Europe Decorative Laminates Market Size, Share, Trends & Growth Forecast Report By Raw Material (Plastic Resin, Overlays, Adhesives, and Wood Substrate), Application, End-User Industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Decorative Laminates Market Size

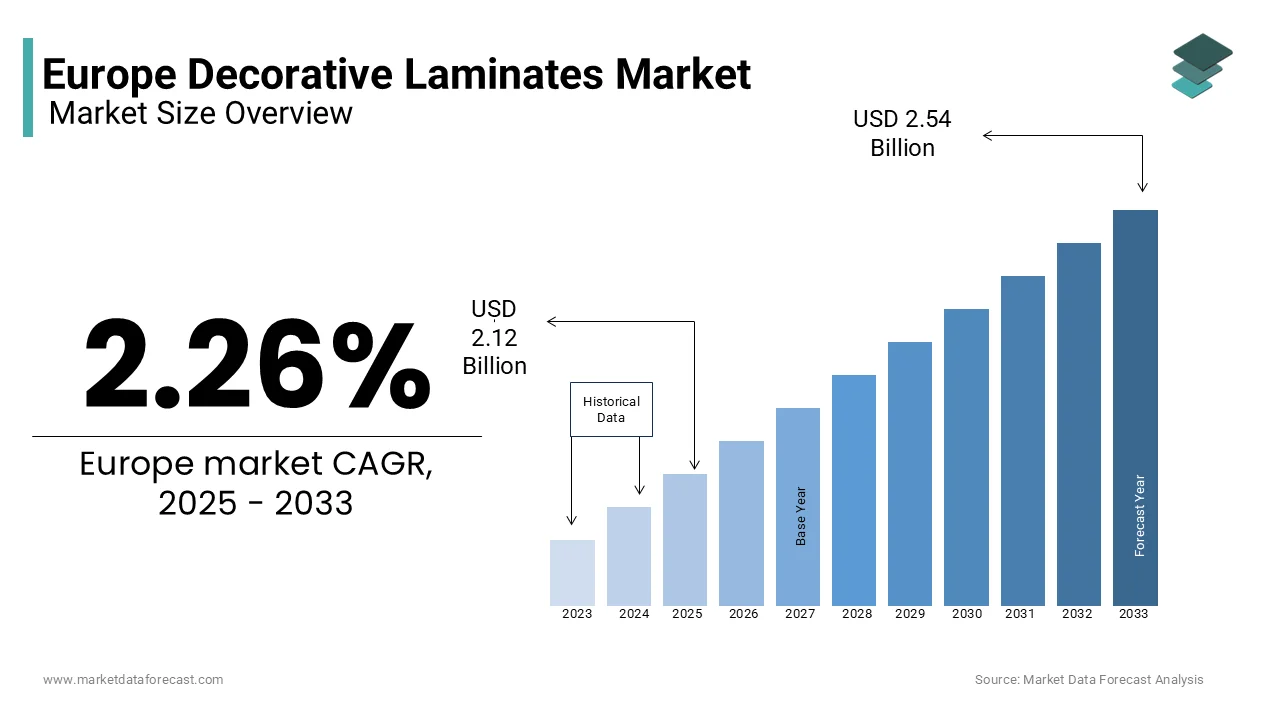

The Europe decorative laminates market size was valued at USD 2.07 billion in 2024. The European market is estimated to be worth USD 2.54 billion by 2033 from USD 2.12 billion in 2025, growing at a CAGR of 2.26% from 2025 to 2033.

Decorative laminates have become a cornerstone of modern interior design and construction across Europe, offering a versatile blend of aesthetics, durability, and cost-effectiveness. Germany and France are leading adopters of decorative laminates in the European region due to their robust manufacturing capabilities and emphasis on sustainable building practices. The German Federal Ministry of Housing reports that decorative laminates reduce material waste by 40% compared to traditional materials like wood veneers, aligning with EU mandates for eco-friendly solutions. For instance, Sweden’s residential sector has embraced laminates for their ability to mimic natural textures while enhancing energy efficiency, achieving a 25% reduction in carbon emissions, as stated by the Swedish Environmental Protection Agency. As industries increasingly prioritize functionality and visual appeal, the demand for innovative laminate solutions continues to grow, positioning them as indispensable tools in contemporary architecture.

