Europe Crane Market Size, Share, Trends & Growth Forecast Report By Product Type (Mobile Cranes, Marine and Port Cranes, Fixed Cranes), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Crane Market Size

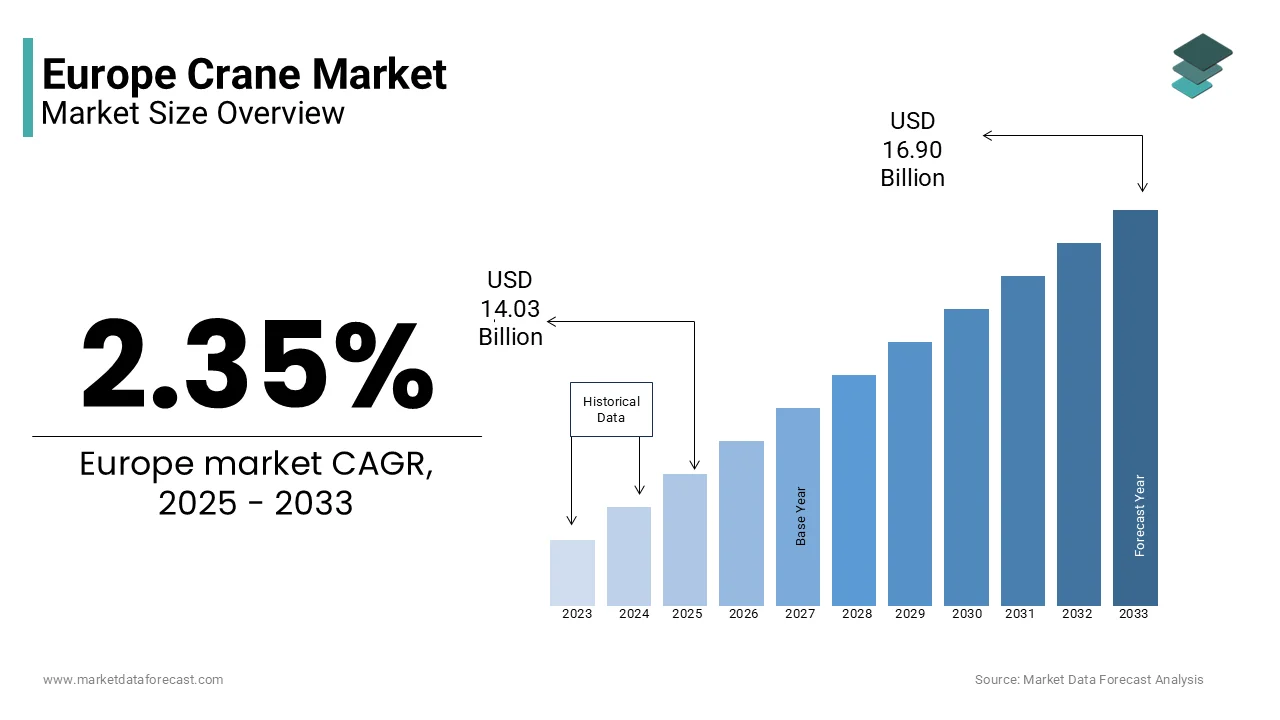

The Europe Crane market size was valued at USD 13.71 billion in 2024. The European market is estimated to be worth USD 16.90 billion by 2033 from USD 14.03 billion in 2025, growing at a CAGR of 2.35% from 2025 to 2033.

The Europe crane market is a dynamic sector, driven by robust demand from construction, infrastructure, and industrial applications. The European Union’s focus on sustainable infrastructure development and renewable energy projects has created a favorable environment for crane adoption. As per Eurostat, construction activity in Europe grew by 4.5% in 2022 with the need for advanced lifting solutions. Additionally, investments in port modernization and urbanization have bolstered the demand for specialized cranes by ensuring steady market growth.

MARKET DRIVERS

Infrastructure Development Initiatives

Infrastructure development initiatives are a primary driver of the Europe crane market with the EU’s commitment to green and sustainable projects. According to the European Investment Bank, over €750 billion has been allocated under the EU Green Deal for infrastructure projects renewable energy installations and smart city developments. These initiatives require advanced lifting solutions, such as mobile and fixed cranes, to handle heavy machinery and materials. Additionally, government-led urbanization programs, particularly in Eastern Europe that have amplified the need for cranes in residential and commercial projects that is propelling market expansion.

Expansion of Renewable Energy Projects

The expansion of renewable energy projects significantly propels the Europe crane market in wind and solar energy sectors. According to the International Renewable Energy Agency (IRENA), Europe added over 17 GW of wind capacity in 2022 by requiring specialized cranes for turbine installation and maintenance. Fixed cranes and crawler cranes are widely used in these projects due to their high load-bearing capacity and precision. Public-private partnerships further accelerate innovation, thereby ensuring sustained market growth.

