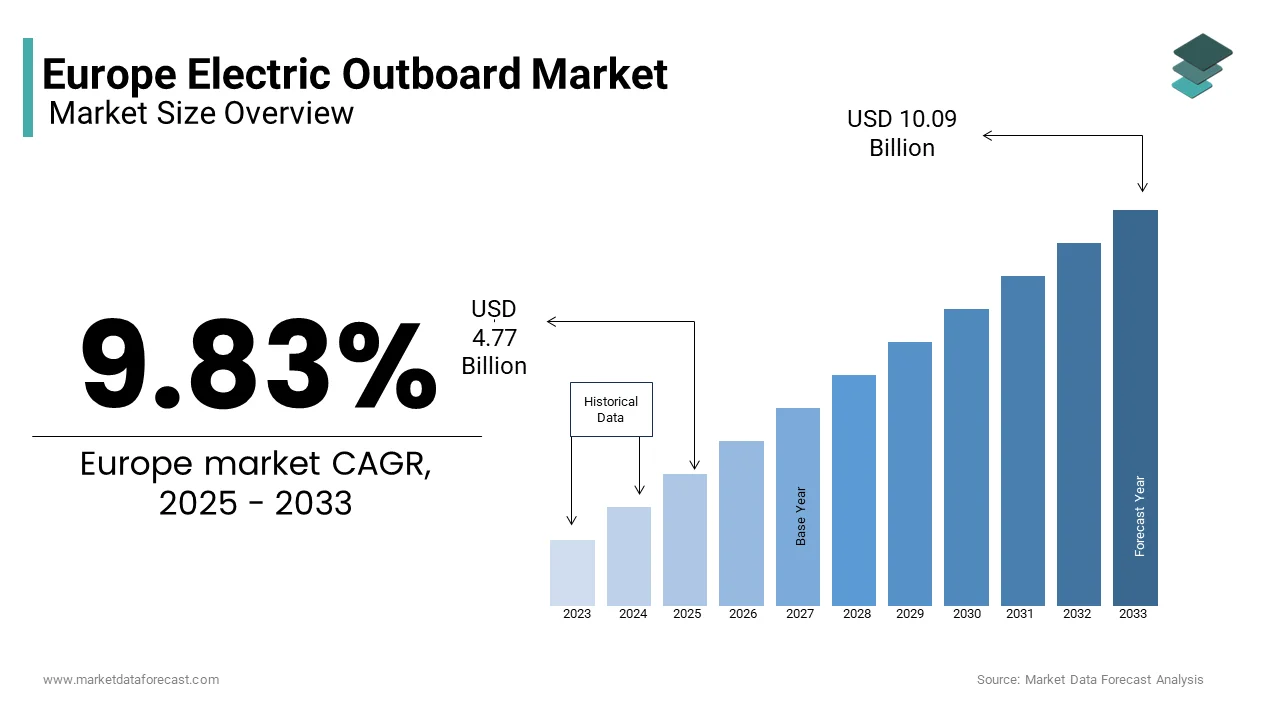

The Europe electric outboard market size was valued at USD 4.34 billion in 2024 and is anticipated to reach USD 4.77 billion in 2025 from USD 10.09 billion by 2033, growing at a CAGR of 9.83% during the forecast period from 2025 to 2033.

Electric outboard engines are compact, emission-free propulsion systems designed for small to medium-sized watercraft, including recreational boats, fishing vessels, and commercial dinghies. These engines are gaining traction as an eco-friendly alternative to traditional gasoline-powered outboards, aligning with stringent EU regulations aimed at reducing greenhouse gas emissions and combating water pollution.

The growth of the market is fueled by increasing consumer awareness about climate change, coupled with advancements in battery technology that enhance performance and efficiency. According to the European Environment Agency, maritime activities contribute to nearly 15% of coastal water pollution which is prompting governments to incentivize cleaner alternatives like electric outboards. Additionally, countries such as Norway, Sweden, and Germany are leading adopters due to their robust infrastructure for electric vehicles and renewable energy integration. A study by Eurostat reveals that over 60% of new recreational boats sold in Europe are now equipped with or compatible with electric propulsion systems. The demand for sustainable leisure and commercial boating is rising. Hence, the electric outboard engines market is set to play a key role in transforming Europe’s marine industry into a greener and more sustainable ecosystem.

