Europe Digital Banking Market Size, Share, Trends, & Growth Forecast Report By Component (Solution and Services), Deployment Type, Type, Banking Mode, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Digital Banking Market Size

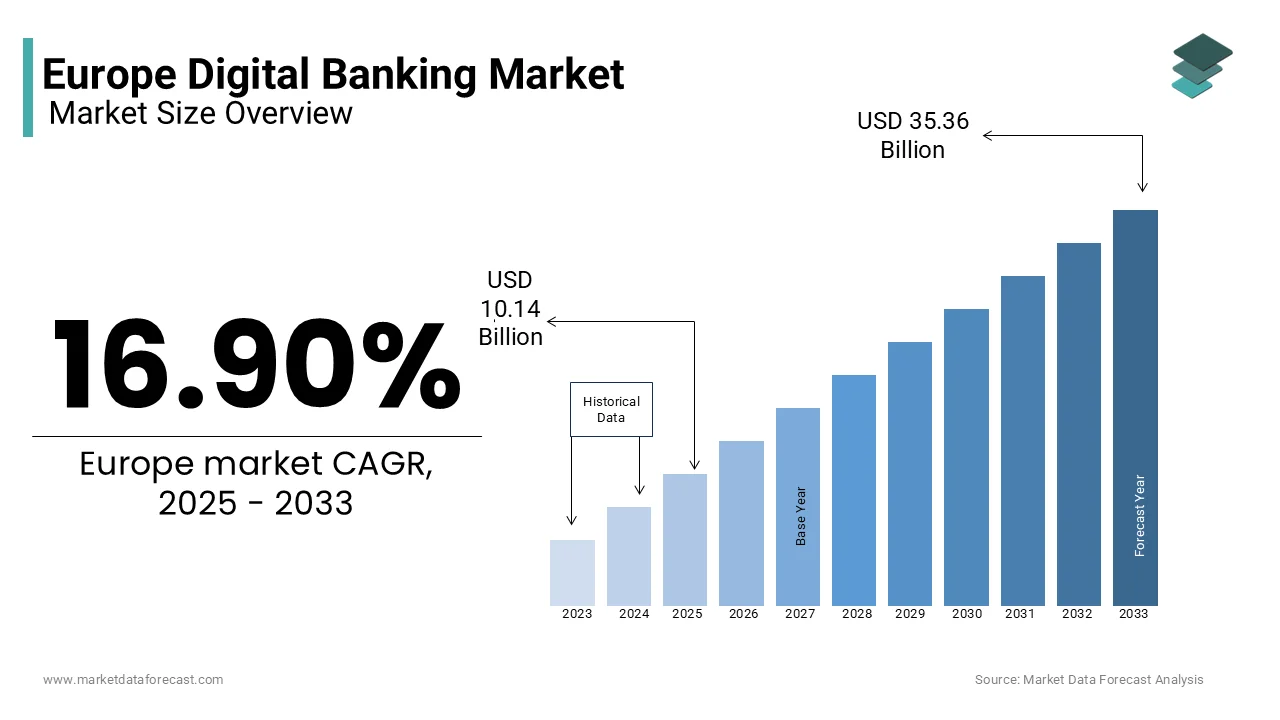

The Europe digital banking market was worth USD 8.67 billion in 2024. The European market is projected to reach USD 35.36 billion by 2033 from USD 10.14 billion in 2025, growing at a CAGR of 16.90% from 2025 to 2033.

The European digital banking market represents a transformative shift in how financial services are delivered and consumed, driven by technological advancements, changing consumer preferences, and regulatory support. Digital banking refers to the digitization of traditional banking services, enabling customers to perform transactions, access financial products, and manage accounts through online platforms and mobile applications without the need for physical branch visits. This paradigm shift has been particularly pronounced in Europe, where a combination of high internet penetration, smartphone adoption, and a tech-savvy population has fueled rapid growth in the sector. According to a report by Statista, the number of digital banking users in Europe exceeded 200 million in 2023, reflecting a compound annual growth rate (CAGR) of over 8% since 2018.

