Europe Drone Market Size, Share, Trends, & Growth Forecast Report Segmented By Category (Consumer, Commercial Drones, Military Drones, and Others), Type, Payload, Power Source, End Use, Sales Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Drone Market Size

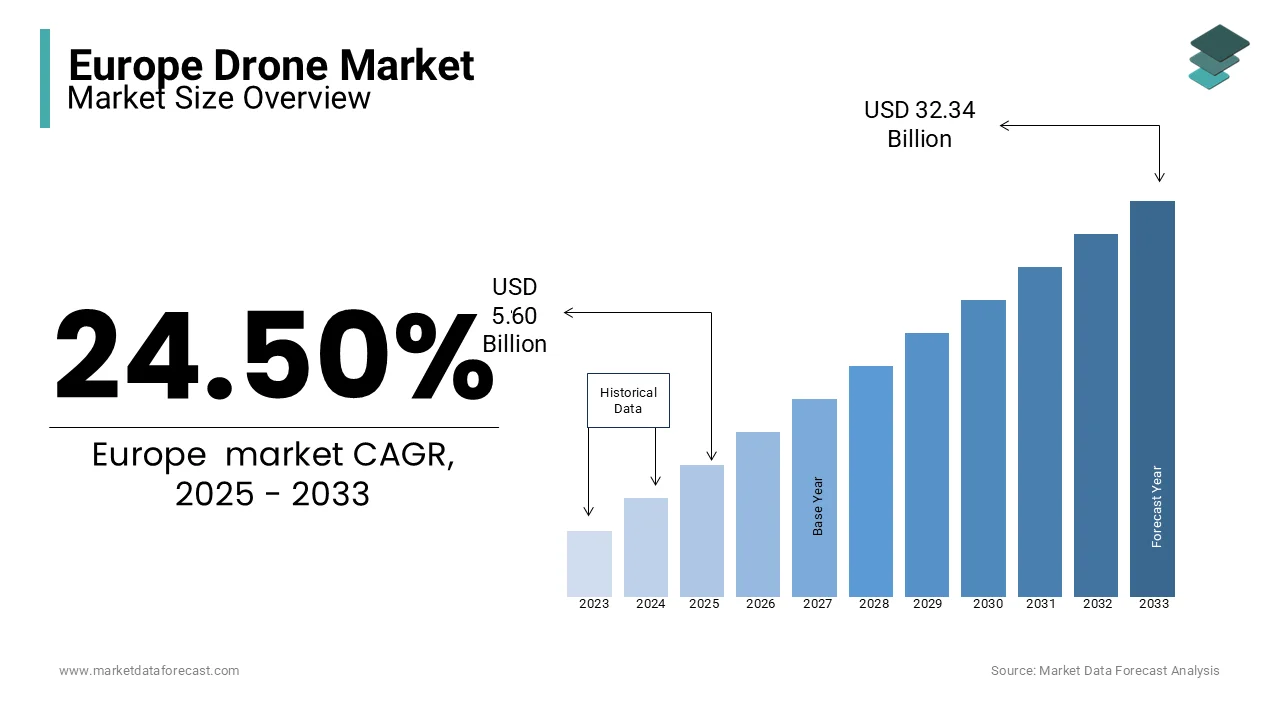

The Europe drone market was worth USD 4.50 billion in 2024. The Europe market is expected to reach USD 5.60 billion in 2025 and USD 32.34 billion by 2033, rising at a CAGR of 24.50% during the foreseen period.

The Europe drone market has been experiencing robust growth due to the advancements in drone technology and increasing adoption across diverse industries, the rising demand for unmanned aerial vehicles (UAVs) in sectors such as agriculture, construction, and law enforcement. The European Union Aviation Safety Agency (EA SA) has introduced stringent regulations to ensure safe and efficient drone operations, further boosting market confidence. Germany leads the drone market in Europe. The strong industrial base and proactive adoption of Germany of drones for infrastructure inspection and logistics have solidified its position. France follows closely, with significant investments in drone startups and research initiatives under the Horizon Europe program. Additionally, the European Commission’s Smart Cities initiative has encouraged municipalities to deploy drones for urban planning and emergency response, creating new avenues for growth. These developments underscore the pivotal role of innovation and regulation in shaping the Europe drone market.

