Europe Diagnostic Imaging Market Research Report – Segmented By Type ( MRI,fNIRS) Application ( Oncology,Neurology) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Diagnostic Imaging Market Size

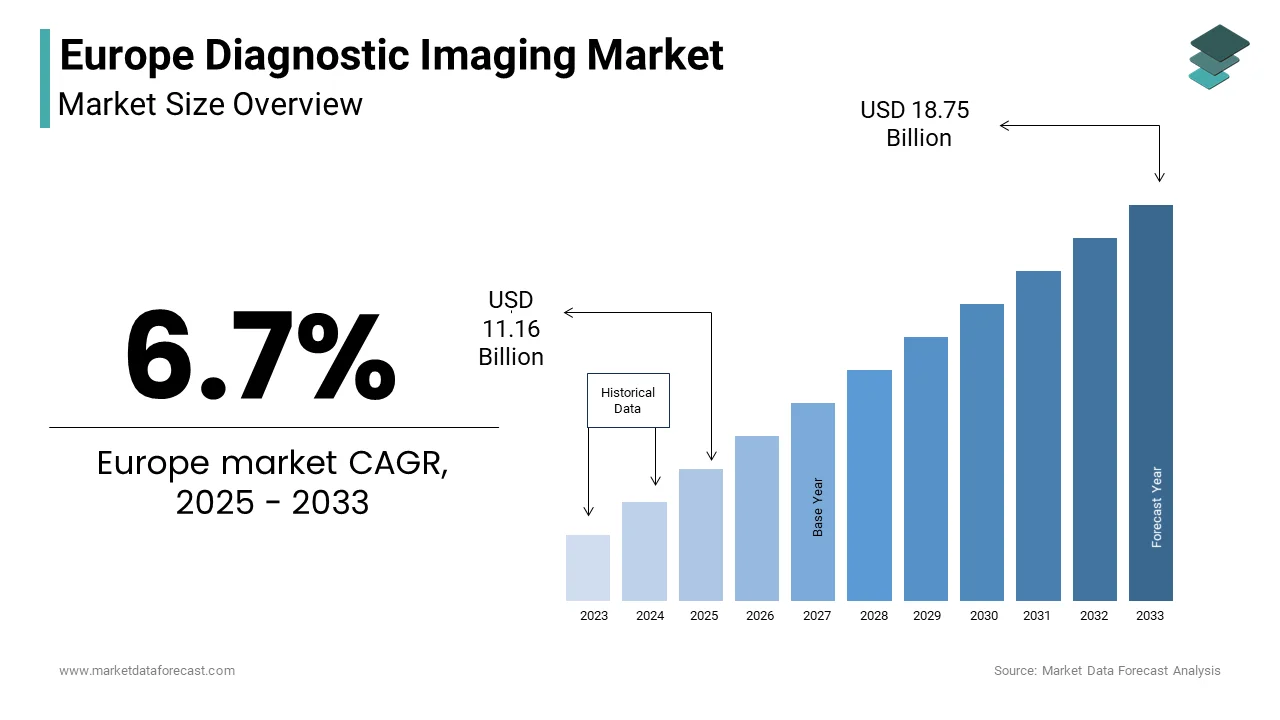

The Europe Diagnostic Imaging Market was valued at USD 10.46 billion in 2024. The Europe Diagnostic Imaging Market is expected to have 6.7% CAGR from 2024 to 2033 and be worth USD 18.75 billion by 2033 from USD 11.16 billion in 2025.

The Europe medical imaging market is a foundation of modern healthcare. It is supported by advancements in diagnostic technologies and an aging population. Moreover, Germany, France, and the UK are pivotal contributors and collectively accounting for over 60% of regional demand. The European Union’s emphasis on early disease detection and personalized medicine has created a conducive environment for innovation. As per Eurostat, chronic diseases such as cancer and cardiovascular disorders account for over 70% of all deaths in Europe is exhibiting the need for advanced imaging solutions. Collaborations between hospitals, research institutions, and manufacturers further enhance accessibility and adoption is ensuring robust market growth.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is a primary driver of the Europe medical imaging market, particularly given the region’s aging demographic. According to the World Health Organization (WHO), chronic conditions such as cancer, cardiovascular diseases, and diabetes account for over 80% of healthcare expenditures in Europe. Advanced imaging technologies like MRI and CT scans play a critical role in early diagnosis and treatment planning. A study shows that the worldwide demand for oncology imaging grew by 15% from 2020 to 2022, with Europe leading in adoption rates. Governments across the region are investing heavily in healthcare infrastructure is amplifying the integration of imaging technologies. For example, the UK’s National Health Service (NHS) expanded its radiology departments in 2022 is surging higher utilization. This focus on addressing chronic diseases propels market expansion.

