Europe Courier, Express, and Parcel Market Size, Share, Trends & Growth Forecast Report By Service Types (Standard Delivery, Express Delivery, Same-Day Delivery, and Last-Mile Delivery), Business Models, Destination, Mode of Transport, End-Use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Courier, Express, and Parcel (CEP) Market Size

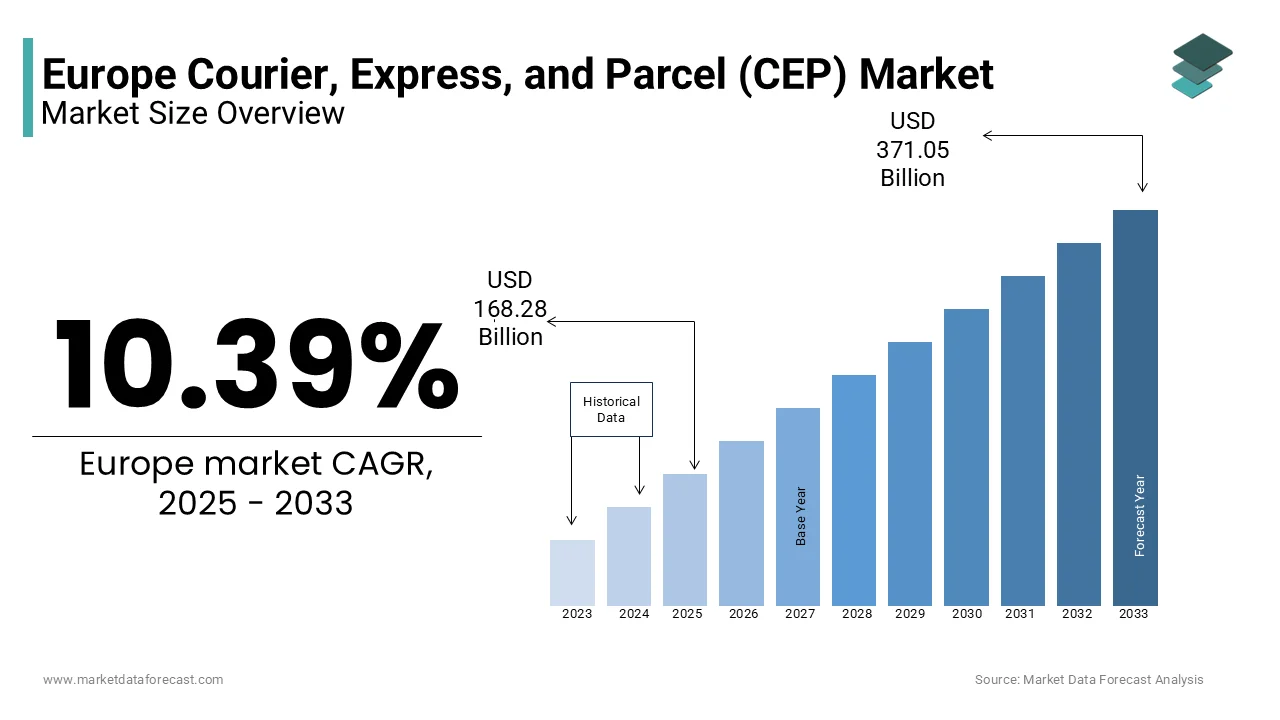

The Europe Courier, Express, and Parcel (CEP) market size was valued at USD 152.44 billion in 2024. The European market is estimated to be worth USD 371.05 billion by 2033 from USD 168.28 billion in 2025, growing at a CAGR of 10.39% from 2025 to 2033.

