Europe DNA Sequencing Products Market Size, Share, Trends & Growth Forecast Report By Product Type (Consumables and Reagents, Equipment), Application, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe DNA Sequencing Products Market Size

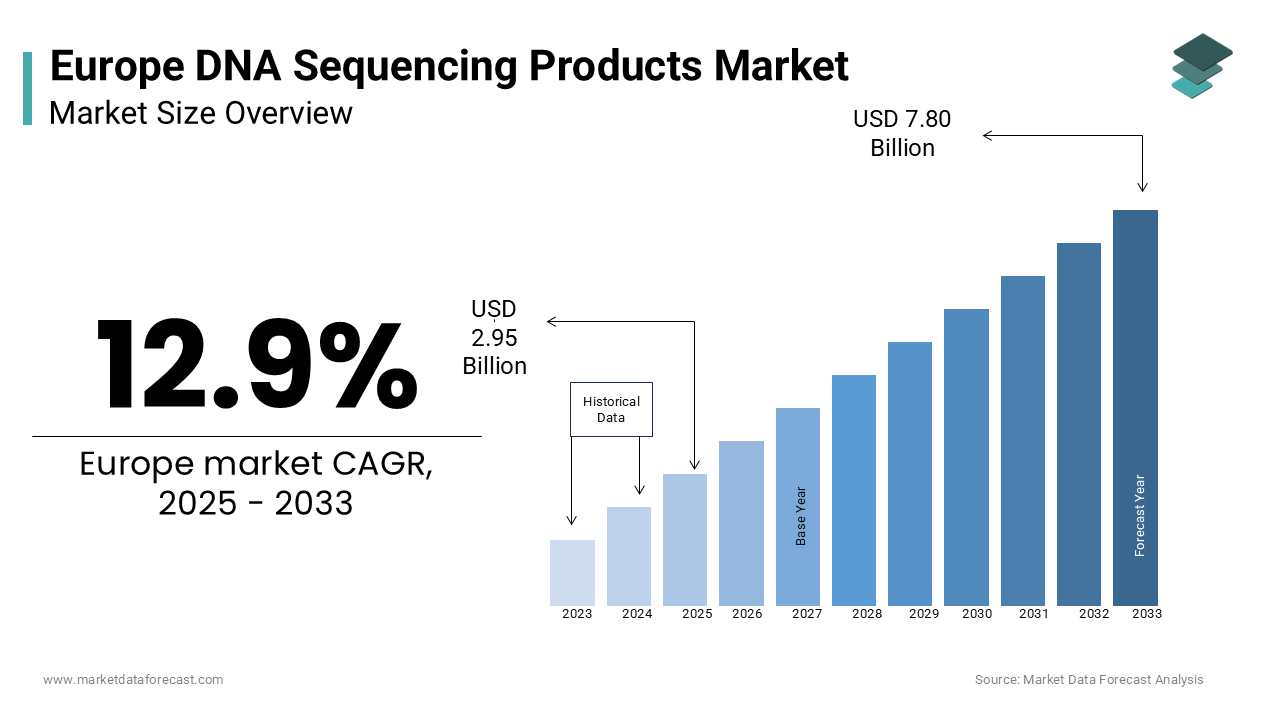

The europe DNA sequencing products market was worth USD 2.61 billion in 2024. The European market is estimated to grow at a CAGR of 12.9% from 2025 to 2033 and be valued at USD 7.80 billion by the end of 2033 from USD 2.95 billion in 2025.

DNA sequencing technologies enable the decoding of genetic information, offering insights into disease mechanisms, biomarker identification, and personalized treatment strategies. The increasing adoption of next-generation sequencing (NGS) platforms that have revolutionized genomic analysis with their speed, accuracy, and cost-effectiveness are fuelling the demand for DNA sequencing products in the European region. According to the European Commission, more than 30% of all clinical trials in Europe now incorporate genomic data, reflecting the critical role of DNA sequencing in drug discovery and therapeutic development. Additionally, advancements in CRISPR-based gene editing and single-cell sequencing have expanded the scope of applications, enabling breakthroughs in oncology, reproductive health, and rare diseases. As per Eurostat, investments in genomics R&D across Europe exceeded €20 billion in 2022, with significant portions allocated to sequencing technologies.

