Europe E-Learning Market Size, Share, Trends, & Growth Forecast Report Segmented By Delivery Mode (Online, LMS, and Mobile), Learning Mode, End User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe E-Learning Market Size

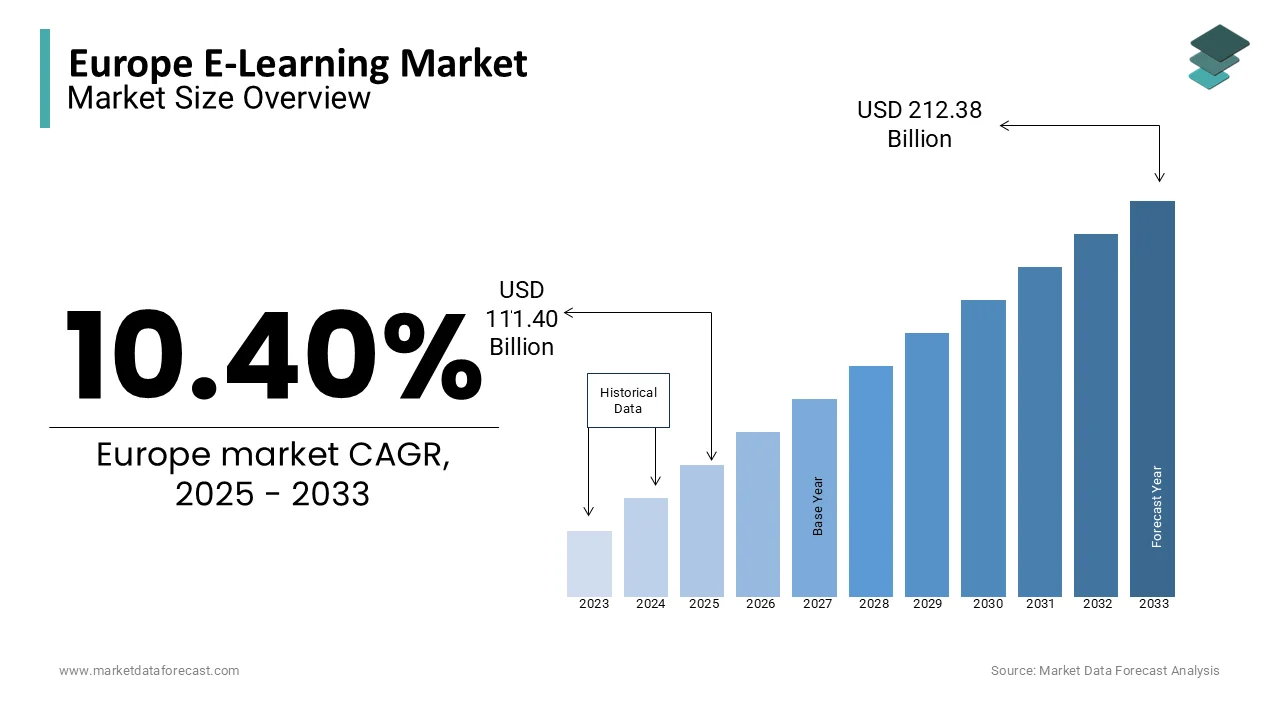

The Europe e-learning market was worth USD 102.77 billion in 2024. The European market is projected to reach USD 212.38 billion by 2033 from USD 111.40 billion in 2025, rising at a CAGR of 10.40% from 2025 to 2033.

E-learning or electronic learning is the delivery of educational content and training programs through digital platforms, which enables learners to access resources anytime and anywhere. It encompasses a variety of formats, including online courses, virtual classrooms, mobile learning, and gamified learning experiences. The European e-learning market is experiencing substantial growth owing to the increasing internet penetration, advancements in digital technology, and a strong focus on upskilling the workforce. The European Commission emphasizes digital education as a cornerstone of its Digital Education Action Plan, which aims to enhance digital literacy and promote the use of technology in education systems across member states. Additionally, according to the reports of the Eurostat, internet access in European households surpassed 92% in 2023 and is providing a solid foundation for the expansion of e-learning platforms. The COVID-19 pandemic further accelerated the adoption of e-learning, with schools, universities, and businesses rapidly transitioning to digital solutions. As per the reports from UNESCO, more than 100 million students in Europe benefited from online education during school closures.

MARKET DRIVERS

Government Initiatives and Funding in Europe

The European e-learning market is significantly propelled by robust government initiatives and funding aimed at enhancing digital education. The European Court of Auditors' Special Report 11/2023 highlights that the EU has implemented various actions to support the digitalisation of schools, including the Digital Education Action Plan. This plan emphasizes the integration of digital technologies into education systems, aiming to improve digital skills among citizens. Such strategic initiatives underscore the EU's commitment to fostering a digitally competent population, thereby driving the adoption and expansion of e-learning platforms across member states.

Growing Demand for Vocational Education and Training (VET)

The increasing emphasis on vocational education and training (VET) in Europe serves as a significant driver for the e-learning market. According to the European Centre for the Development of Vocational Training (Cedefop), there is a rising need for upskilling and reskilling the workforce to meet evolving labor market demands. Cedefop's statistics indicate that approximately 13% of EU workers are affected by digital skills mismatches, highlighting the necessity for continuous learning opportunities. E-learning platforms offer flexible and accessible solutions for individuals seeking to enhance their vocational skills, thereby aligning with the EU's objectives to promote lifelong learning and improve employability among its citizens.

