Europe Diapers Market Size, Share, Trends & Growth Forecast Report By Product Type (Baby Diapers, Adult Diapers), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Diapers Market Size

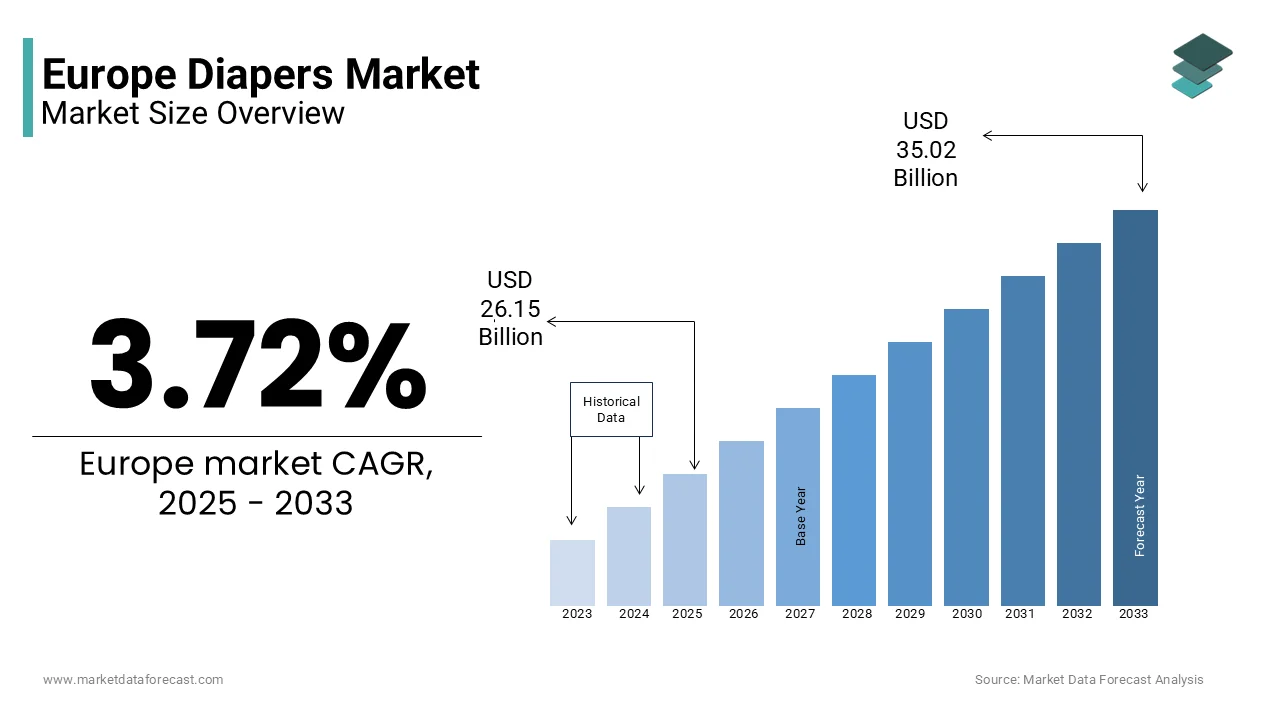

The diapers market size in Europe was valued at USD 25.21 billion in 2024. The European market is estimated to be worth USD 35.02 billion by 2033 from USD 26.15 billion in 2025, growing at a CAGR of 3.72% from 2025 to 2033.

Diapers are designed for infants, toddlers, and adults with a dual focus on functionality, comfort and sustainability. The changing consumer preferences and stringent regulatory standards are contributing to the demand for diapers worldwide. The aging population in Europe and high birth rates in certain countries further amplify demand for diapers in this region. Infant diapers dominate the overall market in Europe as this segment is strongly supported by Europe’s annual birth cohort of over 5 million babies, as reported by the European Commission. However, the adult diaper segment is witnessing rapid growth, fueled by an aging demographic over 20% of Europeans are aged 65 or above, according to Eurostat. Incontinence-related challenges among the elderly have made adult diapers indispensable, with Germany alone spending approximately €40 billion annually on geriatric care products, including incontinence aids. Sustainability has emerged as a pivotal trend, with France’s Ministry of Ecological Transition highlighting that less than 5% of consumers currently opt for biodegradable options despite growing environmental concerns.