The globalization, e-commerce proliferation, and evolving consumer expectations are fuelling the demand for Courier, Express, and Parcel (CEP) (CEP) services in the European region. The region's robust infrastructure, coupled with advanced technological adoption, has positioned Europe as a global leader in logistics innovation. The rise of cross-border trade within the European Union has further bolstered demand, with intra-EU shipments accounting for nearly 40% of total parcel volumes in 2021, according to the European Commission. Additionally, the surge in online shopping, fueled by the pandemic, has amplified parcel volumes by 25% year-on-year in 2020, as highlighted by McKinsey & Company. Despite these positive trends, the market faces challenges such as fluctuating fuel prices and stringent environmental regulations, which are reshaping operational strategies. Overall, the European CEP market remains resilient, underpinned by a dynamic interplay of demand drivers and regulatory frameworks.

MARKET DRIVERS

E-Commerce Boom in Europe

The exponential growth of e-commerce stands as one of the most significant drivers of the Europe Courier, Express, and Parcel (CEP) market. As per Eurostat, online retail sales in Europe grew by 17% annually between 2019 and 2022, reaching a staggering €750 billion. This surge has directly translated into increased parcel volumes, with companies like DHL and FedEx reporting a 30% spike in deliveries during peak seasons. The convenience of online shopping, coupled with same-day and next-day delivery options, has heightened consumer expectations, pushing logistics providers to innovate. Moreover, small and medium-sized enterprises (SMEs) are increasingly adopting e-commerce platforms, contributing to a 20% rise in B2C shipments across Europe, according to PwC. Urban areas, particularly in Western Europe, have witnessed a 40% increase in last-mile delivery demands, further propelling market growth. The integration of AI-driven route optimization and real-time tracking systems has enabled couriers to meet these demands efficiently, solidifying e-commerce as a pivotal growth driver.

Sustainability Initiatives

An increase in the number of sustainability initiatives in Europe are further propelling the European Courier, Express, and Parcel (CEP) market forward. According to the World Economic Forum, over 60% of European consumers prioritize eco-friendly delivery options, influencing logistics providers to adopt green practices. Companies like UPS and DPD have invested heavily in electric vehicles (EVs), with EV fleets growing by 25% annually since 2020, as per BloombergNEF. Additionally, the European Green Deal mandates a 55% reduction in carbon emissions by 2030, compelling couriers to transition toward sustainable operations. Innovations such as biodegradable packaging and carbon-neutral delivery services have gained traction, with DHL committing to achieving zero emissions by 2050. These initiatives not only align with regulatory requirements but also enhance brand loyalty among environmentally conscious consumers.

MARKET RESTRAINTS

Rising Operational Costs

One of the primary factors hampering the growth of the Europe Courier, Express, and Parcel (CEP) market is the escalating operational costs, driven by inflationary pressures and labor shortages. According to the International Labour Organization, labor costs in the logistics sector have risen by 15% since 2021, exacerbated by a 20% shortfall in skilled workforce availability. This shortage has forced companies to offer higher wages and invest in automation, which, while beneficial in the long term, imposes immediate financial burdens. Fuel price volatility further compounds the issue, with diesel costs surging by 40% in 2022, as reported by the European Automobile Manufacturers' Association. These rising expenses have eroded profit margins, particularly for smaller players unable to absorb such shocks. Consequently, many firms have passed on these costs to consumers through higher delivery fees, which risks alienating price-sensitive customers and dampening overall market growth.

Regulatory Hurdles

Stringent regulatory frameworks are further restraining the expansion of the Europe Courier, Express, and Parcel (CEP) market. The European Union’s General Data Protection Regulation (GDPR) mandates strict compliance for handling customer data, imposing fines of up to €20 million or 4% of annual turnover for violations, as per Deloitte. This has necessitated substantial investments in cybersecurity and data management systems, diverting resources from core operations. Additionally, environmental regulations, such as the EU Emissions Trading System (ETS), require logistics providers to offset carbon emissions, increasing operational complexity. According to Capgemini, 35% of companies struggle to meet these regulatory demands, leading to delays and inefficiencies. While these measures aim to promote sustainability, their implementation often disrupts established workflows, creating a barrier to seamless market expansion.

