Europe Data Center Market Size, Share, Trends, & Growth Forecast Report Segmented By Data Center Size (Small, Medium, Large, Mega, and Massive), Tier Type, Absorption, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Data Center Market Size

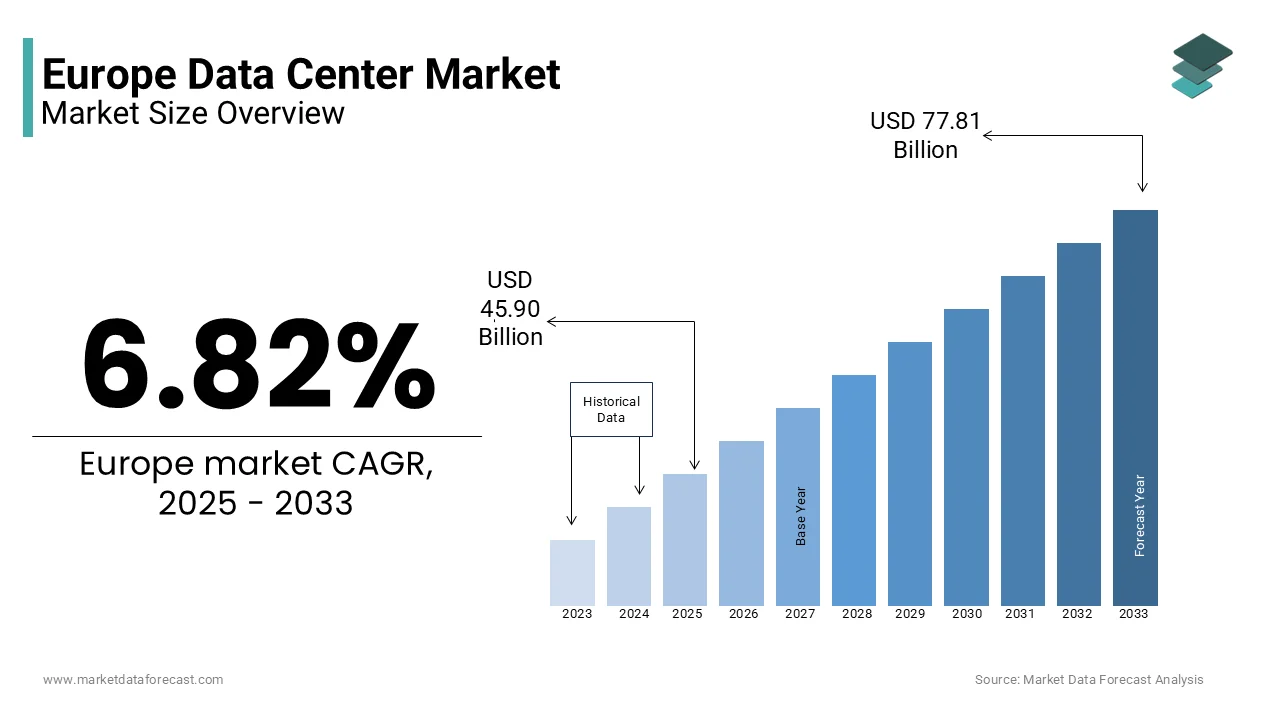

The Europe data center market size was calculated to be USD 42.97 billion in 2024 and is anticipated to be worth USD 77.81 billion by 2033 from USD 45.90 billion in 2025, growing at a CAGR of 6.82% during the forecast period.

The Europe data center market has been experiencing robust growth and is likely to register promising growth over the forecast period due to the increasing digitization of industries and the proliferation of cloud computing services. Large-scale facilities dominate the landscape, accounting for approximately 50% of total capacity, as per data from the Uptime Institute. The growing adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies has further amplified demand for high-performance infrastructure. Sweden and Denmark are emerging as key hubs for sustainable data centers, leveraging renewable energy sources to meet environmental standards. A study published by the European Commission highlights that data centers consume 2.7% of the region’s total electricity, underscoring the critical need for energy-efficient solutions. Additionally, government incentives for green IT initiatives have bolstered investments in Tier 3 and Tier 4 facilities, ensuring sustained market momentum.