MARKET RESTRAINTS

Digital Infrastructure Disparities

Uneven digital infrastructure across Europe poses a significant restraint on the e-learning market. According to Eurostat, as of 2023, while over 92% of households in the EU had internet access, rural and remote regions lag behind urban areas in broadband availability and speed. This digital divide limits the accessibility of e-learning platforms for individuals in underserved regions, reducing the market’s potential reach. The European Court of Auditors emphasizes that insufficient high-speed internet connectivity in certain regions remains a critical challenge to achieving digital equity in education.

Digital Skills Gap

The lack of adequate digital skills among learners and educators restricts the adoption of e-learning solutions. The European Commission’s Digital Economy and Society Index (DESI) 2023 reveals that nearly 44% of EU citizens lack basic digital skills. Additionally, a shortage of digitally trained educators further exacerbates the issue, hindering the effective integration of e-learning tools in traditional and vocational education. This gap undermines the full utilization of e-learning platforms, creating barriers to widespread adoption and success in digital education initiatives.

MARKET OPPORTUNITIES

Expansion of Online Learning Participation

The European e-learning market is experiencing significant growth, driven by an increasing number of individuals engaging in online education. In 2023, 30% of EU internet users aged 16 to 74 reported participating in online courses or utilizing online learning materials, marking a 2 percentage point increase from the previous year. Notably, countries like the Netherlands and Finland lead with participation rates exceeding 50%. This upward trend indicates a growing acceptance and reliance on digital learning platforms across Europe, presenting substantial opportunities for e-learning providers to expand their offerings and reach a broader audience. Source

Emphasis on Lifelong Learning and Upskilling

The European Union's focus on lifelong learning and upskilling initiatives creates a favorable environment for the e-learning market. The "Upskilling Pathways" initiative aims to help adults acquire a minimum level of literacy, numeracy, and digital skills, addressing the needs of approximately 61 million adults in the EU who struggle with basic skills. This policy framework encourages the development and adoption of flexible learning solutions, such as e-learning platforms, to provide accessible education opportunities for adults seeking to enhance their competencies and employability.

MARKET CHALLENGES

Limited Accessibility in Remote Regions

Accessibility to e-learning platforms remains a significant challenge in rural and underserved areas of Europe. Eurostat data reveals that while overall broadband penetration in the EU reached 92% in 2023, rural coverage is still below the average at 87%, and high-speed internet access remains limited. This digital divide restricts equal opportunities for individuals in these regions to participate in e-learning programs, hindering the market’s full potential. Addressing this gap requires substantial investments in infrastructure development, which remains a pressing challenge for regional governments and the private sector.

Language and Content Localization Barriers

The multilingual nature of Europe poses challenges for the e-learning market due to the need for localized content in various languages. According to the European Commission, the EU is home to 24 official languages and over 60 regional and minority languages. E-learning providers face difficulties in creating diverse, culturally relevant content that caters to such linguistic diversity. This limitation affects user engagement and adoption rates, particularly in smaller or less economically developed member states, where resources for localized content production may be limited. Overcoming these barriers is essential for achieving widespread e-learning adoption across Europe.

REGIONAL ANALYSIS

The UK had the leading share of the European e-learning market in 2023 and the domination of the UK is anticipated to continue in the European market throughout the forecast period due to its strong investment in digital education and advanced infrastructure. According to the UK Department for Education, the country has consistently prioritized technology integration in schools and professional training programs, with e-learning platforms widely adopted across sectors. High internet penetration, reaching over 95% of households, and government-backed initiatives like the EdTech Strategy further bolster its position as a top performer in the region.

Germany is predicted to showcase promising growth in the European market over the forecast period. The focus of Germany on vocational training and workforce development is majorly driving the e-learning market growth in Germany. According to the reports from the Federal Institute for Vocational Education and Training, over 60% of organizations in Germany utilize e-learning tools for employee training. This alignment with industrial needs ensures a thriving market for digital education platforms in the country.

France is another key player in the European e-learning market and is likely to exhibit notable growth over the forecast period. The emphasis of France on digital literacy and national education reforms are propelling the French market growth. As per the reports from the Ministry of National Education in France, significant investments in online learning platforms, particularly during the COVID-19 pandemic, to ensure uninterrupted education. The government’s commitment to promoting lifelong learning and digital inclusion positions France as a leading market in Europe.

KEY MARKET PLAYERS

Adobe Inc., Articulate Global Inc., Cegos Group, Cengage Learning Inc, Cisco Systems Inc., City and Guilds Group, D2L Corp., Docebo Inc., Hive Learning Ltd, are some of the major players in the Europe e-learning market.

MARKET SEGMENTATION

This research report on the European e-learning market is segmented and sub-segmented into the following categories.

By Delivery Mode

- Online

- LMS

- Mobile

By Learning Mode

- Self-Paced

- Instructor-Led

By End User

- Academic

- Corporate

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current state of the e-learning market in Europe?

The e-learning market in Europe is well-established and continuously growing, driven by technological advancements, increasing adoption of digital tools in education, and demand for flexible learning solutions across schools, universities, and corporations.

How has the corporate sector contributed to the growth of e-learning in Europe?

The corporate sector has contributed to growth by increasingly using e-learning for employee training, skill enhancement, and compliance education, as it reduces training costs and offers flexibility.

What technologies are shaping the future of e-learning in Europe?

Technologies such as artificial intelligence, virtual reality, gamification, and adaptive learning are shaping the future of e-learning, offering more personalized and interactive experiences.

What is the outlook for the e-learning market in Europe?

The market is expected to grow steadily due to ongoing digital transformation efforts, the push for lifelong learning, and the demand for cost-effective and accessible educational solutions across various sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]