MARKET DRIVERS

Rising Demand for Precision Medicine in Europe

The escalating demand for precision medicine serves is driving the growth of the European DNA sequencing products market. According to the European Society for Medical Oncology, precision medicine accounts for over 25% of all cancer treatments in Europe, with genomic profiling playing a central role in tailoring therapies to individual patients. According to the European Commission, advancements in DNA sequencing technologies have enabled the identification of actionable mutations in over 80% of cancer cases, significantly improving treatment outcomes. For instance, NGS platforms achieve accuracy rates exceeding 99%, making them indispensable for diagnosing and managing complex diseases. Additionally, the integration of AI-driven analytics has enhanced the interpretation of sequencing data, reducing diagnostic times by up to 40%. A study by the European Health Economics Association reveals that hospitals utilizing advanced sequencing technologies report a 30% improvement in patient survival rates, underscoring their transformative impact.

Advancements in Next-Generation Sequencing (NGS) Technologies

Technological breakthroughs in next-generation sequencing (NGS) platforms are fuelling the growth of the European DNA sequencing products market. According to the European Medical Device Technology Association, NGS systems have reduced sequencing costs by over 90% since their introduction, enabling widespread adoption across research and clinical settings. The European Commission notes that investments in NGS technologies have surged by 25% annually over the past five years, with applications spanning oncology, rare diseases, and infectious disease surveillance. For example, NGS platforms can sequence an entire human genome in less than 24 hours, achieving throughput rates that surpass traditional Sanger sequencing methods. Additionally, advancements in single-cell sequencing and long-read technologies have expanded the scope of genomic research, enabling deeper insights into cellular heterogeneity and complex genetic disorders. A report by the European Biotech Research Institute underscores that companies leveraging NGS technologies report a 40% increase in operational efficiency.

MARKET RESTRAINTS

High Costs and Complexity of Sequencing Technologies

The substantial costs and technical complexity associated with DNA sequencing technologies are restraining the growth of the European market. According to the European Health Economics Association, the average cost of a high-throughput NGS platform ranges between €100,000 and €500,000, depending on the application and scale. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs), which account for over 60% of biotechnology companies in Europe. According to the European Commission, the complexity of optimizing sequencing workflows often results in extended timelines, delaying commercialization by up to two years. Additionally, the need for specialized expertise in bioinformatics and data analysis further exacerbates resource constraints, limiting accessibility for emerging players. A study by the European Biotechnology Research Institute reveals that over 40% of sequencing projects face delays due to technical challenges, such as data storage and computational bottlenecks. These barriers not only hinder market entry but also impede the scalability of innovative therapies, posing a formidable challenge to widespread adoption.

Ethical Concerns and Regulatory Hurdles

Ethical concerns surrounding genetic privacy and regulatory hurdles are hindering the growth of the European DNA sequencing products market. According to the European Group on Ethics in Science and New Technologies, public skepticism regarding the use of genomic data for research and clinical applications has led to stringent regulatory restrictions and limited funding for certain initiatives. For instance, a survey conducted by the European Public Opinion Research Institute reveals that over 50% of respondents express reservations about the security and misuse of genetic information, particularly in population-scale sequencing projects. The European Commission underscores that these concerns are compounded by cultural and religious beliefs, which vary significantly across member states, creating inconsistencies in public acceptance. Additionally, compliance with the General Data Protection Regulation (GDPR) imposes rigorous testing and documentation requirements, increasing operational burdens for manufacturers. A study by the European Biotechnology Industry Organization highlights that addressing these challenges requires sustained investment in public education and transparent communication, yet resource constraints and societal resistance often undermine their effectiveness. These barriers not only hinder market growth but also impede efforts to maximize the therapeutic potential of DNA sequencing technologies.

