Europe Data Collection and Labeling Market Size, Share, Trends, & Growth Forecast Report By Data Type (Audio, Image/Video, Text, and Others), Application (Manufacturing, IT, Healthcare, BFSI, E-Commerce and Retail, Government, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Data Collection and Labeling Market Size

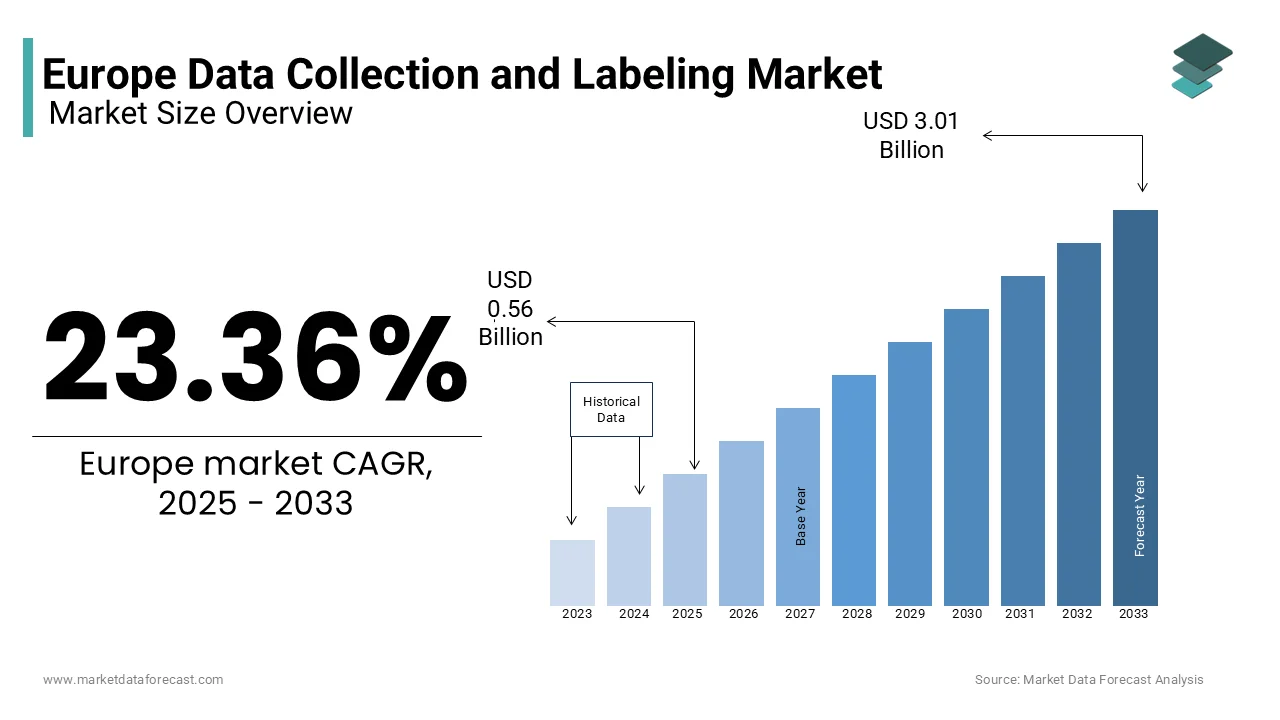

The Europe data collection and labelling market was worth USD 0.46 billion in 2024. The European market is expected to reach USD 3.01 billion by 2033 from USD 0.56 billion in 2025, rising at a CAGR of 23.36% from 2025 to 2033.

As industries increasingly adopt AI-driven solutions, the demand for high-quality, accurately labelled datasets has skyrocketed. Data collection involves gathering raw information from diverse sources, while labeling assigns contextual meaning to this data, enabling algorithms to learn and make informed decisions. This process is pivotal for applications such as autonomous vehicles, healthcare diagnostics, natural language processing, and predictive analytics. Europe, with its stringent data privacy regulations under the General Data Protection Regulation (GDPR), presents both challenges and opportunities for stakeholders. The emphasis of Europe on ethical AI practices has spurred innovation in anonymization and secure data handling techniques. Furthermore, as per a study by Statista, Germany, France, and the United Kingdom are leading contributors to the European data collection and labelling market due to their robust technological infrastructure and strong industrial base. With increasing investments in AI research and development, coupled with government initiatives promoting digital transformation, Europe is poised to solidify its position as a global leader in data-centric AI solutions.