Market Drivers

Stringent Environmental Regulations and Emission Reduction Goals

Stringent environmental regulations and emission reduction goals are Core motivators propelling the Europe electric outboard engines market. The European Environment Agency reports that maritime activities contribute approximately 15% of coastal water pollution which is prompting governments to enforce stricter emission standards under frameworks like the EU Green Deal. These regulations mandate a shift toward cleaner propulsion systems, with Norway and Sweden leading by offering subsidies for electric marine technologies. Additionally, Eurostat reported that over 70% of EU member states have implemented incentives to phase out fossil fuel-powered boats in protected water bodies. This regulatory push has accelerated the adoption of electric outboard engines, particularly among commercial operators and recreational boaters. Countries aim to achieve carbon neutrality by 2050. The demand for zero-emission marine solutions is expected to grow, making electric outboards a key enabler of sustainable boating practices across Europe.

Advancements in Battery Technology and Energy Efficiency

Advancements in battery technology and energy efficiency are pivotal in driving the Europe electric outboard engines market. Lithium-ion batteries which power these engines have seen a 40% improvement in energy density over the past decade, according to the International Renewable Energy Agency (IRENA). This progress has significantly enhanced the performance and range of electric outboards, addressing previous limitations such as limited runtime and slower speeds. According to the European Commission, investments in renewable energy infrastructure including charging stations for marine applications have grown by 25% annually and are further supporting adoption. These technological advancements are critical in meeting consumer expectations for reliable, high-performance, and eco-friendly marine propulsion systems.

Market Restraints

Limited Charging Infrastructure

A major barrier to adoption in the European electric outboard engines market is the inadequate charging infrastructure. According to the European Alternative Fuels Observatory (EAFO), as of 2022, there were only about 330,000 public charging points across Europe, with a stark imbalance between urban and rural regions. This lack of infrastructure creates range anxiety among boaters who fear being stranded without access to power sources on waterways. According to the International Energy Agency, less than 10% of Europe’s marinas are equipped with reliable electric charging facilities. Such gaps discourage potential buyers from transitioning to electric outboard engines despite their environmental benefits. Expanding this infrastructure requires substantial investment, making it a slow and challenging process.

High Upfront Costs

The high upfront cost of electric outboard engines compared to traditional gasoline-powered alternatives is another key difficulty. Eurostat reports that electric marine propulsion systems can be up to three times more expensive initially, deterring price-sensitive consumers. For instance, an average 5kW electric outboard engine costs approximately €4,000 to €6,000 whereas a similar gasoline model ranges between €1,500 to €2,500. Many buyers prioritize immediate affordability even though operational savings exist due to lower maintenance and fuel expenses. A report by the European Marine Equipment Council emphasizes that financial incentives like subsidies or tax breaks remain insufficient in several EU countries which is further limiting affordability for small-scale boat owners and recreational users alike. This cost barrier slows down the transition to sustainable marine technologies.

Market Opportunity

Stringent Emission Regulations Driving Demand

Stringent emission regulations imposed by the European Union will likely substantially benefit the European electric outboard engines market. The European Environment Agency states that maritime transport contributes approximately 13% of the EU’s total greenhouse gas emissions from the transportation sector that is prompting stricter policies under the European Green Deal. By 2030, the EU aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels. These regulations are pushing boat manufacturers and operators to adopt cleaner alternatives like electric outboard engines. According to a report by the European Commission, financial incentives such as subsidies for zero-emission technologies have increased by 20% in the past five years. This regulatory push creates a favourable environment for electric outboard engine manufacturers to expand their market share while aligning with sustainability goals.

Growing Demand for Sustainable Tourism

The rising trend of sustainable tourism in Europe presents another potential opportunity for the European electric outboard engines market. As per the European Travel Commission, eco-friendly travel options have grown by 30% over the past decade with tourists increasingly seeking low-impact recreational activities. Electric outboard engines which produce zero emissions and minimal noise pollution and aligns perfectly with this demand. A study by Eurostat reveals that coastal and inland water tourism contributes over €60 billion annually to the European economy, making it a lucrative segment for innovation. Additionally, the International Maritime Organization emphasizes that quieter and cleaner vessels enhance the experience of nature tourism, attracting environmentally conscious travelers. This shift toward sustainable tourism provides a strong impetus for manufacturers to develop advanced electric outboard solutions tailored to recreational boating needs.