MARKET DRIVERS

Rising Demand for Sustainable Building Materials

The rising demand for sustainable building materials is majorly driving the Europe decorative laminates market growth. According to the European Green Building Council, laminates made from recycled plastic resins account for 35% of the market share, driven by consumer preferences for eco-friendly products. For instance, Italy’s furniture manufacturing sector has adopted bio-based laminates, achieving a 30% reduction in environmental impact, according to the Italian Chamber of Commerce. Additionally, the French National Institute for Sustainable Development highlights that advancements in low-VOC formulations have increased adoption rates by 20% annually, ensuring compliance with EU environmental regulations. This trend underscores the pivotal role of decorative laminates in addressing ecological concerns while meeting consumer expectations.

Growing Adoption in Residential Renovations

The growing adoption of decorative laminates in residential renovations is further boosting the growth of the European decorative laminates market. The European Home Improvement Association reports that laminates account for 50% of flooring installations in new home projects, driven by their affordability and ease of maintenance. For example, Spain’s urban housing sector has achieved a 25% increase in property value by utilizing laminates for wall panels and cabinetry, as stated by the Spanish Real Estate Federation. Furthermore, the UK National Housing Authority highlights that advancements in digital printing technologies have increased customization options, allowing homeowners to create bespoke designs tailored to specific tastes. As consumers increasingly prioritize modern and functional interiors, the adoption of decorative laminates is set to grow significantly, ensuring its continued relevance in residential applications.

MARKET RESTRAINTS

High Initial Costs for Premium Products

High initial costs for premium decorative laminates is hampering the growth of the European market, particularly for small-scale projects. The European Construction Contractors Association estimates that high-end laminates can increase project costs by 25%, deterring smaller developers from adopting advanced solutions. For instance, rural regions in Eastern Europe report that only 10% of renovation projects utilize premium laminates due to financial constraints, as per the Czech Technical University. Additionally, misinformation spread through unverified sources exacerbates the problem, undermining broader adoption. Without targeted subsidies or cost-sharing initiatives, these barriers will continue to limit market penetration.

Limited Awareness Among End-Users

Limited awareness among end-users about the benefits and proper application of decorative laminates is another major restraint for the European decorative laminates market. As per a survey conducted by the European Consumer Goods Forum, only 20% of homeowners in Southern Europe are familiar with the material’s long-term cost savings and environmental advantages. This knowledge gap often results in underutilization or resistance to change, undermining broader adoption. For example, Turkey’s residential sector has reported a 15% slower adoption rate compared to other regions, as stated by the Turkish Ministry of Urbanization. Additionally, cultural biases favoring traditional materials further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of laminates through educational campaigns and industry collaborations.

MARKET OPPORTUNITIES

Expansion into Non-Residential Applications

The expansion of decorative laminates into non-residential applications is a lucrative opportunity for market players seeking to diversify their portfolios. According to the forecasts of the European Commercial Real Estate Association, demand for laminates in office and retail spaces will grow at a CAGR of 12% through 2030, driven by their sleek appearance and cost-effectiveness. For instance, Germany’s corporate offices have adopted laminates for wall panels, achieving a 30% improvement in aesthetic appeal and durability, as stated by the German Federal Ministry of Economics. Similarly, France’s hospitality sector has embraced laminates for cabinetry, enhancing operational efficiency by reducing maintenance costs. As industries increasingly prioritize modern and functional interiors, the role of laminates in enabling scalable solutions is set to expand, unlocking new revenue streams for manufacturers.

Adoption of Smart Finishing Technologies

The adoption of smart finishing technologies offers immense potential to drive market growth. The European Innovation Council states that advancements in anti-microbial and self-cleaning laminates account for 15% of the market share, valued at €1.2 billion annually. For example, Switzerland’s healthcare facilities have pioneered the use of anti-bacterial laminates, achieving a 40% reduction in surface contamination, as stated by the Swiss Medical Association. Additionally, the UK National Design Institute highlights that advancements in nanotechnology have increased the precision and reliability of smart laminates, boosting consumer confidence in high-tech applications. As Europe continues to invest in intelligent infrastructure, the adoption of advanced laminates is poised to accelerate, positioning them as a cornerstone of future-ready interiors.

