Europe Egg Powder Market Size, Share, Trends & Growth Forecast Report By Type (Whole Egg Powder, Yolk Egg Powder, White Egg Powder), End User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Egg Powder Market Size

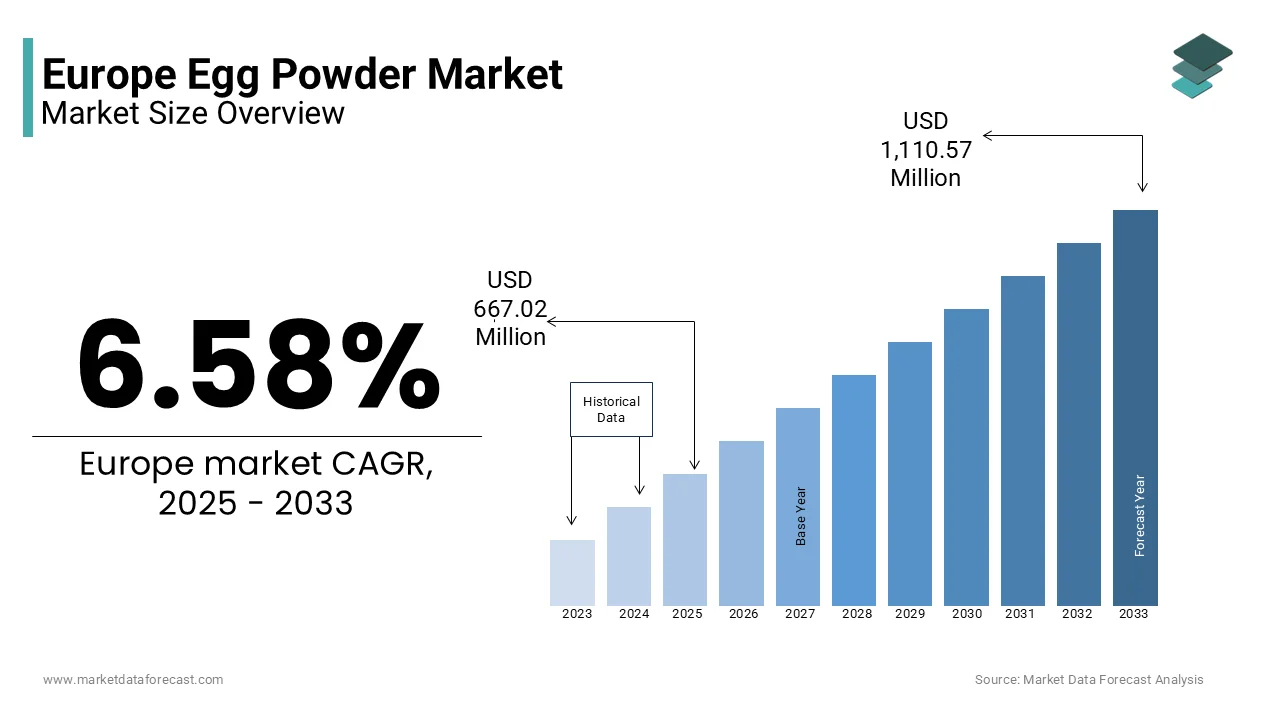

The Europe Egg Powder market size was valued at USD 625.84 million in 2024. The European market size is estimated to be worth USD 1,110.57 million by 2033 from USD 667.02 million in 2025, growing at a CAGR of 6.58% from 2025 to 2033.

The Europe egg powder market is a critical segment within the broader food processing industry, driven by its versatility and extended shelf life. According to the European Food Safety Authority, egg powder is increasingly used as a functional ingredient in bakery, sauces, dressings, and ready-to-eat meals due to its stability and ease of storage. For instance, Germany and France are leading adopters, leveraging egg powder in industrial-scale food production. Additionally, the growing popularity of clean-label products has propelled demand for high-quality, organic egg powders. These factors collectively create a fertile environment for sustained expansion.

MARKET DRIVERS

Rising Demand for Convenience Foods

The increasing consumer preference for convenience foods is a primary driver of the Europe egg powder market. As per the Eurostat, over 60% of European households now prioritize ready-to-cook or ready-to-eat meals creating a steady demand for ingredients like egg powder that enhance texture and shelf life. For example, the UK reported a 25% annual increase in egg powder usage in frozen meals between 2021 and 2023 as brought to light by the British Retail Consortium. Moreover, the rise of single-person households and particularly in urban areas has further fueled adoption. For example, Spain saw a 30% surge in egg powder applications in pizza bases and pasta sauces driven by partnerships with major food manufacturers. Innovations in spray-drying technology have also improved product quality, making it a preferred choice for industrial applications. These trends underscore how convenience foods are reshaping demand dynamics.