MARKET DRIVERS

Increasing Aging Population and Geriatric Care Demand

The aging population in Europe is a significant driver of the diaper market, particularly for adult incontinence products. Eurostat reports that over 20% of Europeans are aged 65 or above, a figure projected to reach nearly 30% by 2050. This demographic shift has led to a surge in demand for adult diapers, as age-related incontinence affects approximately 25% of individuals over 60, according to the World Health Organization. Germany, with its advanced geriatric care infrastructure, spends €40 billion annually on elderly care products, including incontinence aids, as highlighted by the German Federal Ministry of Health. The growing prevalence of conditions like dementia and mobility issues further amplifies the need for reliable hygiene solutions. Governments across Europe are prioritizing affordable access to these products through healthcare subsidies, ensuring accessibility for elderly citizens and driving market growth.

Rising Birth Rates in Select Regions and Infant Hygiene Awareness

Another key driver is the steady birth rate in certain European regions, coupled with heightened awareness about infant hygiene. The European Commission notes that Europe records over 5 million births annually, sustaining demand for infant diapers. Countries like France and Ireland report higher birth rates compared to the EU average, supported by family-friendly policies such as parental leave and child benefits. Additionally, France’s National Institute of Statistics (INSEE) highlights that 95% of parents prioritize premium-quality diapers to prevent skin irritation and ensure comfort. Innovations in materials, such as ultra-absorbent and breathable fabrics, have further fueled consumer preference for high-end products. As health-conscious parenting trends grow, the demand for safe, sustainable, and effective infant diapers continues to expand, reinforcing their dominance in the European diaper market.

MARKET RESTRAINTS

Environmental Concerns and Waste Management Challenges

A significant restraint for the European diaper market is the environmental impact of disposable diapers, which contributes to landfill waste and pollution. The European Environment Agency reports that non-biodegradable hygiene products account for approximately 3% of total landfill waste in Europe, with an estimated 7 billion units discarded annually. Most diapers are made from plastics and synthetic materials that take centuries to decompose, exacerbating ecological concerns. France’s Ministry of Ecological Transition highlights that less than 5% of consumers opt for biodegradable or eco-friendly diaper options, despite growing awareness of sustainability. Governments are imposing stricter regulations on single-use plastics, increasing compliance costs for manufacturers. This regulatory pressure, combined with limited adoption of sustainable alternatives, poses a challenge to market expansion, as companies must balance affordability with environmental responsibility.

High Costs of Premium and Specialized Products

Another major restraint is the high cost of premium and specialized diapers, which limits accessibility for low-income households. Eurostat reveals that the average household expenditure on infant care products in Europe exceeds €1,200 annually, with diapers accounting for a significant portion. Germany’s Federal Ministry of Health notes that specialized products, such as those for sensitive skin or adult incontinence, are often priced 30-50% higher than standard options, making them unaffordable for many consumers. Additionally, the United Kingdom’s Office for National Statistics reports that 20% of families struggle to afford basic hygiene products due to rising living costs. While government subsidies exist in some regions, they are often insufficient to address widespread affordability issues. This financial barrier restricts market penetration, particularly among economically vulnerable populations, hindering inclusive growth.

MARKET OPPORTUNITIES

Growing Demand for Eco-Friendly and Biodegradable Diapers

A significant opportunity in the European diaper market lies in the rising demand for eco-friendly and biodegradable products, driven by heightened environmental awareness. The European Environment Agency highlights that over 60% of consumers prioritize sustainable products, yet less than 5% currently use biodegradable diapers, indicating a vast untapped potential. France’s Ministry of Ecological Transition reports that government incentives for green products have encouraged manufacturers to innovate, with biodegradable options seeing a 20% annual growth in adoption. Additionally, the UK’s Waste and Resources Action Programme (WRAP) estimates that replacing traditional diapers with biodegradable alternatives could reduce landfill waste by up to 2 million tons annually. This shift aligns with Europe’s broader sustainability goals, offering manufacturers a chance to capture a growing niche while addressing ecological concerns and enhancing brand loyalty.

