Europe Current Sensor Market Research Report - Segmented By Type (Open Loop , Close Loop ) Technology ( Hall Effect , Current Transformer ) Output Type ( Analog , Digital ) End User ( Industrial , Automotive ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts (2025 to 2033)

Europe Current Sensor Market Size

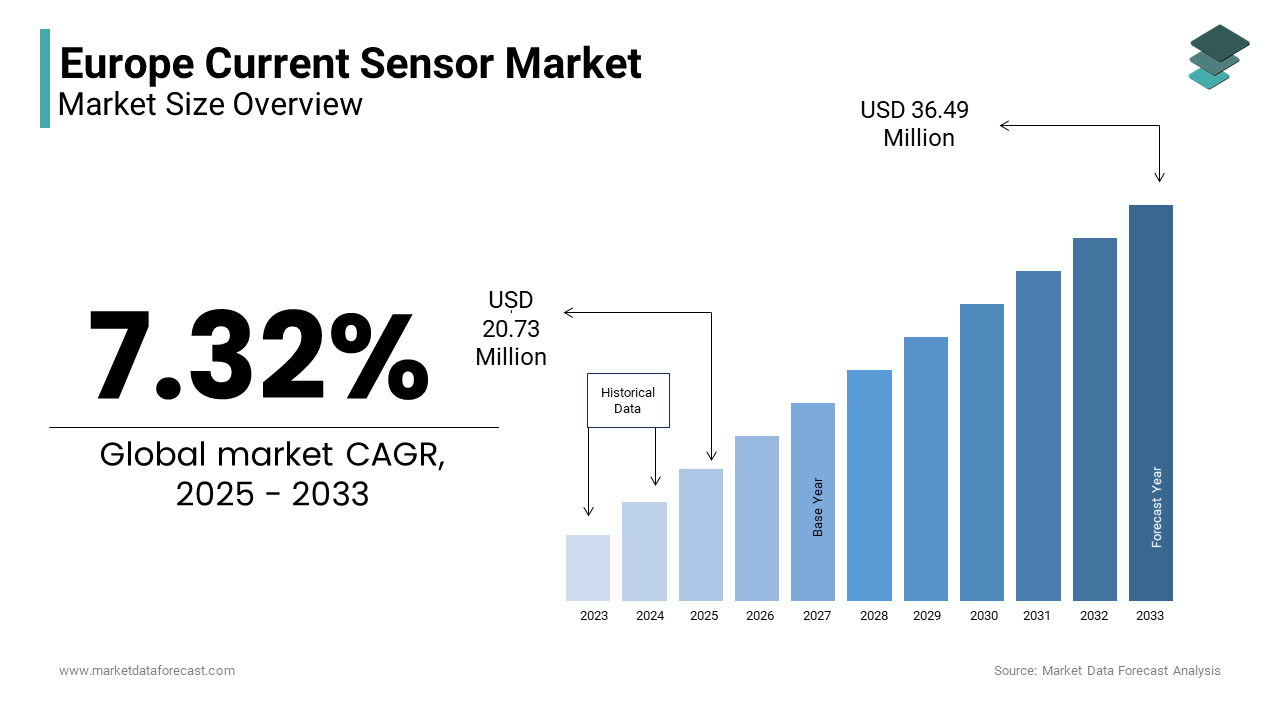

The europe current sensor market Size was valued at USD 19.32 million in 2024. The europe current sensor market size is expected to have 7.32 % CAGR from 2025 to 2033 and be worth USD 36.49 million by 2033 from USD 20.73 million in 2025.

Current sensors are devices designed to detect electric current in a circuit and convert it into a measurable output, enabling efficient power management, fault detection, and system optimization. These sensors are integral to industries such as automotive, industrial automation, renewable energy, consumer electronics, and healthcare, where accurate current monitoring is essential for safety, performance, and energy efficiency.

The growing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has been a significant driver of this market, with the European Automobile Manufacturers' Association (ACEA) reporting that EV sales in Europe increased by 45% in 2022 alone. Additionally, the European Commission’s Green Deal initiatives have spurred investments in renewable energy systems where current sensors play a pivotal role in optimizing solar inverters and wind turbines. According to the International Energy Agency (IEA), Europe accounts for over 30% of global renewable energy capacity, further boosting demand for advanced sensing technologies. Furthermore, advancements in IoT-enabled devices and smart grid infrastructure have expanded the use of current sensors in smart homes and industrial automation. Europe’s focus on sustainability, digitalization, and innovation means the current sensor market is poised for robust growth and is offering immense opportunities for manufacturers and stakeholders in the coming years.

