Europe Electric Lawn Mowers Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type, End User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Electric Lawn Mowers Market Size

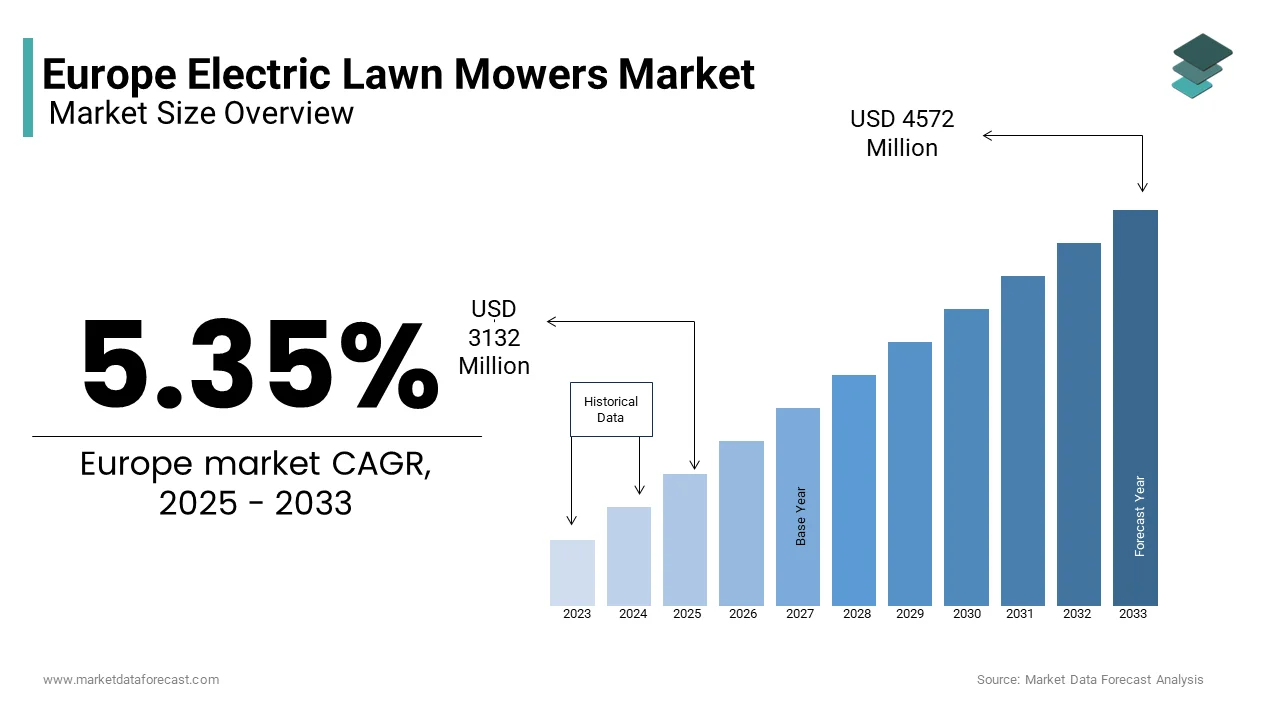

The Europe electric lawn mowers market size was valued at USD 2972.88 million in 2024 and is anticipated to reach USD 3132 million in 2025 from USD 4752 million by 2033, growing at a CAGR of 5.35% during the forecast period from 2025 to 2033.

Electric lawnmowers operate either through corded electricity or rechargeable lithium-ion batteries and are gaining significant traction as eco-friendly alternatives to traditional gasoline-powered models. These mowers are prized for their low noise levels, reduced carbon emissions, and ease of maintenance, which makes them particularly appealing to residential users, landscaping professionals, and municipal authorities managing public green spaces. According to Eurostat, over 60% of European households with gardens now prefer electric lawn care equipment, reflecting a clear shift toward sustainable gardening practices.

