Europe Electric Insulator Market Size, Share, Trends, & Growth Forecast Report By Material (Ceramic/porcelain, Glass, and Composite), Voltage, Application, Product, End-Use, Rating, Installation, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Electric Insulator Market Size

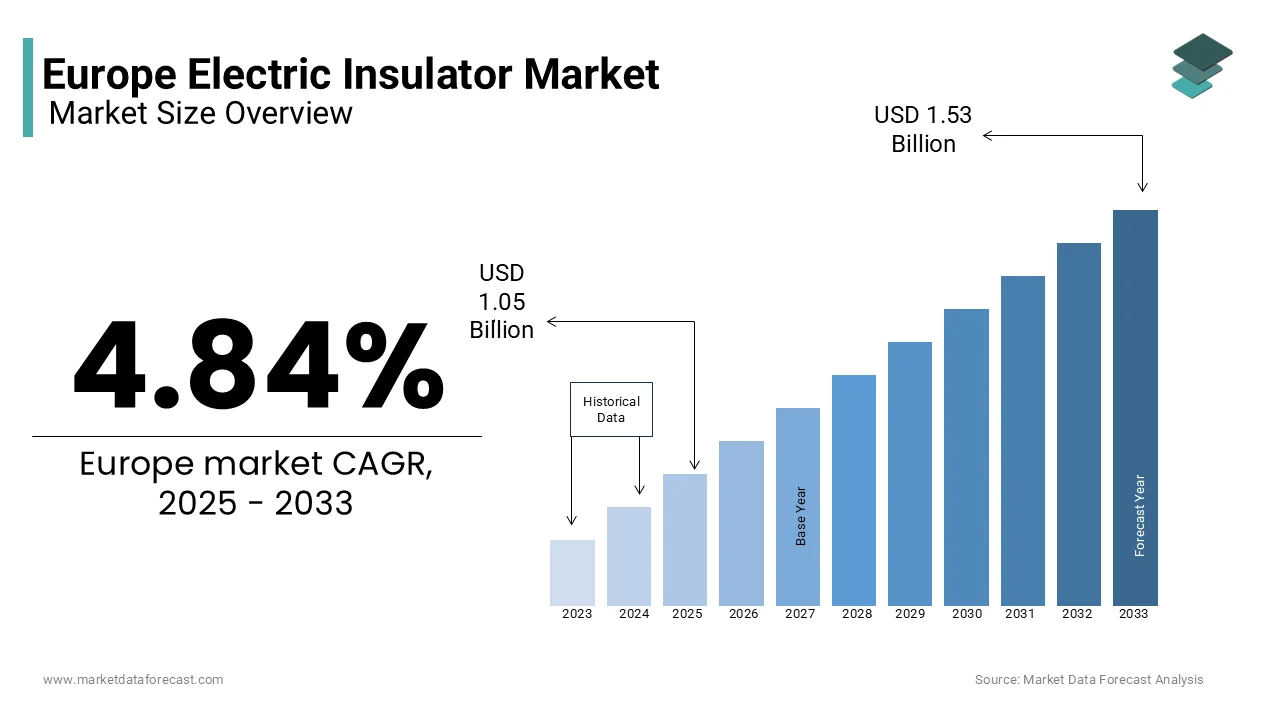

The Europe electric insulator market was worth USD 1.0 billion in 2024. The European market is projected to reach USD 1.53 billion by 2033 from USD 1.05 billion in 2025, growing at a CAGR of 4.84% from 2025 to 2033.

Electric insulators, which are critical components in power systems, are designed to prevent the flow of electric current between conductors or from conductors to the ground. These devices are typically made from materials such as porcelain, glass, or polymer composites, each offering distinct advantages in terms of durability, performance, and environmental resistance. As Europe continues its transition toward renewable energy sources and modernizes its aging grid infrastructure, the demand for high-performance electric insulators has surged significantly.

