Europe Dental Practice Management Software Market Size, Share, Trends & Growth Forecast By Deployment Mode, Application, End-user and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Dental Practice Management Software Market Size

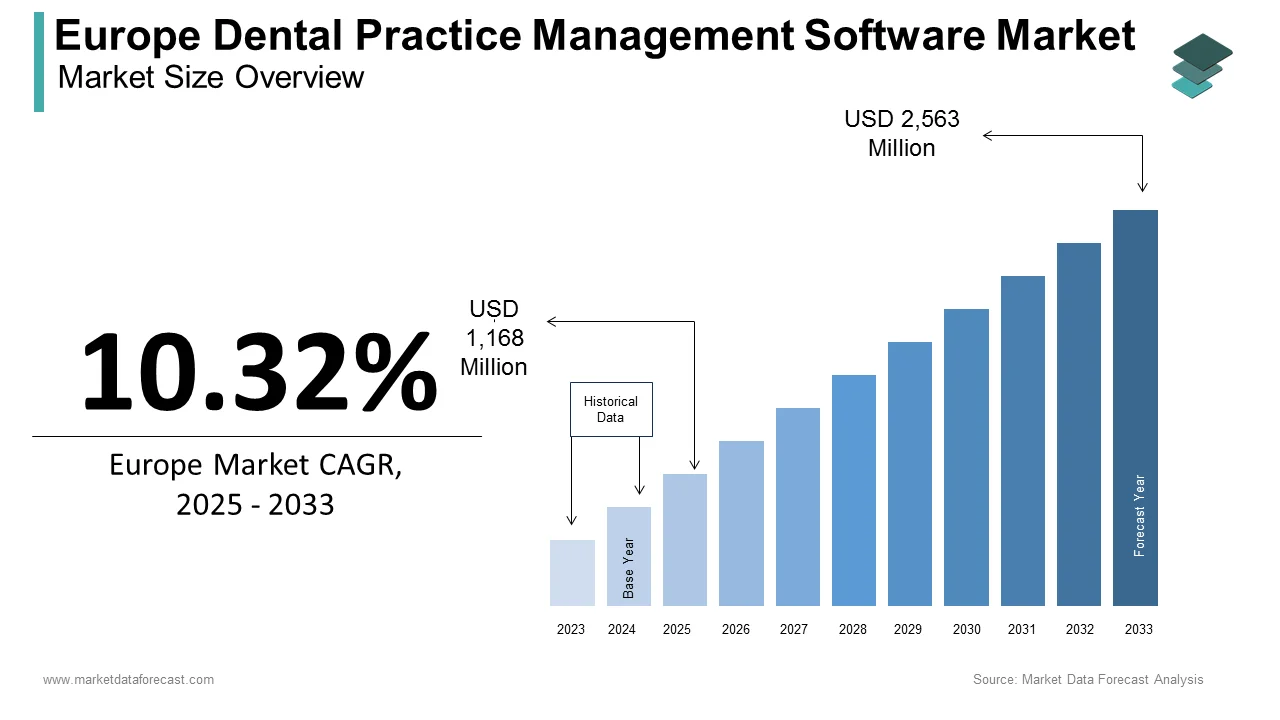

The dental practice management software market size in Europe was valued at USD 1,509 million in 2024. The European market is estimated to be worth USD 2,563 million by 2033 from USD 1,168 million in 2025, growing at a CAGR of 10.32% from 2025 to 2033.

These software solutions offer functionalities such as appointment scheduling, patient record management, billing, insurance claims processing, and treatment planning by enabling dental professionals to enhance operational efficiency and improve patient care.

The rise of telemedicine and remote consultations has further accelerated the demand for integrated software solutions that facilitate seamless communication between patients and practitioners. According to the Eurostat, over 70% of European dental clinics now use some form of digital management tool by reflecting a shift toward automation and data-driven decision-making. According to the European Health Data Space, the importance of secure and interoperable systems by encouraging practices to adopt advanced software for compliance with data protection regulations like GDPR.

The key drivers of this market include the rising prevalence of dental disorders with an aging population requiring specialized care, and government initiatives promoting digital health transformation. According to the World Health Organization, oral health issues affect over 50% of Europeans. The demand for innovative, user-friendly software solutions is expected to reshape the future of dental care delivery across Europe.

MARKET DRIVERS

Increasing Adoption of Digital Health Solutions

The growing adoption of digital health solutions is a major driver of the European dental practice management software market. According to the Eurostat, over 70% of healthcare providers in Europe now use digital tools for administrative and clinical tasks by reflecting a broader trend toward digitization. This shift is fueled by government initiatives, such as the European Health Data Space, which promotes interoperable systems to enhance data sharing and operational efficiency. Dental practices are increasingly adopting software solutions to streamline appointment scheduling, billing, and patient record management, reducing administrative burdens. As telemedicine gains traction, with a reported 30% increase in remote consultations during the pandemic, according to the European Centre for Disease Prevention and Control.

