Europe Egg Donation Market Size, Share, Trends & Growth Forecast Report By Type (Fresh, Frozen), Service Provider and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Egg Donation Market Size

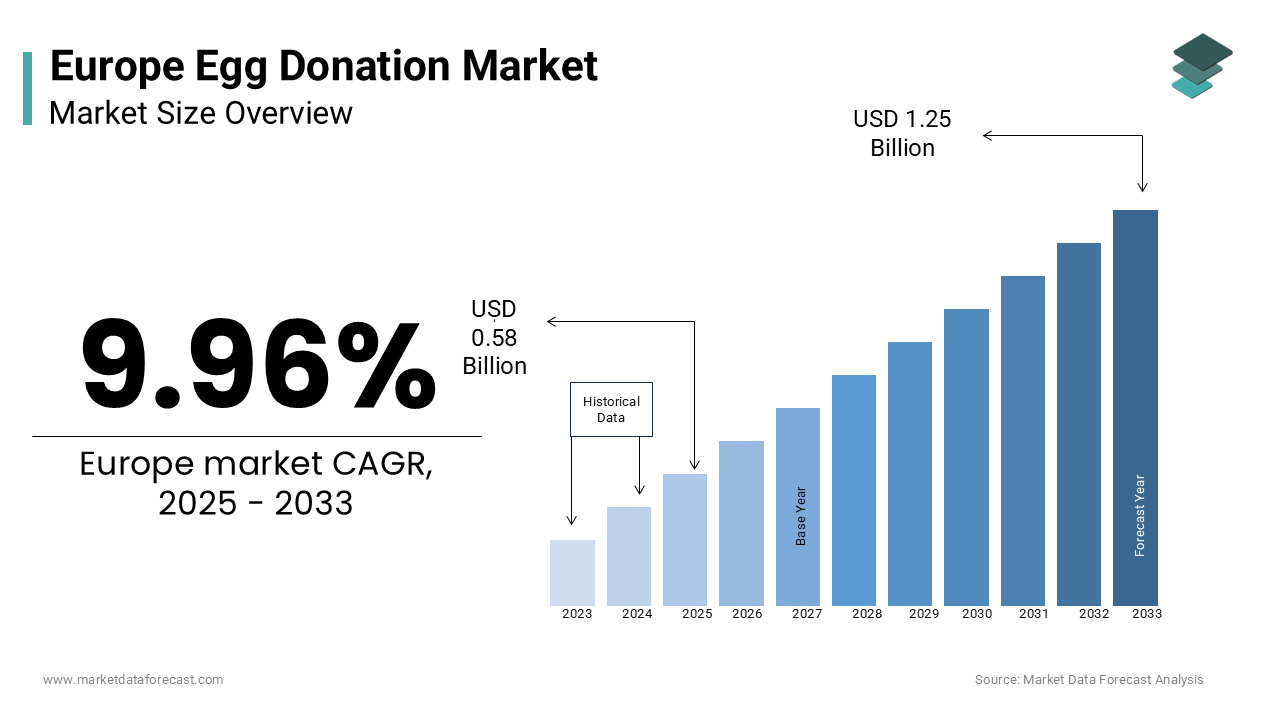

The europe egg donation market was worth USD 0.53 billion in 2024. The European market is estimated to grow at a CAGR of 9.96% from 2025 to 2033 and be valued at USD 1.25 billion by the end of 2033 from USD 0.58 billion in 2025.

Egg donation refers to the provision of donated eggs for assisted reproductive technologies (ART), including in vitro fertilization (IVF) and other fertility treatments. The European egg donation market has gained prominence due to rising infertility rates, delayed parenthood, and advancements in reproductive medicine. According to the European Society of Human Reproduction and Embryology (ESHRE), approximately 15% of couples in Europe face infertility issues, with a growing number opting for egg donation as a viable solution. Key factors driving this growth include increased awareness about fertility treatments, supportive government policies, and the availability of advanced medical infrastructure. For instance, Spain leads Europe in egg donation cycles, accounting for over 30% of all procedures performed annually. However, ethical concerns and regulatory variations across countries pose challenges to uniform market expansion. Despite these hurdles, the egg donation market remains integral to addressing fertility challenges and enabling parenthood for individuals and couples across Europe.

MARKET DRIVERS

Rising Infertility Rates Across Europe

Infertility is a growing concern in Europe, with delayed parenthood being a significant contributing factor. According to Eurostat, the average age of first-time mothers in Europe has risen to 31 years, up from 28 years two decades ago. This delay increases the likelihood of age-related fertility issues, driving demand for egg donation services. According to ESHRE, more than 700,000 ART cycles are performed annually in Europe, with egg donation accounting for 15% of these procedures. Considering this trend, Germany witnessed a 20% increase in egg donation cycles between 2020 and 2022, underscoring the growing reliance on this service.

Advancements in Reproductive Technologies

Technological advancements in ART have significantly improved success rates, making egg donation more appealing. According to the European Fertility Society, the success rate of IVF using donor eggs exceeds 50% for women under 40, compared to 30% for non-donor cycles. Innovations such as cryopreservation and genetic screening have further enhanced outcomes, encouraging more individuals to opt for egg donation. These advancements not only improve patient confidence but also expand the market’s reach.

MARKET RESTRAINTS

Ethical and Legal Restrictions

Ethical debates and legal restrictions hinder the growth of the egg donation market in certain regions. According to the European Bioethics Institute, countries like Italy and Germany impose strict regulations on egg donation, limiting its accessibility. For instance, Italy prohibits anonymous donations, which has reduced participation rates by 25%. Such restrictions create barriers for individuals seeking fertility treatments and stifle market expansion.

