Europe Data Center Power Market Size, Share, Trends, & Growth Forecast Report Segmented By Component (Solutions and Services), Solutions, Services, End-use, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Data Center Power Market Size

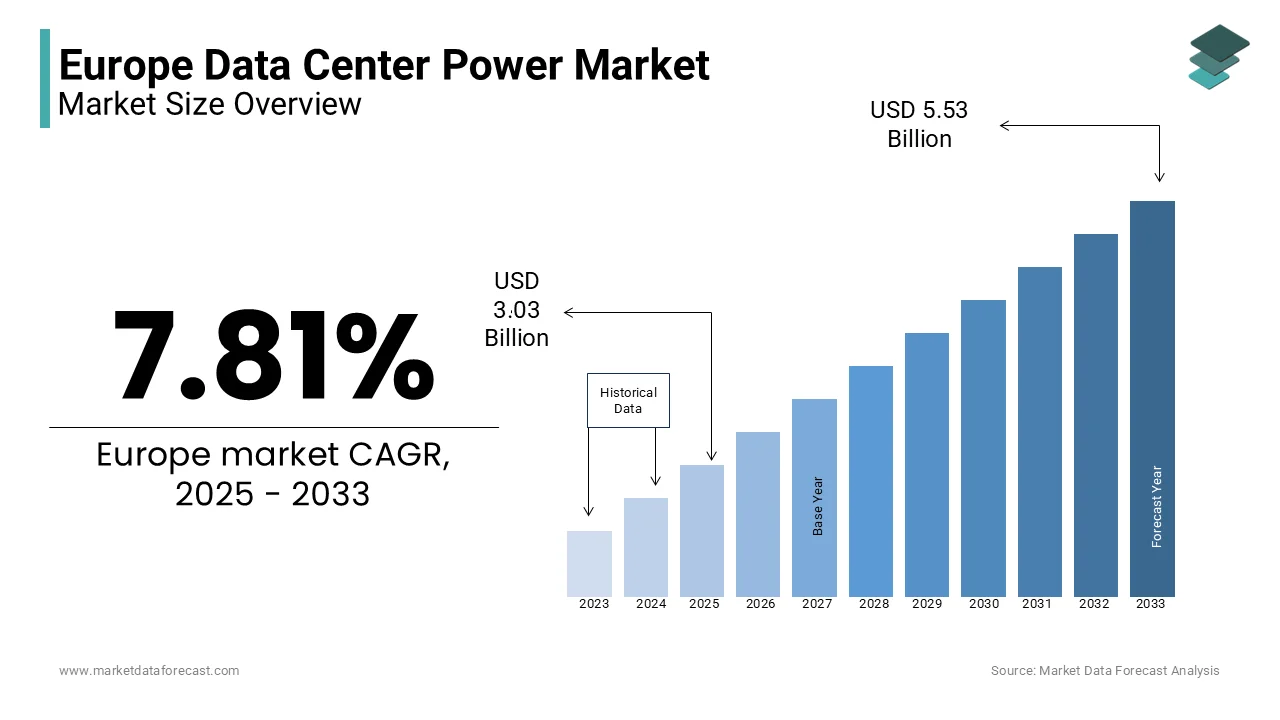

The Europe data center power market was worth USD 2.81 billion in 2024. The European market is estimated to reach USD 5.53 billion by 2033 from USD 3.03 billion in 2025, rising at a CAGR of 7.81% from 2025 to 2033.

