Europe Cybersecurity Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware, Software, and Services), Security Type, Solutions, Services, Deployment, Organization Size, Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Cybersecurity Market Size

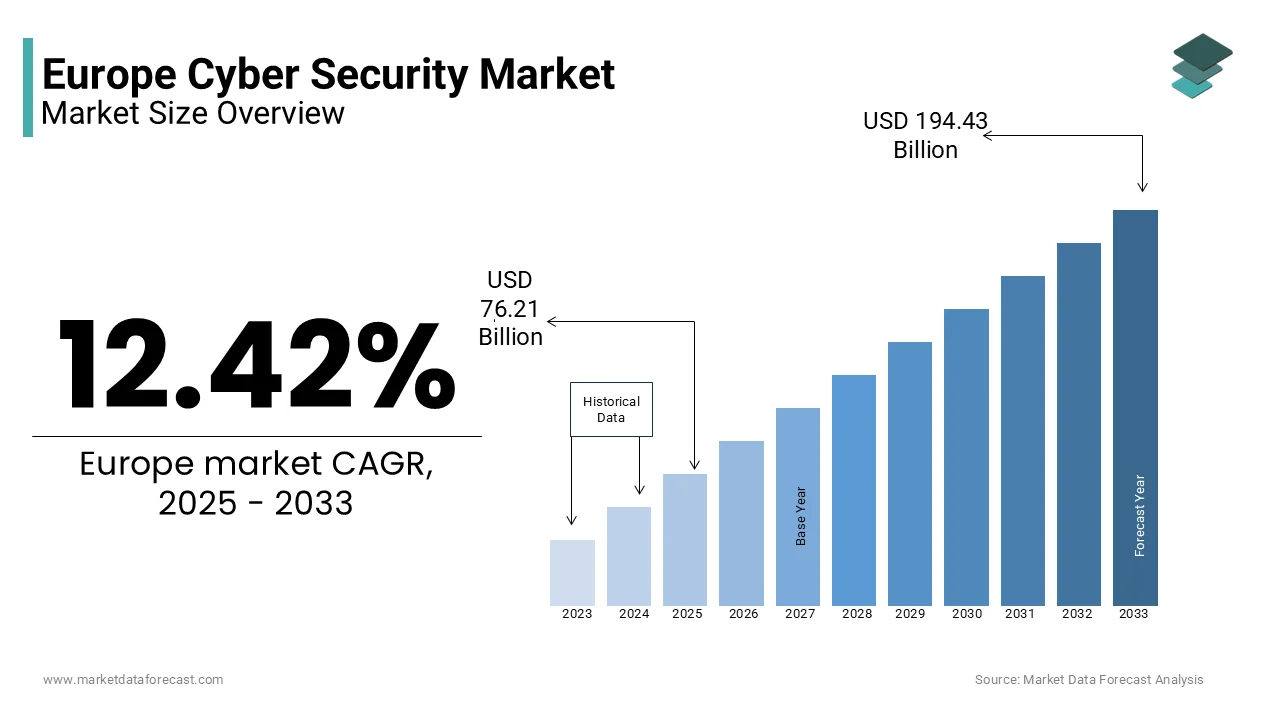

The size of the European cybersecurity market was worth USD 67.79 billion in 2024. The europe market is expected to be valued at USD 76.21 billion in 2025 and USD 194.43 billion by 2033, growing at a CAGR of 12.42% from 2025 to 2033.

The Europe cyber security market is witnessing unprecedented growth as organizations across the region grapple with escalating cyber threats and stringent regulatory requirements. This expansion is driven by the increasing sophistication of cyberattacks, which have surged by 40% over the past two years, as reported by the European Union Agency for Cybersecurity (ENISA).

Germany leads the regional market and is accounting for nearly 25% of Europe’s total cyber security revenue, due to its robust industrial base and proactive adoption of advanced security measures. The United Kingdom follows closely, leveraging its expertise in financial services and technology to combat rising cybercrime. As per Kaspersky Lab, ransomware attacks targeting European businesses increased by 60% in 2022, underscoring the urgent need for comprehensive security solutions. Additionally, the General Data Protection Regulation (GDPR) has compelled organizations to invest heavily in compliance-driven security frameworks further fueling market growth. These trends collectively position Europe as a critical hub for innovation and investment in cyber security.

