Europe E-Bike Market Size, Share, Trends & Growth Forecast Report By Drive Type (Belt Drive and Chain Drive), Battery (Lead-acid Battery, Lithium-ion Battery & Others), End-Use (Personal and Commercial) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 To 2033

Europe E-Bike Market Size

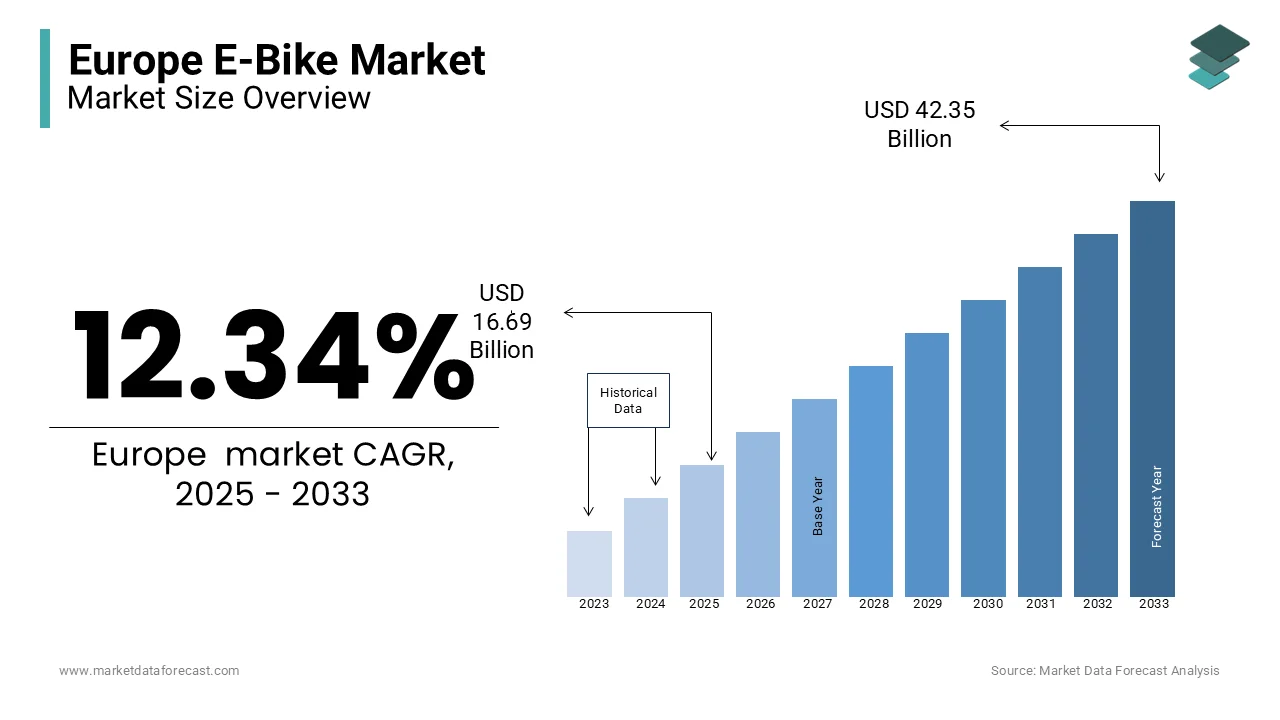

The European e-bike market size was valued at USD 14.86 billion in 2024 and is anticipated to reach USD 16.69 billion in 2025 from USD 42.35 billion by 2033, growing at a CAGR of 12.34% from 2025 to 2033.

The European e-bike market has been experiencing significant growth over the last few years owing to the increasing consumer demand for sustainable transportation solutions, rising environmental awareness, and advancements in e-bike technology. E-bikes or electric bicycles are equipped with a small electric motor that assists the pedaling of the rider, making them an attractive alternative to traditional bicycles and cars. As urban mobility shifts towards more eco-friendly and efficient options, e-bikes have gained popularity for both recreational and commuting purposes, offering convenience, cost-effectiveness, and reduced environmental impact.

The European electric bike market is particularly strong in countries like Germany, the Netherlands, and France, where cycling culture is deeply rooted, and government incentives support the adoption of electric mobility. In 2020, Europe saw over 3 million e-bike sales, with Germany accounting for approximately 50% of the market share, according to the European Cyclists’ Federation. The growing popularity of e-bikes is also fueled by technological advancements, such as improvements in battery life, lighter frames, and more powerful motors, making them more accessible to a wider audience. Additionally, urbanization, traffic congestion, and the need for efficient and environmentally friendly transportation solutions are contributing to the market's expansion. With the European Union's continued focus on sustainability, the e-bike market is poised for further growth, with projections indicating a steady increase in demand over the coming years.