MARKET OPPORTUNITIES

Expansion into Emerging Therapeutic Areas

The growing emphasis on emerging therapeutic areas is a notable opportunity for the European DNA sequencing products market. According to the European Federation of Pharmaceutical Industries and Associations, applications in rare diseases, infectious diseases, and reproductive health are projected to account for over 40% of all sequencing-based interventions by 2030. The European Commission highlights that patient-specific sequencing platforms, developed using NGS and CRISPR technologies, enable the production of targeted therapies with enhanced efficacy and reduced side effects. For instance, the demand for reproductive health applications, such as preimplantation genetic testing are predicted to grow exponentially over the next decade. Additionally, collaborations between academic institutions and pharmaceutical companies have facilitated the development of scalable platforms for personalized sequencing solutions. A study by the European Biotech Research Institute underscores that hospitals utilizing sequencing-based therapies report a 25% improvement in patient outcomes, reflecting their growing acceptance. These dynamics position emerging therapeutic areas as a key growth driver, emphasizing their role in advancing precision healthcare.

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation into DNA sequencing workflows offers significant opportunities to enhance efficiency and innovation. According to the European Medical Device Technology Association, AI-driven algorithms can analyze vast datasets to optimize sequencing protocols and predict genetic variations, reducing processing times by up to 50%. For example, machine learning models developed by the European Biotechnology Research Institute have demonstrated a 95% accuracy rate in identifying pathogenic mutations, surpassing traditional manual analysis methods. The European Commission notes that automation technologies, such as robotic systems for sample preparation and library construction, have increased throughput by 30%, enabling faster scalability. Additionally, cloud-based platforms facilitate real-time data sharing and collaboration, ensuring compliance with regulatory standards. A study by the European Health Economics Association reveals that companies leveraging AI and automation report a 20% reduction in operational costs. These innovations not only elevate the standard of sequencing operations but also create new revenue streams for market players, positioning AI as a catalyst for sustainable growth.

MARKET CHALLENGES

Data Storage and Computational Bottlenecks

Data storage and computational bottlenecks is a major challenge to the European DNA sequencing products market. According to the European Data Protection Board, a single human genome generates approximately 200 GB of raw data, necessitating robust infrastructure for storage and analysis. The European Commission reports that over 30% of sequencing facilities faced shortages of computational resources in 2022, resulting in a 15% decline in operational capacity. Additionally, the integration of AI-driven analytics and machine learning models requires high-performance computing systems, which are often inaccessible to smaller institutions. A study by the European Biotech Research Institute reveals that data storage and computational limitations disproportionately affect SMEs, which lack the resources to establish scalable IT infrastructures. Furthermore, the perishable nature of sequencing data necessitates stringent backup and archiving protocols, which are often compromised during system upgrades. These vulnerabilities not only threaten operational continuity but also undermine efforts to meet the growing demand for genomic insights, posing a formidable challenge to market resilience.

Shortage of Skilled Bioinformaticians and Geneticists

The shortage of skilled bioinformaticians and geneticists is another major factor hindering the growth of the European DNA sequencing products market. According to the European Society for Human Genetics, there are fewer than 5,000 certified professionals specializing in genomic data analysis across Europe, with significant regional disparities in their distribution. The European Commission highlights that this shortage is particularly acute in Southern and Eastern Europe, where the ratio of experts to sequencing projects is as low as 1:100. Furthermore, the complexity of analyzing large-scale genomic datasets requires extensive training and experience, which limits the number of qualified practitioners capable of deriving actionable insights from sequencing data. A study by the European Cardiovascular Research Institute reveals that over 40% of sequencing facilities face delays in generating diagnostic reports due to a lack of trained personnel. Additionally, the rapid pace of technological advancements necessitates continuous education and upskilling, further straining already limited resources. These workforce challenges not only restrict the availability of sequencing services but also undermine efforts to meet the growing demand for genomic insights, posing a significant barrier to market expansion.

SEGMENTAL ANALYSIS

By Product Type Insights

The consumables and reagents segment held 66.1% of the European DNA sequencing products market share in 2024. The growth of the consumables and reagents segment in the European market is attributed to their indispensable role in sample preparation and sequencing workflows, serving as the foundation for all genomic analysis activities. According to the European Medicines Agency, the demand for high-quality consumables and reagents has surged by 20% annually, driven by the increasing adoption of NGS platforms and personalized medicine. The European Commission highlights that advancements in chemically defined reagents and library preparation kits have enhanced reproducibility and scalability, reducing batch-to-batch variability by up to 30%. Additionally, the versatility of consumables enables their application across diverse sequencing platforms, further solidifying their dominance. A study by the European Biotech Research Institute reveals that over 80% of biopharmaceutical companies prioritize investments in premium-grade consumables, reflecting their critical importance in ensuring consistent and reliable sequencing performance.

