Europe Dental Software Market Size, Share, Trends & Growth Forecast Report By Type (Practice Management Software, Patient Communication Software, Treatment Planning Software, Patient Education Software), Application (Clinical Application, Administrative), Deployment (On-Premise Model, Web-Based/Cloud-Based Model), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Dental Software Market Size

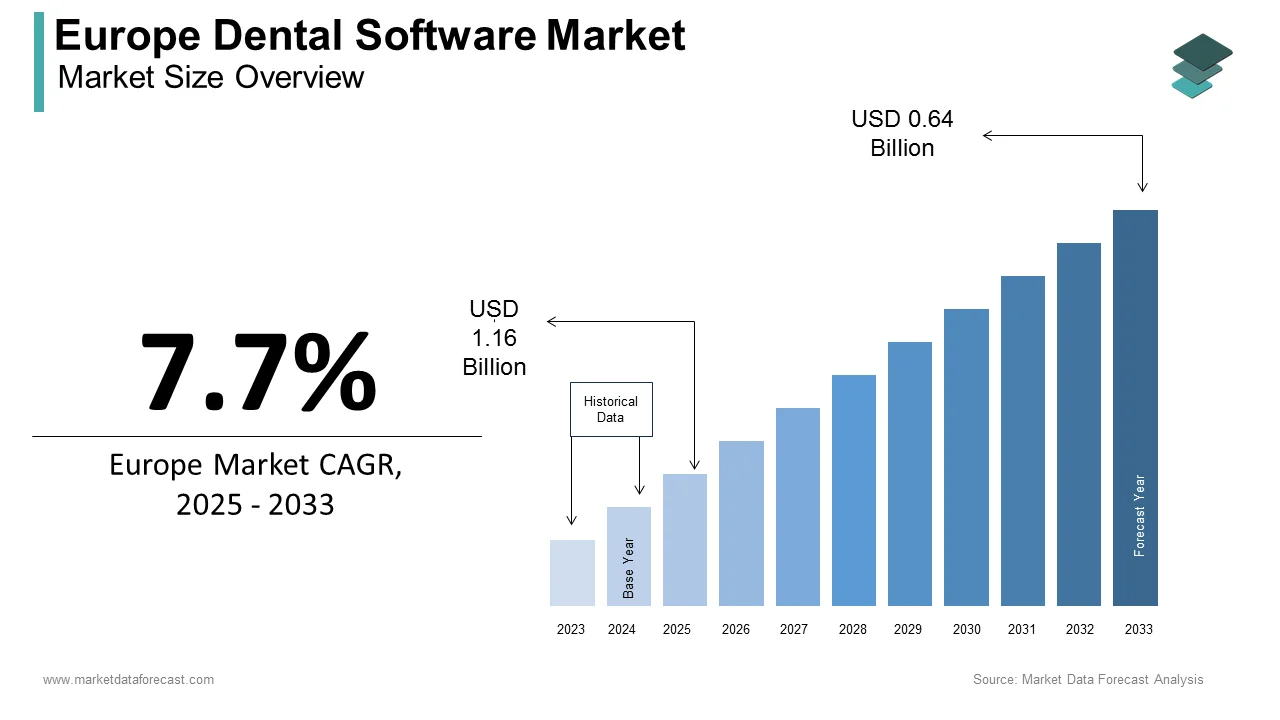

The dental software market size in Europe was valued at USD 0.59 billion in 2024. The European market is estimated to be worth USD 1.16 billion by 2033 from USD 0.64 billion in 2025, growing at a CAGR of 7.7% from 2025 to 2033.

Dental software includes a wide array of solutions, including practice management systems, imaging software, electronic health records (EHR), billing platforms, and patient communication tools, all designed to streamline operations and enhance clinical outcomes. According to a report by the European Federation of Periodontology, over 60% of dental clinics in Western Europe have adopted some form of digital practice management software as of 2023. In Europe, the demand for dental software is growing significantly owing to the factors such as the increasing digitization of dental practices, the growing emphasis on precision, efficiency, and patient-centric care, increasing aging population and rising awareness of oral health, with Eurostat reporting that dental visits across Europe increased by 15% between 2020 and 2023.