Market Challenges

Limited Battery Technology and Performance

The limitation of current battery technology which affects performance and usability is a major challenge faced by the European electric outboard engines market. According to the European Maritime Safety Agency, most lithium-ion batteries used in electric outboard engines offer a limited range of approximately 20 to 50 nautical miles on a single charge, depending on the load and conditions. This range is insufficient for long-distance boating or commercial applications. Additionally, battery charging times remain a concern, with the European Alternative Fuels Observatory reporting an average recharge time of 4-8 hours for marine batteries. These limitations hinder adoption among professional users who require extended operational hours. Furthermore, advancements in battery energy density have been slow, with improvements averaging only 5% annually over the past decade which is delaying the development of more efficient solutions, according to Eurostat.

High Initial Investment Costs

The high initial investment required for electric outboard engines which acts as a barrier for many consumers in the market. The European Marine Equipment Council states that electric outboard engines are typically priced 2-3 times higher than their gasoline counterparts with entry-level models starting at around €3,000. For small-scale boat owners and recreational users, this upfront cost is often prohibitive despite potential long-term savings in fuel and maintenance. A report by Eurostat reveals that less than 15% of European boaters are willing to invest in premium-priced sustainable technologies without substantial financial incentives. Some EU countries offer subsidies but the European Commission notes that these incentives vary widely across regions and leave many buyers without adequate support. This disparity slows down the broader adoption of electric outboard engines in the market.