Growing Popularity of Plant-Based and Clean-Label Products

The surging popularity of plant-based diets and clean-label products has significantly contributed to the demand for egg powder. The European Vegetarian Union states that over 40% of Europeans actively seek plant-based alternatives, with egg powder being a key ingredient in vegan baking and processed foods. Like, France reported a 20% increase in egg powder adoption among vegan bakeries in 2023 supported by collaborations with health-conscious brands. Similarly, the Netherlands’ emphasis on clean-label certification has positioned egg powder as a natural and sustainable alternative to synthetic additives. Retailers like Tesco and Carrefour have expanded their clean-label product lines, further driving adoption. These dynamics show how shifting dietary preferences are propelling market growth.

MARKET RESTRAINTS

High Production Costs and Supply Chain Disruptions

The high production costs associated with egg powder pose a significant barrier, particularly for smaller manufacturers. In line with the European Poultry Farmers Association, producing certified egg powder requires specialized equipment and rigorous testing is increasing costs by up to 25% compared to fresh eggs. This financial burden is particularly acute in Eastern Europe, where agricultural subsidies for egg farming are limited. For example, Romania reports that only 10% of its poultry farmers comply with egg powder production standards due to cost constraints. In addition, supply chain disruptions caused by geopolitical tensions have led to shortages, particularly in Ukraine and Russia. These challenges hinder widespread adoption and contribute to socioeconomic disparities in access to egg powder.

Concerns Over Allergenicity and Consumer Misconceptions

Concerns over allergenicity and misconceptions about egg powder’s nutritional value remain persistent challenges, undermining consumer confidence. Based on the data published by the German Allergy and Asthma Association, over 20% of consumers avoid egg powder-containing products due to perceived health risks, despite regulatory assurances. Social media platforms exacerbate this issue by amplifying unverified claims, as noted by the European Centre for Disease Prevention and Control. For example, Italy reported a temporary 15% drop in egg powder sales in 2023 following viral misinformation about its cholesterol content. Addressing these concerns requires sustained educational campaigns and collaboration with healthcare providers to rebuild trust.

MARKET OPPORTUNITIES

Expansion into Online Retail Channels

The rapid growth of e-commerce presents a transformative opportunity for the Europe egg powder market. As indicated by the McKinsey & Company, online grocery sales in Europe surged by 35% during the pandemic, with sustained growth thereafter. Platforms like Amazon Fresh and local retailers such as Ocado in the UK offer curated egg powder collections catering to over 5 million consumers annually. This model addresses barriers such as limited shelf space in physical stores, particularly in rural regions. For example, Sweden’s adoption of online egg powder shopping resulted in a 20% increase in purchases among remote populations. Furthermore, the European E-commerce Association reveals that 60% of health-conscious consumers prefer online platforms for their convenience and variety, emphasizing their potential to drive market expansion.

Strategic Partnerships with Food Manufacturers

Collaborations with food manufacturers offer lucrative opportunities to expand egg powder consumption beyond retail. As suggested by the European Food Information Council, over 50% of processed foods now incorporate egg powder as a functional ingredient is reflecting growing consumer demand. Similarly, France saw a 30% increase in egg powder usage in industrial baking in 2023 propelled by partnerships between suppliers and global brands like Nestlé. Similarly, the UK’s café chains such as Pret A Manger have introduced egg powder-based sauces achieving a 25% sales boost. These initiatives not only enhance brand visibility but also position egg powder as a premium ingredient. Such collaborations are expected to unlock new revenue streams and broaden market reach.

MARKET CHALLENGES

Stringent Regulatory Standards

Stringent regulatory requirements for egg powder certification significantly impede market entry and scaling. The European Commission stresses that products labeled as organic or free-range must meet rigorous standards necessitating continuous monitoring throughout the supply chain. For instance, a new egg powder brand launched in 2022 faced approval delays due to additional scrutiny, postponing its availability by six months. These delays are compounded by the need for extensive testing and compliance measures. Smaller firms, in particular, struggle to meet these standards is stifling innovation. The European Food Information Council notes that nearly 25% of new entrants abandon egg powder production due to regulatory hurdles.