The equipment segment is predicted to register the fastest CAGR of 14.4% over the forecast period owing to their critical role in scaling up sequencing operations for commercial applications, including biomarker discovery and population-scale genomics. The European Commission reports that advancements in modular and portable sequencing systems have enhanced operational flexibility, reducing contamination risks and downtime by up to 40%. Additionally, the integration of real-time monitoring and control systems has improved process optimization, achieving productivity gains of 25%. The European Biotechnology Research Institute underscores that the adoption of sequencing equipment is particularly pronounced in large-scale research facilities, where multidisciplinary teams collaborate to optimize yield and quality. A study by the European Health Economics Association highlights that companies utilizing advanced sequencing equipment report a 30% reduction in production costs, reflecting their growing popularity.

By Application Insights

The diagnostics segment captured 41.8% of the European DNA sequencing products market share in 2024. The growth of the diagnostics segment in the European market is attributed to the indispensable role of sequencing technologies in identifying genetic mutations and biomarkers associated with diseases such as cancer, cardiovascular disorders, and rare genetic conditions. According to the European Medicines Agency, over 70% of clinical trials in Europe now incorporate genomic data, underscoring their critical importance in early detection and personalized treatment strategies. The European Commission highlights that advancements in NGS platforms have enhanced the predictive accuracy of diagnostic assays, reducing false-positive rates by up to 30%. Additionally, the versatility of sequencing technologies enables their application across diverse therapeutic areas, further reinforcing their dominance. A study by the European Biotech Research Institute reveals that over 85% of hospitals prioritize investments in sequencing-based diagnostic platforms, reflecting their integral role in modern healthcare.

The personalized medicine segment is anticipated to register a promising CAGR of 16.7% over the forecast period due to its critical role in tailoring therapies to individual genetic profiles, enhancing treatment efficacy and reducing adverse effects. The European Commission reports that advancements in AI-driven analytics and single-cell sequencing have expanded their applicability, achieving success rates exceeding 85% in clinical trials. Additionally, the scalability and robustness of sequencing systems make them ideal for large-scale implementation, particularly in oncology and rare disease management. The European Medicines Agency underscores that the adoption of personalized medicine is particularly pronounced in chronic and complex conditions, where unmet medical needs persist. A study by the European Health Economics Association highlights that hospitals utilizing sequencing-based personalized therapies report a 30% improvement in patient outcomes, reflecting their growing acceptance.

By End User Insights

The academic and government research institutes segment occupied 54.8% of the European market share in 2024. The dominating position of the segment in the European market is rooted in their role as primary hubs for genomic research and innovation, driving advancements in fields such as oncology, rare diseases, and population genomics. According to the European Commission, over 60% of all sequencing projects in Europe are initiated by academic institutions, supported by government funding and collaborative initiatives. The European Medical Device Technology Association highlights that advancements in NGS platforms and bioinformatics tools have enhanced the scalability and reproducibility of research, achieving productivity gains of up to 25%. Additionally, the versatility of sequencing technologies enables their application across diverse research disciplines, further solidifying their dominance. A study by the European Biotech Research Institute reveals that over 90% of research grants prioritize investments in sequencing technologies, reflecting their critical role in advancing scientific discovery.

The pharmaceutical and biotechnology companies segment is anticipated to register the highest CAGR of 15.5% over the forecast period. The critical role that pharmaceutical and biotechnologies companies play in drug discovery, biomarker identification, and therapeutic development that leverage sequencing technologies to enhance precision and efficiency is primarily driving the expansion of the segment in the European market. The European Commission reports that advancements in AI-driven analytics and single-cell sequencing have expanded their applicability, achieving success rates exceeding 85% in clinical trials. Additionally, the scalability and robustness of sequencing systems make them ideal for large-scale implementation, particularly in oncology and rare disease management. The European Medicines Agency underscores that the adoption of sequencing technologies is particularly pronounced in personalized medicine and immunotherapy, where unmet medical needs persist. A study by the European Health Economics Association highlights that companies utilizing advanced sequencing platforms report a 30% improvement in R&D efficiency, reflecting their growing popularity.