The market is further bolstered by stringent EU regulations aimed at curbing greenhouse gas emissions from small combustion engines, as outlined by the European Environment Agency. Key drivers to the market growth include the rising adoption of robotic lawnmowers, which accounted for nearly 25% of total sales in Western Europe, as per the German Federal Ministry for Economic Affairs and Energy. Additionally, countries like Germany, Sweden, and the Netherlands are leading adopters due to strong government incentives promoting green technologies. As battery efficiency continues to improve and costs decline, the European electric lawn mower market is poised for transformative growth, catering to both environmentally conscious consumers and the burgeoning demand for smart gardening solutions.

Growing Environmental Awareness and Regulatory Support

Increasing environmental awareness and stringent emission regulations are driving the growth of the European electric lawn market. According to the European Environment Agency, small gasoline-powered engines, including lawnmowers, contribute approximately 5% of total non-road greenhouse gas emissions in the EU. To combat this, the EU has implemented regulations to phase out high-emission equipment, encouraging the adoption of eco-friendly alternatives like electric mowers. According to Eurostat, over 70% of European consumers now prioritize environmentally sustainable products, with electric lawn mowers being a key beneficiary of this trend. Furthermore, government initiatives, such as subsidies for energy-efficient gardening tools, have accelerated adoption rates. For instance, the Swedish Energy Agency reports that sales of electric lawn care equipment increased by 30% in Sweden between 2020 and 2022 due to tax incentives for green technologies, reinforcing the role of policy-driven demand in propelling market growth.

Advancements in Battery Technology and Urbanization

Advancements in lithium-ion battery technology have revolutionized the European electric lawn mower market, enhancing performance and usability. The International Energy Agency states that modern batteries now offer up to 40% longer runtimes compared to models from five years ago which is addressing earlier concerns about limited operational capacity. This technological leap has made cordless electric mowers highly attractive, particularly in urban areas where compact gardens dominate. Eurostat reports that urbanization in Europe has increased by 8% over the past decade, with cities like Berlin and Amsterdam witnessing a surge in demand for low-noise, portable mowers. Additionally, the German Federal Ministry for Economic Affairs notes that robotic lawn mowers, powered by advanced batteries, accounted for nearly 25% of total electric mower sales in 2022. These innovations, coupled with urban lifestyle trends, are driving robust market expansion across the continent.

Market Restraints

High Initial Costs and Economic Constraints

The high initial cost of advanced models but particularly robotic and cordless variants, are restraining the growth of European electric lawnmowers. As per the International Trade Administration, premium electric lawnmowers can cost up to 50% more than their gasoline-powered counterparts, making them less accessible for price-sensitive consumers. Eurostat reports that nearly 40% of households in Eastern Europe cite affordability as a key barrier to adopting electric gardening equipment. Additionally, economic uncertainties such as inflation and rising energy costs have further dampened consumer spending on non-essential items. For instance, the European Central Bank notes that discretionary spending on durable goods, including gardening tools, declined by approximately 12% in 2022 across several EU countries. These financial constraints hinder the widespread adoption of electric lawn mowers despite their long-term cost savings and environmental benefits.

Limited Battery Life and Charging Infrastructure Challenges

The limitation of battery life and the lack of robust charging infrastructure in rural areas is a key obstacles for the market players. The European Environment Agency states that while lithium-ion batteries have improved, many electric lawnmowers still offer only 30-60 minutes of runtime on a full charge, which may not suffice for large gardens or professional use. Furthermore, the German Federal Ministry for Economic Affairs stated that over 35% of rural households face challenges accessing reliable charging solutions, limiting the practicality of cordless models. The Swedish Energy Agency also reports that battery degradation over time reduces performance and that is leading to higher maintenance costs. These limitations discourage potential buyers, particularly in regions with expansive green spaces where gasoline-powered alternatives remain more viable due to their longer operational capacity and refuelling convenience.

Market Opportunities

Expansion of Smart and Robotic Lawn Mowers

The growing adoption of smart and robotic mowers provides a potential opportunity for the market to expand. It is driven by advancements in automation and IoT technologies. The International Energy Agency reports that robotic lawnmowers accounted for nearly 25% of total electric mower sales in 2022, with projections indicating a growth rate of 15% through 2030. These devices appeal to tech-savvy consumers and busy urban households seeking low-maintenance gardening solutions. Eurostat found that more than 60% of European urban households own gardens smaller than 500 square meters is making them ideal candidates for robotic mowers. Additionally, the German Federal Ministry for Economic Affairs notes that subsidies promoting smart home integration have boosted demand for connected gardening tools. Cities like Stockholm and Vienna are investing in smart city initiatives. The market is poised to benefit from increased consumer interest in automated energy-efficient solutions.