Data center power is a crucial segment in the entire data center industry and focus on the energy infrastructure required to support the operation of data centers. Data center power includes power distribution systems, backup power solutions, energy storage, and advanced power management technologies designed to ensure uninterrupted and efficient energy supply. The demand for data center power is rapidly growing owing to the increasing

As data centers consume substantial amounts of electricity to power servers, cooling systems, and other critical infrastructure, the demand for reliable and sustainable power solutions has become a top priority for operators across Europe. The European data center power market has been experiencing significant growth from the last few years due to the rapid expansion of digital services, cloud computing, and the increasing adoption of artificial intelligence and IoT technologies. Germany, the UK, and the Nordic regions are at the forefront of this transformation by leveraging renewable energy sources like wind, solar, and hydropower to reduce carbon emissions. For instance, the Nordic countries, with their abundant renewable energy resources and cooler climates, have become attractive hubs for energy-efficient data center operations. According to a report by CBRE Group, the total power capacity of data centers in Europe exceeded 12 gigawatts in 2023, which is indicating the pivotal role of Europe in the global data center power landscape. This trend is expected to continue as operators increasingly invest in innovative power solutions to meet both operational and environmental goals.

MARKET DRIVERS

Surge in Cloud Computing Adoption in Europe

The rapid adoption of cloud computing is a significant driver of the Europe data center power market. Businesses across sectors are increasingly migrating to cloud-based platforms, leading to a surge in demand for data storage and processing capabilities. According to Eurostat, over 60% of European enterprises utilized cloud computing services in 2022, a substantial increase from previous years. This shift necessitates robust power infrastructure to support the high energy consumption of cloud data centers, which often operate around the clock. Hyperscale data centers, which can consume up to 100 megawatts of power, are becoming more prevalent, further driving the need for advanced power solutions to ensure uninterrupted and efficient operations.

Push for Sustainability and Renewable Energy Integration

The emphasis on sustainability and renewable energy integration is another key driver shaping the Europe data center power market. The European Union’s Green Deal and Climate Neutral Data Centre Pact have set ambitious targets for reducing carbon emissions, pushing data center operators to adopt renewable energy sources. According to the International Energy Agency, renewable energy accounted for nearly 40% of the EU’s electricity generation in 2022. Countries like Sweden and Norway are leveraging hydropower and wind energy to power data centers, with some facilities achieving Power Usage Effectiveness (PUE) ratios as low as 1.1. This focus on green energy is driving innovation in energy storage and management systems, transforming the power market landscape.

MARKET RESTRAINTS

High Energy Costs and Operational Expenses

One of the major restraints in the Europe data center power market is the high cost of energy and operational expenses. According to Eurostat, electricity prices for non-household consumers in the European Union averaged €0.20 per kilowatt-hour in 2022, with countries like Germany and Denmark experiencing even higher rates. These elevated costs significantly impact the profitability of data center operations, particularly for smaller operators. Additionally, the need for continuous power supply and backup systems, such as uninterruptible power supplies (UPS) and diesel generators, further escalates operational expenditures. This financial burden can deter new investments and limit the expansion of existing facilities, particularly in regions with less favorable energy pricing.

Regulatory and Environmental Compliance Challenges

Stringent regulatory and environmental compliance requirements pose another significant restraint for the Europe data center power market. The European Union’s Energy Efficiency Directive mandates strict energy performance standards for data centers, pushing operators to adopt costly upgrades to meet these regulations. According to the European Environment Agency, data centers account for approximately 2.7% of the EU’s total electricity consumption, drawing scrutiny from policymakers. Compliance with these regulations often requires significant capital investment in energy-efficient technologies and renewable energy integration, which can be financially burdensome. Furthermore, the complexity of navigating varying national regulations across EU member states adds to the operational challenges, slowing down market growth.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Infrastructure

The growing emphasis on renewable energy presents a significant opportunity for the Europe data center power market. According to the European Commission, the EU aims to achieve a 45% share of renewable energy in its total energy consumption by 2030, up from 22% in 2021. This ambitious target is driving investments in wind, solar, and hydropower projects, creating opportunities for data centers to integrate sustainable energy solutions. Countries like Sweden and Norway, which already generate over 50% of their electricity from renewables, are leading the way. By leveraging these renewable sources, data centers can reduce operational costs, meet regulatory requirements, and enhance their sustainability credentials, attracting environmentally conscious clients.