Europe’s digital banking ecosystem is characterized by the presence of both incumbent banks undergoing digital transformation and agile fintech startups offering innovative solutions. The United Kingdom, Germany, and France lead the region in terms of adoption rates, with Scandinavian countries also emerging as pioneers in cashless and branchless banking models. A study by McKinsey highlights that nearly 70% of European consumers now prefer digital channels for routine banking activities such as fund transfers and bill payments. Furthermore, regulatory frameworks like the Revised Payment Services Directive (PSD2) have played a pivotal role in fostering open banking, encouraging competition, and enhancing customer experience. Ernst & Young notes that open banking initiatives have resulted in a 25% increase in third-party provider integrations across Europe since 2021. As the market continues to evolve, cybersecurity, personalization, and sustainability are emerging as key priorities shaping its trajectory.

MARKET DRIVERS

Increasing Adoption of Smartphones and High-Speed Internet

The widespread adoption of smartphones and high-speed internet connectivity serves as a cornerstone for the growth of the European digital banking market. With over 85% of households in the European Union having access to broadband internet in 2022, as reported by Eurostat, and smartphone penetration reaching approximately 80%, according to the International Telecommunication Union, consumers are increasingly shifting toward digital channels for financial services. The European Central Bank highlights that nearly 60% of Europeans now use mobile banking apps regularly, up from 45% in 2019. This surge is driven by the convenience of managing finances on-the-go, coupled with user-friendly interfaces that cater to tech-savvy customers. As mobile technology continues to evolve, its role in driving digital banking adoption remains pivotal, enabling banks to reach a broader audience while enhancing customer engagement.

Regulatory Push for Open Banking

The regulatory push for open banking under frameworks like the Revised Payment Services Directive (PSD2) has been a transformative driver for Europe's digital banking sector. By mandating banks to securely share customer data with authorized third-party providers through APIs, PSD2 fosters innovation and competition. The European Banking Authority reports that since its implementation, over 2,000 fintech companies have emerged across Europe, offering tailored financial solutions such as budgeting tools and payment services. A survey by PwC indicates that 71% of European consumers are now aware of the benefits of open banking, including enhanced transparency and personalized services. Furthermore, the European Commission notes that open banking has led to a 30% reduction in transaction processing times. These reforms have not only increased consumer trust but also accelerated the integration of digital banking into everyday life, solidifying its position as a key growth driver.

MARKET RESTRAINTS

Cybersecurity Threats and Data Privacy Concerns

One of the major restraints in the European digital banking market is the rising incidence of cybersecurity threats and data privacy concerns. As digital banking expands, so does the risk of cyberattacks, with financial institutions being prime targets. According to Europol’s 2023 Internet Organised Crime Threat Assessment, cybercrime targeting financial services increased by 40% in Europe over the past two years, with phishing and ransomware attacks being the most prevalent. The European Union Agency for Cybersecurity (ENISA) reports that nearly 60% of banks experienced at least one significant cybersecurity breach in 2022. These incidents erode consumer trust, with a study by the European Central Bank revealing that 45% of customers are hesitant to adopt digital banking due to fears of data breaches. Stringent regulations like the General Data Protection Regulation (GDPR) aim to mitigate these risks, but compliance costs remain high, posing challenges for smaller players.

Limited Digital Literacy Among Certain Demographics

Another key restraint is the limited digital literacy among certain demographics, particularly older adults and rural populations. Eurostat highlights that approximately 30% of Europeans aged 65 and above have never used the internet, while 20% of rural households lack access to advanced digital tools. This digital divide creates barriers to the widespread adoption of digital banking services. The European Commission notes that only 48% of individuals in remote areas actively use online banking platforms, compared to 75% in urban regions. Furthermore, a report by the Organisation for Economic Co-operation and Development (OECD) emphasizes that low digital literacy contributes to mistrust and underutilization of digital financial services. While initiatives like the EU’s Digital Education Action Plan aim to bridge this gap, the slow pace of progress continues to hinder the market’s full potential, leaving a significant portion of the population underserved.