MARKET DRIVERS

Rapid Adoption of Artificial Intelligence Across Industries

The rapid adoption of artificial intelligence (AI) across industries such as healthcare, automotive, and retail is a significant driver of the Europe data collection and labeling market. According to the 2021 report of the European Commission on AI investment revealed that the region allocated over €1 billion annually to AI research and innovation under its Horizon Europe program. This funding has accelerated the development of AI-powered solutions, which depend heavily on accurately labeled datasets for training algorithms. For instance, in healthcare, AI applications like medical imaging diagnostics require annotated datasets to achieve precision. According to Eurostat, the healthcare sector in Europe witnessed a 30% increase in AI adoption between 2019 and 2022, underscoring the growing demand for labeled data. As industries strive to enhance operational efficiency and deliver personalized services, the need for robust data collection and labeling processes becomes indispensable. This trend highlights how industrial AI integration acts as a significant growth catalyst for this market.

Implementation of Stringent Data Privacy Regulations

The growing implementation of stringent data privacy regulations, particularly the General Data Protection Regulation (GDPR) is further boosting the European market expansion. A study by the European Data Protection Board indicated that GDPR compliance has led to a 28% rise in demand for anonymized and ethically sourced datasets since its enforcement in 2018. Organizations are increasingly investing in advanced labeling tools to ensure compliance while maintaining data utility. Furthermore, the International Data Corporation (IDC) reported that spending on data governance and privacy solutions in Europe reached €4.5 billion in 2022, reflecting the emphasis on secure data practices. These regulatory frameworks not only foster trust among consumers but also encourage innovation in privacy-preserving technologies. As businesses navigate the complexities of GDPR, the demand for high-quality, compliant data collection and labeling services continues to surge, reinforcing its role as a pivotal market driver.

MARKET RESTRAINTS

High Costs and Resource Intensity of Data Labeling Processes

High cost and resource intensity associated with the process is one of the major factors hindering the growth of the European data collection and labelling market. According to a report by the European Investment Bank, businesses in Europe spend approximately €3 billion annually on data preparation activities, including labeling, which accounts for nearly 25% of their total AI development budget. The complexity of labeling tasks, especially for unstructured data like images, videos, and natural language, requires skilled annotators and advanced tools, further escalating costs. Additionally, Eurostat highlights that small and medium-sized enterprises (SMEs) face challenges in adopting AI due to limited financial resources, with only 15% of SMEs in Europe currently utilizing labeled datasets for AI applications. This financial barrier restricts widespread adoption, particularly among smaller players, limiting the market's overall growth potential despite its critical role in AI development.

Stringent GDPR Compliance and Ethical Concerns

Stringent compliance requirements imposed by the General Data Protection Regulation (GDPR) that often complicates data collection and labeling processes is another major factor hampering the growth of the European market. A study by the European Data Protection Supervisor revealed that over 40% of organizations faced delays in AI projects due to challenges in ensuring GDPR compliance during data labeling. The regulation mandates strict guidelines on data anonymization, consent, and transparency, which can slow down operations and increase administrative overheads. Furthermore, the European Union Agency for Cybersecurity (ENISA) reported that 60% of companies encountered difficulties in sourcing ethically compliant datasets, leading to project bottlenecks. While GDPR ensures data privacy and ethical standards, its rigorous enforcement creates operational hurdles, discouraging some organizations from investing in AI initiatives that rely heavily on labeled data, thereby restraining market expansion.

MARKET OPPORTUNITIES

Growing Demand for Multilingual Data Labeling in Europe

One of the key opportunities in the Europe data collection and labeling market lies in the growing demand for multilingual datasets, driven by the region's linguistic diversity. The European Commission’s 2022 report on digital transformation highlights that over 24 official languages are spoken across the European Union, creating a unique need for language-specific AI models. This has led to a surge in demand for labeled datasets in languages such as German, French, Spanish, and Italian, with the natural language processing (NLP) market projected to grow at a CAGR of 22% through 2027, according to Eurostat. Additionally, the European Language Industry Association (ELIA) estimates that the market for language-based AI solutions will exceed €5 billion by 2025. As businesses aim to deliver localized AI-driven services, data labeling providers have a significant opportunity to cater to this niche yet expanding segment, fostering innovation and regional competitiveness.