The growth of the market is driven by increasing investments in smart grid technologies and the integration of renewable energy systems into national grids. Furthermore, the European Union’s Green Deal initiative, which aims to achieve carbon neutrality by 2050 which emphasizes the importance of robust electrical infrastructure, thereby boosting the insulator market. Despite challenges such as supply chain disruptions and fluctuating raw material costs, the market remains resilient, supported by technological advancements and stringent safety regulations governing electrical installations.

MARKET DRIVERS

Renewable Energy Integration and Decarbonization Goals

The continent's commitment to renewable energy integration and decarbonization goals are mainly driving the European electric insulator market. The European Union’s Green Deal, which aims to make Europe the first climate-neutral continent by 2050 has spurred significant investments in renewable energy projects such as wind and solar power. According to Eurostat, renewable energy accounted for 22.1% of the EU’s gross final energy consumption in 2021, up from 18.9% in 2015. This rapid expansion requires robust electrical infrastructure, including high-performance insulators, to handle the variable outputs of renewable sources. The International Energy Agency (IEA) reports that Europe added over 26 GW of new wind and solar capacity in 2022 alone, necessitating advanced insulators for efficient energy transmission. As renewable energy systems often operate in challenging environments, the demand for durable polymer and composite insulators has surged, further propelling market growth.

Modernization of Aging Grid Infrastructure

The modernization of aging grid infrastructure across Europe is another key driver for the European electric insulator market. Many countries are upgrading their transmission and distribution networks to enhance efficiency and reliability. A report by the European Commission stated that approximately 70% of Europe’s electricity grid infrastructure is over 30 years old which is requiring urgent upgrades to meet current demands. Investments in smart grids and high-voltage transmission lines have increased significantly, with the European Investment Bank allocating over €10 billion annually for energy infrastructure projects. The UK National Grid estimates that nearly £40 billion will be invested in Britain’s electricity network by 2030. These upgrades create a substantial demand for electric insulators, particularly those capable of withstanding high voltages and extreme weather conditions. The emphasis on reducing power losses and improving grid resilience ensures sustained growth in the insulator market, as highlighted by the European Network of Transmission System Operators for Electricity (ENTSO-E).

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Shortages

The ongoing challenge of supply chain disruptions and raw material shortages is affecting the European electric insulator market. The production of electric insulators relies heavily on materials such as porcelain, glass, and advanced polymers which have faced volatility in availability due to global trade uncertainties. According to a report by the European Central Bank, supply chain bottlenecks caused an estimated 1.5% reduction in industrial output across the EU in 2022 and is impacting sectors reliant on specialized components, including electrical equipment. Additionally, according to the International Energy Agency (IEA) which is rising costs of raw materials like silica and alumina, critical for insulator manufacturing, have increased production expenses by up to 20% in some regions. These disruptions are further exacerbated by geopolitical tensions and export restrictions which is creating delays in project timelines and hindering market growth.

Stringent Regulatory Standards and Compliance Costs

Another issue is the burden of stringent regulatory standards and compliance costs associated with the manufacturing and installation of electric insulators. The European Union’s regulations enforced by agencies like the European Environment Agency mandated rigorous testing and certification processes to ensure safety, durability, and environmental sustainability. These measures are essential, but they often lead to increased operational costs for manufacturers. A study by the European Commission indicates that compliance-related expenses account for approximately 15-20% of total production costs for electrical equipment manufacturers. Furthermore, the Federation of European Electrical Engineering Industries notes that smaller firms struggle to meet these requirements and is leading to reduced market participation. This regulatory pressure not only limits innovation but also slows down the adoption of new technologies which is posing a significant challenge to the growth trajectory of the electric insulator market in Europe.

