Europe Cosmetics Market Size, Share, Trends & Growth Forecast Report By Product Type (Skin Care, Hair Care), End User, Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Cosmetics Market Size

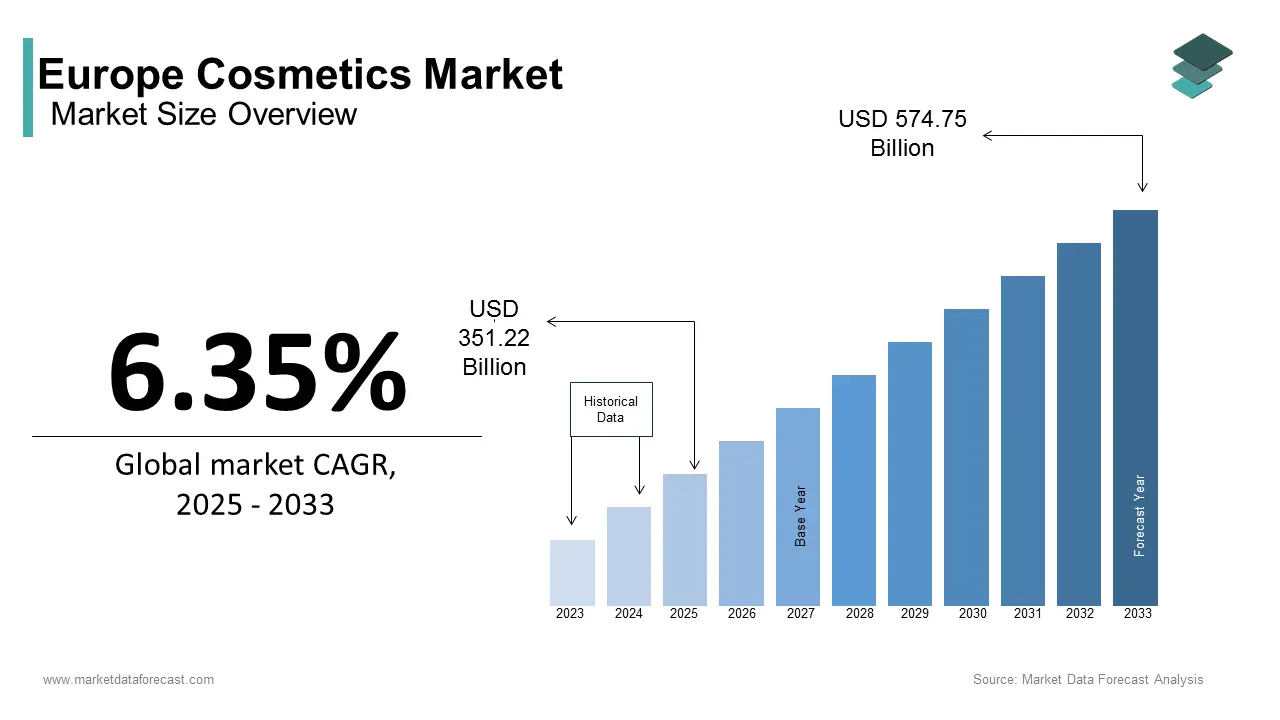

The Europe cosmetics market size was calculated to be USD 330.25 billion in 2024 and is anticipated to be worth USD 574.75 billion by 2033 from USD 351.22 billion in 2025, growing at a CAGR of 6.35% during the forecast period.

The European cosmetics market is expanding steadily, shaped by shifting consumer preferences and a heightened focus on self-care. This upward trajectory is influenced by rising disposable incomes and a surging demand for premium, eco-conscious beauty solutions. France remains the dominant player, contributing nearly 25% of the region’s total cosmetics revenue, according to the French Federation of Beauty Enterprises.

