Europe Direct-to-Consumer Laboratory Testing Market Size, Share, Trends & Growth Forecast Report By Type (Blood, Urine, Saliva, Others), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Direct-to-Consumer Laboratory Testing Market Size

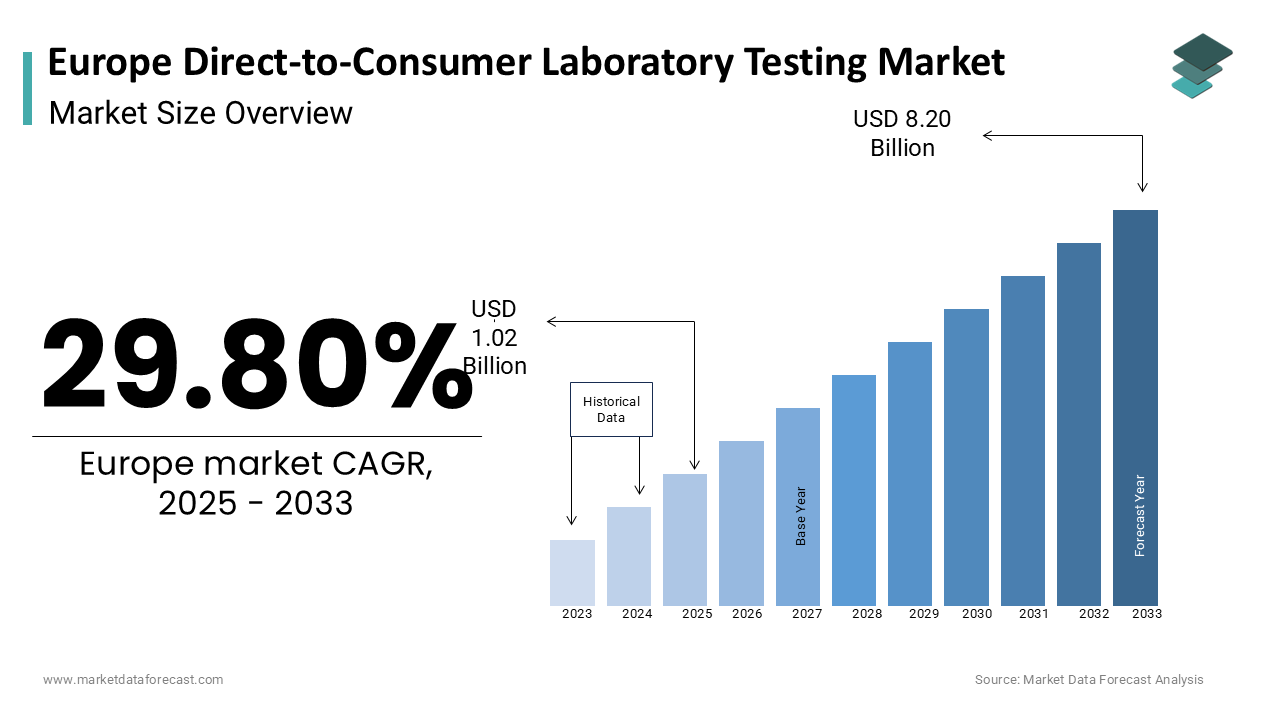

The europe direct-to-consumer laboratory testing market was worth USD 0.78 billion in 2024. The European market is estimated to grow at a CAGR of 29.80% from 2025 to 2033 and be valued at USD 8.20 billion by the end of 2033 from USD 1.02 billion in 2025.

The direct-to-consumer (DTC) laboratory testing include genetic testing, blood analysis, allergy screening, and infectious disease diagnostics, empower individuals to take charge of their health by accessing personalized medical insights conveniently. The rise of digital health platforms and telemedicine has significantly contributed to the expansion of this market. According to the Eurostat, over 70% of Europeans now use online health services by reflecting a growing preference for accessible and self-managed healthcare solutions. Furthermore, the COVID-19 pandemic acted as a catalyst, with the European Centre for Disease Prevention and Control reporting a 40% increase in demand for at-home diagnostic kits during peak periods. However, regulatory challenges persist, as per the European Medicines Agency, which emphasizes the need for stringent quality control and data privacy measures to ensure consumer safety. According to the World Health Organization, over 50 million Europeans live with chronic conditions.

MARKET DRIVERS

Increasing Consumer Awareness and Demand for Preventive Healthcare

The growing awareness among European consumers about preventive healthcare is a major driver of the European direct-to-consumer (DTC) laboratory testing market. According to the European Observatory on Health Systems and Policies, over 60% of Europeans now prioritize preventive measures to manage their health proactively. The rising chronic disease prevalence is ascribed to fuel the growth of the market to the extent. According to the World Health Organization, 50 million Europeans live with conditions like diabetes and hypertension by necessitating regular monitoring. The DTC tests, such as genetic screening and blood analysis, empower individuals to detect potential health risks early without relying on traditional healthcare systems. According to the Eurostat, 70% of Europeans use online health services by reflecting a preference for accessible and self-managed solutions.

