Europe DDoS Protection and Mitigation Market Size, Share, Trends, & Growth Forecast Report By Component, Application, Deployment Mode, Organization Size, Vertical and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe DDoS Protection and Mitigation Market Size

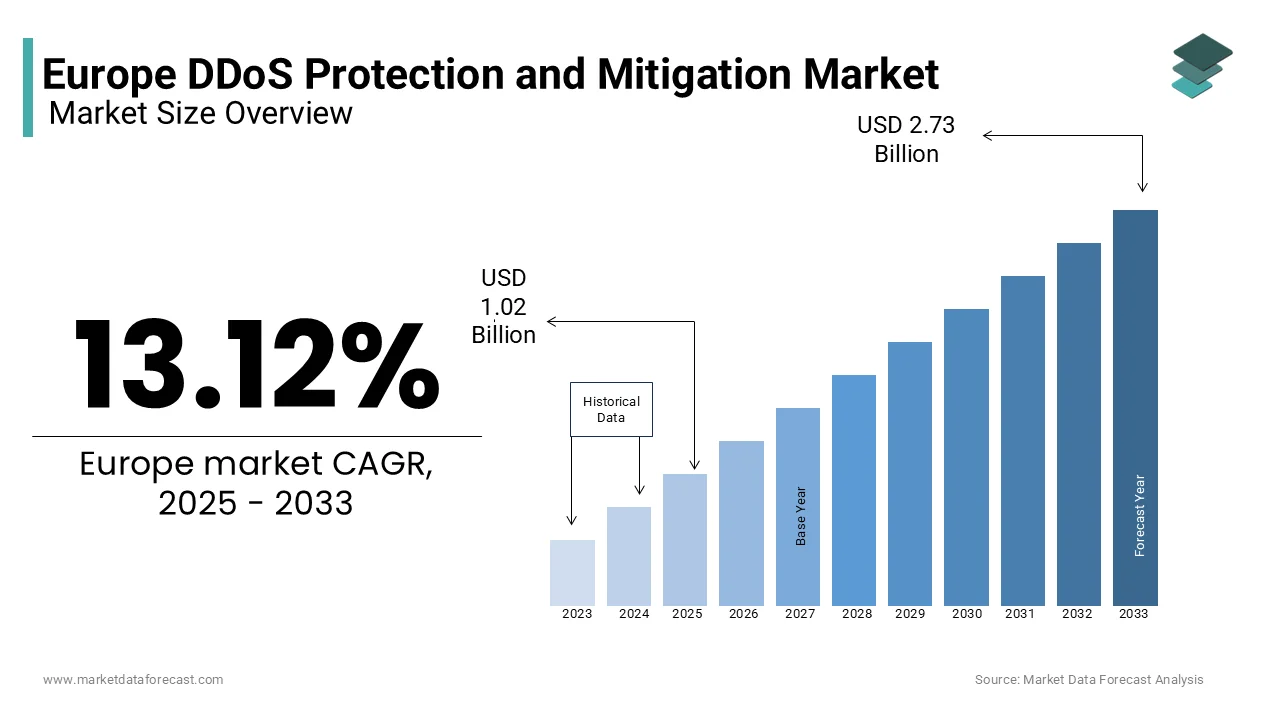

The Europe DDoS protection and mitigation market was valued at USD 0.90 billion in 2024. The europe market is anticipated to be worth USD 2.73 billion by 2033 from USD 1.02 billion in 2025, growing at a CAGR of 13.12% during the forecast period.

The escalating frequency and sophistication of cyberattacks targeting enterprises, governments, and critical infrastructure are fuelling the demand for DDoS protection and mitigation services in the European region. A DDoS attack involves overwhelming a network, server, or service with malicious traffic, rendering it inaccessible to legitimate users. As digital transformation accelerates across industries in Europe, the reliance on cloud computing, IoT devices, and interconnected systems has expanded the attack surface for malicious actors. This has necessitated robust DDoS protection solutions that can detect, mitigate, and prevent such threats in real-time.

In 2023, Europe witnessed a substantial increase in DDoS attacks, with reports from cybersecurity firm Kaspersky indicating a 50% surge in incidents compared to the previous year. The financial sector remains one of the most targeted industries, accounting for nearly 30% of all attacks, according to research published by Netscout. Furthermore, Germany, the United Kingdom, and France are identified as the primary hotspots for DDoS activity due to their advanced digital economies and high internet penetration rates. These trends underscore the growing demand for advanced DDoS mitigation tools, including cloud-based scrubbing services, on-premise hardware appliances, and hybrid solutions.

