Europe Dental Implants Market Research Report – Segmented By Implant (Titanium implants, Zirconia implants) & and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) – Industry Analysis From 2025 to 2033

Europe Dental Implants Market Size

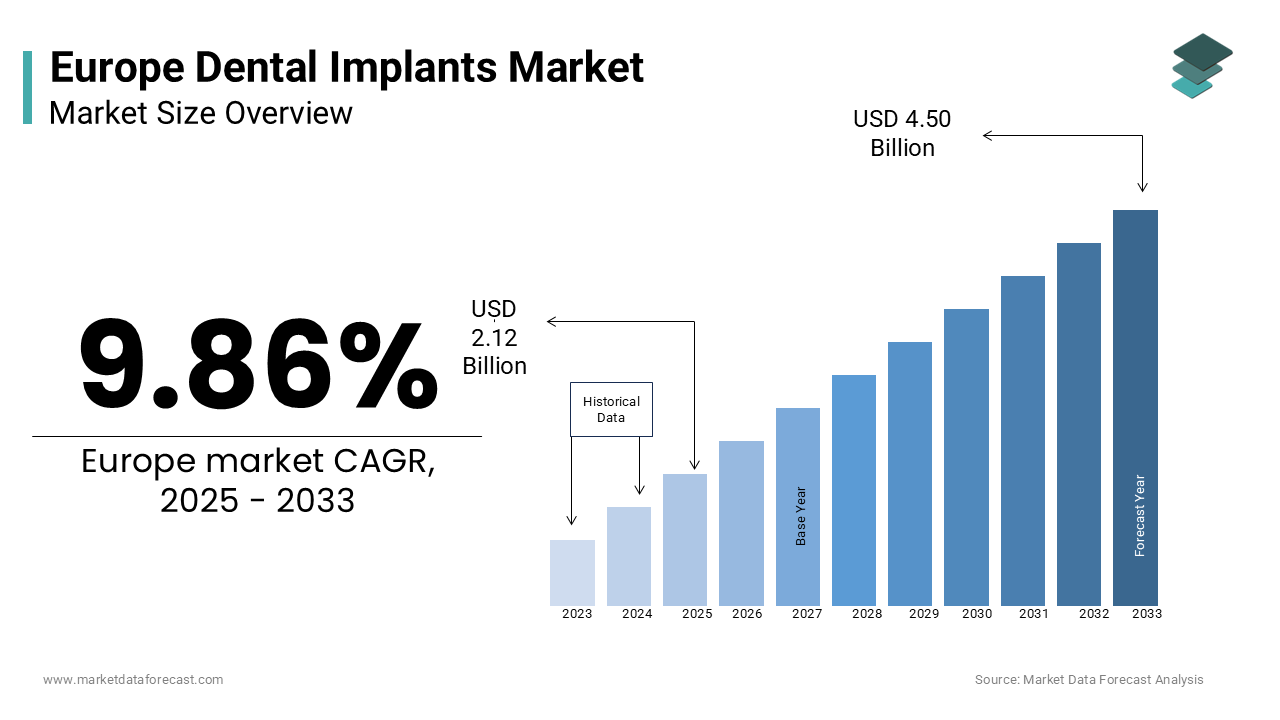

The Europe dental implants market size was valued at USD 1.93 billion in 2024 and is estimated to reach USD 4.50 billion by 2033 from USD 2.12 billion in 2025, registering a CAGR of 9.86% from 2025 to 2033.

The Europe dental implants market is witnessing steady growth. It is driven by advancements in dental technology and an aging population requiring restorative dental care. Also, the expansion is fueled by increasing awareness about oral health and the rising adoption of minimally invasive implant procedures.

Germany leads the regional market, accounting for over 25% of total revenue, as per the German Dental Association. This dominance is attributed to the country’s robust healthcare infrastructure and widespread acceptance of advanced dental solutions. Additionally, the European Federation of Periodontology reports that over 60% of Europeans aged 45 and above suffer from tooth loss, creating substantial demand for dental implants. Innovations in biocompatible materials and digital dentistry are further reshaping the dynamics of the market, enhancing patient outcomes and satisfaction.

MARKET DRIVERS

Aging Population and Rising Tooth Loss Incidence

The aging population across Europe is a primary driver of the dental implants market. According to the World Health Organization, over 20% of Europeans are aged 65 and above, and this demographic is projected to grow by 15% by 2030. For instance, the Italian National Institute of Statistics shows that over 70% of seniors experience tooth loss, necessitating restorative solutions like dental implants. This trend is further amplified by lifestyle factors such as poor dietary habits and smoking, which contribute to periodontal diseases. As per the European Oral Health Organization, over 50% of adults in urban areas seek dental implants for functional and aesthetic reasons, propelling demand for advanced solutions. Companies like Straumann have capitalized on this shift by introducing affordable and durable implant systems tailored for elderly patients.

