Europe Data Center Server Market Size, Share, Trends & Growth Forecast Report By Form Factor (Rack Server, Blade Server, Tower Server) , End-user and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Data Center Server Market Size

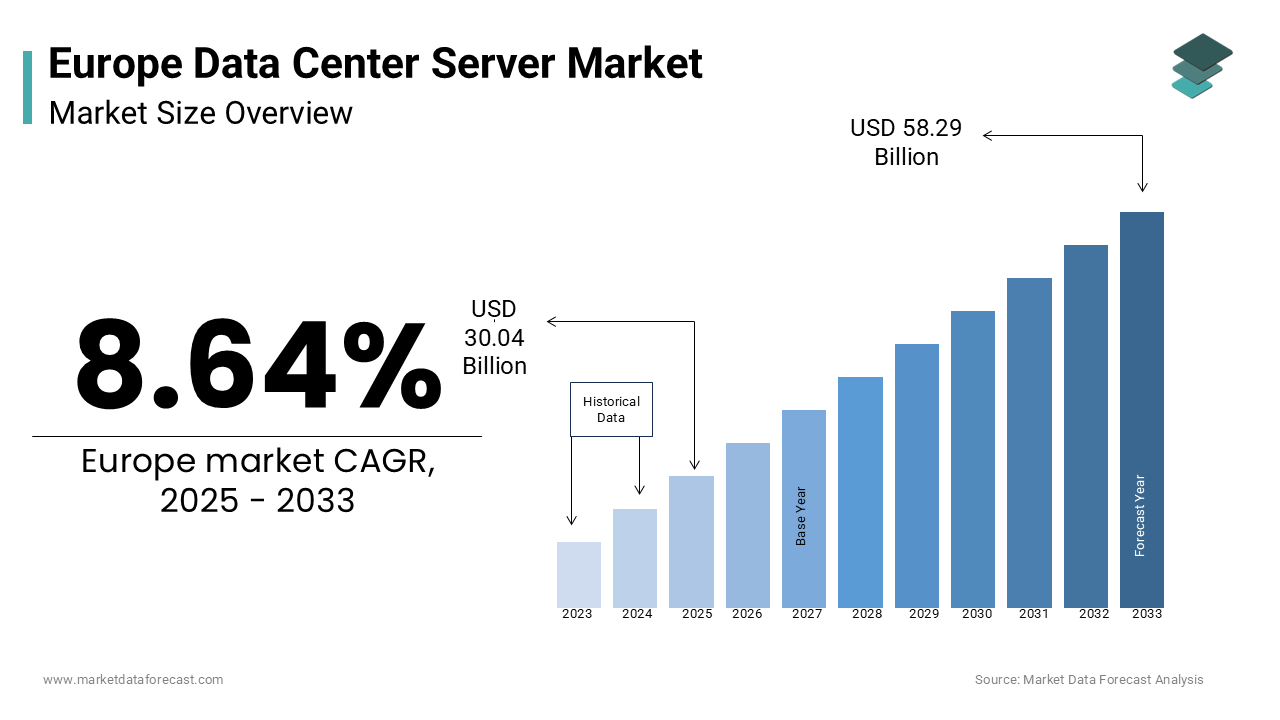

The europe data center server market was worth USD 27.65 billion in 2024. The European market is estimated to grow at a CAGR of 8.64% from 2025 to 2033 and be valued at USD 58.29 billion by the end of 2033 from USD 30.04 billion in 2025.

The Europe data center server market is experiencing robust growth due to factors such as increasing digital transformation initiatives and the proliferation of cloud computing services. According to the European Commission’s Digital Economy and Society Index, over 70% of European enterprises now rely on cloud-based solutions, fueling demand for advanced server infrastructure. Germany leads the region with the highest market share, followed by the UK and France, owing to their strong IT ecosystems and high adoption of artificial intelligence (AI) technologies. Additionally, stringent data privacy regulations like the General Data Protection Regulation (GDPR) have prompted organizations to invest in localized data centers, further propelling market expansion. As per the European Data Centre Association, hyperscale data centers are emerging as key contributors, accounting for nearly 40% of total server deployments in Europe.