REGIONAL ANALYSIS

Germany captured 26.1% of the European DNA sequencing products market share in 2024 and emerged as the leading player in the European market. The dominating role of Germany in the European market is attributed to the country's robust biotechnology infrastructure and strong emphasis on R&D, with investments exceeding €10 billion annually. According to the German Biotechnology Industry Organization, Germany hosts over 600 biotechnology companies, many of which specialize in genomics and sequencing technologies for drug discovery and diagnostics. The European Commission highlights that Germany’s aging population, with over 21% aged 65 or older, drives demand for advanced therapeutics, further amplifying the need for optimized sequencing platforms. Additionally, the country’s expertise in automation and AI-driven analytics has positioned it as a hub for technological advancements in genomic research.

France occupied a notable share of the European DNA sequencing products market in 2024. The prominent position of France in the European market is driven by the country’s proactive approach to healthcare innovation and its universal healthcare system, which ensures equitable access to advanced therapies. The French Biotechnology Association reports that France performs over 30% of all clinical trials involving sequencing technologies in Europe, supported by government initiatives to modernize biotechnology infrastructure. Additionally, France’s expertise in genome editing and CRISPR technologies has positioned it as a leader in developing next-generation sequencing platforms. The European Commission underscores that collaborations between public and private entities have accelerated innovation, propelling the market growth in France.

The UK is expected to witness a prominent CAGR in the European DNA sequencing products market over the forecast period. The growing number of initiatives in genomics and sequencing technologies in the UK is primarily fuelling the UK market growth. According to the British Biotechnology Association, the UK performs over 25% of all sequencing-related R&D activities in Europe, supported by nationwide awareness campaigns and specialized research centers. The UK Department of Health underscores that the rising prevalence of chronic diseases and advancements in personalized medicine have amplified demand for sequencing technologies. Additionally, the country’s focus on sustainability and ethical sourcing aligns with global trends, enhancing its market reputation.

Italy is anticipated to command a notable share of the European market over the forecast period. The growing investments of Italy in biotechnology infrastructure and its strong tradition of medical innovation are boosting the expansion of Italy in the European market. The Italian Biotechnology Association reports that Italy performs over 20% of all sequencing-related clinical trials in Europe, supported by advancements in genome editing and automation technologies. Additionally, Italy’s expertise in personalized medicine has expanded the scope of sequencing applications, enhancing their therapeutic utility. The European Commission highlights that collaborations between academic institutions and industry players have accelerated innovation, driving the market growth in Italy.

Spain is projected to witness a healthy CAGR in the European market over the forecast period owing to the country's robust regulatory framework and high adoption rates of advanced sequencing technologies. The Spanish Biotechnology Society emphasizes that Spain performs over 15% of all sequencing-related R&D activities in Europe, supported by investments in automation and AI-driven platforms. Additionally, the country’s focus on regenerative medicine and biotechnological advancements has expanded the therapeutic applications of sequencing technologies. The European Commission highlights that Spain’s strategic initiatives to enhance procedural safety and accessibility have strengthened its market position.

MARKET SEGMENTATION

This research report on the DNA sequencing products market is segmented and sub-segmented based on categories.

By Product Type

- Consumables and Reagents

- Equipment

By Application

- Biomarkers

- Diagnostics

- Reproductive Health

- Forensics

- Personalized Medicine

- Others

By End Users

- Academic and Government Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the DNA Sequencing Market in Europe?

Growth is driven by advancements in genomic research, government support, personalized medicine demand, and decreasing sequencing costs.

Which industries use DNA sequencing products in Europe?

ndustries include healthcare (genetic testing), biotechnology (drug discovery), agriculture (genetic research), and academic research.

What are the challenges in the DNA Sequencing Market in Europe?

Challenges include the high costs of sequencing platforms, data management, and ethical/privacy concerns regarding genetic data.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]