MARKET DRIVERS

Government Incentives and Subsidies

One of the primary drivers of the European e-bike market is the increasing number of government incentives and subsidies aimed at promoting sustainable transport. Many European nations offer financial incentives for the purchase of e-bikes, making them more affordable for consumers. For instance, in Germany, the government introduced a program that offers substantial subsidies for the purchase of electric bicycles, as part of a broader effort to reduce carbon emissions and promote green transportation. These initiatives not only make e-bikes more financially accessible but also encourage consumers to make the shift from traditional vehicles to more eco-friendly alternatives. The push from governments, particularly in major European countries, is a significant factor in accelerating the adoption of e-bikes.

Advancements in E-Bike Technology

Technological advancements are another key factor driving the growth of the e-bike market in Europe. Innovations in battery life, motor efficiency, and overall e-bike design have made these bicycles more attractive and practical for everyday use. With improvements in battery technology, e-bikes now offer longer range and faster charging times, addressing previous limitations and making them a more convenient option for commuting and leisure. Lighter frames and enhanced motor integration also contribute to a smoother and more enjoyable riding experience. These technological improvements make e-bikes more accessible and appealing to a wider range of people, further contributing to their popularity in the European market.

MARKET RESTRAINTS

High Initial Costs

The high upfront costs of e-bikes continue to be a key restraint for the European market. Despite technological advancements that have reduced costs in recent years, e-bikes still represent a significant investment compared to traditional bicycles. The average price of an e-bike in Europe is approximately €2,500 to €4,000, depending on the model and specifications, which is about 2 to 3 times more expensive than a standard bike. According to the European Commission, this price barrier makes it difficult for a large portion of the population to adopt e-bikes, especially in lower-income groups. Despite government subsidies, the initial cost remains a limiting factor for many consumers, hindering the growth of the market.

Underdeveloped Charging Infrastructure

The lack of adequate public charging infrastructure is another significant challenge for the European e-bike market. While home charging options are available, public charging stations remain sparse, especially in smaller cities and rural areas. According to the European Cyclists' Federation, as of 2021, only a small percentage of cities in Europe had sufficient charging points for e-bikes. In fact, only about 10% of EU cities had charging infrastructure adequate for e-bikes, compared to 70% for electric cars. This limited access to charging stations discourages long-distance travel and impedes the convenience of using e-bikes, which contributes to the slow adoption rate. Expanding charging networks is vital to support the continued growth of e-bikes across Europe.

MARKET OPPORTUNITIES

Urbanization and Traffic Congestion

Rapid urbanization in Europe is creating a demand for efficient urban mobility solutions. The United Nations estimates that 75% of Europe's population will live in urban areas by 2050, exacerbating traffic congestion. E-bikes offer a practical solution, with the European Commission noting that they can reduce urban travel time by up to 50% compared to cars. Cities like Copenhagen, where 62% of residents commute by bike, exemplify this trend. E-bikes also address last-mile connectivity issues, particularly in densely populated areas. Their ability to navigate traffic and reduce reliance on public transport, especially post-pandemic, makes them a key component of sustainable urban mobility.

MARKET CHALLENGES

Safety Concerns and Regulatory Hurdles

Safety issues and varying regulations across European countries present a significant challenge for the e-bike market. The European Transport Safety Council reports that e-bike-related accidents have increased by 30% in urban areas over the past five years, raising concerns among potential users. Additionally, differing speed limits and licensing requirements for e-bikes across EU member states create confusion. For example, Germany mandates a speed limit of 25 km/h for e-bikes, while France allows up to 45 km/h for certain models, as noted by the European Commission. These inconsistencies hinder cross-border usage and complicate compliance for manufacturers, slowing market growth.

Battery Recycling and Environmental Concerns

The environmental impact of e-bike batteries is a growing challenge. The European Environment Agency highlights that only 5% of lithium-ion batteries from e-bikes are currently recycled, leading to significant electronic waste. With over 3 million e-bikes sold annually in Europe, as reported by the Confederation of the European Bicycle Industry, the disposal of used batteries poses a sustainability issue. Additionally, the extraction of raw materials like lithium and cobalt raises ethical and environmental concerns. The lack of standardized recycling protocols across the EU further exacerbates this problem, undermining the eco-friendly image of e-bikes and deterring environmentally conscious consumers.

SEGMENTAL ANALYSIS

By Drive Type Insights

The chain drive e-bikes segment dominated the European market, holding a market share of 65.6% in 2024. The growth of the segment is majorly credited to its durability, cost-effectiveness, and widespread compatibility with existing bicycle infrastructure. Chain drives are particularly favored for their ability to handle high torque, making them ideal for hilly terrains and long-distance commuting. The Confederation of the European Bicycle Industry notes that chain drives are also easier to repair and maintain, contributing to their popularity. Their established presence in the market and lower production costs further solidify their position as the preferred choice for manufacturers and consumers alike.