MARKET DRIVERS

Rising Demand for Cloud Computing Services

Cloud computing has become the backbone of modern enterprises, driving significant investments in data center server infrastructure. According to the International Data Corporation (IDC), Europe’s public cloud market is expected to reach €75 billion by 2025, reflecting a compound annual growth rate of 12%. This surge in cloud adoption necessitates scalable and high-performance servers capable of handling massive workloads. Industries such as e-commerce, healthcare, and finance are increasingly migrating to hybrid and multi-cloud environments, creating sustained demand for advanced server solutions. Furthermore, the rise of edge computing, which reduces latency by processing data closer to the source, has amplified the need for distributed server architectures. As per Eurostat, over 50% of European businesses now utilize edge computing, underscoring its role in shaping server market dynamics.

Expansion of Artificial Intelligence and Big Data Analytics

Artificial intelligence (AI) and big data analytics are transforming industries across Europe, creating an unprecedented demand for powerful data center servers. According to the European AI Alliance, AI-driven applications accounted for 30% of server deployments in 2023, a figure expected to rise to 45% by 2028. AI workloads require specialized hardware, including GPUs and TPUs, to process vast datasets efficiently. For instance, financial institutions leverage AI for fraud detection, while manufacturing firms use predictive maintenance models, both of which rely on robust server infrastructure. Additionally, the European Commission’s investment of €20 billion in AI research and innovation has spurred private sector participation, further boosting server demand. As per the European Technology Observatory, AI-related server shipments grew by 25% annually between 2021 and 2023, highlighting their critical role in market expansion.

MARKET RESTRAINTS

High Initial Investment Costs

The deployment of data center servers involves substantial upfront costs, posing a significant barrier for small and medium-sized enterprises (SMEs). The average cost of setting up a mid-sized data center incurs huge costs, depending on location and scale. This includes expenses related to server procurement, cooling systems, power supply, and cybersecurity measures. Such financial constraints limit market penetration, particularly in Eastern European countries where economic disparities persist. While larger enterprises can absorb these costs, SMEs often struggle to justify the investment, especially given the ongoing operational expenses associated with server maintenance. As per the European Federation of Small Businesses, less than 15% of SMEs in Europe have adopted advanced server technologies due to budgetary limitations.

Stringent Energy Efficiency Regulations

Data centers are among the largest consumers of electricity in Europe, prompting regulatory bodies to enforce stringent energy efficiency standards. According to the European Environment Agency, data centers account for approximately 2.5% of the continent’s total electricity consumption. Regulations such as the EU Code of Conduct for Data Centres mandate operators to adopt energy-efficient practices, including the use of renewable energy sources and advanced cooling technologies. While these measures aim to reduce carbon footprints, they also increase operational complexities and costs. As per the European Data Centre Industry Group, compliance with these regulations requires significant upgrades to existing server infrastructures, deterring some organizations from expanding their data center capacities. These challenges create a delicate balance between sustainability goals and market growth.

MARKET OPPORTUNITIES

Emergence of Edge Data Centers

The growing adoption of edge computing presents a lucrative opportunity for the Europe data center server market. According to the European Telecommunications Standards Institute, the demand for edge data centers is projected to grow significantly by 2030. These facilities enable real-time data processing by placing servers closer to end-users, reducing latency and enhancing application performance. Industries such as autonomous vehicles, smart cities, and industrial IoT heavily rely on edge computing, driving demand for compact yet powerful servers. For instance, the European Smart City Initiative estimates that 60% of urban infrastructure will integrate edge computing by 2028. This trend not only expands the addressable market but also creates opportunities for manufacturers to develop specialized server solutions tailored to edge environments.

Integration of Green Technologies

The shift toward sustainable operations offers significant growth potential for the data center server market. According to the European Green Deal, data centers must achieve carbon neutrality by 2050, encouraging the adoption of green technologies. Innovations such as liquid cooling systems, solar-powered servers, and energy-efficient processors are gaining traction. As per the European Renewable Energy Council, renewable energy usage in data centers increased by 20% in 2023, driven by government incentives and corporate sustainability goals. Manufacturers that prioritize eco-friendly designs stand to benefit from heightened consumer demand and regulatory support. This alignment with environmental objectives positions the market for long-term success while addressing global climate concerns.