A major force driving market transformation is the increasing preference for clean and organic beauty products. Research from Euromonitor International indicates that over 60% of European consumers favor natural ingredients and sustainable packaging, prompting brands to refine formulations and enhance eco-friendly designs. Simultaneously, the growing impact of digital marketing and influencer collaborations has strengthened brand reach, fostering sustained consumer interest. These developments collectively reinforce Europe's position as a dynamic and influential hub within the global beauty industry.

MARKET DRIVERS

Surging Demand for Clean and Organic Products

The growing preference for clean and organic cosmetics is a major force driving the European cosmetics market. Research indicates that over 70% of European consumers seek beauty products free from harmful chemicals, creating a lucrative space for natural alternatives. In Germany, for instance, organic skincare sales surged by 25% in 2022, according to the German Organic Cosmetic Association. This shift is further reinforced by rising environmental consciousness. Data from Eurostat reveals that more than half of European consumers are willing to pay extra for eco-friendly products, prompting manufacturers to adopt sustainable production methods. Certifications such as COSMOS and Ecocert have strengthened brand credibility, appealing to environmentally conscious buyers. These evolving preferences solidify clean and organic cosmetics as a key pillar of market expansion.

Impact of Social Media and Digital Marketing

Social media and digital marketing have redefined how consumers interact with cosmetic brands, significantly influencing purchasing decisions. A McKinsey & Company report highlights that over 80% of European millennials and Gen Z rely on platforms like Instagram and TikTok for beauty recommendations, fueling demand for trending products. In the UK, for example, Glossier experienced a 40% surge in sales following targeted influencer campaigns, as reported by the British Beauty Council. The integration of AI-driven marketing tools has further accelerated this trend. Deloitte notes that brands utilizing AI-powered personalized advertisements have seen engagement rates rise by 30%. Additionally, virtual try-on technologies have enhanced the online shopping experience, easing concerns about product suitability. Collectively, these factors reinforce digital marketing’s central role in shaping the European cosmetics landscape.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Costs

Stringent regulatory requirements present a major hurdle for the European cosmetics market, particularly regarding product safety and labeling. The European Commission mandates compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), necessitating extensive testing and certification investments. These costs weigh heavily on businesses, especially smaller manufacturers. In Italy, for instance, small-scale producers struggle to compete with industry giants due to the financial burden of regulatory adherence. The European Environmental Agency reveals that ingredient bans, including restrictions on microplastics and parabens, have further driven reformulation expenses. While large corporations can absorb these costs, smaller brands often face challenges in maintaining affordability while innovating. These financial constraints pose a notable barrier to market growth.

Proliferation of Counterfeit Cosmetics

The widespread availability of counterfeit cosmetics undermines consumer trust and brand integrity. The Organisation for Economic Co-operation and Development (OECD) estimates that counterfeit goods represent 10% of global cosmetics sales, with Europe serving as a significant distribution hub. In Spain, authorities seized over USD 100 million worth of counterfeit beauty products in 2022, according to the Spanish Customs Agency. The rise of online marketplaces has exacerbated this issue, enabling counterfeiters to reach unsuspecting buyers. A KPMG survey found that more than 50% of consumers express hesitation about purchasing cosmetics online due to concerns over authenticity. Beyond damaging brand reputation, the presence of counterfeit products introduces operational risks and regulatory challenges, hindering market expansion.

MARKET OPPORTUNITIES

Expansion of Men’s Grooming Products

The rising demand for men’s grooming presents a transformative opportunity in the European cosmetics market. A Bain & Company study projects substantial growth in this segment through 2030, reflecting its increasing popularity among younger consumers. In Sweden, for instance, L’Oréal Men Expert has launched specialized skincare lines tailored to male buyers is boosting sales by 30%, according to the Swedish Retail Federation. This shift is largely driven by evolving societal norms that encourage men to invest in personal care. Besides, the integration of grooming services within barbershops and salons has expanded accessibility, reinforcing sustained demand for men’s cosmetics.