MARKET DRIVERS

Increasing Adoption of Electric Vehicles

The rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is one of the major drivers for the European current sensor market. It is fueled by stringent emission regulations and sustainability goals. The European Automobile Manufacturers' Association (ACEA) reports that EV sales in Europe surged by 45% in 2022 and is accounting for over 20% of total vehicle sales. Current sensors are critical components in EV powertrains, enabling precise monitoring of battery currents, motor control, and energy management systems. As per the International Energy Agency (IEA), Europe represents 30% of the global EV market, with governments investing heavily in charging infrastructure and incentives. For instance, Germany alone allocated €6 billion in subsidies for EV adoption in 2023. This trend has significantly increased demand for high-precision current sensors, as they ensure efficiency, safety, and compliance with EU emission targets under the European Green Deal.

Growth in Renewable Energy Systems

The expansion of renewable energy systems which is supported by Europe’s commitment to achieving carbon neutrality by 2050 is among the key propellents for the European current sensor market. The European Commission states that renewable energy accounts for over 40% of electricity generation in the EU, with solar and wind capacities growing by 15% annually. Current sensors play a vital role in optimizing renewable energy systems such as solar inverters and wind turbines by ensuring accurate current measurement and fault detection. The International Renewable Energy Agency (IRENA) notes that Europe leads globally in offshore wind installations, with over 25 GW added in 2022. Additionally, investments in smart grids and energy storage systems have surged, with the European Investment Bank funding €10 billion in green energy projects annually. These advancements underscore the critical role of current sensors in enhancing energy efficiency and supporting Europe’s transition to sustainable power solutions.

MARKET RESTRAINTS

High Costs of Advanced Sensor Technologies

High cost associated with advanced sensor technologies limits their adoption among small and medium-sized enterprises (SMEs) is a significant restraint for the European current sensor market. The European Semiconductor Industry Association (ESIA) found that premium current sensors and particularly those used in industrial automation and electric vehicles, can cost up to €50–€200 per unit, depending on specifications. These costs are prohibitive for SMEs operating on tight budgets and especially in price-sensitive industries like consumer electronics. Additionally, the International Energy Agency (IEA) notes that the integration of IoT-enabled smart sensors requires substantial upfront investments in infrastructure which is further increasing barriers to entry. Larger corporations can absorb these costs, but smaller players face challenges in scaling operations. This financial burden slows down the widespread adoption of cutting-edge current sensors, despite their long-term benefits.

Stringent Regulatory Standards and Compliance Challenges

Complexity of adhering to stringent regulatory standards is another major issue for the European current sensor market. It poses challenges for manufacturers and users of current sensors. The European Commission emphasizes that compliance with directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) adds layers of complexity to production processes. Non-compliance can result in penalties exceeding €1 million, as reported by the European Environmental Bureau. Furthermore, the rapid evolution of industry standards for energy efficiency and safety creates uncertainty for manufacturers, requiring frequent updates to product designs. The ESIA notes that over 30% of companies face delays in product launches due to certification processes. These regulatory hurdles increase operational costs and slow innovation, hindering the market’s growth potential.

MARKET OPPORTUNITIES

Expansion in Smart Grid and IoT Applications

The rapid expansion of smart grid and Internet of Things (IoT) applications provides a potential opportunity for the growth of the European current sensor market. It is driven by Europe’s focus on digitalization and energy efficiency. The European Commission revealed that investments in smart grid technologies have exceeded €10 billion annually with over 200 million smart meters deployed across the EU by 2023. Current sensors are integral to these systems, enabling real-time monitoring, fault detection, and load management. The International Energy Agency (IEA) reports that smart grids can reduce energy losses by up to 15% and is creating a strong demand for advanced sensors. Additionally, the European Semiconductor Industry Association (ESIA) states that IoT-enabled devices are expected to grow at a CAGR of 12% through 2030, further boosting sensor adoption. This convergence of smart infrastructure and IoT presents a lucrative opportunity for manufacturers to innovate and capture emerging market segments.

Rising Demand in Industrial Automation

Another notable prospect is the increasing demand for current sensors in industrial automation which is fuelled by Europe’s push toward Industry 4.0 and smart manufacturing. The European Association of Electrical Contractors reports that the industrial automation sector is projected to grow by 8.5% annually, with Germany, France, and Italy leading investments in automated systems. Current sensors play a critical role in motor control, robotics, and predictive maintenance which is ensuring operational efficiency and reducing downtime by up to 30%. The European Investment Bank notes that over €20 billion has been allocated to digital transformation projects in manufacturing since 2022. Furthermore, the International Federation of Robotics said that Europe accounts for 25% of global industrial robot installations and driving demand for precise and reliable sensing solutions. This trend positions current sensors as essential components in the evolution of smart factories across the region.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and the scarcity of critical raw materials, which have been exacerbated by geopolitical tensions and global trade uncertainties are among the prime challenges for the Europe current sensor market. The European Commission reports that over 80% of rare earth metals, essential for manufacturing advanced sensors, are imported from outside the EU which is making the market vulnerable to supply shocks. According to the European Semiconductor Industry Association (ESIA), lead times for semiconductor components, integral to current sensors, have increased by 50% since 2021, driving up production costs. Additionally, the International Energy Agency (IEA) notes that material shortages could reduce manufacturing capacity by up to 20% in high-demand sectors like automotive and renewable energy. These disruptions hinder timely product delivery and increase operational risks for manufacturers.