Rising Prevalence of Dental Disorders and Aging Population

The rising prevalence of dental disorders and an aging population are significant drivers of the European dental practice management software market. As per World Health Organization, oral health conditions, such as caries and periodontal diseases, affect over 50% of the European population by increasing the need for efficient practice management. According to the Eurostat, over 20% of Europe’s population will be aged 65 or older by 2030 by leading to higher demand for specialized dental care. Older adults often require complex treatments by necessitating robust software for treatment planning and insurance claims processing. The European Federation of Periodontology emphasizes that practices using advanced software achieve a 25% improvement in operational efficiency by enabling them to manage larger patient loads effectively. The adoption of management software becomes critical to addressing these demographic and healthcare challenges.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

The high cost of implementing dental practice management software poses a significant restraint to market growth in Europe. According to the European Federation of Periodontology, only 30% of smaller clinics have fully integrated digital solutions by reflecting the slow adoption rate among budget-constrained practices. While larger clinics may absorb these costs more easily, smaller practices often struggle to justify the expense, particularly when existing manual systems remain functional. This economic disparity creates a fragmented landscape by limiting widespread adoption. Many dental practices delay upgrading their systems by hindering the overall growth potential of the dental practice management software market.

Data Privacy Concerns and Regulatory Compliance Challenges

The data privacy concerns and stringent regulatory requirements is another major restraint for the European dental practice management software market. The General Data Protection Regulation (GDPR), enforced by the European Data Protection Board, imposes strict rules on the collection, storage, and processing of sensitive patient data. A study by the European Union Agency for Cybersecurity (ENISA) reveals that 60% of healthcare providers express concerns about data breaches when adopting new software systems. Furthermore, the European Health Data Space initiative emphasizes that non-compliance with GDPR can result in fines of up to €20 million or 4% of annual turnover by deterring some practices from transitioning to digital platforms. These challenges are compounded by the need for secure interoperability between systems by creating hesitancy among dental professionals and slowing the pace of software adoption across Europe.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics presents a significant opportunity for the European dental practice management software market. According to the European Commission’s Digital Economy and Society Index, over 50% of healthcare providers are exploring AI-driven solutions to enhance operational efficiency and patient care. AI-powered tools can analyze patient data to predict treatment outcomes, optimize appointment scheduling, and identify high-risk patients for preventive care. As per European Federation of Periodontology, practices leveraging AI report a 20% reduction in administrative workload and improved diagnostic accuracy. Furthermore, advancements in machine learning enable personalized treatment plans by aligning with the growing demand for patient-centric care. The investments like the EU’s €1 billion funding for AI research where dental practices can achieve greater scalability and innovation by positioning this technology as a transformative force in the market.

Expansion of Cloud-Based Solutions and Telemedicine Integration

The rising adoption of cloud-based solutions and telemedicine integration offers another major growth opportunity for the European dental practice management software market. According to the Eurostat, 70% of European healthcare providers now use cloud platforms due to their cost-effectiveness, scalability, and remote accessibility. According to the European Centre for Disease Prevention and Control, telemedicine usage surged by 40% during the pandemic by creating a robust foundation for software solutions that integrate virtual consultations with practice management systems. Cloud-based platforms enable real-time data sharing, secure storage, and seamless collaboration between practitioners and patients. Additionally, the European Health Data Space initiative supports interoperable systems by ensuring compliance with GDPR while enhancing usability. As dental practices increasingly prioritize flexibility and patient convenience, cloud-based solutions are poised to revolutionize the delivery of modern dental care across Europe.

MARKET CHALLENGES

Resistance to Change Among Dental Practitioners

The resistance to change among dental practitioners poses a significant challenge to the adoption of dental practice management software in Europe. According to the European Federation of Periodontology, only 45% of dental professionals fully embrace digital tools with many preferring traditional methods due to familiarity and perceived complexity. A survey by the European Regional Organization for Dental Practice Management reveals that 30% of practitioners cite a lack of technical expertise as a barrier by leading to hesitancy in transitioning to software-based systems. This resistance is particularly prevalent among older practitioners with Eurostat reporting that over 50% of dentists aged 55 and above are reluctant to adopt new technologies. The absence of adequate training programs further exacerbates this issue is limiting the potential benefits of these solutions.

Fragmented Regulatory Landscape Across Member States

The fragmented regulatory landscape across European countries presents another major challenge for the dental practice management software market. According to the European Data Protection Board, while GDPR provides a unified framework for data protection, individual member states interpret and enforce these regulations differently. According to the European Health Data Space initiative, 60% of cross-border dental practices face compliance challenges due to varying national requirements. Additionally, the cost of ensuring compliance with multiple regulatory frameworks increases administrative burdens for software providers. These complexities hinder the seamless integration of software solutions across borders is limiting scalability and market expansion. The lack of a cohesive approach continues to impede the widespread adoption of standardized dental practice management systems in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Delivery, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Carestream Dental, LLC, Epic Systems Corporation, Henry Schein, Inc., Patterson Dental Supply, Inc., and others. |

SEGMENTAL ANALYSIS

By Delivery Insights

The Cloud-based segment dominated the European dental practice management software market with a 45.2% of share in 2024 due to its scalability, flexibility, and cost-effectiveness by making it ideal for small and medium-sized practices. According to the European Health Data Space initiative, 70% of new adopters prefer cloud solutions due to their real-time data access and seamless integration with telemedicine platforms. These systems reduce upfront costs by 30% compared to on-premises solutions, while enabling secure backups and remote accessibility.