Advancement of Sustainable Packaging Solutions

The cosmetics industry is witnessing a rapid transition toward sustainable packaging, opening new growth avenues for brands prioritizing environmental responsibility. Research from Euromonitor International indicates that over 70% of European consumers prefer products with recyclable or biodegradable packaging, incentivizing businesses to adopt eco-conscious alternatives. In Germany, for example, Lush has introduced package-free solid cosmetics, reducing plastic waste by 40%, as reported by the German Sustainability Council. The broader adoption of circular economy principles has further accelerated this movement. Data from the European Environment Agency shows that sustainable packaging can cut carbon emissions by 25% compared to conventional materials, aligning with shifting consumer values. Certifications such as FSC (Forest Stewardship Council) have further strengthened brand credibility, attracting environmentally conscious buyers.

MARKET CHALLENGES

Intensified Competition and Brand Loyalty Struggles

Fierce competition among established brands and private labels poses a significant challenge in the European cosmetics market, complicating efforts to cultivate brand loyalty. Private label cosmetics account for over 25% of total sales, with major retailers like Boots and Sephora offering cost-effective alternatives to premium brands. In France, private labels held a 30% share of the skincare market in 2022, according to the French Retail Federation. This competitive landscape is further exacerbated by aggressive pricing strategies, making brand differentiation increasingly difficult. Research suggests that over 60% of consumers frequently switch brands based on discounts and promotions, emphasizing the challenge of long-term customer retention. Additionally, limited innovation in traditional product categories has constrained opportunities for premiumization, making it harder for brands to carve out a distinct market position.

Shifting Consumer Preferences

Rapid changes in consumer preferences create uncertainty for cosmetics manufacturers, affecting product development and marketing strategies. A study by the European Consumer Organization reveals that over 40% of European consumers frequently alter their beauty routines based on social media trends and celebrity endorsements. In Italy, for example, a sudden surge in demand for Korean beauty products led to a 15% decline in sales of traditional European brands, as reported by the Italian Beauty Association. This unpredictability forces manufacturers to adapt quickly or risk losing market share. PwC research indicates that over 50% of European cosmetics companies cite evolving consumer preferences as a major operational challenge, diverting resources from long-term strategic planning. These ongoing shifts complicate profitability and hinder sustained market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.35% |

|

Segments Covered |

By Product, End User, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

L'Oréal S.A., Unilever PLC, Coty Inc., Estée Lauder Companies Inc., Procter & Gamble, Henkel AG & Co. KGaA, Beiersdorf AG, Shiseido Company, Limited, Avon Products Inc., and Colgate-Palmolive Co. |

SEGMENTAL ANALYSIS

By Product Insights

The skin care segment in 2024 dominated the Europe cosmetics market and captured 42.7% of the total revenue in 2024. This leadership is driven by the growing emphasis on anti-aging and hydration solutions, particularly among middle-aged and elderly consumers. In France, for instance, anti-aging creams accounted for over 50% of all skincare sales, according to the French Federation of Beauty Enterprises. A key factor driving this dominance is increasing consumer awareness of skin health and protection. Eurostat data indicates that over 70% of European consumers consider sunscreens and moisturizers essential, driving sustained demand across various demographics. Moreover, advancements in formulation technologies have enhanced product efficacy while minimizing irritation, further strengthening consumer confidence. These factors collectively reinforce skincare’s position as the backbone of the European cosmetics market.

The haircare segment is experiencing the fastest growth, with a projected CAGR of 7.9% during the forecast period. This expansion is fueled by the growing popularity of hair styling and treatment products, particularly among younger consumers. In Germany, for example, sales of hair masks and serums surged by 35% in 2022, as reported by the German Haircare Association. A significant driver of this growth is the increasing demand for personalized haircare solutions that cater to specific hair types and concerns. Additionally, the incorporation of natural ingredients has addressed safety concerns related to chemical exposure, making these products more appealing to health-conscious buyers. These innovations underscore haircare’s evolving role in addressing diverse consumer needs and preferences.