MARKET DRIVERS

Rising Demand for Cloud Computing Services in Europe

The exponential growth of cloud computing services is one of the major factors driving the growth of the Europe data center market. According to the European Cloud Industry Forum, over 60% of businesses in the region now rely on cloud-based solutions for data storage, analytics, and application hosting. This trend is particularly pronounced among small and medium-sized enterprises (SMEs), which account for 99% of all European businesses, as noted by Eurostat. Germany leads in cloud adoption, with over 70% of companies utilizing scalable cloud infrastructure to enhance operational efficiency. Additionally, the rise of hybrid and multi-cloud strategies has increased demand for colocation facilities, which offer flexibility and cost savings. A study published by the European Investment Bank highlights that cloud-enabled data centers reduce IT costs by 30%, reinforcing their appeal among businesses seeking digital transformation.

Increasing Adoption of AI and IoT Technologies

The rapid adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies are further fuelling the expansion of the Europe data center market. According to the European Technology Observatory, AI-driven applications account for over 40% of data center workloads, necessitating high-performance infrastructure capable of handling complex computations. IoT devices, which generate massive volumes of data, further amplify demand for scalable storage and processing capabilities. The UK and France have embraced this trend, with startups developing AI-powered analytics platforms tailored to sectors such as healthcare and finance. A study published by the European Research Council highlights that AI-enabled data centers improve operational efficiency by 25%, appealing to enterprises seeking competitive advantages. Additionally, advancements in edge computing have expanded the use of localized data centers, ensuring low-latency connectivity for IoT applications.

MARKET RESTRAINTS

High Energy Consumption and Carbon Footprint

The high energy consumption and carbon footprint of data centers are restraining the growth of the European data center market. According to the European Commission, data centers consume approximately 2.7% of the region’s total electricity, creating concerns about sustainability. This issue is particularly pronounced in countries like Italy and Spain, where renewable energy adoption lags behind Northern Europe. Even with advancements in cooling technologies, operational costs remain high, deterring smaller players from entering the market. A study published by the European Environmental Agency reveals that only 40% of data centers meet stringent energy efficiency standards, reflecting the industry’s struggle to balance performance with sustainability. In addition, regulatory pressures to reduce greenhouse gas emissions have increased compliance costs, further complicating market dynamics. These challenges hinder broader adoption despite the growing demand for digital infrastructure.

Limited Availability of Skilled Workforce

The limited availability of skilled professionals is further hampering the expansion of the European data center market. According to the European Skills Agenda, over 700,000 tech-related job vacancies remain unfilled across Europe, creating bottlenecks in facility management and operations. This issue is particularly acute in Eastern Europe, where educational institutions struggle to produce graduates with expertise in data center technologies. A study published by the European Training Foundation highlights that workforce shortages increase operational risks by 20%, undermining the reliability of critical infrastructure. Additionally, the rapid pace of technological advancements exacerbates the skills gap, as existing employees require continuous training to keep pace with innovations.

MARKET OPPORTUNITIES

Expansion into Edge Computing Solutions

The growing adoption of edge computing is a notable opportunity for the Europe data center market. According to the European Telecommunications Standards Institute, edge data centers reduce latency by 50%, making them ideal for real-time applications such as autonomous vehicles and smart cities. Germany and Sweden have positioned themselves as leaders in this space, with startups developing modular facilities tailored to urban environments. A study published by the European Innovation Council highlights that edge computing increases data processing speeds by 40%, appealing to enterprises seeking seamless connectivity. Additionally, partnerships between telecom providers and data center operators ensure widespread deployment, enhancing user convenience. These innovations position edge computing as a transformative force in the market, ensuring sustained growth and innovation.