MARKET OPPORTUNITIES

Expansion of Smart Grid Infrastructure

The rapid expansion of smart grid infrastructure across the continent is a significant opportunity for the Europe electric insulator market. The European Union’s commitment to modernizing its energy systems is evident in its allocation of over €150 billion under the EU Recovery and Resilience Facility for clean energy and digitalization projects, as reported by the European Commission. Smart grids which integrate advanced technologies for real-time monitoring and control requires high-performance insulators to ensure reliable electricity transmission and distribution. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), investments in smart grid technologies are expected to grow at a CAGR of 8.2% through 2030 which is creating substantial demand for innovative insulator solutions. Additionally, the UK Department for Business, Energy & Industrial Strategy estimates that smart grid adoption could reduce power outages by up to 30%, further driving the need for durable and efficient insulators.

Rising Demand for High-Voltage Direct Current (HVDC) Systems

The increasing deployment of High-Voltage Direct Current (HVDC) systems which are critical for long-distance power transmission and cross-border energy trade is another key opportunity for the European electric insulator market. The International Energy Agency (IEA) revealed that HVDC projects in Europe are projected to expand significantly, with an estimated investment of €40 billion in new HVDC lines by 2030. These systems rely on specialized insulators capable of withstanding high voltages and extreme environmental conditions creates a niche market for advanced polymer and composite insulators. A report by the European Investment Bank states that HVDC technology can reduce transmission losses by up to 40% compared to traditional alternating current systems makes it a priority for countries like Germany and Norway. Furthermore, the European Association for Storage of Energy emphasizes that HVDC systems are integral to integrating renewable energy sources and thereby amplifying the demand for cutting-edge insulator technologies in the region.

MARKET CHALLENGES

Economic Uncertainty and Inflationary Pressures

Among the key challenges facing the Europe electric insulator market is the economic uncertainty and inflationary pressures affecting the region. The European Central Bank reports that inflation in the Eurozone reached a record high of 10.6% in 2022 which is significantly increasing the cost of raw materials such as silica, alumina, and polymers, which are critical for insulator production. This has led to a rise in manufacturing costs, with some companies reporting up to a 25% increase in production expenses, according to the Federation of European Electrical Engineering Industries. Additionally, the economic slowdown has caused delays in infrastructure projects, further impacting demand. The European Commission found that industrial output growth in the electrical equipment sector slowed by 3.4% in 2022 due to these financial constraints. Such economic instability poses a significant challenge to market expansion and profitability.

Environmental and Sustainability Concerns

Another pressing challenge is the growing emphasis on environmental sustainability and the need to reduce the carbon footprint of manufacturing processes. The European Environment Agency mandates strict regulations on emissions and waste management which have increased operational complexities for manufacturers. A study by the European Commission reveals that compliance with environmental standards can raise production costs by up to 15%, particularly for traditional materials like porcelain and glass. Furthermore, the shift toward sustainable alternatives, such as recyclable polymer insulators, requires significant investment in research and development. The International Energy Agency notes that only 30% of European manufacturers currently meet the EU’s green manufacturing benchmarks leaves many struggling to adapt. These sustainability challenges not only strain resources but also slow down innovation and market competitiveness in the electric insulator market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.84% |

|

Segments Covered |

By Material, Voltage, Application, Product, End-Use, Rating, Installation, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Eren Elektrik Sanayi ve Ticaret, General Electric, GIPRO GmbH, Hitachi Energy Ltd., INAEL Electrical Systems, Izoelektro, LA GRANJA INSULATORS, LAPP Insulators GmbH, Maschinenfabrik Reinhausen GmbH, NGK INSULATORS, LTD., PFISTERER Holding AG, POINSA, PPC Austria Holding GmbH, Sediver, Siemens Energy, and TE Connectivity. |

SEGMENTAL ANALYSIS

By Material Insights

The Ceramic or porcelain insulators segment dominated the Europe electric insulator market and held 45.2% of the market share in 2024 due to their durability, high mechanical strength, and cost-effectiveness makes them ideal for high-voltage transmission lines. The International Energy Agency reported that over 60% of Europe’s aging grid infrastructure still relies on porcelain insulators underscores their importance in maintaining reliable electricity transmission. Despite environmental concerns, innovations in eco-friendly production have sustained their demand, particularly in Eastern Europe, where affordability remains critical.