MARKET DRIVERS

Increasing Adoption in Agriculture in Europe

Agriculture is one of the most significant drivers propelling the Europe drone market forward. According to the European Space Agency, over 30% of drones sold in Europe are utilized for precision agriculture, a figure expected to rise as farmers seek sustainable farming practices. Drones equipped with multispectral sensors are being used to monitor crop health, optimize irrigation, and assess soil conditions, leading to increased yields and reduced resource wastage. For instance, in Spain, drones have helped reduce pesticide usage by 40%, as per the Spanish Ministry of Agriculture. The European Union’s Common Agricultural Policy (CAP) further incentivizes the use of drones by providing subsidies for technology adoption. A report by AgriTech Tomorrow highlights that the global agricultural drone market is projected to grow at a CAGR of 28% through 2030, with Europe playing a central role. Companies like DJI and Parrot have introduced affordable, user-friendly drones tailored for small-scale farmers, driving widespread adoption.

Rising Demand in Construction and Infrastructure

The growing demand for drones in the construction and infrastructure sectors in Europe is further promoting the growth of the European drone market. According to McKinsey & Company, the use of drones in construction projects can reduce surveying time by up to 90%, making them indispensable for large-scale developments. In Germany, drones are extensively used for monitoring highway expansions and inspecting bridges, reducing operational costs by 20%, as per the German Federal Ministry of Transport. The European Green Deal has also accelerated drone adoption by promoting sustainable construction practices. For example, drones equipped with thermal imaging cameras are being deployed to assess energy efficiency in buildings, aligning with EU climate goals. Furthermore, as per a study by Deloitte, the integration of AI-powered drones in construction workflows is expected to increase productivity by 35% by 2025. These technological advancements, coupled with supportive policies, underscore the transformative impact of drones on Europe’s construction industry.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

One of the primary restraints hindering the Europe drone market is the complex and stringent regulatory framework governing UAV operations. According to EASA, drones operating in European airspace must comply with a three-tier classification system based on risk levels, which often delays project approvals and increases operational complexity. For instance, obtaining permits for beyond-visual-line-of-sight (BVLOS) operations can take several months, limiting the scalability of drone applications in sectors like logistics and delivery. Additionally, as per the European Parliament, privacy concerns have led to stricter data protection laws under the General Data Protection Regulation (GDPR), impacting drone operations that involve image or video capture. These regulations require operators to anonymize collected data, adding to compliance costs. While these measures aim to enhance safety and privacy, they pose significant barriers for smaller companies and startups, which often lack the resources to navigate the regulatory landscape effectively.

Limited Battery Life and Payload Capacity

The limited battery life and payload capacity of drones that restrict their functionality in high-demand applications is further hindering the expansion of the European drone market. According to a study by the Fraunhofer Institute, the average flight time of commercial drones ranges between 20 to 40 minutes, depending on the payload weight. This limitation is particularly challenging for industries like energy and infrastructure, where drones are required to perform extended inspections over large areas. Furthermore, as per the International Energy Agency, the current generation of lithium-ion batteries used in drones has reached its performance ceiling, with incremental improvements unlikely to meet growing demands. While hydrogen fuel cells and solid-state batteries hold promise, their commercial viability remains uncertain. These technical limitations not only hinder operational efficiency but also increase costs due to frequent battery replacements and downtime, posing a significant challenge for market growth.

MARKET OPPORTUNITIES

Expansion into Urban Air Mobility (UAM)

Urban air mobility (UAM) in Europe is a significant opportunity for the Europe drone market, with cities like Paris and Hamburg investing heavily in drone-based transportation systems. According to Roland Berger, the UAM market in Europe is projected to reach USD 4.2 billion by 2030, driven by the need for sustainable urban transport solutions. Companies like Volocopter and Lilium are pioneering electric vertical takeoff and landing (eVTOL) drones, which are expected to revolutionize last-mile delivery and passenger transport. The European Innovation Council (EIC) has allocated over USD 500 million to support UAM startups, fostering innovation in this emerging sector. As per a study by the European Investment Bank, integrating drones into urban mobility networks could reduce traffic congestion by 30% and lower carbon emissions by 25%. These initiatives highlight the immense potential of UAM to reshape Europe’s transportation landscape while creating lucrative opportunities for drone manufacturers and service providers.

