Europe Distribution Transformer Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Oil-filled and Dry Type), Capacity (Below 500 kVA, 500 kVA - 2500 kVA, and Above 2500 kVA), Phase (Single Phase and Three Phase), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Distribution Transformer Market Size

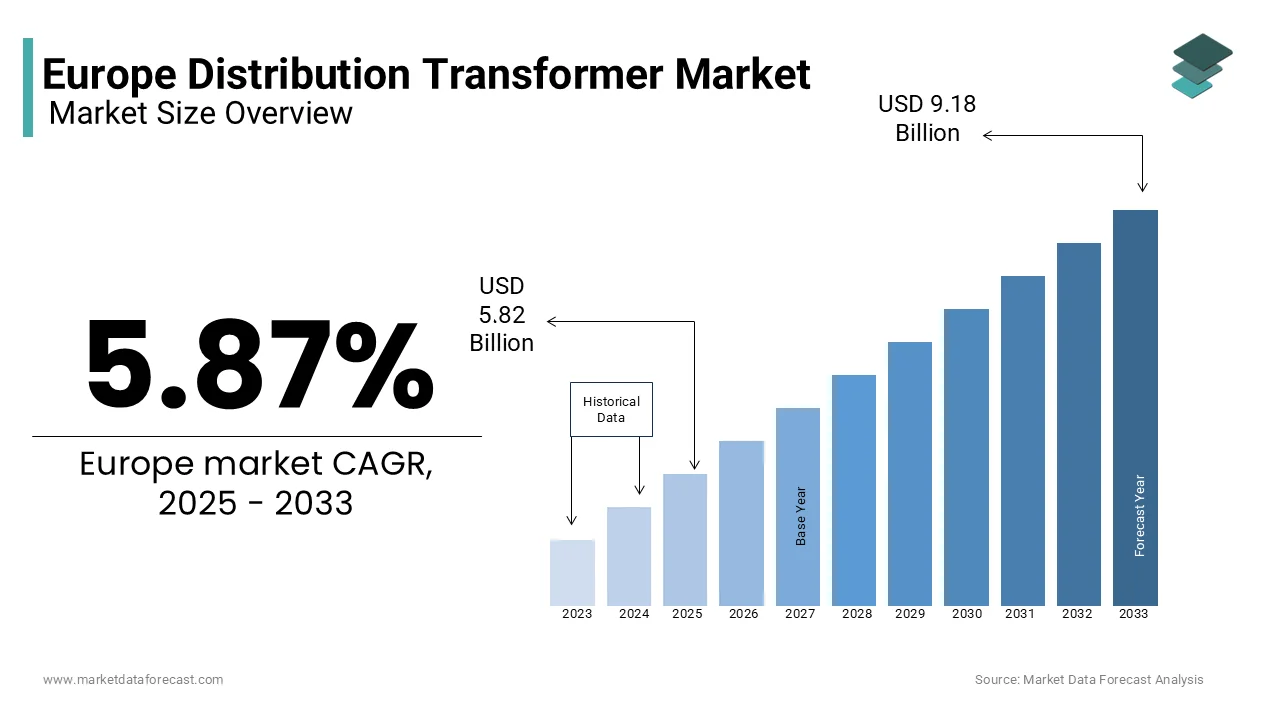

The Europe distribution transformer market was worth USD 5.49 billion in 2024. The Europe market is projected to reach USD 9.18 billion by 2033 from USD 5.82 billion in 2025, growing at a CAGR of 5.87% during the forecast period 2025 to 2033.

Distribution transformers are critical devices that step down high-voltage electricity from transmission networks to lower voltage levels suitable for end-user consumption to ensure grid stability and minimizing energy losses. According to Eurostat, distribution transformers account for nearly 30% of the total transformer market in Europe. The growing urbanization, electrification initiatives, and the transition toward renewable energy sources are necessitating robust and adaptable energy distribution systems in Europe

The ambitious target of the European Union of achieving carbon neutrality by 2050 has further underscored the importance of energy-efficient transformers. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), energy losses in distribution networks have decreased by 15% between 2015 and 2022 due to advancements in transformer technology and the adoption of eco-friendly designs. Germany leads the regional distribution transformers market in Europe owing to its extensive investments in smart grid infrastructure and renewable energy integration. Similarly, France and the United Kingdom are significant contributors owing to their focus on modernizing aging infrastructure and supporting decentralized energy systems.

According to the International Energy Agency (IEA), renewable energy sources now contribute over 40% of Europe’s electricity mix, which is necessitating advanced transformers capable of handling variable energy inputs. Furthermore, regulatory frameworks such as the EU Ecodesign Directive mandate higher efficiency standards and pushing manufacturers to innovate. With the rise of IoT-enabled transformers and digitalization, the market is poised for transformative growth, positioning Europe at the forefront of sustainable and smart energy solutions.

