Europe Conveyor Belt Market Size, Share, Trends, & Growth Forecast Report By Product Type (Belt, Roller, Pallet, and Overhead), End-User Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Conveyor Belt Market Size

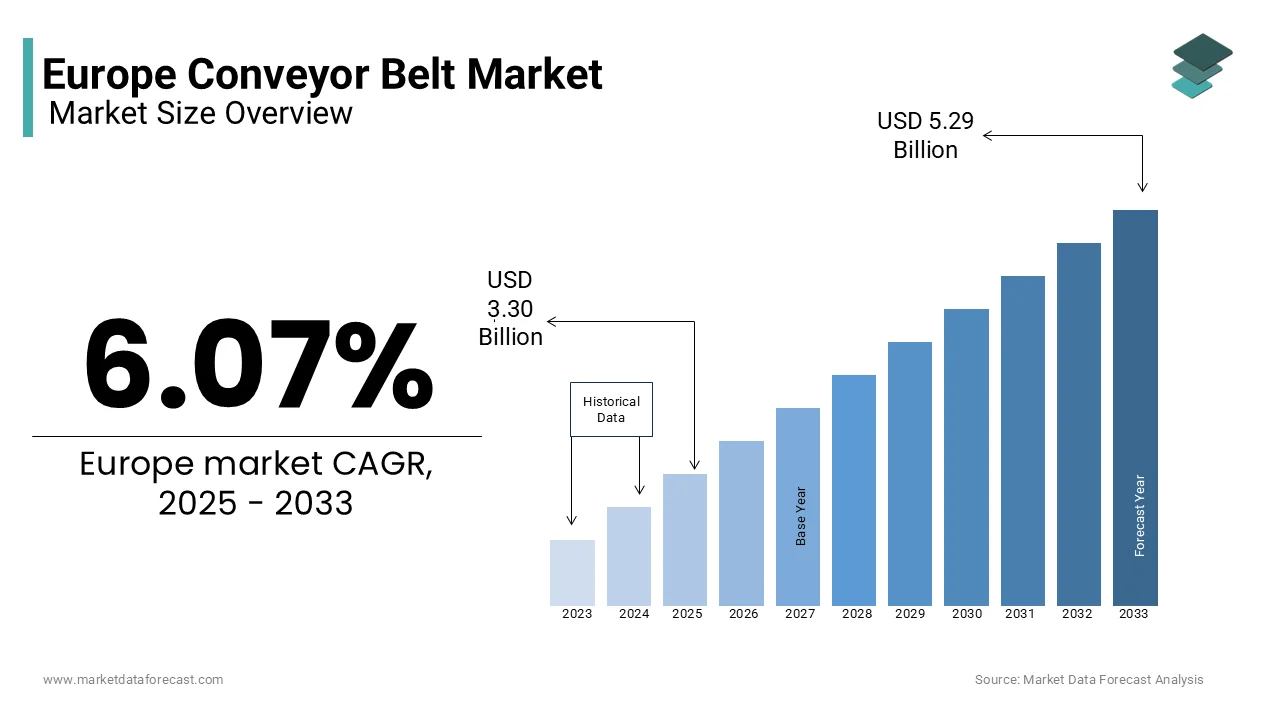

The Europe conveyor belt market was worth USD 3.11 billion in 2024. The European market is projected to reach USD 5.29 billion by 2033 from USD 3.30 billion in 2025, rising at a CAGR of 6.07% from 2025 to 2033.

Conveyor belts have become an indispensable component of modern material handling systems across Europe, enabling seamless transportation of goods in industries ranging from manufacturing to logistics. Germany and France leading adoption of conveyer belts in Europe due to their advanced industrial infrastructure and emphasis on automation. The German Federal Ministry of Economics reports that conveyor belt systems reduce operational inefficiencies by 40%, aligning with EU mandates for sustainable and efficient supply chains. For instance, Sweden’s automotive sector has embraced modular conveyor systems, achieving a 30% improvement in production line efficiency, as stated by the Swedish Automotive Industry Association. As industries increasingly prioritize speed, precision, and sustainability, the demand for innovative conveyor belt solutions continues to grow, positioning them as critical tools in contemporary logistics and manufacturing ecosystems.

