Europe Edtech Market Size, Share, Trends, & Growth Forecast Report Segmented By Sector (Preschool, K-12, Higher Education, and Others), End-use, Type, and Deployment, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Edtech Market Size

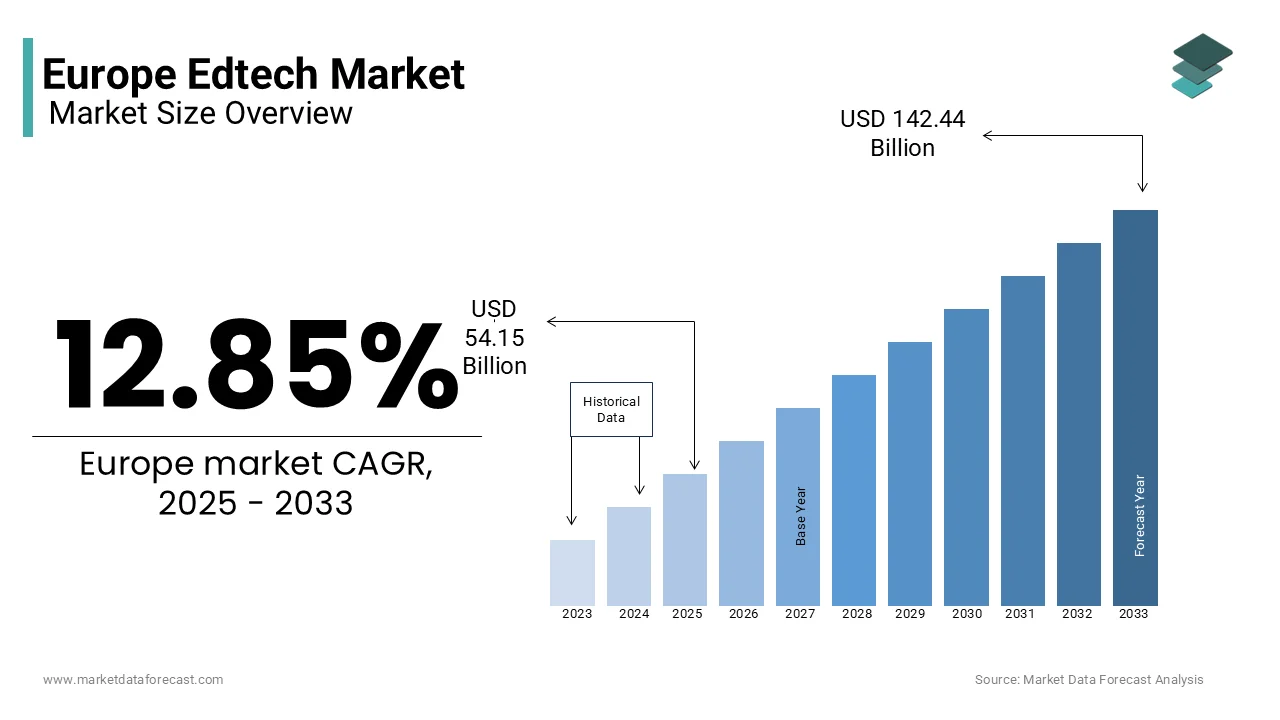

The Europe Edtech market was valued at USD 47.98 billion in 2024. The European market is estimated to reach USD 142.44 billion by 2033 from USD 54.15 billion in 2025, growing at a CAGR of 12.85% from 2025 to 2033.

Edtech or educational technology includes a wide range of digital tools, platforms, and solutions designed to enhance learning experiences, streamline administrative processes, and facilitate personalized education. In recent years, the European edtech market has witnessed significant growth due to the proliferation of digital devices, the rise of online learning, and the growing demand for upskilling and reskilling in response to shifting workforce requirements.

The growing investments in digital infrastructure, government initiatives promoting digital literacy, and the widespread adoption of blended learning models are likely to fuel for demand for edtech in Europe in the coming years. The COVID-19 pandemic acted as a catalyst and accelerated the adoption of edtech solutions as schools and universities transitioned to remote learning. For instance, the European Commission reported that over 60% of educational institutions in the EU incorporated digital tools into their curricula during the pandemic, a trend that has persisted post-pandemic.

