Europe Diagnostic Electrocardiograph (ECG) Market Size, Share, Trends & Growth Forecast Report By Product, Lead Type, End User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Diagnostic Electrocardiograph (ECG) Market Size

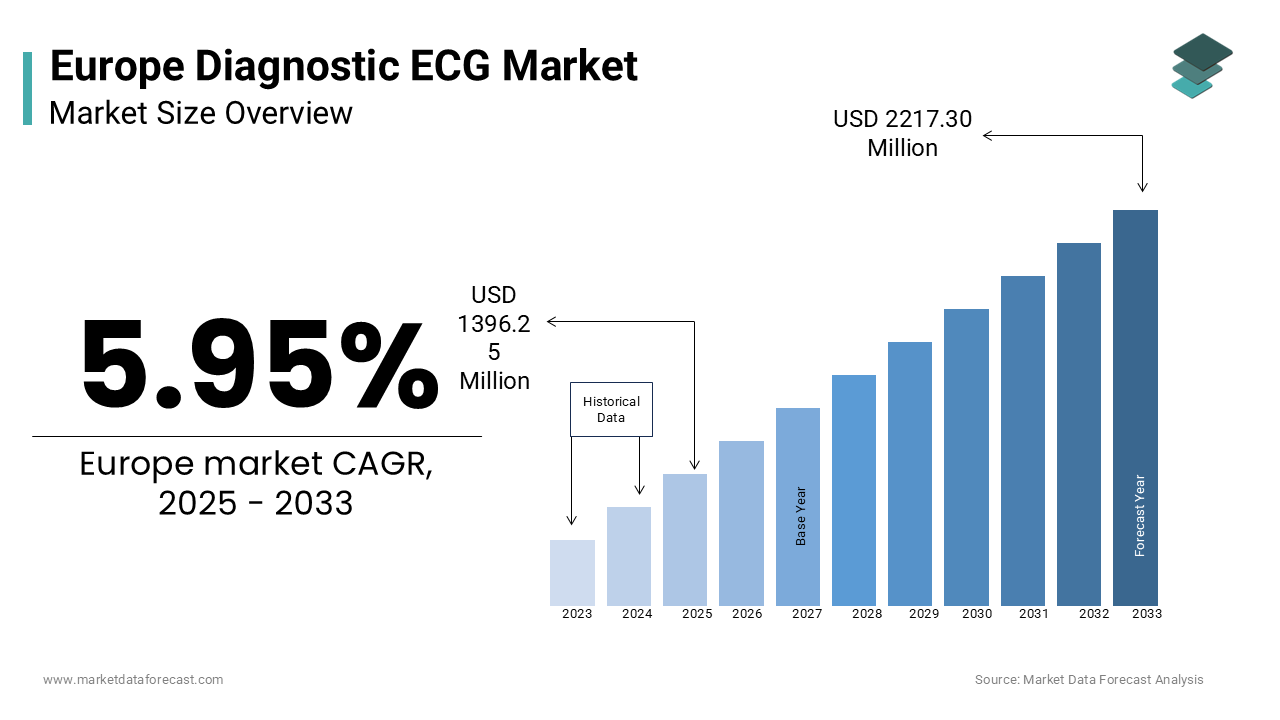

The diagnostic electrocardiograph (ECG) market size in Europe was valued at USD 1318 Million in 2024. The European market size is expected to be valued at USD 2217.30 Mn by 2033 from USD 1396.42 Mn in 2025, growing at a CAGR of 5.9% from 2025 to 2033.

The European diagnostic electrocardiograph (ECG) market is experiencing substantial growth, driven by the rising prevalence of cardiovascular diseases (CVDs) and ongoing advancements in healthcare technology. According to the European Society of Cardiology (ESC), CVDs remain the leading cause of death in Europe, responsible for 45% of all mortalities. With the region’s aging population, the demand for efficient and reliable ECG diagnostic solutions continues to grow. Technological innovations such as wearable ECG monitors and AI-powered diagnostic tools are transforming this market landscape. Projections indicate significant growth for the European diagnostic electrocardiograph (ECG) market during the forecast period, fueled by increasing healthcare investments and government-led initiatives aimed at early diagnosis and preventive care.