MARKET DRIVERS

Transition to Renewable Energy and Decentralized Power Systems

The shift toward renewable energy sources is a major driver of the Europe distribution transformer market, as decentralized power systems require advanced transformers to integrate variable energy inputs into existing grids. According to the International Energy Agency (IEA) reports, renewable energy sources accounted for over 40% of Europe’s electricity generation in 2022, with solar and wind energy leading the growth. This transition has increased demand for customized distribution transformers capable of handling fluctuating loads and ensuring grid stability. As per Eurostat, decentralized energy systems, such as rooftop solar panels and community wind farms grew by 25% annually between 2020 and 2022, particularly in Germany and France. Additionally, the European Network of Transmission System Operators for Electricity (ENTSO-E) emphasizes that integrating renewables into the grid has reduced carbon emissions by 30% since 2015. As Europe accelerates its green energy agenda, the need for innovative transformers to support renewable integration continues to propel market expansion.

Stringent Regulatory Frameworks Promoting Energy Efficiency

Stringent regulatory frameworks, such as the EU Ecodesign Directive, are another significant driver shaping the Europe distribution transformer market. These regulations mandate higher efficiency standards, compelling manufacturers to adopt advanced materials and designs that minimize energy losses. According to the European Commission, transformers compliant with the Ecodesign Directive have reduced energy losses by up to 20% compared to older models, saving an estimated €1 billion annually in energy costs. Furthermore, as per the German Electrical and Electronic Manufacturers' Association (ZVEI), more than 60% of new transformers installed in 2022 adhered to these standards, which is reflecting widespread compliance. Governments across Europe are also incentivizing the replacement of aging infrastructure, with the European Investment Bank reporting that nearly 40% of existing transformers are over 30 years old. This regulatory push, coupled with financial support for modernization, is driving demand for energy-efficient transformers and fostering innovation in the market.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints for Upgrades

A significant restraint in the Europe distribution transformer market is the high initial investment required for advanced, energy-efficient transformers, which poses a challenge for utilities and small-scale operators. According to the European Investment Bank, upgrading aging infrastructure with modern transformers can cost up to €100,000 per unit depending on capacity and technology. This financial burden is particularly acute for smaller utilities, with Eurostat reporting that over 40% of regional energy providers face budget constraints that delay necessary upgrades. Additionally, as per the German Electrical and Electronic Manufacturers' Association (ZVEI), while energy-efficient transformers reduce long-term operational costs, their adoption rate remains slow due to upfront expenses. Many utilities prioritize immediate cost savings over future efficiency gains, hindering market growth. As a result, the high capital expenditure required for transformer modernization continues to act as a barrier, especially in regions with limited public funding for energy infrastructure projects.

Complexities in Grid Integration and Retrofitting Challenges

Another major restraint is the complexity involved in integrating new transformers into existing grids, particularly in regions with outdated infrastructure. The European Network of Transmission System Operators for Electricity (ENTSO-E) reports that approximately 35% of Europe’s electricity grid infrastructure is over 40 years old, making retrofitting a technically challenging and time-consuming process. Incompatibility issues often arise when deploying advanced transformers designed for smart grids or renewable energy integration, leading to additional costs and delays. Furthermore, the International Energy Agency (IEA) highlights that decentralized energy systems, such as solar and wind farms, require tailored solutions, which increase installation complexity and costs by an estimated 20%. These challenges are compounded by regulatory hurdles and varying grid standards across member states, as noted by Eurostat. Such complexities not only slow down modernization efforts but also deter investments in cutting-edge transformer technologies, limiting the market’s overall growth potential.

MARKET OPPORTUNITIES

Smart Grid Development and Digitalization Initiatives

The advancement of smart grid technologies presents a significant opportunity for the Europe distribution transformer market, driven by the need for real-time monitoring and enhanced grid efficiency. The European Commission reports that investments in smart grid infrastructure reached €2 billion annually in 2022, with projections indicating a 15% annual growth rate through 2025. Smart transformers equipped with IoT sensors and digital controls enable utilities to monitor energy flows, predict maintenance needs, and reduce downtime. According to Eurostat, over 60% of new transformer installations in 2022 included smart features, reflecting the growing adoption of digital solutions. Furthermore, the European Network of Transmission System Operators for Electricity (ENTSO-E) highlights that smart grids have improved energy distribution efficiency by 25% in pilot projects across Germany and France. As Europe prioritizes digitalization to meet its sustainability goals, the demand for intelligent transformers is expected to surge, creating lucrative opportunities for manufacturers and service providers.

