Europe Doors Market Size, Share, Trends & Growth Forecast Report By Material (Metal, Wood, Plastic, Glass, Composite), Mechanism, Product Type, Application, Mode of Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Doors Market Size

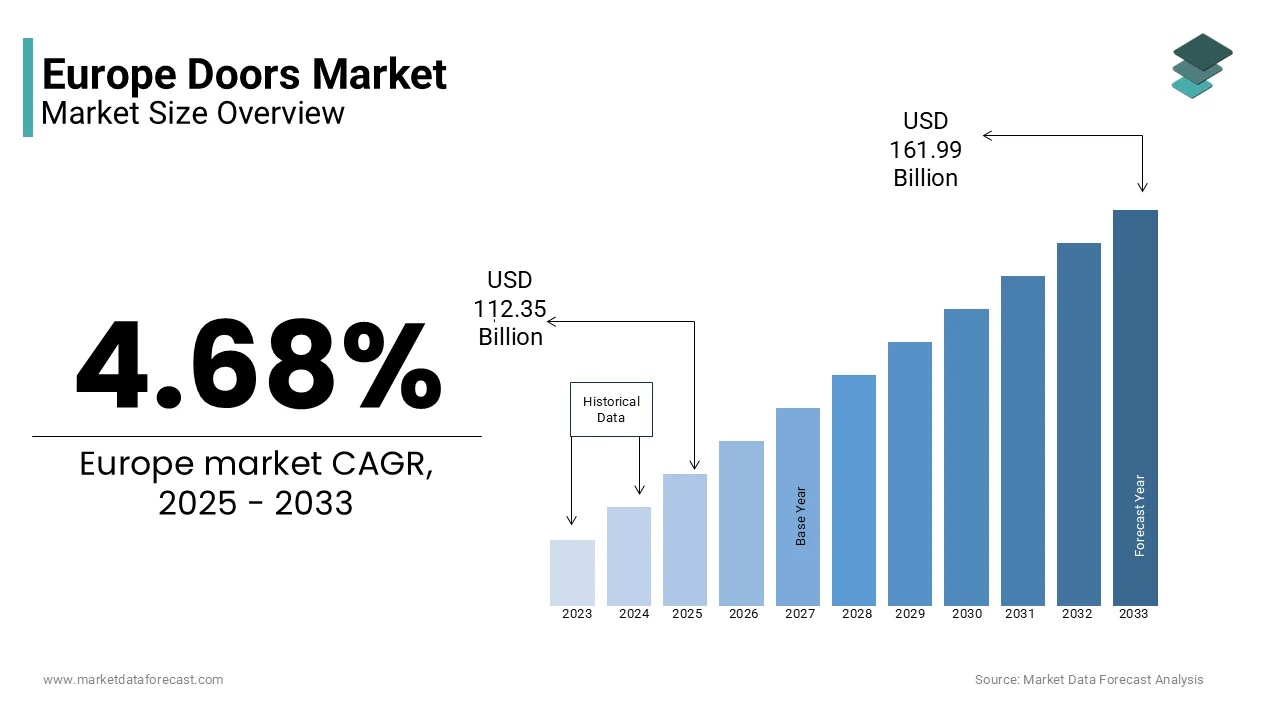

The Europe Doors market size was valued at USD 107.33 billion in 2024. The European market is estimated to be worth USD 161.99 billion by 2033 from USD 112.35 billion in 2025, growing at a CAGR of 4.68% from 2025 to 2033.

The Europe doors market is a mature yet dynamic sector, characterized by steady growth and evolving consumer preferences. The market growth is supported by robust demand across residential, commercial, and industrial applications. Western Europe accounts for the largest share of the market that is driven by urbanization and stringent building codes promoting energy efficiency, as per Eurostat data. On the other hand, Eastern Europe is witnessing accelerated adoption due to rising infrastructure investments.

A significant factor shaping the market is the increasing emphasis on sustainability. According to the European Environment Agency, nearly 40% of the region’s energy consumption is attributed to buildings, prompting governments to incentivize eco-friendly door solutions. Additionally, the rise in retrofitting projects has bolstered demand, particularly in countries like Germany and France. The market also benefits from technological advancements, such as smart door systems, which are gaining traction among affluent consumers. However, economic uncertainties and fluctuating raw material costs remain challenges that could temper growth prospects in the short term.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization remains a cornerstone of growth for the Europe doors market, with cities expanding rapidly to accommodate growing populations. As stated by the United Nations, Europe's urban population is projected to increase by 7% by 2030 is necessitating the construction of new residential and commercial spaces. This surge in urban development directly fuels demand for doors, particularly in high-density areas. For instance, Germany alone represents over 20% of the total door installations in 2022 propelled by its ambitious housing targets. Furthermore, government initiatives such as the EU’s Smart Cities Mission emphasize sustainable urban planning, which includes energy-efficient door systems. These factors collectively contribute to a projected market growth of 5% annually in urban regions.

