Europe Dental Insurance Market Size, Share, Trends & Growth Forecast Report By Coverage, Procedure, End-user and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis (2025 to 2033)

Europe Dental Insurance Market Size

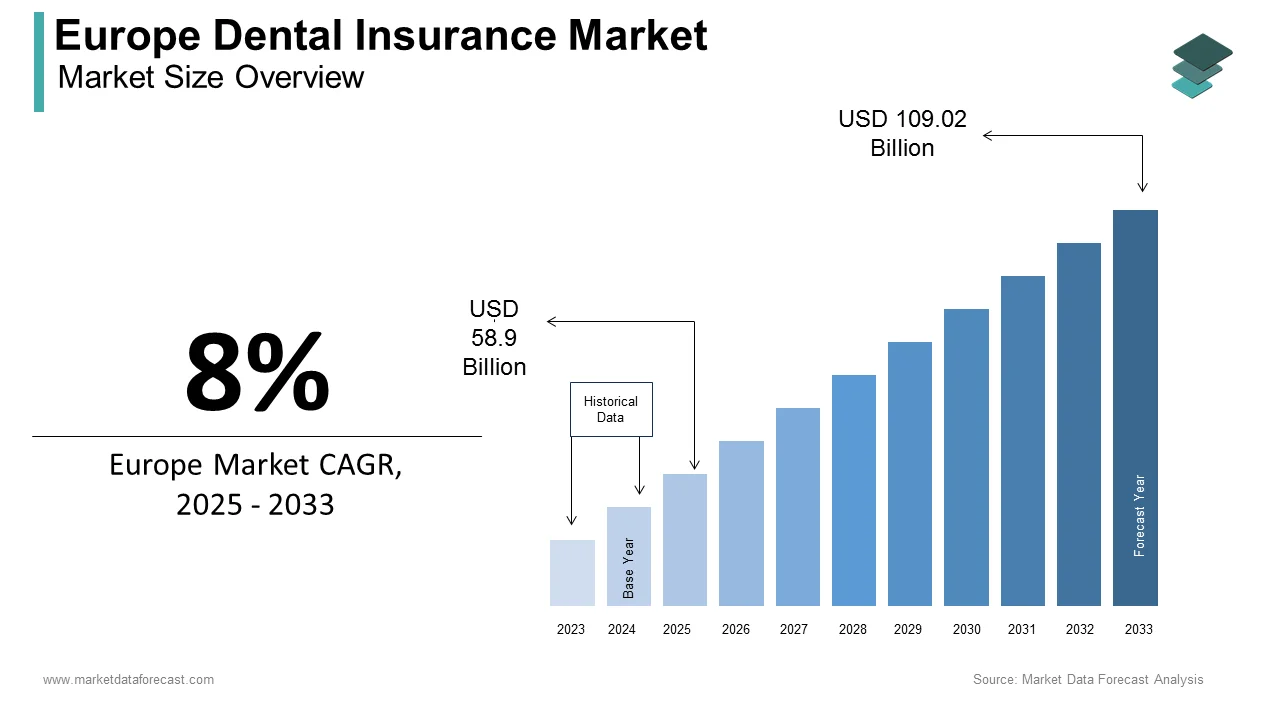

The dental insurance market in Europe was valued at USD 54.54 bn in 2024. The European market is further anticipated to be worth USD 109.02 billion by 2033 from USD 58.9 billion in 2025, growing at a CAGR of 8% from 2025 to 2033.

Europe is one of the lucrative regional segments in the global dental insurance market and captured 31.8% of the global market share in 2023. Europe is also predicted to witness prominent growth over the forecast period. The European population has substantial awareness of oral health, and Europe has favorable regulatory frameworks for the dental insurance market. Dental insurance in Europe is playing a significant role and supporting oral health by making dental care more accessible and affordable. Dental insurance coverage varies significantly by country in Europe. For instance, in countries such as Germany and the Netherlands, dental insurance is often included in standard health insurance packages. The statutory health insurance of Germany covers basic dental care, with about 90% of the population having some level of coverage. In the Netherlands, dental care for children up to 18 is covered under basic health insurance, while adults can opt for additional dental insurance. On the other hand, in countries like the UK, dental care under the National Health Service (NHS) is subsidized but not fully covered, which is further resulting in many seeking private dental insurance. For instance, about 45% of adults in the UK have some form of dental insurance.

MARKET DRIVERS

YoY Growth in the Awareness of Oal Health in Europe

The awareness of oral health is significantly rising across Europe. An increase in public health campaigns, educational initiatives, and the increasing availability of information online are primarily contributing to the growing awareness of oral health in Europe. With the growing awareness of oral hygiene, people understood the potential consequences of neglecting dental health, which further resulted in the surge of dental insurance adoption. As per the data of the European Federation of Periodontology, approximately 70-80% of Europeans suffer from some form of gum disease, which is completely preventable with proper oral hygiene and regular dental visits. The growing prevalence of dental diseases and increasing awareness of oral health are resulting in a growing number of dental check-ups. According to a survey by Eurobarometer, more than 60% of Europeans consider dental care to be an essential aspect of their overall health, which is promoting the European population to take dental insurance to get financial protection against the costs of dental diseases.

The Escalating Costs Associated with Dental Treatments

Dental procedures, especially advanced treatments such as implants, orthodontics, and periodontal surgeries, are expensive. According to the European Dental Market Report, the average cost of a dental implant in Europe ranges from €1,000 to €2,500, which is a significant financial burden for many individuals without insurance. Countries such as the UK and Germany have witnessed a substantial rise in dental treatment costs. In the UK, the NHS dental treatment costs have increased by over 5% annually, which is motivating people to adopt private dental insurance plans to cover these expenses. Similarly, in Germany, while basic dental care is covered by statutory health insurance, many advanced treatments are not fully reimbursed, which results in an increase in out-of-pocket expenses among people in Europe.

