Europe Digital Transformation Market Size, Share, Trends, & Growth Forecast Report Segmented By Solution (Big Data & Analytics, Artificial Intelligence (AI), Cyber Security, Cloud Computing, Mobility, Social Media, and Others (Internet-of-Things (IoT), Blockchain, Business Intelligence)), Service, Deployment, Enterprise Size, and End-use, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Digital Transformation Market Size

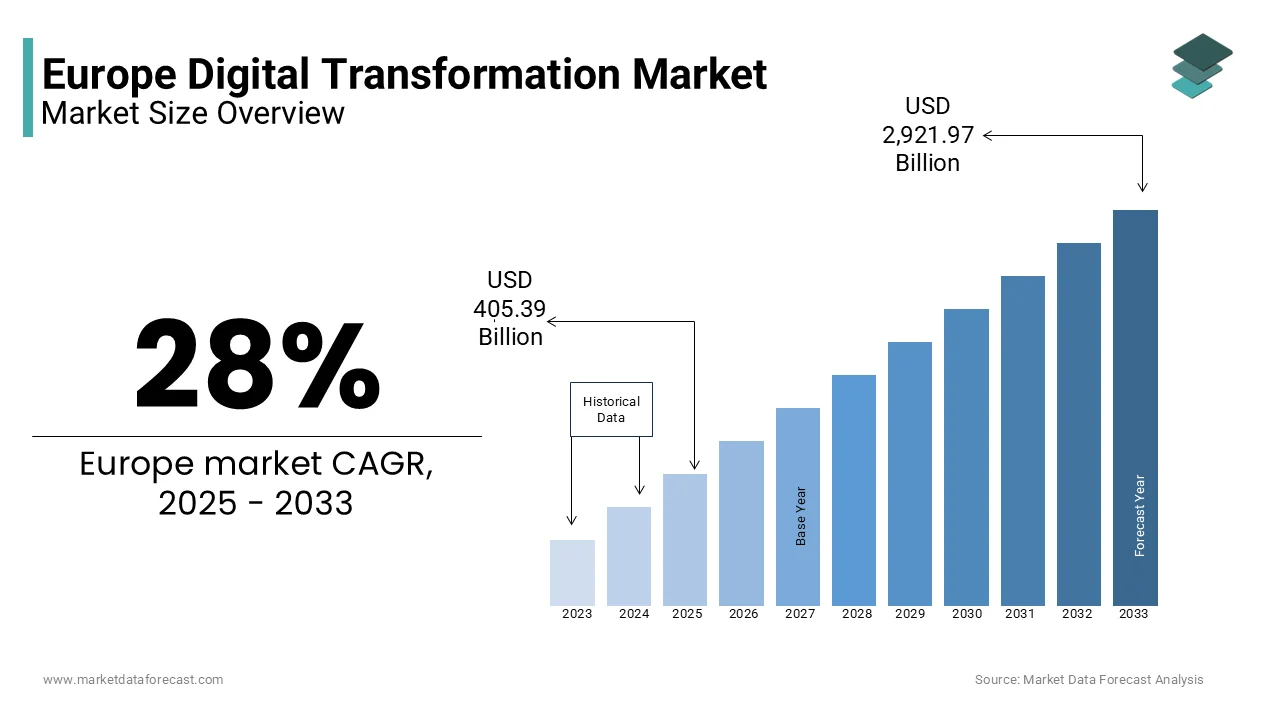

The Europe digital transformation market was valued at USD 316.68 billion in 2024. The European market is estimated to reach USD 2,921.97 billion by 2033 from USD 405.39 billion in 2025, rising at a CAGR of 28% from 2025 to 2033.

Digital transformation refers to the adoption of digital tools, platforms, and processes to enhance efficiency, innovation, and customer experiences. In Europe, this market growth is fueled by the increasing demand for cloud computing, artificial intelligence, big data analytics, Internet of Things (IoT), and cybersecurity solutions. The region’s commitment to becoming a global leader in digital innovation is evident through initiatives such as the European Union’s Digital Single Market strategy, which aims to foster seamless digital services across member states.

Key sectors driving this growth include healthcare, manufacturing, retail, and financial services, where digital tools are revolutionizing traditional workflows. For instance, the adoption of AI in healthcare is projected to save European economies over €200 billion annually by 2030, as per the European Commission. Additionally, the manufacturing sector is leveraging IoT and automation to enhance productivity, with Germany leading the charge as Europe’s largest industrial hub.