MARKET DRIVERS

Escalating Cyber Threat Landscape

The increasing frequency and complexity of cyberattacks are among the most significant drivers propelling the Europe cyber security market forward. According to ENISA, the number of cyber incidents reported in Europe rose by 70% in 2022, with ransomware and phishing attacks being the most prevalent. For instance, the NHS in the UK faced a major ransomware attack that disrupted operations, brings to light the vulnerabilities in critical infrastructure. As per a report by Cybersecurity Ventures, cybercrime damages worldwide are expected to reach USD 10.5 trillion annually by 2025, with Europe accounting for a substantial share. This alarming trend has prompted governments and private entities to prioritize investments in advanced security solutions. For example, France allocated USD 1.5 billion under its national cyber strategy to enhance public and private sector resilience. Furthermore, industries like finance and healthcare, which are highly targeted, are adopting next-generation firewalls and endpoint protection systems to mitigate risks. These factors spotlights the pivotal role of the evolving threat landscape in driving demand for cyber security solutions.

Stringent Regulatory Frameworks

A critical driver is the implementation of stringent regulatory frameworks, such as GDPR which mandate robust data protection measures. In accordance with the European Commission, non-compliance with GDPR can result in fines of up to 4% of annual global turnover is compelling organizations to adopt comprehensive cyber security strategies. For instance, in 2021, Amazon was fined USD 887 million for GDPR violations, signaling the importance of compliance. The Network and Information Systems (NIS) Directive further amplifies this trend by requiring operators of essential services to implement rigorous security protocols. As per Deloitte, spending on compliance-driven security solutions in Europe grew by 30% in 2022, reflecting the impact of these regulations. Besides, countries like Germany and Sweden have introduced national laws aligning with EU directives, creating a unified yet demanding regulatory environment. These measures not only enhance security but also drive sustained growth in the cyber security market.

MARKET RESTRAINTS

High Implementation Costs

Among the primary restraints hindering the Europe cyber security market is the high cost associated with implementing advanced security solutions. According to Gartner, deploying a comprehensive cyber security framework for a mid-sized enterprise can cost between USD 500,000 and USD 1 million, depending on the scale and complexity. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs) which account for over 90% of businesses in Europe, as per Eurostat. For instance, a survey by the Federation of Small Businesses revealed that 60% of SMEs in the UK cited budget constraints as the main barrier to adopting robust cyber security measures. While larger organizations can absorb these costs, smaller entities often struggle to justify the investment, leaving them vulnerable to attacks. Apart from these, the recurring expenses associated with software updates, hardware maintenance, and employee training add to the financial strain is limiting the market’s accessibility.

Talent Shortage and Skill Gaps

A significant restraint is the acute shortage of skilled cyber security professionals. According to a study by ISC², Europe faces a shortfall of over 300,000 cyber security experts, with demand outpacing supply by 40%. This talent gap hampers organizations’ ability to effectively implement and manage security solutions, leading to operational inefficiencies. The European Cyber Security Organisation (ECSO) stresses that this shortage is exacerbated by the rapid evolution of cyber threats, which requires continuous upskilling. For example, in Germany, only 30% of IT professionals possess the expertise needed to address advanced persistent threats (APTs). Furtehr, the lack of standardized training programs across the region complicates efforts to bridge this gap.

MARKET OPPORTUNITIES

Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into cyber security solutions presents a transformative opportunity for the Europe market. The PwC through its study points out that AI-driven security tools are expected to reduce detection and response times by 50% is enabling organizations to counteract sophisticated threats more effectively. For instance, in 2022, the UK government invested USD 200 million in AI-based cyber defense initiatives are fostering innovation in this space. As per McKinsey & Company, AI-powered solutions can analyze vast datasets in real-time, identifying anomalies and predicting potential breaches with unparalleled accuracy. Companies like Darktrace and CrowdStrike are already leveraging AI to offer autonomous threat detection and response systems, gaining traction across industries. Moreover, the European Commission’s Horizon Europe program allocates USD 1 billion annually to support AI research, positioning Europe as a leader in this domain.

