Europe E-Commerce Automotive Aftermarket Market Size, Share, Growth, Trends And Forecast Report, Segmented By Replacement Type, End-Use And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis, From 2025 to 2033

Europe E-Commerce Automotive Aftermarket Market Size

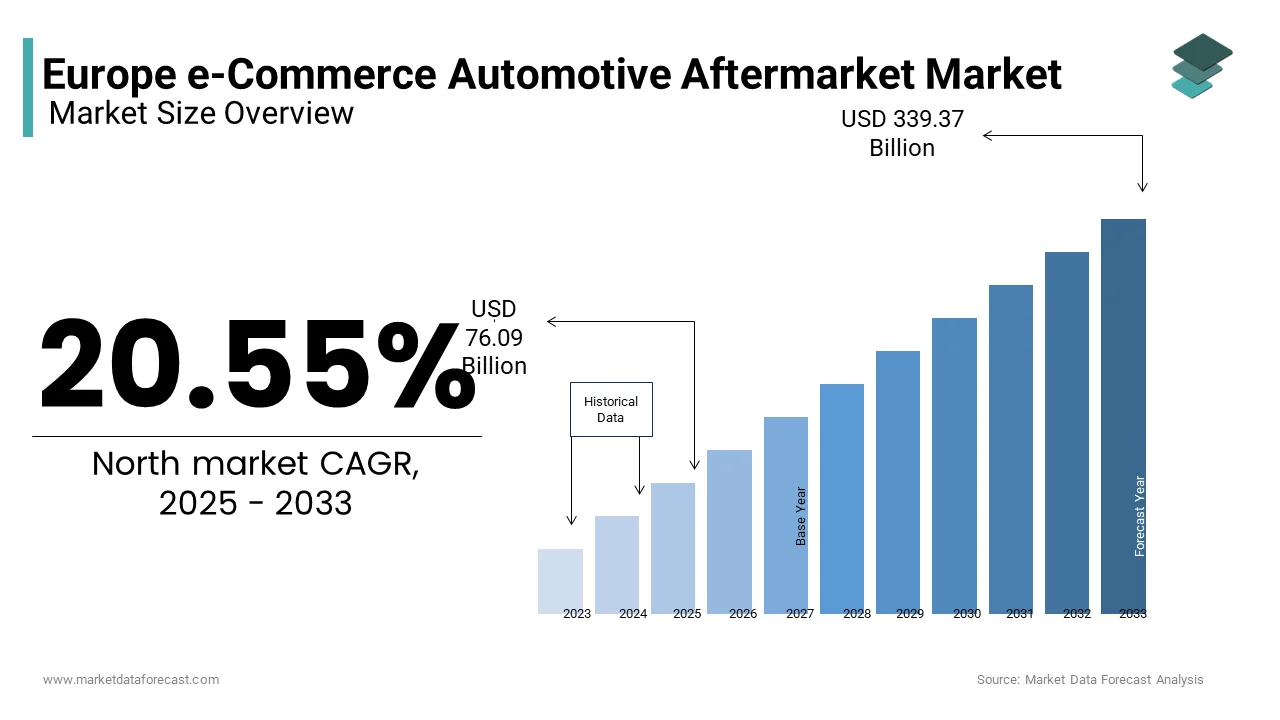

The Europe e-commerce automotive aftermarket market was valued at USD 63.12 billion in 2024 and is anticipated to reach USD 76.09 billion in 2025 from USD 339.37 billion by 2033, growing at a CAGR of 20.55% during the forecast period from 2025 to 2033.

The Europe e-commerce automotive aftermarket has established a robust presence, which was driven by the increasing adoption of online platforms for purchasing automotive parts and accessories. The rise of electric vehicles (EVs) and aging fleets has further fueled demand for replacement parts is creating opportunities for e-commerce players. As per McKinsey, online platforms offering convenience, competitive pricing, and doorstep delivery have gained significant traction, particularly among DIY enthusiasts and small repair shops. Additionally, advancements in logistics and payment systems have streamlined operations by making e-commerce a preferred channel for automotive aftermarket purchases.