MARKET DRIVERS

Rising Demand for Automation in Manufacturing in Europe

The rising demand for automation in manufacturing is a key driver propelling the Europe conveyor belt market forward. The European Robotics Association states that automated conveyor systems account for 60% of material handling processes in large-scale manufacturing facilities, driven by their ability to enhance productivity and reduce labor costs. For instance, Italy’s automotive plants have achieved a 25% reduction in cycle times by integrating conveyor belts with robotic arms, according to the Italian Chamber of Commerce. Additionally, the French National Institute for Industrial Research highlights that advancements in IoT-enabled conveyor systems have increased adoption rates by 20% annually, ensuring compliance with Industry 4.0 standards. This trend underscores the pivotal role of conveyor belts in supporting Europe’s shift toward smart manufacturing while addressing economic and operational challenges.

Growing Adoption in E-Commerce Logistics

The growing adoption of conveyor belts in e-commerce logistics is another major driver boosting the regional market expansion. The European E-Commerce Association reports that automated conveyor systems account for 45% of warehouse operations, driven by the surge in online shopping and the need for faster order fulfillment. For example, Spain’s retail warehouses have achieved a 35% improvement in delivery times by adopting high-speed conveyor systems, as stated by the Spanish Retail Federation. Furthermore, the UK National Logistics Council highlights that advancements in energy-efficient conveyor designs have reduced operational costs by 15%, enhancing profitability for logistics providers. As consumers increasingly prioritize speed and reliability, the adoption of conveyor belts in this sector is set to grow significantly, ensuring its continued relevance in modern supply chains.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

High initial costs and maintenance expenses is a major restraint to the growth of the Europe conveyor belt market, particularly for small and medium-sized enterprises (SMEs). The European Federation of Small Businesses estimates that deploying advanced conveyor systems can exceed €1 million, deterring smaller companies from adopting such technologies. For instance, rural regions in Eastern Europe report that only 10% of SMEs utilize automated conveyor systems due to financial constraints, as per the Czech Business Confederation. Additionally, the Swiss Engineering Society highlights that improper maintenance often leads to system failures, undermining broader adoption. Without targeted subsidies or cost-sharing initiatives, these barriers will continue to limit market penetration.

Limited Flexibility in Customization

Limited flexibility in customization is further hampering the growth of the Europe conveyor belt market, particularly in niche applications requiring specialized configurations. The European Industrial Equipment Manufacturers Association reports that over 60% of firms in Central Europe remain hesitant to adopt conveyor systems due to concerns about adaptability and scalability. For instance, Italy’s food processing sector has reported that only 5% of projects utilize fully customized conveyor belts, as stated by the Italian Food Processors Association. Additionally, cultural biases favoring conventional material handling methods further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of flexible conveyor systems through pilot projects and industry collaborations.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion of conveyor belt systems into emerging markets is a major opportunity for market players seeking to diversify their portfolios. According to the forecasts of the European Trade Association, demand for conveyor belts in Eastern Europe will grow at a promising CAGR through 2030, driven by industrialization and infrastructure development. For instance, Turkey’s manufacturing hubs have adopted modular conveyor systems, achieving a 40% improvement in operational efficiency, as stated by the Turkish Ministry of Industry. Similarly, Russia’s mining sector has embraced heavy-duty conveyor belts for bulk material transport, enhancing supply chain reliability. As emerging economies prioritize modernization, the role of conveyor belts in enabling efficient logistics is set to expand, unlocking new revenue streams for manufacturers.

Adoption of Smart Conveyor Technologies

The adoption of smart conveyor technologies offers immense potential to drive market growth. The European Smart Manufacturing Consortium states that IoT-enabled conveyor systems account for 25% of the market share, valued at €2.1 billion annually. For example, France’s pharmaceutical sector has pioneered the use of real-time monitoring systems integrated into conveyor belts, achieving a 30% reduction in downtime, as stated by the French Pharmaceutical Manufacturers Association. Additionally, the Swiss Innovation Agency highlights that advancements in predictive maintenance algorithms have increased consumer confidence in high-tech applications, boosting adoption rates by 20%. As Europe continues to invest in intelligent supply chains, the adoption of smart conveyor belts is poised to accelerate, positioning them as a cornerstone of future-ready logistics.