Advancements in Biotechnology and Digital Health Platforms

The advancements in biotechnology and the proliferation of digital health platforms are propelling the growth of the European DTC laboratory testing market. According to the European Federation of Laboratory Medicine, innovations in genomic sequencing and biomarker detection have reduced testing costs by 30% over the past five years by making these services more affordable. Furthermore, the integration of AI and machine learning into diagnostic tools has improved accuracy and accessibility. According to the European Commission’s Digital Economy and Society Index, 85% of households in Europe have internet access by enabling seamless adoption of online health solutions. Telemedicine platforms, supported by the European Centre for Disease Prevention and Control, have also expanded during the pandemic, with a 40% rise in at-home diagnostic kit usage. These technological advancements enhance consumer trust and convenience by driving widespread adoption of DTC laboratory testing across Europe.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Challenges

The stringent regulatory frameworks pose a significant restraint to the European direct-to-consumer (DTC) laboratory testing market. According to the European Medicines Agency, DTC tests must comply with the In Vitro Diagnostic Regulation (IVDR), which mandates rigorous quality control and clinical validation for all diagnostic tools. However, the European Federation of Laboratory Medicine reports that only 40% of DTC testing providers currently meet these stringent standards is leading to concerns about test accuracy and reliability. Non-compliance not only undermines consumer trust but also increases operational costs for companies striving to adhere to regulations. According to the European Commission, over 50% of EU member states have imposed partial bans on certain DTC tests particularly genetic screenings due to ethical concerns.

Data Privacy Concerns and Ethical Issues

The data privacy concerns and ethical dilemmas represent another major restraint for the European DTC laboratory testing market. The General Data Protection Regulation (GDPR), enforced by the European Data Protection Board, imposes strict rules on the collection, storage, and processing of sensitive health data. A study by the European Union Agency for Cybersecurity (ENISA) revealed that 60% of consumers are hesitant to share their health information online with the fear of potential misuse or breaches. Furthermore, ethical concerns arise with genetic testing, as per the European Society of Human Genetics, which notes that over 70% of surveyed individuals worry about the misuse of genetic data by insurers or employers. These challenges create hesitancy among consumers and increase scrutiny for companies by slowing the adoption of DTC testing solutions across Europe.

MARKET OPPORTUNITIES

Expansion of Personalized Medicine and Genomic Testing

The growing emphasis on personalized medicine presents a significant opportunity for the European direct-to-consumer (DTC) laboratory testing market. According to the European Federation of Pharmaceutical Industries and Associations, over 30% of new drug approvals in Europe are now tailored to genetic profiles. Advances in biotechnology have reduced the cost of sequencing by 50% over the past decade by making it more accessible for consumers. According to the World Health Organization, 20% of Europeans express interest in genetic testing to understand predispositions to diseases like cancer and cardiovascular conditions. DTC platforms can leverage this trend by offering affordable, at-home genomic tests that empower individuals to make informed health decisions.

Integration with Telemedicine and Digital Health Ecosystems

The integration of DTC laboratory testing with telemedicine and digital health ecosystems offers another major growth opportunity. According to the Eurostat, 70% of Europeans use online health services by reflecting the rapid adoption of digital solutions. According to the European Centre for Disease Prevention and Control, telemedicine usage surged by 40% during the pandemic by creating a robust foundation for DTC testing to align with virtual consultations and remote monitoring. Additionally, the European Commission’s Digital Economy and Society Index reveals that 85% of households in Europe have internet access by enabling seamless integration of DTC platforms with wearable devices and health apps. DTC providers can enhance user engagement and convenience by combining at-home testing with real-time data sharing and medical advice.

MARKET CHALLENGES

Limited Accessibility and Awareness Among Underserved Populations

A significant challenge for the European direct-to-consumer (DTC) laboratory testing market is the limited accessibility and awareness among underserved populations. As per the Eurostat, over 20% of Europeans in rural areas are lack reliable internet access, which is critical for engaging with DTC platforms. According to the European Public Health Alliance, only 40% of low-income households are aware of DTC testing options by creating disparities in adoption rates. Language barriers and cultural differences further exacerbate this issue in Eastern Europe, where health literacy remains a concern. According to the World Health Organization, health inequities persist across the EU with marginalized groups often excluded from innovative healthcare solutions. DTC testing risks alienating a significant portion of the population by hindering its potential to achieve widespread adoption and inclusivity.