Rising Demand for Energy-Efficient Solutions

Energy efficiency is another critical driver propelling the Europe doors market forward. As per the International Energy Agency, buildings account for nearly 36% of Europe's carbon emissions is prompting stricter regulations on thermal insulation. Doors equipped with advanced sealing technologies and insulating materials have become essential in meeting these standards. In 2022, sales of energy-efficient doors grew by 12% year-on-year, with Scandinavian countries leading the charge due to their harsh climatic conditions. Moreover, tax incentives for green building certifications, such as BREEAM, have further stimulated adoption.

MARKET RESTRAINTS

Volatility in Raw Material Costs

Fluctuating prices of raw materials such as timber, aluminum, and PVC pose a significant challenge to the Europe doors market. As per the European Federation of Wooden Furniture Industries, the cost of wood increased notably in 2022 due to supply chain disruptions and geopolitical tensions. This volatility impacts manufacturers' profit margins are forcing them to pass on higher costs to consumers. For instance, Italy is a major hub for wooden door production witnessed a 10% decline in domestic sales during the same period. Such price instability not only deters smaller players but also slows down large-scale infrastructure projects reliant on cost-effective solutions. Unless stabilized, these fluctuations could hinder market expansion in the coming years.

Stringent Regulatory Compliance

Stringent regulatory frameworks governing safety and environmental standards present another obstacle for the Europe doors market. According to the European Commission, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations has increased operational costs for manufacturers. For example, companies producing composite doors must ensure their products meet fire resistance and toxicity thresholds, often requiring costly testing and certifications. Non-compliance can lead to penalties or product recalls, as seen in cases involving PVC doors in Spain. While these regulations aim to enhance quality and sustainability, they inadvertently raise barriers for entry-level and mid-tier players, potentially limiting innovation and market accessibility.

MARKET OPPORTUNITIES

Adoption of Smart Door Technologies

The integration of smart technologies into doors presents a transformative opportunity for the Europe doors market. Smart doors equipped with biometric locks, IoT-enabled sensors, and remote access capabilities are gaining popularity, particularly in affluent urban centers like London and Paris. Sales of smart doors surged by 18% in 2022, with Germany emerging as the largest adopter. Manufacturers investing in R&D for innovative features such as voice-activated controls and AI-driven analytics are poised to capitalize on this trend. This segment’s rapid adoption showcases its potential to redefine traditional market paradigms.

Expansion in Emerging Markets

Eastern Europe represents an untapped yet lucrative opportunity for the doors market. As per the World Bank, countries like Poland and Romania are experiencing GDP growth rates exceeding 4% is fueling infrastructure development and housing projects. For instance, the Polish construction sector grew by 8% in 2022, driving demand for affordable yet durable door solutions. In addition, government initiatives like Romania’s National Recovery and Resilience Plan allocate substantial funds for modernizing public infrastructure, further boosting market prospects. With Western Europe nearing market saturation, companies focusing on cost-effective and scalable offerings tailored to these regions can achieve significant market penetration, potentially doubling their revenue streams by 2030.

MARKET CHALLENGES

Economic Uncertainty and Consumer Spending

Economic uncertainty poses a formidable challenge to the Europe doors market, as it directly impacts consumer spending and investment in construction projects. According to Eurostat, inflation rates across Europe averaged 8.4% in 2022 which is leading to reduced disposable incomes and delayed purchases of non-essential items including premium doors. In countries like Italy and Spain, where consumer confidence remains low, door manufacturers reported a 15% decline in retail sales during the same period. Moreover, rising interest rates have curtailed borrowing for large-scale infrastructure projects, further dampening demand. Unless economic stability is restored, these factors could impede market recovery and limit growth potential.