Integration with IoT and AI Technologies

The integration of drones with Internet of Things (IoT) and artificial intelligence (AI) technologies is another promising opportunity for the European drone market. According to Gartner, the global IoT market is expected to grow at a CAGR of 25% through 2026, with Europe playing a pivotal role in adopting smart city solutions. Drones equipped with AI-driven analytics can process real-time data from IoT sensors, enabling applications such as environmental monitoring, disaster management, and smart grid inspections. For instance, as per the European Environment Agency, drones integrated with IoT systems have reduced wildfire detection times by 50% in Mediterranean countries. Additionally, companies like Airbus and AeroVironment are developing autonomous drones capable of performing complex tasks without human intervention. These advancements not only enhance operational efficiency but also open new revenue streams for drone manufacturers, positioning Europe as a global leader in intelligent drone solutions.

MARKET CHALLENGES

Public Perception and Privacy Concerns

The public perception and privacy concerns in Europe with respect to drones is one of the major challenges to the European drone market. According to Eurobarometer, nearly 60% of Europeans express skepticism about the widespread use of drones, citing fears of surveillance and data misuse. This apprehension is exacerbated by high-profile incidents, such as unauthorized drone flights near airports, which have heightened public anxiety. The European Data Protection Board has mandated strict compliance with GDPR, requiring drone operators to implement robust data anonymization protocols. As per a study by the University of Cambridge, failure to address privacy concerns could result in a 15% reduction in consumer acceptance of drone services. To mitigate this, companies like Flyability and Skydio are investing in transparent communication strategies and privacy-enhancing technologies. However, overcoming public resistance remains a significant hurdle for market expansion.

Cybersecurity Vulnerabilities

The growing vulnerability of drones to cybersecurity threats is also challenging the expansion of the Europe drone market. According to the European Network and Information Security Agency (ENISA), cyberattacks on drones have surged by 40% over the past two years, with hackers targeting both hardware and software systems. For instance, in 2022, a coordinated attack disrupted drone operations at a major logistics hub in the Netherlands, causing significant financial losses. As per Kaspersky Lab, drones are particularly susceptible to GPS spoofing and signal jamming, which can compromise navigation and data integrity. Moreover, the integration of drones with IoT networks expands the attack surface, necessitating advanced encryption and threat detection mechanisms. Addressing these vulnerabilities requires substantial investment in cybersecurity infrastructure, posing a challenge for operators striving to balance security with affordability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

24.50% |

|

Segments Covered |

By Category, Type, Payload, Power Source, End Use, Sales Channel, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

BAE Systems Inc, Pix4D SA, Aerialtronics, Parrot SAS, Flyability, AltiGator, Delair, and SenseFly SA |

SEGMENTAL ANALYSIS

By End Use Insights

The agriculture segment accounted for 31.3% of the Europe drone market share in 2024. The domination of agriculture segment in the European drone market is primarily driven by the sector’s rapid adoption of drones for precision farming, which enhances productivity while minimizing environmental impact. For instance, in Italy, drones equipped with NDVI sensors are being used to monitor vineyards, improving grape quality and yield by 20%, as per the Italian Ministry of Agriculture. The commitment of the European Union to sustainable farming practices is further accelerating the expansion of the agriculture segment in the European drone market. The Common Agricultural Policy (CAP) allocates USD 2 billion annually to support technology adoption, including drones. Additionally, as per AgriTech Tomorrow, the cost of drone-based crop monitoring has decreased by 35% over the past five years, making it accessible to small-scale farmers. These developments underscore agriculture’s pivotal role in driving the Europe drone market.

The media & entertainment segment is predicted to witness the fastest CAGR in the European drone market over the forecast period due to the increasing use of drones for aerial cinematography and live event coverage. For example, during the 2022 UEFA Champions League Final in Paris, drones captured stunning aerial footage, enhancing viewer engagement. The declining cost of high-resolution cameras and stabilizers that have made drones more versatile is promoting the expansion of the media & entertainment segment in the European drone market. Furthermore, advancements in AI-driven flight planning have enabled filmmakers to execute complex shots with minimal manual intervention. These innovations highlight the immense potential of drones in transforming the entertainment industry.