Expansion of Cloud Security Solutions

A promising opportunity lies in the growing adoption of cloud security solutions that is driven by the widespread migration to cloud-based infrastructures. For example, in France, companies like OVHcloud are collaborating with cyber security firms to develop tailored solutions for hybrid cloud environments. Also, As per IDC, the global cloud security sphere is projected to grow notably in the coming years, with Europe playing a pivotal role. The rise of multi-cloud and hybrid architectures has amplified the need for encryption, access control, and threat monitoring tools. Also, regulatory frameworks like GDPR mandate stringent data protection measures, further boosting demand. These developments underscore the lucrative prospects of cloud security in shaping the future of the Europe cyber security market.

MARKET CHALLENGES

Evolving Sophistication of Attack Vectors

One of the most pressing challenges facing the Europe cyber security market is the rapidly evolving sophistication of attack vectors, which outpaces the development of defensive measures. The ENISA found that attackers are increasingly leveraging AI and automation to execute highly targeted campaigns such as deepfake phishing and zero-day exploits. For instance, in 2022, a deepfake audio scam targeting a UK energy firm resulted in a loss of USD 243,000 is sheding light on the growing threat of synthetic content. As per Palo Alto Networks, the average time taken to detect and mitigate such attacks has increased by 30% over the past year, underscoring the challenge of staying ahead of adversaries. Moreover, the rise of ransomware-as-a-service (RaaS) platforms has democratized access to malicious tools, enabling even novice hackers to launch devastating attacks. These trends not only strain existing security frameworks but also necessitate continuous innovation, posing a significant challenge for market participants.

Fragmented Security Ecosystems

Another critical challenge is the fragmented nature of security ecosystems, which hinders seamless integration and collaboration. According to Accenture, over 60% of European organizations use multiple, incompatible security tools, leading to inefficiencies and gaps in protection. For example, in Germany, a survey by Bitkom revealed that 45% of companies struggle to unify their security operations due to disparate systems. The lack of interoperability complicates efforts to achieve end-to-end visibility and real-time threat intelligence sharing. As stated by the European Cyber Security Organisation (ECSO), this fragmentation is exacerbated by varying regulatory requirements across member states, which create additional layers of complexity. Furthermore, the absence of standardized protocols for information sharing limits the effectiveness of collaborative defense mechanisms.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.42% |

|

Segments Covered |

By Component, Security Type, Solutions, Services, Deployment, Organization Size, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Sophos Ltd., Darktrace Holdings Limited, F-Secure, STORMSHIELD, SHIELD AI Technologies Pte. Ltd., Bitdefender, Bridewell, SecurityHQ, Hacken.io, and InfoGuard AG. |

SEGMENTAL ANALYSIS

By Component Insights

The services segment secured the dominant position in the Europe cyber security market by capturing 58.3% of the total market share in 2024. This rise is supported by the increasing demand for managed security services (MSS) and professional consulting and particularly among SMEs struggling to build in-house capabilities. For instance, in the UK, over 70% of small businesses rely on third-party providers for threat detection and incident response, as per TechUK. Moreover, a key factor behind the segment’s dominance is the scalability and cost-effectiveness of outsourced solutions. The IDC reveals that managed security services reduce operational costs by 30% while enhancing threat visibility and response times. Also, the growing complexity of cyber threats has created a niche for specialized services, such as penetration testing and compliance audits.

The Software segment is the fastest-growing segment, with a projected CAGR of 14% from 2025 to 2033. This growth is fueled by the increasing adoption of advanced solutions like endpoint detection and response (EDR) and security information and event management (SIEM). For example, in France, companies like Thales are developing AI-driven software platforms to enhance real-time threat analysis capabilities. Interestingly, a significant driver of this segment’s rapid expansion is the shift toward remote work, which has amplified the need for robust software-based protections. According to Eurostat, over 40% of European employees worked remotely during the pandemic, creating new vulnerabilities. Furthermore, the integration of cloud-native architectures has spurred demand for scalable and flexible software solutions.

By Security Type Insights

The network security held the largest portion of the Europe cyber security market i.e. 33.6% of the total revenue in 2024. This dominance is propelled by the critical role network security plays in safeguarding data transmission and preventing unauthorized access. For instance, in Germany, over 80% of enterprises deploy firewalls and intrusion detection systems (IDS) to protect their networks. Further, a key factor behind the segment’s leadership is the proliferation of IoT devices, which expand the attack surface and necessitate robust network defenses. According to ENISA, the number of connected devices in Europe is expected to exceed 5 billion by 2025 is creating unprecedented demand for network security solutions. Besides these, the rise of 5G networks has accelerated investments in next-generation firewalls and secure SD-WAN technologies.