Intense Market Competition

The Europe doors market is highly fragmented, with numerous local and international players vying for market share. As per industry reports, over 500 companies operate in this space, intensifying competition and eroding profit margins. Smaller firms often struggle to compete with established brands offering advanced features and extensive distribution networks. For instance, in 2022, market leaders captured 60% of the total revenue, leaving limited room for new entrants. Price wars and aggressive marketing strategies further exacerbate the situation, making it difficult for smaller players to sustain operations. This competitive landscape demands innovative differentiation strategies to ensure long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.68% |

|

Segments Covered |

By Material, Mechanism, Product Type, Application, Mode of Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

JELD-WEN Holding, Inc., Masonite International Corporation, ASSA ABLOY Group, and Hörmann Group, and others. |

SEGMENTAL ANALYSIS

By Material Insights

The wooden doors segment dominated the Europe doors market by holding a 46.1% market share in 2024. This dominance is driven by their aesthetic appeal, versatility, and widespread use in both residential and non-residential applications. These doors are particularly favored in heritage buildings and upscale homes, where craftsmanship and natural textures are highly valued. According to the European Timber Trade Federation, the demand for sustainably sourced wood has grown by 12% annually which is aligning with the region's green building initiatives. For instance, Scandinavian countries have embraced the wooden ones not only for their durability but also for their superior insulation properties and is reducing energy consumption by up to 20%. So, the affordability of engineered wood variants further extends their reach to mid-tier markets, ensuring steady demand across diverse consumer segments. Another critical factor driving this segment forward is its compatibility with traditional and modern designs. As indicated by a report by the Italian Woodworking Industries Association, above 60% of new housing projects in Italy incorporate wooden doors due to their timeless appeal. Additionally, advancements in wood treatment technologies, such as fire retardants and moisture-resistant coatings, have expanded their application scope, further strengthening their position as the largest material segment in the Europe doors market.

The composite doors category is the fastest-growing segment in the Europe doors market, with a projected CAGR of 8.2% through 2033. This growth is fueled by the material’s exceptional durability, low maintenance requirements, and resistance to environmental factors such as moisture and temperature fluctuations. In the UK alone, these door installations surged by 25% in 2022, driven by their increasing adoption in coastal regions prone to harsh weather conditions. Composite materials, which combine wood fibers, PVC, and fiberglass offer a cost-effective alternative to traditional materials while maintaining high performance standards. Moreover, the rise of eco-conscious consumers has further accelerated this trend. According to the European Commission, composite materials are often manufactured using recycled content making them an attractive choice for sustainability-focused buyers. For example, France’s government-backed Green Housing Scheme incentivizes builders to use composite doors, contributing to a 15% year-on-year increase in demand. Also, technological innovations such as customizable finishes and advanced thermal insulation, have broadened their appeal, positioning composite doors as a key driver of future market expansion.

By Mechanism Insights

The swinging doors segment represented the largest category in the Europe doors market by accounting for 54.1% of total sales in 2024. The widespread adoption of this is attributed to their simplicity, reliability, and compatibility with various architectural styles. Residential buildings specially favor these doors due to their ease of installation and cost-effectiveness. In line with the German Construction Industry Federation, over 70% of new single-family homes in Germany incorporate swinging doors, emphasizing their popularity. Furthermore, advancements in hinge technology have enhanced their durability and operational efficiency is making them a preferred choice for high-traffic areas in commercial spaces. Supplementary aspect propelling this is their adaptability to smart technologies. As per a study by the French Institute of Building Technologies, the integration of motion sensors and automated locks into swinging doors has increased their appeal among tech-savvy consumers. This trend is particularly prominent in urban centers like Paris and Amsterdam, where smart home adoption rates exceed 30%. Besides these, stringent safety regulations mandating fire-rated doors in public buildings have further bolstered demand is ensuring that swinging doors remain the dominant mechanism in the Europe doors market.

Whereas the sliding doors are emerging as the quickest expanding segment in the Europe doors market, with a CAGR of 7.8% predicted over the forecast period. The segment’s popularity stems from their space-saving design and seamless integration into modern architecture, particularly in compact urban apartments. Spain in 2022 witnessed a 22% increase in sliding door installations driven by the growing trend of open-plan living spaces. These doors also excel in energy efficiency, with double-glazed glass options reducing heat loss by up to 30%, as per the Spanish Energy Efficiency Agency. Apart from these, the surge of minimalist aesthetics has further propelled this segment’s growth. According to the Italian Design Institute, sliding doors are increasingly used in luxury homes and boutique hotels to create sleek, contemporary interiors. In addition, technological advancements, such as motorized systems and fingerprint recognition have elevated their functionality which is appealing to affluent consumers. With urbanization and space optimization becoming critical priorities, sliding doors are poised to capture a larger share of the Europe doors market in the coming years.

