Europe Diamond Market Size, Share, Trends & Growth Forecast Report By Type (Natural, Synthetic), Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Diamond Market Size

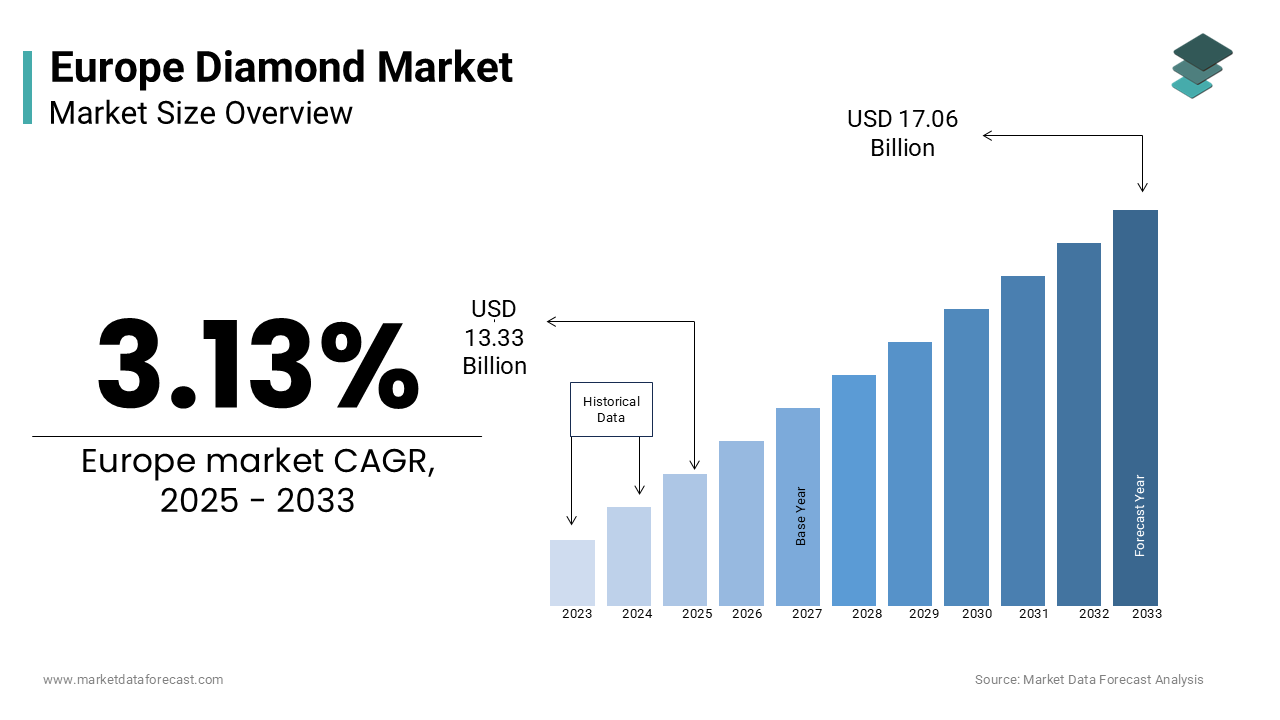

The europe diamond market was worth USD 12.93 billion in 2024. The European market is estimated to grow at a CAGR of 3.13% from 2025 to 2033 and be valued at USD 17.06 billion by the end of 2033 from USD 13.33 billion in 2025.

The Europe diamond market is experiencing steady growth and is driven by its dual appeal in luxury jewelry and industrial applications. This expansion is fueled by rising consumer spending on luxury goods, particularly among affluent demographics in Western Europe. The UK leads the regional market and is accounting for nearly 20% of Europe’s total diamond sales, as per the British Gemological Association.

A key factor shaping the market is the growing emphasis on ethically sourced and sustainable diamonds. As per Eurostat, over 60% of European consumers prioritize conflict-free diamonds, driving innovation in certifications like the Kimberley Process. Besides this, advancements in lab-grown diamonds have broadened accessibility, ensuring sustained demand across both retail and industrial sectors.

MARKET DRIVERS

Rising Demand for Luxury Jewelry

The increasing demand for luxury jewelry is one of the most significant drivers propelling the Europe diamond market forward. For instance, in France, diamond jewelry sales surged by 25% in 2022, as per the French Jewelry Federation. This trend is further amplified by the growing popularity of personalized and bespoke designs. According to the World Luxury Association, custom-made diamond jewelry accounts for 30% of all luxury purchases is reflecting heightened consumer interest in exclusivity. Also, the integration of digital platforms has enhanced customer engagement, allowing brands to offer tailored recommendations. These developments ensure that luxury jewelry remains a cornerstone of the market’s growth trajectory.

Expansion of Industrial Applications

A critical driver is the surging popularity of industrial-grade diamonds, which fuels demand across sectors like manufacturing and technology. According to a study by Deloitte, the industrial diamond segment grew by 30% in 2022, with markets like Germany and Italy leading the charge, as per the German Engineering Association. The emphasis on precision tools and advanced materials has further amplified this trend. As per Eurostat, industrial diamonds reduce machining costs by 20% while improving efficiency, aligning with consumer values. Additionally, advancements in nanotechnology have broadened their appeal, addressing previous concerns about durability and performance. These factors underscore the pivotal role of industrial applications in reshaping the diamond market.