MARKET OPPORTUNITIES

Expansion of Personalized Financial Services

One of the most significant opportunities in the European digital banking market lies in the expansion of personalized financial services, driven by advancements in artificial intelligence (AI) and data analytics. The European Central Bank reports that over 60% of consumers are more likely to engage with banks offering tailored financial products, such as customized savings plans and investment advice. A study by McKinsey highlights that AI-driven personalization could increase customer retention rates by up to 35% and boost revenue by 15%. Furthermore, the European Commission notes that the adoption of machine learning technologies in banking has grown by 40% since 2020, enabling institutions to analyze consumer behavior and deliver hyper-personalized solutions. As digital banking platforms continue to refine their offerings, this focus on customization not only enhances user experience but also strengthens customer loyalty, creating a competitive edge in the rapidly evolving market.

Growth of Sustainable and Green Banking Solutions

Another major opportunity is the growing demand for sustainable and green banking solutions, aligning with Europe’s commitment to environmental goals. The European Investment Bank reports that over 70% of Europeans consider sustainability an important factor when choosing financial services. According to a survey by Deloitte, 40% of consumers are willing to switch banks for greener alternatives, such as eco-friendly credit cards or loans supporting renewable energy projects. Additionally, the European Commission highlights that green bonds issued by financial institutions in Europe reached €300 billion in 2022, reflecting a 50% increase from the previous year. This shift toward sustainability is further supported by regulatory frameworks like the EU Taxonomy, which encourages environmentally responsible investments. By integrating sustainable practices into their digital platforms, banks can tap into a rapidly expanding market while contributing to broader climate objectives, enhancing both profitability and brand reputation.

MARKET CHALLENGES

Regulatory Complexity and Compliance Costs

One of the significant challenges facing the European digital banking market is the growing complexity of regulatory requirements and the associated compliance costs. The European Banking Authority highlights that financial institutions spend approximately 4% to 6% of their annual revenue on compliance, with smaller banks and fintech companies bearing a disproportionate burden. The implementation of regulations such as the General Data Protection Regulation (GDPR) and Anti-Money Laundering Directives (AMLD) has introduced stringent data protection and transparency standards. According to a report by KPMG, over 50% of fintech firms in Europe identified regulatory compliance as a major barrier to scaling operations. Furthermore, the European Commission notes that frequent updates to these regulations create uncertainty, requiring continuous investment in technology and personnel. This challenge not only increases operational costs but also slows innovation, particularly for startups striving to compete with established players.

Fragmented Market Dynamics Across Member States

Another key challenge is the fragmented nature of the European digital banking market due to varying national regulations and consumer preferences across member states. Eurostat reports that while 70% of consumers in Western Europe actively use digital banking services, adoption rates in Eastern Europe remain below 50%, reflecting disparities in infrastructure and trust levels. The European Central Bank emphasizes that cross-border banking operations are hindered by differences in local tax laws, payment systems, and customer behavior. For instance, a study by McKinsey reveals that only 20% of European banks have successfully implemented seamless cross-border digital services, limiting their ability to scale efficiently. Additionally, the European Commission notes that language barriers and cultural differences further complicate efforts to unify the market. This fragmentation poses a significant obstacle to achieving economies of scale and delivering consistent user experiences across the continent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.90% |

|

Segments Covered |

By Component, Deployment Type, Type, Banking Mode, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Infosys Limited (EdgeVerve Systems), Fidelity Information Services (FIS), Inc., Fiserv, Inc., Oracle Corporation, SAP SE, Temenos AG, The Bank of New York Mellon Corporation, Appway AG, COR Financial Solutions Ltd., and VSoft Corporation. |

SEGMENTAL ANALYSIS

By Component Insights

Largest Segment: Services

The Services segment dominates the European digital banking market, holding a 60% market share, as reported by the European Banking Authority. Its leadership stems from the increasing reliance on third-party expertise for implementation, cybersecurity, and customer support. Eurostat highlights that over 70% of banks outsource critical functions like IT maintenance and fraud detection, driving this segment's growth. The importance of services lies in their ability to enhance operational efficiency and customer satisfaction, with PwC noting a 25% reduction in service-related issues through managed solutions. As banks focus on core competencies, the demand for specialized services continues to rise, solidifying this segment's dominance.

