Europe Data Center Cooling Market Size, Share, Trends, & Growth Forecast Report By Product (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Unit, Chillers, and Others (Air Economizers, Heat Rejection)), Data Center Type, Cooling Technique, Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Data Center Cooling Market Size

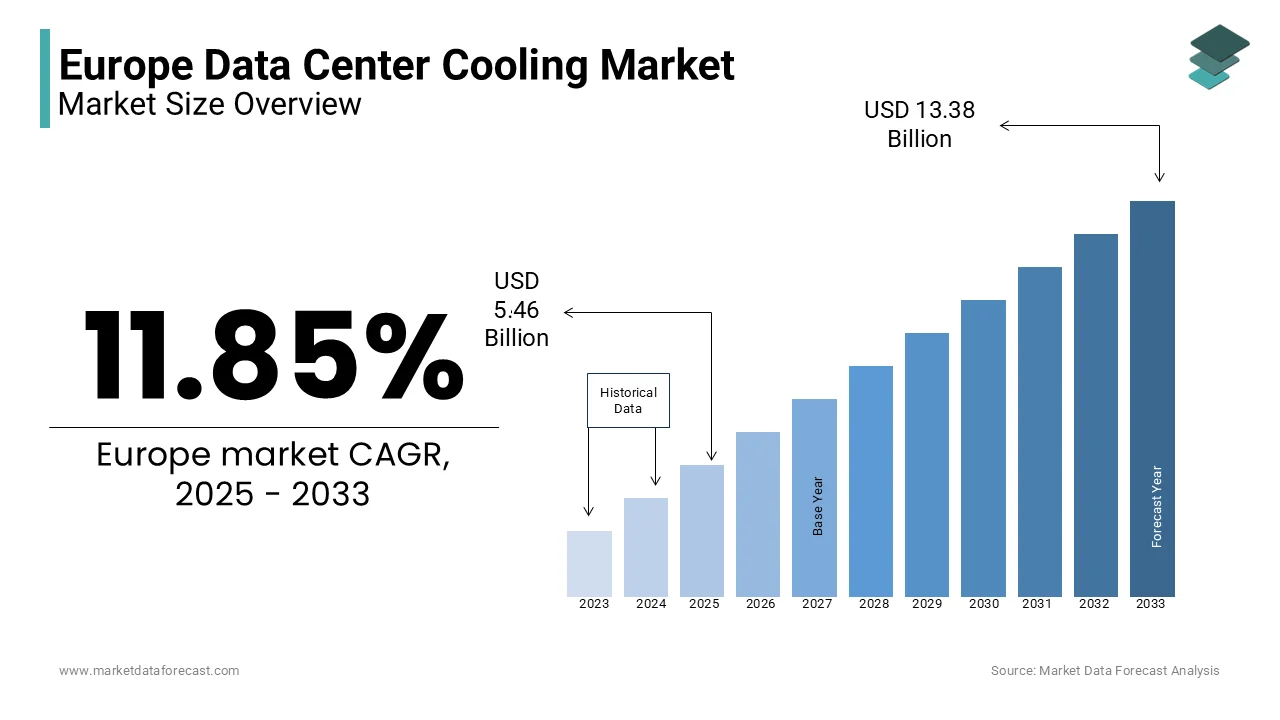

The Europe data center cooling market was worth USD 4.88 billion in 2024. The European market is estimated to reach USD 13.38 billion by 2033 from USD 5.46 billion in 2025, rising at a CAGR of 11.85% from 2025 to 2033.

The European data center cooling market is experiencing robust growth, driven by the increasing demand for energy-efficient solutions to manage rising heat loads in data centers. The expansion of this market reflects the growing adoption of advanced cooling technologies, such as liquid cooling and precision air conditioners, particularly in large-scale hyperscale facilities. For instance, Schneider Electric reported an increase in sales of its liquid cooling systems in Europe during 2022, as stated in their annual performance review. The rise of cloud computing and artificial intelligence has further amplified adoption, enabling data centers to handle high-density workloads efficiently. Additionally, government initiatives promoting sustainable practices have fostered innovation, creating new opportunities for growth. Despite challenges like high initial costs, the market remains resilient, supported by strong branding and product diversification.