SEGMENTAL ANALYSIS

By Power

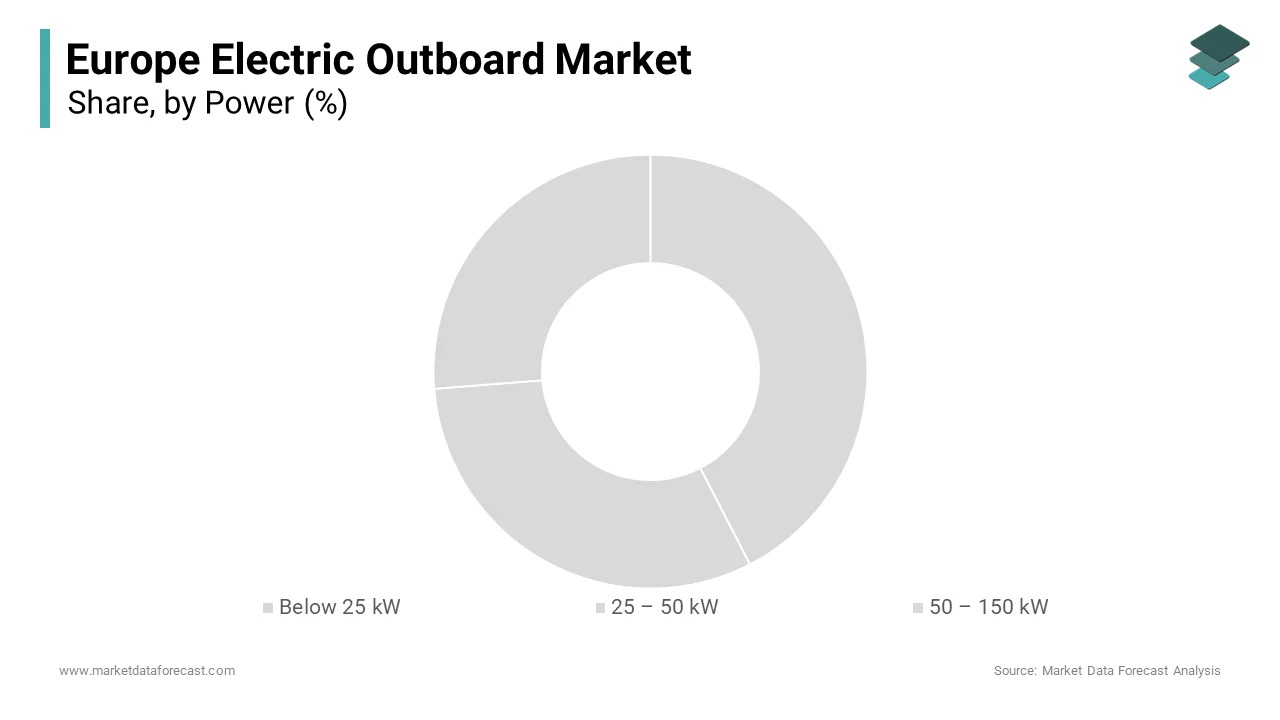

The "Below 25 kW" segment dominated the European electric outboard engines market by holding a market share of 70.8% owing to its alignment with recreational boating which accounts for over 80% of Europe's boating activities, according to the European Boating Industry. Engines in this range, priced between €1,500 and €4,000 are affordable for small boat owners. Their importance lies in supporting sustainable tourism, with the European Travel Commission reporting a 30% rise in eco-friendly travel. These engines also meet emission targets under the European Green Deal, making them vital for reducing maritime pollution.

However, the "25–50 kW" segment is predicted to witness the highest CAGR of 12.5% from 2025 to 2033 due to the increasing demand for mid-sized electric engines in water taxis and small commercial vessels which is supported by EU subsidies for sustainable marine technologies. The International Maritime Organization stated that this segment bridges the gap between recreational and commercial use, addressing the need for higher thrust without excessive costs. With commercial applications expected to grow by 20% annually, this segment is critical for achieving Europe’s goal of cutting maritime emissions by 55% by 2030 under the European Green Deal.

By Speed (mph)

The "Below 5 mph" segment led the market by capturing a 60.5% share due to its dominance in leisure and eco-friendly applications. This speed range is ideal for calm water activities like fishing, lake cruising, and nature tours, which account for over 70% of recreational boating in Europe, according to the European Boating Industry. These engines are energy-efficient, extending battery life by up to 40% compared to higher-speed models. Their importance lies in supporting sustainable tourism, with the European Travel Commission reporting a 25% annual rise in demand for low-impact boating. By reducing noise and emissions, this segment aligns with the EU’s goal of cutting maritime pollution under the European Green Deal.

The "Above 15 mph" segment is predicted to witness the highest CAGR of 18.3% from 2025 to 2033. This growth is fueled by advancements in motor and battery technology, enabling high-speed electric outboards to deliver thrilling experiences for recreational users and meet commercial needs for faster transport. The International Maritime Organization reported that these engines reduce emissions by up to 70% compared to gasoline alternatives. It currently accounts for only 10% of the market but it is important because it addresses performance demands and supports emission reduction targets under the European Green Deal, making it a key driver of innovation in the marine sector.

By Application

The "Recreational" segment was the largest segment and held 80% share owing to the rising demand for eco-friendly leisure boating, with Eurostat reporting that recreational activities contribute over €20 billion annually to Europe’s economy. Electric outboards are preferred for their quiet operation and zero emissions, making them ideal for lakes and inland waterways. According to the European Travel Commission, a 30% surge in sustainable tourism which is boosting demand further. Affordable pricing and suitability for small boats also make these engines accessible to hobbyists. This segment’s importance lies in reducing maritime pollution while aligning with the EU’s Green Deal targets for emission reductions.

The "Commercial" segment is estimated to register the fastest CAGR of 14.7% from 2025 to 2033 This rapid growth is fueled by stricter emission regulations under the European Green Deal and increasing urban mobility needs. The International Maritime Organization states that electric outboards can cut emissions by up to 50% compared to traditional engines. Currently representing 15% of the market, this segment is critical for applications like water taxis and small ferries. Eurostat notes cities such as Amsterdam and Venice are investing heavily in electric water transport, driving adoption. Its importance lies in promoting sustainable marine transport while supporting Europe’s climate goals and enhancing operational efficiency in commercial sectors.

By Distribution channel

The "Indirect Sales" segment dominated the market and held 70.2% share due to established distribution networks, including marine dealers and online platforms, which provide consumers with accessibility and post-purchase support. According to the European Marine Equipment Council, indirect channels enhance customer trust through warranties and technical assistance, critical for product adoption. Additionally, e-commerce growth has boosted this segment, with marine retailers reporting a 25% annual rise in online sales. Its importance lies in enabling widespread market penetration, catering to diverse customers, from recreational users to small businesses, while aligning with EU goals of promoting sustainable marine technologies through accessible channels.