Regulatory frameworks such as the General Data Protection Regulation (GDPR) have also heightened awareness around data security, compelling organizations to adopt stringent protective measures. As cybercriminals continue to exploit vulnerabilities, the proactive stance of Europe on cybersecurity innovation positions the region as a pivotal player in shaping global standards for DDoS defense mechanisms.

MARKET DRIVERS

Expansion of IoT Devices and Interconnected Systems

The proliferation of Internet of Things (IoT) devices and interconnected systems is a significant driver of the Europe DDoS protection and mitigation market. According to the European Union Agency for Cybersecurity (ENISA), the number of IoT devices in Europe is projected to exceed 25 billion by 2025, creating an expanded attack surface for cybercriminals. These devices often lack robust security protocols, making them easy targets for botnet-driven DDoS attacks. As per the reports of the UK National Cyber Security Centre, IoT-related DDoS attacks surged by over 300% in 2022 alone, underscoring the growing threat landscape. Industries such as smart cities, industrial automation, and connected healthcare are particularly vulnerable due to their reliance on interconnected systems. This rapid expansion has forced organizations to invest in advanced DDoS mitigation solutions to safeguard critical infrastructure and ensure uninterrupted operations.

Regulatory Compliance and Data Protection Mandates

Stringent regulatory frameworks, such as the General Data Protection Regulation (GDPR), are another key driver propelling the demand for DDoS protection in Europe. As per the mandates of the European Commission, organizations must implement robust cybersecurity measures to protect sensitive data, with non-compliance resulting in fines of up to €20 million or 4% of global turnover. This has incentivized businesses to adopt DDoS mitigation strategies to prevent service disruptions that could lead to regulatory penalties. Additionally, as per the European Central Bank, financial institutions face an average of 85,000 cyber threats per month, with DDoS attacks being a major component. Governments across Europe are also launching initiatives like the EU Cybersecurity Strategy, which emphasizes enhancing resilience against cyber threats. Such regulatory pressures and strategic initiatives are driving substantial investments in DDoS protection technologies to ensure compliance and safeguard digital ecosystems.

MARKET RESTRAINTS

High Costs of Advanced DDoS Protection Solutions

The high costs associated with implementing and maintaining advanced DDoS protection solutions pose a significant restraint for the European market. According to Eurostat, small and medium-sized enterprises (SMEs), which account for over 99% of businesses in the EU, often lack the financial resources to invest in cutting-edge cybersecurity technologies. As per European Investment Bank, nearly 40% of SMEs cite budget constraints as a primary barrier to adopting robust cybersecurity measures. For instance, deploying hybrid DDoS mitigation systems or cloud-based scrubbing services can cost upwards of €50,000 annually, making them unaffordable for many smaller organizations. This financial burden is further exacerbated by the need for continuous updates and skilled personnel to manage these systems. As a result, a significant portion of the European business ecosystem remains underprepared, limiting the overall growth potential of the DDoS protection market.

Complexity in Implementation and Skill Gaps

The complexity of implementing DDoS protection solutions, coupled with a shortage of skilled cybersecurity professionals, acts as another major restraint in Europe. The European Cybersecurity Organization (ECSO) estimates that there will be a shortfall of 350,000 cybersecurity experts in the EU by 2025, creating challenges for organizations seeking to deploy and manage sophisticated DDoS mitigation tools. Furthermore, the UK National Cyber Security Centre reports that over 60% of organizations face difficulties in integrating DDoS protection systems with their existing IT infrastructure due to technical complexities. This issue is particularly pronounced in industries like healthcare and manufacturing, where legacy systems are prevalent. The lack of expertise not only delays implementation but also increases operational risks, as improperly configured systems may fail to detect or mitigate attacks effectively. These barriers hinder the widespread adoption of DDoS protection technologies across Europe.