MARKET CHALLENGES

Cybersecurity Threats

Cybersecurity is one of the significant challenges to the Europe data center server market, as cyberattacks targeting sensitive data continue to rise. For instance, ransomware attacks increased by 30% in 2023, with data centers being prime targets due to their centralized storage capabilities. Protecting servers from breaches requires continuous investment in advanced security protocols, firewalls, and encryption technologies. However, as per the European Cybersecurity Organization, over 40% of data centers lack comprehensive cybersecurity frameworks, leaving them vulnerable to attacks. These threats not only compromise data integrity but also erode customer trust, hindering market growth.

Talent Shortages in IT Infrastructure Management

The shortage of skilled professionals capable of managing complex server infrastructures poses another challenge. According to the European IT Skills Gap Report, over 500,000 IT jobs remain unfilled across Europe, with server management being one of the most affected areas. This talent gap exacerbates operational inefficiencies, delays project timelines, and increases reliance on third-party vendors. As per the European Association for IT Professionals, training programs and certifications are insufficient to bridge this gap, particularly in emerging technologies like AI and edge computing. Addressing this issue requires collaborative efforts between governments, educational institutions, and private enterprises to develop a robust workforce pipeline.

SEGMENTAL ANALYSIS

By Form Factor Insights

The rack servers segment occupied the major share of 56.1% of the Europe data center server market in 2024. The dominance of rack servers segment in the European market is attributed to their modular design, which allows for efficient space utilization and scalability. Rack servers are particularly favored in hyperscale data centers, where high-density configurations are essential. According to Eurostat, rack server deployments grew by 20% annually between 2021 and 2023, driven by their compatibility with virtualization technologies. These attributes make them indispensable for enterprises seeking cost-effective and flexible server solutions.

The blade servers segment is another promising segment and is projected to grow at a CAGR of 8.2% over the forecast period. The superior performance and energy efficiency of blade server is majorly propelling the expansion of the blade servers segment in the European market. According to the European Technology Observatory, blade servers reduce power consumption by 30% compared to traditional rack servers, making them ideal for high-performance computing (HPC) applications. Their compact form factor also minimizes cooling requirements, aligning with sustainability goals. As per the European Data Centre Association, blade servers are increasingly adopted in AI and machine learning workloads, underscoring their role in driving market innovation.

By End User Insights

The IT & telecommunication segment held 35.2% of the Europe data center server market share in 2024. The reliance of IT and telecommunications industry on cloud services, 5G networks, and IoT platforms, all of which require robust server infrastructure, is one of the major factors contributing to the domination of IT and telecommunications segment in the European market. According to Eurostat, telecom operators invested €15 billion in server upgrades in 2023 alone to support network virtualization and edge computing initiatives. These investments solidify the sector’s position as the primary driver of server demand.

The media and entertainment segment is projected to grow at a CAGR of 9.5% over the forecast period. The proliferation of streaming services and high-definition content are primarily fuelling the expansion of the media and entertainment segment in the European market. According to the European Broadcasting Union, video streaming accounted for 60% of internet traffic in 2023, necessitating advanced server capabilities for seamless content delivery. Additionally, the rise of augmented reality (AR) and virtual reality (VR) applications further amplifies server demand. As per the European Film and Television Industry Report, server adoption in this segment is expected to double by 2028, reflecting its rapid evolution.

REGIONAL ANALYSIS

Germany captured the leading share of 28.2% of the Europe data center server market share in 2024. The dominating position of Germany in the European market is attributed to their robust IT ecosystem, including over 40% of Europe’s hyperscale data centers. The country’s strategic location, advanced infrastructure, and strong manufacturing base make it a hub for server deployments. According to the German Data Centre Federation, investments in renewable energy-powered data centers have further strengthened its position, attracting global tech giants.

Spain is another significant market for data center servers in Europe and is projected to grow at a CAGR of 7.8% over the forecast period owing to the increasing digitalization and government initiatives promoting green data centers. According to the Spanish Ministry of Industry, renewable energy integration in data centers rose by 25% in 2023, making Spain an attractive destination for sustainable server solutions. This focus on eco-friendly technologies positions Spain as a key growth driver in the region.