MARKET RESTRAINTS

High Operational Costs

The high operational costs pose a significant challenge to the Europe crane market for small and medium enterprises (SMEs). The average cost of operating a large mobile crane exceeds €500 per hour is deterring smaller players from adopting advanced models. Maintenance, fuel, and skilled labor expenses further escalate costs that is limiting accessibility. While larger corporations can absorb these expenses, SMEs often struggle to secure financing or navigate complex procurement processes. This financial barrier restricts market diversity and innovation is hindering its full potential.

Stringent Emission Regulations

The stringent emission regulations impact the adoption of traditional diesel-powered cranes by creating challenges for manufacturers and operators. According to the European Environment Agency, non-compliance with Stage V emission standards results in penalties and operational restrictions, forcing companies to invest in cleaner technologies. Transitioning to electric or hybrid cranes requires significant capital investment and technological upgrades, which many firms find prohibitive. While advancements in eco-friendly models address environmental concerns that their limited availability and higher costs create barriers to widespread adoption.

MARKET OPPORTUNITIES

Adoption of Electric and Hybrid Cranes

The adoption of electric and hybrid cranes represents a transformative opportunity for the Europe crane market, driven by the region’s commitment to decarbonization. Governments across the region offer subsidies and tax incentives for eco-friendly equipment by encouraging businesses to transition. For instance, Sweden’s carbon tax policy has driven significant investments in electric cranes that is amplifying their contribution to sustainable construction practices. Innovations in battery technology and energy efficiency ensure higher performance by positioning electric cranes as a cornerstone of future growth.

Expansion into Emerging Markets

Expanding crane operations into emerging markets within Eastern Europe unlocks new opportunities for the Europe crane market. According to Eurostat, countries like Poland and Romania are experiencing rapid urbanization, with construction activity growing by over 10% annually. Investments in infrastructure and industrial projects create a robust demand for mobile and fixed cranes. Partnerships with local contractors and governments streamline distribution by ensuring equitable access. Additionally, advancements in compact crane designs cater to space-constrained urban environments, enhancing usability and adoption rates.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions hinder the timely availability of crane components and spare parts that is by impacting operational efficiency. According to a study by the European Federation of Engineering Industries, logistical challenges such as port congestion and transportation delays account for over 30% of project delays annually. The COVID-19 pandemic exacerbated these issues are gearing up vulnerabilities in global supply networks. Additionally, geopolitical tensions and trade restrictions further complicate procurement processes, affecting market stability. Harmonizing supply chain frameworks across member states is essential to ensure seamless operations and prevent shortages during critical periods.

Skilled Labor Shortages

Skilled labor shortages pose a significant challenge to the Europe crane market in operational efficiency and safety. According to the European Construction Industry Federation, over 40% of construction firms report difficulties in hiring qualified crane operators and technicians. The complexity of modern cranes is coupled with stringent safety regulations that requires specialized training, which remains inconsistent across regions. While vocational programs and certifications aim to address this issue, their reach remains limited. Addressing this challenge requires increased investment in workforce development and digital tools to enhance training accessibility.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.35% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Liebherr Group GmbH, Konecranes Plc, Terex Corporation, Fassi Gru S.p.A., The Manitowoc Company Inc., Gorbel Inc., Buckner Heavylift Cranes LLC, Palfinger AG, Tadano Ltd., Broderson Manufacturing Corp, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The mobile cranes segment dominated the Europe crane market with an estimated share of 45.3% in 2024. Their widespread adoption is driven by their versatility and mobility by making them ideal for diverse applications such as construction, mining, and infrastructure projects. According to Eurostat, over 60% of large-scale construction projects in Europe utilize mobile cranes that is reflecting robust demand. Advances in telescopic boom technology and load-sensing systems have enhanced performance by attracting significant investment. Additionally, government mandates for efficient material handling in urban areas have bolstered adoption that will ensure market’s growth.

The marine and port cranes segment is gaining huge traction over the growth rate with an anticipated CAGR of 6.8% during the forecast period. Increasing investments in port modernization and maritime trade is likely to fuel the growth of the market. Innovations in automation and remote operation have expanded their application scope is ensuring higher efficiency and safety. The affordability and scalability of marine cranes make them an attractive option for large-scale logistics operations, propelling rapid adoption.

By Application Insights

The construction and infrastructure segment was accounted in holding 50.1% of the Europe crane market share in 2024. Their dominance is attributed to the region’s focus on sustainable urbanization and renewable energy projects. According to the European Construction Industry Federation, over €500 billion was invested in construction projects in 2022. The rise of modular construction techniques has further amplified the need for advanced lifting solutions with clinical trials is showing promising results. Additionally, collaborations between contractors and crane manufacturers have accelerated product development.

The mining segment is augmented in witnessing a fastest CAGR of 7.2% in the next coming years. Its growth is driven by increasing mineral extraction activities and investments in automation. Europe’s mining sector is undergoing a digital transformation that requires specialized cranes for material handling and equipment maintenance. The affordability and precision of crawler cranes make them an attractive option for large-scale operations by ensuring exponential growth.