Adoption of Advanced Power Management Technologies

The increasing adoption of advanced power management technologies offers another major opportunity for the Europe data center power market. Innovations such as AI-driven energy optimization, modular UPS systems, and lithium-ion batteries are transforming how data centers manage power consumption. According to the International Energy Agency, implementing such technologies can improve energy efficiency by up to 30% in data centers. These advancements not only reduce energy costs but also enhance operational reliability and scalability. As hyperscale data centers expand across Europe, the demand for cutting-edge power management solutions is expected to grow, creating a lucrative market for technology providers and driving further innovation in the sector.

MARKET CHALLENGES

Grid Infrastructure Limitations

A major challenge facing the Europe data center power market is the strain on existing grid infrastructure. The rapid growth of data centers, particularly hyperscale facilities, has significantly increased electricity demand, often outpacing the capacity of local power grids. According to the European Network of Transmission System Operators for Electricity, electricity demand in the EU is projected to grow by 1.5% annually through 2030, with data centers being a key contributor. In regions like Ireland, where data centers account for nearly 14% of total electricity consumption as reported by the Sustainable Energy Authority of Ireland, grid congestion and reliability issues are becoming increasingly common. Upgrading grid infrastructure requires substantial investment and time, creating a bottleneck for data center expansion.

Skilled Workforce Shortages

The Europe data center power market is also challenged by a shortage of skilled professionals capable of designing, operating, and maintaining advanced power systems. According to the European Commission, the digital skills gap in the EU affects over 70% of businesses, with the data center sector being particularly impacted. The complexity of modern power management technologies, such as AI-driven energy optimization and renewable energy integration, demands specialized expertise. This skills shortage can delay project timelines, increase operational costs, and hinder innovation. Addressing this gap requires significant investment in training and education programs, as well as collaboration between industry stakeholders and educational institutions to build a sustainable talent pipeline.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.81% |

|

Segments Covered |

By Component, Solutions, Services, End-use, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

ABB, Black Box, CyrusOne, Eaton, Equinix Inc., GDS Holdings, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand, N1 Critical Technologies, NTT Global Data Centers, Raman Power Technologies, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp are some of the key players in the Europe data center power market. |

SEGMENTAL ANALYSIS

By Component Insights

The "Solutions" segment dominated the Europe data center power market by holding a prominent share in 2024. The segment’s growth is attributed to the widespread adoption of uninterruptible power supply (UPS) systems and power distribution units (PDUs), which are indispensable for ensuring reliable operations. The growing complexity of IT infrastructure that is coupled with the rising demand for energy-efficient systems, has fueled the uptake of these solutions. Key drivers of this segment include the increasing deployment of hyperscale data centers and the need for resilient power systems to support mission-critical applications. According to Schneider Electric, hyperscale facilities accounted for 40% of Europe’s total data center capacity in 2023, driving demand for advanced power solutions. Additionally, the integration of smart technologies, such as AI-driven PDUs, enhances operational efficiency.

The services segment is likely to pose with a fastest CAGR of 12.5% during the forecast period. This growth is fueled by the rising demand for design and consulting services, which help operators optimize power infrastructure and comply with regulatory standards.

The increasing complexity of data center architectures necessitates expert guidance, particularly in integrating renewable energy solutions. Moreover, the growing emphasis on predictive maintenance services ensures uninterrupted operations that will further propel the growth of the segment.

By Solutions Insights

The uninterruptible power supply (UPS) segment held 45.3% of the Europe data center power market share in 2024. The segment’s growth is driven by the critical role UPS systems play in ensuring uninterrupted power supply to data centers, especially during grid outages or voltage fluctuations. The increasing reliance on cloud computing and the proliferation of hyperscale facilities have amplified the demand for robust UPS systems.