Increasing Demand for Sustainable Municipal Green Space Management

The rising demand for sustainable solutions in municipal green space management across Europe presents a substantial growth opportunity for the European electric lawn market. The European Environment Agency states that local governments are increasingly adopting electric lawnmowers to maintain parks and public spaces, which aligns with EU targets to reduce urban carbon footprints. For instance, the Swedish Energy Agency reports that municipalities using electric equipment reduced their greenhouse gas emissions by up to 40% compared to traditional methods. Furthermore, Eurostat reveals that public spending on green infrastructure has grown by 10% annually since 2020, creating a lucrative market for commercial-grade electric mowers. Cities like Amsterdam and Copenhagen are prioritizing eco-friendly urban planning. Manufacturers have a unique opportunity to cater to municipal needs and contribute to Europe’s broader sustainability goals.

Market Challenge

Limited Adoption in Rural and Large Garden Areas

Restricted adoption in rural areas and among owners of large gardens where the operational constraints of electric mowers become apparent. According to the European Environment Agency, more than 40% of rural households in Europe own gardens exceeding 1,000 square meters, which often exceed the runtime capacity of battery-powered models. These mowers typically offer only 30-60 minutes of operation on a single charg,e which is making them impractical for extensive use, as reported by the German Federal Ministry for Economic Affairs. Additionally, Eurostat notes that rural regions frequently lack access to reliable charging infrastructure, further hindering adoption. This limitation forces many consumers in these areas to rely on gasoline-powered alternatives, slowing the transition to electric solutions despite their environmental benefits.

Competition from Established Gasoline-powered Models

The entrenched competition from well-established gasoline-powered lawn mowers continues to dominate in performance, and affordability for certain applications is a major challenge for the European electric lawn mower market. The International Trade Administration states that gasoline mowers still account for approximately 55% of total lawn mower sales in Europe and particularly in professional landscaping and agricultural sectors. Eurostat reports that nearly 35% of professional users prioritize the longer runtime and higher power output of gasoline models which are better suited for demanding tasks. Furthermore, the Swedish Energy Agency revealed that the lower upfront cost of gasoline mowers makes them more appealing to budget-conscious buyers and especially in Eastern Europe. This entrenched preference poses a significant barrier for electric mowers, which requires manufacturers to invest heavily in education and marketing to shift consumer perceptions and demonstrate the long-term value of electric alternatives.

SEGMENTAL ANALYSIS

Europe Electric Lawn Mowers Market By Product Type

The walk-behind electric lawnmowers segment led the European market and accounted for 65.2% of the total market share in 2024. Their affordability and suitability for small to medium-sized gardens are prevalent in urban areas, which is primarily driving the growth of this segment in the global market. According to the German Federal Ministry for Economic Affairs, over 70% of European households with gardens prefer walk-behind models due to their ease of use and low noise levels. These mowers align with EU sustainability goals, offering zero emissions and energy efficiency. Their importance lies in catering to residential users, who form the largest consumer base while supporting Europe’s transition to eco-friendly gardening solutions.

Fastest-Growing Segment: Stand-on Electric Lawn Mowers

Stand-on electric lawnmowers are the fastest-growing segment, with a projected CAGR of 9.2% from 2023 to 2030, according to the European Environment Agency. This growth is driven by increasing demand from professional landscapers and municipalities managing large green spaces. The UK Department for Business, Energy & Industrial Strategy notes that stand-on models reduce labor costs by up to **30%** compared to traditional methods, enhancing operational efficiency. As cities expand green infrastructure, these mowers are becoming vital for maintaining parks and sports fields, making them a key enabler of sustainable urban development across Europe.