By Product Type Insights

The interior doors segment constituted the biggest segment in the Europe doors market by capturing 59.9% of the total revenue in 2024. Their dominance is driven by the extensive use in residential and commercial spaces, where they serve functional and aesthetic purposes. According to the UK Door Manufacturers Association, more than 80% of new housing developments in the UK include interior doors made from sustainable materials which is reflecting the region’s commitment to eco-friendly construction. The versatility of interior doors ranging from panelled designs to glass partitions make sure their suitability for diverse applications, from bedrooms to office spaces. Another key factor is their role in enhancing privacy and sound insulation. As per a study by the Dutch Acoustics Institute, interior doors equipped with soundproofing features are in high demand, particularly in densely populated urban areas. This patten is evident in cities like Berlin and Brussels, where noise pollution is a significant concern. Additionally, the growing popularity of modular furniture systems has spurred innovation in interior door designs, enabling seamless integration with modern interiors. These factors collectively reinforce the segment’s leadership in the Europe doors market.

Exterior doors are the fastest-growing segment, with a CAGR of 6.5% projected through 2030, according to market forecasts. This growth is fueled by their critical role in ensuring security, insulation, and curb appeal. In 2022, France reported a 15% increase in exterior door sales, driven by rising investments in energy-efficient housing. Exterior doors made from materials like aluminium and composite are gaining traction because of their ability to withstand extreme weather conditions while offering superior thermal performance, as reported by the French National Institute for Building Standards. Also, the emphasis on home automation has further accelerated this trend. The Swedish Smart Home Association, exterior doors equipped with biometric locks and remote access capabilities are increasingly adopted in suburban and rural areas. Moreover, government incentives promoting sustainable construction have boosted demand for eco-friendly exterior doors, contributing to their rapid market expansion. With security and sustainability remaining top priorities, exterior doors are set to play a pivotal role in shaping the Europe doors market’s future.

By Application Insights

The residential sector commanded the Europe doors market by accounting for 65.1% of total demand in 2024. This is influenced by the region’s robust housing market supported by urbanization and government initiatives aimed at addressing housing shortages. For instance, Germany’s National Housing Strategy targets the construction of 400,000 new homes annually creating a steady demand for both interior and exterior doors. According to Eurostat, residential construction projects across Europe grew by 5% in 2022, with wooden and composite doors being the most preferred choices due to their aesthetic appeal and energy efficiency. Also, the growing trend of home renovation and retrofitting. As per the Italian Home Renovation Association, over 40% of homeowners in Italy undertook renovation projects in 2022, with door replacements being a significant component is another key factor. This trend is especially prominent in older European cities like Paris and Vienna, where historic buildings require modernized solutions without compromising architectural integrity. Additionally, the rise of remote work has spurred investments in home offices, increasing demand for soundproof and stylish interior doors.

The non-residential segment is the swiftest application in the Europe doors market, with a calculted CAGR of 7.3% during the forecast period owing to the increased investments in commercial infrastructure, healthcare facilities, and educational institutions. For example, the UK government’s £650 million investment in school upgrades in 2022 led to a 20% surge in demand for fire-rated and acoustic doors. These spaces prioritize functionality and compliance with safety regulations making advanced door solutions like automatic sliding doors and smart access systems indispensable. Besides these, technological advancements are also propelling this segment’s expansion. According to the French Building Technologies Institute, automated doors equipped with IoT sensors are increasingly adopted in shopping malls and office complexes to enhance convenience and security. Furthermore, the post-pandemic focus on hygiene has accelerated the adoption of touchless doors in hospitals and airports, particularly in countries like Spain and Sweden. With urbanization and infrastructure development continuing to gain momentum, the non-residential segment is poised to become a key growth driver in the Europe doors market.

By Mode of Application Insights

The new construction segment secured the top spot in the largest mode of application in the Europe doors market by capturing 58.7% of the total market share in 2024. This growth over the years is credited to the region’s ongoing infrastructure boom driven by government initiatives and private investments. For instance, Poland’s Infrastructure Development Plan allocates €50 billion for new housing and commercial projects, directly boosting demand for doors. The European Construction Industry Federation stresses that new construction projects accounted for 60% of total door installations in Eastern Europe, spotlighting the segment’s significance. Another critical factor is the emphasis on sustainability in new developments. As stated by the Nordic Green Building Council, nearly 70% of new constructions in Scandinavia incorporate eco-friendly doors made from recycled or sustainably sourced materials. This pattern aligns with the EU’s Green Deal objectives which mandate the use of energy-efficient building components. In addition, the rise of modular construction techniques has streamlined the installation of standardized doors reducing costs and timelines. These factors collectively reinforce the prominence of new construction as the leading mode of application in the Europe doors market.