Misinterpretation of Results and Lack of Professional Guidance

The absence of professional guidance in interpreting DTC test results poses another major challenge for the market. The European Federation of Laboratory Medicine warns that over 50% of consumers misinterpret their DTC test outcomes by leading to unnecessary anxiety or inappropriate health decisions. Unlike traditional diagnostics, DTC tests often lack follow-up consultations with healthcare professionals by leaving individuals to navigate complex medical data independently. According to the European Medicines Agency, 30% of reported complaints about DTC tests involve inaccurate or misleading information. As per the European Observatory on Health Systems and Policies, 60% of general practitioners express concerns about patients relying solely on DTC results without seeking professional advice.

SEGMENTAL ANALYSIS

By Type Insights

The Blood segment dominated the European DTC laboratory testing market with a significant share of 45.2% in 2024 with the growing prevalence of chronic diseases like diabetes and hypertension, which affect over 50 million Europeans, according to the World Health Organization. Blood tests are highly reliable for monitoring conditions such as cholesterol levels and infectious diseases by making them indispensable for preventive healthcare. Advances in minimally invasive blood collection devices have also enhanced accessibility for at-home use.

The saliva segment is anticipated to CAGR of 15.3% from 2025 to 2033. This growth is driven by the rising demand for genetic testing and personalized wellness solutions, where saliva-based tests excel due to their non-invasive nature. Technological advancements have reduced DNA sequencing costs by 30% over the past decade by making these tests more affordable. Saliva tests appeal to tech-savvy consumers seeking insights into ancestry, fitness predispositions, and nutritional needs. The saliva-based testing is pivotal in empowering individuals to take charge of their health with a transformative force in the DTC laboratory testing market.

By Application Insights

The Routine Clinical Testing segment was the largest by capturing 35.3% of the European DTC laboratory testing market share in 2024 due to its role in preventive healthcare by enabling early detection of conditions like high cholesterol and kidney dysfunction. According to the Eurostat, over 60% of Europeans prioritize annual health check-ups. Routine clinical tests are cost-effective and provide actionable insights into overall health by making them indispensable for proactive disease management. This segment plays a critical role in reducing healthcare burdens by promoting early intervention and improving long-term wellness outcomes.

The Genetic Testing segment is attributed to grow a CAGR of 16.7% during the forecast period. This growth is fueled by advancements in DNA sequencing technologies, which have reduced costs by 30% over the past decade by making genetic tests more affordable. According to the World Health Organization, preventive healthcare is gaining traction with consumers increasingly seeking personalized insights into ancestry, fitness predispositions, and disease risks. Genetic testing appeals to tech-savvy demographics by empowering them to make informed health decisions.

REGIONAL ANALYSIS

Germany direct-to-consumer (DTC) laboratory testing market held with 28.3% of share in 2024 with a robust healthcare infrastructure and high consumer awareness about preventive health measures. According to the European Federation of Laboratory Medicine, over 70% of Germans prioritize regular health check-ups with the driving demand for accessible DTC tests. Additionally, Germany’s strong emphasis on technological innovation and digital health platforms has accelerated adoption in urban areas. DTC testing provides an efficient solution for routine monitoring and early detection with a growing aging population and rising chronic disease prevalence.

France is anticipated to pose a lucrative CAGR of 12.8% from 2025 to 2033. France’s success is driven by its strong emphasis on preventive healthcare and government-backed initiatives promoting early disease detection. According to the Santé Publique France, 60% of French consumers prefer non-invasive health solutions, such as saliva-based genetic tests and urine analysis kits. Additionally, France’s investments in biotechnology and AI integration has enhanced the accuracy and accessibility of DTC tests. The country’s commitment to sustainability and ethical practices in healthcare further boosts consumer trust.

The United Kingdom direct-to-consumer laboratory testing market dominance is fueled by its highly digitalized population, with Eurostat reporting that 85% of households have internet access by enabling seamless adoption of online health services. The National Health Service (NHS) has also promoted telemedicine and at-home diagnostics, particularly during the pandemic, which a 40% surge in demand for DTC tests, as per the European Centre for Disease Prevention and Control. The UK’s focus on personalized medicine and wellness further drives growth by making it a hub for innovative DTC solutions tailored to consumer needs.

MARKET SEGMENTATION

This research report on the direct-to-consumer laboratory testing market is segmented and sub-segmented based on categories.

By Type

- Blood

- Urine

- Saliva

- Others

By Application

- Routine clinical testing

- Diabetes testing

- Genetic testing

- Thyroid stimulating hormone testing

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the Direct-to-Consumer Laboratory Testing Market?

Challenges include concerns about data privacy, lack of professional medical guidance for interpreting results, regulatory barriers, and consumer misunderstandings about the scope and accuracy of tests.

What is the future outlook for the Direct-to-Consumer Laboratory Testing Market in Europe?

The market is expected to grow rapidly due to the increasing demand for health autonomy, technological advancements, and greater consumer interest in preventive healthcare. More companies are likely to enter the market with new test offerings and services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]