MARKET OPPORTUNITIES

Growing Adoption of Cloud-Based DDoS Protection Solutions

The increasing adoption of cloud-based DDoS protection solutions presents a significant opportunity for the European market. According to a report by the European Commission, over 60% of European enterprises are expected to migrate their critical workloads to the cloud by 2025 due to the scalability and cost-efficiency of cloud services. Cloud-based DDoS mitigation offers real-time traffic monitoring and automated threat response, making it an attractive option for businesses of all sizes. The UK National Cyber Security Centre highlights that cloud-based solutions can reduce mitigation response times by up to 70%, significantly enhancing network resilience. Additionally, the European Union Agency for Cybersecurity (ENISA) projects that the demand for cloud security services, including DDoS protection, will grow at a CAGR of 18% through 2028. This shift towards cloud adoption, coupled with the need for robust cybersecurity, is creating a fertile ground for innovation and investment in cloud-based DDoS protection technologies.

Rising Investments in Cybersecurity Infrastructure

Europe’s growing emphasis on strengthening cybersecurity infrastructure through public and private investments is another major opportunity for the DDoS protection market. The European Investment Bank reports that EU member states allocated over €1.9 billion in 2023 to fund cybersecurity initiatives, including DDoS mitigation projects, as part of the EU Digital Decade strategy. Furthermore, the European Central Bank emphasizes that financial institutions alone are projected to increase their cybersecurity budgets by 25% annually to combat rising cyber threats. A study by the European Cybersecurity Organization (ECSO) reveals that industries such as healthcare, energy, and transportation are prioritizing DDoS protection to safeguard critical infrastructure, with the energy sector expected to invest €400 million in DDoS solutions by 2026. These investments are driving technological advancements and creating opportunities for service providers to develop tailored solutions that address the unique needs of various sectors across Europe.

MARKET CHALLENGES

Evolving Sophistication of DDoS Attack Techniques

The rapidly evolving sophistication of DDoS attack techniques poses a significant challenge for the European market. According to the European Union Agency for Cybersecurity (ENISA), advanced DDoS attacks leveraging artificial intelligence and machine learning have increased by 40% in 2023, making them harder to detect and mitigate. These attacks often utilize multi-vector strategies, combining volumetric, protocol, and application-layer assaults to overwhelm traditional defense mechanisms. The UK National Cyber Security Centre reports that over 65% of organizations faced multi-vector DDoS attacks in the past year, with an average downtime of 12 hours per incident. Such disruptions not only impact business continuity but also result in significant financial losses, estimated at €1.5 million per attack for large enterprises. The constant need to upgrade mitigation technologies to counter these advanced threats places immense pressure on organizations, particularly those with limited cybersecurity expertise or resources.

Fragmented Regulatory Landscape Across EU Member States

The fragmented regulatory landscape across EU member states creates another major challenge for the DDoS protection market. While frameworks like the General Data Protection Regulation (GDPR) provide a unified approach to data protection, cybersecurity regulations remain inconsistent across countries. The European Commission highlights that only 15 out of 27 EU member states have implemented comprehensive national cybersecurity strategies, leading to disparities in enforcement and compliance requirements. This fragmentation complicates cross-border operations for businesses, as they must navigate varying standards and reporting obligations. Additionally, the European Cybersecurity Organization (ECSO) notes that the lack of harmonized regulations delays the deployment of standardized DDoS mitigation solutions, hindering scalability and interoperability. These inconsistencies not only increase operational complexities but also create barriers for service providers aiming to offer region-wide protection services, ultimately slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.12% |

|

Segments Covered |

By Component, Application, Deployment Mode, Organization Size, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

NETSCOUT (US); Akamai Technologies (US); Imperva (US); Radware (Israel); Corero Network Security (US); Cloudflare (US); Link11 (Germany), Nexusguard (Hong Kong); A10 Networks, (US); Fortinet (US); Huawei Technologies (China); Verisign (US); Sucuri (US); SiteLock (US); Flowmon Networks (Czech Republic); StackPath, (US); DOSarrest Internet Security (Canada); NSFOCUS (US); and Seceon (US). |

SEGMENTAL ANALYSIS

By Component Insights

The services segment had the largest share of 45.3% in the Europe DDoS protection market in 2024. Managed DDoS protection services are leading due to their cost-effectiveness and ability to provide 24/7 monitoring and real-time mitigation, which is critical for SMEs lacking in-house expertise. Eurostat highlights that over 60% of European SMEs rely on third-party providers for cybersecurity. The importance of this segment lies in its scalability, with cloud-based scrubbing services growing by 50% in two years, enabling businesses to counter increasingly complex attacks without heavy upfront investments.