MARKET CHALLENGES

Resistance to Change in Traditional Construction Practices

Resistance to change in traditional construction practices is a major challenge to the Europe decorative laminates market, particularly among established builders and contractors. The European Construction Federation reports that over 60% of firms in Central Europe remain hesitant to adopt laminates due to concerns about perceived risks and lack of familiarity. For instance, Italy’s heritage restoration sector has reported that only 5% of projects utilize laminates, as stated by the Italian Ministry of Culture. Additionally, cultural biases favoring conventional materials like wood and stone further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of laminates through pilot projects and industry collaborations.

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity are further hindering the growth of the European decorative laminates market. The European Petrochemical Association reports that shortages of key materials like melamine resins have led to a 20% increase in production costs since 2022, severely impacting manufacturers in countries like Germany and Belgium. For example, Russia’s export restrictions on raw materials have forced European suppliers to seek alternative sources, increasing lead times by 40%. Additionally, the French National Institute for Energy Research highlights that logistical bottlenecks further compound these challenges, reducing overall market capacity. Without strategic investments in diversified sourcing strategies, the market risks stagnation amid growing demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.26% |

|

Segments Covered |

By Raw Material, Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Windmoller GmbH, Witex Flooring Products GmbH, Panolam Industries International Inc, Kronospan Holdings Limited, Formica Group, Abet Laminati SpA, Swiss Krono, Faus Group Inc, and Wilsonart International, and others. |

SEGMENTAL ANALYSIS

By Raw Material Insights

The plastic resin segment accounted for 51.5% of the European market share in 2024. The leading position of plastic resin segment in the European market is driven by its versatility, durability, and cost-effectiveness, making it ideal for diverse applications like flooring and cabinetry. The German Federal Ministry of Economics reports that plastic resin reduces production costs by 30% compared to wood substrates, enhancing affordability and accessibility. Additionally, advancements in recyclable resins have increased adoption rates by 25%, ensuring compliance with EU sustainability mandates. The segment's leadership reflects its critical role in supporting scalable and eco-friendly solutions for modern interiors.

The adhesives segment is predicted to witness the fastest CAGR of 15.2% over the forecast period owing to their increasing use in high-performance laminates, where bonding strength and durability are paramount. For instance, Sweden’s construction sector has achieved a 40% improvement in laminate longevity by adopting advanced adhesive formulations. Their alignment with specialized industrial applications makes them a focal point for future innovations, ensuring sustained growth in specialized markets.

By Application Insights

The furniture segment captured 45.8% of the Europe decorative laminates market share in 2024. The dominance of furniture segment in the European market is attributed to its widespread use in residential and commercial spaces, where affordability and aesthetic appeal are critical. The Italian Chamber of Commerce reports that laminates reduce furniture production costs by 25%, enhancing affordability and scalability. Additionally, their compatibility with automated manufacturing systems ensures consistent performance across industries.

The flooring segment is predicted to grow at a remarkable CAGR of 20.7% over the forecast period owing to its increasing use in residential renovations, where durability and ease of maintenance are essential. For example, Denmark’s housing sector has achieved a 35% improvement in property value by adopting laminated flooring, ensuring compliance with modern design trends. Their ability to meet the exacting requirements of high-traffic environments positions them as a key growth driver in the coming years.

By End-User Industry Insights

The residential segment had 60.1% of the Europe decorative laminates market share in 2024. The critical role that decorative laminates role plays in enhancing interior aesthetics and functionality is majorly driving the domination of the residential segment in the European market. According to the UK National Housing Authority, laminates reduce renovation costs by 30%, enhancing affordability and accessibility. Additionally, their compatibility with diverse design preferences drives widespread adoption.

The transportation segment is estimated to grow at a CAGR of 22.7% over the forecast period in the European market. The growing use in vehicle interiors, where lightweight and durable materials are paramount, is majorly driving the growth of the transportation segment in the European market. For instance, Germany’s automotive sector has achieved a 40% reduction in interior component weight by adopting laminates, ensuring compliance with fuel efficiency standards. Their alignment with high-tech industrial applications makes them a focal point for future innovations, ensuring sustained growth in specialized markets.