Technological Advancements in Imaging Technologies

Technological advancements in imaging technologies significantly propel the Europe medical imaging market, supported by innovations in AI and machine learning. These technologies enhance diagnostic accuracy, reduce scan times, and improve workflow efficiency. For example, Siemens Healthineers introduced AI-powered MRI systems in 2022 is enabling real-time image analysis and reducing human error. Also, the European Commission’s Horizon Europe program has allocated over €5 billion to support digital health innovations is fostering the adoption of cutting-edge imaging solutions. The alignment with technological trends ensure sustained market growth and dominance.

MARKET RESTRAINTS

High Costs of Imaging Equipment

High costs of imaging equipment pose a significant challenge to the Europe medical imaging market and is particularly for smaller healthcare facilities. Maintenance and operational expenses further escalate costs, limiting accessibility. While larger institutions can absorb these expenses, smaller clinics often struggle to secure funding or navigate complex procurement processes. This financial barrier restricts market diversity and innovation, hindering its full potential.

Stringent Regulatory Approvals

Stringent regulatory approvals impact the timely availability of advanced imaging technologies which is creating barriers for manufacturers and healthcare providers. As per the European Medicines Agency (EMA), compliance with Medical Device Regulation (MDR) requirements often delays product launches by up to two years. The complexity of approval processes when coupled with inconsistent standards across member states complicates market entry. Besides these, post-market surveillance requirements increase operational costs, affecting profitability. The larger corporations can navigate these challenges however smaller firms often face significant hurdles and is limiting innovation and accessibility.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Diagnostics

The expansion of telemedicine and remote diagnostics represents a transformative opportunity for the Europe medical imaging market and is backed by the rise of digital health platforms. Based on a report by PricewaterhouseCoopers, telemedicine adoption surged by 40% during the COVID-19 pandemic is showcasing its potential to address healthcare access challenges. Imaging technologies integrated with cloud-based platforms enable seamless sharing of diagnostic data, fostering collaboration between specialists and primary care providers. The EU’s Digital Single Market strategy has allocated over €6 billion to support telemedicine initiatives are fostering innovation. For instance, France’s national health system partnered with Philips Healthcare to develop remote imaging solutions, enhancing patient outcomes. Therefore, this shift towards virtual care creates a lucrative growth avenue for the market.

Adoption of AI and Machine Learning Solutions

The acceptance of AI and machine learning solutions unlocks new opportunities in the Europe medical imaging market, propelled by their potential to improve diagnostic accuracy and efficiency. Technlogical break-throughs such as automated lesion detection and predictive analytics streamline workflows is reducing physician workload. Partnerships between tech companies and healthcare providers ensure knowledge sharing and resource pooling is accelerating innovation. For example, Germany’s Charité Hospital collaborates with IBM Watson to develop AI-powered imaging platforms are making sure of higher adoption rates and market differentiation.

MARKET CHALLENGES

Data Privacy Concerns

Data privacy concerns constitute a major challenge to the Europe medical imaging market and is particularly given the sensitive nature of patient information. As indicated by a study by the European Data Protection Board, above 60% of consumers express skepticism about sharing personal health data through digital imaging platforms. The General Data Protection Regulation (GDPR) imposes strict compliance requirements, complicating data management for developers. Breaches and misuse of health data further exacerbate consumer mistrust, impacting adoption rates. The big companies can invest in robust cybersecurity measures but smaller startups generally find it tough to meet regulatory standards, limiting innovation and accessibility.

Skilled Workforce Shortages

Skilled workforce shortages hinder the efficient operation of advanced imaging technologies, undermining market growth. According to the European Federation of Radiographers Societies, over 40% of radiology departments report difficulties in hiring qualified technicians and radiologists. The complexity of operating AI-driven imaging systems requires specialized training, which remains inconsistent across regions. While vocational programs and certifications aim to address this issue, their reach remains limited. Addressing this challenge requires increased investment in workforce development and digital tools to enhance training accessibility, ensuring long-term viability and consumer trust.

REPORT COVERAGE

|

PORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.7 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

C.H. Robinson Worldwide Inc. (US), IJ.B. Hunt Transport Services (US), Ceva Holdings LLC (France), FedEx Corp (US) |

SEGMENTAL ANALYSIS

By Type Insights

The MRI segment dominated the Europe medical imaging market by capturing 31.3% of the total share in 2024. The widespread usage is driven by its ability to provide detailed soft tissue images, making it ideal for diagnosing neurological and musculoskeletal conditions. As per Eurostat, over 10 million MRI scans were performed in Europe in 2022 is reflecting robust demand. Advances in AI-driven imaging and faster scanning technologies have enhanced usability, attracting significant investment. Also, government mandates for early disease detection have bolstered adoption is ensuring steady growth.