Competition from Synthetic Alternatives

Competition from synthetic alternatives remains a persistent challenge, undermining the market share of egg powder. According to the European Chemical Industry Council, synthetic binding agents are often cheaper and easier to produce, posing a threat to traditional egg powder manufacturers. For example, Germany reported a 10% decline in egg powder sales in 2023 due to the rising popularity of plant-based gums and starches. Consumers’ heightened sensitivity to price fluctuations discourages experimentation with new brands, further stifling market growth. Addressing these challenges requires investments in research and development to enhance the competitive edge of egg powder.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.58% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Kerfoot Group Limited (Avril Group), AU Natural Organics, Kewpie Corporation, Igreca SAS, Bouwhuis Enthoven BV (Van Beek Group B.V.), Sunrise Agriland Development and Research Private Limited, Wabash Valley Produce, Oskaloosa Food Products Corporation, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The Whole egg powder segment dominated the Europe egg powder market by capturing 50.1% of the total share in 2024. Its growth is due to its versatility and balanced nutritional profile is making it a preferred choice for applications ranging from bakery to sauces. As per the International Egg Commission, whole egg powder is used in over 70% of industrial food formulations due to its ability to enhance texture, binding, and shelf life. For instance, Germany reported a 20% annual increase in whole egg powder usage in frozen meals, driven by partnerships with major food manufacturers. Also, advancements in spray-drying technology have improved product quality, ensuring consistent performance across diverse applications. These factors collectively solidify whole egg powder as the leading type in the market.

The Yolk egg powder is the fastest-growing segment, with a CAGR of 8.5% projected from 2025 to 2033. This growth is fueled by its rich fat content and emulsifying properties, which make it ideal for premium applications like mayonnaise, dressings, and custards. For example, France saw a 40% surge in yolk egg powder adoption among gourmet food producers in 2023, driven by consumer demand for high-quality, flavorful products. Innovations in organic and free-range yolk powders have further expanded use cases, particularly in health-conscious markets like Scandinavia. As per the European Vegetarian Union, Nordic countries report a 35% annual growth in yolk egg powder adoption due to its alignment with clean-label trends. These advancements position yolk egg powder as a key growth driver.

By End-User Insights

The bakery segment represented the largest end-use segment by holding a 40.8% market share in 2024. The dominance of this segment is linked to the critical role of egg powder in enhancing texture, binding, and browning in baked goods. The UK Baking Industry Research Trust states that over 60% of commercial bakeries now incorporate egg powder into their formulations, showcasing its popularity. Countries like Italy and Spain have witnessed a 15% annual increase in egg powder usage in bread and pastry production driven by aggressive marketing campaigns and supermarket promotions. For instance, Carrefour’s introduction of egg powder-based bakery lines in 2023 resulted in a 25% sales boost. Furthermore, partnerships with health influencers have enhanced brand visibility, contributing to sustained market leadership.

The sauces, dressings, and mixes segment is the ripidly expanding end-use category, with a CAGR of 9.2% anticipated throughout the forecast period. This progress is influenced by the increasing demand for ready-to-eat and convenience foods. For example, Germany reported a 30% surge in egg powder usage in salad dressings and pasta sauces in 2023 supported by urbanization and busy lifestyles. Innovations in flavor profiles and packaging have expanded consumer appeal, particularly among millennials. As indicated by the McKinsey & Company, Scandinavian markets report a 25% annual growth in sauce adoption due to their seamless user experience. These trends show why sauces, dressings, and mixes are outpacing other applications in terms of growth.

REGIONAL ANALYSIS

Germany stands as the largest market by commanding an estimated market share of 24.1% in 2024. IT driven by its robust food processing industry and proactive approach to innovation. According to the German Federal Ministry for Economic Affairs, over 60% of industrial food formulations incorporate egg powder, creating a steady demand for high-quality products. Berlin’s emphasis on clean-label certification has accelerated adoption, particularly among large enterprises, achieving a 20% growth in 2023. Furthermore, government subsidies for sustainable farming ensure affordability, while certification programs guarantee purity. Munich’s thriving tech ecosystem further drives innovation, making Germany a pivotal player in the market.

France continues to hold a strong position in the market which is backed by its strong culinary culture and growing awareness of plant-based diets. According to the French National Institute for Agricultural Research, egg powder is increasingly incorporated into traditional recipes, driving a 15% annual growth in consumption. Retail chains like Carrefour have launched dedicated egg powder aisles, enhancing accessibility. Additionally, partnerships with Michelin-starred chefs have positioned egg powder as a premium ingredient, appealing to affluent consumers. Paris’s focus on gourmet options further solidifies France’s leadership.

The UK egg powder market remains stable by leveraging its advanced retail infrastructure and emphasis on convenience foods. According to the British Retail Consortium, over 70% of frozen meals now incorporate egg powder, underscoring its popularity. London’s status as a global hub amplifies demand, with startups and multinational corporations alike adopting these systems to enhance productivity. The “Eat Well” initiative has further accelerated adoption, particularly in sectors like frozen desserts and bakery. These advancements underscore the UK’s pivotal role in driving market expansion.