Intense Competition from Low-Cost Imports

Another crucial problem is the intense competition posed by low-cost imports from Asia which decreases the competitiveness of European manufacturers. The European Commission states that imports of inexpensive sensors from countries like China account for nearly 40% of the European market, pressuring domestic players to lower prices or risk losing market share. The ESIA emphasizes that European manufacturers face a cost disadvantage of approximately 25% compared to their Asian counterparts due to higher labour and compliance costs. Furthermore, the European Environmental Bureau notes that many imported sensors do not meet stringent EU standards and is creating unfair competition. These imports cater to budget-conscious buyers, but they stifle innovation and profitability for local companies striving to maintain quality and adhere to regulatory requirements, posing a long-term threat to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.32% |

|

Segments Covered |

By Type, Technology, Output Type, End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Melexis N.V. (Xtrion N.V.),Allegro Microsystems, Inc. (Sanken Electric Co., Ltd.),LEM International S.A. |

SEGMENT ANALYSIS

By Type Insights

The "Open Loop" segment dominated the European current sensor market and held a 60.8% share in 2024 due to its cost-effectiveness, with prices up to 30% lower than closed-loop sensors and is making it ideal for budget-sensitive applications like consumer electronics and IoT devices. As per the International Electrotechnical Commission (IEC), open-loop sensors are widely adopted due to their compact design and low power consumption which align with Europe’s focus on energy-efficient technologies. These are less accurate than closed-loop variants, but their simplicity and reliability ensure widespread use in non-critical systems, solidifying their importance in driving affordability and accessibility in the current sensor market.

On the other hand, the "Closed Loop" segment is anticipated to witness the fastest CAGR of 9.5% due to its superior accuracy and immunity to noise and is making it essential for high-precision applications like EVs and renewable energy systems. The European Automobile Manufacturers' Association (ACEA) reports that over 70% of EV powertrains rely on closed-loop sensors for real-time feedback and motor control. Despite higher costs, their ability to meet stringent regulatory standards ensures rising demand. This segment’s importance lies in supporting Europe’s sustainability goals, particularly in advancing smart grids, industrial automation, and clean energy solutions, positioning it as a key driver of innovation in the market.

By Technology Insights

The "Hall Effect" technology led the European current sensor market and accounted for 55.5% share because of its versatility and cost-effectiveness, with prices ranging from €10 to €50 and is making it accessible for applications like EVs, renewable energy, and consumer electronics. The International Electrotechnical Commission (IEC) stated that Hall Effect sensors measure both AC and DC currents which is ensuring widespread adoption. Their compact size and low power consumption align with Europe’s sustainability goals, driving demand in IoT and industrial automation. This segment’s importance lies in enabling affordable, precise current measurement while supporting the transition to energy-efficient technologies.

However, the "Flux Gate" technology is estimated to register the fastest CAGR of 10.2% owing to its unmatched accuracy and reliability, critical for high-precision industries like aerospace, defense, and medical equipment. The European Space Agency (ESA) notes its use in satellite systems where minimal error margins are essential. Despite higher costs exceeding €100 per unit, advancements in miniaturization have reduced barriers to adoption. The IEC reports increasing demand for Flux Gate sensors in harsh environments, ensuring safety and efficiency. Its importance lies in addressing niche but vital applications, positioning it as a key enabler of innovation in advanced systems.

By Output Type Insights

The "Analog" output type commanded the European current sensor market and held a 60.8% share due to its compatibility with legacy systems and cost-effectiveness, with prices ranging from €15–€40 per unit. The International Electrotechnical Commission (IEC) reported that analog sensors provide continuous signal outputs, making them ideal for real-time monitoring in industries like automotive and manufacturing. Their simplicity and reliability ensure widespread adoption, particularly in regions with older infrastructure. Despite the rise of digital technologies, analog sensors remain vital for operational efficiency in traditional systems, supporting Europe’s industrial base while offering an affordable solution for budget-sensitive applications.