Key players in the market include both established companies and innovative startups that offer solutions such as learning management systems (LMS), virtual classrooms, and AI-driven personalized learning platforms. The UK, Germany, and France are leading the charge in the European edtech market.

MARKET DRIVERS

Increasing Demand for Upskilling and Reskilling in Europe

The Europe edtech market is significantly driven by the growing need for upskilling and reskilling, particularly as industries undergo rapid digital transformation. According to the European Centre for the Development of Vocational Training, over 70% of European companies faced skills shortages in 2022, especially in digital and technical domains. This has spurred demand for edtech platforms that offer flexible, on-demand learning solutions. For instance, the European Commission reported a 30% increase in European users on platforms like Coursera and Udemy, seeking professional certifications and skill-based courses. This trend highlights the pivotal role of edtech in addressing workforce challenges and supporting lifelong learning initiatives across the continent.

Government Initiatives Promoting Digital Education

Government policies and investments are another major driver of the Europe edtech market. The European Union’s Digital Education Action Plan, with a budget of €1.5 billion for 2021-2027, aims to enhance digital competencies and infrastructure across member states. Eurostat data reveals that over 80% of EU schools now regularly use digital tools, a significant increase from 50% in 2019. Additionally, the UK’s Department for Education reported a 40% rise in edtech adoption in schools since 2020, driven by policy support and funding. These initiatives have accelerated the integration of edtech solutions, particularly in underserved regions, fostering a more inclusive and technologically advanced educational landscape.

MARKET RESTRAINTS

Data Privacy and Regulatory Challenges

One major restraint in the Europe edtech market is stringent data privacy regulations, particularly the General Data Protection Regulation (GDPR). Compliance with GDPR requires edtech companies to implement robust data protection measures, which can be costly and complex. According to the European Commission, 69% of Europeans are concerned about their personal data being used without their consent. This has led to slower adoption of edtech solutions in schools and institutions, as they fear non-compliance penalties. For instance, a report by the European Data Protection Board highlighted that GDPR-related fines exceeded €1.6 billion in 2022, creating hesitancy among educational institutions to adopt new technologies.

Digital Divide and Infrastructure Gaps

Another significant restraint is the digital divide across Europe, which limits equitable access to edtech solutions. Eurostat data reveals that in 2022, 14% of EU households in rural areas lacked access to high-speed internet, compared to 4% in urban areas. This disparity affects students' ability to utilize online learning platforms effectively. Additionally, the European Commission reported that only 60% of schools in less developed regions had adequate digital infrastructure, hindering the widespread adoption of edtech tools. These gaps create uneven opportunities for students, slowing the overall growth of the edtech market in Europe.

MARKET OPPORTUNITIES

Increasing Demand for Online and Hybrid Learning

The Europe edtech market is witnessing a surge in demand for online and hybrid learning solutions, driven by the shift in educational preferences post-pandemic. According to Eurostat, over 60% of EU citizens aged 16-74 used the internet for online learning in 2022, a significant increase from pre-pandemic levels. Governments are also supporting this trend; for example, the European Commission’s Digital Education Action Plan aims to enhance digital skills and infrastructure, with a €1.1 billion investment by 2027. This growing acceptance of digital education creates a vast opportunity for edtech companies to expand their offerings and cater to diverse learning needs across Europe.

Government Initiatives and Funding for Digital Transformation

Government-led initiatives are a major opportunity for the Europe edtech market. The European Union’s Recovery and Resilience Facility has allocated €50 billion to support digital transformation, including education. Countries like Germany and France are investing heavily in edtech; for instance, Germany’s DigitalPakt Schule program has committed €6.5 billion to modernize school infrastructure. Additionally, the European Commission’s Horizon Europe program has earmarked €95.5 billion for research and innovation, including edtech solutions. These investments create a favorable environment for edtech companies to innovate and scale, addressing challenges like skill gaps and accessibility while driving market growth.

MARKET CHALLENGES

Market Fragmentation Across Countries

The European EdTech market faces significant challenges due to fragmentation across different national educational systems. Each country in Europe has unique curricula, languages, and regulations, making it difficult for EdTech companies to scale solutions across borders. The European EdTech Alliance reports that startups and companies struggle with adapting products to meet varying government policies, leading to slower adoption rates. This regulatory complexity discourages investment and innovation, limiting the potential of digital learning tools. Moreover, a lack of standardization in digital education policies forces companies to localize their offerings, increasing costs and operational difficulties. Addressing this issue requires greater policy alignment and support from governments to create a more unified EdTech market across Europe.