MARKET DRIVERS

Rising Demand for Convenience and Accessibility

The growing preference for online shopping has significantly bolstered the Europe e-commerce automotive aftermarket. According to a study by Deloitte, over 70% of European consumers now prefer purchasing automotive parts online due to the convenience of browsing extensive catalogs and comparing prices. Platforms like Amazon and specialized websites offer 24/7 accessibility by enabling customers to place orders at their convenience. Furthermore, the proliferation of mobile apps has simplified the purchasing process by allowing users to order parts directly from their smartphones. This trend is particularly evident in urban areas, where time constraints and busy lifestyles drive demand for quick and hassle-free solutions. Countries like the UK and Sweden, with high internet penetration rates, are leading adopters of this trend. The integration of AI-driven recommendation engines on e-commerce platforms also enhances customer experience by driving repeat purchases and loyalty.

Increasing Adoption of Electric Vehicles (EVs)

The rapid adoption of electric vehicles across Europe is another major driver of the e-commerce automotive aftermarket. According to the European Automobile Manufacturers' Association (ACEA), EV sales surged by 63% in 2022 by accounting for 20% of total vehicle registrations. This shift has created a parallel demand for specialized EV parts, such as batteries, inverters, and charging components, which are increasingly available through online platforms. Companies like Bosch and Continental have launched dedicated e-commerce portals to cater to this niche market is offering tailored solutions for EV owners. Additionally, government incentives for EV adoption, such as subsidies and tax breaks that accelerated this trend. France and Germany, with their aggressive EV policies, are witnessing heightened demand for online EV parts.

MARKET RESTRAINTS

Counterfeit and Low-Quality Products

One of the primary restraints in the Europe e-commerce automotive aftermarket is the prevalence of counterfeit and low-quality products. According to a report by the European Union Intellectual Property Office (EUIPO), counterfeit automotive parts account for approximately €2.2 billion in annual losses within the EU. These products not only undermine consumer trust but also pose significant safety risks when used in critical systems like braking or steering. The anonymity of online platforms makes it easier for unscrupulous sellers to distribute substandard goods by complicating enforcement efforts. Furthermore, the lack of stringent quality checks on certain third-party marketplaces exacerbates the issue. While larger platforms like Amazon have implemented anti-counterfeiting measures, smaller regional players often struggle to ensure product authenticity. This challenge hinders the growth of e-commerce in the automotive aftermarket, as consumers remain wary of potential risks.

Complex Return and Warranty Policies

Another significant restraint is the complexity of return and warranty policies associated with online automotive parts purchases. According to PwC, over 30% of European consumers cite cumbersome return processes as a deterrent to buying automotive parts online. Unlike traditional brick-and-mortar stores, where exchanges can be handled in person, e-commerce transactions often involve lengthy procedures, including shipping costs and inspection delays. Additionally, warranty claims for defective parts can be challenging, particularly when dealing with cross-border purchases. For instance, customers in smaller countries like Denmark and Switzerland may face difficulties resolving issues with international sellers. This lack of transparency and reliability erodes consumer confidence, limiting the appeal of online platforms.

MARKET OPPORTUNITIES

Integration of Augmented Reality (AR) Tools

The integration of augmented reality (AR) tools presents a transformative opportunity for the Europe e-commerce automotive aftermarket. According to Gartner, AR adoption in retail is expected to grow by 20% annually through 2025, driven by its ability to enhance user experience. In the automotive sector, AR applications allow customers to visualize how specific parts, such as wipers or lighting systems, will fit and function in their vehicles before making a purchase. Companies like BMW and Audi have already begun experimenting with AR-enabled platforms that is by enabling DIY enthusiasts to accurately identify and select compatible parts. This technology not only reduces return rates but also increases customer satisfaction by minimizing mismatches. The UK and Germany, with their tech-savvy populations, are ideal markets for AR adoption.