The cloud security segment is emerging as the quickest one to dvelop having a calculated CAGR of 16.6% in the future. This progress is fueled by the accelerating adoption of cloud computing and the need to protect sensitive data stored in cloud environments. For example, in Sweden, companies like Ericsson are partnering with cloud providers to develop encryption and access control solutions tailored for hybrid infrastructures. A significant driver of this segment’s rapid expansion is the increasing regulatory scrutiny of cloud-based data storage. In line with the GDPR guidelines, organizations must ensure adequate protection for personal data, driving demand for cloud security tools. Moreover, the rise of multi-cloud strategies has created a need for centralized security management platforms.

By Solutions Insights

The Unified Threat Management (UTM) commanded under this category of the Europe cyber security market by holding a market share of 28.1% in 2024. UTM solutions integrate multiple security functions like firewall, antivirus, and intrusion prevention into a single platform is making them ideal for SMEs seeking cost-effective and simplified security measures. For instance, in Italy, over 60% of small businesses use UTM solutions to streamline their security operations, as per ANITEC-Assinform. A notable aspect taking forward the segment is the growing complexity of cyber threats, which necessitates comprehensive protection. As per IDC, UTM solutions reduce operational overhead by 25% while enhancing threat visibility and response times. Furthermore, the rise of remote work has increased demand for scalable and flexible UTM platforms capable of securing distributed networks.

The Risk & Compliance Management segment is rising at the fastest rate and is expected to have a CAGR of 18.1% over the forecast period owing to the increasing emphasis on regulatory compliance and risk mitigation, particularly in highly regulated industries like finance and healthcare. For instance, in the Netherlands, banks are investing heavily in risk assessment tools to comply with the Digital Operational Resilience Act (DORA), as per the Dutch Banking Association. A significant point of this segment’s rapid expansion is the rising cost of non-compliance. According to PwC, penalties for regulatory violations in Europe have surged by 50% over the past two years, prompting organizations to adopt advanced risk management solutions. Furthermore, the integration of AI and predictive analytics has enhanced the accuracy and efficiency of risk assessments. These innovations underscore the transformative potential of risk & compliance management in addressing regulatory challenges.

By Services Insights

The managed services segment remained the category with highest portion in 2024 in the Europe cyber security market that is 63.4% of the total service revenue. It happened due to the growing demand for outsourced security operations, particularly among SMEs lacking the resources to build in-house capabilities. For instance, in Spain, above 70% of small businesses rely on managed security service providers (MSSPs) for threat detection and incident response, as per AMETIC. A key factor behind the segment’s dominance is the scalability and cost-effectiveness of managed services. Based on a study by Gartner, MSSPs reduce operational costs by 35% while enhancing threat visibility and response times. Beyond these, the increasing complexity of cyber threats has created a niche for specialized services, such as 24/7 monitoring and vulnerability assessments.

The market saw the professional services segment expanding swiftly in the market and is estimated possess a CAGR of 15.8% from 2025 to 2033. The development is backed by the rising demand for specialized consulting and implementation services and especially in industries undergoing digital transformation. For example, in Sweden, companies like Ericsson are partnering with professional service providers to develop tailored security frameworks for 5G networks. A big driver of this segment’s rapid expansion is the increasing complexity of security ecosystems, which necessitates expert guidance. According to Eurostat, over 50% of European organizations cite integration challenges as a barrier to effective security implementation, driving demand for professional services. Besides, the growing emphasis on compliance has spurred investments in risk assessments and audit services. These innovations highlight the immense potential of professional services to address emerging security challenges.