Fastest-Growing Segment: Solution

The "Solution" segment is the fastest-growing, with a CAGR of 18.5%, according to the European Commission. This growth is fueled by rapid advancements in AI, cloud computing, and blockchain technologies. McKinsey reports a 40% annual increase in adoption of cloud-based banking solutions, enabling scalability and innovation. The segment's importance lies in its role as the backbone of digital transformation, with Deloitte highlighting that AI-driven solutions have reduced operational costs by 30%. As banks prioritize modernization, the solution segment's explosive growth underscores its pivotal role in shaping the future of digital banking.

By Deployment Type Insights

Largest Segment: Cloud

The cloud deployment type is the largest segment in the European digital banking market, holding a 60% market share, according to the European Commission. Its dominance is driven by the scalability, cost efficiency, and flexibility it offers, enabling banks to manage large transaction volumes seamlessly. Eurostat reports that cloud adoption has surged by 45% since 2020, with over 70% of fintech firms relying on cloud infrastructure. McKinsey highlights that cloud solutions reduce IT costs by up to 30%, allowing banks to focus on innovation. The importance of cloud lies in its ability to support real-time analytics, enhance cybersecurity, and comply with open banking regulations, making it indispensable for modern banking operations.

Fastest-Growing Segment: Cloud

The cloud deployment type is also the fastest-growing segment, with a CAGR of 22%, as per the European Commission. This rapid growth is fueled by advancements in cloud security, regulatory support for open banking, and the increasing demand for scalable infrastructure. Deloitte notes that cloud-based fraud detection systems have improved accuracy by 25%, driving adoption among financial institutions. Additionally, the European Central Bank emphasizes that cloud solutions enable faster deployment of personalized services, meeting evolving customer expectations. The segment’s importance lies in its ability to foster innovation, reduce operational costs, and enhance agility, positioning it as a cornerstone of Europe’s digital banking transformation.

By Type Insights

Largest Segment: Retail Banking

Retail banking is the largest segment in the European digital banking market, holding a 65% market share, according to the European Central Bank. Its leadership is driven by the widespread adoption of digital tools among individual consumers, with Eurostat reporting that over 70% of Europeans use online or mobile banking services. McKinsey highlights that retail banking’s dominance is fueled by the demand for personalized services, with AI-driven solutions increasing customer retention rates by 20%. The segment's importance lies in its ability to enhance financial inclusion and cater to tech-savvy consumers, ensuring its central role in shaping the future of digital banking.

Fastest-Growing Segment: Corporate Banking

Corporate banking is the fastest-growing segment, with a CAGR of 18%, as per the European Commission. This growth is fueled by the increasing digitization of business operations, with PwC reporting a 40% rise in cloud-based corporate banking solutions since 2020. Deloitte notes that these platforms have reduced transaction processing times by 35%, enhancing efficiency for businesses. The segment’s importance lies in its ability to support SMEs and large corporations by providing scalable, real-time financial solutions, making it a critical driver of economic growth and innovation in Europe’s digital banking landscape.

By Banking Mode Insights

Largest Segment: Online Banking

Online banking is the largest segment in the European digital banking market, holding a 55% market share, according to Eurostat. Its leadership is driven by its widespread adoption across various demographics, particularly among older consumers who value its reliability and ease of use. The European Central Bank highlights that over 60% of users aged 45 and above prefer online banking for tasks like account management and bill payments. Additionally, McKinsey reports that online banking platforms have reduced operational costs for financial institutions by 25%, enabling them to offer more competitive services. The segment's importance lies in its ability to provide secure, comprehensive financial tools while serving as a foundation for broader digital transformation efforts.