Expansion of Adult Diaper Market through Healthcare Integration

The integration of adult diapers into mainstream healthcare systems presents another major opportunity, fueled by Europe’s aging population. Eurostat projects that nearly 30% of Europeans will be aged 65 or above by 2050, driving demand for incontinence solutions. Germany’s Federal Ministry of Health notes that public healthcare programs now cover adult diapers for eligible patients, improving accessibility and affordability. Furthermore, the World Health Organization estimates that age-related incontinence affects 25% of adults over 60, creating a robust market for specialized products. Innovations such as smart diapers equipped with sensors for real-time health monitoring are gaining traction, particularly in institutional settings like nursing homes. By aligning with healthcare policies and leveraging technological advancements, companies can expand their reach and cater to the evolving needs of elderly consumers, ensuring long-term growth.

MARKET CHALLENGES

Fluctuating Raw Material Costs and Supply Chain Disruptions

A significant challenge for the European diaper market is the volatility in raw material costs, exacerbated by supply chain disruptions. The European Commission reports that key materials like fluff pulp and superabsorbent polymers have seen price increases of up to 25% since 2021 due to global shortages and geopolitical tensions. These fluctuations directly impact production costs, particularly for manufacturers reliant on imported materials. Germany’s Federal Ministry for Economic Affairs highlights that small and medium-sized enterprises (SMEs) in the hygiene sector face a 15-20% rise in operational expenses, limiting their ability to compete with larger players. Additionally, transportation bottlenecks and rising fuel prices further strain supply chains, delaying product availability. These challenges create financial instability for manufacturers, making it difficult to maintain affordable pricing for consumers while ensuring consistent quality.

Limited Awareness and Adoption of Sustainable Alternatives

Another major challenge is the limited awareness and adoption of sustainable diaper alternatives, despite growing environmental concerns. France’s Ministry of Ecological Transition notes that less than 5% of European consumers actively choose biodegradable or reusable diapers, primarily due to insufficient education about their benefits and higher upfront costs. Eurostat reveals that over 70% of households still rely on conventional disposable diapers, contributing to approximately 3% of total landfill waste in Europe. Furthermore, the UK’s Waste and Resources Action Programme (WRAP) emphasizes that misconceptions about the performance and durability of eco-friendly options deter widespread adoption. Without targeted campaigns and government-led initiatives to promote sustainable choices, manufacturers face difficulties in scaling green innovations, hindering progress toward reducing the environmental footprint of the diaper market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.72% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Procter & Gamble Company, Kimberly-Clark Corporation, Essity AB, PAUL HARTMANN, SCA Group, Ontex BV, Abena A/S, The Hain Celestial Group, Inc., and others. |

SEGMENTAL ANALYSIS

Product Type Insights

The baby disposable diapers segment accounted for 70.8% of the European market share in 2024. The baby disposable diapers segment thrives due to convenience, high absorption capacity, and widespread availability. The U.S. Census Bureau highlights that over 10 million babies are born annually in the U.S. alone, driving demand. Their importance lies in addressing hygiene needs effectively, reducing skin irritation risks, and saving time for caregivers.

The adult pant-type diapers segment is expected to showcase a CAGR of 8.5% over the forecast period owing to the increasing aging populations. The WHO projects 1.4 billion people aged 60+ by 2030. Rising awareness of incontinence solutions and active lifestyles among seniors further propel demand. These products provide comfort, dignity, and ease of use, making them critical for improving quality of life.