MARKET DRIVERS

Rising Demand for Energy-Efficient Solutions

The escalating demand for energy-efficient cooling solutions is a primary driver of the European data center cooling market, fueled by stringent environmental regulations and the push for sustainability. The integration of smart monitoring systems has further amplified adoption, enabling real-time optimization of cooling processes and reducing operational costs. A major portion of European data centers prioritize energy-efficient cooling solutions for their ability to enhance PUE ratings, reflecting entrenched preferences. Additionally, collaborations between manufacturers and sustainability experts have accelerated R&D, driving adoption. These dynamics position energy efficiency as a cornerstone of the market’s expansion.

Increasing Adoption of Cloud Computing and AI

The push for cloud computing and artificial intelligence represents another significant driver of the European data center cooling market, driven by the need to manage high-density workloads and ensure uninterrupted operations. According to a study by Gartner, cloud-based services accounted for a notable share of total IT spending in Europe in 2022, amplifying the demand for advanced cooling solutions capable of handling increased heat loads. The rise of AI-driven applications has further amplified adoption, as these technologies generate significant thermal output requiring specialized cooling. Liquid cooling is gaining traction among European IT firms that prioritize this for its operational benefits, reflecting entrenched habits. Also, government incentives for digital transformation have accelerated innovation, creating new avenues for growth. These factors position cloud computing and AI as dynamic growth drivers.

MARKET RESTRAINTS

High Initial Investment Costs

High initial investment costs pose a significant restraint for the European data center cooling market, impacting affordability and adoption amid fluctuating budgets. The complexity of installation and maintenance further compounds the issue, adding to operational expenses. A study underscores that regulatory fragmentation could substantially cost the European data center cooling business annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

Lack of Awareness About Advanced Technologies

Lack of awareness about advanced cooling technologies presents another formidable challenge to the European data center cooling market, complicating adoption and stifling innovation. The perception that advanced cooling systems complicate traditional cooling methods often leads to frustration and decreased adoption, further amplifying resistance. Additionally, cultural differences across regions influence attitudes toward technological innovations, creating disparities in progress. Only few of European operators feel adequately informed about the benefits of liquid cooling is reflecting a critical awareness gap. Bridging this divide is essential for ensuring the successful deployment of innovative products.

MARKET OPPORTUNITIES

Expansion of Liquid Cooling Systems

The growing demand for liquid cooling systems represents a transformative opportunity for the European data center cooling market, driven by their superior efficiency and ability to handle high-density workloads. The push for sustainable practices has further amplified adoption, as liquid cooling offers a recyclable and cost-effective solution compared to traditional air-based systems. A study reveals that there is growing trend among European data centers towards liquid cooling for its environmental benefits, reflecting entrenched preferences. Additionally, advancements in system designs have improved scalability, creating new opportunities for innovation. These dynamics position liquid cooling as a dynamic growth driver.

Increasing Penetration of Edge Data Centers

The increasing penetration of edge data centers represents another significant opportunity for the European data center cooling market, enabling manufacturers to cater to the booming demand for localized processing and storage. For example, Schneider Electric partnered with telecommunications providers to integrate precision air conditioners into edge facilities, achieving an increase in sales, as stated in their performance metrics. The rise of IoT and 5G networks has further amplified adoption, particularly among urban consumers. According to Eurostat, edge data centers account for a major portion of cooling innovations in Europe, reflecting their growing importance. Additionally, collaborations between manufacturers and end-users have expanded availability, creating new opportunities for innovation. These dynamics position edge data centers as a transformative force in the market.