The software solutions is another key segment and is expected to register the fastest CAGR of 17.7% over the forecast period due to the rise of hybrid IT environments and the need for flexible, scalable tools to combat application-layer attacks. The European Cybersecurity Organization (ECSO) states that over 50% of organizations have adopted software solutions for their adaptability and advanced threat intelligence integration. Their affordability compared to hardware and ability to address evolving attack vectors make them indispensable, positioning software as the most dynamic component of the DDoS protection market.

By Application Insights

The network segment led the market by accounting for 60.2% in the European market in 2024. The domination of the network segment is driven by the high frequency of volumetric attacks, which overwhelm network bandwidth and disrupt critical infrastructure. The UK National Cyber Security Centre highlights that network-based attacks account for over 60% of all DDoS incidents, with an average attack size reaching 500 Gbps. This segment's importance lies in its role in preventing widespread service outages, which cost enterprises up to €1 million per hour, according to Eurostat. As industries rely heavily on uninterrupted connectivity, robust network-level mitigation remains a top priority.

The endpoint segment is anticipated to grow at a CAGR of 20.9% over the forecast period. The rise of remote work and IoT adoption is primarily driving the growth of the endpoint segment in the European market. Endpoints are increasingly targeted to form botnets, making their protection critical. The segment's rapid expansion underscores its importance in reducing the attack surface and preventing cascading cyberattacks. With 70% of organizations prioritizing endpoint security, as highlighted by ECSO, this segment is pivotal in addressing emerging threats posed by decentralized and interconnected environments.

By Deployment Mode Insights

The hybrid segment captured 40.7% of the European market share in 2024. The ability of hybrid deployment model to combine on-premises hardware for low-latency mitigation with cloud-based scrubbing for large-scale attacks is majorly driving the domination of the hybrid segment in the Europe DDoS protection and mitigation market. The UK National Cyber Security Centre reports that hybrid solutions are particularly effective against multi-vector attacks, which account for over 65% of all DDoS incidents. This segment's importance lies in its flexibility and resilience, enabling organizations to address diverse attack types while ensuring minimal downtime. With enterprises increasingly prioritizing comprehensive protection, hybrid systems have become indispensable for safeguarding critical infrastructure and maintaining operational continuity.

The cloud segment is anticipated to grow at a exponential CAGR of 18.4% over the forecast period owing to the rapid adoption of cloud computing. Cloud solutions offer scalability and cost-efficiency, addressing the needs of businesses transitioning to digital ecosystems. Their ability to handle volumetric attacks exceeding 500 Gbps, as highlighted by ENISA, makes them crucial for combating modern threats. As organizations seek flexible, real-time mitigation tools, the cloud segment's role in democratizing access to advanced DDoS protection technologies becomes increasingly vital, positioning it as a key driver of market expansion.

By Organization Size Insights

The large enterprises segment occupied the largest share of 61.7% of the European market share in 2024. The domination of large enterprises segment in the European market is attributed to the large need to safeguard complex IT infrastructures and comply with stringent regulations like GDPR. ENISA reports that large enterprises face an average of 85,000 cyber threats monthly, with DDoS attacks being a significant component. These organizations prioritize advanced solutions like hybrid systems to mitigate multi-vector attacks, which account for 70% of disruptions in critical sectors such as finance and energy. The segment's importance lies in its role as a key innovator in DDoS mitigation, ensuring operational resilience and preventing losses exceeding €1 million per hour during outages.

The SME segment is predicted to showcase the highest CAGR of 20.8% over the forecast period owing to the rising cyberattacks. Limited in-house expertise and increasing awareness of financial risks have led SMEs to adopt affordable cloud-based and managed DDoS solutions. The European Investment Bank highlights a 25% increase in SMEs adopting these solutions in 2023. As SMEs digitize further, their demand for scalable, cost-effective protection is surging, making them a pivotal driver of market expansion and innovation in accessible cybersecurity tools tailored to smaller organizations.

By Vertical Insights

The IT and telecommunications segment dominated the market by holding 26.2% of the European market share in 2024. The backbone of digital infrastructure, with telecom providers facing an average of 100,000 DDoS attacks annually, is propelling the growth of the IT and telecommunications segment in the European market. This importance of the sector lies in ensuring uninterrupted internet and communication services, which are vital for other industries. The high frequency of volumetric attacks targeting this vertical necessitates advanced solutions like AI-driven threat detection and real-time mitigation. With downtime costing millions, IT and telecoms remain pivotal in maintaining Europe's digital resilience.