MARKET RESTRAINTS

High Costs of Ethical Sourcing

One of the primary restraints hindering the Europe diamond market is the high cost associated with ethical sourcing and certification. In line with the European Environmental Bureau, the price of conflict-free diamonds is 15% higher than uncertified alternatives due to stringent auditing processes. For instance, in Belgium, over 40% of retailers cited affordability as a barrier to adopting fully traceable supply chains, as per the Belgian Diamond Industry Association. While affluent consumers can absorb these costs, middle-income households often struggle to justify the investment, limiting market accessibility. Also, recurring expenses for audits and certifications add to the financial strain, posing a significant challenge for broader adoption of ethical practices.

Consumer Skepticism Over Lab-Grown Diamonds

A significant restraint is the growing skepticism surrounding lab-grown diamonds, which undermines their perceived value. According to the European Consumer Organization, over 50% of European buyers associate synthetic diamonds with lower quality, discouraging purchases. This perception is exacerbated by the lack of transparency in production processes and limited awareness about sustainability benefits. As per the World Wildlife Fund, only 30% of consumers trust lab-grown diamonds, driving demand for natural alternatives. These challenges not only reduce market turnover but also limit opportunities for innovation, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Adoption of Blockchain for Traceability

The integration of blockchain technology presents a transformative opportunity for the Europe diamond market. A study by Bain & Company states, over 60% of European consumers are willing to pay a premium for diamonds with verifiable ethical origins, creating a niche for brands offering transparent supply chains. For instance, in the UK, companies like De Beers introduced blockchain-certified diamonds, boosting sales by 20%, as per the British Gemological Association.A notable driver of this trend is the growing emphasis on corporate responsibility and environmental accountability. As per Eurostat, blockchain reduces fraud risks by 40% while enhancing consumer trust, aligning with market demands. Apart from this, certifications like the Responsible Jewellery Council have enhanced brand credibility, attracting premium buyers. These innovations highlight the immense potential of blockchain to reshape the market landscape.

Growth of Customization Services

Another promising opportunity lies in the rapid adoption of customization services, which cater to the growing demand for unique and meaningful designs. The emphasis on individuality and self-expression has further amplified this trend. As indicated by McKinsey & Company, over 50% of millennials and Gen Z consumers prioritize bespoke products, creating a niche for innovative solutions. Moreover, advancements in 3D printing have improved design flexibility, addressing previous concerns about complexity. These factors showcase the transformative potential of customization to address emerging consumer needs.

MARKET CHALLENGES

Intense Competition and Price Wars

Among the most pressing challenges facing the Europe diamond market is the intense competition among established brands and private labels, which complicates efforts to build brand loyalty. In accordance to study, private label diamonds account for over 25% of total sales in Europe, with major retailers like Cartier and Tiffany offering affordable alternatives to branded products. For instance, in Italy, private labels captured 30% of the diamond jewelry market share in 2022, as per the Italian Retail Federation. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. Also, the lack of innovation in traditional categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

Another critical challenge is the volatility of raw material prices, which impacts production costs and pricing strategies. According to the International Diamond Exchange, the price of rough diamonds fluctuated by up to 20% over the past year due to geopolitical tensions and supply chain disruptions. For example, in Belgium, shortages of raw materials caused logistical challenges, leading to a 10% increase in production costs, as per the Belgian Diamond Bourse. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As reported by the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. These challenges not only strain profitability but also hinder long-term planning and investment in the market.

SEGMENTAL ANALYSIS

By Type Insights

The Natural diamonds segment dominated the Europe diamond market and is capturing 768.2% of the total revenue in 2024. This is driven by their timeless appeal and association with luxury, appealing to affluent consumers seeking exclusivity. For instance, in France, natural diamonds accounted for over 80% of all diamond jewelry sales, as per the French Jewelry Federation. A key factor behind the segment’s dominance is the growing preference for rare and certified stones. According to Eurostat, natural diamonds command a 30% premium over synthetic alternatives, ensuring compliance with consumer expectations. Like, advancements in cutting and polishing techniques have addressed previous concerns about brilliance, enhancing appeal. These attributes solidify natural diamonds as the cornerstone of the market.

The Synthetic diamonds are the fastest-growing segment, with a projected CAGR of 8% from 2025 to 2033. This growth is fueled by their affordability and eco-friendly credentials, appealing to younger demographics. For example, in the UK, synthetic diamond sales gained immense popularity, with sales surging by 40% in 2022, as per the British Gemological Association. A significant driver of this segment’s rapid expansion is the growing emphasis on sustainability and ethical sourcing. According to Statista, over 50% of millennials and Gen Z consumers prioritize environmentally friendly products, creating a niche for innovative solutions. Additionally, advancements in chemical vapor deposition (CVD) technology have improved quality, addressing previous concerns about durability.