The "Digital" output type is predicted to witness the highest CAGR of 11.5%. This growth is fueled by the increasing adoption of IoT-enabled devices and smart grid technologies. The European Commission notes that digital sensors enable real-time data analytics and remote monitoring, aligning with Europe’s sustainability goals. Priced at €30 to €100 per unit, they integrate seamlessly with advanced communication protocols like CAN and Modbus. The IEC emphasizes their role in reducing system complexity and enhancing scalability. Their importance lies in driving innovation and supporting Europe’s transition to digitalized, energy-efficient infrastructure, making them indispensable for modern applications like smart manufacturing and renewable energy systems.

By End User Insights

The "Industrial" segment led the European current sensor market and accounted for a 35.8% share in 2024 due to the adoption of automation and Industry 4.0 technologies with the International Energy Agency (IEA) reporting that industrial applications reduce energy losses by up to 15%. The European Investment Bank stated €20 billion in investments for industrial digitalization since 2022, boosting demand. Current sensors are critical for motor control, robotics, and predictive maintenance, ensuring operational efficiency. Their ability to optimize energy use and enhance productivity makes them indispensable in modernizing Europe’s industrial base, supporting sustainability and competitiveness.

The "Automotive" segment is the fastest-growing, with a CAGR of 12.3%, according to the ESIA. This growth is fueled by the surge in electric vehicle (EV) adoption with EV sales rising 45% in 2022, as reported by the European Automobile Manufacturers' Association (ACEA). Current sensors are vital for battery management and motor control, ensuring safety and efficiency. The IEA notes Europe accounts for 30% of the global EV market, driving innovation. Their importance lies in enabling precise current measurement, supporting Europe’s transition to sustainable mobility while meeting regulatory emission targets under the European Green Deal.

Country Level Analysis

Germany dominated the European current sensor market and held a 25.4% share in 2024. This is due to robust industrial base, with over 30% of Europe’s automation systems manufactured in Germany. According to the International Energy Agency (IEA), Germany’s focus on Industry 4.0 and smart manufacturing drives demand for advanced sensors in robotics and predictive maintenance. Additionally, Germany is a global leader in automotive innovation, accounting for 20% of Europe’s EV production, as per the European Automobile Manufacturers' Association (ACEA). Government initiatives supporting renewable energy and digitalization further boost adoption. These factors solidify Germany’s position as a hub for cutting-edge applications and is ensuring sustained growth in the current sensor market.

France contributed notably to the European current sensor market with a CAGR of 9.2. This growth is fueled by significant investments in renewable energy and smart grid infrastructure, with France aiming to generate 40% of its electricity from renewables by 2030. The International Renewable Energy Agency (IRENA) notes that France leads Europe in offshore wind projects and is driving demand for precise current measurement in solar inverters and wind turbines. Furthermore, the French government has allocated €30 billion to digital transformation initiatives which is enhancing IoT-enabled applications. Current sensors play a critical role in optimizing energy efficiency and enabling smart technologies, positioning France as a key player in advancing sustainable energy solutions.

The United Kingdom holds the third position owing to its strong automotive sector which accounts for 15% of Europe’s EV production is supported by £2 billion in government funding for EV infrastructure. The European Semiconductor Industry Association (ESIA) emphasizes that IoT adoption in consumer electronics and smart homes also fuels demand for compact, energy-efficient sensors. Additionally, the UK’s focus on reducing carbon emissions aligns with the European Green Deal, encouraging innovations in energy management systems. These factors make the UK a pivotal market for current sensors, balancing sustainability and technological advancement across industries.

KEY MARKET PLAYERS

Key players operating in the Europe Current Sensor Market profiled in this report are Melexis N.V. (Xtrion N.V.),Allegro Microsystems, Inc. (Sanken Electric Co., Ltd.),LEM International S.A.,Honeywell International, Inc.,TDK Corporation,Texas Instruments, Inc.Infineon Technologies AG,Asahi Kasei Corporation

MARKET SEGMENTATION

This research report on the Europe Current Sensor Market has been segmented and sub-segmented into the following categories.

By Type

- Open Loop

- Close Loop

By Technology

- Hall Effect

- Current Transformer

- Flux Gate

- Others

By Output Type

- Analog

- Digital

By End User

- Industrial

- Automotive

- Consumer Electronics

- Telecommunication

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What factors are driving the growth of the Europe current sensor market ?

Key drivers include the increasing adoption of electric vehicles, advancements in industrial automation, and stringent energy efficiency regulations.

Which countries in Europe are leading the current sensor market?

Germany, France, and the United Kingdom are prominent markets due to their strong automotive industries and focus on renewable energy.

What are the primary applications of current sensors in Europe?

Current sensors are primarily used in automotive applications, industrial automation, energy management, and consumer electronics.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]