Europe Digital Twin Market Research Report- Segmentation By Industry ( Automotive & Transportation, Healthcare) and Country (UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe.) - Industry Analysis on Size, Share, Trends, Growth, Opportunities & Forecast Report | 2025 to 2033.

Europe Digital Twin Market Size

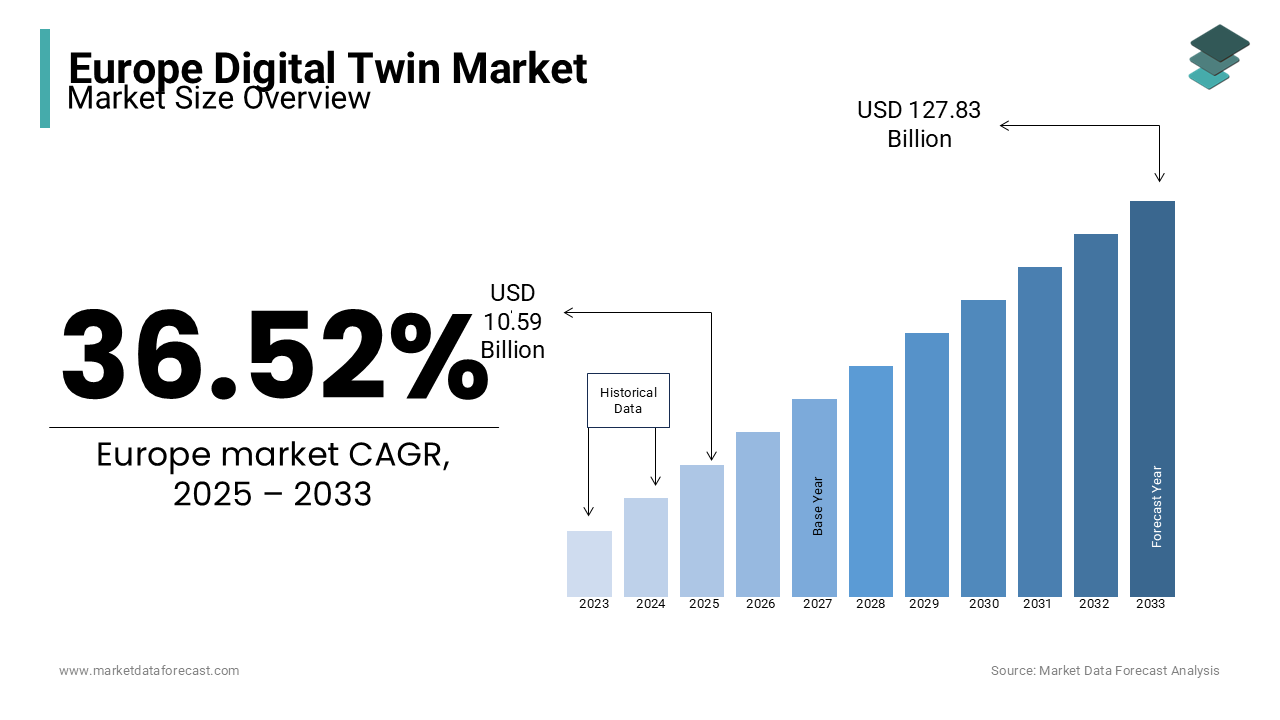

The Europe Digital Twin Market was valued at USD 7.76 billion in 2024. The Europe Digital Twin Market is expected to have 36.52 % CAGR from 2025 to 2033 and be worth USD 127.83 billion by 2033 from USD 10.59 billion in 2025.

Digital twin technology refers to the creation of virtual replicas of physical objects, systems, or processes the enable real-time simulation, analysis, and optimization. In Europe, the adoption of digital twin solutions spans various sectors, including manufacturing, healthcare, energy, and urban planning. The focus of Europe on sustainability and smart city development drives its application, as digital twins help optimize energy usage, reduce waste, and enhance infrastructure planning.

MARKET DRIVERS

Increased Adoption of IoT and Smart Technologies in Europe

The widespread integration of IoT devices across European industries drives the adoption of digital twin technologies. By 2023, Europe accounted for over 25% of global IoT deployments, highlighting the region’s commitment to smart technologies. Digital twins leverage data from IoT sensors to create real-time virtual models, improving operational efficiency and predictive maintenance. In manufacturing, for example, the use of digital twins has reduced downtime by up to 30%, as reported by industry sources. This growing reliance on connected devices creates a robust demand for advanced simulation tools, positioning digital twins as a cornerstone technology.

Focus on Sustainability and Energy Optimization

Europe’s strong commitment to sustainability significantly fuels the digital twin market. Buildings equipped with digital twin solutions have reported energy savings of up to 20%, addressing the EU’s energy efficiency goals. In addition, Europe’s renewable energy capacity, which grew by 6% in 2022 according to official energy reports, benefits from digital twin technologies in optimizing grid performance and managing resources. These applications align with the EU’s climate targets, including achieving net-zero emissions by 2050, further promoting the adoption of digital twin systems across energy and environmental sectors.