Unequal Digital Infrastructure and Access

Limited digital infrastructure in certain regions poses another major challenge for the European EdTech market. While urban centers often have high-speed internet and advanced learning tools, rural and economically disadvantaged areas face connectivity issues and outdated technology. According to the European Commission’s Digital Economy and Society Index (DESI), around 10% of households in rural areas still lack basic broadband access, making online education inaccessible for many students. Additionally, disparities in school funding contribute to unequal technology adoption, leaving underprivileged students at a disadvantage. Governments and private stakeholders must invest in expanding digital infrastructure and ensuring affordability to bridge the digital divide and promote inclusive digital learning opportunities across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.85% |

|

Segments Covered |

By Sector, End-use, Type, Deployment, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

BYJU'S, Blackboard Inc., Chegg, Inc., Coursera Inc., Edutech, edX LLC, Google LLC, Instructure, Inc., Microsoft, Udacity, Inc., and upGrad Education Private Limited are some of the key players in the Europe Edtech market. |

SEGMENTAL ANALYSIS

By Sector Insights

The K-12 education segment led the market and accounted for 60.3% of the European market share in 2024. The domination of the K-12 segment is majorly due to its universal accessibility, government funding, and compulsory education laws in most countries. In the U.S. alone, over 50 million students are enrolled in K-12 public schools, highlighting its scale. The sector is critical for foundational learning, workforce preparation, and societal development. Governments worldwide invest heavily in K-12, with the U.S. spending over $700 billion annually on public K-12 education.

The higher education segment is anticipated to witness a CAGR of 9.1% over the forecast period owing to the increasing demand for specialized skills, online learning platforms, and global enrollment trends. According to UNESCO, by 2030, global higher education enrollment is projected to reach 594 million students, up from 220 million in 2021. The rise of digital education, coupled with government initiatives to improve access, has fueled this expansion. Higher education is vital for innovation, economic growth, and addressing skill gaps in emerging industries like technology and healthcare.

By End-use Insights

The consumer segment occupied 65.6% of the European market share in 2024. The lead of the consumer segment is majorly driven by the rising demand for personalized, flexible, and accessible learning options. In 2022, over 30 million learners enrolled in online courses in the U.S. alone, reflecting the shift toward self-paced education. The segment is critical for lifelong learning, skill development, and career advancement. According to the National Center for Education Statistics, 74% of adults participate in informal learning activities annually, underscoring its importance in today’s knowledge-driven economy.

The business segment is expected to exhibit the fastest CAGR of 11.5% over the forecast period owing to the increasing corporate investments in employee training and development to address skill gaps and improve productivity. The global corporate training market was valued at $370 billion in 2022, with companies spending an average of $1,308 per employee annually on training. The rise of digital learning platforms and the need for compliance with industry standards further accelerate this trend. This segment is vital for workforce readiness, innovation, and maintaining competitiveness in a rapidly evolving business landscape.

By Type Insights

The software segment held a dominant position by capturing 55.8% of the European edtech market share in 2024. The widespread adoption of Learning Management Systems (LMS), classroom management tools, and collaboration platforms are fuelling the expansion of the software segment in the Europe edtech market. In 2022, over 90% of U.S. schools used at least one type of educational software, with LMS platforms like Canvas and Google Classroom being the most popular. According to the National Center for Education Statistics, software tools have improved student engagement and teacher efficiency, making them indispensable in modern education.

The content segment is growing aggressively in the Europe and is estimated to exhibit the fastest CAGR of 16.3% over the forecast period due to the increasing demand for digital textbooks, video lectures, and interactive learning modules. The global digital content market in education was valued at $11.5 billion in 2022 and is projected to triple by 2030. The shift toward personalized and adaptive learning, coupled with government initiatives to digitize education, has accelerated this trend. For instance, the European Commission reported that 70% of teacher in the EU now use digital content regularly, highlighting its importance in enhancing learning outcomes.