Advancements in Dental Technology

Technological advancements in dental implants are also propelling the market forward. The European Dental Federation indicates that innovations such as computer-aided design and manufacturing (CAD/CAM) have improved the precision and success rates of implant procedures by 30%. For example, Sweden introduced robotic-assisted implant surgeries in 2023, targeting high-income demographics seeking cutting-edge treatments. As per McKinsey & Company, over 60% of dental clinics now utilize digital workflows, reducing procedure times and enhancing patient satisfaction. These developments position technological innovation as a key growth driver in the coming years.

MARKET RESTRAINTS

High Cost of Procedures

High costs associated with dental implants pose a significant restraint for the market. In line with the European Consumer Organisation, the average cost of a single implant ranges from €2,000 to €4,000 is making it unaffordable for low-income populations. For instance, Spanish consumers reported a 25% decline in implant procedures in rural areas due to financial constraints, as stated by the Spanish Dental Association. Additionally, limited insurance coverage for elective dental treatments exacerbates affordability concerns. As per the European Health Insurance Alliance, only 30% of private insurers offer reimbursement for implants are hindering widespread adoption among middle-income households.

Regulatory Challenges

Stringent regulatory frameworks also act as a restraint for the market. According to the European Medicines Agency, compliance with safety and efficacy standards for dental implants can delay product launches by up to two years. For example, France’s recent legislation requiring detailed clinical trial data created additional hurdles for manufacturers introducing zirconia-based implants, as highlighted by the French National Medical Council. Furthermore, varying regulations across member states complicate market entry strategies for multinational operators. These complexities hinder growth and force companies to allocate resources toward meeting compliance requirements.

MARKET OPPORTUNITIES

Growing Demand for Aesthetic Dentistry

The increasing demand for aesthetic dentistry offers a promising opportunity for the Europe dental implants market. For example, Swiss clinics attract over 50,000 international patients annually for premium zirconia implants, reflecting their global appeal. Besides these, government incentives for medical tourism have encouraged investments in luxury dental facilities, aligning with the rising preference for personalized care. These developments state the potential of aesthetic dentistry to reshape the industry landscape.

Expansion into Emerging Markets

Emerging markets in Eastern Europe present untapped opportunities for growth. The World Bank sheds light on countries like Poland and Romania are witnessing rapid urbanization, with healthcare spending increasing by 15% annually. Dental implant providers are capitalizing on this trend by establishing local operations, catering to underserved populations seeking affordable solutions. For instance, Hungary’s booming dental tourism industry attracted over €1 billion in investments in 2023, creating demand for scalable implant technologies. These developments underscore the potential of emerging markets to drive future growth.

MARKET CHALLENGES

Competition from Alternative Solutions

Intense competition from alternative solutions, such as removable dentures, poses a pressing challenge for the Europe dental implants market. As stated by Deloitte, traditional dentures captured over 40% of the restorative dentistry market share in 2023 and is driven by their affordability and ease of maintenance. Like, UK-based consumers increasingly prefer dentures for their perceived cost-effectiveness, limiting implant demand. This shift is further amplified by aggressive marketing strategies adopted by manufacturers, who emphasize affordability and convenience.

Supply Chain Disruptions for Raw Materials

Supply chain disruptions for raw materials also challenge the market, particularly for procuring critical components like titanium and zirconia. The European Logistics Association stresses that shortages caused by geopolitical tensions delayed production schedules by up to six months in 2023. This issue is compounded by reliance on imports for specialized materials. As per the European Raw Materials Alliance, over 90% of high-grade titanium used in implants is sourced from foreign markets, making the supply chain vulnerable to external shocks. For example, tariffs imposed on Chinese imports raised production costs for manufacturers, limiting their ability to meet growing demand.

SEGMENTAL ANALYSIS

By Implant Insights

The titanium implants dominated under this segment of the Europe dental implants market and held a substantial market share in 2024. This upward pattern is caused by their superior biocompatibility and durability, particularly for long-term restorative solutions. For instance, the German Dental Federation reports that over 80% of implant procedures utilize titanium-based systems is reflecting their widespread adoption. Advancements in surface modification techniques have further enhanced the segment’s appeal. As per the European Biomedical Materials Association, modern coatings now improve osseointegration by 25%, boosting patient outcomes. Also, promotional pricing offered by suppliers has encouraged widespread adoption, solidifying titanium implants’ dominance.

The Zirconia implants segment is the fastest-growing segment, with a projected CAGR of 10.5% through 2033. This growth is fueled by increasing consumer preference for metal-free solutions, particularly among younger demographics. For example, the Swedish Dental Association shows that over 50% of millennials opt for zirconia implants due to their aesthetic appeal and hypoallergenic properties. Innovations in material science have accelerated adoption. For instance, Switzerland introduced translucent zirconia implants in 2023, targeting high-end clinics serving affluent clients.