MARKET RESTRAINTS

High Implementation Costs

The deployment of digital twin technology across industries in Europe is restrained by the high cost of implementation. Creating and maintaining digital twins requires significant investment in IoT sensors, advanced software, and robust data infrastructure. For example, industry reports show that implementing a comprehensive digital twin system can cost organizations between €250,000 and €1 million, depending on the scale and complexity. These costs can be prohibitive, particularly for small and medium-sized enterprises (SMEs), which make up over 99% of European businesses according to Eurostat. This financial barrier limits the accessibility of digital twin solutions to larger organizations with sufficient budgets.

Data Privacy and Security Challenges

The extensive use of real-time data in digital twin systems poses challenges related to data privacy and cybersecurity. Digital twins often require the collection of sensitive operational and personal data, increasing the risk of breaches. According to the European Data Protection Supervisor, data breach incidents in Europe rose by over 60% in the past three years, highlighting the growing security concerns. Furthermore, compliance with strict regulations like the General Data Protection Regulation (GDPR) increases the complexity of implementing digital twin solutions, as non-compliance can result in fines of up to 4% of an organization’s global turnover. These challenges make organizations hesitant to fully adopt the technology.

MARKET OPPORTUNITIES

Government Initiatives Promoting Digital Twin Adoption

The European Union's strategic initiatives significantly bolster the digital twin market. The Digital Europe Programme, with a budget exceeding €8.1 billion, focuses on integrating digital technologies into businesses and public services, emphasizing areas like supercomputing and artificial intelligence. Such substantial funding facilitates the development and deployment of digital twin technologies across various sectors. Additionally, the Destination Earth initiative aims to create a high-precision digital model of the Earth, leveraging digital twin technology to monitor and predict environmental changes, thereby supporting climate change mitigation efforts. These programs underscore the EU's commitment to advancing digital twin applications, presenting significant growth opportunities in the European market.

Emphasis on Sustainable Development

Europe's dedication to sustainable development presents a substantial opportunity for the digital twin market. Digital twins enable efficient resource management and predictive maintenance, aligning with the EU's sustainability objectives. The European Commission's twin transition strategy highlights the integration of digital and green initiatives to achieve carbon neutrality by 2050. By facilitating energy optimization and reducing waste, digital twin technologies play a crucial role in this transition, encouraging industries to adopt these solutions to meet environmental targets. This alignment with sustainability goals accelerates the adoption of digital twins across various sectors, including manufacturing, energy, and urban planning.

MARKET CHALLENGES

Integration with Legacy Systems

A significant challenge in the European digital twin market is the integration of advanced digital twin solutions with existing legacy systems. Many organizations, particularly in manufacturing and utilities, rely on older infrastructure that lacks compatibility with modern digital technologies. The European Commission has identified that approximately 54% of small and medium-sized enterprises (SMEs) in Europe are only at a basic level of digital intensity, complicating the adoption of advanced solutions. Bridging this gap requires costly upgrades and extensive customization, creating a barrier for businesses seeking to implement digital twin systems seamlessly.

Skills Gap and Workforce Training

The shortage of skilled professionals proficient in implementing and managing digital twin technologies is another major challenge. Eurostat data shows that over 37% of European businesses reported difficulties in filling ICT-related roles, highlighting a broader skills gap in digital competencies. The complexity of digital twin systems, which require expertise in data analytics, IoT integration, and simulation software, further exacerbates this issue. Without adequate workforce training and education programs, many organizations face hurdles in deploying these technologies effectively, hindering the full potential of the digital twin market in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.67 % |

|

Segments Covered |

By Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Eaton Corp PLC, Gentex Corp, Halma PLC, Hitachi Ltd, Honeywell International Inc, Iteris Inc |

SEGMENT ANALYSIS

Industry Insights

The automotive and transportation segment accounted for 40.7% of the European digital twin market share in 2024. The dominating position of automotive and transportation segment in the European market is attributed to the industry's reliance on advanced technologies to enhance vehicle design, production, and performance. For instance, Volkswagen employs digital twins to simulate crash tests, reducing development time by 30% and saving €50 million annually, as stated in their innovation report. The shift toward electric vehicles (EVs) has further accelerated adoption, with companies using digital twins to optimize battery performance and charging infrastructure. According to the European Automobile Manufacturers' Association, EV production supported by digital twin technologies has increased by 45% in the past three years. Additionally, the integration of autonomous driving systems requires precise simulations, making digital twins indispensable. A study by KPMG highlights that automotive companies leveraging digital twins have achieved a 20% reduction in prototyping costs, solidifying the sector's leadership in the market.

The healthcare is anticipated to witness the fastest CAGR in the European digital twin market over the forecast period owing to the increasing demand for personalized medicine and remote patient monitoring. For example, Philips Healthcare uses digital twins to create virtual replicas of patients' organs, enabling tailored treatment plans and reducing diagnostic errors by 25%, as per their clinical outcomes report. The aging population in Europe further fuels adoption, with the European Health Parliament projecting a 30% increase in healthcare spending by 2030. Additionally, the COVID-19 pandemic highlighted the importance of digital health solutions, accelerating investments in digital twin technologies. According to a study by Deloitte, hospitals using digital twins for resource allocation have reported a 20% improvement in operational efficiency. These factors position healthcare as a dynamic and rapidly expanding segment within the digital twin market.