Expansion into Rural and Underserved Areas

Expanding e-commerce services into rural and underserved areas offers significant growth potential for the Europe automotive aftermarket. According to Eurostat, approximately 30% of Europe’s population resides in rural regions, where access to physical automotive stores is limited. Online platforms can bridge this gap by providing affordable and accessible solutions for vehicle maintenance and repairs. For instance, companies like RockAuto and Europarts have successfully penetrated rural markets by offering extensive catalogs and competitive pricing. Additionally, advancements in last-mile delivery networks, driven by investments from logistics giants like DHL and FedEx, have made it feasible to serve remote locations efficiently. Countries like Spain and Italy, with vast rural populations, stand to benefit immensely from this trend.

MARKET CHALLENGES

Cybersecurity Threats

Cybersecurity threats pose a significant challenge to the Europe e-commerce automotive aftermarket, undermining consumer trust and operational integrity. According to a report by Cybersecurity Ventures, cyberattacks on e-commerce platforms are projected to cost businesses $10.5 trillion annually by 2025. The automotive aftermarket is particularly vulnerable due to the sensitive nature of customer data, including payment information and vehicle details. High-profile breaches, such as those targeting major retailers, have heightened awareness of these risks, deterring some consumers from making online purchases. Moreover, smaller regional players often lack the resources to implement robust cybersecurity measures by making them easy targets for hackers. For instance, phishing attacks and ransomware incidents have disrupted operations for several European e-commerce platforms. Addressing these vulnerabilities requires substantial investment in encryption technologies, employee training, and compliance with data protection regulations like GDPR.

Logistics and Supply Chain Bottlenecks

Logistics and supply chain bottlenecks represent another pressing challenge for the Europe e-commerce automotive aftermarket. According to a study by KPMG, disruptions caused by geopolitical tensions and the pandemic have increased lead times by up to 30% in 2022. The automotive aftermarket relies heavily on timely delivery of parts for urgent repairs that is making these delays problematic. Cross-border shipments, common in the EU, are further complicated by customs regulations and port congestion. For example, countries like Turkey and Czech Republic, which depend on imports for certain components, face frequent supply shortages. Additionally, rising fuel costs and labor shortages have inflated transportation expenses thereby reducing profit margins for e-commerce players. To mitigate these challenges, companies must invest in localized warehousing and advanced inventory management systems is ensuring resilience against future disruptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.55% |

|

Segments Covered |

By Replacement Parts, End-Use and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Advance Auto Parts; Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone Inc.; CARiD.com; eBay Inc.; Flipkart.com; National Automotive Parts Association; O’Reilly Auto Parts; RockAuto, LLC; U.S. Auto Parts Network, Inc. |

SEGMENTAL ANALYSIS

By Replacement Parts Insights

The braking system segment dominated the Europe e-commerce automotive aftermarket by holding a 25.3% of share in 2024. The rising importance of braking components in vehicle safety is driving consistent demand for replacements, where that is ascribed to fuel the growth of this segment. Aging fleets across Europe in countries like Italy and Spain, contribute significantly to this trend. According to ACEA, over 30% of vehicles on European roads are older than 10 years is necessitating frequent brake pad and rotor replacements. Additionally, the rise of online platforms offering detailed compatibility guides and installation tutorials has empowered DIY enthusiasts to purchase and replace braking components independently. The availability of premium brands like Brembo and TRW through e-commerce channels further enhances customer trust and adoption.

The lighting segment is likely to grow with a CAGR of 8.3% throughout the forecast period. This growth is fueled by the increasing adoption of LED and adaptive lighting systems, which are gaining popularity for their energy efficiency and enhanced visibility. Germany and France, with their focus on sustainable technologies, are key drivers of this trend. Additionally, the customization trend, where consumers upgrade headlights and interior lighting for aesthetic purposes, has created new opportunities for e-commerce platforms. Companies like Osram and Philips have partnered with online retailers to offer exclusive deals is boosting sales. Furthermore, advancements in smart lighting, such as IoT-enabled bulbs, are attracting tech-savvy buyers will further accelerate the growth of the market.