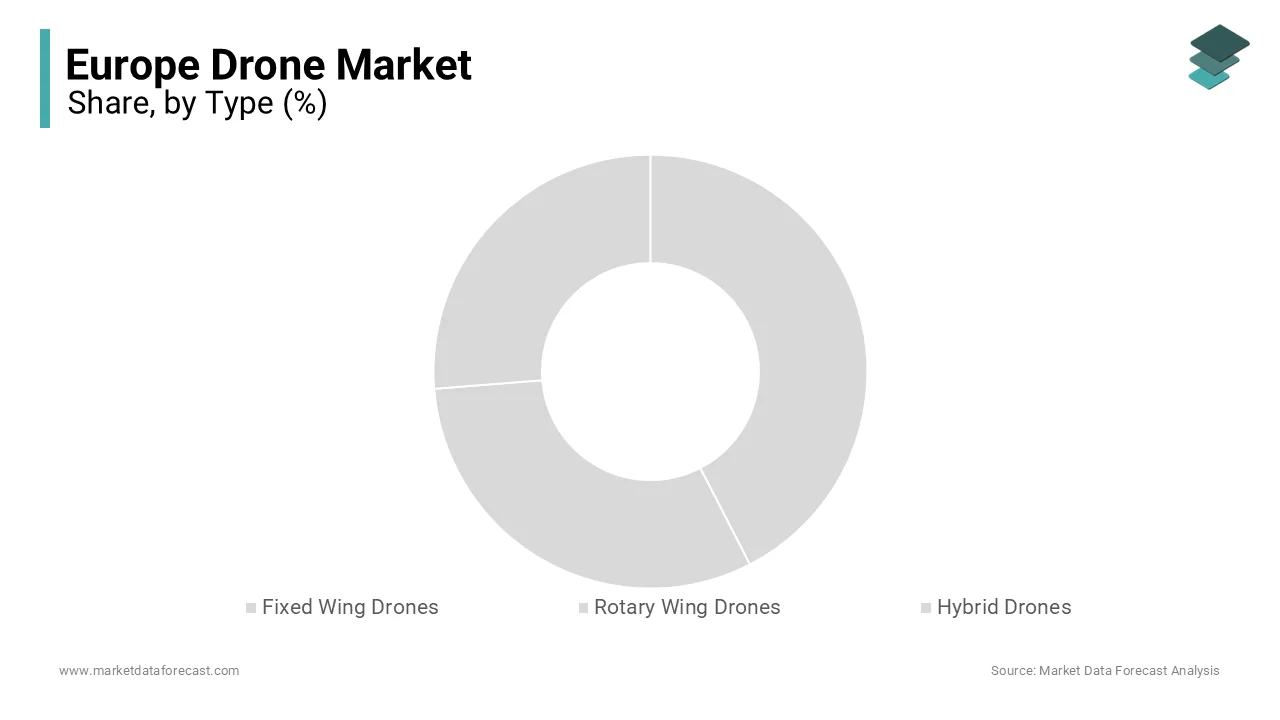

By Type Insights

The rotary-wing drones segment led the market by holding 64.9% of the European drone market share in 2024. The ease of operation, their versatility and ability of rotary-wing drones to hover make them ideal for applications such as aerial photography, search and rescue, and infrastructure inspection is majorly driving the domination of the rotary-wing drones segment in the European market. For instance, in Switzerland, rotary-wing drones are extensively used for avalanche monitoring, reducing response times by 50%, according to the Swiss Alpine Club. As per Drone Industry Insights, rotary-wing drones require minimal training compared to fixed-wing models, making them accessible to a broader user base. Additionally, advancements in battery technology have extended their flight times, addressing previous limitations. These attributes ensure that rotary-wing drones remain the preferred choice for diverse applications across Europe.

The fixed-wing drones segment is anticipated to witness the fastest CAGR in the European drone market over the forecast period owing to their superior endurance and payload capacity, which make them ideal for long-range applications such as mapping and environmental monitoring. For example, in Norway, fixed-wing drones are being used to survey remote fjords, reducing surveying costs by 40%, according to the Norwegian Mapping Authority. The development of hybrid propulsion systems that combine electric motors with internal combustion engines is also aiding the expansion of the fixed-wing drones segment in the European market. As per the European Space Agency, these systems have increased flight durations by up to 50%, enhancing operational efficiency. Furthermore, the integration of AI-powered navigation systems has improved their usability in challenging terrains. These advancements underscore the transformative potential of fixed-wing drones in addressing complex operational needs.