Despite these advancements, challenges such as data privacy concerns, regulatory complexities, and the digital skills gap persist. However, with robust government support and private sector investments, Europe is poised to remain at the forefront of global digital transformation efforts.

MARKET DRIVERS

Sustainability and Green Technologies

The European Green Deal, spearheaded by the European Commission, is a major driver of digital transformation in Europe that is by aiming to achieve climate neutrality by 2050. Digital technologies such as IoT, AI, and big data are pivotal in optimizing energy use, reducing emissions, and enabling smart infrastructure. According to the European Environment Agency, digital solutions could cut greenhouse gas emissions by up to 20% by 2030. For example, smart grids and energy management systems are gaining traction, with investments in smart energy projects surpassing €50 billion in 2022, as reported by the International Energy Agency. These technologies are transforming industries like energy and manufacturing, by promoting efficiency and sustainability.

Demand for Digital Public Services

The growing expectation for seamless digital public services is another factor that is driving the growth of the Europe digital transformation market. The European Union’s Digital Economy and Society Index (DESI) reveals that 84% of Europeans use the internet regularly is fueling demand for online government services. The EU’s eGovernment Action Plan aims to make all key public services available online by 2030. Eurostat data shows that over 70% of EU citizens used online public services in 2022, up from 50% in 2015.

MARKET RESTRAINTS

Data Privacy and Regulatory Challenges

Data privacy concerns and stringent regulatory frameworks are significant restraints in Europe’s digital transformation market. The General Data Protection Regulation (GDPR), enforced by the European Union, imposes strict rules on data handling, which can increase compliance costs and complexity for businesses. According to the European Data Protection Board, GDPR-related fines exceeded €1.6 billion in 2022 with the financial risks of non-compliance. Additionally, a survey by the European Commission found that 65% of businesses consider GDPR compliance a major challenge, particularly for small and medium-sized enterprises (SMEs). These regulations, while essential for protecting consumer rights, can slow down innovation and deter investments in digital initiatives.

Digital Skills Gap

The shortage of digital skills across Europe is a critical barrier to digital transformation. The European Commission’s Digital Economy and Society Index (DESI) reports that 42% of Europeans lack basic digital skills, while only 26% possess advanced skills. This gap is particularly pronounced in sectors like cybersecurity and AI, where demand for skilled professionals far exceeds supply. According to Eurostat, over 70% of businesses in the EU faced difficulties recruiting ICT specialists in 2022. The European Centre for the Development of Vocational Training estimates that by 2030, Europe could face a shortage of 8 million ICT workers. This skills gap hampers the adoption of advanced technologies and limits the region’s ability to fully capitalize on digital transformation opportunities.

MARKET OPPORTUNITIES

Expansion of 5G and Connectivity Infrastructure

The rollout of 5G networks across Europe presents a significant opportunity for digital transformation. The European Commission’s 5G Action Plan aims to ensure uninterrupted 5G coverage in all urban areas and major transport routes by 2025. According to the European Telecommunications Network Operators’ Association, 5G coverage in Europe reached 62% of the population in 2023, with investments in 5G infrastructure exceeding €30 billion. Enhanced connectivity will enable innovations in smart cities, autonomous vehicles, and IoT applications, driving economic growth. The European Commission estimates that 5G could contribute €150 billion annually to the EU economy by 2025 is creating new opportunities for businesses and public services to leverage high-speed, low-latency networks.

Growth of Artificial Intelligence and Automation

The adoption of artificial intelligence (AI) and automation technologies offers immense potential for Europe’s digital transformation. The European Union’s Coordinated Plan on AI aims to boost annual AI investments to €20 billion by 2030 is fostering innovation across sectors. According to Eurostat, AI adoption in European businesses increased by 25% between 2020 and 2023, with the manufacturing and healthcare sectors leading the way. The European Commission predicts that AI could add €2.7 trillion to the EU’s GDP by 2030. Automation in manufacturing, is expected to improve productivity by 20%, as per the European Parliamentary Research Service.

MARKET CHALLENGES

Cybersecurity Threats and Vulnerabilities

Cybersecurity risks pose a significant challenge to Europe’s digital transformation efforts. The European Union Agency for Cybersecurity (ENISA) reported a 47% increase in cyberattacks across the EU in 2022, with ransomware and phishing being the most prevalent threats. According to Eurostat, 40% of European businesses experienced at least one cyber incident in 2022 by costing the economy an estimated €265 billion annually. The growing reliance on digital infrastructure in critical sectors like healthcare and energy that amplifies the potential impact of cyberattacks. Despite the EU’s Cybersecurity Strategy and the NIS2 Directive, many organizations struggle to implement robust security measures by leaving them vulnerable to disruptions and financial losses.

