Europe Dough Conditioners Market Size, Share, Trends & Growth Forecast Report By Ingredients (Enzymes, Emulsifiers), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Dough Conditioners Market Size

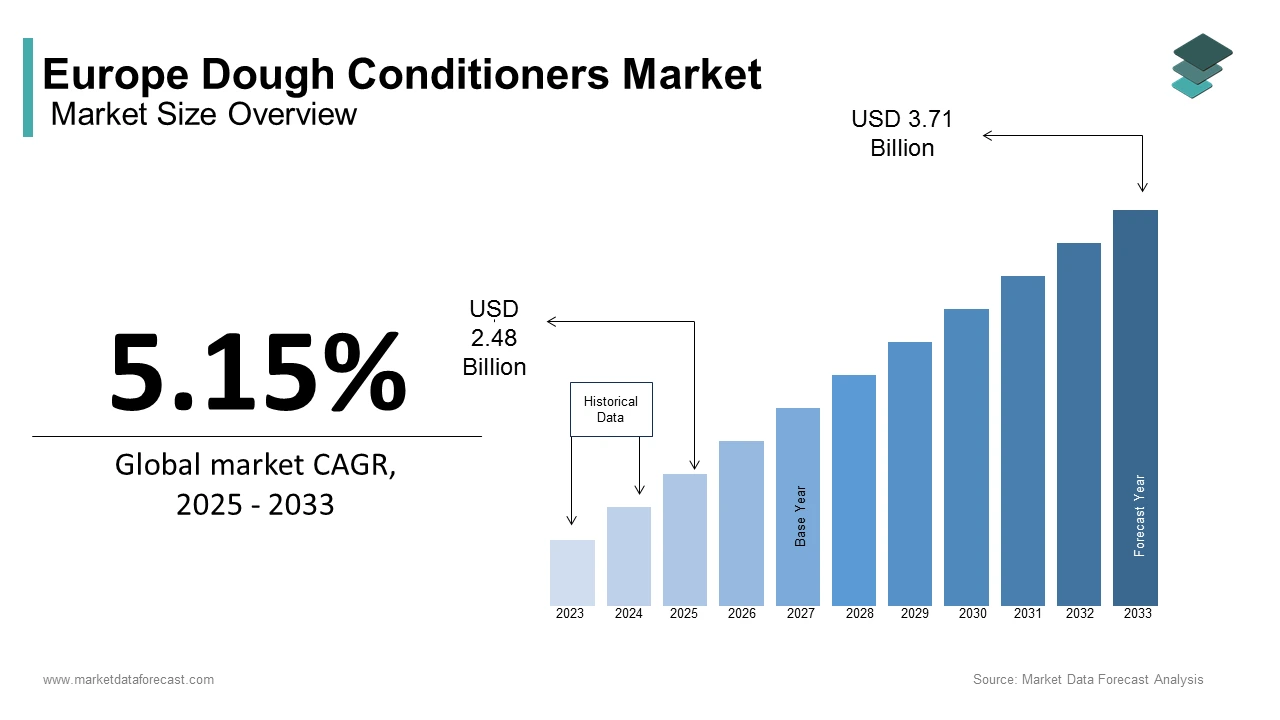

The Europe dough conditioners market size was calculated to be USD 2.36 billion in 2024 and is anticipated to be worth USD 3.71 billion by 2033 from USD 2.48 billion in 2025, growing at a CAGR of 5.15% during the forecast period.

Dough conditioners are additives or blends of ingredients designed to enhance the texture, shelf life, and overall quality of baked goods by improving dough elasticity, fermentation stability, and crumb structure. According to the European Food Safety Authority (EFSA), the demand for dough conditioners has grown steadily due to the increasing industrialization of baking processes and consumer preferences for high-quality, consistent baked products. Over the forecast period, the rise of convenience foods, urbanization and busy lifestyles are expected to fuel the adoption of dough conditioners in bread, pizza crusts, tortillas, and cakes. Despite regulatory scrutiny over certain chemical additives, natural and clean-label alternatives are gaining traction, reflecting evolving consumer demands.