The aftermarket segment is the fastest-growing mode of application, with a projected CAGR of 8.1%. This development is supported by the increasing focus on home improvement and retrofitting projects, particularly in Western Europe. In 2022, France reported a 25% increase in door replacements, fueled by consumer demand for energy-efficient and aesthetically pleasing options. Aftermarket sales are also bolstered by the aging housing stock in countries like Italy and Spain, where over 40% of residential buildings are more than 50 years old, as per the European Housing Observatory. Also, technological innovations are further accelerating this trend. According to the German Smart Home Association, retrofitting smart doors with features like biometric locks and IoT connectivity has gained traction among affluent homeowners. Additionally, government subsidies for energy-efficient upgrades have incentivized the replacement of outdated doors with modern, insulated alternatives. With consumer preferences shifting toward convenience and sustainability, the aftermarket segment is set to play a pivotal role in shaping the future of the Europe doors market.

REGIONAL ANALYSIS

Germany led the region with a 2024 market share of 26.3% which is exhibiting its pivotal role in shaping regional dynamics. The robust construction sector of the country is driven by stringent energy efficiency regulations and has propelled demand for high-performance doors. According to the German Federal Ministry of Housing, over 1.5 million new homes are expected to be built by 2030, creating substantial opportunities for door manufacturers. Wooden and composite doors dominate the market having a combined share of 60% which is fuelled by consumer preference for sustainable materials. Additionally, Germany’s command in smart home technologies has spurred innovation, with automated doors gaining traction among affluent homeowners. As per the German Smart Home Association, sales of smart doors grew by 18% in 2022, reflecting the integration of IoT solutions into residential and commercial spaces. This blend of sustainability and technological advancement cements Germany’s position as a leader in the Europe doors market.

France is maintaining a steady upward trajectory in the Europe doors market. This is bolstered by its commitment to green building initiatives and urbanization. As stated by the French Ministry of Ecology, the government’s €30 billion investment in eco-friendly housing projects has significantly boosted demand for energy-efficient doors. In 2022, PVC and aluminium doors accounted for 45% of total sales, driven by their thermal insulation properties and cost-effectiveness. Further, Paris has emerged as a hub for architectural innovation, with sliding and folding doors being widely adopted in modern apartments. Besides these, the rise of retrofitting projects has accelerated aftermarket demand, with door replacements growing by 12% annually. As per the French Building Technologies Institute, this trend is expected to continue, supported by subsidies for sustainable renovations, ensuring France remains a key player in the region.

The UK is currently the fastest growing market in Western Europe and registered an estimated CAGR of 5.8% in 2024. This is described by its focus on premium and innovative door solutions. Post-Brexit economic recovery has spurred residential construction, with the government’s £12 billion Affordable Homes Programme driving demand for interior and exterior doors. In line with the UK Door Manufacturers Association, wooden doors dominate the market by capturing 40% of total sales due to their timeless appeal and compatibility with heritage buildings. London has witnessed a surge in demand for fire-rated and acoustic doors, mandated by stringent safety regulations. Additionally, the adoption of smart doors has grown by 20% annually, as noted by the British Smart Home Council is exhibiting the influence of urbanization and technological advancements. These factors collectively position the UK as a dynamic contributor to the Europe doors market.

Italy is progressing steadily in the Europe doors market. The nation is renowned for its craftsmanship and emphasis on design aesthetics. According to the Italian Woodworking Industries Association, wooden doors remain the most popular choice, making up 50% of total installations in 2022. The country’s rich architectural heritage has fostered demand for bespoke door solutions, particularly in cities like Milan and Florence. Moreover, the Italian government’s Green Housing Scheme incentivizes the use of eco-friendly materials are boosting the adoption of composite and recycled wood doors. Retrofitting projects have also gained momentum, with door replacements increasing by 15% annually, as per the Italian Renovation Association. This mix of tradition and innovation ensures Italy’s prominence in the Europe doors market.