Top of Form

By Deployment Insights

The on-premises deployment segment gained the maximum share in this category of the Europe cyber security market i.e. 64.9% in 2024. The position of segment is backed by the enduring preference for localized control over sensitive data, particularly among large enterprises and government entities. For instance, in Germany, over 70% of federal agencies rely on on-premises solutions to comply with stringent data sovereignty laws, as per the German Federal Office for Information Security (BSI). A key factor behind the segment’s dominance is the growing emphasis on data privacy and regulatory compliance. As per GDPR guidelines, organizations are required to ensure that personal data remains within national borders, creating a strong demand for on-premises systems. Additionally, industries like healthcare and finance, which handle highly sensitive information, prefer on-premises solutions due to their enhanced security features. The Eurostat stresses that the number of cyberattacks targeting on-premises infrastructures decreased by 15% in 2022, underscoring their reliability.

The cloud-based deployment is the fastest-growing segment, with a projected CAGR of 14.2% owing to the increasing adoption of cloud computing and the need for scalable, cost-effective security solutions. For example, in France, companies like OVHcloud are collaborating with cyber security firms to develop cloud-native tools tailored for hybrid environments. A notable driver of this segment’s rapid expansion is the rise of remote work, which has amplified the need for flexible and accessible security frameworks. According to Eurostat, over 40% of European employees worked remotely during the pandemic, creating new vulnerabilities. Moreover, the integration of AI and machine learning into cloud-based platforms has enhanced their ability to detect and mitigate threats in real-time.

By Organization Size Insights

The large enterprises dominated the Europe cyber security market by capturing 65% of the total revenue in 2022, according to IDC. The prominence is influenced by their extensive digital ecosystems and higher vulnerability to sophisticated cyber threats. For instance, in the UK, financial institutions spend an average of USD 1.5 million annually on cyber security, as per TechUK, reflecting their proactive approach to risk management. A major factor behind the segment’s dominance is the increasing regulatory scrutiny faced by large enterprises. According to PwC, penalties for non-compliance with GDPR have surged by 50% over the past two years, prompting organizations to invest heavily in advanced security measures. Additionally, the complexity of managing multi-cloud and hybrid architectures has created a niche for specialized solutions, further driving demand. These attributes ensure that large enterprises remain the primary drivers of the Europe cyber security market.

The SMEs are the fastest-growing segment, with a projected CAGR of 16.9% in the years. This growth is fueled by the rising awareness of cyber risks and the availability of cost-effective security solutions tailored for smaller organizations. For example, in Spain, over 60% of SMEs now use managed security services to protect their networks, as per AMETIC. A major factor of this segment’s rapid expansion is the increasing frequency of attacks targeting SMEs. As indicated by ENISA, cyberattacks on small businesses rose by 40% in 2022 sheds light on their vulnerability. Furthermore, government initiatives, such as subsidies and training programs, have encouraged SMEs to adopt cyber security measures.

REGIONAL ANALYSIS

Germany was at the forefront of the Europe cyber security market by commanding a market share of 25.7% in 2024. The established industrial base and proactive adoption of advanced security measures by the country have positioned it as a leader in the region. For instance, the German government allocated USD 2 billion under its national cyber strategy to enhance public and private sector resilience against cyber threats. A key factor driving Germany’s dominance is its focus on innovation and R&D. According to the Fraunhofer Institute, Germany accounts for over 30% of all cyber security patents filed in Europe, reflecting its commitment to technological advancement. Additionally, industries like automotive and manufacturing, which are highly targeted, are investing heavily in next-generation firewalls and endpoint protection systems.

The United Kingdom is witnessing major progress in this market. The country’s expertise in financial services and technology has propelled its growth in the cyber security sector. For instance, the UK government launched the National Cyber Strategy 2022, allocating USD 1.5 billion to foster innovation and collaboration. A significant driver of the UK’s success is its emphasis on regulatory harmonization. As stated by the European Commission, the UK played a key role in developing the EU’s cyber security framework, ensuring a unified approach across member states. Also, London’s position as a global financial hub has spurred investments in fintech security solutions, further boosting the market.