Expansion of AI in Emerging Sectors Like Agriculture and Smart Cities

The rising adoption of AI in emerging sectors such as agriculture and smart cities that require specialized data labeling services is another promising opportunity in the European market. The European Environment Agency reports that smart city initiatives are expected to generate €100 billion in economic value by 2030, with AI playing a pivotal role in optimizing urban infrastructure, energy management, and transportation systems. Similarly, the European Agricultural Machinery Association (CEMA) predicts that AI adoption in agriculture will grow by 30% annually, driven by precision farming technologies that rely on labeled datasets for crop monitoring and yield prediction. Furthermore, a study by the European Investment Bank reveals that investments in AI for sustainable development reached €15 billion in 2022. These trends present a lucrative opportunity for data labeling companies to expand their expertise into these high-growth sectors, supporting Europe’s transition toward sustainability and technological advancement.

MARKET CHALLENGES

Shortage of Skilled Workforce for Data Annotation

The shortage of skilled professionals capable of performing high-quality data annotation is a significant challenge to the European market. As per the European Centre for the Development of Vocational Training (Cedefop), the demand for AI-related skills, including data labeling, has grown by 40% since 2019, yet only 25% of the workforce possesses the necessary expertise. This skills gap is particularly pronounced in Eastern and Southern Europe, where Eurostat reports a 35% lower availability of tech-savvy workers compared to Western Europe. Additionally, the European Commission’s Digital Economy and Society Index (DESI) 2022 reveals that only 58% of EU enterprises provide adequate digital training to their employees. As a result, companies face delays in project timelines and increased costs due to outsourcing or hiring external experts. Addressing this workforce challenge is critical to sustaining growth in the data labeling industry.

Complexity of Handling Unstructured and Multimodal Data

The complexity involved in handling unstructured and multimodal data that is becoming increasingly prevalent in AI applications is another notable challenge to the European market. According to the European Data Market Study conducted by the European Commission, over 80% of data generated in sectors like healthcare, automotive, and media is unstructured, including images, videos, and sensor data. Labeling such data requires advanced tools and techniques, which are often costly and time-intensive. Furthermore, a report by the European Union Agency for Cybersecurity (ENISA) indicates that 60% of organizations struggle with integrating multimodal datasets, leading to inconsistencies and errors in AI model training. The lack of standardized frameworks for annotating complex data types exacerbates the issue, making it difficult for businesses to achieve scalability. These challenges highlight the need for innovative solutions to streamline the labeling of diverse and intricate datasets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.36% |

|

Segments Covered |

By Data Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Globalme Localization Inc., Trilldata Technologies Pvt Ltd, Alegion, Reality AI, Dobility Inc., Global Technology Solutions, Playment Inc., Appen Limited, Labelbox Inc., Scale AI, Avery Dennison Corporation, and Summa Linguae Technologies S.A. |

SEGMENTAL ANALYSIS

By Data Type Insights

The image/video data segment had the leading share of 45.4% in the Europe data collection and labeling market by data type in 2024. The dominance of image/video segment in the European market is driven by its critical role in computer vision applications like autonomous vehicles and surveillance systems. Eurostat reports that the automotive sector alone contributes 40% of this demand, with investments in ADAS reaching €7 billion in 2022. The segment's importance lies in enabling real-time decision-making, but challenges like frame-by-frame annotation increase costs. Its leadership stems from the widespread adoption of AI in retail, healthcare, and security, ensuring sustained demand.

The audio data segment is predicted to witness the fastest CAGR of 30.8% in the European market over the forecast period owing to the rise of voice-activated technologies, including virtual assistants and transcription services. As per the Digital Transformation Monitor of the European Commission, a 50% increase in labeled audio datasets since 2020 due to the applications in healthcare diagnostics and language learning platforms. Manual annotation remains essential, with the European Broadcasting Union noting that 50% of datasets require human intervention. The segment's rapid expansion reflects the increasing adoption of smart speakers and voice-based AI solutions, underscoring its importance in enhancing user experiences across industries.

By Application Insights

The IT segment held 25.6% of the European data collection and labelling market in 2024. The leading position of IT segment in the European market is primarily attributed to the widespread adoption of AI-driven software solutions, cybersecurity systems, and natural language processing tools, which rely heavily on labeled datasets. The European Commission’s Digital Economy and Society Index (DESI) 2022 highlights that 70% of IT enterprises in Europe now use AI technologies. The sector's importance lies in its role as an innovation hub, driving advancements across industries. However, challenges like handling unstructured data persist. With EU investments exceeding €10 billion annually in digital transformation, the IT sector remains pivotal in shaping the future of AI applications.