The Composite insulators segment is predicted to witness the highest CAGR of 7.8% during the forecast period because of their lightweight, hydrophobic properties, and resistance to pollution makes them ideal for renewable energy projects and coastal areas. The European Network of Transmission System Operators for Electricity (ENTSO-E) reports that composite insulators account for over 30% of new installations in high-voltage systems. Their superior performance in reducing maintenance costs and preventing leakage currents has made them indispensable in modernizing Europe’s grids and is further accelerating their adoption across the continent.

By Voltage Insights

The High voltage insulators segment dominated the Europe electric insulator market by capturing 40.8% of the market share in 2024 owing to their critical role in long-distance power transmission and renewable energy integration, such as offshore wind farms and HVDC systems. As per the International Energy Agency (IEA), over 60% of Europe’s high-voltage infrastructure investments target renewable energy projects, necessitating advanced insulators. High voltage insulators, often made from composites, reduce power losses and enhance grid reliability. Their ability to withstand extreme conditions makes them indispensable for modernizing Europe’s electricity networks, ensuring efficient energy distribution across the continent.

The Low voltage insulators segment is estimated to register the fastest CAGR of 6.5% over the forecast period. This growth is fueled by the rise of decentralized energy systems, such as rooftop solar panels, and the increasing adoption of smart home technologies. Eurostat reports that decentralized energy systems grew by 15% annually between 2020 and 2022, driving demand for low voltage solutions. Additionally, the European Environment Agency notes that energy-efficient technologies like LED lighting contribute significantly to this segment’s expansion. Low voltage insulators ensure safety and efficiency in localized applications, making them vital for Europe’s transition to sustainable and consumer-focused energy systems. Their adaptability to emerging technologies underscores their rapid growth trajectory.

By Application Insights

The cables and transmission lines segment accounted for 45.8% of the European electric insulator market in 2024. This segment leads due to its critical role in long-distance electricity transmission and renewable energy integration. According to the International Energy Agency (IEA), over 70% of Europe’s electricity grid relies on robust insulators to prevent energy losses and ensure safety. With renewable energy projects like offshore wind farms growing at 15% annually, the demand for high-performance insulators has surged. Their ability to withstand extreme conditions and reduce power outages makes them indispensable for modernizing Europe’s grid infrastructure and achieving energy transition goals.

The Bus bars segment is expected to exhibit a noteworthy CAGR of 8.5% during the forecast period. The rapid expansion of electric vehicle (EV) charging infrastructure and data centers is driving the growth of this segment. ACEA reports that EV charging stations grew by 30% in 2022 alone, significantly boosting demand for reliable bus bar insulators. Composite materials are increasingly preferred for their lightweight and high-performance characteristics. As Europe accelerates toward sustainable mobility and industrial electrification, bus bar insulators play a vital role in ensuring safe and efficient power distribution, making this segment crucial for future energy systems.

By Product Insights

The Suspension insulators segment ruled the European electric insulator market by holding 40.6% of the total share in 2024 due to their critical role in high-voltage transmission lines, which are essential for renewable energy integration. The International Energy Agency (IEA) stated that over 70% of Europe’s electricity grid relies on suspension insulators to ensure efficient long-distance power transmission. Composite variants, in particular, are gaining traction due to their resistance to pollution and extreme weather conditions. With Europe investing €150 billion in smart grids and renewable projects, suspension insulators are indispensable for reducing energy losses and enhancing grid reliability.

However, the "Other Insulators" segment including post, bushing, and strain insulators is predicted to witness the highest CAGR of 9.2% during the forecast period. The increasing adoption of smart grids and renewable energy systems which require specialized insulators for transformers and switchgears is propelling the development of this segment. The European Transformer Industry Association reports a 12% annual rise in demand for bushing insulators, vital for voltage regulation in transformers. As Europe accelerates its energy transition, these insulators play a pivotal role in supporting advanced electrical systems. Their ability to address niche operational challenges underscores their importance in modernizing infrastructure and achieving sustainability goals.