By Deployment Insights

The cloud deployment segment accounted for 70.4% of the European market share in 2024 and stood as the most dominating segment. In addition to that, the cloud segment is expected to progress rapidly during the forecast period and register a CAGR of 26.8% during the forecast period. The cost-effectiveness, scalability, and ease of access of cloud deployment is primarily driving the expansion of the cloud segment in the European market. In 2022, over 85% of U.S. educational institutions adopted cloud-based solutions for learning management and collaboration. According to the National Center for Education Statistics, cloud platforms have improved accessibility for remote learners, with 60% of students using cloud-based tools daily. Cloud deployment is critical for modern education, enabling seamless integration of digital resources and supporting hybrid learning models.

REGIONAL ANALYSIS

The United Kingdom dominated the Europe edtech market with an estimated share of 30.3% in 2024 with the underpinned by several key factors, including the country’s advanced digital infrastructure, with 97% internet penetration as reported by the Office for National Statistics (ONS) in 2022. The UK government has played a pivotal role through initiatives like the EdTech Strategy Fund, which allocated £10 million to support innovation in education technology. Additionally, over 85% of schools in the UK have adopted digital learning tools by enabling seamless integration of technology into classrooms. The UK’s dominance is significant not only because it drives regional growth but also because it sets global benchmarks for Edtech adoption and implementation by influencing policies across Europe.

France is witnessing rapid EdTech growth in Europe and is strongly supported by policies such as the "Grande École du Numérique" and investments in digital classrooms. The edtech market in France is predicted to expand at a CAGR of 16.4% over the forecast period owing to the increasing demand for online learning platforms and corporate training solutions.

Germany is anticipated to grow with a CAGR of 15.3% in the next coming years owing to the investments in AI-based learning platforms and its robust industrial base, which supports technological innovation. Italy, France, and Spain are expected to witness steady growth in the coming years. Italy is poised for significant growth due to increased government funding aimed at upgrading digital infrastructure in schools. Spain’s focus on STEM education and vocational training is likely to boost its market share, while France benefits from strong private sector participation and partnerships with Edtech startups. These countries are increasingly prioritizing inclusive education by leveraging digital tools to bridge gaps in access and quality. Collectively, their efforts underscore Europe’s commitment to fostering innovation and sustainability in education by ensuring that Edtech becomes a cornerstone of future learning ecosystems.

KEY MARKET PLAYERS

BYJU'S, Blackboard Inc., Chegg, Inc., Coursera Inc., Edutech, edX LLC, Google LLC, Instructure, Inc., Microsoft, Udacity, Inc., and upGrad Education Private Limited are some of the key players in the Europe Edtech market.

STRATEGIES USED BY THE MARKET PARTICIPANTS

Content Localization and Personalization

To strengthen their position in the Europe Edtech market, key players are prioritizing content localization and personalization to cater to the unique needs of diverse European audiences. Companies like BYJU'S have localized their offerings to align with national education standards and curricula across different countries, ensuring compliance and relevance. Similarly, Coursera partners with European universities to offer region-specific courses in multiple languages, enhancing accessibility for non-English-speaking learners. This strategy not only improves user engagement but also builds trust among local educational institutions and students. By tailoring content to cultural and linguistic preferences, these companies ensure higher adoption rates and a competitive edge in fragmented markets.

Partnerships with Educational Institutions

Strategic partnerships with schools, universities, and governments are a cornerstone strategy for Edtech companies operating in Europe. Google LLC and Microsoft have collaborated extensively with European schools to integrate tools like Google Classroom and Microsoft Teams into their teaching processes, facilitating remote and hybrid learning. Blackboard Inc., on the other hand, works closely with universities to implement Learning Management Systems (LMS) that streamline administrative tasks and enhance teaching efficiency. These partnerships help companies embed their solutions into formal education systems, creating long-term relationships and driving widespread adoption. By aligning with trusted institutions, Edtech providers build credibility and secure a stable foothold in the market.

Focus on Upskilling and Professional Development

The growing demand for upskilling and reskilling among working professionals has prompted many Edtech players to focus on professional development programs. Coursera and edX LLC collaborate with top universities and corporations to offer specialized courses and certifications in fields like AI, data science, and cybersecurity, addressing workforce demands. Udacity, Inc. targets tech professionals with its nanodegree programs, which provide hands-on training in emerging technologies. By catering to the needs of both individuals and corporate clients, these platforms attract a steady stream of paying users while positioning themselves as leaders in lifelong learning. This focus on upskilling not only drives revenue growth but also ensures alignment with Europe’s evolving labor market requirements.