Country Level Analysis

Germany captured the dominating position in the European digital twin market by holding 26.2% of the European market share in 2024. The leading position of Germany in the European market is driven by its robust industrial base and commitment to Industry 4.0 initiatives. For instance, Siemens, headquartered in Munich, has pioneered the use of digital twins in manufacturing, achieving a 30% reduction in production costs, as stated in their innovation strategy document. The German government's investment in smart factories and IoT infrastructure has further propelled adoption, with the Federal Ministry for Economic Affairs allocating €5 billion to digital transformation projects. According to Statista, over 60% of German companies have integrated digital twins into their operations, citing their ability to enhance efficiency and competitiveness. Additionally, the presence of world-class research institutions fosters innovation, ensuring Germany remains at the forefront of technological advancements in the digital twin space.

France is a promising market for digital twin in the European region. The strong emphasis of France on digital innovation and sustainability drives its prominence in this domain. For example, Renault utilizes digital twins to optimize its production lines, reducing energy consumption by 15%, as highlighted in their environmental impact report. The French government's "France Relance" initiative, which allocates €30 billion to digital transformation, has accelerated the adoption of digital twin technologies across industries. According to the French National Institute of Statistics and Economic Studies, the adoption rate of digital twins in France grew by 50% in the past two years, reflecting the country's proactive approach. Furthermore, partnerships between academic institutions and private enterprises foster cutting-edge research, enabling France to maintain its competitive edge in the European market.

Top 3 Players in the market

The European digital twin market is led by Siemens AG, Dassault Systèmes, and General Electric. Siemens AG contributes significantly to the global market by providing end-to-end digital twin solutions, with a focus on industrial automation. Dassault Systèmes excels in offering simulation and modeling tools, with its 3DEXPERIENCE platform being adopted by over 50% of Fortune 500 companies, as per their market analysis. General Electric plays a pivotal role in the energy and healthcare sectors, leveraging digital twins to optimize turbine performance and patient care. According to GE's sustainability report, their digital twin solutions have contributed to a 20% reduction in operational costs globally.

Top strategies used by the key market participants

Key players in the European digital twin market employ strategies such as strategic partnerships, acquisitions, and R&D investments to strengthen their positions. For instance, Siemens AG collaborates with Microsoft to integrate its digital twin platform with Azure cloud services, enhancing scalability and accessibility. Dassault Systèmes focuses on acquiring niche startups to expand its portfolio, as seen in its acquisition of Medidata Solutions for €5 billion. General Electric invests heavily in R&D, dedicating €2 billion annually to develop advanced digital twin applications, as stated in their innovation roadmap.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The key players of the Europe Digital Twin Market include Accenture plc, Capgemini SE, IBM Corporation, Infosys Limited, Microsoft Corporation, Oracle Corporation, PTC Inc., SAP SE, SAS Institute, TIBCO Software Inc., Wipro Limited, ABB Group, Ansys Inc., Autodesk, Inc., AVEVA Group plc, Bentley Systems, Incorporated, Dassault Systèmes, General Electric Company, Robert Bosch GmbH, Rockwell Automation, Schneider Electric SE, Siemens AG., and Others.

The European digital twin market is highly competitive, characterized by the presence of global giants and regional innovators. Siemens AG, Dassault Systèmes, and General Electric dominate the landscape, leveraging their expertise in industrial automation, simulation, and energy solutions. According to a study by Roland Berger, the market is fragmented, with numerous players focusing on niche applications such as healthcare and smart cities. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

In June 2023, Siemens AG partnered with SAP to integrate digital twin solutions with enterprise resource planning systems, aiming to streamline industrial operations.

In March 2023, Dassault Systèmes acquired Hexagon AB, a provider of 3D measurement technologies, to enhance its simulation capabilities.

In January 2024, General Electric launched a new digital twin platform for renewable energy, designed to optimize wind turbine performance.

In September 2023, ABB collaborated with IBM to incorporate AI-driven analytics into its digital twin offerings, targeting predictive maintenance applications.

In November 2023, Schneider Electric invested €1 billion in developing digital twin solutions for smart cities, focusing on energy efficiency and sustainability.

MARKET SEGMENTATION

This research report on the Europe Digital Twin Market is segmented and sub-segmented into the following categories.

By Industry

- Automotive & Transportation

- Healthcare

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the future outlook for the Europe Digital Twin Market?

The market is expected to grow rapidly, with increasing adoption across industries, advancements in AI integration, and support from governments for digital transformation and sustainability goals.

What is the current size of the Europe Digital Twin Market?

The market is growing significantly, with projections indicating strong expansion from 2025 to 2033, driven by IoT adoption and digital transformation initiatives.

Which industries are driving the growth of the Europe Digital Twin Market?

Industries driving the growth include manufacturing, healthcare, energy and utilities, automotive, transportation, aerospace, and smart cities.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]