Furthermore, factors such as the growing aging population in Europe, the increasing number of initiatives and reforms from the governments of European countries, technological Advancements in Dental Care, and the expansion of private health insurance providers contribute to the expansion of Europe's dental insurance market. Higher disposable incomes, rapid adoption of employer-sponsored dental insurance plans and growing focus on preventive healthcare support the dental insurance market growth in Europe.

MARKET RESTRAINTS

On the other hand, the high costs associated with premiums primarily impede the dental insurance market growth in Europe. In addition, factors such as limited coverage for advanced treatments, complex reimbursement processes, and lack of awareness about the benefits of dental insurance hinder the dental insurance market growth in Europe. Furthermore, the growing out-of-pocket expenses, stringent regulatory requirements and saturation in mature markets hamper the Europe dental insurance market growth.

SEGMENTAL ANALYSIS

By Coverage Insights

The dental preferred provider organizations (DPPO) segment dominated the market in 2024. The DPPO segment accounted for 36.4% of the European market share in 2023. The popularity and widespread adoption of DPPO plans among European consumers majorly propel the segmental growth in the European market. DPPO plans allow policyholders to choose from a wide network of dentists and specialists, and this flexibility is greatly appreciated by people who like to have options when it comes to selecting their dental care providers. The comprehensive coverage of DDPO plans further boosts the expansion of the segment in the European market. For instance, as per the 2022 study by the European Dental Association, DPPO plans to cover approximately 80% of preventive care costs, 60% of basic procedures, and 50% of major procedures. The cost-effectiveness of DDPO plans also contributes to their increasing adoption and segmental growth in the European market.

By Procedure Insights

The preventive procedures segment led the market in Europe in 2023. The preventive procedures segment occupied 42.9% of the European market share in 2023. Preventive dental procedures include routine dental check-ups, cleanings, fluoride treatments, dental sealants, and X-rays. The growth of the preventive procedures segment is majorly driven by the rising awareness about the importance of maintaining good oral hygiene and preventing dental diseases. For instance, as per the statistics of the European Federation of Periodontology, more than 60% of Europeans knew the importance of preventive dental care. The low cost of preventive procedures compared to major dental treatments and initiatives and regulations from the governments of European countries to improve public health and reduce healthcare costs promote the growth rate of the preventive procedures segment. According to a report by the European Commission, 70% of dental insurance policies in Europe provide full coverage for preventive procedures.

By End-User Insights

The corporate segment did well in the European market in 2024. The corporate segment was the leading segment and had 61.4% of the European market share in 2023. Companies increasingly view dental insurance as a valuable perk that enhances employee satisfaction and retention. The corporate wellness programs and tax incentives and regulatory support to employers who provide dental insurance to their employees by some of the governments of European countries boost the expansion of the corporate segment.

REGIONAL ANALYSIS

The UK had 26.1% of the European market share and played the dominating role in the regional market in 2023. The National Health Service (NHS) of the UK has been providing the foundation for dental care, but private dental insurance plans fill the gaps by offering more extensive coverage for advanced treatments. According to data from the British Dental Association, approximately 20% of UK residents have private dental insurance and NHS service. The high adoption of employer-sponsored plans in the UK further promotes the growth of the UK dental insurance market. Several companies in the UK offer dental insurance as part of their benefits packages to attract and retain talent. As per the statistics of the UK Employee Benefits Survey, an estimated 60% of medium to large companies in the UK offer dental insurance to their employees. The UK government's regulatory support and initiatives to increase the awareness of oral health among people also contribute to the UK market expansion.

Germany is expected to play a key role in the European market during the forecast period. Germany ranks among the top countries in Europe for dental care quality. The comprehensive care and advanced dental care that Germany offers to propel the German market growth majorly. As per the data of the German Insurance Association, more than 70% of people in Germany have some sort of dental insurance. An increase in the number of initiatives by employers and the government of Germany to promote the adoption of dental insurance further promotes the growth of the German market.

France is anticipated to account for a substantial share of the European market during the forecast period. France has Mutuelle health insurance system that provides extensive dental coverage as part of their health insurance plans. More than 90% of people in France is covered by mutuelle health insurance that includes dental benefits. The French government strongly supports dental health through subsidies and public awareness campaigns, which further promote the dental insurance market in France.

KEY MARKET PARTICIPANTS

Aetna Inc. (CVS Health Corporation), AFLAC Inc., Allianz SE, Ameritas Life Insurance Corp., AXA S.A., Cigna, Delta Dental Plans Association, MetLife Inc., United HealthCare Services Inc., United Concordia (Highmark Inc.) and HDFC ERGO Health Insurance Ltd. (Apollo Munich) are some of the major players in the Europe dental insurance market.

MARKET SEGMENTATION

This research report on the Europe dental insurance market has been segmented and sub-segmented into the following categories.

By Coverage

- Dental Health Maintenance Organizations (DHMO)

- Dental Preferred Provider Organizations (DPPO)

- Dental Indemnity Plans (DIP)

- Dental Exclusive Provider Organizations (DEPO)

- Dental Point Of Service (DPS)

By Procedure

- Preventive

- Major

- Basic

By End-users

- Individuals

- Corporates

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which companies are playing a big role in the Europe dental insurance market?

The Europe dental insurance market is anticipated to grow at a CAGR of 8% over the next 5 years of timeline.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]