Integration of Advanced Technologies

Edtech companies are leveraging advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Augmented Reality (AR) to enhance learning experiences. BYJU'S uses AI-driven adaptive learning algorithms to personalize content based on individual student performance, improving engagement and outcomes. Instructure, Inc. incorporates analytics into its Canvas LMS platform to provide educators with actionable insights into student progress and engagement. These technological innovations set companies apart by offering superior value to users, from personalized learning paths to real-time feedback. By integrating cutting-edge tools, Edtech providers not only improve learning outcomes but also establish themselves as innovators in a highly competitive market.

Expansion into Emerging Markets within Europe

To capture untapped opportunities, Edtech players are expanding their presence in emerging European markets, particularly in Eastern Europe. upGrad Education Private Limited has extended its online learning offerings to countries like Poland and Romania, where Edtech adoption is still growing. Similarly, Chegg, Inc. provides affordable study resources and tutoring services to students in smaller European markets, addressing affordability concerns. By entering these underserved regions, companies can tap into high-growth areas and gain first-mover advantages. This expansion strategy allows them to diversify their user base and reduce dependency on saturated Western European markets, ensuring sustained growth in the long term.

Freemium Models and Affordable Pricing

Many Edtech companies are adopting freemium models and tiered pricing structures to attract a broader audience, including students and institutions with limited budgets. Google LLC offers free versions of Google Workspace for Education, with premium features available at a cost, making it accessible to schools of all sizes. Chegg, Inc. provides free study tools alongside subscription-based services like textbook rentals and tutoring, lowering barriers to entry for price-sensitive users. Freemium models not only increase brand visibility but also convert free users into paying customers over time. By offering affordable options, these companies ensure inclusivity and accessibility, strengthening their market position in Europe.

Focus on Lifelong Learning

To address the growing emphasis on continuous education, Edtech players are promoting lifelong learning by offering courses and certifications for all age groups, from K-12 students to retirees. Coursera and edX LLC provide a wide range of programs, from basic literacy courses to advanced degrees, catering to diverse learner needs. Microsoft supports digital literacy through its free Microsoft Learn platform, empowering individuals to acquire essential skills for the modern workforce. By promoting lifelong learning, these companies build brand loyalty and appeal to a broader demographic, ensuring sustained engagement and revenue growth. This strategy aligns with Europe’s focus on fostering a knowledge-based economy and preparing citizens for future challenges.

Sustainability and Accessibility Initiatives

In line with Europe’s commitment to sustainability and inclusivity, Edtech companies are adopting initiatives to promote accessibility and environmental responsibility. Microsoft integrates accessibility features like screen readers and voice recognition into its educational tools, ensuring usability for learners with disabilities. Blackboard Inc. ensures its LMS complies with accessibility standards such as WCAG 2.1, making education more inclusive. Additionally, companies are adopting sustainable practices, such as reducing carbon footprints in their operations. These initiatives not only enhance brand reputation but also align with EU policies on sustainability and digital inclusion, reinforcing their leadership in the market.

Strategic Acquisitions and Collaborations

Strategic acquisitions and collaborations are key strategies used by Edtech companies to expand their product portfolios and enter new markets. BYJU'S acquired Aakash Educational Services to strengthen its presence in test preparation and offline coaching, broadening its service offerings. Similarly, edX LLC merged with 2U, Inc. to create one of the largest online learning platforms globally, enhancing its scale and reach. These strategic moves enable companies to consolidate their market position, diversify their offerings, and achieve economies of scale. By acquiring innovative startups or forming alliances with established players, Edtech companies accelerate their growth and stay ahead of competitors in the dynamic European market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BYJU, an Edtech giant, localized its offerings to align with national education standards across European countries. This localization strategy is anticipated to allow BYJU'S to cater to diverse linguistic and cultural preferences, ensuring compliance with regional curricula and enhancing user engagement. Similarly, Coursera partnered with European universities to offer region-specific courses in multiple languages, strengthening its position as a leading provider of accessible and relevant educational content.

- In April 2024, Google LLC and Microsoft expanded their partnerships with European schools by integrating tools like Google Classroom and Microsoft Teams into teaching processes. These collaborations are anticipated to allow both companies to facilitate remote and hybrid learning while building long-term relationships with educational institutions. Blackboard Inc. also partnered with universities to implement its Learning Management System (LMS), streamlining administrative tasks and enhancing teaching efficiency, further solidifying its market presence.