The Functional near-infrared spectroscopy (fNIRS) segment is the fastest-growing segment, with a CAGR of 18%. The growth is fueled by its non-invasive nature and ability to monitor brain activity in real-time. An investigation found that fNIRS is increasingly used in neurology and psychiatry applications are driving demand. Innovations in wearable devices have expanded its application scope and is particularly in pediatric and geriatric care. The affordability and portability of fNIRS make it an attractive option for diverse healthcare settings, propelling rapid adoption.

By Application Insights

The Oncology segment commanded the largest share of the Europe medical imaging market i.e. 28.6% of total revenue in 2024. The dominance of this segment is attributed to the rising incidence of cancer and the critical role of imaging in diagnosis and treatment planning. In accordance with the European Cancer Information System, over 4 million new cancer cases were reported in Europe in 2022, reflecting robust demand. The rise of AI-driven imaging tools has further amplified adoption, ensuring higher accuracy and efficiency. Furthermore, collaborations between biotech firms and research institutions have accelerated product development is strengthening oncology’s position.

The Neurology is the swiftest expanding segment, with a CAGR of 15.8%. The progress is driven by increasing awareness of neurological disorders and advancements in imaging technologies. A report emphasizes that functional imaging tools such as fMRI and fNIRS are increasingly used to study brain activity is propelling demand. Innovations in AI and machine learning further enhance diagnostic capabilities, ensuring exponential growth.

Country Level Analysis

Germany holds the largest share in the European medical imaging market and contributed 27.5% of regional demand in 2024. Its dominance is credited to robust healthcare infrastructure and investments in research and development. According to the German Federal Ministry of Health, over €1 billion was allocated to medical imaging projects in 2022, reflecting robust innovation. The presence of renowned institutions fosters collaboration, ensuring steady growth.

The UK is rapidly advancing in the medical imaging space. The country’s NHS integrates advanced imaging solutions into routine diagnostics, boosting adoption. As per the UK BioIndustry Association, the medical imaging sector attracted over £500 million in investments in 2022. Collaborations between universities and industry players further enhance its growth trajectory.

France is witnessing steady growth in medical imaging and is supported by government initiatives and a thriving tech ecosystem. As indicated by the Bpifrance, the French government invested €300 million in medical imaging startups, fostering innovation. The country’s focus on preventive care aligns with EU goals are driving market expansion.

Italy is experiencing the fastest growth rate in the European medical imaging market. According to Assobiotec, Italian companies lead in developing AI-driven imaging tools, enhancing adoption. The country’s aging population fuels demand, ensuring sustained growth.

Spain’s medical imaging market is expanding steadily which is driven by its robust healthcare infrastructure and growing tech sector. The Red Española de Salud Digital states that Spain hosts over 50 clinical trials involving

medical imaging solutions, reflecting its commitment to innovation.

Top 3 Players in the market

Siemens Healthineers

Siemens Healthineers is a leader in the Europe medical imaging market, renowned for its innovative MRI and CT systems. The company’s focus on AI-driven solutions ensures high demand for its advanced imaging tools. Siemens invests heavily in R&D, ensuring continuous innovation and expanding its global footprint.

GE Healthcare

GE Healthcare is a key player, leveraging its expertise in oncology imaging to develop advanced solutions. The company’s focus on personalized medicine aligns with EU priorities, ensuring steady growth. Its strategic acquisitions strengthen its position in the global market.

Philips Healthcare

Philips Healthcare contributes significantly to the Europe medical imaging market, focusing on remote diagnostics and telemedicine. The company’s partnerships with academic institutions drive innovation, ensuring prominence in the biotech sector.

Top strategies used by the key market participants

Investment in AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing the medical imaging sector, enhancing diagnostic accuracy, workflow efficiency, and clinical decision-making. Leading companies are heavily investing in AI-driven imaging solutions that can detect abnormalities with greater precision, automate image analysis, and reduce the burden on radiologists. Siemens Healthineers, for example, has developed AI-powered oncology imaging platforms that improve early cancer detection and treatment planning, ensuring faster and more reliable results. AI is also being utilized in real-time image reconstruction, anomaly detection, and predictive analytics, enabling physicians to make data-driven decisions. Additionally, deep learning algorithms are enhancing image resolution and reducing noise in MRI and CT scans, leading to clearer and more detailed diagnostic images. The push for AI in medical imaging is not only improving patient outcomes but also optimizing hospital workflows, leading to cost savings and higher operational efficiency.