REGIONAL ANALYSIS

Germany led the Europe crane market with a dominant share of 25.4% in 2024 owing to the robust industrial activity and proactive investments in renewable energy projects. According to the German Mechanical Engineering Industry Association, over 30% of wind turbine installations in Europe occur in Germany is driving demand for fixed and crawler cranes. Government incentives for green infrastructure further amplify adoption that is ensuring steady growth.

The UK crane market is esteemed to grow lucratively with an anticipated CAGR of 10.2% during the forecast period. The country’s focus on sustainable construction and urbanization drives adoption. According to the UK Construction Products Association, crane usage in residential projects grew by 15% in 2022. Innovations in compact crane designs cater to space-constrained urban environments that is by boosting adoption rates.

France crane market growth is supported by large-scale infrastructure projects and port modernization initiatives. According to Bpifrance, investments in renewable energy and logistics amplify demand for specialized cranes is prompting the market growth in next coming years.

Italy contributes 12% to the market, leveraging its expertise in modular construction and industrial applications. According to Assobiotec, Italian contractors prioritize advanced lifting solutions, fostering innovation and adoption.

Spain accounts for 10% of the market, driven by urbanization and renewable energy projects. According to Red Española de Energía, over 5 GW of wind capacity was added in 2022, creating a robust demand for cranes.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Liebherr Group GmbH, Konecranes Plc, Terex Corporation, Fassi Gru S.p.A., The Manitowoc Company Inc., Gorbel Inc., Buckner Heavylift Cranes LLC, Palfinger AG, Tadano Ltd., Broderson Manufacturing Corp are playing dominating role in Europe crane market.

The Europe crane market is characterized by intense competition, driven by demand from construction, logistics, and renewable energy sectors. Key players focus on innovation, sustainability, and strategic partnerships to maintain their competitive edge. The market is fragmented, with global giants like Liebherr, Konecranes, and Terex competing alongside regional manufacturers. Technological advancements, such as automation, IoT integration, and remote monitoring, are reshaping the industry landscape. Additionally, the growing emphasis on reducing carbon footprints has pushed companies to develop energy-efficient cranes. Governments' investments in infrastructure development and renewable energy projects further fuel market growth. Companies are also expanding their service networks to provide better after-sales support, enhancing customer loyalty. Mergers, acquisitions, and collaborations are common strategies to consolidate market presence and diversify product portfolios. The competition is further intensified by the entry of cost-effective solutions from Asian manufacturers, forcing European players to focus on premium offerings and cutting-edge technology. Overall, the market's dynamics are shaped by innovation, regulatory compliance, and evolving customer demands.

TOP PLAYERS IN THIS MARKET

Liebherr Group GmbH

Liebherr Group is a leader in the Europe crane market, renowned for its innovative mobile and tower cranes. The company’s focus on sustainability ensures high demand for its eco-friendly models. Liebherr invests heavily in R&D, ensuring continuous innovation and expanding its global footprint.

Konecranes Plc

Konecranes Plc is a key player, leveraging its expertise in port and industrial cranes to develop advanced solutions. The company’s focus on automation aligns with EU priorities, ensuring steady growth. Its strategic acquisitions strengthen its position in the global market.

Manitowoc Company

Manitowoc Company contributes significantly to the Europe crane market, focusing on construction and infrastructure applications. The company’s partnerships with contractors drive innovation, ensuring leadership in the industry.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Technological Advancements

Companies invest in IoT-enabled cranes and automation solutions to improve efficiency and safety.

Sustainability Initiatives

Developing energy-efficient cranes and adopting eco-friendly manufacturing processes to align with EU regulations.

Strategic Expansions

Establishing new manufacturing facilities and service centers across key regions to strengthen market reach.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Liebherr launched a new line of electric-powered tower cranes. This initiative aimed to meet the rising demand for sustainable construction equipment in Europe.

- In May 2023, Konecranes acquired a Finnish automation firm specializing in crane control systems. This acquisition was designed to enhance Konecranes' technological capabilities and market leadership.

- In July 2023, Terex expanded its service network in Eastern Europe by opening three new maintenance centres. This move aimed to improve customer satisfaction and increase market share.

- In October 2023, Manitowoc partnered with a German engineering company to develop advanced lifting solutions for wind energy projects. This collaboration sought to capitalize on the growing renewable energy sector.

- In December 2023, Palfinger introduced a smart crane equipped with AI-driven load management. This launch aimed to set new standards in operational efficiency and safety.

MARKET SEGMENTATION

This research report on the Europe crane market is segmented and sub-segmented into the following categories.

By Product Type

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

By Application

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate for the Europe crane market?

The market is expected to grow at a compound annual growth rate (CAGR) of 2.35% from 2025 to 2033.

2. What factors are driving the growth of the Europe crane market?

Key drivers include increasing infrastructure investments, urbanization, rising demand for smart and energy-efficient cranes, and growing renewable energy projects such as wind farms.

3. Which countries dominate the Europe crane market?

Germany holds the largest share, driven by its robust construction sector, renewable energy projects, and advanced manufacturing base. Other significant markets include France, the United Kingdom, and Italy.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]