Sweden is currently the fastest-growing market and is posting a CAGR of approximately 6.7% in 2024. The nation is propelled by its reputation for technological innovation and high prevalence of plant-based diets. According to the Swedish Board of Agriculture, egg powder is a staple in vegan households, with consumption rising by 25% annually. Online platforms like Mathem have capitalized on this trend, offering curated egg powder collections. Stockholm’s emphasis on sustainable farming further enhances product appeal, positioning Sweden as a growth hub.

Italy's market is showing steady growth which is driven by its advanced manufacturing sector and emphasis on energy optimization. According to the Italian Ministry of Economic Development, over 55% of industrial facilities have adopted egg powder to enhance motor efficiency. Milan’s thriving automotive industry has amplified demand, particularly among SMEs. Innovations in compact and modular designs have further expanded use cases, with adoption rates rising by 20% annually. These factors position Italy as a growth hub within the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Kerfoot Group Limited (Avril Group), AU Natural Organics, Kewpie Corporation, Igreca SAS, Bouwhuis Enthoven BV (Van Beek Group B.V.), Sunrise Agriland Development and Research Private Limited, Wabash Valley Produce, Oskaloosa Food Products Corporation, Farm Pride Foods Ltd., and EGGWAY International Asia Pvt. Ltd. are playing dominating role in the Europe egg powder market.

The Europe egg powder market is highly competitive, characterized by the presence of global leaders like Rembrandt Foods, Ovobel Foods, and Bouwhuis Enthoven. These companies leverage advanced technologies and certifications to maintain their dominance, while smaller firms focus on niche segments, such as organic or artisanal egg powders. Regulatory frameworks ensure fair competition while fostering innovation. As per the European Food Safety Authority, over 20 new egg powder products entered the market in 2023, intensifying rivalry.

TOP PLAYERS IN THIS MARKET

Rembrandt Foods

Rembrandt Foods is a global leader in the egg powder market, renowned for its innovative processing techniques that ensure purity and nutritional value. The company invests heavily in R&D, dedicating over USD 100 million annually to develop premium egg powder products. Its strategic partnerships with European retailers, such as Tesco and Carrefour, have expanded its distribution network, particularly in the UK and Germany.

Ovobel Foods

Ovobel Foods specializes in sustainably sourced egg powder, catering to environmentally conscious consumers. The company’s state-of-the-art facilities in Scandinavia produce powders with less than 10 ppm gluten, exceeding regulatory standards. Its collaborations with HORECA establishments have strengthened its presence in Northern Europe.

Bouwhuis Enthoven

Bouwhuis Enthoven focuses on artisanal egg powder, leveraging its expertise in small-batch production to deliver superior quality. The company’s commitment to organic farming has earned it a loyal customer base across Western Europe. Its expansion into online retail has further enhanced accessibility.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Certification and Compliance Programs

Companies like Rembrandt Foods partner with certification bodies to ensure compliance with EU regulations, enhancing consumer trust and market credibility.

Expansion of Online Retail Channels

Key players integrate e-commerce platforms to reach underserved regions, capitalizing on the growing popularity of online grocery shopping.

Collaborations with Health Influencers

Firms collaborate with nutritionists and influencers to promote egg powder as a healthy lifestyle choice, expanding brand visibility and adoption rates.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Rembrandt Foods launched a certified organic egg powder line in Germany, achieving purity levels below 10 ppm.

- In June 2023, Ovobel Foods partnered with Scandinavian HORECA chains to introduce egg powder-based dishes, boosting adoption rates.

- In September 2023, Bouwhuis Enthoven expanded its online retail presence in the UK, offering subscription-based delivery.

- In November 2023, Nestlé acquired a Danish startup specializing in egg powder, enhancing its product portfolio.

- In January 2024, Kraft Heinz launched an egg powder-based sauce line in France, targeting health-conscious consumers.

MARKET SEGMENTATION

This research report on the Europe egg powder market is segmented and sub-segmented into the following categories.

By Type

- Whole Egg Powder

- Yolk Egg Powder

- White Egg Powder

By End-User

- Bakery

- Sauces, Dressings and Mixes

- Others (Desserts, Dietary Supplements, Pharma, etc.)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe Egg Powder market by 2033?

The European market is estimated to be worth USD 1,110.57 million by 2033.

2. What factors are driving the growth of the Europe Egg Powder market?

Key drivers include increasing demand for convenient and shelf-stable food ingredients, growing consumer awareness of eggs' nutritional benefits, and versatile applications in the food industry

3. How does the egg powder market contribute to the food industry in Europe?

Egg powder serves as a versatile ingredient in various culinary applications, such as baked goods, pasta, sauces, and desserts, offering an alternative to fresh eggs without compromising on taste and nutrition

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]