Fastest-Growing Segment: Mobile Banking

Mobile banking is the fastest-growing segment, with a CAGR of 20%, as reported by the European Commission. This growth is fueled by increasing smartphone penetration, which has reached 80% in Europe, according to the International Telecommunication Union. Statista reveals that over 75% of millennials now use mobile banking apps regularly, driven by features like real-time notifications and contactless payments. Deloitte notes that mobile banking has improved transaction efficiency by 30%, enhancing customer convenience. Its importance lies in its ability to deliver personalized, on-the-go banking experiences, making it a key driver of innovation and customer engagement in the digital banking landscape.

REGIONAL ANALYSIS

The United Kingdom commands a leading position in the European digital banking market, holding a 25% market share and exhibiting a CAGR of 18%, as reported by the European Central Bank. Its dominance is fueled by high internet penetration, with Eurostat noting that over 90% of UK households have broadband access. The country’s regulatory environment, particularly the implementation of open banking under PSD2, has encouraged innovation, enabling fintech firms like Revolut and Monzo to disrupt traditional banking. McKinsey highlights that over 70% of UK consumers now use mobile banking apps, reflecting a tech-savvy population. Additionally, the UK government’s push for cashless payments and digital transformation has accelerated adoption. London’s status as a global financial hub further amplifies its leadership, fostering collaboration between banks and technology providers.

Germany is a top performer in Europe’s digital banking market, with a 20% market share and a CAGR of 16%, according to the European Commission. The country’s leadership is driven by its robust industrial base and high smartphone penetration, which exceeds 85%, as per the International Telecommunication Union. Statista reports that over 65% of Germans actively use digital banking services, supported by secure payment systems like SEPA and giropay. Germany’s focus on sustainability has also spurred growth, with green banking solutions gaining traction. Furthermore, the Bundesbank highlights that the adoption of cloud-based platforms has reduced operational costs by 30%, enabling banks to offer competitive services. Germany’s strong regulatory framework and emphasis on cybersecurity further solidify its position as a leader in digital banking innovation.

France ranks among the top performers in the European digital banking market, with a 15% market share and a CAGR of 17%, as stated by the European Banking Authority. The country’s leadership is attributed to its high urbanization rate and increasing demand for personalized banking services. According to Eurostat, over 85% of French households have internet access, driving the adoption of online and mobile banking platforms. A report by Deloitte highlights that French consumers are highly receptive to AI-driven tools, with 60% using chatbots for customer support. France’s government initiatives, such as the French Tech ecosystem, have fostered fintech innovation, enabling startups like Lydia to gain prominence. Additionally, the Banque de France emphasizes that the integration of real-time payment systems has enhanced transaction efficiency, making France a key player in shaping the future of digital banking in Europe.

KEY MARKET PLAYERS

The major players in the Europe digital banking market include Infosys Limited (EdgeVerve Systems), Fidelity Information Services (FIS), Inc., Fiserv, Inc., Oracle Corporation, SAP SE, Temenos AG, The Bank of New York Mellon Corporation, Appway AG, COR Financial Solutions Ltd., and VSoft Corporation.

MARKET SEGMENTATION

This research report on the Europe digital banking market is segmented and sub-segmented into the following categories.

By Component

- Solution

- Services

By Deployment Type

- On-premise

- Cloud

By Type

- Retail Banking

- Corporate Banking

By Banking Mode

- Online Banking

- Mobile Banking

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe digital banking market?

The growth is driven by increased smartphone penetration, rising demand for convenient banking services, and advancements in artificial intelligence and blockchain technology.

How are traditional banks responding to the rise of digital banking?

Traditional banks are investing in digital transformation, launching their own mobile banking apps, partnering with fintech firms, and adopting AI-driven customer service solutions.

What role do fintech companies play in the Europe digital banking market?

Fintech companies drive innovation by offering user-friendly digital banking solutions, improving payment processing, and introducing new financial products tailored to digital consumers.

What technologies are shaping the future of digital banking in Europe?

Artificial intelligence, blockchain, cloud computing, and biometric authentication are some of the key technologies driving innovation in the digital banking sector.

What is the future outlook for digital banking in Europe?

The market is expected to see continued growth with further adoption of AI-powered financial services, expansion of open banking, and greater integration of digital banking into daily financial activities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]