On the other hand, the "Direct Sales" segment is anticipated to witness the fastest CAGR of 16.2% from 2025 to 2033. This growth is driven by manufacturers leveraging direct-to-consumer strategies, such as branded online stores and exclusive showrooms, to offer personalized solutions and reduce intermediary costs. The International Trade Administration notes that direct sales foster stronger customer relationships, appealing to eco-conscious buyers seeking transparency. While currently accounting for 30% of the market, its importance lies in allowing manufacturers to capture higher margins and build brand loyalty. This trend supports innovation and aligns with the EU’s push for sustainable products, ensuring long-term competitiveness in the evolving electric outboard market.

REGIONAL ANALYSIS

Germany

Germany dominated the European electric outboard engines market by holding a 25% share owing to the country’s robust infrastructure for renewable energy and electric mobility, supported by government incentives like subsidies for eco-friendly marine technologies. The European Environment Agency stated that Germany accounts for over 30% of Europe’s charging infrastructure, making it easier for boaters to adopt electric engines. Additionally, Germany’s strong manufacturing base and focus on sustainability align with the European Green Deal, driving demand. The German Marine Industry Association notes that recreational boating and inland water tourism contribute significantly to this growth, ensuring the country remains at the forefront of innovation in the marine sector.

France

France is the second-largest market and had a CAGR of 14.2%. It is fuelled by its booming sustainable tourism industry, particularly along the Mediterranean and Atlantic coasts. The European Travel Commission reports a 25% annual increase in eco-friendly boating activities, boosting demand for electric outboards. France’s stringent emission regulations under the EU Green Deal also encourage adoption, with financial incentives such as tax breaks for low-emission vessels. The French Maritime Cluster emphasizes that investments in clean maritime technologies have risen by 20% annually, supporting commercial and recreational applications. This combination of policy support and tourism growth solidifies France’s position as a key player in the electric outboard engines market.

Sweden: Pioneering Green Maritime Solutions

Sweden ranks third with a 12% market share as pointed out by the Swedish Transport Administration. Because of its commitment to sustainability, with ambitious goals to achieve net-zero emissions by 2045. Sweden’s extensive archipelagos and inland waterways make electric outboards ideal for eco-friendly recreational boating, which accounts for over 60% of marine activities, according to the Swedish Maritime Administration. The European Alternative Fuels Observatory notes that Sweden has one of Europe’s highest densities of marine charging stations, reducing range anxiety for users. Additionally, Swedish manufacturers are global leaders in green technology, fostering innovation. This focus on sustainability and technological advancement ensures Sweden remains a pioneer in adopting electric outboard engines across both recreational and commercial sectors.

KEY MARKET PLAYERS

Propel Technologies, Oceanvolt, Elco Motor Yachts, AquaWatt, Vision Marine Technologies, Sleipner Motor AS, Torqeedo, Newport Vessels, OXE Marine AB, Minn Kota, Greenline Yachts, Steyr Motors GmbH, Evoy, ePropulsion. These are the market players that are dominating the Europe electric outboard engines market.

MARKET SEGMENTATION

This research report on the Europe electric outboard engines market is segmented and sub-segmented into the following categories.

By Power

- Below 25 kW

- 25 – 50 kW

- 50 – 150 kW

By Speed (mph)

- Below 5 mph

- 5-10 mph

- 10-15 mph

- Above 15 mph

By Application

- Commercial

- Recreational

- Military

By Distribution channel

- Direct Sales

- Indirect Sales

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the European electric outboard engines market?

The Europe electric outboard market size was valued at USD 4.77 billion in 2025 from USD 10.09 billion by 2033

What are the market drivers that are driving the European electric outboard engines market?

Stringent environmental regulations, emission reduction goals, and advancements in battery technology and energy efficiency are the market drivers of European electric outboard engines.

Who are the market players that are dominating the European electric outboard engines market?

Propel Technologies, Oceanvolt, Elco Motor Yachts, AquaWatt, Vision Marine Technologies, Sleipner Motor AS, Torqeedo, Newport Vessels, OXE Marine AB, Minn Kota, Greenline Yachts, Steyr Motors GmbH, Evoy, ePropulsion. These are the market players that are dominating the Europe electric outboard engines market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]