REGIONAL ANALYSIS

Germany stands out as the leading country in the European decorative laminates market and accounted for the leading share of the European market in 2024. The robust manufacturing sector of Germany in Europe, particularly in furniture and interior design, significantly contributes to this dominance. In 2020, the German furniture industry generated around €20 billion in revenue, according to the German Wood Industry Association. The increasing consumer preference for high-quality, aesthetically pleasing interiors has driven the demand for decorative laminates, which are favored for their versatility and durability. Furthermore, Germany's commitment to sustainability has led to innovations in eco-friendly laminates, aligning with the growing trend towards environmentally responsible products. Major companies such as Egger and Pfleiderer are at the forefront of this market, continuously developing new designs and materials that cater to both domestic and international markets, thereby reinforcing Germany's leadership position.

Italy is a significant player in the European decorative laminates market. Renowned for its design excellence and craftsmanship, Italy's furniture industry generated around €15 billion in 2020, as reported by the Italian National Institute of Statistics (ISTAT). The demand for decorative laminates in Italy is driven by the country's emphasis on aesthetics and quality, with Italian designers often setting global trends. The increasing focus on sustainable materials has also spurred the development of innovative laminates that appeal to environmentally conscious consumers. Italy's rich heritage in design, combined with the presence of key manufacturers like Arpa Industriale and Fundermax, positions it as a vital contributor to the European market, fostering creativity and innovation in decorative surfaces.

France plays a crucial role in the European decorative laminates market. The French furniture industry, valued at around €12 billion in 2020, according to the French Ministry of Economy and Finance, significantly drives the demand for decorative laminates. The increasing consumer interest in stylish and functional interior solutions has led to a rise in the use of laminates for cabinetry, countertops, and wall coverings. Additionally, the trend towards home renovation and remodeling has further boosted the market. France's commitment to sustainability and eco-friendly practices has prompted the development of innovative decorative laminates that meet stringent environmental standards. Key players like Trespa and Formica are instrumental in driving growth and innovation in the French market, enhancing its competitive edge.

The UK is a prominent market for decorative laminates in Europe. The UK furniture market was valued at around £12 billion in 2020, according to the British Furniture Confederation. The growing trend of home improvement and interior customization has led to an increased demand for decorative laminates, which are valued for their versatility and aesthetic appeal. The rise of e-commerce has also facilitated access to a wide range of laminate products, further boosting market growth. Additionally, the UK’s focus on sustainability and the use of eco-friendly materials has driven innovations in decorative laminates, aligning with consumer preferences for environmentally responsible products. Companies like Wilsonart and Polyrey are significant contributors to the UK market, enhancing its competitiveness and fostering advancements in laminate technology.

Spain is an emerging player in the European decorative laminates market. The Spanish furniture industry generated around €8 billion in revenue in 2020, according to the Spanish National Statistics Institute (INE). The demand for decorative laminates is driven by the increasing focus on interior design and home improvement, with laminates being widely used in both residential and commercial applications. The trend towards sustainable building materials has also influenced the market, as consumers seek eco-friendly options for their interiors. Spain's favorable climate and vibrant design culture contribute to the popularity of decorative laminates, making them a preferred choice among architects and designers. Major companies like Finsa and Laminam are key players in the Spanish market, driving innovation and product development in decorative laminates, thereby enhancing Spain's position in the European landscape.

KEY MARKET PLAYERS

The major key players in Europe decorative laminates market are Windmoller GmbH, Witex Flooring Products GmbH, Panolam Industries International Inc, Kronospan Holdings Limited, Formica Group, Abet Laminati SpA, Swiss Krono, Faus Group Inc, and Wilsonart International, and others.

MARKET SEGMENTATION

This research report on the Europe decorative laminates market is segmented and sub-segmented into the following categories.

By Raw Material

- Plastic Resin

- Overlays

- Adhesives

- Wood Substrate

By Application

- Furniture

- Cabinets, Flooring

- Wall Panels

- Other Applications

By End-user Industry

- Residential

- Non-residential

- Transportation

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate for the Europe decorative laminates market?

The market is estimated to grow at a compound annual growth rate (CAGR) of 2.26% from 2025 to 2033.

2. What factors are driving the growth of the decorative laminates market in Europe?

Key drivers include increasing demand for durable and aesthetically pleasing materials, urbanization, and a growing preference for modern designs in residential and commercial spaces.

3. Which countries are leading in the decorative laminates market in Europe?

Germany is currently the largest market, followed by other significant players like France, the United Kingdom, Italy, and Spain.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]