By End-Use Insights

The Utilities segment dominated the European electric insulator market by holding 40.3% of the total share in 2024 which is propelled by the critical role of insulators in electricity transmission and distribution networks, particularly in integrating renewable energy sources like wind and solar. The European Commission found that over €10 billion is invested annually in utility infrastructure upgrades, with high-voltage insulators being essential for minimizing energy losses. For instance, ENTSO-E reports that 70% of Europe’s grid modernization projects rely on advanced insulators to enhance reliability. Their importance lies in supporting decarbonization goals and ensuring uninterrupted power supply makes them indispensable for Europe’s energy transition.

The residential segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 7.8% during the forecast period. Factors such as the increasing adoption of decentralized energy systems are taking the growth of the segment ahead, such as rooftop solar panels, which grew by 18% annually between 2020 and 2022, as per the European Environment Agency. Additionally, smart home technologies and energy-efficient housing initiatives have driven demand for low-voltage insulators. The agency notes that residential solar PV installations exceeded 25 GW in 2022, underscoring the need for reliable insulation solutions. As Europe prioritizes sustainability and consumer-driven electrification, residential insulators are vital for enabling safe and efficient energy use, positioning this segment as a key growth driver in the market.

By Rating Insights

The ≤ 11 kV segment commanded the European electric insulator market and accounted for 20.7% of the total share in 2024 and is driven by its widespread use in low-voltage applications, such as residential wiring, lighting systems, and small-scale renewable energy installations like rooftop solar panels. The European Environment Agency reports that decentralized energy systems grew by 18% annually between 2020 and 2022, boosting demand for this segment. With over 60% of Europe’s households relying on low-voltage networks, these insulators are critical for ensuring safe and efficient power distribution. Their affordability, ease of installation, and adaptability to smart home technologies make them indispensable for Europe’s energy-efficient housing initiatives.

The > 400 kV to ≤ 800 kV segment is likely to experience the fastest CAGR of 15% from 2025 to 2033. This progress is fueled by Europe’s increasing investments in ultra-high-voltage direct current (UHVDC) projects which are essential for integrating large-scale renewable energy sources like offshore wind farms. The European Commission revealed that over €50 billion has been allocated for UHVDC infrastructure through 2030. These insulators minimize power losses over long distances makes them vital for cross-border energy trade and decarbonization goals. Europe accelerates its transition to renewable energy, so, this segment plays a pivotal role in enabling efficient and reliable electricity transmission across vast regions.

By Installation Insights

The transmission segment led the European electric insulator market and captured 40.3% of the total share in 2024. Its position in market was due to its critical role in high-voltage electricity transmission, particularly in integrating renewable energy sources like offshore wind farms and cross-border HVDC systems. The International Energy Agency (IEA) reports that over 70% of Europe’s renewable energy capacity relies on advanced transmission insulators to minimize energy losses and ensure grid reliability. Composite insulators are widely used due to their resistance to pollution and extreme weather conditions. Their ability to support long-distance power delivery makes them indispensable for achieving Europe’s decarbonization and energy transition goals.

The railways segment is anticipated to witness the fastest CAGR of 8.5% during the forecast period. Europe’s push for sustainable transportation, with railway electrification projects increasing by 8% annually is driving the growth. According to the European Commission, over €100 billion has been allocated for green mobility initiatives through 2030, boosting demand for overhead catenary and signaling insulators. Composite insulators are preferred for their durability and performance in high-speed rail systems. As Europe aims to reduce carbon emissions from transportation, railway insulators are becoming vital for ensuring safe and efficient power supply to expanding rail networks, supporting the continent’s shift toward eco-friendly mobility solutions.