By End-Use Insights

The business-to-customer (B2C) segment led the Europe e-commerce automotive aftermarket share by accounting for 55.4% in 2024. The growth of the segment is driven by the growing number of DIY enthusiasts and individual car owners seeking affordable and convenient solutions for vehicle maintenance. The UK and Sweden, with their high internet penetration rates, are key contributors to this trend. Platforms like eBay and Amazon have capitalized on this demand by offering user-friendly interfaces and competitive pricing. Additionally, the rise of social media influencers promoting DIY repairs has further boosted B2C sales. According to Nielsen, over 40% of European consumers rely on online reviews and recommendations before purchasing automotive parts.

The business-to-business (B2B) segment is anticipated to grow with a fastest CAGR of 9.1% during the forecast period. This growth is fueled by the increasing reliance of repair shops and fleet operators on e-commerce platforms for bulk purchases. Germany and France, with their large automotive service industries, are leading adopters of this trend. Companies like ZF Friedrichshafen and Valeo have launched dedicated B2B portals by offering volume discounts and customized solutions for professional buyers. Additionally, the integration of AI-driven analytics on these platforms enables businesses to optimize inventory management and procurement processes. The shift toward digitalization and automation in the automotive repair sector further accelerates B2B adoption is making it as a key growth driver in the coming years.

COUNTRY ANALYSIS

Top 5 Leading Countries in the Europe E-Commerce Automotive Aftermarket

Germany held a prominent position in the Europe e-commerce automotive aftermarket by capturing 22.6% of the share in 2024. The country’s growth is likely to be driven by attributed to its strong automotive manufacturing base and high vehicle ownership rates. According to ACEA, Germany accounts for over 40 million registered vehicles is creating a steady demand for replacement parts. Berlin and Munich serve as innovation hubs by fostering collaborations between e-commerce platforms and automotive manufacturers. The adoption of EVs and hybrid vehicles has further expanded the market with companies like Bosch offering specialized online solutions for these technologies.

The UK is esteemed to register a CAGR of 15.6% during the forecast period owing to the tech-savvy population and robust e-commerce infrastructure. UK consumers shop online regularly by making it an ideal market for automotive parts. London and Manchester are key centers for innovation, with startups leveraging AR and AI to enhance customer experience. The rise of EV adoption is supported by government incentives that has also boosted demand for specialized components available through online platforms.

France is steadily growing with a growing automotive service industry and focus on sustainability. According to INSEE, France’s automotive aftermarket generated €25 billion in revenue in 2022. Paris and Lyon are leading innovators, with companies adopting digital tools to streamline operations. Government policies promoting green technologies have encouraged the use of eco-friendly parts, aligning with consumer preferences.

Italy is poised to have prominent growth in the future period owing to its aging vehicle fleet and increasing adoption of online shopping. According to ANFIA, over 35% of Italian vehicles are older than 10 years. Milan and Turin are key contributors, with local e-commerce platforms catering to DIY enthusiasts and repair shops. Investments in logistics have improved accessibility that will escalate the growth of the market.

Spain ecommerce automotive aftermarket growth is driven by growing rural population and expanding e-commerce network. According to ICEX Spain, online sales of automotive parts grew by 25% in 2022. Madrid and Barcelona are innovation hubs, with companies focusing on affordability and convenience.

KEY MARKET PLAYERS

Advance Auto Parts; Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone Inc.; CARiD.com; eBay Inc.; Flipkart.com; National Automotive Parts Association; O’Reilly Auto Parts; RockAuto, LLC; U.S. Auto Parts Network, Inc. are the market players that are dominating the Europe e-commerce automotive aftermarket market.

Top 3 Players in the Market

Amazon

Amazon dominates the Europe e-commerce automotive aftermarket by offering an extensive catalog of parts and accessories. Its user-friendly interface and competitive pricing attract both individual buyers and businesses. Amazon’s Prime membership program ensures fast and reliable delivery, enhancing customer satisfaction. Strategic partnerships with automotive brands further strengthen its market position.

RockAuto

RockAuto specializes in providing high-quality automotive parts at affordable prices, catering primarily to DIY enthusiasts. The platform’s detailed compatibility guides and extensive inventory make it a trusted choice for European consumers. RockAuto’s focus on customer education, through tutorials and FAQs, sets it apart from competitors is driving repeat purchases.