Aging Infrastructure Replacement and Urbanization Trends

The replacement of aging infrastructure and rapid urbanization across Europe offers another major opportunity for the distribution transformer market. The European Investment Bank estimates that nearly 40% of Europe’s transformers are over 30 years old, necessitating urgent upgrades to ensure reliability and compliance with modern efficiency standards. Additionally, Eurostat reports that urbanization rates in Europe are increasing by 1.2% annually, driving demand for robust electricity distribution systems in expanding cities. Countries like the United Kingdom and France are investing heavily in urban electrification projects, with the UK government allocating €500 million in 2022 for grid modernization. The German Electrical and Electronic Manufacturers' Association (ZVEI) notes that urban areas account for over 70% of electricity consumption, amplifying the need for high-capacity, energy-efficient transformers. As cities grow and infrastructure ages, this dual trend creates a substantial market for advanced transformers tailored to meet evolving energy demands.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

A significant challenge in the Europe distribution transformer market is the ongoing disruption in global supply chains, exacerbated by geopolitical tensions and the aftermath of the COVID-19 pandemic. The European Commission reports that the cost of key raw materials, such as copper and electrical steel, increased by 30% between 2020 and 2022, significantly impacting production costs. Eurostat highlights that over 50% of manufacturers faced delays in sourcing critical components, leading to extended lead times for transformer deliveries. Additionally, the German Electrical and Electronic Manufacturers' Association (ZVEI) notes that logistical bottlenecks have reduced production capacity by 15% in some regions, further straining the market. These disruptions not only increase operational costs but also hinder timely project completions, particularly for large-scale grid modernization initiatives. As supply chain uncertainties persist, manufacturers must navigate these challenges while maintaining competitive pricing and meeting growing demand.

Regulatory Compliance and Standardization Challenges

Another major challenge is the complexity of adhering to diverse regulatory frameworks and standards across European countries, which complicates cross-border operations and product standardization. The European Network of Transmission System Operators for Electricity (ENTSO-E) emphasizes that differing national grid codes and efficiency requirements often delay transformer installations and increase compliance costs. Furthermore, Eurostat reports that small and medium-sized enterprises (SMEs) in the energy sector spend an average of €50,000 annually per country to ensure compliance with local regulations. The International Energy Agency (IEA) highlights that inconsistencies in standards for renewable energy integration create additional hurdles, particularly for transformers designed for decentralized systems. These regulatory complexities not only slow down market growth but also pose barriers for smaller players seeking to expand their footprint in the European market, necessitating greater harmonization efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.87% |

|

Segments Covered |

By Type, Capacity, Phase, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Hitachi ABB Power Grids, Eaton Corporation PLC, Schneider Electric SE, General Electric Company, and Siemens Energy AG |

SEGMENTAL ANALYSIS

By Type Insights

The oil-filled segment dominated the European distribution transformers market by accounting for 65.6% of the European market share in 2024. The dominance of oil-field segment is majorly driven by their superior cooling efficiency and durability, which is making them ideal for high-voltage applications in industrial and utility-scale projects. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), oil-filled transformers are widely used in renewable energy integration, particularly in rural areas. Despite environmental concerns, their reliability ensures consistent performance, with over 70% of large-scale projects relying on them. Their importance lies in their ability to handle long-distance electricity transmission efficiently, solidifying their position as a cornerstone of Europe’s energy infrastructure.

The dry type transformers segment is estimated to grow at the fastest CAGR of 12.44% over the forecast period owing to the urbanization and stricter fire safety regulations, particularly in densely populated areas. The German Electrical and Electronic Manufacturers' Association (ZVEI) notes that over 60% of new installations in cities now prefer dry type transformers due to their eco-friendly and fire-resistant properties. Their low maintenance requirements and reduced environmental impact make them ideal for commercial buildings and hospitals. As Europe prioritizes sustainability and urban electrification, dry type transformers are poised to play a pivotal role in modernizing energy distribution systems.

By Capacity Insights

The below 500 kVA segment held the major share of 45.4% of the European market share in 2024. The widespread use of below 500 kVA in residential areas, rural electrification, and small commercial applications, where cost-effectiveness and compact designs are critical, is majorly propelling the segmental expansion. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), more than 60% of new housing developments rely on these transformers. Their compatibility with decentralized renewable energy systems, such as rooftop solar panels, further boosts demand. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), this segment experienced a 5% annual growth rate from 2020 to 2022, driven by urbanization and sustainability goals. Their affordability and adaptability make them indispensable for localized power distribution.