The healthcare sector is anticipated to grow at a significant CAGR of 45.7% over the forecast period owing to the integration of AI in medical imaging, diagnostics, and personalized medicine. The European Federation of Pharmaceutical Industries and Associations (EFPIA) reports that over 60% of healthcare providers now utilize AI tools, requiring high-quality annotated datasets. The European Commission has allocated €5.3 billion to digital health initiatives, further accelerating adoption. The segment's importance lies in improving patient outcomes and operational efficiency. Challenges include GDPR compliance and data privacy concerns. Despite these hurdles, the increasing reliance on AI for predictive analytics underscores its transformative potential in revolutionizing healthcare delivery.

REGIONAL ANALYSIS

Germany held the dominating position in the Europe data collection and labeling market by holding a 28.7% of the European market in 2024. The domination of Germany in the European market is primarily due to its robust industrial base, particularly in manufacturing and automotive sectors, which heavily rely on AI-driven solutions. According to the German Federal Ministry for Economic Affairs, Germany accounts for over 35% of Europe’s industrial AI investments, driving demand for labeled datasets in predictive maintenance and autonomous systems. Additionally, Germany’s strong emphasis on Industry 4.0 initiatives, supported by €10 billion in annual funding, has accelerated the adoption of advanced technologies. The presence of global tech giants and research institutions further strengthens its position. Despite challenges like high costs, Germany’s commitment to innovation ensures its dominance in shaping the region’s data labeling landscape.

The United Kingdom is another top performer and held a substantial share of the European market in 2024. The promising position of the UK in the European data collection and labelling market is attributed to its thriving IT and healthcare sectors, which extensively utilize AI for applications like natural language processing and medical diagnostics. The UK Office for Artificial Intelligence reports that the country attracted €4.5 billion in AI investments in 2022, reflecting its global prominence. Furthermore, the National Health Service (NHS) has been pivotal in adopting AI tools, requiring vast amounts of labeled data. The UK’s favorable regulatory environment and government initiatives, such as the £1 billion AI Sector Deal, have fostered growth. While GDPR compliance remains a challenge, the UK’s focus on ethical AI practices solidifies its leading role in the market.

France is expected to witness a CAGR of 26.4% in the European market over the forecast period owing to the significant investments in AI research and development, with the government allocating €1.5 billion under its AI strategy. France’s expertise in computer vision and autonomous systems has driven demand for image and video data labeling, particularly in the automotive sector. According to Statista, France ranks second in Europe for AI startups, fostering innovation in data-centric technologies. Additionally, the French Data Protection Authority emphasizes GDPR-compliant data practices, ensuring trust and reliability. Despite resource-intensive processes, France’s strategic focus on AI ethics and digital transformation positions it as a key player in the regional market.

KEY MARKET PLAYERS

The major players in the Europe data collection and labelling market include Globalme Localization Inc., Trilldata Technologies Pvt Ltd, Alegion, Reality AI, Dobility Inc., Global Technology Solutions, Playment Inc., Appen Limited, Labelbox Inc., Scale AI, Avery Dennison Corporation, and Summa Linguae Technologies S.A.

MARKET SEGMENTATION

This research report on the Europe data collection labelling market is segmented and sub-segmented into the following categories.

By Data Type

- Audio

- Image/Video

- Text

- Others

By Application

- Manufacturing

- IT

- Healthcare

- BFSI

- E-Commerce and Retail

- Government

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe data collection and labeling market?

The growth is driven by increasing adoption of AI and machine learning, demand for high-quality training data, and expanding applications in industries like healthcare, automotive, and retail.

Which industries contribute the most to data collection and labeling in Europe?

The key industries include healthcare, automotive, IT & telecommunications, BFSI, retail, and government sectors, with AI-driven applications requiring extensive labeled datasets.

What role does AI play in automating the data labeling process?

AI-powered tools assist in semi-automating annotation processes, reducing manual effort, improving accuracy, and speeding up data labeling through techniques like active learning and synthetic data generation.

What is the future outlook for the data collection and labeling market in Europe?

The market is expected to grow with increasing AI applications, rising demand for high-quality training datasets, and advancements in automation technologies reducing dependency on manual annotation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]