By Distribution Channel Insights

The pharmacies segment dominated the market by accounting for 45.9% of the European market share in 2024. The role of pharmacies as trusted providers of prescription medications and OTC products is propelling the growth of the pharmacies segment in the European market. With over 80% of consumers preferring pharmacies for health-related purchases, they are critical in ensuring accessibility to essential medicines. In the U.S. alone, pharmacies generated $400 billion in revenue in 2021 (FDA). Their importance lies in offering expert advice, fostering customer trust, and serving as primary healthcare touchpoints.

The online stores segment is rapidly growing and is estimated to exhibit a CAGR of 16.3% during the forecast period owing to the rising e-commerce adoption and digital health trends. The convenience, competitive pricing, and personalized offerings of online stores is primarily driving the segmental expansion. The COVID-19 pandemic accelerated this growth, with 70% of consumers purchasing health products online in 2021 (CDC). Its importance lies in bridging gaps in healthcare access, especially in rural areas, while leveraging AI-driven recommendations to enhance customer experience.

REGIONAL ANALYSIS

Germany captured the leading share of 24.2% of the Europe diaper market share in 2024 owing to the relatively high birth rate of Germany compared to other European nations, coupled with its advanced healthcare infrastructure and strong consumer purchasing power. The demand for premium and innovative diaper products is further fueled by urbanization and awareness of hygiene standards. Additionally, Germany’s emphasis on eco-friendly and sustainable baby care products aligns with regional environmental policies, making it a hub for diaper manufacturers.

The UK is predicted to exhibit a CAGR of 3.5% over the forecast period. The UK’s obust e-commerce ecosystem has significantly contributed to this growth, enabling convenient access to premium and innovative diaper brands. Rising awareness about hygiene and child health, combined with higher disposable incomes, has further propelled demand. The UK government’s initiatives promoting parental support and childcare have also played a crucial role in sustaining this market’s expansion.

France is another notable market for diapers in Europe and is anticipated to showcase a prominent CAGR during the forecast period. The government subsidies aimed at supporting families and improving childcare facilities in France that indirectly boosts diaper consumption is driving the French market growth. Moreover, French consumers are increasingly prioritizing eco-friendly and biodegradable diapers, reflecting their commitment to sustainability. This trend has encouraged manufacturers to introduce environmentally conscious products, enhancing France’s prominence in the diaper market. The combination of supportive policies, rising urbanization, and green consumer preferences makes France a key player in the region.

KEY MARKET PLAYERS

The major key players in the Europe Diapers market are Procter & Gamble Company, Kimberly-Clark Corporation, Essity AB, PAUL HARTMANN, SCA Group, Ontex BV,Abena A/S, The Hain Celestial Group, Inc., and Others

MARKET SEGMENTATION

This research report on the Europe diapers market is segmented and sub-segmented into the following categories.

Product Type

- Baby Diapers

- Baby Disposable Diaper

- Baby Training Diaper

- Baby Cloth Diaper

- Baby Swim Pants

- Others

- Adult Diapers

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

By Distribution Channel

- Pharmacies

- Online Stores

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe diapers market from 2025 to 2033?

The Europe diapers market is expected to grow from USD 26.15 billion in 2025 to USD 35.02 billion by 2033, representing a Compound Annual Growth Rate (CAGR) of 3.72%.

2. What factors are driving the demand for adult diapers in Europe?

The increasing aging population in Europe is a significant driver, with over 20% of Europeans aged 65 or above. Age-related incontinence affects approximately 25% of individuals over 60, leading to a surge in demand for adult diapers.

3. How are environmental concerns impacting the European diaper market?

Environmental concerns, particularly regarding the waste generated by disposable diapers, are influencing consumer preferences. There is a growing demand for eco-friendly and biodegradable diaper options as consumers become more environmentally conscious.

4. What is the market share of disposable diapers in Europe?

Disposable diapers dominate the market, accounting for a significant revenue share. In 2025, disposable diapers held a revenue share of 77.99% in the Europe baby diapers market.

5. Which country in Europe has the highest birth rate, and how does it affect the diaper market?

France has the highest fertility rate among EU member states, with 1.84 live births per woman as of 2021. This higher birth rate contributes to increased demand for baby diapers in the country

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]