REGIONAL ANALYSIS

Germany was the largest contributor to the Europe dental implants market by commanding a market share of 25.1% in 2024. This dominance is fueled by the country’s robust healthcare infrastructure and widespread adoption of advanced dental technologies. For instance, over 70% of German clinics utilize CAD/CAM systems for implant procedures, reflecting their emphasis on precision and efficiency. A key factor propelling Germany’s growth is its leadership in innovation. According to the Climate Neutral Healthcare Initiative, German manufacturers lead Europe in adopting eco-friendly practices, with over 60% of facilities powered by renewable energy sources.

The United Kingdom captured a market share of approximately 18.1% in 2024. The country’s growth is driven by its thriving medical tourism sector, which accounts for nearly 10% of GDP. For example, London-based clinics attract over 50,000 international patients annually for premium titanium implants, reflecting their global reputation. Another contributing factor is the rise of digital platforms. As per the Tech Nation, the UK e-commerce business attracted over €5 billion in investments in 2023 is creating demand for affordable implant solutions.

France had a notable portion of the market share, as per the French Ministry of Health. The country’s emphasis on aesthetic dentistry makes it a hub for high-end zirconia implants. For instance, Parisian clinics reported a 20% increase in zirconia implant procedures in 2023, driven by the growing preference for metal-free solutions. Additionally, government incentives for medical tourism have encouraged investments in luxury dental facilities, positioning France as a leader in personalized care.

Italy's dental implants market is characterized by a growing demand for aesthetic dentistry and an increasing number of dental clinics offering implant services. The country’s aging population provides a strong foundation for growth. For example, Italian clinics perform over 40% of Europe’s geriatric implant procedures, underscoring their critical role in addressing age-related tooth loss. Consumer awareness about oral health has further boosted demand, particularly among younger demographics.

Sweden is recognized as the fastest-growing regional market in Europe. The country’s focus on sustainability and cutting-edge research makes it a pioneer in biocompatible materials. For instance, over 50% of Swedish millennials are willing to adopt zirconia implants, reflecting their openness to innovation. Government support for startups has also accelerated adoption, positioning Sweden as a key player in emerging technologies.

KEY MARKET PLAYERS

Anthogyr SAS, Institut Straumann AG, Leader Italy, and Nobel Biocare Services AG are some of the key market players in the europe dental implants market

The Europe dental implants market is marked by intense competition, with established giants and emerging players vying for supremacy. According to the European Dental Federation, the top five companies account for over 60% of total sales, reflecting the market’s oligopolistic structure. Straumann, Dentsply Sirona, and Nobel Biocare dominate the landscape, leveraging their technological expertise and extensive distribution networks.

Smaller players, however, are gaining traction through niche offerings,

such as affordable implant solutions and specialized zirconia-based systems. The rise of digital platforms has leveled the playing field, enabling smaller brands to reach wider audiences. Price wars and promotional campaigns are common, particularly in the aesthetic dentistry segment. Despite these challenges, innovation remains a key differentiator, with companies continuously introducing advanced solutions to meet evolving consumer demands.

Top 3 Players in the Market

Straumann Group

Straumann Group leads the Europe dental implants market, contributing significantly to the global industry through its diverse portfolio of innovative products. According to the European Dental Federation, Straumann holds a 25% share of the European market, driven by its focus on biocompatible materials and digital dentistry. The company’s global reach extends to over 100 countries, making it a dominant player worldwide.

Dentsply Sirona

Dentsply Sirona ranks second, renowned for its expertise in producing high-quality titanium implants and CAD/CAM systems. As per the Irish External Trade Organization, Dentsply Sirona’s European operations generated €2 billion in revenue in 2023, bolstered by demand for its precision-engineered solutions. The company’s strategic partnerships with leading clinics enhance its global footprint.

Nobel Biocare

Nobel Biocare holds the third position, leveraging its strong brand presence and commitment to innovation. According to the U.S. Chamber of Commerce, the company achieved a 12% year-on-year growth in Europe in 2023, fueled by its focus on zirconia-based solutions. Its contributions to the global market include tailored offerings for diverse demographics, positioning it as a key player in the industry.

RECENT MARKET DEVELOPMENTS

- In January 2024, Straumann Group launched a new line of affordable titanium implants. This initiative aimed to cater to budget-conscious consumers in Eastern Europe and expand its market reach.

- In March 2024, Dentsply Sirona acquired a Czech dental technology firm. This acquisition was intended to enhance its R&D capabilities and accelerate the development of CAD/CAM systems tailored for small clinics.

- In May 2024, Nobel Biocare introduced a translucent zirconia implant system. This launch aimed to target high-income demographics seeking metal-free and aesthetically pleasing solutions.

- In July 2024, BioHorizons unveiled its first AI-driven implant planning software. This initiative aimed to position the Netherlands as a global hub for precision dentistry while addressing client concerns about procedure accuracy.

- In September 2024, Ivoclar Vivadent partnered with a Swiss biotech startup to develop bioactive implant coatings. This collaboration aimed to explore innovative solutions for faster osseointegration and improved patient outcomes.

MARKET SEGMENTATION

This research report on the europe dental implants market is segmented and sub-segmented based on categories.

By Implant

- Zirconium Implants

- Titanium Implants

By Country

- The United States

- Canada

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]