REGIONAL ANALYSIS

Germany accounted for the leading share of 26.1% of the European drone market share in 2024. The dominance of Germany in the European market is driven by its robust industrial base and a strong emphasis on innovation, particularly in sectors like logistics, agriculture, and infrastructure inspection. According to Statista, over 60% of applications of drones are concentrated in commercial and industrial use cases in Germany. Berlin and Munich are hubs for drone startups and R&D initiatives, supported by government grants totaling €500 million under the Digital Strategy 2025. The rise of e-commerce has further fueled demand, with companies like DHL pioneering drone-based delivery systems for rural areas. Additionally, Germany’s stringent regulatory framework, overseen by the Federal Aviation Office, ensures safe integration of drones into airspace, fostering public trust. Agricultural drones, used for precision farming, account for 35% of total sales, as reported by the German Agricultural Society. With a focus on automation and sustainability, Germany continues to shape the trajectory of Europe’s drone industry.

France occupied a promising share of the European drone market in 2024. Known for its aerospace expertise, France has leveraged its technological prowess to dominate both defense and commercial drone sectors. According to the French Ministry of Armed Forces, the country invested €1.2 billion in military drone development between 2020 and 2023, with systems like the Patroller UAV gaining prominence. Paris and Toulouse are key centers for drone innovation, home to giants like Airbus and Parrot, which collectively control 40% of Europe’s consumer drone segment. Commercial applications, such as infrastructure monitoring and disaster management, have grown by 20% annually since 2021, driven by partnerships with local governments. France’s Directorate General for Civil Aviation (DGAC) has also streamlined regulations, enabling widespread adoption in urban planning and environmental research. Moreover, the rise of eco-friendly drones, powered by renewable energy, aligns with France’s sustainability goals. By balancing defense priorities with commercial innovation, France remains a cornerstone of Europe’s drone landscape.

The UK is anticipated to account for a prominent share of the European drone market over the forecast period. London and Manchester are at the forefront of this transformation, where drones are increasingly deployed for urban logistics, surveillance, and emergency response. According to the UK Civil Aviation Authority, the number of registered commercial drones surged by 30% in 2023, reaching over 10,000 units. The rise of e-commerce giants like Amazon has accelerated investments in drone delivery systems, with trials showing a potential 40% reduction in delivery times. The UK government’s Future Flight Challenge, worth £125 million, has spurred innovation in autonomous systems, benefiting sectors like construction and media. Additionally, the UK’s commitment to Net Zero targets has encouraged the adoption of electric drones, which now represent 25% of total sales. Regulatory frameworks, such as the Drone and Model Aircraft Registration Scheme, ensure safety while promoting growth. By integrating cutting-edge technology with practical applications, the UK continues to influence Europe’s drone evolution.

Italy is predicted to register a healthy CAGR in the European drone market during the forecast period. Renowned for its agricultural heritage, Italy has embraced drones as a tool for precision farming, with the sector growing by 25% annually since 2020, according to Coldiretti. Milan and Bologna are key markets, where companies like DJI and local startups collaborate to develop advanced imaging and mapping solutions. Agricultural drones now cover over 2 million hectares of farmland, optimizing water usage and crop yields. Beyond agriculture, drones are transforming tourism, particularly in regions like Tuscany and Sicily, where aerial photography enhances marketing efforts. The Italian Ministry of Infrastructure has also adopted drones for urban planning and disaster management, with investments exceeding €200 million in 2023. Italy’s regulatory environment, overseen by ENAC, supports innovation while ensuring compliance with EU standards. By leveraging its diverse economy, Italy continues to carve out a unique niche in Europe’s drone market.

Spain is estimated to account for a considerable share of the European drone market during the forecast period. Madrid and Barcelona are pivotal in driving growth, particularly in sectors like renewable energy and logistics. According to the Spanish Association of Unmanned Systems, the drone market grew by 18% in 2023, valued at €700 million. Spain’s commitment to renewable energy has led to widespread adoption of drones for solar panel inspections and wind turbine maintenance, which account for 30% of total applications. The rise of e-commerce has also spurred demand for last-mile delivery solutions, with companies like Correos testing drone-based systems in rural areas. Furthermore, Spain’s thriving tourism industry benefits from drones used in promotional campaigns and event management, particularly in coastal regions like Costa del Sol. The Spanish Aviation Safety Agency (AESA) has implemented progressive regulations, enabling startups to innovate without excessive red tape. By aligning with national priorities like sustainability and digitalization, Spain continues to emerge as a dynamic player in Europe’s drone market.

KEY MARKET PLAYERS

BAE Systems Inc, Pix4D SA, Aerialtronics, Parrot SAS, Flyability, AltiGator, Delair, and SenseFly SA are leading players in the Europe drone market.