The belt drive segment is anticipated to grow at the fastest CAGR of 18.5% over the forecast period owing to the increasing demand for low-maintenance and eco-friendly transportation solutions. Belt drives are quieter, cleaner, and require less maintenance compared to chain drives, making them attractive for urban commuters. The International Energy Agency highlights that belt drives are gaining traction due to their compatibility with mid-drive motors, which enhance performance and efficiency. Additionally, the rise of premium e-bike models, particularly in Western Europe, is fueling the adoption of belt drives, as they align with the growing preference for sustainable and high-quality mobility solutions.

By Battery Insights

The lithium-ion battery segment ruled the European e-bike market by accounting for 70.7% of the European market share in 2024. This dominance is attributed to its high energy density, longer lifespan, and lightweight properties, making it ideal for e-bikes. Lithium-ion batteries also align with Europe's sustainability goals, reducing carbon emissions by up to 50% compared to conventional vehicles, according to the European Environment Agency. Their efficiency and declining costs, driven by advancements in battery technology, further solidify their leading position.

However, the lithium-ion battery segment is predicted to be the fastest growing segment and is likely to register a CAGR of 15.2% over the forecast period owing to the increasing consumer preference for eco-friendly transportation and government incentives promoting e-bike adoption. For instance, the European Union's Green Deal aims to reduce transport emissions by 90% by 2050, accelerating demand. Additionally, the declining cost of lithium-ion batteries, which fell by 89% between 2010 and 2021, enhances affordability, driving market expansion. This segment's rapid growth underscores its critical role in Europe's transition to sustainable mobility.

REGIONAL ANALYSIS

Germany held the largest share of the e-bike market in Europe and the leading position of Germany in this regional market is expected to continue throughout the forecast period. Germany stands as the largest market for electric bicycles in Europe, with 2.1 million new e-bikes sold in 2023. This figure is nearly three times higher than sales in France, the second-largest market. E-bikes now account for 53% of all new bike sales in Germany, a significant increase from 39% in 2020. This surge is attributed to strong government incentives, a robust cycling culture, and a well-developed infrastructure supporting e-bike usage. The European Commission notes that such initiatives are integral to achieving the EU's goal of reducing greenhouse gas emissions by 55% by 2030, thereby fostering a more sustainable transportation ecosystem.

France is another major market for e-bikes in Europe. France recorded the second-highest European sales, with just over a third of the sales volume of Germany. The French market has seen a substantial increase in e-bike adoption, driven by government subsidies and a growing interest in sustainable transportation options. The French government has implemented various incentives to encourage the use of electric bicycles, contributing to the market's expansion. These efforts align with France's commitment to reducing carbon emissions and promoting eco-friendly transportation solutions.

Netherlands is a lucrative market for e-bikes in Europe. Despite its significantly smaller population, the Netherlands ranks third in e-bike sales in Europe. The country is renowned for its strong cycling culture and extensive infrastructure, which has facilitated the rapid adoption of e-bikes. E-bikes made up half of all bicycle sales for the first time in 2020, and their share in the market has grown to 57% since then. This high penetration rate is attributed to the Netherlands' commitment to sustainable transportation and the integration of e-bikes into daily life.

KEY MARKET PLAYERS

Giant Manufacturing Co. Ltd, Merida Industry Co. Ltd, Leader 96, BH Bikes, Pedego Electric Bikes, Yamaha Motor Co, Accell Group N.V, Energica Motor Co., Mahindra & Mahindra Ltd., Robert Bosch GmbH. Some of the market players dominate the European e-bike market.

MARKET SEGMENTATION

This research report on the Europe e-bike market is segmented and sub-segmented into the following categories.

By Drive

- Belt Drive

- Chain Drive

By Battery

- Lead-acid Battery

- Lithium-ion Battery

- Others

By End Use

- Personal

- Commercial

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe e-bike market?

The Europe e-bike market size is anticipated to reach USD 16.69 billion in 2025

What market drivers are driving the Europe e-bike market?

One of the primary drivers of the European e-bike market is the increasing number of government incentives and subsidies aimed at promoting sustainable transport and also Technological advancements are another key factor driving the growth of the e-bike market in Europe.

who are the market players dominating the Europe e-bike market?

Giant Manufacturing Co. Ltd, Merida Industry Co. Ltd, Leader 96, BH Bikes, Pedego Electric Bikes, Yamaha Motor Co, Accell Group N.V, Energica Motor Co., Mahindra & Mahindra Ltd., Robert Bosch GmbH are dominating the Europ e-bike market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]