Strategic Acquisitions

Major players in the medical imaging industry are actively pursuing strategic acquisitions to expand their technological capabilities, enter new markets, and strengthen their competitive edge. By acquiring smaller tech firms specializing in AI imaging, remote diagnostics, and cloud-based radiology solutions, companies can integrate cutting-edge innovations into their product portfolios. In 2023, GE Healthcare acquired a telemedicine startup, significantly enhancing its capabilities in remote diagnostics and virtual imaging services. This acquisition allowed the company to leverage cloud-based radiology solutions, improving accessibility to medical imaging in rural and underserved areas. Strategic acquisitions also enable companies to diversify their offerings, integrating advanced imaging modalities, automated workflow solutions, and AI-powered analytics. As competition intensifies in the industry, acquisitions remain a crucial strategy for firms aiming to stay ahead of technological advancements, scale their operations, and drive long-term growth.

Collaborations with Healthcare Providers

Strong partnerships between medical imaging companies and healthcare providers are accelerating innovation, improving imaging accessibility, and driving patient-centered advancements. By working closely with hospitals, research institutions, and diagnostic centers, firms can co-develop cutting-edge imaging technologies that address real-world clinical needs. Philips Healthcare, for example, has established strategic collaborations with leading hospitals and academic research centers to develop novel imaging solutions, particularly in MRI, CT, and molecular imaging. These partnerships allow for the real-time validation of new technologies, ensuring that imaging solutions align with clinical requirements and patient care standards. Additionally, collaborations help streamline the integration of AI-assisted diagnostics into hospital systems, enabling faster and more precise disease detection. Through joint research initiatives and clinical trials, imaging companies can refine their products, improve interoperability, and enhance diagnostic accuracy, ultimately leading to sustained market growth and improved healthcare outcomes

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few promising companies in the Europe Diagnostic Imaging Market profiled in this report are GE Healthcare, Siemens Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Hologic Inc., Fujifilm Corporation & Shimadzu Corporation.

The Europe medical imaging market is a highly competitive arena, characterized by innovation-driven strategies and the presence of global leaders such as Siemens Healthineers, GE Healthcare, and Philips. According to Grand View Research, the market is projected to grow at a CAGR of 5.8% from 2023 to 2030, fueled by an aging population, rising prevalence of chronic diseases, and increasing adoption of advanced imaging technologies. Companies are differentiating themselves through cutting-edge innovations like AI-integrated imaging systems, hybrid modalities, and cloud-based platforms. Regional players such as Canon Medical Systems and Fujifilm Healthcare focus on affordability and niche applications, fostering competition. Regulatory compliance with the EU Medical Device Regulation (MDR) ensures safety and efficacy, creating a standardized yet challenging environment. Strategic mergers, acquisitions, and partnerships are prevalent, enabling firms to expand their geographic footprint and product portfolios. Investments in R&D and collaborations with academic institutions further enhance technological prowess. The growing emphasis on precision medicine and telemedicine has also driven demand for portable and remote imaging solutions, intensifying competition among key players striving to meet evolving healthcare needs.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Siemens Healthineers launched its AI-enhanced MRI system, designed to improve diagnostic accuracy and reduce scan times by 30%. This innovation aims to solidify Siemens' place in advanced imaging technologies.

- In January 2024, GE Healthcare partnered with a leading European hospital network to deploy AI-driven CT scanners. This collaboration seeks to streamline workflows and enhance early disease detection capabilities.

- In May 2024, Philips acquired a cloud-based imaging startup based in Sweden. This acquisition is anticipated to expand Philips’ digital health ecosystem and strengthen its remote diagnostics offerings.

- In February 2024, Canon Medical Systems introduced a portable ultrasound device tailored for rural healthcare settings. This move targets underserved regions, addressing accessibility challenges and boosting market penetration.

- In April 2024, Fujifilm Healthcare announced a partnership with a German research institute to develop next-generation hybrid imaging systems. This initiative aligns with the EU’s focus on precision medicine and enhances Fujifilm’s innovation pipeline.

MARKET SEGMENTATION

This research report on the Europe Diagnostic Imaging Market has been segmented and sub-segmented into the following categories.

By Type

- MRI

- fNIRS

By Application

- Oncology

- Neurology

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the key drivers of the diagnostic imaging market in Europe?

The market size is influenced by factors like technological advancements, increasing prevalence of chronic diseases, and rising demand for early diagnosis.

Which imaging modalities are most commonly used in Europe?

Common modalities include X-ray, MRI, CT scan, ultrasound, and nuclear imaging (PET & SPECT).

What are the key trends shaping the Europe Diagnostic Imaging Market?

Trends include AI integration in imaging, portable and point-of-care imaging solutions, and increased adoption of cloud-based imaging software.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]