TOP PLAYERS IN THE MARKET

The Europe drone market is dominated DJI, Parrot, and AeroVironment, each contributing significantly to the global market. DJI, headquartered in China, holds a substantial presence in Europe, offering a wide range of drones for commercial and recreational use. Parrot, a French company, is renowned for its innovative agricultural drones, which integrate seamlessly with precision farming tools. As per AgriTech Tomorrow, Parrot’s drones are used in over 50% of European farms utilizing UAV technology. Meanwhile, AeroVironment, based in the United States, specializes in military-grade drones, with a growing footprint in Europe’s defense sector. According to Defense News, AeroVironment’s drones are deployed by NATO forces for reconnaissance missions, highlighting its global influence. These players collectively drive innovation and set benchmarks for the Europe drone market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe drone market employ diverse strategies to strengthen their positions. One prominent strategy is strategic partnerships. For instance, in March 2023, DJI partnered with Airbus to develop AI-driven drones for urban air mobility, aiming to capitalize on the growing demand for sustainable transport solutions.

Another strategy is product diversification. In June 2023, Parrot launched the ANAFI Ai, a 4G-connected drone designed for enterprise applications. This move aligns with the company’s goal of expanding its footprint in the commercial drone sector. Additionally, as per the European Investment Bank, AeroVironment has invested heavily in R&D, focusing on hydrogen-powered drones to address battery life limitations. These strategies reflect a commitment to innovation and market leadership.

COMPETITIVE LANDSCAPE

The Europe drone market is characterized by intense competition, with established players and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like DJI and Parrot dominate the consumer and agricultural segments, while AeroVironment leads in defense applications.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, Volocopter and Lilium are pioneering urban air mobility solutions, challenging incumbents in the logistics and transportation sectors. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and cybersecurity remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, DJI launched the Matrice 350 RTK, a high-performance drone designed for industrial applications. This initiative aimed to enhance DJI’s presence in the European commercial drone market.

- In May 2023, Parrot acquired a French AI startup specializing in computer vision. This acquisition aimed to integrate advanced analytics into Parrot’s agricultural drones, improving crop monitoring capabilities.

- In July 2023, AeroVironment signed a contract with the UK Ministry of Defence to supply Switchblade drones. This agreement aimed to strengthen AeroVironment’s foothold in Europe’s defense sector.

- In September 2023, Volocopter partnered with Frankfurt Airport to establish a drone-based air taxi service. This collaboration aimed to position Volocopter as a leader in urban air mobility.

- In November 2023, Lilium secured USD 350 million in funding from the European Investment Bank. This investment aimed to accelerate the development of Lilium’s eVTOL drones for regional air travel.

MARKET SEGMENTATION

This research report on the Europe drone market is segmented and sub-segmented into the following categories.

By Category

- Consumer

- Commercial Drones

- Military Drones

- Others

By Type

- Fixed Wing Drones

- Rotary Wing Drones

- Hybrid Drones

By Payload

- Up to 25 Kg

- 25 Kg to 50 Kg

- 51 Kg to 100 Kg

- 101 Kg to 150 Kg

- Above 150 Kg

By Power Source

- Electric Drones

- Gas/Gasoline/Diesel Drones

- Hybrid Drones

By End Use

- Agriculture & Forestry

- Delivery & Logistics

- Media & Entertainment

- Construction & Mining

- Oil & Gas

- Power & Utilities

- Government & Civil Services

- Industrial & Discreet Manufacturing

- Recreational Activities

By Sales Channel

- OEMs

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe drone market?

The growth of the Europe drone market is driven by increasing demand for drones in commercial sectors like agriculture, delivery services, and infrastructure inspection, as well as their expanding use in defense and surveillance.

Which industries are adopting drones the most in Europe?

Industries such as agriculture, construction, logistics, energy, and public safety are the primary adopters of drones in Europe due to their efficiency in mapping, monitoring, and delivery tasks.

Are drones being used for public safety in Europe?

Yes, drones are widely used for public safety in Europe, including search and rescue missions, disaster management, and traffic monitoring, as they provide quick access to real-time data.

What technological advancements are shaping the drone market in Europe?

Technological advancements such as AI-powered drones, enhanced battery life, advanced sensors, and autonomous navigation systems are shaping the future of the European drone market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]