A key factor fueling this dominance is the growing emphasis on energy efficiency. According to Eaton Corporation, modern modular UPS systems offer up to 99% efficiency by making them indispensable for operators aiming to reduce operational costs while maintaining reliability. Additionally, stringent EU regulations mandating carbon neutrality have encouraged the adoption of eco-friendly UPS technologies. According to a study by BloombergNEF, nearly 30% of European data centers upgraded their UPS systems in 2023 to align with sustainability goals.

The busway segment is emerging with a CAGR of 14.2% from 2025 to 2033. This growth is fueled by the increasing deployment of modular data centers, which rely heavily on busway systems for flexible and scalable power distribution. Busways are particularly advantageous in edge computing environments, where compact designs and rapid scalability are essential. As per Siemens, installations of busway systems in European edge data centers grew by 25% in 2023 owing to their ability to simplify power distribution and reduce installation time. Furthermore, advancements in smart busway technologies, such as real-time monitoring and predictive maintenance capabilities, are enhancing their appeal.

By Services Insights

The support and maintenance segment was the largest by capturing 50.2% of the Europe data center power market share in 2024. The growth of the segment is driven by the rising importance of ensuring continuous uptime and optimal performance in data centers, where even minor disruptions can result in significant financial losses.

The rising complexity of data center operations has heightened the demand for specialized maintenance services. According to IBM, nearly 60% of European data centers outsourced their maintenance needs in 2023 to address challenges related to aging infrastructure and evolving technological requirements. Predictive maintenance, powered by AI and IoT, is gaining traction as it enables operators to identify potential issues before they escalate. A study by Capgemini reveals that predictive maintenance reduced downtime by 25% in European data centers.

The design and consulting segment is ascribed to register a CAGR of 13.8% in the next coming years. This growth is driven by the increasing need for expert guidance in designing energy-efficient and compliant data center infrastructures. Europe’s stringent environmental regulations, such as the EU Green Deal, have necessitated the integration of renewable energy solutions into data center designs. As per a report by Arup, 40% of new data center projects in Europe sought external consulting services in 2023 to ensure compliance with these regulations. Additionally, the growing adoption of edge computing has created demand for customized designs tailored to specific use cases. These factors, coupled with the expertise offered by consulting firms, are propelling the segment’s rapid expansion.

By End-use Insights

The IT and telecommunications sector dominated the Europe data center power market and held 38.1% of share in 2024. The growth of the segment is solely to be driven by the sector’s pivotal role in driving digital transformation across the continent, with enterprises increasingly relying on cloud-based services and high-speed connectivity.

The proliferation of 5G networks and IoT devices has further amplified the demand for robust data center power solutions. According to Ericsson, the number of 5G subscriptions in Europe is expected to reach 200 million by 2025 that is creating a surge in data traffic and necessitating advanced power management systems. Additionally, the shift toward remote work and digital-first business models has increased the dependency on IT infrastructure. According to a study by Nokia, investments in IT infrastructure accounted for 45% of total enterprise spending in 2023.

The healthcare sector is likely to grow with a prominent CAGR of 15.3% from 2025 to 2033. This growth is fueled by the increasing adoption of digital health technologies, such as telemedicine, electronic health records (EHRs), and AI-driven diagnostics, which require reliable and scalable data center power solutions. The COVID-19 pandemic acted as a catalyst for digital transformation in healthcare, accelerating the deployment of remote patient monitoring systems and virtual consultations. According to McKinsey, telehealth adoption in Europe surged by 300% during the pandemic by creating a sustained demand for data center infrastructure. Furthermore, the integration of IoT-enabled medical devices has increased the volume of data generated by necessitating advanced power systems to ensure seamless operations.

REGIONAL ANALYSIS

Germany stands as a cornerstone of the Europe data center power market, commanding approximately 22% of the regional share in 2023, according to Statista. The country’s dominance is driven by its robust industrial base and digital transformation initiatives. Germany hosts over 100 hyperscale data centers, with Frankfurt emerging as one of the largest data center hubs globally. According to a report by Bitkom, investments in digital infrastructure reached €45 billion in 2023 with the nation’s commitment to technological advancement.