MARKET DRIVERS

Increasing Industrialization of the Bakery Sector

The rapid industrialization of the bakery sector serves as a key driver propelling the Europe dough conditioners market. According to Eurostat, the bakery industry accounts for over 30% of the European food processing sector, with industrial bakeries producing approximately 60% of all baked goods consumed across the region. This shift towards large-scale production necessitates the use of dough conditioners to ensure consistency, reduce waste, and optimize manufacturing processes. The Confederation of European Bakeries reports that the adoption of dough conditioners has increased by 15% annually in industrial settings, driven by their ability to improve dough machinability and extend shelf life. Furthermore, the growing demand for packaged and convenience foods, particularly among urban populations, has amplified the need for standardized baking solutions. Germany and France, two of the largest bakery markets in Europe, have witnessed significant investments in automated baking technologies, further boosting demand for dough conditioners. The International Food Information Council estimates that industrial bakeries utilizing dough conditioners achieve up to 20% higher production efficiency, underscoring their critical role in enhancing operational performance and meeting consumer expectations for high-quality baked goods.

Rising Demand for Clean-Label and Natural Ingredients

The escalating demand for clean-label and natural ingredients has emerged as another significant driver shaping the Europe dough conditioners market. According to the European Food Safety Authority (EFSA), over 70% of European consumers prioritize transparency in food labeling, seeking products free from artificial additives and preservatives. This trend has prompted manufacturers to reformulate their products using natural dough conditioners, such as enzymes derived from microbial sources and plant-based emulsifiers. The European Commission highlights that the clean-label food segment is projected to grow at a CAGR of 9.2%, creating a fertile ground for natural dough conditioners to thrive. Ingredients like ascorbic acid and lipase are increasingly favored for their ability to enhance dough properties without compromising health standards. Additionally, the rise of health-conscious millennials and Gen Z consumers has further amplified demand for baked goods featuring natural conditioners. The European Association for the Promotion of Health notes that nearly 60% of new product launches in the bakery sector now emphasize natural ingredients, underscoring the immense potential for market players to capitalize on this trend and expand their portfolios.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

One of the primary restraints impeding the growth of the Europe dough conditioners market is the stringent regulatory frameworks governing the use of food additives. According to the European Food Safety Authority (EFSA), several chemical-based dough conditioners, including potassium bromate and azodicarbonamide, have been banned or restricted due to potential health risks, limiting the range of available options for manufacturers. According to the European Parliament, inconsistencies in regulatory standards across member states further complicate compliance, which is creating barriers for smaller companies and startups. Additionally, the absence of harmonized guidelines for labeling and advertising dough conditioners leads to confusion among consumers and stakeholders. The European Consumer Organisation reports that nearly 40% of new product formulations face delays due to regulatory hurdles, stifling market growth and innovation. Addressing these challenges requires collaborative efforts between regulatory bodies, industry players, and research institutions to streamline approval processes and foster a conducive environment for market expansion.

High Costs of Advanced Enzymes

Another significant restraint facing the Europe dough conditioners market is the high cost associated with advanced enzyme-based formulations. According to the Organisation for Economic Co-operation and Development (OECD), the production of specialized enzymes, such as fungal amylases and xylanases, involves complex biotechnological processes and significant capital investment, leading to elevated prices. These costs are subsequently passed on to manufacturers, making enzyme-based conditioners less accessible, particularly for small-scale bakeries and artisanal producers. The European Commission reports that the average price of enzyme-based dough conditioners is approximately 25% higher than traditional chemical alternatives, limiting their adoption in cost-sensitive segments. Additionally, fluctuations in raw material availability, such as agricultural substrates used in enzyme production, further exacerbate pricing volatility. This economic barrier not only restricts market penetration but also challenges manufacturers in achieving economies of scale, thereby hindering widespread adoption.