Fragmented Digital Policies Across Member States

The lack of harmonized digital policies across EU member states is a major challenge. While the European Union promotes a Digital Single Market, disparities in national regulations and implementation hinder seamless cross-border digital services. According to the European Commission’s Digital Economy and Society Index (DESI), only 60% of EU countries have aligned their digital strategies with the EU’s broader goals. For instance, varying data localization laws and differing standards for digital taxation create operational complexities for businesses. Achieving policy coherence remains critical to unlocking the full potential of Europe’s digital transformation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

28% |

|

Segments Covered |

By Solution, Service, Deployment, Enterprise Size, End-use, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Accenture plc, Adobe Systems Inc., Broadcom, Inc., Cisco Systems, Inc., Dell EMC, Dempton Consulting Group, Google Inc., Happiest Minds, Hewlett Packard Enterprise Co., International Business Machines Corporation, Kellton Tech Solutions Ltd., Microsoft Corporation, Salesforce, Inc., SAP SE, and TIBCO Software are some of the major players in the Europe digital transformation market. |

SEGMENTAL ANALYSIS

By Solution Insights

The cloud computing segment dominated Europe’s digital transformation market with an estimated share of share of 30.3% in 2024. The growth of the segment is driven by its scalability, cost-efficiency, and ability to support remote work and digital services. Eurostat reports that 65% of EU enterprises used cloud services in 2022, up from 50% in 2018. The EU’s Gaia-X initiative further strengthens this segment by promoting secure and interoperable cloud infrastructure. Cloud computing is enabling data storage, processing, and analytics by making it indispensable for industries like finance, healthcare, and public administration.

The AI segment is likely to achieve a CAGR of 25.5% during the forecast period. This rapid growth is driven by AI’s transformative potential across sectors, including healthcare, manufacturing, and autonomous vehicles. The EU’s Coordinated Plan on AI aims to boost annual investments to €20 billion by 2030. According to Eurostat, AI adoption in businesses increased by 25% between 2020 and 2023. AI’s ability to enhance efficiency, reduce costs, and enable innovation makes it a key driver of economic growth, contributing an estimated €2.7 trillion to the EU’s GDP by 2030, as per the European Parliamentary Research Service.

By Service Insights

The professional services dominated the digital transformation services market in Europe by holding 35.7% in 2024. The growth of the segment is driven by its role in providing strategic guidance, consulting, and managed services, which are essential for businesses navigating complex digital transitions. Eurostat reports that 60% of European businesses relied on external consultants for digital transformation projects in 2022. Professional services ensure compliance with regulations like GDPR, optimize technology investments, and drive innovation. Their importance lies in enabling organizations to adapt to digital trends that will enhance operational efficiency, and achieve long-term growth in a competitive market.

The implementation and integration services segment is likely to hit a CAGR of 18.4% from 2025 to 2033ss. This growth is driven by the increasing complexity of digital ecosystems and the need for seamless integration of technologies like cloud computing, IoT, and big data analytics. According to Eurostat, 70% of EU enterprises faced challenges in integrating new digital tools in 2022, with the demand for specialized services. Implementation and integration ensure operational synergy, scalability, and interoperability, making them indispensable for businesses aiming to maximize the value of their digital investments and stay competitive.

By Deployment Insights

The hosted (cloud-based) deployment model segment was the largest with dominant share of the Europe digital transformation market in 2024. The growth of the segment is due to its cost-effectiveness, scalability, and ease of access. Businesses prefer cloud solutions to reduce upfront infrastructure costs and leverage remote work capabilities. The global shift toward digital transformation, accelerated by the COVID-19 pandemic, has further boosted cloud adoption.

The hosted (cloud-based) deployment model segment is likely to gain huge traction with a CAGR of 17.5% from 2025 to 2033. This growth is driven by increasing demand for SaaS solutions, AI-driven cloud services, and hybrid work models. The U.S. Bureau of Labor Statistics notes that 85% of enterprises now use cloud services is emphasizing their importance in enhancing operational efficiency and innovation. According to the National Institute of Standards and Technology (NIST), cloud adoption reduces IT costs by up to 40% is making it a strategic priority for businesses worldwide.