The healthcare segment is projected to witness the fastest CAGR of 26.4% over the forecast period owing to the digitization of patient records and telemedicine services. According to the European Central Bank, downtime costs exceed €500,000 per hour, which is emphasizing the urgency for robust DDoS protection. As healthcare becomes increasingly reliant on digital tools, investments in cloud-based and managed solutions are surging to safeguard sensitive data and ensure uninterrupted access to critical medical services. This vertical's rapid expansion underscores its growing vulnerability and the need for scalable cybersecurity measures.

REGIONAL ANALYSIS

Germany outperformed the other countries in the Europe DDoS protection and mitigation market and accounted for highest share of 28.1% in the European market in 2024. The advanced digital economy of Germany is primarily boosting the German market growth. According to the German Federal Office for Information Security, more than 70% of enterprises adopting cloud-based solutions in Germany. The robust industrial base of Germany, particularly in manufacturing and automotive sectors, makes it a prime target for cyberattacks, with ENISA reporting a 40% increase in DDoS incidents targeting critical infrastructure in 2023. The country’s strong regulatory framework, including strict GDPR compliance, further accelerates investments in advanced DDoS mitigation tools.

The United Kingdom is another top performer in the Europe DDoS protection market and is estimated to showcase a notable CAGR over the forecast period. The growth of the UK market is attributed to its highly digitized financial services sector, which faces an average of 85,000 cyber threats monthly, with DDoS attacks being a significant component. The UK government’s £2.6 billion investment in cybersecurity initiatives, as stated by the Department for Science, Innovation and Technology, has bolstered adoption of hybrid and cloud-based solutions. Additionally, the rise of remote work and e-commerce has increased vulnerability to attacks, driving demand for scalable protection.

France is likely to hold a substantial share of the European market over the forecast period owing to its strong emphasis on securing critical infrastructure, with energy and telecommunications sectors being primary targets. ANSSI reports a 50% surge in DDoS attacks on French organizations in 2023, prompting significant investments in AI-driven mitigation technologies. France’s Digital Transformation Plan, which allocates €500 million annually to cybersecurity, has accelerated the adoption of advanced solutions. The increasing reliance on IoT devices and smart city initiatives further amplifies the need for resilient DDoS protection.

KEY MARKET PLAYERS

Companies playing a notable role in the European DDoS protection and mitigation market include NETSCOUT (US); Akamai Technologies (US); Imperva (US); Radware (Israel); Corero Network Security (US); Cloudflare (US); Link11 (Germany), Nexusguard (Hong Kong); A10 Networks, (US); Fortinet (US); Huawei Technologies (China); Verisign (US); Sucuri (US); SiteLock (US); Flowmon Networks (Czech Republic); StackPath, (US); DOSarrest Internet Security (Canada); NSFOCUS (US); and Seceon (US).

MARKET SEGMENTATION

This research report on the Europe ddos protection and mitigation market is segmented and sub-segmented into the following.

By Component

- Hardware Solutions

- Software Solutions

- Services

By Application

- Network

- Application

- Database

- Endpoint

By Deployment Mode

- On-Premises

- Cloud

- Hybrid

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Government and Defense

- Banking, financial services, and insurance

- Manufacturing

- Energy and Utilities

- IT and Telecommunications

- Healthcare

- Education

- Retail

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How does the General Data Protection Regulation (GDPR) influence the DDoS protection market in Europe?

GDPR has heightened the need for robust cybersecurity measures, including DDoS protection, as organizations are required to ensure the security of personal data. Non-compliance with GDPR can lead to significant fines, pushing businesses to invest in DDoS mitigation solutions.

Which types of DDoS attacks are most prevalent in Europe?

In Europe, the most prevalent types of DDoS attacks include volumetric attacks, application layer attacks, and protocol attacks. Volumetric attacks are particularly common, overwhelming network bandwidth with excessive data.

What role does artificial intelligence (AI) play in the DDoS protection market in Europe?

AI plays a significant role by enhancing the detection and mitigation of DDoS attacks. AI-driven solutions can analyze vast amounts of data in real-time, identifying and responding to threats more quickly and accurately than traditional methods.

How is the shift to cloud services influencing the DDoS protection market in Europe?

The shift to cloud services is significantly influencing the market, as cloud-based DDoS protection offers scalable, cost-effective solutions that are easy to deploy. As more businesses migrate to the cloud, the demand for cloud-based DDoS mitigation solutions is growing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]