The cloud-based segment is anticipated to exhibit a CAGR of 12.3% from 2025 to 2033. This growth is driven by increased internet penetration, with Eurostat reporting that over 70% of European households have reliable internet access by enabling widespread adoption. According to the European Centre for Disease Prevention and Control, 40% surge in telemedicine usage during the pandemic, that further accelerate the demand for cloud platforms. These solutions offer scalable infrastructure, real-time updates, and enhanced security by aligning with the shift toward remote care.

By Application Insights

The patient communication software was the largest segment and held 35.9% of the European dental practice management software market share in 2024 owing to the driven by its ability to enhance patient engagement and streamline operations, with 60% of clinics using tools for appointment reminders and virtual consultations. According to the Eurostat, automated reminders reduce no-show rates by 20% by improving revenue and efficiency.

The Payment Processing Software segment is esteemed to register a CAGR of 13.8% from 2025 to 2033. This growth is fueled by the rising preference for digital payments, with over 70% of Europeans favoring cashless transactions. Secure and seamless payment solutions reduce manual errors, enhance patient convenience, and improve practice efficiency. The surge in contactless payments and digital wallets further accelerates adoption. The payment processing software is pivotal in meeting evolving consumer expectations by ensuring secure transactions, and driving operational agility across Europe.

By End User Insights

The Dental Clinics segment dominated the European dental practice management software market by capturing a significant share in 2024. The growth of the segment is driven by the widespread adoption of software among small and medium-sized practices to streamline operations and enhance patient care. With over 70% of clinics using these tools, they benefit from features like appointment scheduling, billing automation, and telemedicine integration. According to the Eurostat, such solutions reduce administrative burdens by 30% by improving efficiency and patient satisfaction.

The hospitals segment is estimated to witness a CAGR of 10.5% from 2025 to 2033. This growth is fueled by increasing investments in digital health infrastructure and the need for integrated systems to manage specialized dental departments. Hospitals require advanced software to handle high patient volumes and ensure GDPR compliance, with 40% of adopting solutions for cross-departmental coordination. The rise of telehealth and hospital-based dental services further accelerates demand.

REGIONAL ANALYSIS

Germany positioned top by holding 28.7% of the European dental practice management software market share in 2024 with a robust healthcare infrastructure and high awareness of digital solutions among dental professionals. According to the European Federation of Periodontology, over 70% of German dental clinics use advanced software for administrative and clinical tasks, which was driven by government incentives promoting digitization. Germany’s aging population, with Eurostat reporting that 20% will be aged 65 or older by 2030 with increased demand for efficient dental care management.

The United Kingdom dental practise management market is projected to exhibit a CAGR of 10.2% in the foreseen years. The UK’s dominance is fueled by its rapid adoption of cloud-based software, with Eurostat studies that revealed 85% of households have reliable internet access by enabling seamless integration of digital tools. The National Health Service (NHS) has also promoted telemedicine and remote consultations, which surged by 40% during the pandemic, as per the European Centre for Disease Prevention and Control. UK dental practices prioritize scalable, cost-effective solutions by making cloud-based systems ideal for managing patient records and billing. The UK remains a hub for innovation in dental practice management software as digital health initiatives expand.

France dental practise management software market is attributed to have a significant growth opportunities in next coming years. France’s success is driven by its focus on patient-centric care and government-backed initiatives promoting preventive healthcare. According to the Santé Publique France, 60% of French consumers prefer digital tools for appointment scheduling and reminders by boosting demand for integrated software solutions. France’s dominance in AI and biotechnology further enhances software capabilities by enabling predictive analytics and personalized treatment plans.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe dental practice management software market profiled in this report are Carestream Dental, LLC, Epic Systems Corporation, Henry Schein, Inc., Patterson Dental Supply, Inc., and Others.

MARKET SEGMENTATION

This research report on the Europe dental practice management software market has been segmented and sub-segmented into the following categories.

By Delivery

- On-premises

- Web-based

- Cloud-based

By Application

- Patient Communication

- Invoice/Billing

- Payment Processing

- Insurance Management

- Others

By End-use

- Dental Clinics

- Hospitals

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the CAGR of the Europe dental practice management software market?

The Europe dental practice management software market is predicted to grow at a CAGR of 10.32% from 2025 to 2033.

What factors are driving the growth of the Europe dental practice management software market?

Factors driving the growth of the Europe dental practice management software market include a rise in the number of dental practices, an increasing demand for better patient care, the need for accurate and up-to-date patient records, and technological advancements in software solutions.

What are the challenges faced by the Europe dental practice management software market?

Some challenges faced by the Europe dental practice management software market include the high cost of software implementation, the need for training and support, the need to comply with regulations such as GDPR, and the risk of data breaches.

Who are the key players operating in the Europe dental practice management software market?

Key players in the Europe dental practice management software market include Dentisoft Technologies, Carestream Dental, DentiMax LLC, Patterson Dental, and Henry Schein.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]