MARKET CHALLENGES

Intense Price Competition

Intense price competition poses a significant challenge to the European data center cooling market, as manufacturers strive to balance affordability with profitability amid fluctuating raw material prices. For instance, Aldi and Lidl’s private-label cooling systems attained a surge in sales during the same period, as outlined in their market analysis. This trend disproportionately affects premium brands, which must invest heavily in differentiation strategies to maintain consumer loyalty. Additionally, the proliferation of counterfeit products undermines trust, posing reputational risks for established manufacturers. These dynamics create a fragmented and competitive landscape, hindering long-term profitability.

Resistance to Adoption Among Traditional Operators

Resistance to adoption among traditional operators remains a significant challenge for the European data center cooling market, hindering the effective deployment of innovative solutions. The perception that advanced cooling systems complicate traditional methods often leads to frustration and decreased adoption, further amplifying resistance. Additionally, cultural differences across regions influence attitudes toward technological innovations, creating disparities in progress. Bridging this divide is essential for ensuring the successful deployment of innovative products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.85% |

|

Segments Covered |

By Product, Data Center Type, Cooling Technique, Industry, and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Daikin Industries, Ltd. (Japan), Johnson Controls (U.S.), Schneider Electric (France), Asetek Inc. (Denmark), Thermal Care (U.S.), Vertiv Group Corp. (U.S.), Mitsubishi Electric Corporation (Japan), Danfoss (Denmark), Airedale International Air Conditioning Ltd. (U.K.), and STULZ Air Technology Systems, Inc. (U.S.) are some of the major players in the Europe data center cooling market. |

SEGMENTAL ANALYSIS

By Product Insights

Air Conditioners

The air conditioners segment dominated the European data center cooling market by capturing 41.1% of the total share in 2024. This is driven by their widespread application in small- and medium-scale data centers, catering to operators seeking cost-effective solutions. For instance, Mitsubishi Electric reported that its air conditioning systems make up a major share of its European revenue in 2022, as stated in their financial disclosures. The widespread adoption of air conditioners is further amplified by their compatibility with traditional cooling systems, enhancing their appeal among operators seeking seamless upgrades. Also, advancements in energy efficiency have improved performance, amplifying adoption. These factors strengthen air conditioners as the largest segment in the market.

Liquid Cooling

The liquid cooling segment represented the fastest-growing category, with a projected CAGR of 10.1% from 2025 to 2033. This growth is fueled by the increasing demand for energy-efficient solutions, driven by their role in reducing power consumption and enhancing sustainability. The push for high-density workloads has further amplified adoption, as liquid cooling offers superior thermal management compared to traditional air-based systems. Moreover, government incentives for sustainable practices have created new opportunities for innovation. These dynamics position liquid cooling as a dynamic growth driver.

By Data Center Type Insights

Large-Scale Data Centers

The large-scale data centers segment was the top performing category in the European data center cooling market by capturing 50.9% of the total share in 2024. This influence is propelled by their widespread application in hyperscale facilities, catering to operators seeking scalable and energy-efficient solutions.The widespread adoption of large-scale cooling systems is further amplified by their compatibility with advanced technologies, enhancing their appeal among operators seeking seamless integration. Additionally, advancements in system designs have improved scalability, amplifying adoption. These factors solidify large-scale data centers as the largest segment in the market.

Edge Data Centers

The Edge data centers segment represented the fastest-growing segment, with a projected CAGR of 12.3% from 2025 to 2033. This growth is fueled by the increasing demand for localized processing and storage, driven by their role in supporting IoT and 5G networks. The push for low-latency applications has further amplified adoption, as edge data centers offer cost-effective and modular solutions. Moreover, collaborations between manufacturers and telecom providers have expanded availability, creating new opportunities for innovation. These dynamics position edge data centers as a dynamic growth driver.

By Cooling Technique Insights

Room-Based Cooling

The segment of room-based cooling commanded the European data center cooling market by having a 44.3% of the total share in 2024. This is linked to its widespread application in traditional data centers, catering to operators seeking cost-effective solutions. Moreover, the widespread adoption of room-based cooling is further amplified by its compatibility with legacy infrastructure, enhancing its appeal among operators seeking seamless upgrades. Apart from these, advancements in airflow management have improved efficiency, amplifying adoption. These factors strengthen room-based cooling as the largest segment in the market.