The adoption of renewable energy solutions further bolsters Germany’s position. According to BloombergNEF, 45% of the country’s data centers now rely on renewable energy sources by aligning with the EU’s Green Deal objectives. Additionally, the growing demand for cloud services that is fueled by SMEs adopting digital tools that has propelled the need for advanced power systems.

The UK data center power market is likely to witness a CAGR of 13.2% during the forecast period. London serves as a critical hub by hosting nearly 70% of the UK’s data centers. The region’s strategic location, coupled with favorable regulatory frameworks, has attracted significant foreign investments. The rise of fintech and e-commerce sectors has further amplified demand for reliable power solutions. A study by Barclays reveals that 60% of UK businesses adopted cloud-based platforms in 2023, necessitating robust data center infrastructures. Moreover, the UK government’s commitment to achieving net-zero emissions by 2050 has spurred innovations in energy-efficient power technologies.

France data center power market is gearing up to have steady growth opportunities in the next coming years. Paris has emerged as a key player by housing over 40% of the country’s data centers. The French government’s €30 billion investment in digital modernization initiatives during 2023 has significantly boosted the sector’s growth. A pivotal driver of this growth is the increasing adoption of AI and IoT technologies. As per Capgemini, 50% of French enterprises implemented AI-driven solutions in 2023 is creating a surge in data processing requirements. Furthermore, the emphasis on sustainable practices has encouraged operators to adopt renewable energy-powered systems. According to the report by EDF, 35% of French data centers integrated solar or wind energy solutions in 2023 by aligning with national sustainability goals.

The Netherlands data center market is more likely to have sustainable growth rate in the next coming years. Amsterdam is a global leader, with over 80% of the country’s data centers located in its vicinity. The region’s strategic connectivity, supported by robust fiber-optic networks that has made it a preferred destination for multinational corporations. The Netherlands’ commitment to green energy has also played a crucial role. According to Greenpeace, 60% of Dutch data centers operate on renewable energy, setting a benchmark for sustainability. Additionally, the rise of edge computing has created new opportunities for localized power solutions. A study by ING Bank predicts that edge computing will account for 30% of the Netherlands’ data center investments by 2025.

Sweden data center power market is having steady pace in the next future period. The country’s cold climate and abundant renewable energy resources make it an ideal location for energy-efficient data centers. Stockholm and Malmö are rapidly emerging as key hubs by attracting global players like Google and Facebook.

A major driver of Sweden’s growth is its commitment to carbon neutrality. According to the Swedish Energy Agency, 98% of the country’s electricity comes from renewable sources, making it highly attractive for eco-conscious operators. Additionally, tax incentives introduced by the government have encouraged investments in sustainable data center projects.

KEY MARKET PLAYERS

ABB, Black Box, CyrusOne, Eaton, Equinix Inc., GDS Holdings, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand, N1 Critical Technologies, NTT Global Data Centers, Raman Power Technologies, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp are some of the key players in the Europe data center power market.

TOP 3 PLAYERS IN THE MARKET

Schneider Electric

Schneider Electric is a global leader in energy management and automation solutions, playing a pivotal role in shaping the Europe data center power market. The company offers innovative products such as uninterruptible power supply (UPS) systems, PDUs, and software for energy optimization. Schneider’s EcoStruxure platform, which integrates IoT and AI, has been widely adopted across Europe to enhance operational efficiency and sustainability. Schneider has positioned itself as a trusted partner for operators aiming to achieve carbon neutrality by focusing on renewable energy integration. Its contributions extend beyond Europe is influencing global trends in energy-efficient data center designs.