MARKET OPPORTUNITIES

Expansion of Cross-Border Logistics

The expansion of cross-border logistics in Europe is a promising opportunity for the European courtier, express and parcel market. With the European Single Market facilitating seamless trade across member states, cross-border parcel volumes have grown by 18% annually since 2020, according to KPMG. Countries like Poland, Spain, and Italy have emerged as key growth hubs, driven by rising consumer demand for international products. Logistics providers are capitalizing on this trend by establishing dedicated cross-border networks, enabling faster and more cost-effective deliveries. For instance, Deutsche Post DHL has expanded its European distribution centers by 25%, enhancing connectivity and reducing transit times. Additionally, advancements in customs clearance technologies have streamlined cross-border operations, reducing delays by 30%, as per Accenture. By tapping into underserved regions and optimizing cross-border capabilities, companies can unlock significant revenue potential.

Adoption of Autonomous Delivery Solutions

The adoption of autonomous delivery solutions is another major opportunity for the Europe Courier, Express, and Parcel (CEP) market. According to Boston Consulting Group, autonomous vehicles could reduce last-mile delivery costs by up to 40%, revolutionizing urban logistics. Pilot projects, such as Starship Technologies’ robotic deliveries in London and Hamburg, have demonstrated a 25% improvement in efficiency, as noted by Roland Berger. Drone technology is also gaining momentum, with trials conducted by companies like Amazon and Wing showcasing the potential to deliver parcels within 30 minutes. The European Investment Bank estimates that autonomous solutions could capture 15% of the last-mile delivery market by 2030. By investing in these innovations, logistics providers can address urban congestion, lower emissions, and cater to the growing demand for ultra-fast deliveries, positioning themselves at the forefront of industry evolution.

MARKET CHALLENGES

Urban Congestion and Infrastructure Limitations

Urban congestion in Europe is challenging the expansion of the Europe Courier, Express, and Parcel (CEP) market, particularly in densely populated cities like Paris, Berlin, and Milan. According to TomTom’s Traffic Index, traffic congestion in European metropolitan areas increased by 12% in 2022, leading to delays in last-mile deliveries. This issue is compounded by limited parking spaces and restricted access zones, which hinder efficient operations. According to the European Environment Agency, urban logistics accounts for 25% of city traffic, exacerbating pollution and noise levels. To mitigate these challenges, companies are exploring alternative delivery models, such as micro-distribution centers and cargo bikes. However, scaling these solutions requires significant investment and collaboration with municipal authorities, which remains a complex undertaking. Without addressing infrastructure limitations, urban congestion will continue to impede market efficiency and customer satisfaction.

Cybersecurity Threats

Cybersecurity threats are an emerging challenge for the Europe Courier, Express, and Parcel (CEP) market, given the increasing reliance on digital platforms and IoT devices. According to Verizon’s Data Breach Investigations Report, the logistics sector experienced a 30% rise in cyberattacks in 2022, with ransomware incidents targeting shipment tracking systems and customer databases. These breaches not only disrupt operations but also erode consumer trust, as sensitive data such as addresses and payment details are compromised. A study by Marsh McLennan reveals that 45% of logistics firms lack robust cybersecurity measures, leaving them vulnerable to sophisticated attacks. Addressing this challenge requires substantial investments in encryption technologies and employee training programs. Failure to do so could result in reputational damage and regulatory penalties, undermining long-term market stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.39% |

|

Segments Covered |

By Service Types, Business Models, Destination, Mode of Transport, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Koninklijke PostNL, Parcelforce Worldwide, Fedex Corporation, United Parcel Service Inc, Deutsche Post AG, Singapore Post Limited, SG Holdings Co., Ltd., DACHSER, Aramex International LLC, DTDC Express Ltd., and Swiss Post Ltd, and others. |

SEGMENTAL ANALYSIS

By Service Types Insights

The standard delivery segment accounted for 45.9% of the European market share in 2024. The dominating position of standard delivery segment in the European market is attributed to its affordability and reliability, catering to both B2B and B2C customers. The widespread adoption of standard delivery is driven by bulk shipping needs, particularly in manufacturing and wholesale sectors, which account for 30% of total parcel volumes, according to Bain & Company. The compatibility of standard delivery with road transport that handles 70% of all deliveries is further propelling the expansion of the standard delivery segment in the European market. Road-based standard delivery offers flexibility and cost-effectiveness, making it the preferred choice for domestic shipments. Moreover, advancements in route optimization software have enhanced efficiency, reducing delivery times by 15%. These factors collectively reinforce the dominance of standard delivery in the European logistics landscape.