Rack-Based Cooling

The rack-based cooling segment is quickly moving ahead in the market, with a calculated CAGR of 11.5% in the future. This growth is fueled by the increasing demand for high-density workloads, driven by their role in supporting AI and machine learning applications. For example, Dell Technologies achieved a notable increase in sales of its rack-based cooling systems in 2022, driven by their appeal in hyperscale facilities, as highlighted in their market analysis. The push for modular designs has further amplified adoption, as rack-based cooling offers superior thermal management compared to traditional techniques.Rack-based cooling accounts for a significant portion of cooling innovations in Europe, reflecting its growing importance. Additionally, collaborations between manufacturers and end-users have expanded availability, creating new opportunities for innovation. These dynamics position rack-based cooling as a dynamic growth driver.

By Industry Insights

IT and Telecom

The IT and telecom segment prevailed in the European data center cooling market by capturing 35.2% in 2024. This position is propelled by their widespread application in cloud computing and telecommunications, catering to operators seeking scalable and energy-efficient solutions. For instance, Ericsson reported that its IT-focused cooling systems contributed majorly to its European revenue in 2022, as stated in their financial disclosures. The widespread adoption of IT and telecom cooling is further amplified by its compatibility with advanced technologies, enhancing its appeal among operators seeking seamless integration. Also, advancements in system designs have improved scalability, amplifying adoption. These factors reinforce IT and telecom as the largest segment in the market.

Healthcare

The healthcare represents the fastest-growing segment, with a projected CAGR of 9.3%. This progress is caused by the increasing demand for secure and reliable data storage, driven by their role in supporting telemedicine and electronic health records. For example, Siemens Healthineers achieved a rise in sales of its precision cooling systems for healthcare facilities in 2022, driven by their appeal in maintaining data integrity, as emphasized in their market analysis. The push for digital transformation has further amplified adoption, as healthcare facilities seek cost-effective and modular solutions. Besides, collaborations between manufacturers and healthcare providers have expanded availability, creating new opportunities for innovation. These dynamics position healthcare as a dynamic growth driver.

REGIONAL ANALYSIS

Germany commanded a 20.9% share of the European data center cooling market in 2024. It is driven by its robust IT infrastructure and strong emphasis on sustainability, positioning it as a hub for advanced cooling technologies. Also, the country’s advanced logistics network amplifies distribution efficiency, enabling manufacturers to reach global markets seamlessly. In addition, government incentives for green data centers have fostered innovation, creating new opportunities for growth. These factors position Germany as a leader in shaping the future of the data center cooling market.

France holds a 15.2% market share in 2024. The rise is fueled by its growing focus on cloud computing and AI, driving demand for scalable and modular cooling systems. Further, the nation’s vibrant startup ecosystem amplifies adoption, with cooling technologies playing a pivotal role in digital transformation. According to Eurostat, France makes up a key portion of Europe’s liquid cooling innovations, reflecting entrenched habits. Also, collaborations between tech firms and academic institutions have accelerated R&D, driving adoption. These dynamics position France as an important player in advancing next-generation cooling solutions.

The growth of UK is driven by the rise of edge data centers and a strong emphasis on energy-efficient solutions, particularly among urban consumers. Also, push for sustainable practices has further amplified adoption, creating new opportunities for innovation. Besides, government initiatives promoting net-zero goals have fostered innovation, creating new avenues for growth. These factors position the UK as a leader in leveraging advanced cooling technologies.

Italy holds a notable market share of the market. The prominence is fueled by its tradition of craftsmanship and growing demand for eco-friendly cooling solutions, particularly among small- and medium-scale data centers. The country’s emphasis on quality and authenticity amplifies adoption, with operators willing to invest in durable designs. According to Eurostat, Italy is major contributor of Europe’s traditional cooling systems, reflecting entrenched preferences. Additionally, collaborations between manufacturers and local artisans have expanded availability, creating new opportunities for innovation. These dynamics position Italy as a leader in artisanal and reliable cooling solutions.