TOP 3 PLAYERS IN THE MARKET

The Europe cyber security market is led by three key players: Palo Alto Networks, Check Point Software Technologies, and Kaspersky Lab, each contributing significantly to the global market. Palo Alto Networks, headquartered in the United States, holds a substantial presence in Europe, offering a wide range of next-generation firewalls and cloud security solutions. According to Gartner, Palo Alto Networks’ products are used by over 50% of Fortune 500 companies operating in Europe, underscoring its leadership. Check Point Software Technologies, based in Israel, specializes in threat prevention and network security, with a growing footprint in Europe’s defense and financial sectors. As per IDC, Check Point’s solutions are deployed by over 40% of European banks are reflecting its global influence. Meanwhile, Kaspersky Lab, a Russian company, is renowned for its antivirus and endpoint protection solutions, widely adopted by SMEs across Europe.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe cyber security market employ diverse strategies to strengthen their positions. One prominent strategy is strategic partnerships. For instance, in March 2023, Palo Alto Networks partnered with Deutsche Telekom to develop AI-driven security solutions for 5G networks, aiming to capitalize on the growing demand for secure telecom infrastructures.

Another strategy is product diversification. In June 2023, Check Point Software Technologies launched Quantum IoT Protect, a solution designed to secure Internet of Things (IoT) devices. This move aligns with the company’s goal of expanding its footprint in the IoT security sector.

Additionally, as per the European Investment Bank, Kaspersky Lab has invested heavily in R&D, focusing on quantum-resistant encryption to address future security challenges. These strategies reflect a commitment to innovation and market leadership.

COMPETITIVE LANDSCAPE

The Europe cyber security market is characterized by intense competition, with established players and emerging startups vying for market share. Key players like Palo Alto Networks and Check Point dominate the enterprise segment, while Kaspersky Lab leads in the consumer space.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, Darktrace and CrowdStrike are pioneering AI-driven solutions, challenging incumbents in the threat detection and response sectors. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and talent shortages remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Palo Alto Networks acquired a French AI startup specializing in predictive analytics. This acquisition aimed to integrate advanced threat intelligence into its product portfolio.

- In May 2024, Check Point Software Technologies launched Quantum CloudGuard, a solution designed to secure multi-cloud environments. This initiative aimed to address the growing demand for cloud-native security tools.

- In July 2024, Kaspersky Lab signed a partnership agreement with a Swedish IoT manufacturer to develop embedded security solutions. This collaboration aimed to enhance the security of connected devices in Europe.

- In September 2024, Darktrace introduced its Autonomous Response 2.0 platform, leveraging AI to automate threat mitigation processes. This move aimed to strengthen its position in the enterprise security market.

- In November 2024, CrowdStrike secured USD 500 million in funding from the European Investment Bank. This investment aimed to accelerate the development of its cloud-based endpoint protection solutions.

KEY MARKET PLAYERS

The major players in the Europe cyber security market include Sophos Ltd., Darktrace Holdings Limited, F-Secure, STORMSHIELD, SHIELD AI Technologies Pte. Ltd., Bitdefender, Bridewell, SecurityHQ, Hacken.io, and InfoGuard AG.

MARKET SEGMENTATION

This research report on the Europe Cyber Security market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Infrastructure Protection

- Data Security

- Others (Wireless Security, Web & Content Security)

By Solutions

- Unified Threat Management (UTM)

- IDS/IPS

- DLP

- IAM

- SIEM

- DDoS

- Risk & Compliance Management

- Others (Firewall, Antimalware, Antivirus)

By Services

- Professional Services

- Risk and Threat Assessment

- Design, Consulting, and Implementation

- Training & Education

- Support & Maintenance

- Managed Services

By Deployment

- Cloud-based

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- IT & Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others (Education, Media & Entertainment)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which European country has the largest cybersecurity market?

The United Kingdom currently has the largest cybersecurity market in Europe, driven by high investment in cybersecurity infrastructure and stringent regulatory requirements.

How is the GDPR influencing the cybersecurity market in Europe?

The General Data Protection Regulation (GDPR) has significantly influenced the cybersecurity market in Europe by imposing strict data protection requirements, which have increased the demand for advanced cybersecurity solutions to ensure compliance.

What are the major challenges faced by the cybersecurity market in France?

The major challenges in the French cybersecurity market include a shortage of skilled cybersecurity professionals, high costs of advanced cybersecurity solutions, and the rapidly evolving nature of cyber threats.

Are there any government initiatives in Eastern Europe to boost cybersecurity?

Yes, several Eastern European countries, such as Poland and the Czech Republic, have launched government initiatives to boost cybersecurity. These include national cybersecurity strategies, investment in cybersecurity education, and collaboration with international cybersecurity organizations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]