On the other hand, the UK, France, and Italy are expected to witness steady growth in the European market over the forecast period. According to the UK Department for Digital, Culture, Media & Sport, these nations benefit from digital transformation initiatives, such as smart city projects and AI adoption. France’s emphasis on edge computing and Italy’s focus on IoT applications further enhance their contributions to the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure, Equinix, Interxion (a Digital Realty company), OVHcloud, and Vertiv are some of the key market players in the data center server market

The Europe data center server market is highly competitive, characterized by the dominance of established players like Dell, HPE, and Lenovo, alongside emerging firms focusing on niche segments. According to the European IT Hardware Association, Dell’s leadership stems from its comprehensive product portfolio, while HPE’s focus on sustainability differentiates it from competitors. Lenovo’s affordability strategy appeals to budget-conscious clients, particularly SMEs. Regional fragmentation allows smaller innovators to carve out niches, fostering innovation. Pricing wars occasionally arise, particularly in cost-sensitive markets like Eastern Europe. Regulatory frameworks further intensify rivalry, as manufacturers must continuously adapt to evolving compliance requirements. Despite challenges, collaboration opportunities exist, especially in integrating green technologies and AI-driven solutions. Overall, the competitive landscape reflects a balance between innovation-driven growth and strategic positioning, ensuring dynamic evolution over the forecast period.

Top Players in the Europe Data Center Server Market

1. Dell Technologies

Dell leads the market with a 25% share, as per the European IT Hardware Association. Its PowerEdge servers are renowned for reliability, scalability, and compatibility with cloud platforms. Dell’s focus on AI-optimized hardware has solidified its dominance, particularly among enterprises requiring high-performance computing solutions.

2. HPE (Hewlett Packard Enterprise)

HPE holds a 20% market share, offering innovative solutions like ProLiant servers. According to the European Data Centre Federation, HPE’s emphasis on energy efficiency aligns with regional sustainability goals. The company also partners with renewable energy providers to power data centers, enhancing its appeal in environmentally conscious markets.

3. Lenovo

Lenovo captures 15% of the market, leveraging its ThinkSystem servers for affordability and performance. As per the European Technology Observatory, Lenovo targets SMEs by offering cost-effective yet powerful server solutions. Its partnerships with local distributors have expanded its reach, particularly in emerging markets like Eastern Europe.

Top Strategies Used by Key Players

Key players employ diverse strategies to maintain competitiveness and drive growth. Product innovation remains central, with Dell introducing AI-optimized servers and HPE launching energy-efficient models. Strategic partnerships are another focus, exemplified by HPE’s collaboration with Iberdrola to integrate renewable energy into data centers. Lenovo emphasizes affordability , targeting SMEs through tiered pricing models. Additionally, all three companies prioritize sustainability , aligning with EU regulations and consumer demand for eco-friendly solutions. These multifaceted approaches ensure sustained market presence while addressing evolving customer needs.

RECENT MARKET DEVELOPMENTS

- In March 2024, Dell launched its AI-optimized PowerEdge R760 server in Europe. This initiative aims to cater to rising AI workloads and enhance computational capabilities for enterprises.

- In May 2024, HPE partnered with Iberdrola, a Spanish energy firm. This collaboration seeks to integrate renewable energy into data centers, aligning with sustainability goals.

- In July 2024, Lenovo announced a distribution agreement with TechData in Germany. This move enhances accessibility to affordable servers, particularly for SMEs in underserved regions.

- In September 2024, Dell expanded its Dublin data center. This development ensures localized server solutions for European clients, reducing latency and improving performance.

- In November 2024, HPE initiated a training program for IT professionals in France. This action addresses the talent gap in server management, fostering long-term industry growth.

MARKET SEGMENTATION

This research report on the europe data center server market is segmented and sub-segmented based on categories.

By Form Factor

- Rack Server

- Blade Server

- Tower Server

By End-User

- IT & Telecommunication

- BFSI

- Government

- Media & Entertainment

- Other End-Users

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the Europe Data Center Server Market?

Key drivers include increasing cloud adoption, AI-based workloads, and demand for digital infrastructure. Government support and smart city initiatives also fuel growth.

What server types are prevalent in the Europe Data Center Server Market?

Rack servers, blade servers, tower servers, and microservers are commonly used. High-density and AI-optimized servers are also gaining traction.

What is the future outlook for the Europe Data Center Server Market?

The market is expected to grow steadily with advances in AI, cloud, and digital infrastructure. Sustainability and edge deployment will shape the next phase.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]