By End-User Insights

The women segment had the biggest portion of the Europe cosmetics market in 2024. This dominance is driven by the widespread use of beauty and personal care products among female consumers. In the UK, for instance, over 80% of women use skincare and makeup products daily, according to the British Beauty Council. A major contributing factor is the increasing focus on self-care and wellness, which gained momentum during the pandemic. Additionally, the availability of diverse product ranges and personalized recommendations has opened new opportunities for innovation, ensuring continuous demand. These factors cement women’s position as the primary driving force of the European cosmetics market.

The men’s segment is expanding at a notable pace, with a projected CAGR of 8.3% from 2025 to 2033. This growth is fueled by the rising emphasis on grooming and personal care, particularly among younger consumers. In Sweden, for example, sales of men’s skincare products increased by 40% in 2022, as per the Swedish Retail Federation. A key driver of this trend is shifting societal perceptions of masculinity, encouraging men to invest in self-care. According to Eurostat, over 60% of European men aged 18-35 now use grooming products regularly, creating demand for specialized solutions. Furthermore, the integration of grooming services into barbershops and salons has broadened the accessibility of men’s cosmetics, supporting sustained market expansion. These developments highlight the transformative potential of men’s grooming in reshaping the European cosmetics landscape.

By Distribution Channel Insights

The offline distribution channel remained the dominant segment in the European cosmetics market, accounting for 65.3% of total revenue in 2024. This leadership is driven by the enduring consumer preference for in-store experiences, particularly among older demographics who value product testing before purchase. In Italy, for instance, over 70% of consumers visit physical stores to try cosmetics before making a decision, according to the Italian Retail Federation. A key advantage of offline channels is the availability of expert advice and personalized recommendations, which enhance the shopping experience. Eurostat data indicates that brick-and-mortar stores drive 80% of premium cosmetics sales, highlighting their role in influencing purchase decisions. Additionally, promotional campaigns, such as discounts and loyalty programs, have reinforced their market position, ensuring offline retail remains the primary distribution method for cosmetics in Europe.

The Online distribution segment arose as the fastest-growing party, with a projected CAGR of 12.7% in the future. This expansion is fueled by the widespread adoption of e-commerce platforms and the convenience of doorstep delivery. In the Netherlands, for example, online cosmetics retailers saw a 40% surge in sales in 2022, as per the Dutch E-Commerce Association. A major catalyst for this growth is the integration of advanced technologies, such as augmented reality (AR) and virtual try-on tools, which enhance the digital shopping experience. According to McKinsey & Company, over 50% of European consumers now prefer online platforms for their ability to provide detailed product comparisons and customer reviews. Additionally, subscription-based models and flexible return policies have increased consumer confidence, driving further adoption. These innovations underscore the transformative impact of online channels in reshaping the European cosmetics market.

REGIONAL ANALYSIS

France has long been recognized as a global epicenter for beauty and cosmetics, with a rich heritage of renowned brands and a culture deeply rooted in skincare and fragrance. The country’s rich heritage in perfumery and skincare innovation has positioned it as a leader in the region. For instance, global brands like L’Oréal and Chanel are renowned for their high-quality formulations and luxury appeal, catering to both domestic and international markets. A key factor driving France’s success is its proactive adoption of sustainable practices. According to the French Environmental Ministry, over 60% of French cosmetics manufacturers prioritize eco-friendly sourcing and production methods, aligning with consumer values. Additionally, the rise of digital retail platforms has enabled French brands to reach a broader audience, further boosting demand. These initiatives show France’s pivotal role in advancing the Europe cosmetics market.