ECG diagnostics are critical in the detection and management of cardiovascular diseases, a major healthcare burden in Europe. These devices enable real-time monitoring of heart function, making them essential in emergency situations, routine check-ups, and long-term management of chronic cardiac conditions. With the growing incidence of conditions like atrial fibrillation, the demand for ECG diagnostics has surged. Early diagnosis facilitated by ECGs can prevent life-threatening outcomes, reducing hospitalization rates and improving patient health outcomes. In 2023, the World Health Organization (WHO) underscored the importance of integrating ECG diagnostics into public health strategies to combat the increasing burden of CVDs.

EUROPE DIAGNOSTIC ELECTROCARDIOGRAPH (ECG) MARKET TRENDS

Adoption of Wearable ECG Monitors

Wearable ECG monitors are gaining traction as part of the preventive healthcare movement. Devices like the Apple Watch and Fitbit now feature ECG functionalities, enabling continuous heart monitoring and early detection of arrhythmias. This trend is widely embraced by healthcare professionals and consumers alike, with Europe accounting for 30% of the global wearable ECG market in 2023.

AI and Machine Learning in ECG Diagnostics

AI and machine learning are revolutionizing ECG diagnostics by improving the accuracy of results and automating data interpretation. AI-driven algorithms can detect cardiac abnormalities faster and more precisely than traditional methods. In 2023, GE Healthcare introduced AI-powered ECG analysis, enhancing diagnostic precision and reducing the risk of false positives.

Telemedicine and Remote Monitoring

The post-COVID rise in telemedicine has facilitated the remote monitoring of heart conditions through portable ECG devices. This trend is particularly prominent in Europe, where healthcare systems have integrated telemedicine services for real-time ECG monitoring, minimizing the need for frequent in-clinic visits.

Shift Towards Preventive Care

There is an increasing emphasis on preventive healthcare, which is fueling demand for ECG diagnostics. Early detection of cardiovascular diseases through ECG screening has become a priority for governments and healthcare providers. Investments in preventive care programs are expected to drive the growth of the European ECG market over the next decade.

MARKET DRIVERS

Increasing Cardiovascular Disease Burden

The rising incidence of cardiovascular diseases is a major factor driving the diagnostic ECG market in Europe. According to the European Heart Network, over 6 million new cases of CVDs are reported annually, making it the leading cause of mortality. In 2023, cardiovascular diseases accounted for 45% of deaths in the EU, underscoring the need for advanced diagnostic tools like ECG devices. The growing prevalence of atrial fibrillation and heart failure further amplifies the demand for ECG technology for early detection and management.

Aging Population

Europe’s aging population is another key driver of the ECG market. According to Eurostat, 20% of Europeans are aged 65 and older, and this figure is expected to rise by 30% by 2030. Older individuals are at higher risk of developing cardiac conditions, such as arrhythmias and coronary artery disease, thereby increasing the demand for ECG diagnostics in hospitals, clinics, and home care settings.

Technological Advancements

Technological innovations, including portable ECG devices, wireless monitors, and AI-driven diagnostics, are reshaping the market. Devices like Holter monitors enable long-term cardiac monitoring, while AI algorithms enhance diagnostic efficiency. In 2023, Philips Healthcare introduced a wireless ECG system that transmits real-time data to healthcare providers, reducing the need for in-person consultations.

Government Initiatives

Governments across Europe are actively promoting cardiovascular disease prevention through policies and funding for advanced diagnostic technologies. In 2023, Germany launched a national CVD prevention program with a €200 million investment aimed at improving access to ECG diagnostics. Similarly, the UK's National Health Service (NHS) is investing in AI-powered ECG devices to enhance diagnostic capabilities in primary care.

MARKET RESTRAINTS

High Costs of Advanced ECG Devices

The high cost of advanced ECG devices, particularly those with AI and wireless capabilities, presents a barrier to widespread adoption. In 2023, a 12-lead ECG machine equipped with AI capabilities was priced at approximately €15,000, making it inaccessible for smaller healthcare facilities, particularly in rural and underfunded regions.

Regulatory Hurdles

Strict medical device regulations, such as the EU’s Medical Device Regulation (MDR), can delay the introduction of new ECG products to the market. In 2023, several manufacturers experienced product launch delays due to the extensive clinical trials and certification processes required under MDR guidelines.

Data Security Concerns

As more ECG devices become connected to cloud-based systems, concerns over data privacy and compliance with the General Data Protection Regulation (GDPR) have emerged. In 2023, multiple healthcare providers in Europe were fined for insufficient data protection measures. Ensuring secure data transmission and storage remains a key challenge for manufacturers and healthcare providers alike.

