Europe Dental Bone Graft Substitutes Market Size, Share, Trends & Growth Forecast Report By Type, Application, Product and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis, From (2025 to 2033)

Europe Dental Bone Graft Substitutes Market Size

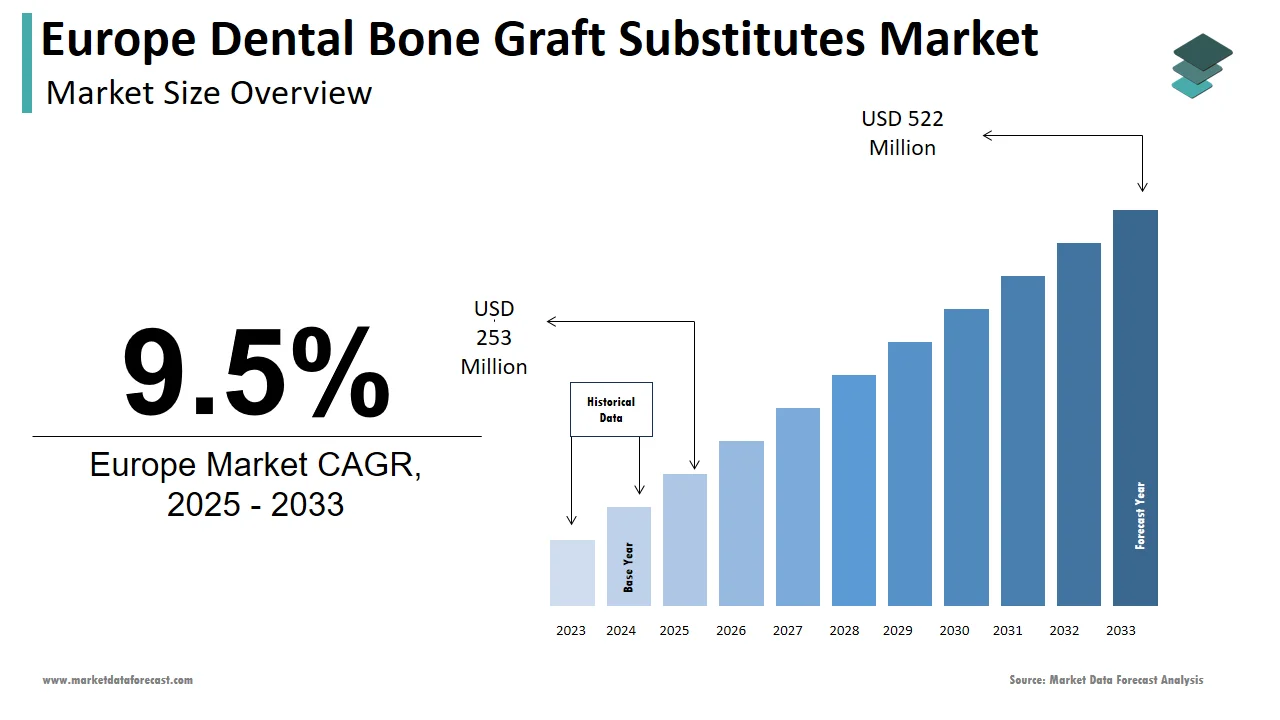

The dental bone graft substitutes market size in Europe was valued at USD 230.6 million in 2024. The European market is estimated to be worth USD 522 million by 2033 from USD 253 million in 2025, growing at a CAGR of 9.5% from 2025 to 2033.

MARKET DRIVERS

Prevalence of Dental Disorders

Dental disorders are increasingly recognized as one of the most prevalent conditions in Europe, which primarily drives the growth of the European dental bone graft substitutes market. Nearly half of the European population is affected by dental diseases. Another factor is poor lifestyle and consumption of unhealthy food, alcohol, and tobacco, which overall affects oral hygiene and contributes to the rise in oral diseases.The rising elderly population and growing awareness about dental care in Europe increase the growth rate of dental preventive care. The use of bone grafts and substitutes in dentistry has markedly increased in recent years due to advancements in dental implantology and the growing need for the repair of craniofacial bone defects. In recent years, continuous technological advancements have been increasing, driving the market to use newer bone grafting materials, such as bone substitute products, despite little evidence-based research for indications and safety. Thus, these matters of concern and continued marked increases in demand for bone graft materials. Despite decreasing prevalence and increased emphasis on preventive care, oral disease remains a notable health challenge propelling market growth.