The same-day delivery segment is predicted to witness a promising CAGR of 18.8% over the forecast period owing to the increasing demand for instant gratification, particularly among urban consumers. Cities like London and Amsterdam have witnessed a 25% surge in same-day delivery requests, driven by the proliferation of on-demand services, according to McKinsey. Technological advancements, such as real-time tracking and AI-driven dispatch systems, have enabled couriers to fulfill same-day orders efficiently. Additionally, partnerships with local retailers and fulfillment centers have reduced lead times by 40%, enhancing customer satisfaction. The rise of gig economy platforms has further accelerated this trend, providing scalable workforce solutions.

By Business Models Insights

The business-to-consumer (B2C) logistics segment dominated the market by holding 56.1% of the European market share in 2024. The leading position of B2C logistics segment in the European market is attributed to the exponential growth of e-commerce, with platforms like Amazon and Zalando driving a 20% annual increase in B2C parcel volumes, as per Forrester. Consumer preferences for convenience and speed have further propelled B2C logistics, particularly in urban areas where same-day and next-day delivery options are in high demand. Additionally, the proliferation of subscription-based services, such as meal kits and fashion rentals, has diversified B2C applications. Companies like DPD and Hermes have capitalized on this trend by expanding their last-mile delivery networks, achieving a 30% improvement in service levels.

The customer-to-customer (C2C) logistics segment is anticipated to exhibit a promising CAGR of 22.9% over the forecast period owing to the rise of peer-to-peer marketplaces like eBay and Vinted, which facilitate second-hand goods transactions. In 2022, C2C parcel volumes surged by 35%, driven by sustainability-conscious consumers, according to NielsenIQ. The advent of shared economy platforms has further catalyzed this trend, enabling individuals to monetize unused items and ship them seamlessly. Innovations such as self-service drop-off points and mobile apps have simplified C2C logistics, reducing operational barriers. Additionally, couriers are leveraging crowdshipping models to optimize resource utilization, cutting delivery costs by 25%. These factors highlight the transformative potential of C2C logistics in meeting evolving consumer needs.

By Destination Insights

The domestic deliveries segment captured 62.7% of the European market share in 2024. The growth of the domestic deliveries segment in the European market is driven by the prevalence of localized supply chains and strong intra-regional trade networks. According to the European Logistics Association, domestic parcels benefit from shorter transit times and lower costs, making them the preferred choice for SMEs and retailers. Urbanization has further amplified demand, with cities like Paris and Madrid witnessing a 20% annual increase in domestic parcel volumes. Additionally, advancements in road and rail infrastructure have enhanced connectivity, enabling couriers to achieve a 98% on-time delivery rate. The integration of smart lockers and automated sorting systems has also improved efficiency, reducing operational bottlenecks.

The international deliveries segment is estimated to witness the fastest CAGR of 16.4% over the forecast period owing to the expansion of cross-border e-commerce, particularly within the European Single Market. According to Eurostat, cross-border parcel volumes grew by 22% in 2022, driven by consumer demand for diverse product offerings. The harmonization of customs procedures and the adoption of digital documentation have streamlined international logistics, reducing clearance times by 30%. Additionally, partnerships with global carriers like FedEx and UPS have enhanced connectivity, enabling faster and more reliable deliveries. The rise of niche markets, such as luxury goods and artisanal products, has further diversified international shipments.