By Application Insights

The Jewelry segment spearheaded the Europe diamond market by holding a controlling market share of 80% in 2024. This poisition is supported by its widespread use in luxury accessories, appealing to affluent consumers seeking exclusivity. For instance, in Italy, diamond jewelry accounted for over 90% of all gemstone sales, as per the Italian Jewelry Federation. A key factor behind the segment’s dominance is the growing trend of gifting and self-purchasing. Additionally, the availability of financing options has made diamond jewelry more accessible, ensuring sustained demand. These attributes ensure that jewelry remains the primary driver of the market.

The Industrial applications are the rapidly growing segment, with a projected CAGR of 6% owing to its extensive use in precision tools and advanced materials, appealing to industries like manufacturing and technology. For example, in Germany, industrial diamonds gained immense popularity, with sales surging by 35% in 2022, as per the German Engineering Association. A significant driver of this segment’s rapid expansion is the growing emphasis on efficiency and precision. According to McKinsey & Company, industrial diamonds reduce machining costs by 20% while improving accuracy, creating a niche for innovative solutions. Additionally, advancements in nanotechnology have broadened their appeal, addressing previous concerns about durability.

REGIONAL ANALYSIS

The UK's diamond market is characterized by a blend of tradition and innovation. The country’s robust retail infrastructure and emphasis on luxury goods have positioned it as a leader in the region. For instance, iconic brands like De Beers are renowned globally for their high-quality diamonds, catering to both domestic and international markets. A key factor driving the UK’s success is its proactive adoption of technological innovations. According to the British Retail Consortium, over 60% of UK retailers now offer blockchain-certified diamonds, enhancing transparency and consumer trust. Additionally, the rise of e-commerce platforms has enabled UK brands to reach a broader audience, further boosting demand.

France's diamond market reflects a rich heritage in luxury goods and a strong cultural affinity for fine jewelry. The country’s strong emphasis on craftsmanship and design has solidified its position as a key player. For instance, French brands like Cartier dominate the mid-tier segment, appealing to cost-conscious yet quality-focused consumers. A significant driver of France’s dominance is its focus on export-oriented growth and innovation. According to the French Jewelry Federation, over 50% of French diamond production is exported, reflecting its global appeal. Also, as per Deloitte, the integration of digital marketing strategies has enhanced brand visibility, encouraging younger demographics to explore luxury diamonds.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Europe diamond market is led by three key players: De Beers Group, Alrosa, and Rio Tinto, each contributing significantly to the global market. De Beers Group, headquartered in the UK, holds a substantial presence in Europe, offering iconic brands like Forevermark and De Beers Jewellers.

Alrosa, based in Russia but with a strong European presence, specializes in ethically sourced natural diamonds, with a growing footprint in markets like Germany and Italy. As per Euromonitor International, Alrosa’s products command a notable market share in the luxury jewelry segment and is driven by their emphasis on transparency and sustainability.

Meanwhile, Rio Tinto, an Australian firm with significant operations in Europe, is renowned for its rare pink and champagne diamonds, widely adopted by high-end designers. These players collectively drive innovation and set benchmarks for quality and ethical sourcing in the Europe diamond market.

The Europe diamond market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like De Beers and Alrosa dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like Diamond Foundry are pioneering lab-grown diamonds, challenging incumbents in the sustainability segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

Top Strategies Used by Key Players

Key players in the Europe diamond market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, De Beers announced a commitment to achieving carbon neutrality across its supply chain by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, Alrosa launched a line of lab-grown diamonds targeting environmentally conscious buyers. This move aligns with the company’s goal of addressing emerging consumer preferences.

Additionally, as per the European Investment Bank, Rio Tinto has invested heavily in blockchain technology to enhance traceability and transparency in its diamond supply chain. These strategies reflect a commitment to innovation and market leadership.

RECENT MARKET DEVELOPMENTS

- In April 2024, De Beers acquired a UK-based startup specializing in blockchain technology for diamond traceability. This acquisition aimed to expand its portfolio of ethically sourced diamonds and cater to environmentally conscious buyers.

- In May 2024, Alrosa partnered with a German e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, Rio Tinto introduced a line of rare colored diamonds targeting high-net-worth individuals. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, Diamond Foundry secured USD 100 million in funding from European investors to scale its lab-grown diamond initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, De Beers launched a campaign promoting its zero-carbon mining initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the europe diamond market is segmented and sub-segmented based on categories.

By Type

- Natural

- Synthetic

By Application

- Jewelry & Ornaments

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the diamond market in Europe?

Key drivers include rising disposable income, growing preference for customized and branded jewelry, the shift towards ethical and sustainable diamonds, and the increasing adoption of lab-grown diamonds.

What is the expected growth rate of the Europe diamond market?

The market is expected to grow steadily, with the lab-grown diamond segment witnessing double-digit growth, while natural diamonds maintain a strong presence in the high-end luxury segment.

What is the future growth outlook for the Europe diamond market?

The market is expected to experience steady growth, driven by sustainable diamond demand, digitalization, and the rise of lab-grown diamonds. Natural diamonds will continue to dominate the luxury segment, while lab-grown diamonds will expand in the mid-range and affordable segments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]