Eaton Corporation

Eaton Corporation is renowned for its advanced power management solutions, particularly its modular UPS systems tailored for data centers. The company’s focus on energy efficiency and scalability has made it a preferred choice for hyperscale facilities and edge computing environments. Eaton’s Brightlayer suite leverages AI to provide predictive maintenance capabilities, reducing downtime and operational costs. In Europe, Eaton has actively collaborated with governments and private entities to promote sustainable practices. Globally, Eaton’s innovations in microgrid technologies have set new benchmarks for resilient and eco-friendly power systems.

ABB Group

ABB Group specializes in electrification and digitalization solutions is offering cutting-edge technologies for data center power management. Its offerings include intelligent busway systems and smart grid solutions that cater to the growing demand for flexible and scalable infrastructures. ABB’s Ability™ platform enables real-time monitoring and optimization of power usage, aligning with Europe’s stringent environmental regulations. The company has invested heavily in R&D to develop sustainable solutions, contributing to the global transition toward green data centers. ABB’s expertise in integrating renewable energy sources has strengthened its position both regionally and internationally.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships

Leading players in the Europe data center power market have embraced strategic partnerships to expand their reach and enhance product portfolios. For instance, collaborations with renewable energy providers enable companies to offer eco-friendly power solutions. These alliances not only foster innovation but also ensure compliance with EU regulations by strengthening their competitive edge.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies are focusing on developing AI-driven power management systems and modular architectures that cater to evolving customer needs. This approach allows them to address challenges such as energy efficiency and scalability while maintaining in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized facilities and distribution networks, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

COMPETITIVE LANDSCAPE

The Europe data center power market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Schneider Electric, Eaton Corporation, and ABB Group dominate the landscape, leveraging their extensive expertise in energy management and automation solutions. However, the market also features niche players specializing in modular power systems and renewable energy integration is creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in AI, IoT, and predictive analytics to differentiate themselves. According to McKinsey, over 60% of European data center operators prioritize energy-efficient solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating carbon neutrality have forced companies to innovate sustainably.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth with opportunities in emerging segments such as edge computing and renewable energy adoption driving future competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Schneider Electric launched its EcoStruxure IT Expert platform in Europe, enabling real-time monitoring and predictive maintenance for data center power systems. This initiative aims to enhance operational efficiency and reduce downtime.

- In June 2023, Eaton Corporation partnered with Vattenfall, a Swedish energy provider, to integrate renewable energy solutions into its power management systems. This collaboration seeks to meet Europe’s growing demand for sustainable data center infrastructures.

- In September 2023, ABB Group acquired a Finnish startup specializing in AI-driven energy optimization technologies. This acquisition strengthens ABB’s portfolio and positions it as a leader in smart power solutions.

- In January 2024, Vertiv expanded its operations in Eastern Europe by opening a new manufacturing facility in Poland. This move aims to cater to the rising demand for modular data center power solutions in the region.

- In November 2023, Siemens unveiled its Smart Busway System in Germany, designed to support edge computing environments. This launch will promote the Siemens’ commitment to addressing the unique power needs of decentralized data centers.

MARKET SEGMENTATION

This research report on the Europe data center power market is segmented and sub-segmented into the following categories.

By Component

- Solutions

- Services

By Solutions

- PDU

- UPS

- Busway

- Others

By Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By End-use

- IT & Telecommunications

- BFSI

- Government

- Energy

- Healthcare

- Retail

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe data center power market?

The growth is driven by increasing demand for cloud computing, AI workloads, and the expansion of hyperscale data centers, requiring higher power capacities.

How is AI impacting power demand in European data centers?

AI and machine learning applications are increasing power demand, leading to the need for high-density racks and liquid cooling solutions to manage heat generation.

What are the emerging trends in power infrastructure for European data centers?

Trends include the adoption of battery energy storage systems (BESS), microgrids, hydrogen fuel cells, and direct renewable energy integration for sustainability.

What regulations impact power usage in European data centers?

EU regulations like the Energy Efficiency Directive and the Climate Neutral Data Center Pact push for reduced energy consumption and carbon neutrality targets.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]