By Mode of Transport Insights

The roadways segment held the major share of 71.9% of the European market share in 2024. The dominance of roadways segment in the European market is primarily attributed to the extensive road network spanning over 10 million kilometers, which ensures unparalleled accessibility and flexibility. According to the International Transport Forum, road transport handles 80% of last-mile deliveries, making it indispensable for urban logistics. The cost-effectiveness of roadways, coupled with advancements in vehicle technology, has further cemented their position. Electric and hybrid trucks, for instance, have reduced emissions by 25%, aligning with sustainability goals. Additionally, innovations such as platooning and real-time traffic management have enhanced efficiency, cutting delivery times by 15%.

The railways segment is another promising segment and is likely to register a CAGR of 12.2% over the forecast period owing to the push for greener logistics, with railways emitting 70% less CO2 per ton-kilometer compared to road transport, according to the European Environment Agency. High-speed rail networks, such as those operated by Deutsche Bahn, have expanded by 15% annually, enhancing connectivity across key corridors. The integration of digital technologies, such as predictive maintenance and automated scheduling, has improved operational efficiency, reducing delays by 20%. Additionally, governments are investing in rail infrastructure, with the EU pledging €20 billion for modernization projects. These initiatives have positioned railways as a viable alternative for long-haul freight, particularly in regions with stringent emission targets.

By End-Use Insights

The E-commerce segment occupied 41.3% of the European market share in 2024. The dominance of e-commerce segment in the European market is fueled by the exponential growth of online retail, with platforms like Amazon and Zalando driving a 25% annual increase in shipments, according to Statista. The convenience of home delivery and the proliferation of mobile commerce have further amplified demand, particularly among millennials and Gen Z consumers. Urban areas, such as London and Berlin, have witnessed a 30% surge in e-commerce-related parcels, driven by same-day and next-day delivery options. Additionally, the integration of AI-driven analytics has enabled couriers to optimize inventory management and forecast demand accurately.

The healthcare logistics segment is estimated to witness the fastest CAGR of 14.8% over the forecast period owing to the increasing demand for temperature-controlled shipments, particularly for vaccines and biologics. According to the World Health Organization, the cold chain logistics market for pharmaceuticals is projected to reach €15 billion by 2025, reflecting a 20% annual expansion. The rise of telemedicine and home healthcare services has further catalyzed this trend, with couriers delivering medical supplies and diagnostic kits directly to patients. Innovations such as IoT-enabled sensors and blockchain-based tracking systems have enhanced transparency and reliability, reducing spoilage rates by 35%. Additionally, regulatory mandates, such as Good Distribution Practices (GDP), have compelled logistics providers to adopt specialized solutions.

REGIONAL ANALYSIS

Germany accounted for 22.8% of the Europe Courier, Express, and Parcel (CEP) (CEP) market share in 2024. The robust logistics infrastructure of Germany, coupled with its central geographic location, makes it a pivotal hub for domestic and international shipments. The rise of e-commerce giants like Zalando has fueled demand, with parcel volumes growing by 18% annually since 2020, as per McKinsey. The adoption of Industry 4.0 technologies has further strengthened Germany’s position, enabling real-time tracking and predictive analytics in logistics operations. Investments in green logistics, such as Deutsche Post DHL’s GoGreen initiative, have reduced carbon emissions by 30%, aligning with EU environmental goals. Additionally, the country’s dense network of roadways and railways ensures seamless connectivity, driving efficiency and scalability.

The United Kingdom is anticipated to account for a prominent share of the Europe Courier, Express, and Parcel (CEP) market over the forecast period owing to its advanced digital economy and high consumer spending power, as per PwC. London and Manchester are key contributors, accounting for 40% of the UK’s total parcel volumes, according to KPMG. The surge in online shopping post-pandemic has amplified demand, with e-commerce parcels increasing by 25% in 2021, as highlighted by IMRG Capgemini. Innovations such as automated warehouses and drone delivery trials have positioned the UK as a leader in logistics innovation. Furthermore, Brexit-related challenges have spurred investments in customs automation tools, reducing cross-border delays by 20%. Royal Mail’s expansion into sustainable delivery solutions, including electric vans and micro-distribution centers, reflects the nation’s commitment to balancing growth with environmental responsibility.