Additionally, according to the UK Health Security Agency, approximately 40% of dental practices in the UK now utilize cloud-based software solutions owing to their scalability and remote accessibility. Germany and France lead in adoption rates of dental software in Europe, with the German Dental Association noting that 70% of practices in urban areas employ advanced imaging and diagnostic software. The integration of artificial intelligence (AI) and machine learning into dental software is also gaining traction, enabling predictive analytics and personalized treatment plans.

MARKET DRIVERS

Increasing Adoption of Digital Dentistry and Advanced Technologies

The growing adoption of digital dentistry is a key driver propelling the Europe dental software market. According to the European Dental Association, over 65% of dental clinics in Western Europe have integrated advanced imaging and diagnostic tools into their workflows by 2023. This shift is fueled by the rising demand for precision in treatments such as orthodontics, implants, and restorative procedures. The German Dental Association highlights that 70% of urban practices now utilize CAD/CAM software for designing prosthetics, reducing treatment times by up to 40%. Furthermore, Eurostat reports that investments in intraoral scanners and 3D printing technologies have surged by 25% annually since 2021. These advancements necessitate robust dental software solutions for seamless integration and data management. As digital tools become indispensable for enhancing clinical outcomes, their widespread adoption continues to drive the growth of the dental software market across Europe.

Rising Focus on Practice Efficiency and Patient-Centric Care

The emphasis on improving practice efficiency and delivering patient-centric care is another major driver of the Europe dental software market. The UK Health Security Agency reports that approximately 40% of dental practices in the UK have adopted cloud-based practice management software, enabling real-time access to patient records and streamlined appointment scheduling. Similarly, the French National Health Authority highlights that patient communication tools, such as reminder systems and tele-dentistry platforms, have increased patient retention rates by 30% in France. A study by the European Federation of Periodontology reveals that practices using EHR systems have reduced administrative workload by 20%, allowing dentists to focus more on clinical care. With over 60% of European patients prioritizing digital interactions, as per Eurostat, dental software has become essential for enhancing operational efficiency and meeting evolving patient expectations, thereby fueling market expansion.

MARKET RESTRAINTS

High Costs of Implementation and Maintenance

The high costs associated with implementing and maintaining dental software is a major restraint to market growth in Europe. According to the European Federation of Periodontology, nearly 45% of small and medium-sized dental practices cite budget constraints as a primary barrier to adopting advanced software solutions. The French National Health Authority highlights that the initial setup costs for cloud-based practice management systems can exceed €10,000, while annual maintenance fees range from €2,000 to €5,000 per clinic. Additionally, Eurostat reports that over 30% of rural dental practices in Eastern Europe have delayed digital transformation due to limited financial resources. These costs are further compounded by the need for staff training and hardware upgrades, which smaller clinics often struggle to afford. As a result, the adoption of dental software remains uneven across regions, hindering its widespread implementation and slowing overall market expansion.