MARKET OPPORTUNITIES

Expansion into Artisanal and Premium Baked Goods

The growing popularity of artisanal and premium baked goods presents a substantial opportunity for the Europe dough conditioners market. According to the European Confederation of Direct Selling, the artisanal bakery segment is projected to grow at a CAGR of 7.5%, driven by consumer demand for high-quality, handcrafted products with unique textures and flavors. This trend has spurred the adoption of specialized dough conditioners, such as enzymes and emulsifiers, which enable bakers to achieve superior dough performance and consistency while maintaining the authenticity of their recipes. The Italian Ministry of Agriculture highlights that countries like Italy and France, renowned for their artisanal baking traditions, have witnessed a 20% increase in the use of natural dough conditioners over the past five years. Additionally, the integration of clean-label conditioners into premium baked goods aligns with consumer preferences for transparency and sustainability. The European Food Information Council notes that nearly 60% of consumers are willing to pay a premium for baked goods featuring natural ingredients, underscoring the immense potential for market players to innovate and cater to this lucrative segment.

Rising Adoption in Gluten-Free and Specialty Baking

The increasing adoption of gluten-free and specialty baking offers another lucrative opportunity for the Europe dough conditioners market. According to the European Society for Clinical Nutrition and Metabolism, over 1% of the European population suffers from celiac disease, while an additional 6% exhibit gluten sensitivity, driving demand for gluten-free baked goods. This dietary shift has created a niche market for dough conditioners specifically formulated to address the challenges of gluten-free dough, such as poor elasticity and crumbly texture. The German Federal Ministry of Food and Agriculture reports that the gluten-free bakery market is projected to grow at a CAGR of 10.2%, with dough conditioners playing a pivotal role in enhancing product quality. Ingredients like xanthan gum and modified starches are increasingly used to mimic the properties of gluten, ensuring optimal dough performance. Furthermore, the rise of vegan and allergen-free diets has further amplified demand for specialized conditioners, positioning this segment as a key driver of future market growth.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

A significant challenge confronting the Europe dough conditioners market is the vulnerability of supply chains and the scarcity of raw materials essential for production. According to the European Commission, disruptions caused by geopolitical tensions, climate change, and logistical bottlenecks have led to shortages of key inputs, such as microbial strains used in enzyme production and agricultural derivatives for emulsifiers. The European Environment Agency reports that extreme weather events, including droughts and floods, have adversely impacted agricultural yields, reducing the availability of raw materials by up to 25% in certain regions. These supply chain constraints have resulted in increased production costs and prolonged lead times, adversely affecting market dynamics. Furthermore, the reliance on imports for certain raw materials exposes manufacturers to currency fluctuations and trade uncertainties. The Organisation for Economic Co-operation and Development (OECD) notes that over 30% of companies in the dough conditioners industry reported supply chain-related challenges in 2022, underscoring the urgent need for diversification and localization strategies to mitigate risks and ensure business continuity.

Consumer Skepticism and Misinformation

Another pressing challenge facing the Europe dough conditioners market is consumer skepticism and misinformation surrounding their safety and necessity. According to Eurostat, nearly 45% of European consumers remain uncertain about the differences between natural and synthetic dough conditioners, often perceiving all additives as unhealthy. The European Consumer Organisation highlights that misinformation campaigns and conflicting scientific studies have created confusion, deterring potential users from adopting these products. For instance, some consumers associate chemical-based conditioners with adverse health effects, despite evidence suggesting that approved additives pose no significant risks when used within recommended limits. Furthermore, the lack of standardized labeling practices across the region complicates efforts to educate consumers about the nutritional advantages of these products. The European Food Information Council notes that only 30% of surveyed individuals actively seek out baked goods featuring dough conditioners, underscoring the need for targeted marketing and educational initiatives to dispel myths and enhance consumer confidence.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.15% |

|

Segments Covered |

By Ingredients, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Archer Daniels Midland Company (ADM), DuPont Nutrition & Biosciences, Lesaffre, Puratos Group, Lallemand Inc., Corbion, Caldic B.V., AB Mauri, Kerry Group, and IREKS GmbH. |