France accounts for a notable share of the Europe Courier, Express, and Parcel (CEP) market over the forecast period owing to its strategic location and thriving retail sector, according to Deloitte. Paris and Lyon are major logistics hubs, contributing to 35% of the country’s total parcel volumes, as per Roland Berger. The French government’s €10 billion investment in smart city initiatives has enhanced urban logistics, enabling couriers to meet rising last-mile delivery demands. E-commerce platforms like Cdiscount and Fnac have driven a 22% annual increase in B2C shipments, as noted by NielsenIQ. Additionally, sustainability measures, such as La Poste’s commitment to achieving net-zero emissions by 2030, have resonated with environmentally conscious consumers. The integration of AI-driven route optimization systems has also improved operational efficiency, cutting delivery times by 15%.

Italy is expected to grow at a healthy CAGR in the Europe Courier, Express, and Parcel (CEP) market over the forecast period owing to its strong manufacturing base and growing e-commerce ecosystem. Milan and Rome are key contributors, accounting for 45% of the country’s total parcel volumes, as per Gartner. The rise of local e-commerce platforms like Yoox and LuisaViaRoma has fueled demand, with online retail sales growing by 19% annually since 2020, as highlighted by Bain & Company. The Italian government’s €5 billion investment in rail and road infrastructure has enhanced connectivity, reducing transit times by 20%. Additionally, couriers are adopting innovative solutions such as cargo bikes and micro-fulfillment centers to address urban congestion.

Spain holds a considerable share of the Europe Courier, Express, and Parcel (CEP) market, supported by its expanding e-commerce sector and strategic geographic location, according to Accenture. Barcelona and Madrid are key contributors, accounting for 50% of the country’s total parcel volumes, as per Oliver Wyman. The surge in online shopping has driven a 20% annual increase in B2C shipments, as noted by Forrester. Investments in renewable energy-powered logistics hubs have enabled couriers to reduce emissions by 25%, aligning with EU sustainability mandates. Additionally, innovations such as autonomous delivery robots and AI-driven sorting systems have enhanced efficiency, cutting operational costs by 15%.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Koninklijke PostNL, Parcelforce Worldwide, Fedex Corporation, United Parcel Service Inc, Deutsche Post AG, Singapore Post Limited, SG Holdings Co., Ltd., DACHSER, Aramex International LLC, DTDC Express Ltd., and Swiss Post Ltd. are playing dominating role in Europe Courier, Express, and Parcel (CEP) market.

The Europe Courier, Express, and Parcel (CEP) market is characterized by intense competition, with established players vying for dominance amid rapid technological advancements and shifting consumer preferences. According to McKinsey, the top five players collectively account for 70% of the market, reflecting high consolidation. However, the rise of niche players specializing in e-commerce and healthcare logistics is disrupting traditional models.

Regulatory pressures, particularly around sustainability, are reshaping competitive dynamics. Companies that fail to adopt green practices risk losing market share to more agile competitors. Additionally, the proliferation of autonomous delivery solutions and AI-driven analytics is leveling the playing field, enabling smaller firms to compete effectively. This convergence of innovation, regulation, and diversification underscores the complexity of the competitive landscape.

TOP PLAYERS IN THIS MARKET

Deutsche Post DHL Group

Deutsche Post DHL Group is a global leader in logistics, offering an extensive range of services from standard parcel delivery to specialized supply chain solutions. The company’s GoGreen initiative has set a benchmark in sustainability, aiming to achieve zero emissions by 2050. Its investments in digital transformation, such as AI-driven route optimization and blockchain-based tracking, have enhanced operational efficiency. DHL’s strategic partnerships with e-commerce platforms have solidified its position as a preferred logistics provider across Europe.

FedEx Express

FedEx Express plays a pivotal role in connecting Europe to global markets through its extensive air and ground networks. The company’s SenseAware technology enables real-time monitoring of shipments, ensuring transparency and reliability. Its focus on sustainability is evident in its fleet modernization efforts, which include transitioning to electric vehicles. FedEx’s acquisition of TNT Express has expanded its footprint in Europe, enhancing its ability to cater to diverse customer needs.