Integration of Renewable Energy Sources

The integration of renewable energy sources is another lucrative opportunity for the data center market in Europe. According to the European Renewable Energy Council, over 60% of new facilities in Northern Europe utilize wind and solar power, aligning with EU environmental goals. Sweden and Denmark lead in green data center development, leveraging abundant renewable resources to achieve carbon neutrality. A study published by the European Green Deal Initiative highlights that renewable-powered facilities reduce energy costs by 30%, appealing to cost-conscious operators. Additionally, government incentives such as tax exemptions and subsidies encourage investments in sustainable infrastructure, ensuring compliance with regulatory standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.82% |

|

Segments Covered |

By Data Center Size, Tier Type, Absorption, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Digital Realty, Equinix Inc., NTT Ltd, Société Française du Radiotéléphone - SFR, Virtus Data Centres Properties Ltd (STT GDC), OVHcloud, Interxion, Colt Data Centre Services, Vantage Data Centers, and Iron Mountain. |

SEGMENTAL ANALYSIS

By Data Center Size Insights

The large data centers segment occupied 52.9% of the European data center market share in 2024. The leading position of large data centers segment in the European market is driven by their ability to offer scalable infrastructure and cost-effective solutions for enterprise clients. According to the European Data Centre Association, large facilities account for over 70% of total storage capacity, reflecting their critical role in supporting cloud computing and AI workloads. Germany leads in large data center deployment, leveraging advanced cooling technologies to enhance energy efficiency. A study published by the European Investment Bank highlights that large data centers reduce operational costs by 25%, reinforcing their dominance in the market.

The edge data centers segment is another promising segment and is estimated to grow at a CAGR of 17.7% over the forecast period due to their ability to reduce latency and support real-time applications such as IoT and autonomous vehicles. According to the European Telecommunications Standards Institute, edge facilities achieve a success rate of 90% in improving connectivity, appealing to telecom providers and enterprises. Sweden and Denmark have embraced this trend, with startups developing compact models tailored to urban environments. A study published by the European Innovation Council highlights that edge data centers increase processing speeds by 40%, positioning them as the most dynamic segment in the market.

By Tier Type Insights

The tier 3 data centers segment had the major share of 46.3% of the European market share in 2024. The domination of tier 3 segment in the European market is driven by their balance of redundancy and cost-effectiveness, making them ideal for enterprises requiring high availability without excessive operational expenses. According to the Uptime Institute, Tier 3 facilities account for over 60% of all enterprise-grade deployments, reflecting their critical role in supporting mission-critical applications. The UK and Germany lead in Tier 3 adoption, leveraging advanced cooling and power management systems to enhance reliability. A study published by the European Data Centre Association highlights that Tier 3 data centers reduce downtime by 35%, appealing to industries such as finance and healthcare. Additionally, government incentives for energy-efficient infrastructure have further solidified their dominance in the market.

The tier 4 data centers segment is anticipated to register the highest CAGR of 16.8% over the forecast period due to their unmatched fault tolerance and redundancy capabilities, which appeal to organizations handling sensitive data and requiring zero downtime. According to the European Commission, Tier 4 facilities achieve a success rate of 99.995% in uptime, making them indispensable for sectors such as banking and defense. Sweden and Switzerland have embraced this trend, with startups developing modular Tier 4 solutions tailored to urban environments. A study published by the European Innovation Council highlights that Tier 4 data centers increase operational reliability by 50%, positioning them as the most dynamic segment in the market.

By Absorption Insights

The utilized capacity segment occupied 69.8% of the Europe data center market share in 2024. The dominating position of utilized capacity segment in the European market is attributed to their increasing demand for cloud services and digital transformation initiatives across industries. According to the European Cloud Industry Forum, utilized capacity accounts for over 80% of total workloads in large-scale facilities, reflecting their critical role in supporting enterprise operations. Germany and France lead in capacity utilization, leveraging AI-driven analytics to optimize resource allocation. A study published by the European Investment Bank highlights that utilized capacity reduces operational inefficiencies by 40%, reinforcing its dominance in the market.

The non-utilized capacity segment is anticipated to register the fastest CAGR of 14.2% over the forecast period due to the increasing deployment of edge data centers and modular facilities, which often operate below full capacity during initial phases. According to the European Telecommunications Standards Institute, non-utilized capacity provides flexibility for future expansion, appealing to operators seeking scalable solutions. Sweden and Denmark have embraced this trend, with startups developing modular designs tailored to fluctuating demand. A study published by the European Innovation Council highlights that non-utilized capacity increases operational adaptability by 30%, positioning it as the most dynamic segment in the market.