MARKET CHALLENGES

Resistance to Change in Traditional Industries

Resistance to change in traditional industries is a major challenge to the Europe conveyor belt market, particularly among established manufacturers. The European Industrial Automation Federation reports that over 60% of firms in Central Europe remain hesitant to adopt advanced conveyor systems due to concerns about perceived risks and lack of familiarity. For instance, Spain’s textile sector has reported that only 10% of projects utilize automated conveyor belts, as stated by the Spanish Textile Manufacturers Association. Additionally, cultural biases favoring manual material handling methods further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of conveyor systems through pilot projects and industry collaborations.

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity are further challenging the growth of the Europe conveyor belt market, particularly amid global uncertainties. According to the European Petrochemical Association, shortages of key materials like rubber and synthetic polymers have led to a 20% increase in production costs since 2022, severely impacting manufacturers in countries like Germany and Belgium. For example, Russia’s export restrictions on raw materials have forced European suppliers to seek alternative sources, increasing lead times by 40%. Additionally, the French National Institute for Energy Research highlights that logistical bottlenecks further compound these challenges, reducing overall market capacity. Without strategic investments in diversified sourcing strategies, the market risks stagnation amid growing demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.07% |

|

Segments Covered |

By Product Type, End-User Industry, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

SSI Schaefer AG, Mecalux SA, BEUMER Group GmbH & Co. KG, KNAAP AG, and KUKA AG (Swisslog AG). |

SEGMENTAL ANALYSIS

By Product Type Insights

The belt conveyors segment dominated the Europe conveyor belt market by holding a 55% share of the European market in 2024. The versatility, durability, and cost-effectiveness are making them ideal for diverse applications like manufacturing and logistics, which is one of the major factors driving the growth of the belt conveyors segment in the European market. According to the German Federal Ministry of Economics, belt conveyors reduce material handling costs by 30% compared to other systems, enhancing affordability and accessibility. Additionally, advancements in modular designs have increased adoption rates by 25%, ensuring compliance with modern industrial demands.

The roller conveyors segment is predicted to witness a promising CAGR of 18.3% over the forecast period owing to their increasing use in e-commerce and retail logistics, where speed and precision are paramount. For instance, Denmark’s warehouse networks have achieved a 40% improvement in order fulfillment by adopting roller conveyor systems, ensuring compliance with EU logistics standards. Their alignment with high-value commercial applications makes them a focal point for future innovations, ensuring sustained growth in specialized markets.

By End-User Industry Insights

The manufacturing segment led the Europe conveyor belt market by occupying 38.8% of the European market share in 2024. The critical role that conveyer belts play in streamlining production lines and reducing operational inefficiencies that are making it ideal for sectors like automotive and electronics, is majorly driving the growth of the manufacturing segment in the European market. As per the Italian Chamber of Commerce, conveyor systems reduce labor costs by 25%, enhancing affordability and scalability. Additionally, their compatibility with automated workflows drives widespread adoption.

The food and beverage segment is estimated to register a prominent CAGR of 23.2% over the forecast period in the European market. The growing use in food processing and packaging, where hygiene and precision are essential, is boosting the expansion of food and beverages segment in the European market. For example, Germany’s dairy industry has achieved a 35% improvement in production efficiency by adopting conveyor systems with antimicrobial coatings, ensuring compliance with EU health regulations.

REGIONAL ANALYSIS

Germany held 30.2% of the European conveyor belt market share in 2024. The robust industrial base of Germany, particularly in manufacturing and automotive sectors is driving the demand for conveyor belts in Germany. According to the German Engineering Federation (VDMA), the mechanical engineering sector, which includes conveyor systems, generated around €220 billion in revenue in 2020. The increasing automation in industries and the need for efficient material handling solutions have further propelled the growth of the conveyor belt market. Additionally, Germany's commitment to innovation and sustainability has led to the development of advanced conveyor systems that enhance productivity while minimizing environmental impact. The presence of major players like Continental AG and Schaeffler Group strengthens Germany's position as a market leader.