Data Privacy Concerns and Regulatory Compliance Challenges

Data privacy concerns and the complexity of complying with stringent regulations like GDPR is another major restraint for the Europe dental software market. The UK Health Security Agency reports that 60% of dental practices face challenges in ensuring compliance with data protection laws, particularly when integrating third-party software solutions. A study by the European Data Protection Board reveals that non-compliance fines reached an average of €50,000 per incident in 2023, deterring some clinics from adopting digital tools. Furthermore, the German Dental Association notes that 40% of dentists express concerns about cyberattacks and data breaches, which could compromise sensitive patient information. These fears are exacerbated by the increasing reliance on cloud-based systems, which require robust cybersecurity measures. Such regulatory and security challenges create hesitation among practitioners, limiting the pace of adoption and constraining market growth.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics is a promising opportunity for the Europe dental software market. According to the European Dental Association, AI-driven diagnostic tools are projected to reduce misdiagnosis rates by 30% by 2025, enhancing treatment precision and patient outcomes. The UK Health Security Agency highlights that over 50% of dental practices in the UK are exploring AI-based imaging software to improve early detection of conditions like cavities and periodontal diseases. Furthermore, Eurostat reports that investments in AI-powered dental solutions have grown by 40% annually since 2021, driven by their ability to analyze large datasets and provide actionable insights. These technologies enable personalized treatment plans and optimize resource allocation, addressing critical inefficiencies in traditional workflows. As AI adoption accelerates, it is expected to unlock new revenue streams and position dental software as a cornerstone of modern dentistry across Europe.

Expansion of Tele-Dentistry and Remote Care Solutions

The growing demand for tele-dentistry and remote care solutions is a notable opportunity for the Europe dental software market. The French National Health Authority reports that tele-dentistry consultations increased by 60% in 2023, particularly in rural areas where access to dental care remains limited. A study by the European Federation of Periodontology reveals that over 70% of patients prefer digital communication tools, such as virtual consultations and follow-ups, for convenience and cost-effectiveness. Additionally, the German Dental Association notes that practices offering tele-dentistry services have seen a 25% rise in patient engagement and retention. With Eurostat projecting that 80% of European households will have high-speed internet access by 2025, the scalability of tele-dentistry platforms is set to expand further. This trend not only enhances accessibility but also drives innovation in patient management software, creating lucrative opportunities for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Deployment, and Country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Carestream Health Inc (US), DentsplySirona (US), Elite Computer Italia (OrisLine Group) (Italy), Henry Schein Inc (US), KaVo Dental GmbH (Germany), PLANMECA OY (Finland), and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The practice management software segment led the market by accounting for 40.7% of the European market share in 2024. The domination of practice management software segment is driven by its ability to streamline critical administrative tasks like scheduling, billing, and patient record management, reducing workload by 25%, as reported by the UK Health Security Agency. The German Dental Association highlights that 70% of urban clinics use cloud-based systems for real-time data access, ensuring GDPR compliance. This segment's importance lies in its role in enhancing operational efficiency, enabling dentists to focus on clinical care while minimizing errors, making it indispensable for modern practices.

The patient communication software segment is predicted to be the fastest growing segment and grow at a CAGR of 20.1% over the forecast period. The rising demand for tele-dentistry in Europe is majorly boosting the expansion of the patient communication software segment in the European market. The UK Health Security Agency reports that practices using these tools have seen a 30% rise in patient retention. With 80% of European households expected to have high-speed internet by 2025, this segment is revolutionizing accessibility and patient engagement, addressing the growing preference for digital interactions and positioning itself as a key driver of innovation in dental care delivery.

By Application Insights

The administrative segment held 56.4% of the European market share in 2024. The growth of the administrative segment in the European market is driven by its ability to automate critical tasks such as appointment scheduling, billing, and patient data management, reducing administrative workload by 25%, according to the UK Health Security Agency. In France, the National Health Authority highlights that 70% of practices using cloud-based administrative solutions have improved GDPR compliance and operational efficiency. This segment's importance lies in its role in streamlining workflows, minimizing errors, and ensuring smooth clinic operations, making it indispensable for both urban and rural practices across Europe.

The clinical application segment is projected to register a CAGR of 18.8% over the forecast period due to the advancements in digital dentistry, with Eurostat reporting a 35% annual increase in AI-driven diagnostic tools since 2021. The German Dental Association notes that CAD/CAM systems reduce treatment times by 40%, enhancing precision in procedures. As demand for personalized care rises, clinical software is becoming essential for improving diagnostic accuracy and patient outcomes, positioning it as a key driver of innovation in the dental software market and transforming modern dental practices across Europe.