High Costs of Treatment

The high cost of egg donation procedures remains a significant restraint. According to the European Health Economics Association, the average cost of an egg donation cycle ranges from EUR 5,000 to EUR 10,000, depending on the country and clinic. A study by ESHRE reveals that nearly 40% of patients cite financial constraints as a barrier to accessing these services. This affordability issue limits market penetration, particularly among lower-income groups

MARKET OPPORTUNITIES

Expansion of Fertility Tourism

The reputation of Europe for high-quality fertility services has fueled the growth of fertility tourism, creating significant opportunities for the egg donation market. According to the European Travel Commission, Spain and the Czech Republic are leading destinations, attracting over 200,000 international patients annually. Affordable treatment costs and lenient regulations make these countries attractive options for individuals from restrictive regions.

Increased Awareness and Education Campaigns

Awareness campaigns about fertility treatments are driving market growth. According to the European Public Health Alliance, educational initiatives have increased public knowledge of ART by 35% over the past five years. These efforts reduce stigma and encourage more individuals to explore egg donation as a viable option.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

Regulatory fragmentation across Europe poses a significant challenge. According to ESHRE, inconsistent laws regarding donor anonymity, compensation, and eligibility criteria complicate cross-border operations. For example, while Spain allows anonymous donations, France mandates non-anonymous procedures, creating operational hurdles for clinics.

Shortage of Donors

A shortage of egg donors is another pressing issue. According to the European Donor Network, donor shortages have led to waiting periods of up to six months in countries like the UK and France. This scarcity limits the availability of services and delays treatment for prospective parents.

SEGMENTAL ANALYSIS

By Type Insights

The fresh eggs segment dominated the egg donation market in Europe by accounting for 60.9% of the European market share in 2024. According to the European Society of Human Reproduction and Embryology (ESHRE), fresh egg cycles are preferred due to their higher success rates, which exceed 55%, compared to frozen eggs at 45%. The immediate availability of fresh eggs and their perceived quality further enhance their appeal among patients seeking fertility treatments. Clinics offering fresh egg donations often emphasize personalized care and tailored treatment plans, making this segment a cornerstone of the market.

The frozen eggs segment is on the rise and is estimated to register a prominent CAGR of 12.6% over the forecast period. According to the European Cryopreservation Society, advancements in vitrification technology have significantly improved the viability of frozen eggs, reducing costs and increasing accessibility. This technological progress has made frozen eggs an attractive option for patients who require flexibility in timing or wish to preserve fertility for future use. Additionally, the growing trend of egg freezing among younger women for career or personal reasons is driving demand in this segment.

By Service Provider Insights

The fertility clinics led the market by accounting for 54.5% of the European market share in 2024. According to ESHRE, clinics provide specialized services and personalized care, attracting a majority of patients. Their focus on cutting-edge technologies ensures high success rates, solidifying their leadership.

The hospitals segment is anticipated to witness a healthy CAGR over the forecast period in the European market. According to the European Hospital Federation, hospitals are increasingly integrating fertility services into their offerings, leveraging their existing infrastructure and patient base to drive growth.

REGIONAL ANALYSIS

Spain held the leading share of the European egg donation market in 2024. The dominance of Spain in the European market is attributed to lenient regulations, affordable treatments, and world-class fertility clinics. Southern Europe accounts for a dominating share of the overall European market in 2024. This prominence of Southern Europe is fueled by favorable regulatory frameworks, high patient volumes, and established fertility tourism hubs like Spain and Italy. The Mediterranean lifestyle and cultural acceptance of fertility treatments further contribute to its dominance. Eastern Europe is predicted to be the fastest-growing region. According to the European Travel Commission, countries like the Czech Republic and Hungary are emerging as key destinations for fertility tourism due to affordable treatments and high-quality services. Rising awareness and investments in reproductive health infrastructure are also propelling growth in this region.

Key Strategies

To strengthen their market positions, key players in the Europe egg donation market employ several strategic approaches. Partnerships and collaborations are a primary focus, with IVI Fertility working closely with EU governments to promote fertility awareness and streamline regulations. According to ESHRE, RMA invests heavily in research and development, particularly in AI-driven diagnostic tools and genetic screening technologies, to enhance treatment outcomes. Marketing campaigns targeting younger demographics and emphasizing the benefits of egg freezing are also gaining traction. Additionally, FertiClinic focuses on expanding its geographic footprint by establishing clinics in underserved regions, ensuring broader access to fertility services. These strategies not only drive innovation but also build trust and loyalty among patients, ensuring sustained growth in a competitive market.

KEY MARKET PLAYERS

IVI Fertility, Reproductive Medicine Associates (RMA), and FertiClinic are the leading players in the Europe egg donation market. IVI Fertility, headquartered in Spain, is renowned for its cutting-edge technologies and high success rates, performing over 100,000 fertility treatments annually. RMA, based in the UK, specializes in AI-driven diagnostics and personalized treatment plans, setting new standards in patient care. FertiClinic, operating across multiple European countries, focuses on affordability and accessibility, catering to a diverse patient base. These companies leverage their expertise, advanced facilities, and strategic collaborations to maintain their leadership positions.

MARKET SEGMENTATION

This research report on the europe egg donation market is segmented and sub-segmented based on categories.

By Type

- Fresh

- Frozen

By Service Provider

- Hospital

- Fertility Clinics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Egg Donation Market?

Growth is driven by rising infertility rates, increasing acceptance of ART, and advancements in reproductive technologies.

What are the challenges in the Europe Egg Donation Market?

Challenges include ethical concerns, high costs, and the need for a regulated donation process.

What is the future outlook for the Europe Egg Donation Market?

The market is expected to grow with rising demand for fertility treatments and improved egg donation technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]