Europe Electric lawn Mowers Market By End User

The residential segment dominated the European electric lawn mower market and held 60.8% of the total market share in 2024. The widespread adoption of walk-behind mowers among urban households with small to medium-sized gardens are mainly propelling the expansion of this segment. The German Federal Ministry for Economic Affairs sheds light on the fact that over 75% of residential users prefer electric mowers due to their low noise, zero emissions, and ease of use. Urbanization is increasing, and environmental awareness is on the rise. So, this segment is critical in promoting sustainable gardening practices. Residential users form the backbone of market growth which is in accordance with aligning EU goals to reduce carbon footprints and encourage eco-friendly lifestyles.

On the other hand, the professional landscaping services segment is predicted to witness the highest CAGR of 8.5% from 2025 to 2033. The demand for efficient as well as emission-free equipment to maintain large commercial properties and public spaces is fuelling the growth of this segment. The Swedish Energy Agency notes that electric mowers reduce operational noise and emissions by up to 50%, which makes them ideal for urban projects. Cities are expanding green infrastructure. Landscapers are adopting advanced models like stand-on mowers, driving innovation and supporting Europe’s sustainability targets with scalable eco-friendly solutions.

COUNTRY ANALYSIS

Germany

Germany led the European electric lawn mower market in 2024 by holding 25.9% of the total market share. Its control over the market is credited to a strong emphasis on sustainability, with over 60% of households in urban areas adopting eco-friendly gardening tools, according to Eurostat. Germany’s robust manufacturing base and technological innovation have positioned it as a hub for advanced electric mowers, including robotic models. As per the International Energy Agency, Germany’s investments in renewable energy and smart home integration have further boosted demand for connected gardening equipment. Therefore, its proactive environmental policies, high consumer awareness, and significant government incentives promoting green technologies are top factors behind Germany’s rise.

United Kingdom

The United Kingdom has emerged as a top performer and is likely to attain a projected CAGR of 8.2% in the coming years. The country’s position in the market is fueled by its ambitious net-zero emissions targets and the growing adoption of robotic lawnmowers in urban areas. Eurostat reports that over 40% of UK households with gardens now use electric mowers, which is driven by their low noise and zero-emission benefits. Additionally, the British government’s subsidies for sustainable gardening tools have accelerated adoption. The Swedish Energy Agency notes that the UK’s focus on smart city initiatives has increased demand for automated solutions.

Sweden

Sweden is making notable strides in the European electric lawn mower market. It is attributed to its strong environmental ethos, with over 70% of consumers prioritizing eco-friendly products. The nation’s extensive use of renewable energy and government incentives for green technologies have made it a pioneer in adopting battery-powered and robotic lawnmowers. According to the European Environment Agency, Swedish municipalities are also transitioning to electric equipment for maintaining public green spaces, further driving demand.

KEY MARKET PLAYERS

Ryobi Ltd, Husqvarna Group, Ariens, The Toro Co, Robert Bosch Engineering & Business Solutions, Honda Motor Co Ltd, Briggs & Stratton, Stanley Black & Decker. These are the market players dominating the European electric lawn mower market.

MARKET SEGMENTATION

This research report on the Europe electric lawn mowers market is segmented and sub-segmented into the following categories.

By Product Type

- Walk-behind Electric Lawn Mowers

- Front and Wide Area (sit and ride) Electric Lawn Mowers

- Stand-on Electric Lawn Mowers Market

By End User

- Residential

- Professional Landscaping Services

- Golf Courses

- Government and Other End Users

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe electric lawn mowers market?

The current market size of the Europe electric lawnmower market was valued at USD 4752 million in 2025.

What are the market drivers that are driving the Europe electric lawn mowers market?

Growing environmental awareness, regulatory support, and Advancements in battery technology and urbanization are the market drivers that are driving the European electric lawn mowers market.

Who are the market players that are dominating the Europe electric lawn mowers market?

Ryobi Ltd, Husqvarna Group, Ariens, The Toro Co, Robert Bosch Engineering & Business Solutions, Honda Motor Co Ltd, Briggs & Stratton, Stanley Black & Decker.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]