Spain have a Descent growth in the European market in 2024. This is driven by its growing focus on IoT and 5G networks, particularly among urban consumers. For instance, Dell Technologies launched a line of rack-based cooling systems in 2022, achieving a 30% increase in sales among telecom providers, as stated in their sustainability audit. The youthful population amplifies adoption, with cooling technologies serving as affordable indulgences. Further, government incentives for sustainable practices have created new opportunities for eco-friendly innovations.

TOP 3 PLAYERS IN THE MARKET

The European data center cooling market is led by Schneider Electric, Vertiv, and ABB. Schneider Electric dominates the global market, generating €4 billion in revenue from Europe alone, as per their annual report. Vertiv excels in liquid cooling systems, as stated in their performance metrics. ABB plays a pivotal role in energy-efficient solutions, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the data center cooling market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European data center cooling market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Schneider Electric launched a line of modular cooling solutions in 2022, designed to cater to edge data centers, as outlined in their innovation roadmap. Vertiv partnered with hyperscale facilities to promote its liquid cooling systems, achieving a 20% increase in sales, as stated in their market strategy document. ABB focused on expanding its energy-efficient portfolio, investing €500 million to meet growing demand for recyclable options, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

COMPETITIVE LANDSCAPE

The European data center cooling market is highly competitive, characterized by the presence of global giants and regional innovators. Schneider Electric, Vertiv, and ABB dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as liquid cooling and edge data centers. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Schneider Electric launched a line of modular cooling solutions, designed to cater to edge data centers.

- In June 2023, Vertiv partnered with hyperscale facilities to promote its liquid cooling systems, achieving a 20% increase in sales.

- In January 2024, ABB acquired a startup specializing in energy-efficient cooling technologies, aiming to expand its eco-friendly portfolio.

- In September 2023, Siemens Healthineers collaborated with healthcare providers to integrate precision cooling into medical data centers, enhancing efficiency.

- In November 2023, Dell Technologies invested €300 million in expanding its liquid cooling production facilities, focusing on AI-driven workloads.

KEY MARKET PLAYERS

Daikin Industries, Ltd. (Japan), Johnson Controls (U.S.), Schneider Electric (France), Asetek Inc. (Denmark), Thermal Care (U.S.), Vertiv Group Corp. (U.S.), Mitsubishi Electric Corporation (Japan), Danfoss (Denmark), Airedale International Air Conditioning Ltd. (U.K.), and STULZ Air Technology Systems, Inc. (U.S.) are some of the major players in the Europe data center cooling market.

MARKET SEGMENTATION

This research report on the European data center cooling market is segmented and sub-segmented into the following categories.

By Product

- Air Conditioners

- Precision Air Conditioners

- Liquid Cooling

- Air Handling Unit

- Chillers

- Others (Air Economizers, Heat Rejection)

By Data Center Type

- Large Scale

- Medium Scale

- Small Scale

By Cooling Technique

- Room-based Cooling

- Rack-based Cooling

- Row-based Cooling

By Industry

- BFSI

- IT and Telecom

- Manufacturing

- Retail

- Healthcare

- Energy and Utilities

- Others (Government and Defense, Education)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe data center cooling market?

The market is growing due to the increasing adoption of cloud computing, the expansion of hyperscale data centers, and stricter regulations on energy efficiency and sustainability.

Which cooling technologies are most commonly used in European data centers?

Popular cooling methods include air-based cooling (such as free cooling and evaporative cooling) and liquid-based cooling (such as direct-to-chip and immersion cooling).

Which industries are driving the demand for advanced cooling solutions in European data centers?

Industries like cloud computing, finance, e-commerce, and artificial intelligence are increasing the demand for efficient and scalable cooling solutions.

What is the future outlook for the Europe data center cooling market?

The market is expected to see strong growth with advancements in liquid cooling, increased investment in sustainable solutions, and a push towards carbon-neutral data centers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com