- In April 2024, Coursera and edX LLC launched specialized courses and certifications in collaboration with top European universities and corporations. This initiative is anticipated to allow both platforms to address the growing demand for upskilling and reskilling among working professionals, particularly in fields like AI, data science, and cybersecurity. Udacity, Inc. introduced nanodegree programs targeting tech professionals, enabling it to capture a significant share of the professional development market and strengthen its brand as a leader in tech education.

- In April 2024, BYJU integrated AI-driven adaptive learning algorithms into its platform to personalize content based on individual student performance. This technological advancement is anticipated to allow BYJUs to improve learning outcomes and increase user retention. Similarly, Instructure, Inc. incorporated analytics into its Canvas LMS platform, providing educators with actionable insights into student progress. These innovations are expected to position both companies as leaders in the adoption of advanced technologies within the Edtech market.

- In April 2024, upGrad Education Private Limited expanded its online learning offerings to emerging European markets such as Poland and Romania. This strategic move is anticipated to allow upGrad to tap into high-growth regions and diversify its user base. Chegg, Inc. also extended its affordable study resources and tutoring services to smaller European markets, addressing affordability concerns and capturing untapped audiences, thereby strengthening its foothold in underserved areas.

- In April 2024, Google LLC introduced free versions of Google Workspace for Education, with premium features available at a cost. This freemium model is anticipated to allow Google to attract a wider audience, including schools with limited budgets while converting free users into paying customers over time. Similarly, Chegg, Inc. offered free study tools alongside subscription-based services, lowering barriers to entry and enhancing accessibility, which is expected to drive user acquisition and revenue growth.

- In April 2024, Coursera and edX LLC expanded their course offerings to include programs for all age groups, from K-12 students to retirees. This focus on lifelong learning is anticipated to allow both platforms to build brand loyalty and appeal to a broader demographic. Microsoft also promoted digital literacy through its free Microsoft Learn platform, empowering individuals to acquire essential skills for the modern workforce. These initiatives are expected to ensure sustained engagement and strengthen their leadership in the lifelong learning segment.

- In April 2024, Microsoft integrated accessibility features like screen readers and voice recognition into its educational tools, ensuring usability for learners with disabilities. This initiative is anticipated to allow Microsoft to enhance inclusivity and align with EU accessibility standards. Blackboard Inc. ensured its LMS complied with WCAG 2.1 guidelines, further promoting accessibility. Additionally, companies adopted sustainable practices, such as reducing carbon footprints, reinforcing their commitment to environmental responsibility and strengthening their brand reputation.

- In April 2024, BYJU acquired Aakash Educational Services to strengthen its presence in test preparation and offline coaching. This acquisition is anticipated to allow BYJU to expand its service offerings and consolidate its market position. Similarly, edX LLC merged with 2U, Inc., creating one of the largest online learning platforms globally. This merger is expected to enhance edX's scale and reach, enabling it to offer more comprehensive solutions and strengthen its competitive edge in the European Edtech market.

MARKET SEGMENTATION

This research report on the Europe Edtech market is segmented and sub-segmented into the following categories.

By Sector

- Preschool

- K-12

- Higher Education

- Others

By End-use

- Business

- Consumer

By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

By Deployment

- Cloud

- On-Premises

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key trends shaping the Europe EdTech market?

The Europe EdTech market is driven by AI-powered learning tools, immersive technologies like AR/VR, personalized learning platforms, and increased adoption of hybrid learning models. Governments and institutions are also investing in digital infrastructure to support online education.

How is AI influencing the EdTech sector in Europe?

AI is transforming EdTech through adaptive learning, automated assessments, AI tutors, and personalized recommendations. It helps educators analyze student performance and tailor content accordingly, improving learning outcomes.

What types of EdTech startups are thriving in Europe?

Startups focusing on AI-driven tutoring, coding education, language learning, corporate training, and immersive learning experiences (AR/VR) are thriving. B2B EdTech solutions for schools and universities are also gaining traction.

What is the future outlook for the EdTech industry in Europe?

The European EdTech industry is expected to grow steadily with advancements in AI, gamification, and immersive learning. Increased collaboration between governments, startups, and educational institutions will further drive innovation and accessibility.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]