MARKET OPPORTUNITIES

Emerging Technologies

The adoption of emerging technologies, such as AI-driven smart ECG devices and wearable health monitors, presents substantial growth opportunities within the European diagnostic ECG market. Wearable ECG devices, designed for continuous cardiac monitoring, are anticipated to experience rapid expansion due to increasing consumer demand for personalized healthcare solutions. In 2023, Apple announced enhancements to its Apple Watch Series 8, which now includes improved ECG functionalities for ongoing heart monitoring.

Healthcare Reforms and Insurance

Several European countries are implementing healthcare reforms aimed at expanding access to diagnostic tools, including ECG devices. For instance, in 2023, German healthcare insurers began covering home-based ECG monitors, enhancing the accessibility of advanced diagnostic tools for a broader segment of the population. Similarly, France’s healthcare reform in 2024 introduced public-private partnerships to subsidize the cost of AI-based diagnostic tools, extending these benefits to both urban and rural areas. These reforms are expected to drive significant growth in the ECG market by making healthcare services more affordable and accessible across Europe.

Export Opportunities

Countries like Hungary and Poland are emerging as manufacturing hubs for low-cost ECG devices, thereby creating significant export opportunities within Europe. In 2023, Hungary exported over 50,000 ECG devices to neighboring countries such as Romania and Bulgaria, capitalizing on cost-effective manufacturing processes and increasing demand for affordable healthcare solutions. These nations are leveraging their competitive production costs to expand their market presence in Western Europe and other emerging regions, contributing to the overall growth of the diagnostic ECG sector.

MARKET CHALLENGES

Supply Chain Disruptions

Ongoing supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, continue to challenge ECG device manufacturers. In 2023, Philips Healthcare reported production delays for its Efficia ECG machines due to a global semiconductor shortage. Eurostat data indicates that the medical device supply chain in Europe has faced significant bottlenecks, leading to increased costs and extended delivery timelines for ECG devices. These disruptions are particularly pronounced in Eastern Europe, where reliance on imported components remains high, affecting both production and distribution capacities.

Skilled Workforce Shortage

A shortage of skilled healthcare professionals trained to operate advanced ECG systems poses a significant challenge, particularly in Eastern European countries like Romania and Bulgaria, where healthcare infrastructure is still developing. A 2022 European Commission report highlighted the growing demand for technicians skilled in AI-driven diagnostics and wireless monitoring systems. Addressing this skills gap will be critical for the successful implementation and widespread adoption of next-generation ECG technologies, especially in regions with limited healthcare resources.

SEGMENTAL ANALYSIS

By Product Insights

The resting ECG systems segment leads the European diagnostic ECG market, accounting for 45.8% of market share in 2023. These systems are extensively used for routine cardiovascular screenings in hospitals and clinics, as they provide accurate baseline measurements of heart activity, which are crucial for early-stage disease detection. Meanwhile, the holter monitors segment is expected to grow at a CAGR of 6.2%, driven by the increasing demand for long-term, continuous monitoring of cardiac conditions, particularly in outpatient and ambulatory care settings.

By Lead Type Insights

The 12-lead ECG devices dominated the market and held 60.2% of the market share in 2023. These devices capture electrical activity from multiple regions of the heart, making them essential for diagnosing complex cardiac conditions such as ischemia and arrhythmias. Single-lead ECG devices, popularized by wearable technology, are also gaining traction for home-based monitoring. This segment is expected to grow at a CAGR of 7% between 2024 and 2032, reflecting the increasing consumer demand for portable, user-friendly diagnostic solutions.

By End User Insights

The hospital segment remains the largest end-user segment and captured 50.7% of the European market share in 2023, driven by the widespread use of ECG devices in emergency departments, cardiology units, and intensive care wards. The diagnostic centers segment represents the fastest-growing segment, with a projected CAGR of 6.8%, as these facilities increasingly adopt advanced ECG technologies to enhance early diagnosis and preventive care. Additionally, the demand for ambulatory care and home-based ECG monitoring is contributing to market expansion, reflecting broader healthcare trends toward outpatient care and remote diagnostics.

REGIONAL ANALYSIS

The UK, Germany, and France continue to dominate the European diagnostic ECG market due to its well-established healthcare infrastructure and significant investments in medical technologies. In 2023, Germany alone accounted for 26.1% of the region's ECG market, primarily driven by its advanced hospital network and government-backed healthcare initiatives aimed at improving diagnostic and preventive care. The UK and France also play pivotal roles, with their national healthcare systems focusing on the integration of preventive diagnostics and digital health technologies, fostering further market growth.