By Deployment Insights

The web-based/cloud-based deployment segment accounted for the leading share of the European market in 2024 due to its scalability, cost-efficiency, and ability to support remote operations, which are critical for modern practices. The UK Health Security Agency highlights that cloud-based systems reduce administrative workload by 25% and ensure GDPR compliance through robust encryption protocols. This segment's importance lies in enabling real-time data access, seamless tele-dentistry services, and integration with other digital tools, making it indispensable for urban clinics and practices embracing digital transformation across Europe.

REGIONAL ANALYSIS

Germany led the dental software market in Europe in 2024 by occupying a share of 26.3% of the European market share in 2024. The dominating position of Germany in the European market is driven by the country's advanced healthcare infrastructure and high adoption of digital dentistry tools, with 70% of urban clinics utilizing cloud-based practice management systems. The Federal Ministry of Health highlights that Germany’s emphasis on precision medicine and AI-driven diagnostics has accelerated investments in treatment planning and imaging software. Additionally, Eurostat notes that Germany accounts for 30% of all dental software patents filed in Europe, underscoring its role as an innovation hub. With a CAGR of 18% through 2028, Germany’s focus on integrating cutting-edge technologies into dental practices ensures its dominance. The country’s strong regulatory framework and commitment to GDPR compliance further bolster its position as a leader in secure and efficient dental software solutions.

The UK dental software market is predicted to expand at a significant CAGR in the European market over the forecast period. The rapid adoption of tele-dentistry and patient communication tools in the UK are primarily boosting the UK market growth. According to the British Dental Association, over 65% of UK practices now use cloud-based systems for administrative efficiency and remote care delivery. Government initiatives, such as the £2 billion Digital Health Investment Fund, have spurred innovation in AI-driven diagnostic tools. With a CAGR of 20%, the UK’s focus on enhancing accessibility and patient-centric care drives market growth. As digital transformation accelerates, the UK remains pivotal in shaping the future of dental software across Europe.

France is a notable regional segment for dental software in Europe and is anticipated to hold a substantial share of the European market over the forecast period. The widespread adoption of practice management and imaging software in France is primarily driving the French market growth. France’s National Health Strategy emphasizes digital health investments, allocating €500 million annually to cybersecurity and telehealth innovations. Eurostat reports that French dental practices adopting cloud-based systems have reduced administrative workload by 30%. With a CAGR of 19%, France’s focus on integrating AI and predictive analytics into dental workflows positions it as a key innovator. The country’s robust regulatory environment and growing demand for tele-dentistry further solidify its prominence in the regional market.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe dental software market profiled in this report are Carestream Health Inc (US), DentsplySirona (US), Elite Computer Italia (OrisLine Group) (Italy), Henry Schein Inc (US), KaVo Dental GmbH (Germany), PLANMECA OY (Finland), and Others.

MARKET SEGMENTATION

This Europe dental software market research report is segmented and sub-segmented into the following categories.

By Type

- Practice Management Software

- Patient Communication Software

- Treatment Planning Software

- Patient Education Software

By Application

- Clinical Application

- Administrative

By Deployment

- On-Premise Model

- Web-Based/ Cloud-Based Model

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. How fast is the Europe artificial disc market growing?

The Europe artificial disc market is projected to expand from USD 4.14 billion in 2025 to USD 15.77 billion by 2033, at a CAGR of 18.2%.

2. What drives the Europe artificial disc market?

The Europe artificial disc market is driven by an aging population, increasing degenerative disc diseases, and advancements in minimally invasive surgeries.

3. What challenges impact the Europe artificial disc market?

The Europe artificial disc market faces challenges like high procedure costs, limited insurance coverage, and strict regulatory approvals.

4. How is technology shaping the Europe artificial disc market?

The Europe artificial disc market is benefiting from 3D printing, AI-assisted surgery, and customized disc implants.

5. What opportunities exist in the Europe artificial disc market?

The Europe artificial disc market is seeing growth in telemedicine adoption and the development of personalized spinal implants.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]