By Enterprise Size Insights

The large enterprise segment dominated the Europe digital transformation market share in 2024 due to its ability to invest heavily in both cloud and on-premise solutions, ensuring scalability, security, and compliance. According to the U.S. Department of Commerce, 70% of large enterprises have adopted multi-cloud strategies to optimize operations. Their focus on digital transformation and innovation drives demand for advanced technologies like AI and big data analytics. Large enterprises are critical in shaping market trends, with their investments influencing the development of cutting-edge solutions.

The SMEs segment is anticipated to hit a significant CAGR of 20.3% during the forecast period. This growth is driven by the affordability, scalability, and ease of use of cloud solutions. The U.S. Small Business Administration reports that 85% of SMEs now use at least one cloud-based application, enabling them to compete with larger enterprises. Cloud adoption reduces IT costs by up to 40%, as per the National Institute of Standards and Technology (NIST), making it a strategic priority for SMEs.

By End-use Insights

The IT & Telecom sector held the dominant share of the Europe digital transformation market in 2024. The growth of the segment can be driven by the need for scalable, flexible, and cost-efficient solutions to support 5G deployment, IoT services, and data-intensive applications. According to the U.S. Federal Communications Commission (FCC), 80% of telecom companies have adopted cloud technologies to enhance network performance and customer experience.

The Healthcare sector is anticipated to witness a CAGR of 20.3% in the coming years. This growth is fueled by the increasing adoption of telemedicine, electronic health records (EHR), and data analytics to improve patient care and operational efficiency. The HHS reports that 70% of healthcare providers now use cloud-based EHR systems with the sector’s shift toward digital transformation. Cloud adoption in healthcare is critical for enabling remote patient care by ensuring data interoperability, and reducing costs by making it a cornerstone of modern healthcare delivery.

REGIONAL ANALYSIS

Germany dominated the Europe’s digital transformation market with a 25.3% of share in 2024. The country’s growth is ascribed to be driven by its advanced industrial base and focus on Industry 4.0, integrating IoT, AI, and automation into manufacturing. Germany’s digital transformation investments are growing with strong government initiatives and private sector innovation.

The UK digital transformation market is likely to gain huge traction with an expected CAGR of 12.3% during the forecast period. The country’s growth is attributed with its thriving fintech sector, supportive government policies, and a vibrant startup ecosystem. The UK’s focus on digital infrastructure and innovation has made it a key player in Europe’s digital transformation journey.

France is esteemed to have steady growth in the next coming years. The country’s emphasis on AI research, cloud adoption, and digital public services has driven its growth. France’s strategic investments in digital technologies have amplified its position as a leader in Europe’s digital transformation landscape.

KEY MARKET PLAYERS

Accenture plc, Adobe Systems Inc., Broadcom, Inc., Cisco Systems, Inc., Dell EMC, Dempton Consulting Group, Google Inc., Happiest Minds, Hewlett Packard Enterprise Co., International Business Machines Corporation, Kellton Tech Solutions Ltd., Microsoft Corporation, Salesforce, Inc., SAP SE, and TIBCO Software are some of the major players in the Europe digital transformation market.

MARKET SEGMENTATION

This research report on the Europe digital transformation market is segmented and sub-segmented into the following categories.

By Solution

- Big Data & Analytics

- Artificial Intelligence (AI)

- Cyber Security

- Cloud Computing

- Mobility

- Social Media

- Others (Internet-of-Things (IoT), Blockchain, Business Intelligence)

By Service

- Professional Services

- Implementation & Integration

By Deployment

- Hosted

- On-premise

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By End-use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others (Education, Media & Entertainment, Transportation, Travel & Hospitality)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of digital transformation in Europe?

The key drivers include government initiatives for digitalization, increasing adoption of cloud computing, the rise of AI and automation, growing cybersecurity concerns, and demand for enhanced customer experience.

Which technologies are shaping the digital transformation market in Europe?

Cloud computing, artificial intelligence, big data analytics, cybersecurity solutions, blockchain, and the Internet of Things (IoT) are among the most influential technologies driving transformation.

How is cybersecurity influencing digital transformation in Europe?

With the rise in cyber threats, businesses are investing in advanced security measures such as zero-trust architecture, encryption, and AI-driven threat detection to comply with strict EU data protection laws.

What is the future outlook for Europe’s digital transformation market?

The market is expected to continue growing with increased adoption of AI, 5G, quantum computing, and edge computing, along with a stronger focus on sustainability, cybersecurity, and digital inclusion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com