The UK accounts for a substantial share of the European conveyor belt market over the forecast period due to its diverse industrial landscape, including food processing, mining, and logistics. The UK manufacturing sector contributed around £192 billion to the economy in 2020, according to the Office for National Statistics. The growing emphasis on automation and efficiency in supply chains has led to increased investments in conveyor systems. Additionally, the rise of e-commerce has significantly boosted demand for conveyor belts in logistics and warehousing applications. The UK’s focus on innovation and technology adoption in manufacturing processes further enhances the market's growth potential. Companies like Fenner Conveyors and Dunlop Conveyor Belting are key players in the UK market, contributing to advancements in conveyor technology.

France is predicted to witness a prominent CAGR in the European conveyor belt market over the forecast period owing to its strong manufacturing and agricultural sectors. The French manufacturing industry generated around €150 billion in revenue in 2020, according to the French Ministry of Economy and Finance. The demand for conveyor belts is driven by the need for efficient material handling solutions in various industries, including food processing, automotive, and logistics. The increasing focus on automation and Industry 4.0 initiatives has further propelled the adoption of advanced conveyor systems. Additionally, France's commitment to sustainability and reducing carbon emissions has led to the development of eco-friendly conveyor solutions. Major companies like Habasit and Forbo Siegling play a significant role in the French conveyor belt market, driving innovation and product development.

Italy is anticipated to register prominent growth in the European conveyor belt market over the forecast period, with a strong emphasis on manufacturing and industrial automation. The Italian manufacturing sector is a vital component of the national economy, contributing around €200 billion in 2020, according to the Italian National Institute of Statistics (ISTAT). The demand for conveyor belts is driven by the need for efficient material handling in industries such as food and beverage, automotive, and packaging. The increasing trend towards automation and smart manufacturing solutions has further boosted the market. Italy's focus on innovation and technology in manufacturing processes positions it as a key player in the conveyor belt market. Companies like MRF and C.C. Eastern are significant contributors to the Italian market, enhancing the competitiveness of conveyor systems.

Spain is projected to grow at a healthy CAGR in the European conveyor belt market over the forecast period due to its diverse industrial sectors, including automotive, food processing, and logistics. The Spanish manufacturing sector generated around €30 billion in revenue in 2020, according to the Spanish National Statistics Institute (INE). The growing emphasis on automation and efficiency in supply chains has led to increased investments in conveyor systems. Additionally, the rise of e-commerce and the need for efficient logistics solutions have significantly boosted demand for conveyor belts in warehousing and distribution centers. Spain's commitment to innovation and sustainability in manufacturing processes further enhances the market's growth potential. Key players like A. D. M. and A. M. S. are instrumental in driving advancements in conveyor technology within the Spanish market.

KEY MARKET PLAYERS

The major players in the Europe conveyor belt market include SSI Schaefer AG, Mecalux SA, BEUMER Group GmbH & Co. KG, KNAAP AG, and KUKA AG (Swisslog AG).

MARKET SEGMENTATION

This research report on the Europe conveyor belt market is segmented and sub-segmented into the following categories.

By Product Type

- Belt

- Roller

- Pallet

- Overhead

By End-User Industry

- Airport

- Retail

- Automotive

- Manufacturing

- Food and Beverage

- Pharmaceuticals

- Mining

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe conveyor belt market?

The Europe conveyor belt market is driven by industrial automation, increasing demand in mining and manufacturing, and the expansion of logistics and warehousing sectors.

Which industries are the primary consumers of conveyor belts in Europe?

Major industries include mining, food processing, automotive, pharmaceuticals, packaging, and e-commerce logistics.

How is technology influencing the conveyor belt market in Europe?

Advancements in automation, smart sensors, and AI-driven monitoring systems are enhancing efficiency, safety, and predictive maintenance.

What is the future outlook for the Europe conveyor belt market?

The market is expected to grow due to increasing industrial automation, rising e-commerce logistics, and advancements in material technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]