UPS Europe

UPS Europe is renowned for its innovative logistics solutions, leveraging advanced technologies to optimize supply chains. The company’s ORION system uses AI to streamline delivery routes, reducing fuel consumption by 10%. Its commitment to sustainability is reflected in its goal to source 40% of ground fuel from renewable sources by 2025. UPS’s collaboration with small businesses has empowered them to scale their operations, fostering economic growth across the region.

TOP STRATEGIES USED BY KEY PLAYERS

Digital Transformation

Key players in the Europe Courier, Express, and Parcel (CEP) market are heavily investing in digital transformation to enhance operational efficiency and customer experience. Technologies such as AI-driven route optimization, IoT-enabled tracking systems, and blockchain-based documentation have streamlined logistics processes. For instance, DHL’s Resilience360 platform provides real-time visibility into supply chains, mitigating disruptions. These innovations not only improve service levels but also align with evolving consumer expectations for transparency and speed.

Sustainability Initiatives

Sustainability is a core focus for leading companies aiming to meet regulatory requirements and consumer preferences. FedEx and DHL are transitioning to electric and hybrid fleets, reducing emissions by 30%. Additionally, investments in renewable energy-powered warehouses and biodegradable packaging materials reflect their commitment to environmental stewardship. These initiatives not only enhance brand loyalty but also position companies as leaders in green logistics.

Strategic Partnerships

Strategic partnerships with e-commerce platforms and technology providers are enabling couriers to expand their capabilities and reach. Collaborations with Amazon, Alibaba, and Shopify have facilitated seamless integrations, enhancing last-mile delivery efficiency. For example, UPS’s partnership with Deliverr has enabled same-day delivery services in urban areas. These alliances strengthen market presence while addressing the growing demand for instant gratification.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Deutsche Post DHL Group launched its fully electric StreetScooter fleet in Berlin. This initiative aimed to reduce urban emissions and enhance last-mile delivery efficiency.

- In June 2023, FedEx Express partnered with Wing Aviation to trial drone deliveries in rural Sweden. This collaboration sought to address accessibility challenges and expand service coverage.

- In September 2023, UPS Europe introduced its Smart Packaging Solutions, incorporating biodegradable materials. This move aimed to align with EU sustainability mandates and appeal to eco-conscious consumers.

- In November 2023, DPDgroup acquired a majority stake in Urb-it, a micro-mobility logistics provider. This acquisition strengthened DPD’s urban delivery capabilities and reduced reliance on traditional vehicles.

- In January 2024, GLS Group implemented AI-driven predictive analytics for route planning. This initiative aimed to optimize resource allocation and improve delivery accuracy.

MARKET SEGMENTATION

This research report on the Europe Courier, Express, and Parcel (CEP) market is segmented and sub-segmented into the following categories.

By Service Types

- Standard Delivery

- Express Delivery

- Same-Day Delivery

- Last-Mile Delivery

By Business Models

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Customer-to-Customer (C2C)

By Destination

- Domestic

- International

By Mode of Transport

- Roadways

- Airways

- Railways

- Waterways

By End-Use

- E-commerce

- Healthcare

- Manufacturing

- Wholesale & Retail

- Other

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the Europe Courier, Express, and Parcel (CEP) market in 2024?

The Europe Courier, Express, and Parcel (CEP) market size was valued at USD 152.44 billion in 2024.

2. What are some key trends in the Europe Courier, Express, and Parcel (CEP) market?

Key trends include investments in automated delivery systems, adoption of electric vehicles for logistics, regulatory focus on emissions reduction, and integration of digital technologies like GPS tracking and biometrics.

3. What factors are driving the growth of the Europe Courier, Express, and Parcel (CEP) market?

Growth is driven by the expansion of e-commerce, increasing demand for last-mile delivery solutions, technological advancements like drone deliveries and smart lockers, and sustainability initiatives such as green logistics and carbon-neutral shipping.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]