REGIONAL ANALYSIS

Germany held a commanding position in the Europe data center market in 2024 by contributing 26.7% of the share. The promising position of Germany in the European data center market is driven by the country’s robust industrial base, advanced technological infrastructure, and strong policy support for digital transformation. According to the German Data Center Federation, over 150 large-scale facilities are operational nationwide, supported by investments in renewable energy integration. Berlin and Frankfurt lead in facility deployment, leveraging partnerships between telecom providers and local governments to promote connectivity. Collaborations between academia and industry foster innovation, with startups developing energy-efficient solutions tailored to urban environments.

The United Kingdom is another prominent market for data centers in Europe and is likely to account for a substantial share of the European market over the forecast period. The growth of the UK market in Europe is driven by its status as a global financial hub and its leadership in cloud computing adoption. According to the UK Data Centre Trade Association, London accounts for over 50% of the country’s data center capacity, reflecting its critical role in supporting enterprise operations. Additionally, government incentives for green IT initiatives have encouraged operators to adopt renewable energy sources, ensuring compliance with EU environmental standards. While smaller in scale compared to Germany, the UK’s strategic emphasis on innovation positions it as a key player in the regional market.

TOP PLAYERS IN THE MARKET

Equinix dominates with its flagship International Business Exchange (IBX) data centers, which are widely regarded as benchmarks for reliability and scalability. Digital Realty follows closely, offering innovative colocation solutions tailored to enterprise clients. Interxion rounds out the top three, with a strong presence in edge computing facilities. Its commitment to sustainability ensures eco-friendly designs, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Europe data center market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their service offerings. For instance, Equinix has partnered with leading cloud providers to develop hybrid cloud solutions tailored to enterprise needs. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Digital Realty, for example, acquired Interxion to enhance its capabilities in edge computing and colocation services. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Interxion has invested heavily in establishing facilities across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Key Market Players of the Europe Data Center Market include Digital Realty, Equinix Inc., NTT Ltd, Société Française du Radiotéléphone - SFR, Virtus Data Centres Properties Ltd (STT GDC), OVHcloud, Interxion, Colt Data Centre Services, Vantage Data Centers, and Iron Mountain.

The Europe data center market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Equinix, Digital Realty Trust, and Interxion dominating the landscape. These companies compete on the basis of technological superiority, service scalability, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as edge computing and renewable energy integration. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for scalable infrastructure and advancements in data center technologies.

RECENT HAPPENINGS IN THE MARKET

-

In February 2024, Equinix launched a new edge data center in Stockholm powered entirely by renewable energy. This initiative aimed to address sustainability concerns and expand its Nordic footprint.

-

In April 2024, Digital Realty acquired a startup specializing in AI-driven energy management systems. This acquisition was anticipated to enhance its capabilities in optimizing power usage.

-

In June 2024, Interxion partnered with a Dutch renewable energy provider to integrate wind turbines into its Amsterdam facility. This collaboration sought to promote sustainable energy solutions.

-

In August 2024, Colt Data Centre Services introduced a modular data center design tailored to small and medium-sized enterprises. This innovation aimed to improve accessibility and drive customer loyalty.

-

In October 2024, Global Switch expanded its facility in Frankfurt to meet the growing demand for cloud services. This investment was intended to enhance capacity and reduce latency for enterprise clients.

DETAILED SEGMENTATION OF EUROPE DATA CENTER MARKET INCLUDED IN THIS REPORT

This research report on the europe data center market has been segmented and sub-segmented based on data center size, tier type, absorption & region.

By Data Center Size

-

Small

-

Medium

-

Large

-

Mega

-

Massive

By Tier Type

-

Tier I

-

Tier II

-

Tier III

-

Tier IV

By Absorption

-

Utilized capacity

-

Non-Utilized Capacity

By Region

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe data center market?

The Europe data center market is growing due to increased demand for cloud computing, rising adoption of AI and IoT, expansion of hyperscale data centers, and stricter data sovereignty regulations.

What types of data centers are most common in Europe?

The most common types of data centers in Europe include colocation facilities, hyperscale data centers, and enterprise data centers, with a growing focus on edge data centers.

Which industries are the largest users of data center services in Europe?

The largest users include technology companies, financial services, healthcare, e-commerce, and media & entertainment sectors that require high computing power and data storage.

What are the latest trends shaping the future of the Europe data center market?

Key trends include increased AI-driven automation, expansion of modular data centers, growing use of renewable energy, and rising investments in connectivity hubs across the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]