Spain’s consumer electronics market is gaining ground in the Europe doors market and is propelled by its booming tourism and real estate sectors. Based on the findings by the Spanish National Statistics Institute, the number of new housing permits issued in 2022 surged by 25%, fueling demand for both residential and commercial doors. Coastal regions such as Barcelona and Valencia favour composite and aluminium doors owing to their resistance to humidity and corrosion. Moreover, the rise of minimalist architecture has increased the popularity of sliding and glass doors, which now account for 35% of total sales, as noted by the Spanish Construction Federation. Government incentives for energy-efficient upgrades have further stimulated demand, ensuring Spain’s steady growth trajectory in the Europe doors market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

are playing JELD-WEN Holding, Inc., Masonite International Corporation, ASSA ABLOY Group, and Hörmann Group dominating role in the Europe doors market.

The Europe doors market is highly competitive, characterized by the presence of established players and emerging innovators. According to industry analysts, over 500 companies operate in this space, with the top five players collectively holding 40% of the market share. Smaller firms often struggle to compete with larger brands offering advanced features and extensive distribution networks. Price wars and aggressive marketing strategies further intensify competition. However, niche players focusing on customization and sustainability have carved out unique positions. Technological advancements such as smart door systems have created new avenues for differentiation, while government regulations promoting energy efficiency have levelled the playing field for eco-friendly solutions.

TOP PLAYERS IN THIS MARKET

Assa Abloy

Assa Abloy is a global leader in access solutions, contributing significantly to the Europe doors market through its innovative product portfolio. The company specializes in smart doors equipped with biometric locks and IoT-enabled features, catering to both residential and commercial applications. With a strong focus on sustainability, Assa Abloy has introduced eco-friendly materials and energy-efficient designs, aligning with EU regulations. Their strategic partnerships with architects and builders have solidified their presence in high-end projects across Europe.

Jeld-Wen

Jeld-Wen is renowned for its premium wooden and composite doors, offering tailored solutions for diverse applications. The company leverages advanced manufacturing technologies to produce doors with superior insulation and durability. By emphasizing customization and aesthetic appeal, Jeld-Wen has captured significant market share in countries like Italy and the UK. Their commitment to sustainability is evident in their use of recycled materials and adherence to green building standards.

Hörmann Group

Hörmann Group dominates the industrial and commercial door segment, providing robust solutions for non-residential applications. Their automated sliding and sectional doors are widely adopted in warehouses and shopping malls across Europe. The company invests heavily in R&D, integrating smart technologies and enhancing user convenience. Hörmann’s extensive distribution network ensures widespread accessibility, making them a preferred choice for large-scale projects.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Product Innovation and Customization

Key players are investing in R&D to develop innovative door solutions tailored to consumer preferences. For instance, smart doors equipped with IoT sensors and biometric locks are gaining traction, particularly in urban areas.

Sustainability Initiatives

Companies are adopting eco-friendly practices, such as using recycled materials and reducing carbon footprints, to align with EU regulations and cater to environmentally conscious consumers.

Strategic Partnerships

Collaborations with architects, builders, and government agencies have enabled companies to secure large-scale projects and expand their market reach.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Assa Abloy launched a new line of biometric doors in Sweden, enhancing security features for residential applications.

- In June 2023, Jeld-Wen partnered with Italian architects to introduce customizable wooden doors, targeting luxury housing projects.

- In August 2023, Hörmann Group expanded its production facility in Germany to meet rising demand for industrial doors.

- In October 2023, Dormakaba acquired a startup specializing in IoT-enabled door locks, strengthening its smart home offerings.

- In December 2023, Masonite International introduced a range of fire-rated doors in the UK, complying with new safety regulations.

MARKET SEGMENTATION

This research report on the Europe doors market is segmented and sub-segmented into the following categories.

By Material

- Wood

- Glass

- Metal

- Composite

- Plastic

By Mechanism

- Swinging Doors

- Sliding Doors

- Folding Doors

- Overhaed Doors

- Others

By Product Type

- Interior Doors

- Exterior Doors

By Application

- Non-residential

- Residential

By Mode of Application

- New construction

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe Doors market by 2033?

The Europe Doors market is estimated to be worth USD 161.99 billion by 2033.

2. What factors are driving the growth of the Europe Doors market?

Key drivers include increasing construction activities, demand for energy-efficient doors, and advancements in door materials and designs.

3. Which sectors are driving demand for doors in Europe?

The residential, commercial, and industrial sectors are key contributors, driven by renovation projects and new construction activities across these segments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]