The UK's cosmetics market is characterized by its dynamic and trend-sensitive nature as consumers keenly adopting new beauty innovations and trends. The country’s strong retail infrastructure and consumer preference for premium products have solidified its position as a key player. For instance, British brands like The Body Shop dominate the mid-tier segment, appealing to cost-conscious yet quality-focused consumers. A significant driver of the UK’s dominance is its focus on digital transformation and personalized marketing strategies. As per the British Retail Consortium, online cosmetics sales in the UK grew by 35% in 2022, driven by the integration of virtual try-on tools and AI-driven recommendations. Besides, as per Deloitte, over 70% of UK consumers prioritize unique and meaningful designs, encouraging local brands to offer bespoke solutions. These efforts underscore the UK’s leadership in shaping the future of the Europe cosmetics market.

LEADING PLAYERS IN THE EUROPE COSMETICS MARKET

The Europe cosmetics market is led by three key players: L’Oréal, Unilever, and Beiersdorf, each contributing significantly to the global market. L’Oréal, headquartered in France, holds a substantial presence in Europe, offering iconic brands like Garnier and Lancôme. L’Oréal accounts for a major portion of Europe’s total cosmetics sales, reflecting its dominance.

Unilever, based in the UK, specializes in affordable yet innovative beauty solutions, with a growing footprint in markets like Germany and Italy. As per Euromonitor International, Unilever’s products command a notable market share in the mid-tier segment. Meanwhile, Beiersdorf, a German firm, is renowned for its Nivea brand, widely adopted by European households. According to Nielsen, Beiersdorf’s products account for a decent share of the skincare market share in Europe. These players collectively drive innovation and set benchmarks for the Europe cosmetics market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe cosmetics market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, L’Oréal announced a commitment to achieving carbon neutrality across its supply chain by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is digital transformation. In June 2023, Unilever launched a virtual consultation platform, allowing customers to receive personalized skincare recommendations online. This move aligns with the company’s goal of enhancing customer engagement and driving online sales. Additionally, as per the European Investment Bank, Beiersdorf has invested heavily in AI-driven personalization tools to recommend tailored products based on consumer preferences. These strategies reflect a commitment to innovation and market leadership.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Key market players in the European cosmetics market include L'Oréal S.A., Unilever PLC, Coty Inc., Estée Lauder Companies Inc., Procter & Gamble, Henkel AG & Co. KGaA, Beiersdorf AG, Shiseido Company, Limited, Avon Products Inc., and Colgate-Palmolive Co.

The Europe cosmetics market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 25% of the share, fostering a highly dynamic environment. Key players like L’Oréal and Unilever dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like Glossier and The Ordinary are pioneering direct-to-consumer online sales, challenging incumbents in the e-commerce segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, L’Oréal acquired a Swiss startup specializing in clean beauty formulations. This acquisition aimed to expand its portfolio of eco-friendly products and cater to health-conscious buyers.

- In May 2024, Unilever partnered with a German e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, Beiersdorf introduced a line of refillable skincare products targeting environmentally conscious consumers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, The Body Shop secured USD 50 million in funding from European investors to scale its sustainable cosmetics initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, Nivea launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

DETAILED SEGMENTATION OF EUROPE COSMETICS MARKET INCLUDED IN THIS REPORT

This research report on the europe Cosmetics market has been segmented and sub-segmented based on product type, end user, distribution channel & region.

By Product Type

- Skin Care

- Hair Care

By End User

- Women

- Men

By Distribution Channel

- Offline

- Online

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the key players in the Europe Cosmetics Market?

Major players include L'Oréal S.A., Unilever PLC, Estée Lauder, Coty Inc., Henkel AG, and Shiseido Company.

2. What are the key drivers of growth in the Europe Cosmetics Market?

Key drivers include the increasing demand for organic and natural cosmetics, the rising trend of personalized skincare, the popularity of anti-aging products, and the growing focus on sustainable and ethical beauty.

3. Which countries are leading in the Europe Cosmetics Market?

Germany, France, and the UK are the leading countries in the European cosmetics market due to their large consumer base and strong beauty culture.

4. How are cosmetics brands addressing the demand for personalized products?

Many brands offer personalized skincare and makeup solutions through quizzes, AI technology, and personalized packaging, catering to consumers looking for products suited to their unique skin types and preferences.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]