REGIONAL ANALYSIS

Germany dominated the Europe electric insulator market by holding 22.9% of the regional share in 2024. The nation’s dominance is propelled by its aggressive renewable energy policies under the Energiewende initiative, which aims to phase out nuclear power and reduce carbon emissions. As per the International Energy Agency (IEA), Germany added over 5 GW of wind and solar capacity in 2022 alone, necessitating advanced insulators for grid integration. The market benefits from substantial investments in high-voltage transmission systems and smart grids. Germany’s robust industrial base and focus on modernizing aging infrastructure further propel demand. The Federal Ministry for Economic Affairs and Climate Action emphasizes that over €10 billion annually is allocated to energy infrastructure which is ensuring Germany remains a key driver of innovation and growth in the European electric insulator market.

France is a major player accounting for 18.9% of the market share. The country’s leadership stems from its extensive reliance on nuclear energy and ongoing grid modernization projects. The European Commission reports that France is investing €30 billion in upgrading its electricity network by 2030, boosting demand for high-performance insulators. With a CAGR of 6.2%, the market is supported by the integration of renewable energy sources like offshore wind farms in Normandy and Brittany. RTE, France’s transmission system operator, shows that over 70% of grid upgrades involve advanced insulators to enhance reliability. France’s commitment to decarbonization and sustainable energy solutions ensures its position as a leading market for electric insulators in Europe.

Italy holds a significant share of the European electric insulator market and is fueled by its focus on renewable energy integration and the modernization of its aging electrical infrastructure. The Italian Ministry of Economic Development notes that over €5 billion is invested annually in smart grid technologies and renewable energy projects, driving demand for medium and high-voltage insulators. Italy benefits from its strategic location for cross-border energy trade with North Africa and Europe, requiring robust insulators for HVDC systems. The Italian Renewable Energy Association (ANEV) reports that solar and wind energy capacity grew by 12% in 2022 underscores the need for reliable insulation solutions. Italy’s proactive approach to sustainability solidifies its position as a key player in the market.

KEY MARKET PLAYERS

The major players in the Europe electric insulator market include Eren Elektrik Sanayi ve Ticaret, General Electric, GIPRO GmbH, Hitachi Energy Ltd., INAEL Electrical Systems, Izoelektro, LA GRANJA INSULATORS, LAPP Insulators GmbH, Maschinenfabrik Reinhausen GmbH, NGK INSULATORS, LTD., PFISTERER Holding AG, POINSA, PPC Austria Holding GmbH, Sediver, Siemens Energy, and TE Connectivity.

MARKET SEGMENTATION

This research report on the Europe electric insulator market is segmented and sub-segmented into the following categories.

By Material

- Ceramic/porcelain

- Glass

- Composite

By Voltage

- High

- Medium

- Low

By Application

- Cables & transmission lines

- Switchgears

- Transformers

- Bus bars

- Others

By Product

- Pin insulators

- Suspension insulators

- Shackle insulators

- Other insulators

By End-Use

- Residential

- Commercial & industrial

- Utilities

By Rating

- ≤ 11 kV

- > 11 kV to ≤ 22 kV

- > 22 kV to ≤ 33 kV

- > 33 kV to ≤ 72.5 kV

- > 72.5 kV to ≤ 145 kV

- > 145 kV to ≤ 220 kV

- > 220 kV to ≤ 400 kV

- > 400 kV to ≤ 800 kV

- > 800 kV to ≤ 1,200 kV

- > 1,200 kV

By Installation

- Distribution

- Transmission

- Substation

- Railways

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe electric insulator market?

The market is driven by increasing investments in power grid infrastructure, growing renewable energy projects, and rising demand for reliable electricity transmission and distribution networks.

What types of electric insulators are commonly used in Europe?

The most commonly used types are ceramic, composite, and glass insulators, with composite insulators gaining popularity due to their lightweight, high mechanical strength, and superior performance in harsh environments.

What technological advancements are influencing the electric insulator market?

Innovations such as hydrophobic coatings for better performance, improved composite materials for durability, and smart insulators with real-time monitoring capabilities are shaping the market.

What is the future outlook for the Europe electric insulator market?

The market is expected to grow steadily due to increasing grid expansion projects, rising renewable energy installations, and advancements in insulation technology to enhance efficiency and reliability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]