SEGMENTAL ANALYSIS

By Ingredient Type Insights

The enzymes segment accounted for 40.3% of the European dough conditioners market in 2024. The domination of enzymes segment in the European market is driven by their ability to enhance dough elasticity, fermentation stability, and crumb structure without altering the taste or nutritional profile of baked goods. According to the Confederation of European Bakeries, the demand for enzyme-based conditioners has surged by over 25% annually, driven by their compatibility with clean-label trends and increasing adoption in industrial baking processes. Enzymes such as amylase, protease, and xylanase are widely used to address specific challenges, including dough softness and shelf-life extension. The German Federal Ministry of Food and Agriculture reports that enzyme-based conditioners account for nearly 50% of all new product launches featuring dough conditioners, underscoring their pivotal role in shaping market trends. Additionally, advancements in biotechnology have improved the efficiency and affordability of enzyme production, further solidifying their dominance in the market.

The emulsifiers segment is predicted to expand at a CAGR of 6.8% over the forecast period. Factors such as versatility and ability of emulsifiers to improve dough machinability, texture and shelf life is propelling the growth of the emulsifiers segment in the European market. According to the European Commission, emulsifiers such as lecithin and mono- and diglycerides are increasingly favored in both industrial and artisanal baking applications due to their natural origins and minimal processing requirements. The rise of health-conscious consumers and the growing demand for clean-label products have further propelled their adoption, particularly in premium baked goods. The Italian Ministry of Agriculture highlights that emulsifiers are projected to account for 30% of the dough conditioners market by 2028, driven by innovations in plant-based formulations. Their compatibility with gluten-free and vegan baking trends positions them as a key driver of the segmental growth.

By Application Insights

The bread segment occupied for the largest share of 51.2% of the European market in 2024. The domination of bread segment is attributed to the ubiquitous consumption of bread across the region, with countries like Germany, France, and Italy being major contributors. According to Eurostat, bread accounts for over 60% of all baked goods produced in Europe, necessitating the use of dough conditioners to ensure consistent quality and extended shelf life. The French National Institute for Agricultural Research reports that the demand for dough conditioners in bread production has grown by 20% annually, supported by innovations in enzyme technology and the rising popularity of whole-grain and multigrain varieties. Additionally, the integration of clean-label conditioners into bread formulations aligns with consumer preferences for healthier and more transparent products, further reinforcing its leadership position in the market.

The pizza crust segment is predicted to progress at a CAGR of 7.2% over the forecast period due to the increasing popularity of frozen and ready-to-bake pizzas, particularly among urban consumers seeking convenient meal solutions. According to the European Food Information Council, dough conditioners play a critical role in enhancing the texture, elasticity, and freeze-thaw stability of pizza crusts, ensuring optimal performance during storage and preparation. The rise of gourmet and artisanal pizzas has further propelled the adoption of specialized conditioners, such as enzymes and emulsifiers, which enable manufacturers to achieve superior dough properties while maintaining authenticity. The German Federal Ministry of Food and Agriculture highlights that the demand for pizza crust conditioners has surged by 25% over the past five years, driven by the growing prevalence of home delivery services and the expansion of international pizza chains. Their versatility and compatibility with clean-label trends position this segment as a critical driver of future market expansion.

KEY MARKET PLAYERS

Major Players of the Europe Dough Conditioners Market include Archer Daniels Midland Company (ADM), DuPont Nutrition & Biosciences, Lesaffre, Puratos Group, Lallemand Inc., Corbion, Caldic B.V., AB Mauri, Kerry Group, and IREKS GmbH.