Emerging markets in Eastern Europe, including Poland, Hungary, and the Czech Republic, are experiencing accelerated growth due to increasing investments in healthcare infrastructure and a concerted effort to improve diagnostic capabilities. In Poland, the diagnostic ECG market expanded significantly in 2023, spurred by government-led reforms that included funding for cardiovascular diagnostics. Similarly, Hungary and the Czech Republic have seen increased private healthcare investments, supporting the adoption of AI-driven ECG technologies. These technologies are particularly vital for enhancing diagnostic accuracy in rural and underserved regions. The market in Eastern Europe is projected to grow at a strong compound annual growth rate (CAGR) over the forecast period as the region emphasizes preventive healthcare and expands access to diagnostic tools.

KEY MARKET PLAYERS

Some of the notable companies playing a dominant role in the European Diagnostic Electrocardiograph (ECG) Market profiled in this report are BPL Ltd, Cardiac Science Corp, Fukuda Denshi Co., Ltd, GE Healthcare, Medtronic, Inc., Philips Healthcare, Spacelabs Healthcare, Inc., Mortara Instrument, Inc., Midmark Corp, Mindray Medical International Ltd, Nihon Kohden Corp, Scottcare Corp, Schiller Ag, Welch Allyn Inc., and Cardionet.

GE Healthcare holds a significant market share, offering a comprehensive portfolio that includes resting ECG systems, stress ECG devices, and Holter monitors. The company's focus on integrating AI-driven technologies has enhanced diagnostic accuracy, with its MAC VU360 Resting ECG System gaining popularity for its precision and real-time data analytics. Philips Healthcare is another key player, particularly known for its Efficia ECG100 series, which provides cost-effective yet high-performance diagnostic solutions. Philips has made substantial strides in AI and telemedicine, further strengthening its position in the market. Nihon Kohden, a Japanese healthcare technology firm, has carved out a strong presence in Europe, particularly with its Cardiofax ECG machines, which are favored for their diagnostic capabilities and user-friendly interface.

Smaller regional players are also making their mark. Companies like Edan Instruments and Schiller AG are seizing opportunities in markets such as Eastern Europe and the Nordic countries by offering cost-effective, portable ECG systems. These smaller companies are helping to address the demand for affordable diagnostics in both rural and urban healthcare settings.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, GE Healthcare acquired Imaging Healthcare Specialists, enhancing its ECG offerings with more sophisticated AI-based analytics.

- Philips Healthcare completed its acquisition of BioTelemetry in April 2023, a leader in remote cardiac monitoring, solidifying its presence in the telemedicine and wearable ECG market.

- Nihon Kohden expanded its cardiovascular product portfolio with the acquisition of Defibtech, a specialist in automated external defibrillators (AEDs), in August 2023.

- Schiller AG announced a strategic partnership with Medtronic in October 2024, aimed at developing next-generation wireless ECG devices for both hospital and home settings, targeting a broader European market.

- Edan Instruments partnered with Telehealth Solutions in June 2023 to offer integrated telemedicine solutions alongside portable ECG devices across Europe.

- GE Healthcare entered into a joint venture with TechMedX in January 2024, focusing on the creation of AI-driven, cloud-based diagnostic platforms that enhance real-time ECG monitoring and data analytics across the region.

- In 2023, Philips Healthcare launched its AI-powered IntelliSpace Cardiovascular platform, which integrates ECG readings with broader patient health data, offering clinicians more comprehensive insights for better decision-making.

- Nihon Kohden has heavily invested in research and development (R&D) to develop wearable ECG patches, allowing patients to monitor their heart health remotely, a key advancement in patient-centric care.

- In April 2024, GE Healthcare introduced an upgraded version of its Mobile ECG Monitor, designed specifically for home care settings. This system enables real-time data transmission to healthcare providers via a cloud-based platform, improving the quality of remote care and reducing the need for in-person consultations.

MARKET SEGMENTATION

This research report on the European Diagnostic ECG Market has been segmented and sub-segmented into the following categories.

By Product

- Resting ECG System

- Stress ECG Systems

- Holter Monitors

By Lead Type

- Single-Lead Type ECG Devices

- 3-6 Lead Type ECG Device

- 12-Lead Type ECG Devices

- Other Lead Type ECG Devices

By End Users

- Hospitals

- Home/Ambulatory Care Research Centres

- Diagnostic Centres

- Rehabilitation Centres

- Clinics

- Physician Offices

- Surgical Centres

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]