Europarts

Europarts targets professional repair shops and fleet operators by offering tailored solutions for bulk purchases. Its B2B portal integrates advanced analytics, enabling businesses to optimize inventory management. Europarts’ commitment to sustainability, through eco-friendly packaging and parts, aligns with EU environmental goals by reinforcing its reputation as a responsible player.

Top Strategies Used By Key Players

- Digital Marketing and SEO Optimization: Companies like Amazon and RockAuto invest heavily in targeted advertising and search engine optimization to enhance visibility and attract diverse customer segments.

- Expansion of Product Portfolios: Offering specialized components, such as EV parts and smart lighting systems, to cater to emerging trends and technological advancements.

- Strategic Partnerships: Collaborating with automotive manufacturers and logistics providers to ensure seamless supply chain operations and timely deliveries.

Overview Of Competition In The Europe E-Commerce Automotive Aftermarket

The Europe e-commerce automotive aftermarket is highly competitive, characterized by innovation, strategic alliances, and a focus on customer-centric solutions. Key players like Amazon, RockAuto, and Europarts dominate the landscape, leveraging their expertise in digital platforms and logistics to meet diverse consumer needs. The market benefits from advancements in AR, AI, and IoT, enabling personalized shopping experiences and efficient inventory management. Competition is intensified by the entry of niche players targeting specialized segments, such as EV components and smart lighting systems. Additionally, government initiatives promoting digitalization and sustainability provide a conducive environment for growth. Companies are also investing in localized warehousing and last-mile delivery networks to reduce dependency on imports and enhance supply chain resilience. Overall, the competitive dynamics are shaped by innovation, regulatory compliance, and efforts to address evolving customer demands.

RECENT HAPPENINGS IN THIS MARKET

- In February 2023, Amazon launched a dedicated AR tool for visualizing automotive parts in Germany. This initiative aimed to enhance user experience and reduce return rates.

- In April 2023, RockAuto partnered with a UK-based logistics firm to expand its delivery network. This collaboration sought to improve accessibility in rural areas.

- In June 2023, Europarts introduced a new B2B portal featuring AI-driven analytics in France. This launch aimed to streamline procurement processes for repair shops.

- In September 2023, Bosch expanded its e-commerce platform to include EV-specific components in Sweden. This move was designed to capitalize on the growing EV market.

- In November 2023, ZF Friedrichshafen acquired a German startup specializing in IoT-enabled parts. This acquisition aimed to strengthen its position in the smart automotive aftermarket.

MARKET SEGMENTATION

This research report on the Europe e-commerce automotive aftermarket market is segmented and sub-segmented into the following categories.

By Replacement Parts

-

- Engine Parts

- Piston and Piston Rings

- Engine Valves and Parts

- Fuel Injection Systems

- Power Train Components

- Transmission and Steering

- Clutch Assembly Systems

- Gearbox

- Axles

- Wheels

- Tires

- Breaking System

- Brake Calipers

- Brake Pads

- Rotor and Drums

- Brake Disk

- Lighting

- Headlamps

- Tail lamps

- Oothers

- Electrical Parts

- Starter Motor

- Spark Plugs

- Battery

- Others

- Suspension Systems

- Wipers

- Others

- Engine Parts

By End Use

- Business to Business

- Business to Customer

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the e-commerce automotive aftermarket in Europe?

Rising vehicle aging, DIY trends, and digitalization are key growth drivers.

Which product categories are most popular online in the European automotive aftermarket?

Spare parts, accessories, tires, batteries, and lubricants lead in online sales.

Who are the major players in Europe's automotive aftermarket e-commerce?

Key players include eBay Motors, Autodoc, Amazon, Mister Auto, and Oscaro.

How is consumer behavior evolving in the European auto aftermarket e-commerce?

Consumers prefer convenience, price comparison, fast delivery, and mobile shopping.

What challenges does the market face despite rapid growth?

Issues include counterfeit parts, complex logistics, and return management.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]