REGIONAL ANALYSIS

Germany dominated the dough conditioners market in Europe by occupying a share of 25.4% in the European market in 2024. The dominance of Germany in the European market is driven by the country's robust bakery sector, which accounts for over 30% of European bread production. According to Eurostat, Germany produces approximately 8 million tons of bread annually, necessitating the widespread use of dough conditioners to ensure consistency and quality. The Confederation of European Bakeries highlights that the adoption of enzyme-based conditioners has increased by 20% annually, supported by advancements in biotechnology and the growing demand for clean-label products. Additionally, Germany's strong emphasis on industrial automation and precision baking has further amplified demand, positioning it as a leader in the regional market.

France is anticipated to account for a substantial share of the European market over the forecast period. The rich culinary heritage and thriving artisanal bakery sector of France have driven the adoption of specialized conditioners to enhance dough performance and texture. According to the French Ministry of Agriculture, the demand for emulsifiers and enzymes has grown by 18% annually, supported by their use in baguettes, croissants, and other traditional baked goods. France's focus on premium and organic products aligns with clean-label trends, further propelling market growth. Additionally, the country's robust export-oriented bakery industry has increased the adoption of dough conditioners, enhancing their importance in the regional market.

Italy is likely to showcase a prominent CAGR in the Europe dough conditioners market over the forecast period. The artisanal baking traditions in Italy and growing health consciousness have driven the integration of natural dough conditioners into premium products, including pasta, bread, and pastries. According to the Italian Confederation of Bakeries, the demand for clean-label conditioners has surged by 22% annually, supported by their use in ciabatta, focaccia, and other regional specialties. Italy's strong export-oriented food industry further amplifies demand, as manufacturers seek to meet international quality standards. Additionally, the rise of plant-based diets and the popularity of Mediterranean cuisine have positioned dough conditioners as a key ingredient in innovative product development.

Spain is predicted to play a key role in the Europe dough conditioners market over the forecast period. The warm climate and agricultural expertise of Spain have facilitated the cultivation of raw materials like wheat and barley, reducing dependency on imports. According to the Spanish Confederation of Bakeries, the demand for dough conditioners has increased by 15% annually, driven by rising awareness about gluten-free and specialty baking. Spain's vibrant tourism industry has also contributed to market growth, as hotels and restaurants adopt high-quality baked goods featuring advanced conditioners. Additionally, the country's growing focus on sustainability and eco-friendly practices aligns with clean-label trends, ensuring sustained demand for dough conditioners.

The UK is projected to hold a considerable share of the European market over the forecast period. The stringent regulations of the UK against artificial additives and the introduction of sugar taxes have significantly boosted the adoption of natural dough conditioners. According to the British Nutrition Foundation, the UK market for dough conditioners is projected to grow at a CAGR of 5.5%, driven by rising consumer awareness about obesity and diabetes. The UK's thriving food and beverage sector, particularly in frozen and ready-to-bake products, further amplifies demand. Additionally, the prevalence of health-conscious millennials has fueled the popularity of plant-based diets, creating a fertile ground for market expansion.

DETAILED SEGMENTATION OF EUROPE DOUGH CONDITIONERS MARKET INCLUDED IN THIS REPORT

This research report on the Europe dough conditioners market has been segmented and sub-segmented based on ingredients, application & region.

By Ingredients

- Enzymes

- Emulsifiers

By Application

- Bread & Buns

- Cakes & Pastries

- Pizza Dough

- Cookies & Biscuits

- Others (Tortillas, Croissants, etc.)

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the dough conditioners market in Europe?

Increasing demand for clean-label and gluten-free products, advancements in enzyme technology, and the rising popularity of artisanal and industrial baking are key growth drivers.

2. What are the major challenges facing the dough conditioners market?

Challenges include regulatory restrictions on certain chemical conditioners, high costs of natural alternatives, and fluctuating raw material prices.

3. How is the demand for clean-label dough conditioners influencing the market?

Consumers are shifting towards natural and plant-based ingredients, leading manufacturers to innovate with enzyme-based and non-GMO emulsifiers.

4. Who regulates the use of dough conditioners in Europe?

Regulatory bodies such as the European Food Safety Authority (EFSA) and individual national food safety agencies oversee the approval and use of dough conditioners in food products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]