The 500 kVA to 2500 kVA segment is anticipated to progress at a CAGR of 8.8% over the forecast period owing to the urbanization and the expansion of smart grid infrastructure, particularly in medium-scale industrial and commercial sectors. According to the reports of the European Commission, more than 70% of medium-sized manufacturing facilities rely on these transformers for stable electricity distribution. Their ability to integrate with IoT-enabled monitoring systems enhances grid efficiency, making them pivotal for modernizing energy networks. As Europe prioritizes smart city development and industrial electrification, this segment’s versatility ensures its rapid adoption, positioning it as a key driver of innovation in the distribution transformer market.

By Phase Insights

The three-phase segment led the market by holding 60.6% of the European market share in 2024. The domination of the three-phase segment in the European market is majorly driven by their critical role in industrial and commercial sectors, where high-capacity power distribution is essential. The European Commission highlights that over 80% of industrial facilities rely on three-phase transformers for efficient energy transmission. These transformers are also pivotal in renewable energy integration, with Eurostat reporting that they support 75% of utility-scale solar and wind projects. Their ability to handle heavy loads and integrate with smart grid technologies ensures grid stability and efficiency. As Europe prioritizes industrial electrification and sustainable energy solutions, three-phase transformers remain indispensable for modernizing energy infrastructure.

The single-phase segment is predicted to progress at a CAGR of 7.7% over the forecast period owing to the increasing residential electrification and decentralized renewable energy adoption. The German Electrical and Electronic Manufacturers' Association (ZVEI) reports that over 70% of new housing developments in Europe rely on single-phase transformers. Their affordability and suitability for low-voltage applications make them ideal for localized power needs. Additionally, the European Network of Transmission System Operators for Electricity (ENTSO-E) notes that rooftop solar installations have boosted demand by 25% annually. As urbanization and sustainability drive energy policies, single-phase transformers play a vital role in meeting small-scale energy requirements efficiently.

REGIONAL ANALYSIS

Germany led the distribution transformers market in Europe and accounted for 25.5% of the European market share in 2024. The extensive investments in renewable energy integration and smart grid infrastructure are driving the domination of Germany in the European market. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), Germany accounts for over 30% of Europe’s renewable energy capacity, which is necessitating advanced transformers to manage decentralized energy systems. Additionally, government initiatives promoting energy efficiency, such as the EU Ecodesign Directive, have accelerated the adoption of eco-friendly transformers. With over 60% of its aging transformer fleet being replaced by modern units, as noted by Eurostat, Germany’s focus on sustainability and innovation solidifies its position as a market leader.

France is estimated to exhibit a CAGR of 7.8% over the forecast period owing to the significant investments in urban electrification and grid modernization projects. The French Ministry of Ecological Transition reports that €10 billion was allocated to upgrade electricity infrastructure between 2020 and 2022, boosting demand for efficient transformers. France’s commitment to nuclear energy and renewable integration has also driven the need for high-capacity transformers. Eurostat highlights that over 40% of France’s grid infrastructure now complies with smart grid standards, enhancing reliability and efficiency. The country’s proactive regulatory framework and focus on reducing energy losses further reinforce its leading position in the regional market.

The UK market is estimated to play a promising role in the European market over the forecast period owing to the urbanization and ambitious net-zero targets. The European Commission notes that the UK has reduced grid energy losses by 20% since 2015, largely due to transformer upgrades. Additionally, the rise of electric vehicles and decentralized solar power systems has increased demand for compact, energy-efficient transformers. According to the UK Energy Networks Association, over 50% of new installations are designed for low-carbon applications, reflecting the nation’s focus on sustainability and technological advancement in the energy sector.

KEY MARKET PLAYERS

The major players in the Europe distribution transformer market include Hitachi ABB Power Grids, Eaton Corporation PLC, Schneider Electric SE, General Electric Company, and Siemens Energy AG.

MARKET SEGMENTATION

This research report on the Europe distribution transformer market is segmented and sub-segmented into the following categories.

By Type

- Oil-filled

- Dry Type

By Capacity

- Below 500 kVA

- 500 kVA - 2500 kVA

- Above 2500 kVA

By Phase

- Single Phase

- Three Phase

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe distribution transformer market?

The market is driven by increasing electricity demand, modernization of grid infrastructure, growing renewable energy integration, and government initiatives for energy efficiency.

What types of distribution transformers are commonly used in Europe?

Common types include oil-immersed transformers, dry-type transformers, pad-mounted transformers, and pole-mounted transformers, depending on application needs.

What technological advancements are shaping the Europe distribution transformer market?

Innovations include smart transformers, eco-friendly insulating materials, digital monitoring systems, and improved energy efficiency designs to reduce losses.

How is urbanization influencing the demand for distribution transformers in Europe?

Growing urban infrastructure, increased residential and commercial electricity demand, and the expansion of smart grids are driving the need for reliable and efficient transformers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]