Advancements in Dental Technology

The European dental bone graft substitutes market is experiencing positive developments, driven by continuous advancements in dental technology. Researchers are working hard to create new dental bone graft substitutes using different materials, responding to the growing demand. Collaboration between public and private sectors can enhance oral health coverage and access, creating opportunities for expansion in the dental bone graft substitutes market.Dental grafting materials play a crucial role in procedures aimed at restoring or enhancing bone structure in the oral cavity. Traditionally, these materials have been utilized as structural frameworks to support osteo-regenerative processes, particularly meeting the criterion of osteoconductive. The opportunity for improvement lies in exploring materials beyond mere structural support. Researchers are working to enhance the biological properties of dental grafting materials, aiming to facilitate better integration with natural bone and stimulate more efficient regrowth. Moreover, there is a growing awareness of the need for dental grafting materials that not only provide structural support but also actively contribute to the regeneration of bone tissue, providing vast opportunities for market share growth.

MARKET CHALLENGES

Lack of Awareness

The European dental bone graft market faces several challenges hindering its growth. Many people in Europe need to be aware of the benefits of dental bone graft substitutes, and regulatory obstacles create barriers to market expansion. The high cost of dental bone graft procedures is a significant hurdle for numerous Europeans. Limited access to dental care, coupled with reimbursement and insurance coverage issues, restrains the market growth. Insufficient facilities and a shortage of skilled professionals in the bone graft field further intensify the limitations to market growth. Lastly, financial constraints lead to unmet oral health needs, especially for vulnerable and low-income populations, creating significant hurdles in access to dental services. Complications and risks associated with dental procedures further impede the market growth.

Limited Coverage for Dental Care

The challenges in the Bone Graft Market in Europe are multifaceted. Several European countries limit coverage for dental care, leading to increased reliance on private funding compared to other health services. This creates financial barriers for individuals seeking dental treatments. Additionally, a lack of critical information on the causes and prevalence of oral diseases and the effectiveness of preventive activities and oral health services hampers informed policy-making.The materials commonly used for bone grafts globally have drawbacks, especially concerning allografts (materials from unrelated donors) and autografts (materials from the same person). None of the existing products in the market possesses all the ideal qualities for a bone substitute material, such as causing minimal patient discomfort, being easy to handle, having low immune reactions, affordability, and promoting blood vessel growth.

SEGMENTAL ANALYSIS

By Type Insights

The synthetic bone graft segment held the largest share and is expected to grow significantly over the forecast period. Technological advancements are increasing the adoption of synthetic grafts. The longer shelf-life and lack of risk of infection are primary driving factors for the market growth in this segment.

By Application Insights

The socket preservation segment dominated the market with a dominant share as this procedure prevents bone loss while treating dental problems. There is rising awareness among people that preventive care is preferred rather than treatment. This segment is majorly driven by a desire to reduce the necessity of further, more invasive procedures.

REGIONAL ANALYSIS

Germany and the UK dominated the European dental bone graft substitute market due to increasing government initiatives that support the market expansion. Government organizations' favorable reimbursement and insurance policies, which cover the primary procedures and the regulations for product commercialization, drive the regional market. The presence of major revenue-generating countries in the European region is fueling market share growth. The advanced healthcare infrastructure in the region is boosting the market expansion in countries like France and Italy.

KEY MARKET PLAYERS

Institut Straumann AG (Switzerland), Geistlich (Switzerland), DENTSPLY International (U.S.), Zimmer Biomet (U.S.), Medtronic (Ireland), BioHorizons IPH, Inc. (U.S.), ACE Surgical Supply Company, Inc. (U.S.), RTI Surgical, Inc. (U.S.), LifeNet Health (U.S.), and Dentium (Korea) are some of the notable companies in the European dental bone graft substitutes market.

MARKET SEGMENTATION

This Europe dental bone graft substitutes market research report is segmented and sub-segmented into the following categories.

By Type

- Synthetic Bone Graft

- Xenograft

- Allograft

- Demineralized Allograft

By Application

- Socket Preservation

- Ridge Augmentation

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Sinus Lift

By Product

- Bio OSS

- Osteograf

- Grafton

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the Europe dental bone graft substitutes market?

The growth of the Europe dental bone graft substitutes market is driven by factors such as the rising prevalence of dental disorders, increasing awareness about dental care, a growing geriatric population, technological advancements in dentistry, and post-pandemic focus on preventive healthcare.

Who are the major companies operating in the Europe dental bone graft substitutes market?

Major companies operating in the Europe dental bone graft substitutes market include Zimmer Biomet Holdings Inc., Geistlich Pharma AG, Dentsply Sirona Inc., Straumann Holding AG, and Medtronic PLC.

Which countries contribute significantly to the Europe dental bone graft substitutes market?

The United Kingdom and Germany are two countries that hold significant shares in the Europe dental bone graft substitutes market.

What are the key challenges hampering the growth of the Europe dental bone graft substitutes market?

Some key challenges hampering the growth of the Europe dental bone graft substitutes market include the high cost of dental procedures, limited access to dental care in certain regions, reimbursement and insurance coverage issues, lack of awareness about the benefits of dental bone graft substitutes, regulatory constraints, and the availability of skilled professionals in dental bone graft procedures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]